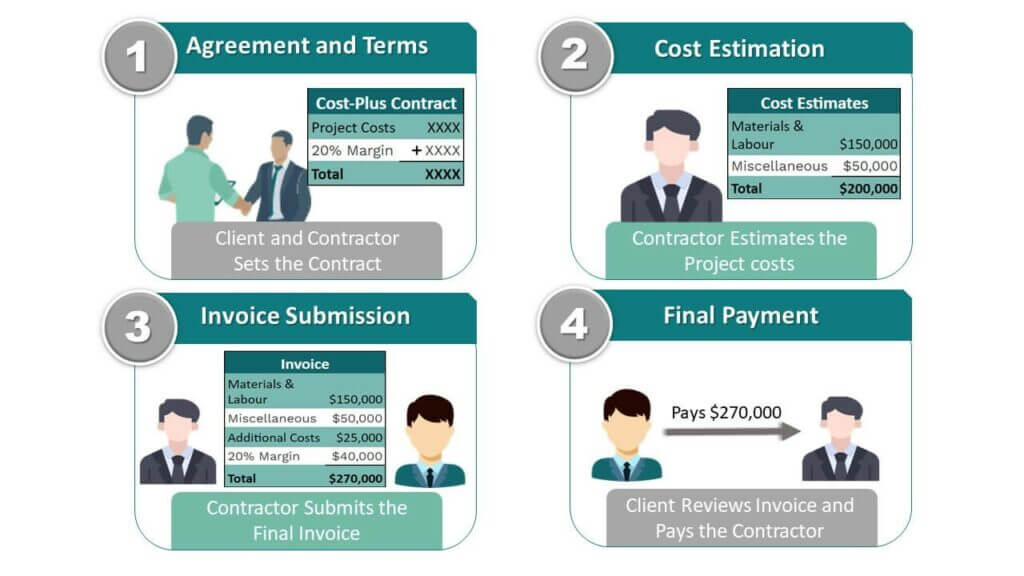

What is cost plus contract – What is a cost-plus contract? It’s a type of agreement where the buyer pays the seller for all the actual costs incurred in completing a project, plus an agreed-upon fee or percentage for profit. This approach is often used in situations where the project scope is uncertain, or where the risks are high. Imagine you’re building a custom home; you might choose a cost-plus contract because you can’t fully predict the costs upfront, and you want to ensure that all necessary materials and labor are covered.

Cost-plus contracts are commonly found in industries like construction, engineering, and government contracting, where projects are often complex and unpredictable. They offer a different approach to risk allocation compared to fixed-price contracts, where the buyer pays a set price regardless of the actual costs.

Definition of Cost-Plus Contract: What Is Cost Plus Contract

A cost-plus contract is a type of agreement where the buyer pays the seller for all the actual costs incurred in completing a project, plus an agreed-upon profit margin. It’s like paying for a meal at a restaurant where the price is based on the ingredients and the chef’s time, plus a fixed percentage for their service.

Industries Where Cost-Plus Contracts Are Commonly Used

Cost-plus contracts are often used in situations where the scope of work is uncertain or subject to change, making it difficult to estimate the final cost upfront. This makes them suitable for projects with high levels of complexity, risk, or where the exact specifications are not fully defined at the start.

- Construction: Complex infrastructure projects like bridges, tunnels, and large buildings often involve unforeseen challenges and require flexibility in the contract.

- Research and Development (R&D): Cost-plus contracts are common in R&D projects where the outcome is uncertain, and the costs can vary significantly depending on the results of the research.

- Defense and Aerospace: Government contracts for military equipment and spacecraft frequently use cost-plus arrangements due to the highly specialized nature of the work and the need for ongoing adjustments.

- Engineering and Consulting: When projects involve a high degree of customization or require extensive expertise, cost-plus contracts provide a framework for managing the unpredictable nature of the work.

Differences Between Cost-Plus Contracts and Fixed-Price Contracts

Cost-plus contracts differ significantly from fixed-price contracts. In a fixed-price contract, the buyer agrees to pay a predetermined amount for the project, regardless of the actual costs incurred by the seller.

The fundamental difference lies in the risk allocation: cost-plus contracts transfer the risk of cost overruns to the buyer, while fixed-price contracts place the risk on the seller.

- Cost-Plus Contracts: The buyer bears the risk of cost overruns, but also has greater control over the project’s scope and budget.

- Fixed-Price Contracts: The seller bears the risk of cost overruns, but the buyer has less control over the project’s scope and budget.

Key Components of a Cost-Plus Contract

A cost-plus contract, as we discussed, is a type of agreement where the contractor is reimbursed for all their actual costs incurred during the project, plus an agreed-upon fee. This fee structure is typically designed to incentivize the contractor to keep costs under control while still ensuring they receive a fair profit for their work.

