What are the income requirements for food stamps in georgia – Wondering if you qualify for food stamps in Georgia? You’re not alone! Food stamps, officially known as SNAP (Supplemental Nutrition Assistance Program), can be a lifeline for many Georgians struggling to put food on the table. But to get these benefits, you need to meet certain income requirements.

This guide breaks down the details, from how income is calculated to the specific limits for different household sizes. Let’s dive in and see if you might be eligible.

Understanding the income requirements for food stamps in Georgia is crucial for those who need assistance. It’s not just about your paycheck, though. Factors like your household size, other income sources, and even your assets can affect your eligibility.

We’ll clarify all of this, so you can determine if food stamps are a good option for you and your family.

Eligibility for Food Stamps in Georgia

The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, is a federal program that helps low-income families and individuals purchase food. In Georgia, the program is administered by the Department of Human Services (DHS). To be eligible for SNAP benefits in Georgia, you must meet specific income and resource requirements.

Income Requirements

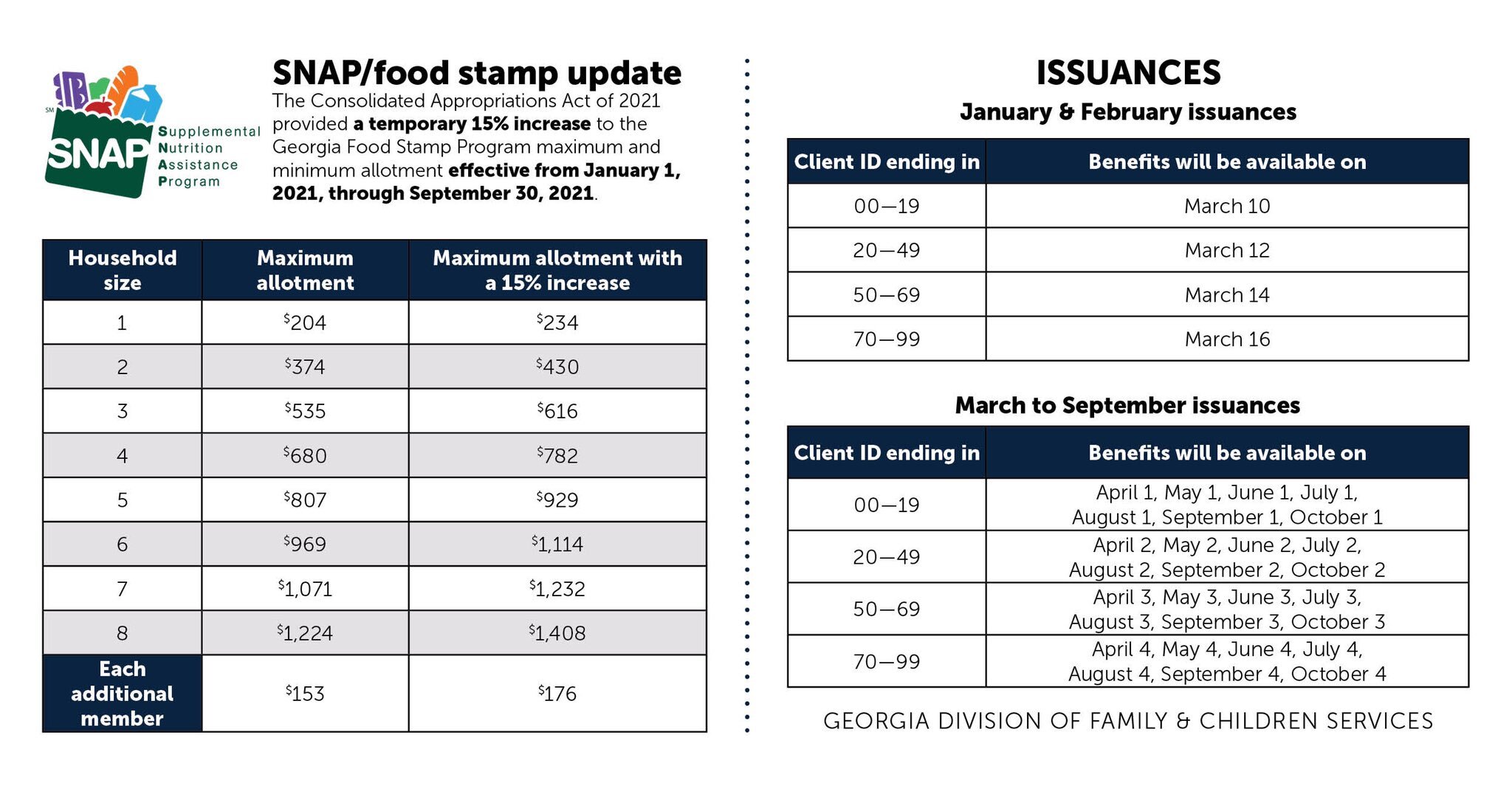

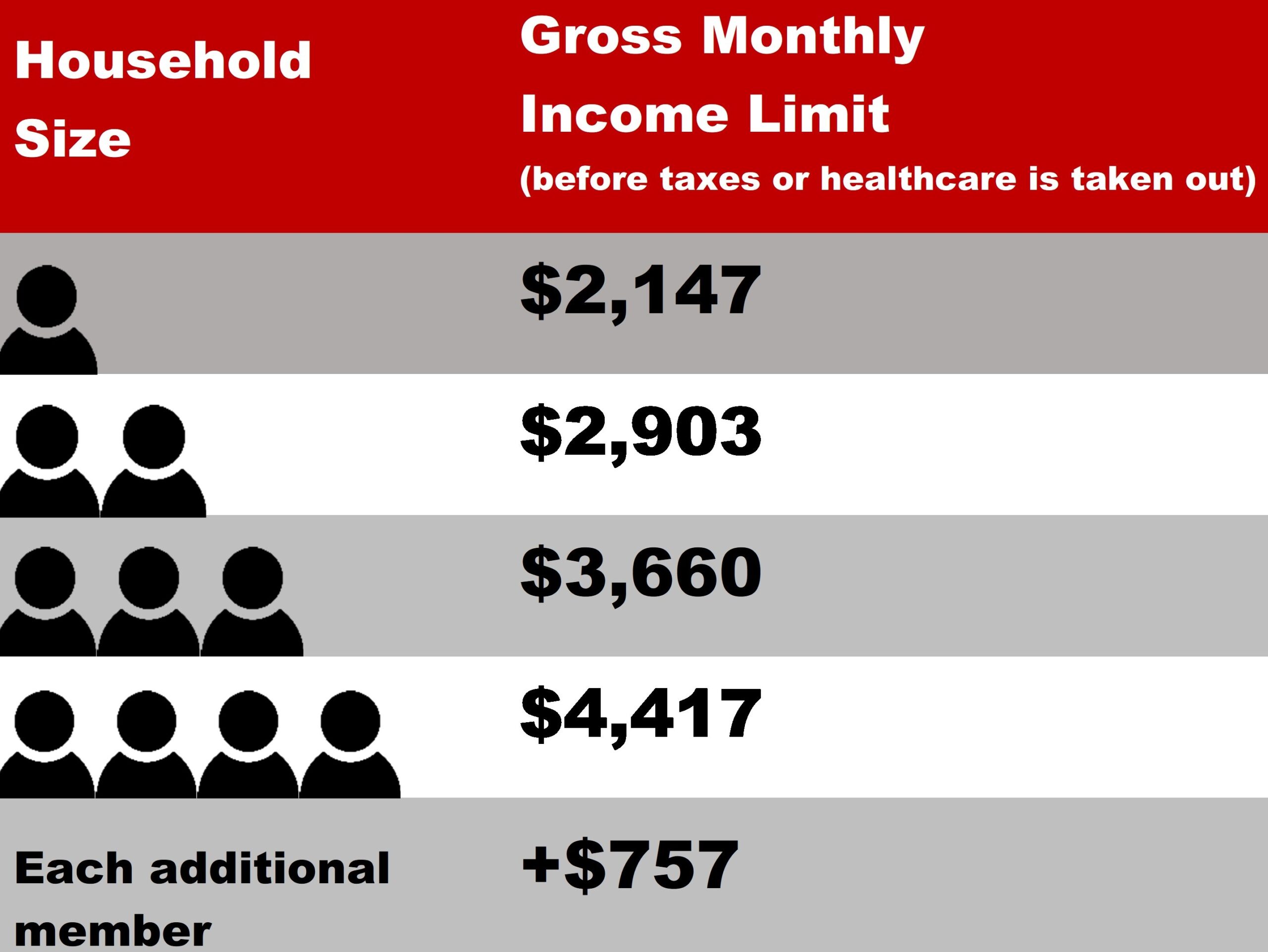

The amount of income you can earn and still qualify for SNAP benefits depends on your household size. The income limits are adjusted regularly based on the federal poverty guidelines. The gross monthly income of your household cannot exceed 130% of the federal poverty guidelines.

For example, a household of one person in Georgia cannot have a gross monthly income over $1,717. A household of four people cannot have a gross monthly income over $3,025.

Household Size

The size of your household is a key factor in determining your eligibility for SNAP benefits. This includes all individuals who live in your home and rely on you for financial support, regardless of their relationship to you. This could include children, spouses, parents, siblings, or other relatives.

Resources

Resources are assets that you own, such as cash, savings accounts, and real estate. The value of your resources cannot exceed a certain limit to be eligible for SNAP.

Age

Age is not a determining factor in SNAP eligibility.

Disability

Individuals with disabilities may be eligible for additional benefits, such as a higher income limit or a waiver of work requirements.

Work Status, What are the income requirements for food stamps in georgia

You are not required to be employed to be eligible for SNAP benefits. However, you must be able to work and actively seeking employment if you are able-bodied and between the ages of 18 and 49.

Income Requirements for Food Stamps in Georgia

.png?itok=9He4Ntt0)

The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, is a federal program that provides financial assistance to low-income households to purchase food. In Georgia, the income requirements for SNAP eligibility are determined by household size and income levels.

