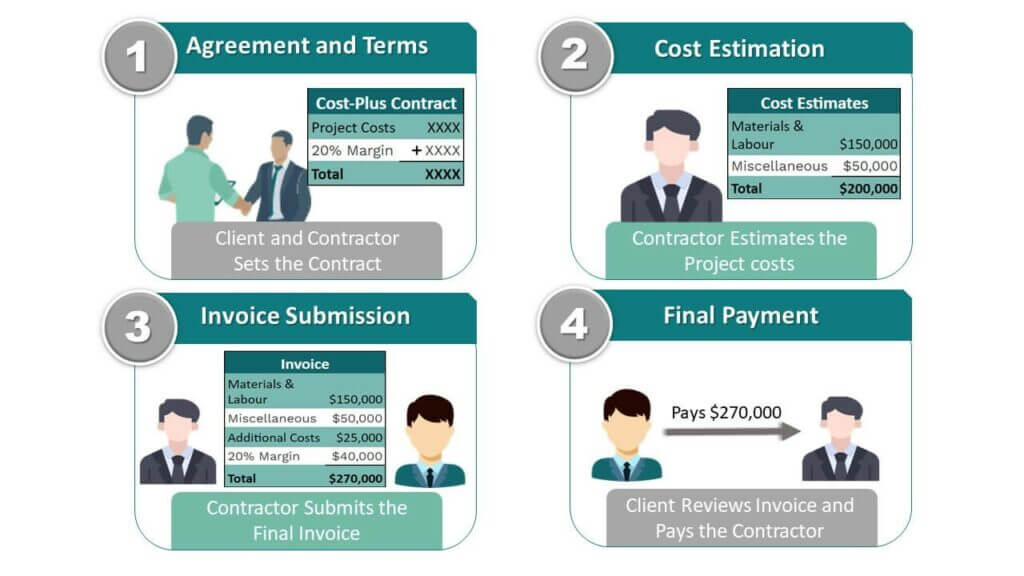

What is a cost plus contract? Imagine a partnership where the buyer pays the seller’s expenses plus a predetermined fee or profit margin. This unique arrangement, known as a cost plus contract, thrives on transparency and collaboration, offering both parties distinct advantages and potential challenges. It’s a method of contracting where the seller is reimbursed for all their actual costs incurred in performing the work, plus a predetermined fee or profit margin.

This structure often comes into play when the scope of the project is uncertain or when the buyer desires a close working relationship with the seller.

Cost plus contracts are often employed in complex projects where precise cost estimation is difficult, such as construction, engineering, and research and development. This approach allows for flexibility and adaptability, especially when unforeseen circumstances arise. However, it’s crucial to understand the inherent risks associated with cost overruns and the need for robust cost control mechanisms.

Definition of a Cost Plus Contract

A cost plus contract, also known as a cost reimbursement contract, is a type of agreement where the buyer reimburses the seller for all allowable costs incurred in performing the work, plus an agreed-upon fee or profit margin. This type of contract is often used when the scope of work is uncertain, the risks are high, or the project requires specialized expertise.

Core Principle of Cost Plus Contracts

The core principle of cost plus contracts is that the buyer pays for all the seller’s actual costs, plus a predetermined fee or profit margin. This means that the seller is incentivized to control costs and complete the project efficiently, as their profit is directly tied to the project’s actual cost.

Structure of a Cost Plus Contract

Cost plus contracts typically include the following key elements:

- Cost Reimbursement: The buyer agrees to reimburse the seller for all allowable costs incurred in performing the work. These costs can include direct costs (e.g., materials, labor, equipment) and indirect costs (e.g., overhead, administrative expenses).

- Fee or Profit Margin: The buyer agrees to pay the seller a predetermined fee or profit margin on top of the reimbursed costs. This fee can be a fixed amount, a percentage of the total cost, or a combination of both.

- Cost Control Measures: To ensure transparency and accountability, cost plus contracts often include cost control measures, such as:

- Cost Reporting: The seller is required to provide regular reports on their incurred costs.

- Cost Audits: The buyer may have the right to audit the seller’s cost records to verify their accuracy.

- Cost Variance Analysis: The buyer and seller may agree to track and analyze cost variances to identify areas for improvement.

- Contract Period: The contract specifies the duration of the project or the time frame within which the work must be completed.

- Termination Clause: The contract may include a termination clause that allows either party to terminate the contract under certain circumstances, such as for non-performance or breach of contract.

Types of Cost Plus Contracts

There are several different types of cost plus contracts, each with its own unique features and risk allocation.

