What is cost reimbursement contract – What is a cost reimbursement contract? Imagine a scenario where you hire a contractor to build your dream home. You agree to pay for all the materials and labor costs, plus a predetermined fee for their services. This is the essence of a cost reimbursement contract, where the client reimburses the contractor for their expenses, often with an added fee for their expertise and effort.

These contracts are commonly used in projects with unpredictable costs or when the exact scope of work is unclear, such as in research and development, government contracts, and complex engineering projects.

Cost reimbursement contracts are often favored for their flexibility and potential for innovation. They allow for adjustments as the project progresses, enabling the contractor to adapt to unforeseen challenges and incorporate new ideas. However, this flexibility comes with inherent risks, as cost overruns and potential for abuse are always a concern. Understanding the intricacies of these contracts is crucial for both clients and contractors to ensure successful project execution and minimize financial risks.

Definition of a Cost Reimbursement Contract

![]()

A cost reimbursement contract, also known as a cost-plus contract, is a type of agreement where the buyer (or client) reimburses the seller (or contractor) for the actual costs incurred in performing the work, plus a predetermined fee or profit margin. This type of contract is often used for projects with significant uncertainty, complexity, or when the scope of work is not fully defined upfront.

Key Characteristics

The fundamental concept of a cost reimbursement contract is based on a shared risk and reward arrangement between the buyer and the seller. The seller bears the risk of cost overruns, while the buyer benefits from the seller’s expertise and potential cost savings. Here are some key characteristics that distinguish cost reimbursement contracts:

- Cost Reimbursement: The buyer reimburses the seller for all allowable costs incurred in performing the work, as documented and verified.

- Fee or Profit Margin: In addition to reimbursing costs, the buyer pays the seller a predetermined fee or profit margin, which is usually a percentage of the total costs incurred.

- Shared Risk and Reward: The buyer and seller share the risk of cost overruns and potential cost savings. The seller is incentivized to control costs, as their profit margin is tied to the total cost of the project.

- Detailed Cost Tracking: Both parties must meticulously track and document all costs incurred during the project. This is essential for accurate reimbursement and dispute resolution.

- Flexibility: Cost reimbursement contracts offer greater flexibility than fixed-price contracts, allowing for changes in scope or requirements during the project.

Industries and Scenarios

Cost reimbursement contracts are commonly used in industries and scenarios where:

- High Uncertainty: The scope of work is not fully defined upfront, and there are significant unknowns or risks involved.

- Complex Projects: Projects involving advanced technology, specialized expertise, or unique challenges are often suited for cost reimbursement contracts.

- Research and Development (R&D): R&D projects are inherently uncertain, and cost reimbursement contracts allow for flexibility in adapting to unforeseen challenges and discoveries.

- Government Contracts: Government agencies frequently use cost reimbursement contracts for large-scale projects, particularly in defense, aerospace, and infrastructure sectors.

- Construction: Cost reimbursement contracts can be used for complex construction projects where the scope of work is subject to change, such as large-scale infrastructure projects or historical preservation projects.

Types of Cost Reimbursement Contracts

Cost reimbursement contracts, also known as cost-plus contracts, are agreements where the contractor is reimbursed for all allowable costs incurred in performing the work, plus an agreed-upon fee. These contracts are typically used for projects with high uncertainty or where the scope of work is not fully defined at the outset.There are several different types of cost reimbursement contracts, each with its own unique features, risks, and benefits.

Understanding these variations is crucial for both contractors and clients to ensure a successful and mutually beneficial project outcome.

Cost-Plus-Fixed-Fee (CPFF)

The CPFF contract type involves the contractor being reimbursed for all allowable costs incurred in performing the work, plus a fixed fee that is agreed upon at the outset of the project. This fixed fee is independent of the actual costs incurred and is typically a percentage of the estimated total cost.The CPFF contract structure offers several advantages for both parties:

- For the contractor, the CPFF contract provides a guaranteed profit margin, regardless of the actual costs incurred. This can be particularly beneficial for projects with high uncertainty or where the scope of work is likely to change.

