What is cost plus contract – What is a cost-plus contract? In essence, it’s a contractual agreement where the buyer pays the seller for all the project costs, plus an agreed-upon fee. This type of contract can be a good option for projects with a lot of uncertainty or complexity, as it allows the seller to recover all of their expenses. However, it also comes with some inherent risks, such as the potential for cost overruns and disputes.

Cost-plus contracts are commonly used in industries where projects are highly customized, involve unpredictable factors, or require specialized expertise. Imagine building a custom home, where the design and materials are constantly evolving. In such cases, a cost-plus contract can provide flexibility and ensure the seller is compensated for unforeseen challenges.

Definition of Cost-Plus Contracts: What Is Cost Plus Contract

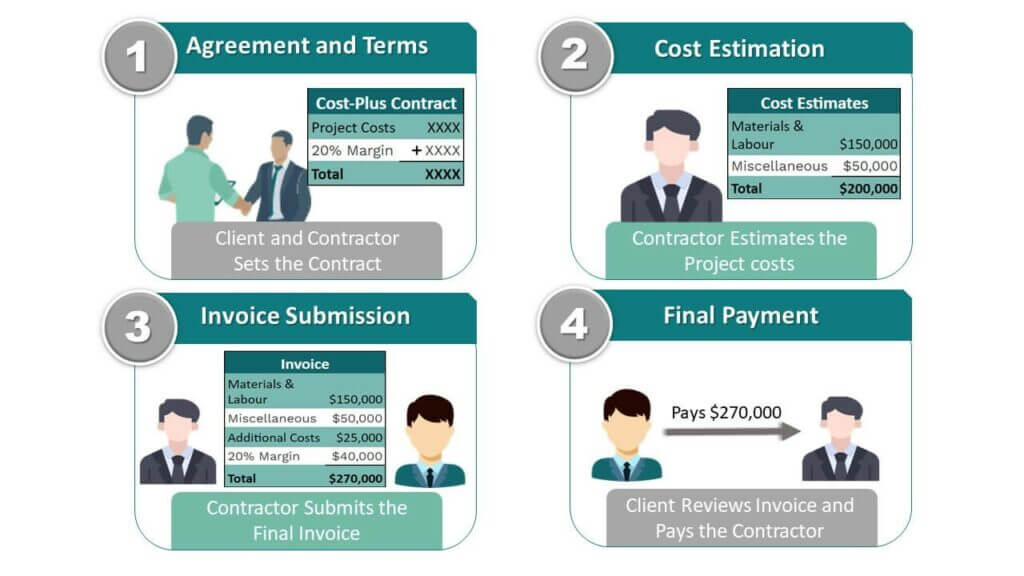

Cost-plus contracts are a type of agreement where the buyer pays the seller for all the actual costs incurred in completing a project, plus an agreed-upon profit margin. This means the seller is essentially reimbursed for their expenses and gets an additional percentage on top. It’s like paying for a meal at a restaurant: you pay for the ingredients, the chef’s time, and the restaurant’s overhead, plus a markup for their profit.

A cost-plus contract is a type of agreement where the buyer pays the seller for all the actual costs incurred in completing a project, plus an agreed-upon profit margin.

Key Elements of Cost-Plus Contracts

The core elements of a cost-plus contract are:* Costs: These are the direct and indirect expenses incurred by the seller in completing the project. Direct costs include materials, labor, and equipment, while indirect costs include overhead, administrative expenses, and insurance.

Profit Margin

This is a percentage of the total costs that the seller is allowed to keep as profit. The profit margin can be fixed or variable, depending on the terms of the contract.

Cost Control

Since the seller is reimbursed for their costs, it’s important to have mechanisms in place to control costs and prevent overspending. This can involve using a cost-reimbursement system, where the seller must submit invoices for approval before being paid.

Risk Allocation

In a cost-plus contract, the buyer assumes more risk than in a fixed-price contract, as they are ultimately responsible for the total cost of the project. However, the seller also has less risk, as they are guaranteed to be paid for their costs.