- Cost Plus Fixed Fee (CPFF): In a CPFF contract, the buyer reimburses the seller for all allowable costs incurred in performing the work, plus a fixed fee that is agreed upon at the outset of the contract. This fee is not affected by the actual cost of the project. This type of contract is often used when the scope of work is uncertain or when the buyer wants to limit the seller’s profit potential.

- Cost Plus Incentive Fee (CPIF): In a CPIF contract, the buyer reimburses the seller for all allowable costs incurred in performing the work, plus an incentive fee that is based on the seller’s performance. The incentive fee is typically calculated as a percentage of the cost savings achieved by the seller. This type of contract incentivizes the seller to control costs and complete the project efficiently.

- Cost Plus Percentage of Cost (CPPC): In a CPPC contract, the buyer reimburses the seller for all allowable costs incurred in performing the work, plus a percentage of the total cost as a fee. This type of contract is often used when the scope of work is uncertain or when the buyer wants to share the risk of cost overruns with the seller. However, it can also incentivize the seller to increase costs, as their profit is directly tied to the total cost of the project.

This type of contract is generally considered less favorable than CPFF or CPIF contracts.

Key Components of a Cost Plus Contract

Cost-plus contracts are agreements where the contractor is reimbursed for all allowable costs incurred in performing the work, plus a predetermined fee or profit margin. This type of contract offers a high degree of risk for the buyer, as the final cost is uncertain and can be influenced by various factors. However, it can be beneficial for projects with complex and unpredictable requirements, where a fixed-price contract is not feasible.

Cost Elements Included in a Cost Plus Contract

The cost elements included in a cost-plus contract are typically categorized as direct and indirect costs.

- Direct Costs: These are costs directly attributable to the specific project, such as materials, labor, and equipment. Examples include the cost of raw materials, wages paid to workers, and rental fees for specialized equipment.

- Indirect Costs: These are costs that are not directly related to a specific project but are necessary for the overall operation of the business. Examples include overhead costs, such as rent, utilities, and administrative expenses.

Cost Audit in Cost Plus Contracts

The cost audit plays a crucial role in cost-plus contracts, ensuring that the contractor is only reimbursed for legitimate and reasonable expenses. An independent auditor reviews the contractor’s cost records and verifies that all costs are properly documented, allocated, and justified. The audit helps to protect the buyer from inflated or unnecessary costs and ensures fairness and transparency in the contract.

Fee or Profit Margin Calculation Methods

There are various methods for calculating the fee or profit margin in cost plus contracts, each with its own advantages and disadvantages.

- Percentage of Costs: This method calculates the fee as a percentage of the total allowable costs incurred by the contractor. For example, a fee of 10% of costs would mean that the contractor receives an additional 10 cents for every dollar spent on the project.

- Fixed Fee: In this method, a predetermined fixed fee is agreed upon, regardless of the actual costs incurred. This provides more certainty for the contractor but may not incentivize cost control.

- Cost Plus Incentive Fee: This method combines a fixed fee with an incentive component, rewarding the contractor for achieving specific cost-saving targets or performance goals. This can motivate the contractor to find ways to reduce costs and improve efficiency.

Advantages of Cost Plus Contracts

Cost plus contracts offer unique advantages for both buyers and sellers, making them a viable option in specific project scenarios. These contracts can be particularly beneficial when dealing with complex or uncertain projects where the scope of work is not fully defined or may change during the project lifecycle.

Benefits for the Buyer

Cost plus contracts can offer several advantages for the buyer, especially in situations where precise cost estimation is challenging.

- Reduced Risk of Cost Overruns: Since the buyer only pays for actual costs incurred, the risk of unexpected cost overruns is significantly reduced. This is especially beneficial for projects with uncertain scope or potential changes during the project lifecycle.

- Greater Flexibility: Cost plus contracts allow for more flexibility in project scope and design changes. The buyer can make adjustments to the project as needed, without the risk of incurring substantial penalties or cost increases associated with fixed-price contracts.

- Access to Specialized Expertise: Buyers can leverage the specialized knowledge and expertise of the seller, who has a vested interest in ensuring project success. This is particularly valuable for projects requiring specialized skills or technologies.

- Increased Transparency: Cost plus contracts typically require detailed documentation of all costs incurred, promoting transparency and accountability. The buyer has access to detailed cost breakdowns, enabling better cost control and monitoring.

Benefits for the Seller

Cost plus contracts can also be advantageous for the seller, particularly when dealing with complex or uncertain projects.

