What are the income guidelines for food stamps in PA? Navigating the complex world of government assistance programs can be daunting, especially when it comes to essential needs like food. The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, offers vital support to individuals and families struggling with food insecurity.

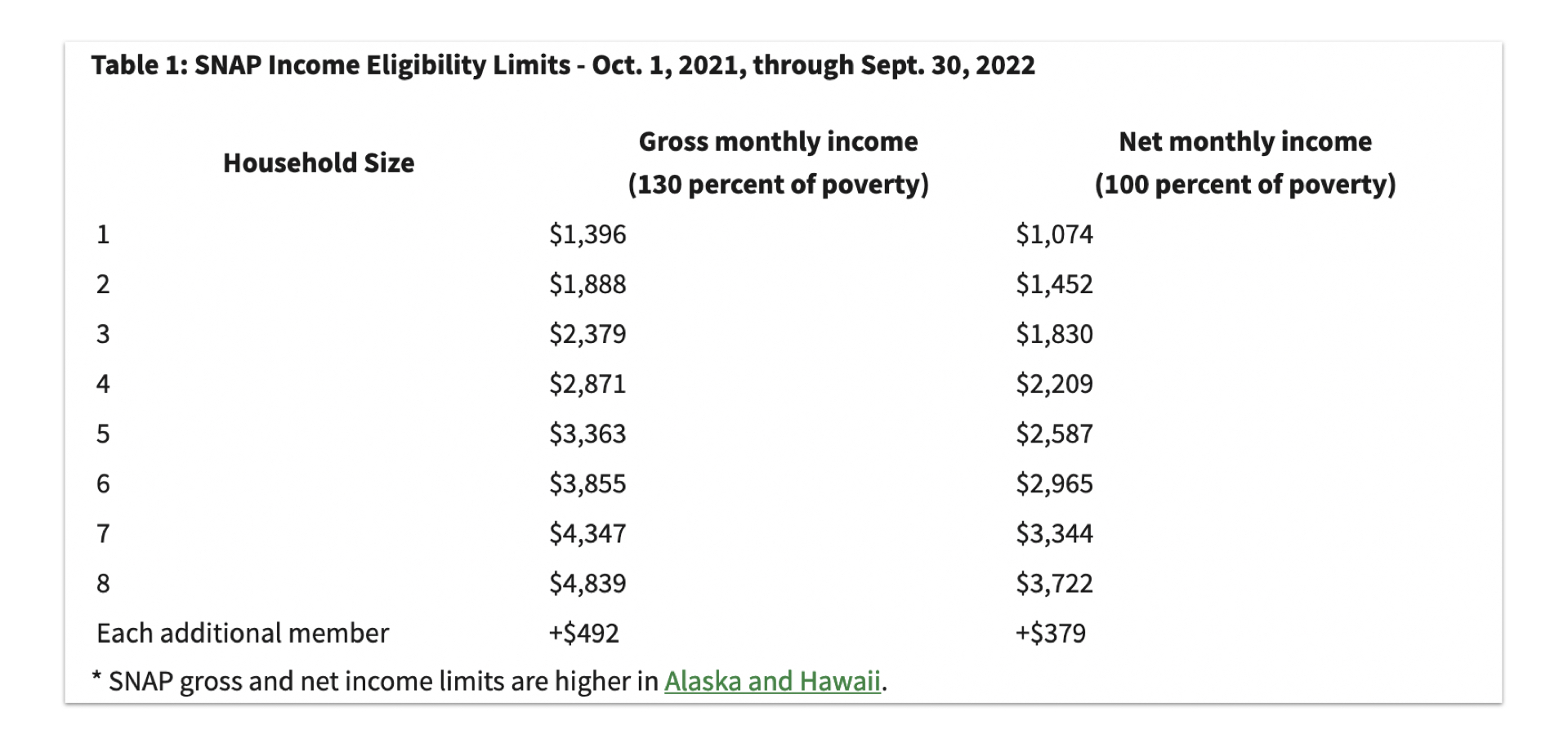

In Pennsylvania, eligibility for SNAP hinges on meeting specific income and asset criteria. Understanding these guidelines is crucial for those seeking to access this valuable resource.

This guide will delve into the income thresholds, asset limits, and deductions that determine SNAP eligibility in Pennsylvania. We will explore the application process, available resources, and provide insights into the impact of SNAP on individuals and families across the state.

Asset Limits for SNAP in Pennsylvania

The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, has asset limits that individuals and families must meet to be eligible for benefits. These limits are designed to ensure that SNAP benefits are targeted towards those with the greatest financial need.

