Can food stamps see 1099 income reddit – Navigating the complex world of government assistance programs like SNAP (Supplemental Nutrition Assistance Program), commonly known as food stamps, can be challenging, especially for those with 1099 income. The question of whether SNAP authorities can see your 1099 income often arises on platforms like Reddit, sparking discussions about eligibility and reporting requirements.

Understanding the intricacies of SNAP eligibility and reporting for self-employed individuals is crucial for accessing this vital resource.

This guide aims to provide clarity on how 1099 income is treated within the SNAP program. We’ll delve into the specifics of eligibility requirements, income reporting procedures, and the impact of 1099 income on benefit calculations. By understanding these key aspects, you can ensure you are accurately reporting your income and maximizing your potential benefits.

Understanding SNAP Eligibility: Can Food Stamps See 1099 Income Reddit

The Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps, provides financial assistance to low-income households to purchase food. Eligibility for SNAP benefits is determined by several factors, including income, household size, and assets.

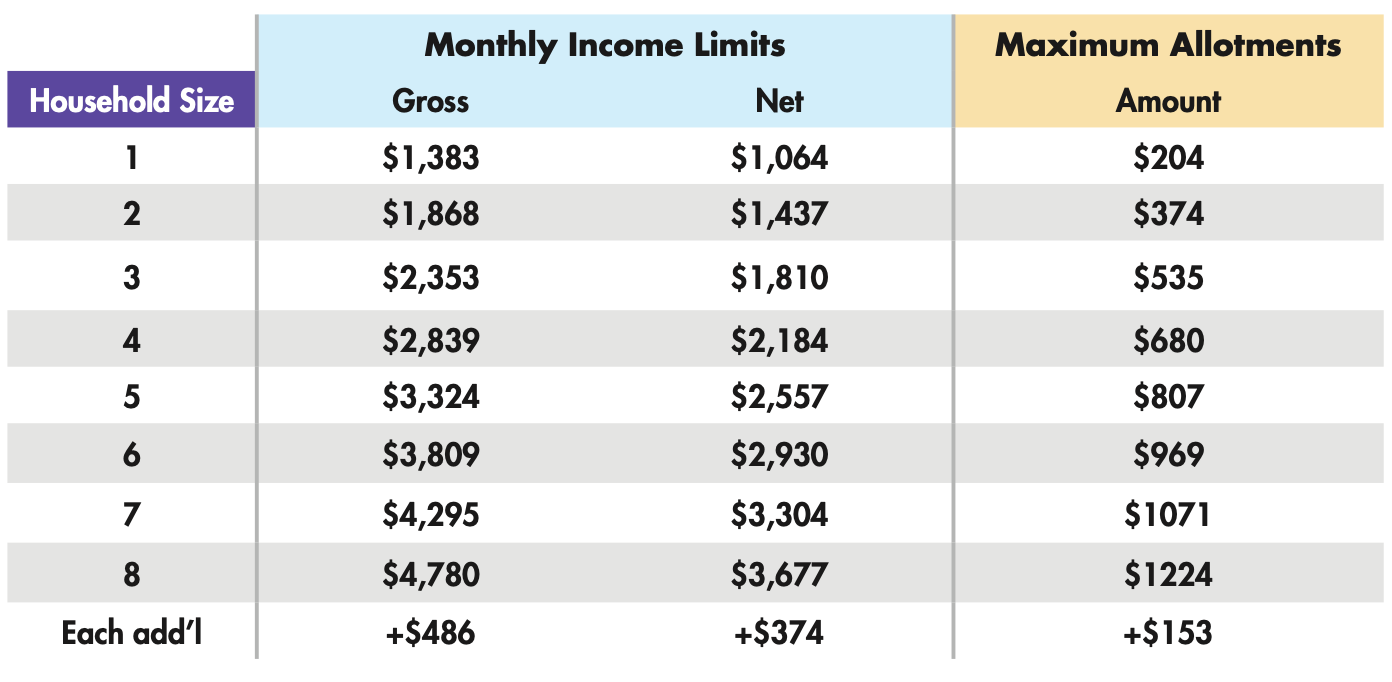

Income Limits

Income limits for SNAP recipients are determined by the household’s size and the state in which they reside. These limits are adjusted periodically to reflect changes in the cost of living. The gross monthly income of a household must be below a certain threshold to qualify for SNAP benefits.

For example, a household of one person in New York City in 2023 can have a gross monthly income of up to $2,343 to be eligible for SNAP benefits.

For households with more members, the income limit increases accordingly.

