What is a cost reimbursement contract sets the stage for this exploration, offering readers a glimpse into a unique contractual arrangement where one party agrees to pay the other for all incurred costs, plus a predetermined fee or profit margin. This type of contract, often used in complex and unpredictable projects, presents both advantages and disadvantages, which we will delve into in detail.

Cost reimbursement contracts, also known as cost-plus contracts, are commonly employed in situations where the exact scope of work is difficult to define upfront. They provide a high degree of flexibility, allowing for adjustments and changes as the project progresses. However, this flexibility comes at a cost – the risk of cost overruns is higher with cost reimbursement contracts, as the paying party assumes a significant portion of the financial responsibility.

Definition of a Cost Reimbursement Contract

A cost reimbursement contract is a type of agreement where the buyer (or client) agrees to pay the seller (or contractor) for all allowable costs incurred in performing a specific task or project, plus a predetermined fee or profit margin. This type of contract is often used for projects with high uncertainty, where the scope of work or the required resources are difficult to define upfront.

Key Characteristics of a Cost Reimbursement Contract

Cost reimbursement contracts are characterized by the following key features:

- Reimbursement of Allowable Costs: The buyer reimburses the seller for all documented and approved costs incurred during project execution. These costs typically include labor, materials, equipment, travel, and other expenses directly related to the project.

- Predetermined Fee or Profit Margin: In addition to reimbursing costs, the buyer also pays the seller a predetermined fee or profit margin. This fee can be a fixed amount, a percentage of the total costs, or a combination of both. The fee compensates the seller for their expertise, management, and risk associated with the project.

- Shared Risk and Reward: Cost reimbursement contracts generally involve a higher degree of risk for the buyer than other contract types, as they are responsible for all allowable costs incurred by the seller. However, the buyer also has the potential to benefit from cost savings or efficiencies achieved by the seller. Conversely, the seller has a lower risk compared to fixed-price contracts, as they are guaranteed to be reimbursed for all allowable costs.

Scenario for Using a Cost Reimbursement Contract

An example of a scenario where a cost reimbursement contract would be suitable is a complex research and development project with significant uncertainty. In such a project, the exact scope of work and the required resources may not be known upfront, and the project may involve significant technological challenges. A cost reimbursement contract would allow the buyer to share the risk with the seller, while also providing flexibility to adapt the project scope and requirements as new information becomes available.

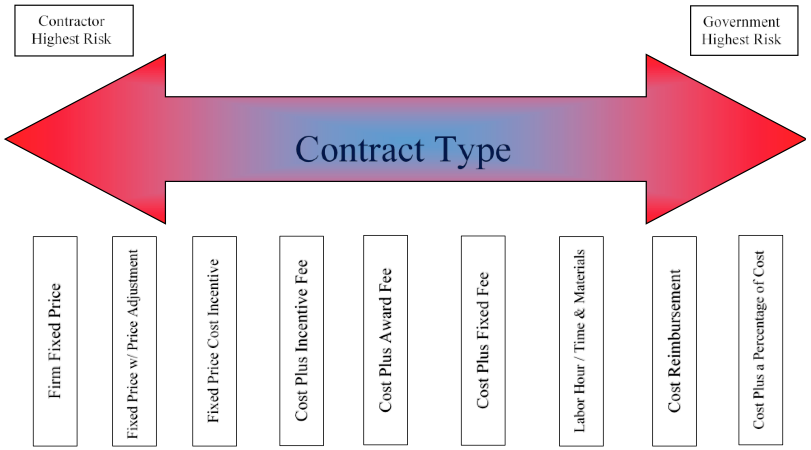

Types of Cost Reimbursement Contracts

![]()

Cost reimbursement contracts are categorized based on the way costs are allocated and risks are distributed between the parties. Each type has unique features and variations, which are crucial to understand for effective contract management.

Cost Plus Fixed Fee (CPFF)

CPFF contracts are characterized by the contractor being reimbursed for all allowable costs incurred during the project, plus a fixed fee that is agreed upon beforehand. This fee is independent of the actual costs incurred and is typically a percentage of the estimated total cost.

The contractor’s profit is limited to the fixed fee, regardless of the actual costs.

This type of contract provides the contractor with the maximum incentive to control costs, as they are directly responsible for any overruns. However, it also places a higher risk on the contractor, as they are not guaranteed a specific profit margin.

Cost Plus Incentive Fee (CPIF)

CPIF contracts offer a combination of cost reimbursement and incentive payments based on the contractor’s performance. The contractor is reimbursed for all allowable costs, and a predetermined incentive fee is awarded based on achieving specific project milestones or exceeding performance targets.

The incentive fee is typically calculated as a percentage of the difference between the target cost and the actual cost, with a maximum and minimum fee defined in the contract.