Cost Reimbursement

The fundamental principle of a cost-plus contract is that the contractor is reimbursed for all eligible costs incurred during the project. This means that the contractor’s profit is not fixed upfront, but rather determined by the total cost of the project. The reimbursement process is typically based on detailed cost breakdowns, invoices, and supporting documentation.

Breakdown of Cost Reimbursement

- Direct Costs: These are the costs directly associated with the project, such as labor, materials, and equipment. The contractor must provide detailed documentation for all direct costs, including receipts, invoices, and timesheets.

- Indirect Costs: These are costs that are not directly related to a specific project but are necessary for the overall operation of the business, such as administrative expenses, rent, and utilities. The contractor may allocate a portion of these costs to the project based on a predetermined allocation method.

- Overhead Costs: These are costs incurred to support the project, such as project management, engineering, and quality control. These costs are typically allocated to the project based on a predetermined overhead rate.

Fee Structure

The fee structure is a critical component of a cost-plus contract. It represents the contractor’s profit for the project and can be determined in various ways.

Determining the Fee Structure

- Percentage of Costs: The fee is calculated as a percentage of the total eligible costs incurred by the contractor. For example, a 10% fee on a project with $1 million in eligible costs would result in a $100,000 fee for the contractor.

- Fixed Fee: The fee is predetermined and remains fixed regardless of the actual costs incurred by the contractor. This approach provides a clear profit margin for the contractor but can incentivize them to inflate costs.

- Incentive Fee: The fee is based on the contractor’s performance in terms of cost control, schedule adherence, and quality. This approach incentivizes the contractor to strive for efficiency and effectiveness, leading to potential cost savings for the project.

Impact of the Fee Structure

- Project Cost: The fee structure significantly impacts the overall project cost. A higher fee will result in a higher total project cost. It is crucial to carefully negotiate the fee structure to ensure it is fair and reasonable for both parties.

- Contractor Motivation: The fee structure can influence the contractor’s motivation to control costs. A fixed fee may encourage cost inflation, while an incentive fee can incentivize efficiency and cost savings.

- Risk Allocation: The fee structure can also impact the allocation of risk between the contractor and the client. A higher fee may indicate a higher risk for the client, while a lower fee may indicate a lower risk for the client.

Advantages of Cost-Plus Contracts

Cost-plus contracts offer a unique approach to project management, where the buyer pays for the actual costs incurred by the seller plus a predetermined profit margin. This approach can be beneficial for both parties involved, particularly in complex or high-risk projects.

Benefits for the Buyer

Cost-plus contracts can be advantageous for buyers, especially when dealing with projects that involve significant uncertainty or complexity. This is because the buyer is not responsible for cost overruns, as long as the seller operates within the agreed-upon scope and adheres to the contract terms.

- Cost Certainty: Cost-plus contracts provide a level of cost certainty for the buyer, as they are only responsible for paying the actual costs incurred by the seller. This eliminates the risk of unexpected cost overruns that can often arise in traditional fixed-price contracts.

- Flexibility: Cost-plus contracts offer flexibility in terms of project scope and design changes. Buyers can make changes to the project as needed without the fear of significant cost penalties.

- Access to Expertise: Buyers can leverage the seller’s expertise and experience, as the seller is incentivized to provide the best possible solution, regardless of the cost. This can be particularly valuable for complex projects where specialized knowledge is required.

Benefits for the Seller

Cost-plus contracts can also be advantageous for sellers, particularly when dealing with projects that involve high risk or uncertainty. The seller is guaranteed to recover their costs, plus a predetermined profit margin.

- Cost Recovery: Cost-plus contracts ensure that sellers are fully reimbursed for their expenses, including labor, materials, and overhead. This reduces the financial risk associated with the project, as the seller is not responsible for absorbing any cost overruns.

- Incentive for Innovation: Cost-plus contracts can encourage sellers to be more innovative and creative, as they are not limited by a fixed budget. This can lead to better solutions and outcomes for the project.

- Reduced Risk: Cost-plus contracts can help sellers manage risk, as they are not responsible for cost overruns. This allows sellers to focus on delivering a high-quality project, rather than worrying about potential financial losses.

Advantages for Complex or High-Risk Projects

Cost-plus contracts are particularly well-suited for complex or high-risk projects where the scope of work is difficult to define upfront. This is because they provide flexibility for both the buyer and seller to adjust the project as needed, while ensuring that the seller is fairly compensated for their efforts.

- Uncertainty in Scope: Cost-plus contracts are ideal for projects where the scope of work is uncertain or likely to change. This is because the seller is reimbursed for their actual costs, regardless of any unforeseen circumstances.

- High Risk: Cost-plus contracts can be beneficial for projects with a high degree of risk, such as those involving new technologies or challenging environments. The seller is protected from potential cost overruns, which can encourage them to take on more risk and explore innovative solutions.

- Unforeseen Circumstances: Cost-plus contracts can help manage unforeseen circumstances that can arise during a project, such as changes in regulations, weather events, or material shortages. The seller is reimbursed for any additional costs incurred due to these circumstances.