Types of Assets Counted

The asset limits for SNAP in Pennsylvania apply to the total value of assets owned by all members of the household. These assets include:

- Cash

- Checking and savings accounts

- Stocks and bonds

- Real estate (excluding the primary residence)

- Vehicles (with some exceptions)

- Other valuable possessions, such as jewelry or artwork

Deductions from Income for SNAP in Pennsylvania

The Pennsylvania Department of Human Services (DHS) allows for certain deductions from your income when determining your eligibility for SNAP benefits. These deductions help to ensure that your income is accurately reflected and that you receive the benefits you are entitled to.

Deductions for Work Expenses, What are the income guidelines for food stamps in pa

Work expenses are essential costs associated with earning income. These deductions can significantly reduce your countable income, making you eligible for SNAP benefits or increasing the amount of benefits you receive.

- Child Care Costs:You can deduct the actual cost of child care expenses for children under 13 years old who are necessary for you to work or look for work. This deduction applies to both employed and unemployed individuals.

- Dependent Care Expenses:If you are caring for a dependent who is 60 years or older or has a disability, you may deduct the actual cost of dependent care expenses incurred to allow you to work or look for work.

- Job Training and Education Expenses:You can deduct the actual costs of job training or education expenses incurred to improve your job skills and increase your earning potential. This deduction applies to both employed and unemployed individuals.

- Job-Related Transportation Costs:If you use public transportation, you can deduct the actual cost of fares or mileage expenses for driving to and from work.

- Job-Related Uniforms and Work Clothing:You can deduct the actual cost of work uniforms and clothing that are not suitable for everyday wear and are required for your job.

Deductions for Medical Expenses

Medical expenses can be significant and can impact your ability to meet basic needs. These deductions can help reduce your countable income and improve your SNAP eligibility.

- Medical Expenses for You or Your Household Members:You can deduct medical expenses for yourself or other members of your household, including insurance premiums, copayments, deductibles, and other medical bills.

- Child Support Payments:You can deduct child support payments you make for children living outside your household.

- Deductions for Certain Disabled Individuals:Individuals receiving Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI) are automatically exempt from certain income and asset tests, making them more likely to qualify for SNAP benefits.

Deductions for Other Expenses

Other expenses can impact your ability to meet basic needs and can be deducted to accurately reflect your income.

- Shelter Costs:You can deduct actual shelter costs, including rent, mortgage payments, property taxes, and insurance.

- Home Energy Costs:You can deduct actual home energy costs, including heating, cooling, and electricity.

- Telephone Costs:You can deduct actual telephone costs for a basic telephone service.

- Other Deductions:You may also be eligible for deductions for certain other expenses, such as court-ordered alimony or child support payments.

Table of Common Deductions and Maximum Amounts

| Deduction | Maximum Amount |

|---|---|

| Child Care Costs | Actual cost of child care expenses |

| Dependent Care Expenses | Actual cost of dependent care expenses |

| Job Training and Education Expenses | Actual cost of job training or education expenses |

| Job-Related Transportation Costs | Actual cost of public transportation fares or mileage expenses |

| Job-Related Uniforms and Work Clothing | Actual cost of work uniforms and clothing |

| Medical Expenses | Actual cost of medical expenses |

| Child Support Payments | Actual amount of child support payments |

| Shelter Costs | Actual cost of shelter expenses |

| Home Energy Costs | Actual cost of home energy expenses |

| Telephone Costs | Actual cost of basic telephone service |

Claiming Deductions on SNAP Applications

To claim deductions on your SNAP application, you will need to provide documentation to support your expenses. This documentation may include:

- Pay stubs or other income documentation

- Child care bills or receipts

- Medical bills or insurance statements

- Rent or mortgage statements

- Utility bills

- Telephone bills

It is important to keep accurate records of your expenses, as you will need them to support your SNAP application.

Applying for SNAP in Pennsylvania

Applying for SNAP in Pennsylvania is a straightforward process. You can apply online, by mail, or in person. Regardless of your chosen method, you will need to provide certain documents to prove your eligibility.

Applying for SNAP Online

Applying for SNAP online is the most convenient option. You can access the online application through the COMPASS website. The online application is user-friendly and allows you to submit your application and supporting documents electronically.

Applying for SNAP by Mail

If you prefer to apply by mail, you can download a SNAP application form from the COMPASS website or request one by calling the COMPASS Customer Service Center. Once you complete the application, you can mail it to the address provided on the form.

Applying for SNAP in Person

You can also apply for SNAP in person at a local County Assistance Office (CAO). The CAO will assist you in completing the application and provide guidance on the necessary documents.