- For the client, the CPFF contract offers the flexibility to make changes to the scope of work without worrying about escalating costs. The fixed fee provides a predictable budget for the project.

However, the CPFF contract also presents certain risks:

- The contractor may have an incentive to inflate costs, as they are reimbursed for all allowable expenses. This can lead to higher project costs for the client.

- The client has limited control over the contractor’s spending, as the contract does not incentivize cost-efficiency.

The CPFF contract is best suited for projects where the scope of work is not fully defined, the risk of cost overruns is high, and the client values flexibility and control over the project’s execution.

Cost-Plus-Incentive-Fee (CPIF)

The CPIF contract type involves the contractor being reimbursed for all allowable costs incurred in performing the work, plus an incentive fee that is based on the contractor’s performance against pre-determined goals. The incentive fee is calculated using a formula that takes into account the actual costs incurred, the target cost, and the performance goals.The CPIF contract offers several advantages for both parties:

- For the contractor, the CPIF contract provides an incentive to control costs and achieve performance goals, as the incentive fee is directly tied to their performance. This can lead to more efficient project execution and higher quality outcomes.

- For the client, the CPIF contract offers the potential for cost savings and improved performance, as the contractor is incentivized to achieve the agreed-upon goals. The client also has more control over the project’s costs and outcomes than with a CPFF contract.

However, the CPIF contract also presents certain risks:

- The complexity of the incentive fee formula can make it difficult to accurately assess the contractor’s performance and determine the appropriate incentive fee. This can lead to disputes and disagreements between the parties.

- The contractor may focus on achieving the performance goals at the expense of cost control, especially if the incentive fee is heavily weighted towards performance.

The CPIF contract is best suited for projects where the client values performance and cost efficiency, but where the scope of work is still somewhat uncertain.

Cost-Plus-Percentage-of-Cost (CPPC)

The CPPC contract type involves the contractor being reimbursed for all allowable costs incurred in performing the work, plus a percentage of those costs as a fee. This percentage is typically agreed upon at the outset of the project and is a fixed percentage of the total costs.The CPPC contract offers several advantages for both parties:

- For the contractor, the CPPC contract provides a predictable profit margin, as the fee is a fixed percentage of the total costs. This can be particularly beneficial for projects with high uncertainty or where the scope of work is likely to change.

- For the client, the CPPC contract offers the flexibility to make changes to the scope of work without worrying about escalating costs. The percentage-based fee provides a predictable budget for the project.

However, the CPPC contract also presents certain risks:

- The contractor may have an incentive to inflate costs, as their fee is directly tied to the total costs incurred. This can lead to higher project costs for the client.

- The client has limited control over the contractor’s spending, as the contract does not incentivize cost-efficiency.

The CPPC contract is generally considered to be less desirable than other cost reimbursement contract types, as it does not incentivize cost control or performance improvement.

Table Comparing Different Cost Reimbursement Contract Types

| Contract Type | Formula | Advantages | Disadvantages |

|---|---|---|---|

| Cost-Plus-Fixed-Fee (CPFF) | Total Costs + Fixed Fee | Guaranteed profit margin for contractor, flexibility for client | Potential for cost inflation, limited client control over costs |

| Cost-Plus-Incentive-Fee (CPIF) | Total Costs + Incentive Fee (based on performance) | Incentive for cost control and performance improvement, potential for cost savings | Complexity of incentive fee calculation, potential for performance focus over cost control |

| Cost-Plus-Percentage-of-Cost (CPPC) | Total Costs + Percentage of Costs | Predictable profit margin for contractor, flexibility for client | Potential for cost inflation, limited client control over costs |

Key Elements of a Cost Reimbursement Contract: What Is Cost Reimbursement Contract

A cost reimbursement contract, also known as a cost-plus contract, is a type of agreement where the contractor is reimbursed for the actual costs incurred in performing the work, plus a predetermined fee or profit margin. This type of contract is typically used for complex projects with uncertain costs or when the scope of work is not fully defined at the outset.

To ensure a successful and transparent project, cost reimbursement contracts must include specific elements that define the scope of work, payment terms, and cost control mechanisms.