This type of contract encourages the contractor to strive for cost efficiency and achieve project objectives, while also providing some financial security. The risk is shared between the parties, with the contractor bearing a portion of the cost overrun and the owner sharing in the potential savings.

Cost Plus Award Fee (CPAF)

CPAF contracts involve a cost reimbursement mechanism, but the fee is awarded based on subjective performance criteria rather than cost savings. The contractor is reimbursed for all allowable costs, and the award fee is determined by a predetermined evaluation process that considers factors like project quality, schedule adherence, and overall performance.

The award fee is typically paid in increments throughout the project, with the final amount based on the overall performance evaluation.

This type of contract places a strong emphasis on performance and incentivizes the contractor to achieve project goals beyond just cost efficiency. The risk is largely borne by the contractor, as the award fee is not guaranteed and is subject to subjective evaluation.

Cost Sharing

In cost-sharing contracts, both the contractor and the owner share the costs and risks of the project. The specific cost allocation and risk distribution are determined by the contract terms, which can vary significantly depending on the project’s nature and the parties’ objectives.

This type of contract is typically used for research and development projects, where both parties have a vested interest in the outcome and are willing to share the financial burden.

The contractor is reimbursed for allowable costs, but the owner also contributes a portion of the costs, often based on a predetermined percentage or formula. The risk is shared proportionally, with both parties bearing a portion of any cost overruns or performance shortfalls.

Table Comparing Cost Reimbursement Contracts

| Contract Type | Cost Allocation | Risk Distribution ||—|—|—|| CPFF | Reimbursed for all allowable costs + fixed fee | Higher risk for contractor || CPIF | Reimbursed for all allowable costs + incentive fee | Shared risk between parties || CPAF | Reimbursed for all allowable costs + award fee based on performance | Higher risk for contractor || Cost Sharing | Shared costs and risks between contractor and owner | Shared risk proportionally |

Key Features of Cost Reimbursement Contracts

Cost reimbursement contracts are characterized by a unique set of features that distinguish them from other contract types. These features are crucial for understanding the dynamics of these agreements and navigating the complexities involved in their implementation.

Cost Allowability

Cost allowability refers to the criteria used to determine which costs incurred by the contractor are eligible for reimbursement by the government. This is a critical aspect of cost reimbursement contracts, as it directly impacts the amount of funding the contractor receives. The government establishes specific rules and regulations governing which costs are considered allowable.

The determination of allowable costs is based on a set of principles that ensure the costs are reasonable, allocable, and incurred in accordance with generally accepted accounting principles.

- Direct Costs: These are costs directly associated with the performance of the contract, such as labor, materials, and travel. They are generally considered allowable if they meet the criteria of being reasonable, allocable, and incurred in accordance with generally accepted accounting principles.

- Indirect Costs: These are costs that cannot be directly traced to a specific contract but are necessary for the overall operation of the contractor’s business. Examples include rent, utilities, and administrative expenses. The allowability of indirect costs is often subject to more scrutiny and may require justification based on specific allocation methods.

Cost Verification

The government has a vested interest in ensuring that the costs claimed by the contractor are accurate and reasonable. This is where the process of cost verification comes into play. The government typically employs a team of auditors to review the contractor’s cost records and ensure compliance with contract terms and cost allowability principles.

Cost verification is a rigorous process that involves examining supporting documentation, conducting interviews with contractor personnel, and applying analytical techniques to assess the accuracy and reasonableness of the costs claimed.

- Cost Audits: Regular audits are conducted to examine the contractor’s cost records and ensure that the costs claimed are reasonable and allowable.

- Cost Accounting Standards: The government may impose specific cost accounting standards that contractors must adhere to. These standards ensure consistency in cost reporting and provide a framework for cost verification.

- Documentation: Contractors are required to maintain detailed documentation for all costs incurred, including invoices, receipts, and time sheets. This documentation serves as evidence to support the costs claimed during audits.

Cost Monitoring and Control

In cost reimbursement contracts, the government assumes a significant level of financial risk, as the contractor is reimbursed for its actual costs. To mitigate this risk, the government implements various mechanisms for monitoring and controlling costs.

- Cost Control Plans: Contractors are often required to develop and implement cost control plans that Artikel their strategies for managing costs and achieving project objectives. These plans may include detailed budgets, cost tracking systems, and performance metrics.

- Cost Reports: Contractors are typically required to submit regular cost reports to the government. These reports provide a detailed breakdown of costs incurred and allow the government to monitor the contractor’s progress and identify potential cost overruns.

- Cost Variance Analysis: The government may conduct cost variance analysis to identify and investigate significant deviations between the planned and actual costs. This analysis helps to identify potential areas for improvement and to ensure that costs are being managed effectively.