Types of Cost-Plus Contracts

Cost-plus contracts, also known as reimbursable contracts, are agreements where the buyer reimburses the seller for all allowable costs incurred in performing the work, plus a predetermined fee or profit margin. These contracts are commonly used in situations where the scope of work is uncertain, the risks are high, or the project requires specialized expertise.The specific type of cost-plus contract chosen depends on the nature of the project, the level of risk, and the desired level of control for both the buyer and the seller.

Here’s a breakdown of the different types of cost-plus contracts:

Cost-Plus-Fixed-Fee (CPFF)

The cost-plus-fixed-fee (CPFF) contract is one of the most common types of cost-plus contracts. In this type of agreement, the seller is reimbursed for all allowable costs incurred in performing the work, plus a fixed fee that is predetermined at the beginning of the project. This fixed fee is a fixed amount, regardless of the actual cost of the project.

- Reimbursement of Allowable Costs: The buyer reimburses the seller for all allowable costs incurred in performing the work. This includes direct costs such as labor, materials, and equipment, as well as indirect costs such as overhead and administrative expenses.

- Fixed Fee: The seller receives a fixed fee, which is a predetermined amount that is not dependent on the actual cost of the project. This fee represents the seller’s profit and is intended to compensate for the seller’s time, effort, and risk.

- Advantages:

- Reduced Risk for the Seller: The seller is guaranteed a fixed fee, regardless of the actual cost of the project. This reduces the seller’s risk and encourages them to focus on completing the project efficiently and effectively.

- Flexibility for the Buyer: The buyer has more flexibility in defining the scope of work and making changes to the project as needed. This is because the seller is reimbursed for all allowable costs.

- Disadvantages:

- Potential for Cost Overruns: The buyer bears the risk of cost overruns, as the seller is reimbursed for all allowable costs. This can lead to unexpected expenses for the buyer.

- Lack of Incentive for Cost Control: The seller has less incentive to control costs, as they are reimbursed for all allowable expenses. This can lead to higher overall project costs.

Cost-Plus-Incentive-Fee (CPIF)

The cost-plus-incentive-fee (CPIF) contract is a variation of the cost-plus-fixed-fee (CPFF) contract. In a CPIF contract, the seller is reimbursed for all allowable costs, plus a fee that is based on the seller’s performance. This incentive fee is designed to motivate the seller to achieve specific performance goals, such as completing the project on time, within budget, or meeting certain quality standards.

- Reimbursement of Allowable Costs: Similar to the CPFF contract, the buyer reimburses the seller for all allowable costs incurred in performing the work.

- Incentive Fee: The incentive fee is a variable amount that is determined based on the seller’s performance. The incentive fee is typically calculated as a percentage of the target cost, with the percentage varying depending on the seller’s performance.

- Advantages:

- Incentive for Cost Control: The seller has a strong incentive to control costs and meet performance goals, as their fee is directly tied to their performance.

- Shared Risk and Reward: The buyer and seller share the risk and reward of the project. The buyer benefits from the seller’s efforts to control costs and meet performance goals, while the seller has the opportunity to earn a higher fee if they exceed expectations.

- Disadvantages:

- Complexity: CPIF contracts can be more complex than CPFF contracts, as they involve the calculation of incentive fees based on performance metrics.

- Potential for Disputes: There is a potential for disputes over the calculation of incentive fees, as the performance metrics may be subjective or difficult to measure.

Cost-Plus-Percentage-of-Cost (CPPC)

The cost-plus-percentage-of-cost (CPPC) contract is a type of cost-plus contract where the seller is reimbursed for all allowable costs, plus a percentage of those costs. This percentage is typically predetermined at the beginning of the project and represents the seller’s profit margin.

- Reimbursement of Allowable Costs: The buyer reimburses the seller for all allowable costs incurred in performing the work.

- Percentage of Cost: The seller receives a percentage of the total allowable costs as a fee. This percentage is typically fixed at the beginning of the project and represents the seller’s profit margin.

- Advantages:

- Simplicity: CPPC contracts are relatively simple to understand and administer, as the seller’s fee is calculated as a percentage of the total allowable costs.

- Disadvantages:

- Lack of Incentive for Cost Control: The seller has less incentive to control costs, as their fee is directly proportional to the total allowable costs. This can lead to higher overall project costs.