Scope of Work

The scope of work is a critical element of any contract, and it is particularly important in cost reimbursement contracts. The scope of work must be clearly defined to prevent disputes and ensure that both parties are on the same page regarding the project’s deliverables. The scope of work should include a detailed description of the work to be performed, including:

- Specific tasks and deliverables

- Project milestones and timelines

- Performance standards and quality requirements

- Any applicable regulations or industry standards

Payment Terms

Payment terms in a cost reimbursement contract are complex and require careful consideration. The contract should clearly define the following:

- Reimbursement rate for allowable costs

- Fee or profit margin structure

- Payment schedule and milestones

- Procedures for submitting cost invoices and supporting documentation

- Methods for resolving payment disputes

Cost Control Mechanisms

Cost control mechanisms are essential for ensuring that the project stays within budget and that the contractor is not overspending. The contract should include provisions for:

- Establishing a budget and cost baseline

- Requiring the contractor to submit regular cost reports

- Implementing cost monitoring and tracking systems

- Establishing procedures for reviewing and approving cost variances

- Defining the roles and responsibilities of the parties in cost control

Cost Reimbursement Guidelines and Procedures, What is cost reimbursement contract

Clear and comprehensive cost reimbursement guidelines and procedures are crucial for preventing disputes and ensuring transparency. The contract should include:

- Definition of allowable and unallowable costs

- Procedures for documenting and supporting cost claims

- Methods for auditing and verifying cost data

- Guidelines for managing cost overruns and changes in scope

Independent Cost Audits

Independent cost audits are a vital element of cost reimbursement contracts. An independent auditor can verify the accuracy of cost claims and ensure that the contractor is not overcharging. The contract should specify:

- The frequency and scope of cost audits

- The qualifications and independence of the auditor

- The procedures for conducting the audits

- The responsibilities of the parties in the audit process

Advantages and Disadvantages of Cost Reimbursement Contracts

Cost reimbursement contracts are a type of contract where the buyer reimburses the seller for all allowable costs incurred in performing the work, plus a fee. This type of contract is often used for complex projects where the scope of work is uncertain or subject to change. Cost reimbursement contracts offer a balance between the buyer’s need for flexibility and the seller’s need for cost recovery.

However, these contracts also carry certain risks, such as cost overruns and potential for abuse.

Advantages of Cost Reimbursement Contracts

Cost reimbursement contracts offer several advantages, making them suitable for specific projects. The most prominent advantages include:

- Increased Flexibility: These contracts allow for changes in the scope of work during the project, providing greater flexibility for both the buyer and the seller. This flexibility is especially valuable when dealing with complex projects with uncertain requirements.

- Potential for Innovation: Cost reimbursement contracts encourage innovation by allowing the seller to explore new solutions and technologies without the constraint of a fixed price. This can lead to better outcomes and more efficient solutions.

- Risk Sharing: Cost reimbursement contracts allow for the sharing of risk between the buyer and the seller. The buyer assumes the risk of cost overruns, while the seller assumes the risk of not being able to cover its costs. This shared risk can be beneficial for both parties.

- Attracting Skilled Contractors: The potential for higher profits and the ability to recover costs can attract skilled and experienced contractors, particularly for projects with challenging technical requirements.

Disadvantages of Cost Reimbursement Contracts

While cost reimbursement contracts offer advantages, they also present potential disadvantages. The most significant disadvantages include:

- Cost Overruns: One of the biggest risks associated with cost reimbursement contracts is the potential for cost overruns. This is because the seller has an incentive to maximize its costs, which can lead to higher-than-expected expenses for the buyer.

- Potential for Abuse: The lack of a fixed price can create opportunities for the seller to inflate its costs or submit fraudulent claims. This can result in significant financial losses for the buyer.

- Lack of Cost Control: The buyer has less control over the seller’s costs in a cost reimbursement contract. This can make it difficult to track expenses and ensure that the project stays within budget.

- Increased Complexity: Cost reimbursement contracts are more complex to manage than fixed-price contracts. They require careful monitoring and oversight to ensure that the seller is properly accounting for its costs.