Advantages and Disadvantages of Cost Reimbursement Contracts

Cost reimbursement contracts can be advantageous in certain situations, but they also come with inherent risks. Understanding the pros and cons is crucial for deciding if this type of contract is suitable for a particular project.

Advantages of Cost Reimbursement Contracts, What is a cost reimbursement contract

The advantages of cost reimbursement contracts are most apparent when dealing with projects that are complex, uncertain, or require a high level of flexibility.

- Reduced Risk for the Contractor: Cost reimbursement contracts shift the risk of cost overruns to the buyer. This can be attractive to contractors who are undertaking projects with a high degree of uncertainty or potential for unforeseen challenges. For example, a contractor might be more willing to take on a complex research and development project with a cost reimbursement contract, knowing that they will be compensated for their actual costs.

- Greater Flexibility: These contracts allow for more flexibility in project scope and execution. This can be beneficial when the project requirements are not fully defined at the outset or may change over time. For instance, in a construction project with unpredictable geological conditions, a cost reimbursement contract allows for adjustments to the scope and cost based on actual site conditions.

- Incentive for Innovation: Cost reimbursement contracts can encourage contractors to be more innovative and creative, as they are not constrained by fixed price limits. This can be particularly beneficial for projects involving cutting-edge technologies or research. A contractor might be more willing to experiment with new techniques or materials knowing that they will be compensated for their efforts, even if they encounter setbacks or delays.

- Stronger Relationship with the Contractor: The collaborative nature of cost reimbursement contracts can foster a stronger relationship between the buyer and contractor. This is because both parties are working together to achieve a common goal, rather than being adversaries in a price negotiation. A close working relationship can be particularly valuable for complex projects where open communication and shared decision-making are essential.

Disadvantages of Cost Reimbursement Contracts

While cost reimbursement contracts offer benefits, they also come with several disadvantages that need careful consideration.

- Cost Overruns: The potential for cost overruns is a major drawback of cost reimbursement contracts. The buyer bears the risk of exceeding the estimated budget, which can lead to significant financial losses. For example, a construction project with a cost reimbursement contract could face unexpected delays and cost increases due to unforeseen weather conditions, labor shortages, or changes in regulatory requirements.

- Lack of Cost Control: The buyer has limited control over the contractor’s costs in a cost reimbursement contract. This can lead to inefficient spending and a lack of transparency, making it difficult to track progress and ensure value for money. For example, a contractor might be tempted to inflate costs or use inefficient methods if they are not closely monitored.

- Complexity and Administrative Overhead: Cost reimbursement contracts are typically more complex to administer than fixed-price contracts. They require detailed cost tracking, regular reporting, and careful auditing to ensure that costs are reasonable and accurate. This can add significant administrative overhead to the project. For instance, a cost reimbursement contract for a large-scale software development project might require extensive documentation, cost reporting, and audits to ensure that the contractor’s expenses are properly accounted for.

- Potential for Contractor Abuse: There is a risk that contractors could take advantage of the cost reimbursement structure to inflate costs or engage in wasteful practices. This is especially true if there is a lack of effective oversight and monitoring by the buyer. For example, a contractor might submit inflated invoices for materials or labor, or they might engage in unnecessary work or delays to increase their profits.

Common Applications of Cost Reimbursement Contracts

Cost reimbursement contracts are frequently employed in scenarios where the scope of work is complex, uncertain, or subject to change. These contracts are particularly well-suited for projects where defining precise deliverables upfront is challenging, and where the contractor needs flexibility to adapt to evolving requirements.

Industries and Projects

Cost reimbursement contracts are commonly used in various industries and project types, including:

- Research and Development (R&D): In R&D projects, the outcomes are often unpredictable, and the scope of work can evolve significantly during the project lifecycle. Cost reimbursement contracts provide the flexibility needed to accommodate these uncertainties and allow for adjustments based on research findings.

- Construction and Engineering: Large-scale infrastructure projects, such as bridges, tunnels, and power plants, often involve complex designs, unpredictable site conditions, and potential changes in scope. Cost reimbursement contracts offer the flexibility to handle these complexities and adjust the project plan as needed.

- Government Contracts: Government agencies frequently utilize cost reimbursement contracts for projects involving national security, defense, or public infrastructure. These contracts provide the government with greater control over the project and allow for adjustments to meet evolving needs.

- IT and Software Development: Complex software development projects, especially those involving cutting-edge technologies or highly customized solutions, often benefit from cost reimbursement contracts. This contract type allows for flexibility in adapting to changing requirements and incorporating new features as the project progresses.