- Guaranteed Profit Margin: The seller is guaranteed a profit margin, typically expressed as a percentage of costs incurred. This ensures a consistent return on investment, even if the project scope changes or unexpected costs arise.

- Incentive to Control Costs: The seller has a strong incentive to control costs, as their profit is directly tied to the project’s overall expense. This encourages efficient project management and cost-effective solutions.

- Reduced Risk of Loss: Cost plus contracts minimize the risk of financial loss for the seller, as they are compensated for all actual costs incurred. This is particularly important for projects with inherent uncertainties or potential delays.

Increased Transparency and Collaboration

Cost plus contracts foster a more collaborative and transparent relationship between the buyer and seller.

- Open Communication: The need for detailed cost documentation encourages open communication between the buyer and seller. This allows for regular updates, discussions on cost variances, and collaborative decision-making on project adjustments.

- Shared Interest in Project Success: Both the buyer and seller share a common interest in ensuring project success, as the seller’s profit is directly linked to the project’s overall cost. This promotes a collaborative environment where both parties work together to achieve project objectives.

- Reduced Disputes: The transparency and shared understanding of costs inherent in cost plus contracts can minimize the potential for disputes and disagreements, contributing to a smoother and more efficient project lifecycle.

Disadvantages of Cost Plus Contracts

Cost-plus contracts, while offering flexibility and risk sharing, come with their own set of drawbacks. These disadvantages can significantly impact project outcomes and require careful consideration before adopting this type of contract.

Potential for Cost Overruns

Cost overruns are a significant risk associated with cost-plus contracts. Since the contractor is reimbursed for all costs incurred, there is a potential for cost inflation and a lack of incentive to control expenses. This can lead to higher-than-expected project costs, exceeding the initial budget and impacting project profitability.

For example, a cost-plus contract for a construction project might lead to increased costs due to inefficient resource allocation, unnecessary work, or delays caused by poor planning.

Challenges in Monitoring and Controlling Costs

Monitoring and controlling costs in cost-plus contracts can be challenging due to the complexity involved in tracking and verifying expenses. The contractor is responsible for submitting detailed cost reports, which require careful review and analysis to ensure accuracy and prevent overbilling. This process can be time-consuming and resource-intensive, particularly for large-scale projects.

In a cost-plus contract for a software development project, it can be difficult to track and verify the time and effort spent by developers, potentially leading to inflated costs.

Lack of Incentive for Cost Efficiency

Cost-plus contracts can lead to a lack of incentive for cost efficiency on the part of the contractor. Since the contractor is reimbursed for all costs, they may not be motivated to find cost-saving solutions or optimize resource utilization. This can result in higher overall project costs and reduced value for the client.

A cost-plus contract for a research and development project might result in the contractor prioritizing research activities without considering the overall cost-effectiveness of the project.

When to Use a Cost Plus Contract

Cost plus contracts are best suited for projects with high uncertainty, where the scope of work is difficult to define upfront. They are typically used when the risks associated with the project are significant, and the contractor needs to be compensated for the actual costs incurred.

Situations Where Cost Plus Contracts Are Appropriate

Cost plus contracts are often used in situations where the scope of work is uncertain, the project is complex, or the risks are high. Here are some examples:

- Research and Development Projects: When developing new technologies or products, the scope of work can be difficult to define upfront, as unforeseen challenges may arise. Cost plus contracts provide flexibility to adjust the scope of work as needed.

- Construction Projects with Complex Designs: Large-scale construction projects with intricate designs and potential for unforeseen site conditions often benefit from cost plus contracts, as they allow for adjustments to the scope of work and compensation for unexpected costs.

- Emergency Response and Disaster Relief: In emergency situations, the scope of work may be unknown until after the event. Cost plus contracts allow for flexibility in responding to changing needs and covering the actual costs incurred.

- Government Contracts: Government contracts often involve complex projects with specific requirements and a high level of scrutiny. Cost plus contracts provide a framework for transparent cost tracking and accountability.

Factors to Consider When Deciding Whether to Use a Cost Plus Contract

Several factors should be considered when deciding whether to use a cost plus contract:

- Scope of Work: If the scope of work is uncertain or subject to change, a cost plus contract may be more appropriate than a fixed-price contract.

- Risk Assessment: Cost plus contracts are often used when the risks associated with the project are high. It’s important to carefully assess the potential risks and determine if a cost plus contract is the best way to mitigate them.

- Contractor Expertise: Cost plus contracts require a high level of trust and transparency between the parties. It’s essential to choose a contractor with a proven track record and expertise in the project area.