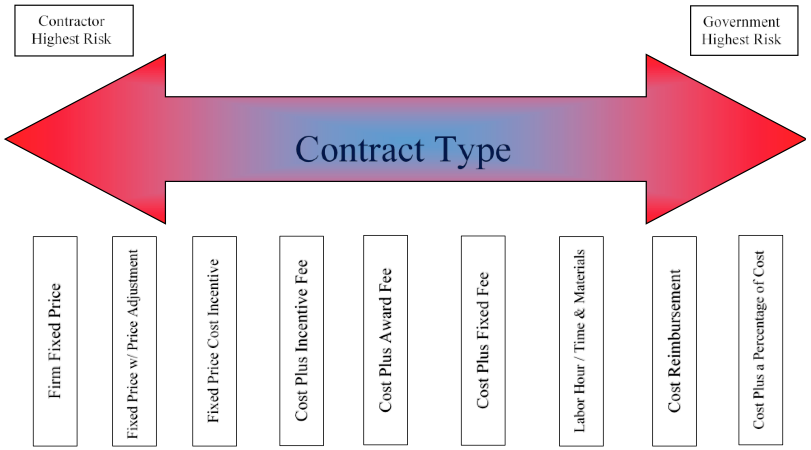

Comparison of Cost Reimbursement Contracts with Other Contract Types

Cost reimbursement contracts have distinct advantages and disadvantages compared to other contract types, such as fixed-price contracts. The following table highlights these differences:

| Characteristic | Cost Reimbursement Contract | Fixed-Price Contract |

|---|---|---|

| Price | Reimbursable costs plus fee | Fixed price |

| Risk | Shared between buyer and seller | Primarily borne by the seller |

| Flexibility | High | Low |

| Cost Control | Lower | Higher |

| Innovation | Encouraged | Limited |

| Suitability | Complex projects with uncertain scope | Projects with well-defined scope and requirements |

Risk Management in Cost Reimbursement Contracts

Cost reimbursement contracts, while offering flexibility and potential cost savings, inherently involve higher risk compared to fixed-price contracts. Effective risk management is crucial for both the contractor and the client to ensure project success and mitigate potential financial losses.

Establishing Clear Cost Control Measures

Implementing robust cost control measures is paramount in cost reimbursement contracts. This involves establishing clear guidelines for cost reporting, tracking, and auditing to ensure transparency and accountability.

- Detailed Cost Breakdown Structure (CBS): A comprehensive CBS is essential for identifying and tracking all project costs. This structure should be agreed upon by both parties and updated regularly throughout the project lifecycle.

- Cost Tracking and Reporting Systems: Implementing efficient cost tracking systems, such as dedicated software or spreadsheets, is crucial for monitoring project expenses. Regular cost reports should be submitted to the client, detailing incurred costs, budget variances, and potential cost overruns.

- Independent Cost Audits: Conducting periodic independent cost audits by qualified professionals can provide an objective assessment of the contractor’s cost management practices and identify potential areas for improvement. These audits can help build trust and ensure that costs are reasonable and justifiable.

Implementing Risk Mitigation Strategies

Proactive risk mitigation strategies are essential to minimize the potential financial impact of unforeseen circumstances. This involves identifying potential risks, assessing their likelihood and impact, and developing strategies to mitigate their effects.

- Risk Assessment and Planning: A thorough risk assessment should be conducted at the outset of the project to identify potential risks, such as delays, changes in scope, or unexpected cost increases. This assessment should consider both internal and external factors.

- Contingency Planning: Develop contingency plans for various potential risks, outlining specific actions to be taken in case of unexpected events. This includes having backup options for critical resources, suppliers, and project timelines.

- Insurance Coverage: Consider obtaining appropriate insurance coverage to protect against potential financial losses due to unforeseen events, such as natural disasters, accidents, or legal liabilities.

Establishing Realistic Cost Estimates

Accurate cost estimates are fundamental for ensuring project feasibility and preventing cost overruns. This involves a thorough understanding of the project scope, complexities, and potential challenges.

