Does BAH count as income for food stamps? This question is crucial for many military members and their families who rely on SNAP benefits to supplement their food budgets. The Basic Allowance for Housing (BAH) is a significant portion of a service member’s pay, and its inclusion in income calculations for SNAP eligibility can significantly impact the amount of benefits received.

Understanding the complexities of BAH and SNAP eligibility is vital for service members to make informed decisions about their finances and access the support they need. This article will delve into the intricacies of how BAH is treated for SNAP purposes, exploring the factors that influence its impact on eligibility and the potential implications for SNAP benefits.

BAH as Income for SNAP Eligibility

The Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps, is a federal program that helps low-income individuals and families purchase food. Eligibility for SNAP is determined by factors such as household size, income, and assets. Understanding how the Basic Allowance for Housing (BAH) is treated as income for SNAP purposes is crucial for those who receive BAH and are considering applying for SNAP benefits.

BAH as Income for SNAP Eligibility

The rules regarding BAH as income for SNAP eligibility are complex and can vary depending on the individual’s situation. In general, BAH is considered income for SNAP purposes. This means that the amount of BAH received will be counted towards the household’s total income when determining SNAP eligibility and benefit amount.

However, there are some exceptions to this rule.

The Department of Agriculture (USDA) defines BAH as income for SNAP purposes, and it is included in the household’s total income when calculating eligibility.

Examples of Situations Where BAH Might Be Considered Income for SNAP

The following examples illustrate situations where BAH might be considered income for SNAP purposes:

- Active-duty military personnel:BAH received by active-duty military personnel is generally considered income for SNAP purposes. The amount of BAH received will be included in the household’s total income when determining SNAP eligibility and benefit amount.

- Veterans:Veterans who receive BAH for housing assistance may also have their BAH counted as income for SNAP purposes. However, there may be exceptions, such as if the veteran is receiving BAH for a disability related to their military service.

- Reserve or National Guard members:BAH received by Reserve or National Guard members while on active duty or training is generally considered income for SNAP purposes.

It is important to note that these are just examples, and the specific rules regarding BAH as income for SNAP eligibility can vary depending on the individual’s situation. Individuals who are considering applying for SNAP benefits should consult with their local SNAP office or a qualified benefits advisor to determine their eligibility.

Factors Influencing BAH’s Impact on SNAP Eligibility

The determination of whether BAH counts as income for SNAP eligibility is a complex issue, influenced by various factors, including federal guidelines, state-specific regulations, and the individual’s circumstances.

The interplay of these factors creates a nuanced landscape where the impact of BAH on SNAP eligibility can vary significantly depending on the state and the specific situation.

State-Specific Rules and Regulations

State-specific rules and regulations play a crucial role in determining how BAH is treated for SNAP eligibility. While federal guidelines provide a general framework, states have the authority to implement their own policies, which can lead to variations in how BAH is considered.

- Some states may consider all BAH as income for SNAP purposes, while others may exempt a portion or all of it, particularly for active-duty military personnel.

- States may have different definitions of “income” for SNAP purposes, which can affect how BAH is categorized.

- States may also have specific rules regarding the treatment of BAH for dependents of military personnel.

Comparison of State Treatment of BAH, Does bah count as income for food stamps

The treatment of BAH for SNAP eligibility can vary significantly across states. Some states, such as California, consider BAH as unearned income and exclude it from SNAP eligibility calculations. Other states, such as Texas, consider BAH as earned income and include it in the SNAP eligibility calculations.

| State | Treatment of BAH | Notes |

|---|---|---|

| California | Excluded from SNAP eligibility calculations | BAH is considered unearned income and is not included in the calculation of SNAP benefits. |

| Texas | Included in SNAP eligibility calculations | BAH is considered earned income and is included in the calculation of SNAP benefits. |

| Florida | Partially excluded from SNAP eligibility calculations | BAH is considered earned income but may be partially excluded for active-duty military personnel. |

Implications of BAH on SNAP Benefits

The impact of BAH on SNAP benefits is multifaceted and depends on various factors, including the specific BAH amount, household size, and other income sources. While BAH is generally considered unearned income, its inclusion in SNAP eligibility calculations can significantly affect the amount of SNAP benefits a household receives.

Impact of BAH on SNAP Benefit Amount

The calculation of SNAP benefits is based on a complex formula that considers household income, expenses, and the federal poverty guidelines. BAH, as unearned income, is included in this calculation. This means that the higher the BAH amount, the lower the potential SNAP benefits a household can receive.

How BAH Affects SNAP Benefit Calculation

- Gross Income:BAH is added to other income sources to determine gross income, which is the total income before deductions.

- Net Income:Certain deductions are subtracted from gross income to calculate net income, which is the income used to determine SNAP eligibility and benefit amount.

- SNAP Benefit Calculation:Net income is then compared to the federal poverty guidelines, and the difference is used to calculate the SNAP benefit amount.

Scenarios Illustrating the Impact of BAH on SNAP Benefits

- Scenario 1: Reduced SNAP Benefits

- A single service member with no other income receives a BAH of $1,500 per month.

- This BAH amount is considered income for SNAP purposes, potentially reducing the individual’s SNAP benefit amount.

- In this scenario, the individual may receive a lower SNAP benefit compared to a service member receiving a lower BAH amount.

- Scenario 2: Increased SNAP Benefits

- A service member with a dependent spouse and children receives a BAH of $2,500 per month.