- Cost Control Mechanisms: Cost plus contracts can lead to cost overruns if not properly managed. It’s important to establish clear cost control mechanisms, such as regular cost reporting and audits, to mitigate this risk.

- Project Management Capabilities: Cost plus contracts require strong project management capabilities to ensure that the project is completed on time and within budget.

Cost Plus Contracts in Different Industries and Sectors

Cost plus contracts are used across a wide range of industries and sectors, including:

- Construction: Cost plus contracts are often used for large-scale infrastructure projects, such as airports, highways, and bridges, where the scope of work can be complex and subject to change.

- Aerospace and Defense: Cost plus contracts are prevalent in the aerospace and defense industries, where projects often involve complex technologies and high levels of risk.

- IT and Software Development: Cost plus contracts can be used for software development projects with uncertain requirements or where the scope of work may evolve over time.

- Healthcare: Cost plus contracts are sometimes used for healthcare projects, such as hospital construction or medical equipment purchases, where the scope of work may be difficult to define upfront.

Example of a Cost Plus Contract

To illustrate the practical application of a cost plus contract, let’s consider a hypothetical scenario involving a construction project. Imagine a company, “GreenTech Construction,” is tasked with building a new solar energy plant for a utility company, “SolarPower Inc.” The project is complex, involving specialized equipment and expertise, and the exact scope of work is subject to change due to unforeseen circumstances.

In this scenario, a cost plus contract could be an ideal choice for both parties. GreenTech Construction would be compensated for all its direct and indirect costs incurred during the project, along with a predetermined profit margin. This provides GreenTech with the financial security to undertake the project without undue risk. Meanwhile, SolarPower Inc. benefits from having greater control over the project’s budget and can potentially achieve cost savings through collaboration and shared risk.

Key Terms and Conditions of a Hypothetical Cost Plus Contract, What is a cost plus contract

The table below Artikels the key terms and conditions of a hypothetical cost plus contract between GreenTech Construction and SolarPower Inc. for the solar energy plant construction project.

| Term | Description | Value | Notes |

|---|---|---|---|

| Contract Type | Cost Plus Contract with a Fixed Fee | Cost Plus Fixed Fee | This specifies the type of cost plus contract being used. |

| Project Scope | Construction of a 100-megawatt solar energy plant | 100 MW Solar Plant | Defines the specific project scope. |

| Fixed Fee | Predetermined profit margin for GreenTech Construction | $5,000,000 | Represents GreenTech’s profit, regardless of project costs. |

| Cost Reimbursement | All direct and indirect costs incurred by GreenTech | Reimbursable | Includes labor, materials, equipment, and overhead. |

| Cost Control | Procedures for tracking and verifying costs | Monthly cost reports, audits | Ensures transparency and accountability for costs. |

| Payment Schedule | Monthly payments based on approved costs | Monthly invoices, 30-day payment terms | Specifies how payments will be made. |

| Change Orders | Process for managing project scope changes | Written change orders, cost impact analysis | Defines how modifications to the project will be handled. |

| Completion Date | Target date for project completion | 18 months from contract signing | Specifies the expected project duration. |

| Performance Bonuses | Incentives for early completion or cost savings | $1,000,000 for completion within 15 months | Provides motivation for exceeding expectations. |

| Termination Clause | Conditions for terminating the contract | Material breach, insolvency, force majeure | Artikels scenarios for ending the contract. |

In essence, cost plus contracts offer a unique approach to project management, balancing the potential for cost overruns with the benefits of transparency and collaboration. By carefully evaluating the project’s complexity, the buyer’s risk tolerance, and the seller’s expertise, both parties can determine whether this contract type aligns with their objectives. Remember, like any partnership, open communication, clear agreements, and a shared commitment to achieving project goals are paramount to success.

Quick FAQs: What Is A Cost Plus Contract

What are some common examples of cost plus contracts?

Common examples include Cost Plus Fixed Fee (CPFF), Cost Plus Percentage of Cost (CPPC), and Cost Plus Incentive Fee (CPIF).

What are the potential risks associated with cost overruns in cost plus contracts?

Risks include poor cost control, lack of incentive for cost efficiency, and the possibility of the seller inflating costs.

How can I mitigate the risk of cost overruns in a cost plus contract?

Implementing robust cost monitoring and control mechanisms, establishing clear performance metrics, and conducting regular cost audits can help mitigate risks.

What are the advantages of using a cost plus contract?

Advantages include increased transparency, greater collaboration, and the ability to handle complex or uncertain projects.