Income Eligibility for Self-Employed Individuals

Self-employed individuals and those with 1099 income are also eligible for SNAP benefits. However, they must meet specific requirements to prove their income and expenses.

- Self-Employment Income:Self-employed individuals must provide documentation of their income and expenses, such as tax returns, bank statements, and invoices.

- 1099 Income:Individuals receiving 1099 income must provide documentation of their income and expenses, such as tax forms, bank statements, and invoices.

- Net Income:The income used to determine SNAP eligibility for self-employed individuals is their net income, which is their gross income minus their business expenses.

- Deductions:Self-employed individuals can deduct business expenses, such as rent, utilities, supplies, and advertising, from their gross income to determine their net income.

Income Verification

The SNAP program requires applicants to provide documentation to verify their income. This documentation may include:

- Pay stubs:For individuals with regular employment.

- Tax returns:For self-employed individuals and those with 1099 income.

- Bank statements:To verify income and expenses.

- Social Security statements:To verify retirement income.

Reporting 1099 Income to SNAP

When you receive income from self-employment or other sources that are reported on a 1099 form, you must report this income to your state’s SNAP agency. This is essential to ensure you are receiving the correct amount of benefits.

Methods for Reporting 1099 Income

You can report your 1099 income to SNAP authorities through several methods. These methods are designed to be accessible and convenient for individuals:

- Online Portal:Many states have online portals where you can report changes in your income and other circumstances affecting your SNAP eligibility. These portals are often user-friendly and allow for quick updates.

- Phone:You can contact your local SNAP office by phone to report your 1099 income. This option is particularly helpful for those who prefer verbal communication or need assistance with the reporting process.

- Mail:Some states allow you to report changes in income by mail. You can obtain the necessary forms from your local SNAP office or download them from their website.

- In-Person:You can visit your local SNAP office in person to report your income. This method allows for face-to-face interaction and clarification of any questions you might have.

Frequency of Income Reporting

The frequency with which you need to report your 1099 income to SNAP depends on your state’s specific requirements. However, most states require you to report changes in your income:

- Monthly:Some states require you to report any changes in your income on a monthly basis. This ensures that your SNAP benefits are adjusted promptly to reflect your current financial situation.

- Quarterly:Other states may require you to report income changes on a quarterly basis, which means every three months.

- Annually:Some states may require you to report your income annually, typically during the recertification process for your SNAP benefits.

Deadlines for Reporting Income

Each state has specific deadlines for reporting changes in income to SNAP. It’s crucial to adhere to these deadlines to avoid any disruptions in your benefits. You can find the specific deadlines for your state on the SNAP website or by contacting your local SNAP office.

Consequences of Failing to Report Income, Can food stamps see 1099 income reddit

Failing to report your 1099 income accurately and promptly can lead to several consequences, including:

- Overpayment of Benefits:If you receive SNAP benefits while failing to report your income, you may be overpaid. This overpayment will need to be repaid, potentially with penalties.

- Suspension or Termination of Benefits:In some cases, failing to report income accurately can result in the suspension or termination of your SNAP benefits.

- Criminal Charges:In extreme cases, failing to report income to SNAP can result in criminal charges. This is typically reserved for instances of intentional fraud or deception.

1099 Income and SNAP Benefit Calculation

The Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps, is a federal program that provides food assistance to low-income individuals and families. SNAP benefits are calculated based on household income, expenses, and other factors. 1099 income, which is income earned from self-employment or independent contracting, is considered when determining SNAP eligibility and benefit amounts.Understanding how 1099 income affects SNAP benefits is crucial for individuals who rely on this program for food assistance.

Calculating SNAP Benefits with 1099 Income

When calculating SNAP benefits, 1099 income is considered as gross income, meaning the total amount earned before deductions. This income is then used to determine the household’s net income, which is the income remaining after certain deductions are subtracted. The net income is then compared to the SNAP income eligibility guidelines to determine if the household qualifies for benefits.

The SNAP benefit calculation formula is: Net Income = Gross Income

Deductions.

Impact of Different 1099 Income Types

Different types of 1099 income can impact SNAP eligibility and benefits differently. For example, income from a side hustle that generates income only occasionally may have a less significant impact than income from a full-time independent contracting job.

- Occasional Income:Income earned from occasional 1099 work, such as occasional freelance projects or part-time gigs, may be considered “casual” income, and SNAP rules allow for some flexibility in how this income is reported. However, it’s crucial to report all income accurately, even if it’s infrequent.