Income Thresholds Based on Household Size

The income thresholds for SNAP eligibility in Georgia vary depending on the number of people in the household. These thresholds represent the maximum gross monthly income a household can have to qualify for SNAP benefits.

- 1 person: $1,775

- 2 people: $2,395

- 3 people: $3,015

- 4 people: $3,635

- 5 people: $4,255

- 6 people: $4,875

- 7 people: $5,495

- 8 people: $6,115

Calculating Gross Income and Net Income

To determine SNAP eligibility, the Georgia Department of Human Services (DHS) calculates both gross income and net income.

Gross Income

Gross income is the total income received from all sources, before taxes or deductions. This includes:

- Wages and salaries

- Self-employment income

- Unemployment benefits

- Social Security benefits

- Pension payments

- Child support received

- Alimony received

- Other income, such as interest, dividends, and capital gains

Net Income

Net income is the gross income minus certain allowable deductions. These deductions may include:

- Work-related expenses, such as child care costs and transportation

- Medical expenses

- Housing expenses

- Dependent care expenses

- Other allowable deductions

Income Requirements for Different Types of Income

The income requirements for SNAP eligibility vary depending on the source of income.

Wages and Salaries

Wages and salaries are counted as gross income for SNAP eligibility. The gross income from wages and salaries is the amount earned before taxes and deductions.

Self-Employment Income

Self-employment income is also counted as gross income for SNAP eligibility. The gross income from self-employment is calculated as the total revenue minus business expenses.

Benefits

Certain benefits, such as unemployment benefits and Social Security benefits, are counted as gross income for SNAP eligibility. However, some benefits, such as TANF (Temporary Assistance for Needy Families) and SSI (Supplemental Security Income), are excluded from gross income for SNAP eligibility.

“In Georgia, the income requirements for SNAP eligibility are based on gross income, which includes all income from all sources, before taxes or deductions.”

Calculating Income for Food Stamps in Georgia

The income requirements for SNAP in Georgia are calculated based on your gross and net income. Gross income is your total income before deductions, while net income is your income after deductions. Understanding how to calculate these figures is crucial for determining your eligibility for SNAP benefits.

Gross Income

Gross income includes all income received by members of your household, such as:

- Wages and salaries

- Self-employment income

- Unemployment benefits

- Social Security benefits

- Pension and retirement income

- Alimony and child support payments received

- Interest and dividends

- Rental income

- Government assistance, such as TANF or SSI

It is essential to report all sources of income, even if you believe it is insignificant, as it could affect your SNAP eligibility.

Net Income

Net income is your gross income minus certain allowable deductions. These deductions can significantly reduce your income and increase your chances of qualifying for SNAP.

- Work Expenses: These include deductions for transportation costs to and from work, work-related child care expenses, and uniform costs.

- Child Care Costs: This deduction covers the cost of child care for children under 13 years old while the parent is working or looking for work.

- Medical Expenses: You can deduct medical expenses that exceed a certain percentage of your gross income.

- Housing Expenses: These include rent or mortgage payments, property taxes, and homeowner’s insurance premiums.

- Other Deductions: Other allowable deductions include dependent care expenses, court-ordered child support payments, and certain disability-related expenses.

The exact amount of these deductions may vary depending on your individual circumstances.

Income Limits for Different Household Sizes

The following table shows the maximum gross and net income limits for different household sizes in Georgia. Remember, these are just maximum limits, and your actual income may need to be lower to qualify for SNAP.

| Household Size | Gross Income Limit | Net Income Limit |

|---|---|---|

| 1 | $1,600 | $1,100 |

| 2 | $2,150 | $1,450 |

| 3 | $2,700 | $1,800 |

| 4 | $3,250 | $2,150 |

| 5 | $3,800 | $2,500 |

| 6 | $4,350 | $2,850 |

| 7 | $4,900 | $3,200 |

| 8 | $5,450 | $3,550 |

Important Note:These income limits are subject to change. For the most up-to-date information, contact the Georgia Department of Human Services.

Summary: What Are The Income Requirements For Food Stamps In Georgia

Navigating the world of food stamps can be confusing, but hopefully, this guide has provided some clarity. Remember, there are resources available to help you apply and understand the process. Don’t hesitate to reach out to your local SNAP office or a community organization for assistance.

And if you’re struggling with food insecurity, know that you’re not alone, and there are programs in place to help. Let’s work together to ensure everyone in Georgia has access to the food they need.

Question Bank

What if I’m working but still struggling to afford groceries?

SNAP is designed to help working individuals and families, too! Even if you have a job, your income might still be below the eligibility limits. Don’t be afraid to apply – you might be surprised at what you qualify for.

Can I get food stamps if I’m receiving other benefits like unemployment?

Yes, unemployment benefits are considered income when determining SNAP eligibility. However, the amount of your unemployment benefits can affect your overall income level and potentially impact your eligibility for food stamps.

What if I’m a student? Do I qualify for food stamps?

Students can qualify for SNAP if they meet the income requirements and other eligibility criteria. You may need to provide proof of enrollment and income, so be prepared to gather those documents.