- Potential for Abuse: The CPPC contract can be susceptible to abuse, as the seller may have an incentive to inflate costs in order to increase their fee.

Advantages of Cost-Plus Contracts

Cost-plus contracts offer distinct advantages for both the buyer and the seller, making them particularly suitable for complex or uncertain projects. These contracts provide flexibility and transparency, allowing for adjustments as project requirements evolve.

Advantages for the Buyer

Cost-plus contracts provide buyers with several benefits, particularly in situations where project scope or specifications are uncertain.

- Reduced Risk: Buyers can mitigate financial risk by transferring the responsibility for cost overruns to the seller. This is especially valuable for projects with unpredictable factors, such as complex engineering or technological advancements.

- Greater Flexibility: Cost-plus contracts allow for modifications and changes to the project scope throughout its lifecycle. This flexibility is crucial when requirements are not fully defined upfront or may evolve during implementation.

- Access to Expertise: Buyers can engage highly skilled and specialized sellers who may not be available under fixed-price contracts. This access to expertise can be invaluable for complex projects requiring specialized knowledge or technical capabilities.

- Enhanced Transparency: Cost-plus contracts provide a transparent view of project costs, allowing buyers to monitor expenses closely and identify potential areas for optimization. This transparency fosters trust and collaboration between the buyer and seller.

Advantages for the Seller

Cost-plus contracts also offer benefits for sellers, particularly when dealing with projects that involve significant uncertainty or complexity.

- Guaranteed Profit: Sellers are assured of a predetermined profit margin, regardless of project costs. This eliminates the risk of incurring losses due to unforeseen circumstances or cost overruns.

- Incentive for Efficiency: Cost-plus contracts can motivate sellers to prioritize efficiency and minimize costs, as they share in the cost savings realized. This incentive aligns the interests of both parties and promotes a collaborative approach.

- Reduced Risk: Sellers are protected from the financial risk of cost overruns, which can be significant in complex or uncertain projects. This reduces their overall risk exposure and allows them to focus on delivering quality work.

- Opportunity for Innovation: Cost-plus contracts can encourage innovation and creativity, as sellers are not constrained by fixed budgets. This can lead to more efficient solutions and better outcomes for the project.

Benefits for Complex or Uncertain Projects

Cost-plus contracts are particularly well-suited for projects that involve significant uncertainty or complexity.

- Uncertain Scope: When project requirements are not fully defined or may evolve during implementation, cost-plus contracts provide the flexibility needed to accommodate changes and ensure project success.

- Technological Advancement: Projects involving cutting-edge technology or rapidly evolving advancements benefit from cost-plus contracts, as they allow for adjustments to address unforeseen challenges and incorporate new developments.

- Complex Engineering: Cost-plus contracts are advantageous for complex engineering projects that require specialized expertise and may involve unexpected technical challenges. This contract type allows for the flexibility and transparency needed to manage these complexities effectively.

- Unforeseen Circumstances: When projects are subject to unforeseen circumstances, such as natural disasters or economic downturns, cost-plus contracts provide a mechanism for adjusting costs and ensuring project completion.

Disadvantages of Cost-Plus Contracts

Cost-plus contracts, while offering flexibility and risk sharing, also present several disadvantages for both the buyer and the seller. These drawbacks can significantly impact the overall project success and financial outcomes.

Potential Drawbacks for Buyer and Seller

Cost-plus contracts can create a situation where the buyer may not have complete control over the project’s costs, while the seller may lack the incentive to minimize expenses. This can lead to potential cost overruns and disputes, jeopardizing the project’s success.

- Buyer’s Perspective: The buyer might face challenges in accurately predicting the final project cost due to the lack of a fixed price. This uncertainty can lead to budget overruns and financial strain. Additionally, the buyer may not have strong incentives for the seller to control costs, potentially resulting in higher-than-expected expenses.

- Seller’s Perspective: The seller, on the other hand, may lack the motivation to control costs effectively. As they are reimbursed for all allowable expenses, there’s a potential for cost inflation and less emphasis on efficiency. This can lead to reduced profitability for the seller and a strained relationship with the buyer.