- Regular Income:Income from a regular 1099 job, such as full-time freelance writing or a consistent independent contracting position, is generally considered a significant source of income. This income will be factored into the SNAP benefit calculation, potentially affecting eligibility and benefit amount.

Examples of 1099 Income Affecting SNAP Benefits

Here are some examples of how 1099 income can affect SNAP benefits:

- Example 1:A single individual earns $1,000 per month from a regular 1099 job. After deductions, their net income is $800. Based on their state’s SNAP eligibility guidelines, they may be eligible for benefits, but the amount will be reduced due to their income.

- Example 2:A family of four earns $2,500 per month from a combination of wages and 1099 income. After deductions, their net income is $2,000. Their SNAP benefits may be reduced or even eliminated, depending on their state’s eligibility guidelines.

Resources for 1099 Income and SNAP

Navigating the complexities of SNAP benefits while receiving 1099 income can be challenging. This section provides a comprehensive guide to valuable resources that can help you understand your eligibility and manage your benefits effectively.

State SNAP Offices

State SNAP offices are your primary point of contact for all SNAP-related inquiries and assistance. They can provide personalized guidance on eligibility requirements, reporting income, and navigating the application process. You can find your state’s SNAP office contact information on the USDA Food and Nutrition Service website.

- The USDA Food and Nutrition Service website offers a comprehensive list of state SNAP offices, complete with contact information, including phone numbers, email addresses, and physical addresses. This centralized resource ensures you can easily locate the appropriate office for your state.

Federal Agencies

Several federal agencies play a crucial role in administering and regulating SNAP benefits. These agencies provide valuable information, resources, and support for SNAP recipients, particularly those with 1099 income.

- The USDA Food and Nutrition Service (FNS) is the primary federal agency responsible for administering SNAP. The FNS website offers a wealth of information on SNAP eligibility, benefits, and program guidelines. It also provides resources for SNAP recipients, including frequently asked questions, program updates, and contact information for state SNAP offices.

- The Internal Revenue Service (IRS) provides essential guidance on reporting 1099 income. Understanding your tax obligations is crucial for accurate SNAP benefit calculations. The IRS website offers resources on tax filing, deductions, and credits for self-employed individuals, which can be relevant for SNAP recipients with 1099 income.

Online Resources

The internet provides a vast array of helpful resources for SNAP recipients with 1099 income. These online platforms offer valuable information, tools, and support to help you navigate the complexities of SNAP benefits and 1099 income.

- The National Coalition for the Homeless (NCH) website offers a comprehensive guide to SNAP benefits, including information on eligibility, income reporting, and other relevant topics. The NCH website is a valuable resource for understanding your rights and navigating the SNAP program.

- The Center on Budget and Policy Priorities (CBPP) website provides in-depth analysis of SNAP policy and its impact on low-income families. The CBPP website offers valuable insights into SNAP program changes, potential challenges, and policy recommendations. It’s a valuable resource for staying informed about SNAP-related issues.

- The Benefits.gov website is a centralized platform for finding and applying for federal benefits, including SNAP. It provides a user-friendly interface for accessing information and applying for benefits online. Benefits.gov is a convenient and efficient resource for SNAP recipients.

Informational Materials

Several organizations and government agencies provide informational materials that can help you understand SNAP eligibility and income reporting requirements. These materials can be particularly helpful for recipients with 1099 income.

- The USDA Food and Nutrition Service publishes a variety of brochures, pamphlets, and fact sheets on SNAP. These materials provide clear and concise information on SNAP eligibility, income reporting, and other program aspects. You can find these resources on the FNS website or by contacting your state SNAP office.

- The National Coalition for the Homeless (NCH) offers several publications and resources specifically tailored to SNAP recipients. These materials provide practical guidance on navigating the SNAP program, understanding your rights, and accessing available resources.

- The Center on Budget and Policy Priorities (CBPP) publishes research reports and policy briefs that analyze SNAP program changes and their impact on low-income families. These publications provide valuable insights into SNAP policy and its implications for recipients with 1099 income.

Common Misconceptions and Clarifications

There are several common misconceptions about 1099 income and SNAP eligibility. Understanding these misconceptions and the correct information can help individuals avoid potential issues and ensure they receive the benefits they qualify for.It’s important to remember that SNAP eligibility is determined by factors such as household size, income, and expenses.

While 1099 income is considered when determining SNAP eligibility, it’s not treated the same as other forms of income.

1099 Income Is Not Always Treated the Same as Other Income

Many individuals believe that 1099 income is treated the same as other forms of income when calculating SNAP benefits. This is a common misconception. While 1099 income is considered, it’s not always calculated in the same way as wages from a traditional job.