- The household also has other income sources, such as the spouse’s salary, totaling $2,000 per month.

- The combined income of $4,500 per month may still qualify the household for SNAP benefits, but the benefit amount may be lower due to the inclusion of BAH.

Resources and Support for Understanding BAH and SNAP

Navigating the complexities of BAH and SNAP eligibility can be challenging, but fortunately, various resources and support systems are available to assist individuals in understanding their rights and benefits.

Official Resources for BAH and SNAP Information

The following official resources provide comprehensive information about BAH and SNAP eligibility criteria, application procedures, and benefit amounts:

- United States Department of Agriculture (USDA) Food and Nutrition Service (FNS):The USDA FNS is the primary agency responsible for administering SNAP benefits. Their website offers a wealth of information about eligibility requirements, application procedures, and other essential details.

- Department of Defense (DoD) Military OneSource:Military OneSource provides comprehensive support and guidance to service members and their families, including information about BAH and its impact on SNAP eligibility.

- State SNAP Agencies:Each state has a dedicated SNAP agency that manages the program within its jurisdiction. These agencies can provide specific information about SNAP eligibility criteria, benefit levels, and application procedures in the respective state.

Key Contact Information for SNAP and BAH Assistance Programs

| Program | Website | Phone Number |

|---|---|---|

| SNAP (Food Stamps) | https://www.fns.usda.gov/snap | 1-800-221-5689 |

| Military OneSource | https://www.militaryonesource.mil | 1-800-342-9647 |

| State SNAP Agencies | Vary by state | Vary by state |

Organizations Providing Support and Guidance

- National Coalition for the Homeless:This organization advocates for the rights of people experiencing homelessness and provides resources and support regarding SNAP and other benefits.

- Legal Aid Organizations:Legal aid organizations offer free or low-cost legal assistance to low-income individuals, including guidance on SNAP eligibility and appeals.

- Military Family Advisory Network (MFAN):MFAN provides support and resources to military families, including information about BAH and its impact on SNAP eligibility.

- Local Community Action Agencies:These agencies often offer assistance with SNAP applications, eligibility determination, and other social services.

Last Point: Does Bah Count As Income For Food Stamps

The impact of BAH on SNAP eligibility can be a complex issue, with state-specific rules and regulations adding further layers of complexity. Understanding the intricacies of how BAH is treated for SNAP purposes is crucial for service members and their families.

By accessing available resources and seeking guidance from relevant organizations, individuals can navigate these complexities and ensure they receive the support they need.

Essential FAQs

What is BAH?

BAH stands for Basic Allowance for Housing. It is a monthly payment provided by the U.S. military to service members to help cover housing costs.

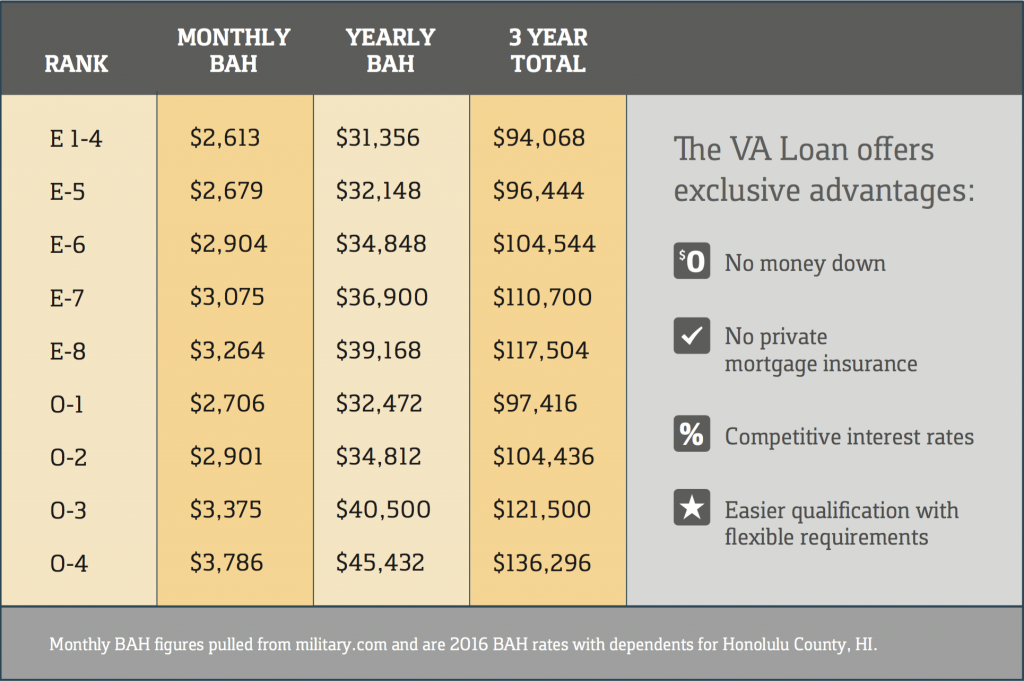

How is BAH calculated?

BAH is calculated based on the service member’s rank, dependents, and location. It is designed to cover the average housing costs in a specific area.

Is BAH always considered income for SNAP?

No, BAH is not always considered income for SNAP purposes. State-specific rules and regulations can influence how BAH is treated for SNAP eligibility.

Where can I find more information about BAH and SNAP?

You can find more information about BAH and SNAP eligibility on the websites of the Department of Defense and the U.S. Department of Agriculture.