- Detailed Cost Analysis: Conduct a detailed cost analysis, considering all project phases, materials, labor, equipment, and overhead expenses. This should include historical data, industry benchmarks, and expert input.

- Cost Reserves: Include cost reserves in the initial budget to account for potential uncertainties and unforeseen expenses. These reserves should be allocated strategically and used only for approved purposes.

- Cost Monitoring and Adjustment: Regularly monitor project costs against the approved budget and make necessary adjustments to ensure that the project remains within financial constraints. This involves analyzing cost variances and implementing corrective measures.

Conducting Regular Cost Reviews

Periodic cost reviews are essential for maintaining project feasibility and ensuring that costs remain within acceptable limits. This involves analyzing cost trends, identifying potential cost overruns, and implementing corrective measures.

- Cost Review Meetings: Conduct regular cost review meetings with the client and contractor to discuss project progress, cost performance, and potential cost overruns. This provides an opportunity for early detection and mitigation of cost issues.

- Cost Variance Analysis: Analyze cost variances between actual costs and budgeted costs to identify the root causes of deviations and implement corrective actions. This involves investigating cost overruns, underruns, and budget changes.

- Cost Optimization Strategies: Explore and implement cost optimization strategies to reduce unnecessary expenses without compromising project quality. This may involve negotiating better pricing with suppliers, improving project efficiency, or identifying alternative materials or methods.

Role of Cost-Sharing Mechanisms

Cost-sharing mechanisms can mitigate financial risks for both the contractor and the client. This involves sharing the financial burden of potential cost overruns or unexpected expenses.

- Shared Savings Clauses: Include clauses that allow both parties to share any savings realized through cost optimization or efficient project execution. This incentivizes both parties to work collaboratively to minimize costs.

- Cost-Sharing Formulas: Establish clear cost-sharing formulas to determine the percentage of costs that each party will bear in case of cost overruns or unforeseen expenses. This should be agreed upon at the outset of the project and clearly Artikeld in the contract.

- Ceiling Prices: Consider setting a ceiling price for the project, beyond which the client will not be responsible for additional costs. This provides financial protection for the client while encouraging the contractor to manage costs effectively.

Legal and Regulatory Considerations

Cost reimbursement contracts are subject to a complex web of legal and regulatory frameworks that aim to ensure fairness, transparency, and accountability in government and commercial transactions. Understanding these legal considerations is crucial for both parties involved to mitigate risks, prevent disputes, and ensure compliance with applicable laws.

Relevant Laws and Regulations

Legal frameworks governing cost reimbursement contracts vary depending on the jurisdiction, industry, and nature of the project. Some key legal and regulatory considerations include:

- Public Procurement Laws: In many countries, government procurement is subject to specific laws and regulations that govern the use of cost reimbursement contracts. These laws often mandate competitive bidding, transparency in pricing, and strict oversight of contract performance. Examples include the Federal Acquisition Regulation (FAR) in the United States, the Public Procurement Regulations in the European Union, and the Government Procurement Act in Canada.

- Contract Law: General principles of contract law apply to cost reimbursement contracts, including formation, interpretation, and breach of contract. These principles dictate the legal obligations and remedies available to both parties in case of disputes. For example, courts may enforce contractual provisions regarding cost allocation, audit rights, and termination clauses.

- Industry Standards: Specific industries may have established standards and best practices for cost reimbursement contracts. These standards can provide guidance on cost accounting, documentation requirements, and dispute resolution mechanisms. For instance, the American Institute of Certified Public Accountants (AICPA) publishes standards for cost accounting that are relevant to cost reimbursement contracts.

- Anti-Kickback Laws: Cost reimbursement contracts can be susceptible to kickback schemes, where contractors inflate costs or make payments to influence decision-making. Anti-kickback laws prohibit these practices and impose penalties on both parties involved. The False Claims Act in the United States is a prominent example of such legislation.