- Average Monthly Income:For 1099 income, SNAP benefits are typically calculated based on an average monthly income, rather than a single month’s income. This means that your income for the past three months or a longer period may be used to determine your SNAP eligibility.

- Deductions:Some expenses associated with self-employment, such as business expenses, can be deducted from 1099 income when calculating SNAP eligibility. This can potentially reduce your countable income and increase your SNAP benefits.

1099 Income Does Not Automatically Disqualify You from SNAP

Another common misconception is that having 1099 income automatically disqualifies you from SNAP. This is not true. You can still be eligible for SNAP even if you have 1099 income, as long as your total income and expenses meet the eligibility criteria.

Self-Employment Income vs. Other Forms of Income

Self-employment income, as reported on a 1099 form, is different from other forms of income, such as wages from a traditional job. This difference can impact how SNAP benefits are calculated.

- Flexibility in Reporting:1099 income can be more flexible in terms of reporting. You can choose to report your income on a monthly, quarterly, or annual basis. This flexibility can affect how your income is considered for SNAP eligibility.

- Deductions:As mentioned earlier, business expenses associated with self-employment can be deducted from 1099 income, potentially reducing your countable income. These deductions are not available for other forms of income, such as wages from a traditional job.

It’s crucial to understand that 1099 income is considered when determining SNAP eligibility, but it’s not treated the same as other forms of income.

Legal and Ethical Considerations

It is crucial to understand the legal and ethical implications of reporting your 1099 income to SNAP accurately. Failure to do so can result in serious consequences, including fines, imprisonment, and even the loss of SNAP benefits.

Reporting 1099 Income Accurately

Reporting your 1099 income accurately to SNAP is a legal obligation. The Supplemental Nutrition Assistance Program (SNAP) requires participants to report all income, including self-employment income, to determine eligibility and benefit levels. Failing to report income accurately can be considered fraud, leading to serious legal repercussions.

Potential Penalties for Fraud or Misrepresentation

Misrepresenting your income to SNAP can lead to various penalties, including:

- Fines:The amount of the fine can vary depending on the severity of the fraud.

- Imprisonment:In severe cases, individuals found guilty of SNAP fraud can face imprisonment.

- Loss of SNAP benefits:SNAP benefits can be terminated for a period of time or permanently if fraud is proven.

- Criminal record:A conviction for SNAP fraud can result in a criminal record, potentially affecting future employment and other opportunities.

It’s important to note that even unintentional errors can lead to penalties. Therefore, it’s essential to be meticulous and accurate when reporting your income.

Ethical Conduct in Applying for and Receiving SNAP Benefits

Receiving SNAP benefits is a privilege, and it’s essential to conduct yourself ethically throughout the process. This includes:

- Honesty and Transparency:Being honest and transparent about your income and circumstances is crucial. This includes reporting all income sources, even if you believe it might affect your eligibility.

- Respect for the Program:Treat SNAP benefits with respect and use them only for their intended purpose, which is to purchase food.

- Understanding Eligibility Criteria:Familiarize yourself with the eligibility criteria for SNAP and ensure you meet the requirements.

Ethical conduct not only protects you from legal consequences but also ensures the integrity of the SNAP program and its ability to serve those who genuinely need it.

Last Point

Successfully navigating the SNAP program with 1099 income requires careful attention to detail and accurate reporting. While the process may seem complex, it’s essential to remember that SNAP is designed to help individuals and families in need. By understanding the rules, seeking guidance from state and federal resources, and maintaining ethical conduct, you can ensure you are receiving the support you are entitled to.

Remember, accurate reporting is crucial for both your eligibility and the integrity of the program itself.

Clarifying Questions

What happens if I don’t report my 1099 income to SNAP?

Failing to report your 1099 income accurately can result in overpayment of benefits, which you may be required to repay. In some cases, it can also lead to penalties or even program disqualification.

How often do I need to report my 1099 income to SNAP?

The frequency of income reporting varies by state. You may be required to report changes in income monthly, quarterly, or annually. Contact your state SNAP office for specific reporting requirements.

Can I use my 1099 income to determine my SNAP eligibility?

No, you cannot use your 1099 income alone to determine eligibility. SNAP considers a variety of factors, including household size, expenses, and other income sources.

What if I have both 1099 income and a regular job?

Both types of income are considered when calculating your SNAP benefits. You will need to report all income sources to ensure accurate benefit determination.