Risks Associated with Cost Overruns

Cost overruns are a significant concern in cost-plus contracts. The lack of a fixed price can lead to uncontrolled spending and unpredictable final costs. This risk can be amplified by factors such as:

- Inadequate Cost Estimation: Initial cost estimates may be inaccurate or incomplete, leading to unforeseen expenses and cost overruns.

- Changes in Scope: Project scope changes, whether due to unforeseen circumstances or evolving requirements, can significantly increase costs.

- Unforeseen Contingencies: Unforeseen events, such as natural disasters, labor shortages, or material price fluctuations, can disrupt project timelines and inflate costs.

Potential for Disputes and Misunderstandings

Cost-plus contracts often involve complex accounting and reporting procedures. This can lead to disagreements and disputes between the buyer and seller regarding the allowable costs and the accuracy of cost reporting. These disagreements can delay project progress and increase legal expenses.

- Interpretation of Contract Terms: Ambiguous contract language or differing interpretations of cost allowances can lead to disputes regarding reimbursable expenses.

- Cost Reporting and Audit: The seller’s cost reporting must be accurate and transparent. Disputes can arise if the buyer questions the validity of the reported costs or the accuracy of the audit process.

- Change Orders and Modifications: Changes in project scope or design can create challenges in determining the appropriate cost adjustments and lead to disputes.

When to Use Cost-Plus Contracts

Cost-plus contracts are best suited for projects with a high degree of uncertainty or complexity, where the scope of work is difficult to define upfront. They offer flexibility and risk sharing, making them ideal for situations where traditional fixed-price contracts might be impractical.

Scenarios Where Cost-Plus Contracts Are Most Suitable

Cost-plus contracts are advantageous in situations where the project involves a significant level of unknowns, making it difficult to estimate the final cost accurately. Here are some examples:

- Research and Development Projects: R&D projects often involve exploration and experimentation, making it challenging to predict the exact time and resources required. Cost-plus contracts provide the flexibility to adjust the scope and budget as the project progresses.

- Construction Projects with Unforeseen Conditions: Construction projects can encounter unexpected geological conditions, environmental challenges, or changes in regulatory requirements. Cost-plus contracts allow for adjustments to address these unforeseen circumstances.

- Government Contracts: Government contracts frequently involve complex specifications and requirements, making it difficult to define the exact scope of work upfront. Cost-plus contracts are commonly used in defense and infrastructure projects.

- Emergency Response Projects: In situations requiring immediate action, such as disaster relief or infrastructure repair, cost-plus contracts provide a way to mobilize resources quickly without the need for extensive upfront planning.

Types of Projects That Might Benefit From a Cost-Plus Contract Approach

Cost-plus contracts are particularly well-suited for projects with the following characteristics:

- Projects with High Technical Complexity: Projects requiring specialized expertise or advanced technology often benefit from a cost-plus approach, as it allows for adjustments based on evolving technical challenges.

- Projects with Changing Requirements: When the scope of work is likely to change during the project lifecycle, cost-plus contracts provide the flexibility to adapt to evolving requirements.

- Projects with a Long Duration: Long-term projects are susceptible to market fluctuations and unforeseen events. Cost-plus contracts help mitigate these risks by allowing for adjustments to the budget and schedule as needed.

- Projects with a High Degree of Customization: Highly customized projects, such as bespoke software development or architectural designs, often require iterative development and adjustments, making cost-plus contracts a suitable option.

Factors to Consider When Deciding Whether to Use a Cost-Plus Contract

Before opting for a cost-plus contract, it’s crucial to consider the following factors:

| Factor | Consideration |

|---|---|

| Project Complexity and Uncertainty | Higher complexity and uncertainty warrant a cost-plus approach. |

| Scope Definition | Clearly defined scope favors fixed-price contracts. Ambiguous scope suggests a cost-plus approach. |

| Risk Tolerance | Higher risk tolerance favors cost-plus, while lower tolerance leans towards fixed-price. |

| Trust and Transparency | Strong trust and transparency between parties are essential for successful cost-plus contracts. |

| Cost Control Measures | Implementing robust cost control mechanisms is crucial to mitigate potential cost overruns. |

| Project Duration | Longer project durations might benefit from cost-plus contracts due to potential market changes. |

Cost Control and Risk Management

Cost-plus contracts, while offering flexibility and shared risk, require meticulous cost control and robust risk management strategies to ensure project success. Effective management of these contracts is crucial for preventing cost overruns and mitigating potential risks.