Real-World Examples

| Industry | Project | Contract Type | Reason for Use |

|---|---|---|---|

| Aerospace | Development of a new satellite system | Cost Plus Fixed Fee (CPFF) | High level of technical complexity and uncertain outcomes, requiring flexibility in the development process. |

| Construction | Construction of a new hospital building | Cost Plus Incentive Fee (CPIF) | Uncertain site conditions and potential changes in scope, requiring flexibility in the project plan. |

| Government | Development of a new weapons system | Cost Plus Percentage of Costs (CPPC) | High level of government oversight and control, allowing for adjustments based on evolving requirements. |

| IT | Development of a new cloud-based platform | Cost Plus Award Fee (CPAF) | Complex technical requirements and potential changes in scope, requiring flexibility in the development process. |

Considerations for Negotiating a Cost Reimbursement Contract

Negotiating a cost reimbursement contract requires careful consideration of several factors to ensure a mutually beneficial and transparent agreement. This type of contract can be complex, so it’s crucial to have a clear understanding of the project scope, responsibilities, and payment terms.

Defining Scope and Responsibilities

Clearly defining the project scope is essential to avoid disputes and ensure both parties are on the same page. This involves outlining the specific deliverables, milestones, and expected outcomes.

- Detailed Scope of Work: A comprehensive description of the project’s deliverables, including specific tasks, activities, and milestones, should be included. This helps prevent misunderstandings and ensures both parties are aligned on the project’s objectives.

- Clear Responsibilities: Define the responsibilities of both the contractor and the client, including roles, duties, and reporting requirements. This clarifies who is accountable for specific tasks and deliverables.

- Change Management Process: Establish a clear process for managing changes to the scope of work. This helps to prevent unexpected costs and delays by outlining procedures for approving and implementing changes.

Payment Terms and Mechanisms

The payment terms should be clearly defined to avoid disputes and ensure timely payments. This includes establishing the reimbursement rate, payment schedule, and procedures for submitting and approving invoices.

- Reimbursement Rate: Determine a fair and reasonable reimbursement rate for the contractor’s costs, including direct and indirect expenses. This could be based on a fixed percentage, a predetermined cost per unit, or a negotiated rate.

- Payment Schedule: Establish a regular payment schedule, such as monthly or quarterly payments, to ensure timely reimbursement. This should be based on the progress of the project and the contractor’s submitted invoices.

- Invoice Submission and Approval: Artikel the procedures for submitting invoices, including the required documentation, supporting evidence, and approval process. This ensures that payments are processed efficiently and accurately.

Managing Risks and Ensuring Fairness

Cost reimbursement contracts can be riskier than other types of contracts due to the potential for cost overruns. It’s crucial to manage these risks and ensure a fair and transparent agreement.

- Risk Assessment: Conduct a thorough risk assessment to identify potential risks associated with the project. This helps to develop strategies for mitigating these risks and minimizing potential cost overruns.

- Cost Control Measures: Implement cost control measures to ensure that expenses are reasonable and necessary. This could involve setting budgets, monitoring expenses, and requiring approvals for major expenditures.

- Auditing and Transparency: Establish a system for auditing the contractor’s costs to ensure accuracy and transparency. This helps to build trust and prevent disputes.

- Incentives and Penalties: Consider incorporating incentives for meeting or exceeding performance targets and penalties for failing to meet agreed-upon milestones. This encourages the contractor to maintain high standards and control costs.

Understanding the intricacies of cost reimbursement contracts is crucial for both parties involved. By carefully defining the scope, responsibilities, and payment terms, and by implementing robust cost monitoring mechanisms, organizations can mitigate risks and ensure a fair and transparent agreement. Ultimately, cost reimbursement contracts offer a viable option for complex projects where flexibility and collaboration are paramount.

Questions Often Asked: What Is A Cost Reimbursement Contract

What are some common examples of industries where cost reimbursement contracts are used?

Cost reimbursement contracts are often used in industries with high levels of uncertainty, such as government contracting, research and development, and construction projects with complex specifications.

What are some key considerations when negotiating a cost reimbursement contract?

When negotiating a cost reimbursement contract, it is essential to clearly define the scope of work, the responsibilities of each party, the payment terms, and the mechanisms for cost monitoring and control. Additionally, both parties should consider risk allocation and how potential cost overruns will be managed.

What are some potential risks associated with cost reimbursement contracts?

Potential risks associated with cost reimbursement contracts include cost overruns, lack of clear cost control mechanisms, and potential disputes over the allowability of costs. It’s crucial to have a robust system for tracking and verifying costs to mitigate these risks.

What are some alternatives to cost reimbursement contracts?

Alternatives to cost reimbursement contracts include fixed-price contracts, time and materials contracts, and unit-price contracts. The choice of contract type depends on the specific project and the level of risk both parties are willing to assume.