Does rent affect food stamps? This question, seemingly straightforward, delves into a complex web of financial considerations and social realities. The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, provides vital support to millions of Americans struggling with food insecurity.

However, the cost of housing, particularly in today’s challenging economic climate, can significantly impact a household’s eligibility for SNAP benefits.

This article explores the intricate relationship between rent and SNAP, examining how housing costs influence SNAP eligibility and ultimately impact a household’s ability to afford basic necessities. We’ll dive into the mechanics of SNAP benefit calculations, explore the concept of rent burden, and analyze the broader implications for food security among low-income renters.

The SNAP Program and Eligibility

The Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps, is a federal program that provides food assistance to low- and very low-income individuals and families. SNAP benefits are distributed through an Electronic Benefit Transfer (EBT) card, which functions like a debit card that can be used to purchase eligible food items at authorized retailers.

Eligibility Requirements for SNAP

To be eligible for SNAP benefits, individuals and households must meet certain income and asset requirements, as well as other eligibility criteria.

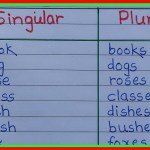

Income and Asset Limits for SNAP Recipients, Does rent affect food stamps

Income Limits

The income limits for SNAP eligibility vary depending on household size, state, and other factors. However, a general guideline is that gross monthly income must be at or below 130% of the federal poverty level. For example, in 2023, the federal poverty level for a household of one is $13,590 per year.

This means that a single person’s gross monthly income must be at or below $1,132.50 to be eligible for SNAP benefits. The income limit for a household of four is $22,350 per year, or $1,862.50 per month.

Asset Limits

SNAP has asset limits, which are the maximum amount of money or resources a household can own and still be eligible for benefits. These limits vary by state but generally include:

- Cash:There is a limit on the amount of cash a household can have in savings accounts, checking accounts, and other liquid assets.

- Vehicles:There are limitations on the value of vehicles owned by the household.

- Real Estate:There are limitations on the value of real estate owned by the household, excluding the primary residence.

Role of Housing Costs in SNAP Eligibility Calculations

Housing costs play a significant role in determining SNAP eligibility. This is because the program takes into account the costs associated with shelter, utilities, and other essential expenses.

The SNAP program uses a formula called the “net income” calculation to determine eligibility. This formula subtracts certain allowable deductions, including housing costs, from gross income to arrive at net income.

States have the option of using either a standard housing deduction or a “shelter deduction” based on actual housing costs. The standard deduction is a fixed amount that varies by state and household size. The shelter deduction, on the other hand, is calculated based on the actual amount spent on rent, mortgage payments, utilities, and other housing-related expenses.

In general, the higher the housing costs, the lower the net income, which can increase the likelihood of SNAP eligibility.

The Impact of Rent on SNAP Benefits

Rent is a significant expense for most households, and it can have a major impact on SNAP benefits. The amount of SNAP benefits a household receives is based on their income, expenses, and household size. Rent is considered a major expense, and it is factored into the calculation of SNAP benefits.

Rent Burden and SNAP Eligibility

The relationship between rent burden and SNAP eligibility is complex. Rent burden is a measure of how much of a household’s income is spent on rent. Households with a high rent burden are more likely to be eligible for SNAP benefits.

This is because they have less money available for other expenses, such as food.For example, a household with an income of $2,000 per month and a rent of $1,000 per month has a rent burden of 50%. This means that they are spending half of their income on rent.

A household with a rent burden of 50% or more is more likely to be eligible for SNAP benefits than a household with a lower rent burden.

The Shelter Deduction

The SNAP program includes a “shelter deduction” to account for housing costs. This deduction is designed to ensure that households have enough money to pay for their rent and other essential expenses. The shelter deduction is calculated based on the household’s actual rent expenses or a standard amount set by the government.The shelter deduction is important because it helps to ensure that households have enough money to meet their basic needs.

Without the shelter deduction, many households would not be able to afford their rent and other essential expenses.