Strategies for Effective Cost Control

Effective cost control in cost-plus contracts requires a proactive approach that emphasizes transparency, accountability, and continuous monitoring. Here are some key strategies:

- Detailed Cost Tracking and Reporting: Implement a comprehensive cost tracking system that captures all project expenses, including direct costs, indirect costs, and overhead. Regular reporting allows for early identification of cost variances and facilitates timely corrective actions.

- Budgeted Cost Estimates: Develop accurate and detailed cost estimates at the outset of the project. This serves as a baseline for tracking actual costs and identifying potential overruns. The estimates should be regularly reviewed and updated as the project progresses.

- Cost Variance Analysis: Regularly analyze cost variances, comparing actual costs to budgeted costs. This analysis helps pinpoint areas where costs are exceeding expectations and facilitates corrective actions. The analysis should consider both the magnitude and root causes of variances.

- Value Engineering: Engage in value engineering exercises to identify opportunities for cost savings without compromising project quality or performance. This involves evaluating design, materials, and processes to identify areas where cost reductions can be achieved.

- Cost Control Mechanisms: Establish clear cost control mechanisms, such as cost ceilings, approved budgets, and change management processes. These mechanisms ensure that costs are managed within predetermined limits and prevent uncontrolled spending.

Strategies for Mitigating Potential Risks

Cost-plus contracts inherently carry risks, but effective risk management strategies can minimize their impact. Here are some key strategies:

- Risk Identification and Assessment: Conduct a thorough risk assessment to identify potential risks that could affect project costs. This assessment should consider both internal and external factors, including technical risks, schedule risks, and financial risks.

- Risk Mitigation Plans: Develop comprehensive risk mitigation plans for each identified risk. These plans should Artikel specific actions to minimize the likelihood and impact of risks. The plans should be regularly reviewed and updated as the project progresses.

- Contingency Planning: Establish contingency plans to address unforeseen events or circumstances that could impact project costs. These plans should include alternative approaches, resources, and timelines for handling unexpected situations.

- Performance Monitoring and Evaluation: Continuously monitor project performance against established benchmarks and metrics. This allows for early identification of potential problems and facilitates timely corrective actions. Performance evaluations should focus on both cost efficiency and project deliverables.

- Communication and Collaboration: Maintain open and effective communication between all project stakeholders, including the client, contractor, and subcontractors. This ensures that everyone is aware of potential risks, cost implications, and mitigation strategies. Collaboration is essential for effective risk management.

Best Practices for Managing Cost-Plus Contracts, What is cost plus contract

Successful management of cost-plus contracts relies on a combination of best practices that ensure transparency, accountability, and cost efficiency. Here are some key best practices:

- Clearly Defined Scope of Work: Establish a detailed and comprehensive scope of work that clearly Artikels the project deliverables, responsibilities, and performance expectations. This minimizes the potential for disputes and ensures that all parties are on the same page.

- Detailed Cost Breakdown: Develop a detailed cost breakdown structure that identifies all project costs, including direct costs, indirect costs, and overhead. This provides a clear understanding of cost components and facilitates accurate cost tracking and analysis.

- Regular Progress Reviews: Conduct regular progress reviews to assess project progress, identify potential issues, and address cost variances. These reviews should involve all key stakeholders and facilitate open communication and collaboration.

- Independent Cost Audits: Consider engaging an independent cost auditor to review project costs and ensure that they are reasonable and justified. This provides an objective assessment of cost control measures and helps maintain transparency and accountability.

- Contractual Provisions: Include robust contractual provisions that address cost control, risk management, and dispute resolution. These provisions should be clearly defined and enforceable, ensuring that all parties are aware of their obligations and rights.

Real-World Examples

Cost-plus contracts are prevalent in various industries where project complexity, uncertainty, and potential for unforeseen expenses are significant. They offer a valuable framework for managing projects with high levels of risk and evolving requirements. Let’s delve into some real-world examples to illustrate the application of cost-plus contracts across diverse sectors.