Legal Disputes Arising from Cost Reimbursement Contracts

Cost reimbursement contracts are prone to legal disputes due to their inherent complexity and the potential for disagreements regarding cost allocation, contract performance, and termination. Common causes of disputes include:

- Cost Overruns: Disputes often arise when contractors claim costs that the contracting party deems unreasonable or unsupported. This can be due to inaccurate cost estimates, unforeseen circumstances, or deliberate cost inflation. Examples include disputes over labor costs, material expenses, and overhead charges.

- Contract Performance Issues: Disputes may arise if the contractor fails to meet performance targets or deadlines, leading to delays, cost overruns, or quality issues. This can be caused by inadequate planning, poor communication, or unforeseen challenges during project execution. For instance, a dispute might occur if a contractor fails to complete a project within the agreed-upon timeframe, resulting in financial penalties or termination of the contract.

- Termination Disputes: Disputes can arise when one party terminates the contract due to non-performance, breach of contract, or other grounds. Termination disputes often involve arguments over the proper termination procedure, the calculation of termination costs, and the allocation of liability.

Best Practices for Drafting and Negotiating Cost Reimbursement Contracts

To minimize legal risks and ensure compliance with applicable laws, parties should carefully draft and negotiate cost reimbursement contracts, incorporating the following best practices:

- Clear and Comprehensive Contract Language: The contract should clearly define the scope of work, payment terms, cost allocation, and dispute resolution mechanisms. Ambiguous or unclear language can lead to misinterpretations and disputes. For example, the contract should specify the types of costs that are reimbursable, the procedures for cost reporting, and the basis for cost allocation.

- Detailed Cost Estimates and Budgeting: Parties should develop realistic cost estimates and budgets based on thorough market research, historical data, and expert input. This will help to mitigate cost overruns and reduce the risk of disputes. For instance, the contract should include a detailed cost breakdown, outlining the estimated cost of labor, materials, equipment, and overhead.

- Robust Audit and Oversight Provisions: The contract should include provisions for regular audits and oversight of the contractor’s cost reporting and performance. This helps to ensure transparency, accountability, and the prevention of cost inflation or fraud. For example, the contract could provide for independent audits of the contractor’s cost records, allowing the contracting party to verify the accuracy and reasonableness of claimed costs.

- Effective Dispute Resolution Mechanisms: The contract should include clear and efficient mechanisms for resolving disputes, such as mediation, arbitration, or litigation. This will help to avoid costly and time-consuming legal battles. For instance, the contract could specify the process for initiating and resolving disputes, including the selection of mediators or arbitrators, the applicable rules of procedure, and the timeframe for resolving disputes.

- Compliance with Applicable Laws and Regulations: Both parties should ensure that the contract complies with all relevant laws, regulations, and industry standards. This includes obtaining necessary permits, licenses, and approvals, and complying with ethical and anti-corruption regulations. For example, the contract should include provisions for compliance with anti-kickback laws, ensuring that all payments and transactions are legitimate and transparent.

Navigating the complexities of cost reimbursement contracts requires careful planning, transparent communication, and robust risk management strategies. By understanding the different types of cost reimbursement contracts, establishing clear cost control mechanisms, and mitigating potential risks, both parties can work collaboratively towards a successful outcome. The key lies in finding the right balance between flexibility and accountability, ensuring that the project’s objectives are met within reasonable financial constraints.

Ultimately, cost reimbursement contracts can be a valuable tool for undertaking complex and innovative projects, but only when both parties are fully aware of the associated risks and responsibilities.

FAQs

What are the most common types of cost reimbursement contracts?

The most common types include cost-plus-fixed-fee, cost-plus-incentive-fee, and cost-plus-award-fee. Each type has different fee structures and risk-sharing mechanisms.

What are the key elements of a cost reimbursement contract?

Essential elements include the scope of work, payment terms, cost control mechanisms, and dispute resolution procedures.

How can I minimize risks associated with cost reimbursement contracts?

Implementing robust cost control measures, conducting regular cost reviews, and establishing clear risk mitigation strategies are crucial.

Are there any legal considerations for cost reimbursement contracts?

Yes, there are laws and regulations governing cost reimbursement contracts. It’s essential to comply with these legal frameworks and seek professional legal advice.