Examples of How Rent Increases Can Impact SNAP Benefits

Rent increases can have a significant impact on SNAP benefits. When rent increases, a household’s SNAP benefits may decrease, as their shelter deduction may not cover the full amount of the rent increase. This can make it difficult for households to afford food and other essential expenses.For example, a household with a rent of $1,000 per month and a shelter deduction of $700 per month receives $300 in SNAP benefits.

If the rent increases to $1,200 per month, the household’s shelter deduction may not increase. This means that the household’s SNAP benefits will decrease to $100 per month. This reduction in SNAP benefits can make it difficult for the household to afford food and other essential expenses.

Rent and Food Security

The cost of rent is a significant factor that impacts food security, particularly for low-income households. High rent costs can force families to make difficult choices between paying rent and putting food on the table, often leading to food insecurity.

The Link Between Rent and Food Insecurity

Rent affordability directly influences a household’s ability to access adequate food. When a substantial portion of income is dedicated to rent, less money remains for other essential needs, including food. This creates a vicious cycle, where financial strain due to high rent leads to food insecurity, which further exacerbates financial challenges.

High Rent Costs and Food Insecurity

High rent costs can contribute to food insecurity in several ways:* Reduced Disposable Income:When a significant portion of income is allocated to rent, it reduces the amount of money available for food, leading to food insecurity.

Difficult Choices

High rent costs often force individuals and families to make difficult choices between paying rent and purchasing food. This can result in skipping meals, reducing portion sizes, or relying on less nutritious and cheaper food options.

Financial Stress

The constant pressure of high rent costs can lead to financial stress, which can negatively impact food choices and contribute to food insecurity.

Prevalence of Food Insecurity Among Low-Income Renters

Studies have consistently shown a strong correlation between low-income renters and food insecurity. * Statistics:

A study by the Center on Budget and Policy Priorities found that nearly half of low-income renters in the United States experience food insecurity.

The USDA’s Food Security Survey found that food insecurity rates are significantly higher among low-income renters compared to homeowners.

Examples

In cities with high rent costs, such as New York City and San Francisco, food insecurity rates among low-income renters are particularly high.

In rural areas, where rent affordability is often a challenge, food insecurity rates among low-income renters are also elevated.

Impact of Rent Affordability on Food Access

Rent affordability plays a crucial role in determining access to food. When rent costs are high, it limits the amount of money available for food, leading to food insecurity.* Rent Burdens:Households with high rent burdens (spending more than 30% of their income on rent) are more likely to experience food insecurity.

Food Deserts

In areas with high rent costs, low-income residents may be concentrated in food deserts, areas with limited access to affordable and nutritious food options.

Food Assistance Programs

High rent costs can also make it challenging for low-income renters to access food assistance programs, such as SNAP (Supplemental Nutrition Assistance Program), due to the limited resources available.

Closing Notes: Does Rent Affect Food Stamps

The connection between rent and food security is undeniable. As housing costs continue to rise, the challenge of affording both adequate shelter and nutritious food becomes increasingly acute for low-income families. Understanding the impact of rent on SNAP benefits is crucial for developing effective policies and programs that address food insecurity among renters.

By advocating for policy changes that acknowledge the realities of rent burden and promote housing affordability, we can work towards a future where everyone has access to the food they need to thrive.

Frequently Asked Questions

How does SNAP work?

SNAP provides financial assistance to eligible individuals and families to purchase food at authorized retailers. The amount of SNAP benefits a household receives is based on factors like income, household size, and other expenses, including rent.

What are the eligibility requirements for SNAP?

To qualify for SNAP, individuals and families must meet specific income and asset limits, as well as residency requirements. The program also considers factors like age, disability, and work status.

What is the “shelter deduction” in SNAP calculations?

The shelter deduction is a specific amount subtracted from a household’s income when calculating SNAP benefits. This deduction accounts for housing expenses, including rent, and can vary depending on the state and local housing market.

Can I lose my SNAP benefits if my rent increases?

Yes, a rent increase can potentially impact your SNAP benefits. If the increase significantly affects your overall household income, you may need to reapply for SNAP or experience a reduction in your benefit amount.