Examples of Industries and Projects

Cost-plus contracts are frequently used in the following industries and types of projects:

- Construction: Large-scale infrastructure projects, such as bridges, tunnels, and airports, often employ cost-plus contracts. The complexity and unpredictability of these projects necessitate a flexible payment structure that accounts for potential changes and unforeseen circumstances.

- Research and Development: Innovative research projects, especially those involving cutting-edge technologies or scientific breakthroughs, often utilize cost-plus contracts. The inherent uncertainty and evolving nature of research necessitate a contract that allows for flexibility and reimbursement of actual costs.

- Defense and Aerospace: The development and production of sophisticated military equipment and spacecraft frequently rely on cost-plus contracts. The highly specialized nature of these projects and the need for strict quality control often justify the use of cost-plus arrangements.

- Engineering and Design: Complex engineering and design projects, such as the construction of power plants or specialized manufacturing facilities, may benefit from cost-plus contracts. The intricate nature of these projects and the potential for design changes necessitate a contract that provides for reimbursement of actual costs.

- Information Technology: Large-scale IT projects, particularly those involving custom software development or complex system integrations, may utilize cost-plus contracts. The evolving nature of technology and the potential for unforeseen technical challenges often necessitate a flexible payment structure.

Case Studies

Successful Implementation

- The Panama Canal Expansion Project: The expansion of the Panama Canal, a massive infrastructure project, employed a cost-plus contract. This approach allowed for flexibility in accommodating unforeseen challenges and changes in scope, ultimately contributing to the successful completion of the project.

- The International Space Station (ISS): The construction of the ISS, a collaborative effort involving multiple countries and agencies, relied heavily on cost-plus contracts. This approach facilitated the coordination of diverse technical contributions and accommodated the evolving nature of the project.

Challenges and Lessons Learned

- The Denver International Airport: The construction of Denver International Airport encountered significant cost overruns and delays, highlighting the potential risks associated with cost-plus contracts. The project’s scope and complexity, coupled with a lack of robust cost control measures, contributed to these challenges.

- The F-35 Joint Strike Fighter Program: The development of the F-35 fighter jet, a complex and expensive program, faced delays and cost overruns. The use of cost-plus contracts, combined with a lack of effective cost control and a changing program scope, contributed to these challenges.

Cost-Plus Contracts in Different Situations

Cost-plus contracts can be tailored to address specific project needs and risks. Here are some examples:

- Fixed-Fee Cost-Plus: In this type of contract, a fixed fee is added to the contractor’s actual costs. This approach provides a predictable profit margin for the contractor while allowing for flexibility in managing project expenses.

- Incentive Fee Cost-Plus: This variation includes an incentive fee structure that rewards the contractor for achieving specific project goals, such as completing the project on time or within budget. This approach encourages efficiency and cost control.

- Cost-Plus-Percentage-of-Cost: This type of contract involves a percentage of the contractor’s actual costs being added as a fee. This approach can incentivize the contractor to increase costs, so it is generally less common.

Cost-plus contracts offer a unique approach to project management, balancing the need for flexibility with the potential for increased costs. While they can be advantageous in certain situations, it’s crucial to carefully consider the risks and implement effective cost control measures to mitigate potential downsides. Understanding the intricacies of this contract type, including its advantages, disadvantages, and real-world applications, can empower you to make informed decisions for your projects.

Question & Answer Hub

How do cost-plus contracts differ from fixed-price contracts?

In a fixed-price contract, the seller agrees to complete the project for a predetermined price, regardless of the actual costs incurred. Cost-plus contracts, on the other hand, allow the seller to recover all of their expenses plus a fee, making them more suitable for projects with uncertain costs.

What are some common cost control measures for cost-plus contracts?

Cost control measures in cost-plus contracts typically involve detailed cost tracking, regular budget reviews, and close collaboration between the buyer and seller. Implementing clear guidelines for expense approval and establishing a system for auditing costs can help mitigate the risk of cost overruns.

What are some real-world examples of cost-plus contracts?

Cost-plus contracts are frequently used in government procurement, research and development projects, and complex construction projects, where the scope of work may be difficult to define upfront.