Required Documents for SNAP Application

You will need to provide the following documents when applying for SNAP:

- Proof of Income: This can include pay stubs, tax returns, Social Security statements, unemployment benefits, or other income sources.

- Proof of Identity: This can include a driver’s license, passport, birth certificate, or other government-issued ID.

- Proof of Residency: This can include a utility bill, bank statement, lease agreement, or other document with your name and address.

- Social Security Numbers: You will need to provide the Social Security numbers for all household members.

Steps Involved in the SNAP Application Process

The SNAP application process involves the following steps:

- Complete the application: You can complete the application online, by mail, or in person.

- Submit the application: Once you complete the application, you will need to submit it to the COMPASS website, by mail, or at a CAO.

- Interview: You may be required to attend an interview with a caseworker to discuss your application and verify your eligibility.

- Verification: The caseworker will verify the information you provided on your application. This may involve contacting your employer, landlord, or other sources.

- Decision: Once the verification process is complete, the caseworker will make a decision on your SNAP application. You will be notified of the decision in writing.

Resources for SNAP in Pennsylvania

Navigating the SNAP program can be challenging, but Pennsylvania offers a variety of resources to assist individuals and families in accessing this vital program. This section will provide a comprehensive overview of these resources, ensuring that those in need can find the support they require.

Pennsylvania Department of Human Services Website

The Pennsylvania Department of Human Services (DHS) website serves as a central hub for all SNAP-related information in Pennsylvania. It provides detailed information on eligibility requirements, application procedures, program benefits, and contact information for local SNAP offices. The website also offers a wealth of resources, including frequently asked questions, program updates, and online application forms.

Local SNAP Offices

Pennsylvania has a network of local SNAP offices located throughout the state. These offices provide personalized assistance to individuals and families applying for SNAP benefits. They offer guidance on completing applications, understanding eligibility requirements, and resolving any issues that may arise during the application process.

To locate the nearest SNAP office, individuals can use the online directory available on the Pennsylvania DHS website.

SNAP Outreach Programs

Pennsylvania is committed to ensuring that all eligible individuals and families have access to SNAP benefits. To achieve this goal, the state has implemented various outreach programs aimed at raising awareness about SNAP and assisting eligible individuals in applying for benefits.

These programs often partner with community organizations, food banks, and other social service agencies to reach out to underserved populations.

Assistance Services

In addition to the resources provided by the Pennsylvania DHS, several organizations offer assistance services to individuals and families applying for SNAP benefits. These services may include:

- Help with completing application forms

- Guidance on navigating the application process

- Advocacy for individuals facing challenges in accessing SNAP benefits

- Financial literacy education

These organizations often have a deep understanding of the SNAP program and can provide invaluable support to individuals and families seeking assistance.

Benefits of Participating in SNAP

SNAP benefits play a crucial role in ensuring food security for individuals and families across Pennsylvania. Participating in SNAP offers numerous benefits, including:

- Improved food security: SNAP provides financial assistance for food purchases, ensuring that individuals and families have access to nutritious meals.

- Enhanced health outcomes: Adequate nutrition is essential for overall health and well-being. SNAP benefits can help individuals and families make healthier food choices, reducing the risk of chronic diseases.

- Increased economic stability: SNAP benefits can help individuals and families manage their budgets, freeing up resources for other essential needs such as housing, healthcare, and education.

- Reduced food insecurity for children: SNAP benefits are particularly important for families with children, as they ensure that children have access to the nourishment they need to grow and thrive.

Last Recap

Understanding the income guidelines for SNAP in Pennsylvania is a critical step towards accessing this essential program. By meeting the eligibility requirements, individuals and families can gain access to vital food assistance, promoting their well-being and contributing to a more secure and stable community.

Navigating the application process can be challenging, but with the right resources and knowledge, individuals can confidently pursue the benefits they deserve.

Question Bank: What Are The Income Guidelines For Food Stamps In Pa

What are the income limits for a family of four in Pennsylvania?

The income limits for a family of four in Pennsylvania vary depending on whether it is gross or net income. The maximum gross income is $4,000 per month, while the maximum net income is $2,622 per month.

Can I apply for SNAP if I am working?

Yes, you can still apply for SNAP even if you are working. SNAP considers your work expenses and other deductions when determining your eligibility.

What happens if I am denied SNAP?

If your SNAP application is denied, you have the right to appeal the decision. You can contact your local SNAP office or the Pennsylvania Department of Human Services to learn more about the appeals process.

How long does it take to receive SNAP benefits after applying?

The processing time for SNAP applications varies depending on the individual case. However, you can expect to receive a decision within 30 days of submitting your application.