Encouraging Collaboration and Innovation

Cost-plus contracts can encourage collaboration and innovation by aligning the interests of both the buyer and the seller. This is because both parties are incentivized to work together to achieve the best possible outcome for the project.

- Shared Goals: Cost-plus contracts promote a shared goal between the buyer and the seller, which is to deliver a successful project. This shared goal can foster a more collaborative and cooperative environment.

- Open Communication: Cost-plus contracts encourage open communication between the buyer and the seller, as both parties are working towards a common objective. This can lead to better decision-making and a more efficient project execution.

- Risk Sharing: Cost-plus contracts involve risk sharing between the buyer and the seller. This can encourage the seller to be more innovative and explore new solutions, knowing that they will be reimbursed for their efforts.

Disadvantages of Cost-Plus Contracts

While cost-plus contracts offer flexibility and shared risk, they also present several drawbacks for both the buyer and the seller. Understanding these potential pitfalls is crucial for making informed decisions about contract type.

Potential Drawbacks for Buyer and Seller

Cost-plus contracts can lead to challenges for both parties involved. For the buyer, the lack of a fixed price can create uncertainty and expose them to potential cost overruns. On the other hand, the seller may face pressure to maximize costs, potentially leading to reduced profit margins.

Risk of Cost Overruns, What is cost plus contract

Cost overruns are a significant concern with cost-plus contracts. The lack of a predetermined price can make it difficult to control expenses, and unexpected costs can quickly escalate the project’s total cost. This can be especially problematic for large-scale projects where scope changes or unforeseen circumstances are more likely.

“Cost overruns can occur when the initial estimates are inaccurate, the project scope changes, or unforeseen circumstances arise.”

- Lack of Incentive for Cost Control: Without a fixed price, the seller may not be as motivated to keep costs down, as they are reimbursed for all expenses. This can lead to less careful budgeting and a tendency to overspend. For example, the seller may choose more expensive materials or labor, leading to higher overall costs.

- Difficulty in Monitoring Costs: Buyers often face challenges in monitoring the seller’s costs, especially when the project involves complex activities or numerous subcontractors. Lack of transparency can make it difficult to identify potential overspending or inefficient practices.

- Risk of Cost Inflation: The seller may have an incentive to inflate costs to increase their profit margin. This can be particularly challenging to detect, especially when the project involves complex activities or specialized expertise.

Reduced Accountability and Lack of Incentive for Cost Control

Cost-plus contracts can create a situation where both parties have reduced accountability for cost control. The buyer may be less likely to scrutinize costs closely, as they are ultimately responsible for paying whatever the final cost turns out to be. Similarly, the seller may be less motivated to keep costs down, as they are reimbursed for all expenses.

“A lack of incentive for cost control can lead to a situation where both parties are less motivated to find ways to reduce expenses.”

- Reduced Motivation for Efficiency: Without a fixed price, the seller may have less incentive to optimize their processes and find ways to reduce costs. This can lead to less efficient project execution and higher overall costs.

- Potential for Abuse: In some cases, the seller may take advantage of the cost-plus structure to inflate costs or pad their expenses. This can lead to significant financial losses for the buyer.

Types of Cost-Plus Contracts

Cost-plus contracts offer flexibility and a clear cost accounting system, but they also require careful management and monitoring to avoid cost overruns. Understanding the different types of cost-plus contracts and their implications for risk allocation, fee structure, and incentive mechanisms is crucial for making informed decisions about project execution.

Cost-Plus-Fixed-Fee (CPFF)

In a CPFF contract, the contractor is reimbursed for all allowable costs incurred during the project, plus a fixed fee that is agreed upon upfront. This fee is typically a percentage of the estimated project cost or a lump sum. The contractor’s profit is capped at the fixed fee, regardless of how much the actual project cost is.

- Risk Allocation: In a CPFF contract, the contractor bears a significant portion of the cost risk, as they are responsible for any cost overruns. However, the contractor’s profit is capped at the fixed fee, which provides some financial protection.

- Fee Structure: The fixed fee is determined upfront and remains constant throughout the project, regardless of the actual cost incurred. This provides a predictable profit margin for the contractor.

- Incentive Mechanisms: There are no specific incentive mechanisms in a CPFF contract. The contractor is motivated to control costs to maximize their profit, but there is no direct incentive to complete the project ahead of schedule or under budget.

- Example: A CPFF contract might be used for a research and development project where the scope of work is uncertain and the costs are difficult to estimate accurately. The fixed fee provides the contractor with a predictable profit margin, while the cost-plus arrangement allows for flexibility in adapting to changing requirements.

Cost-Plus-Incentive-Fee (CPIF)

A CPIF contract is similar to a CPFF contract, but it includes an incentive fee that is paid to the contractor based on the project’s performance. The incentive fee is typically based on factors such as cost, schedule, and performance targets. The contractor is rewarded for exceeding expectations and penalized for failing to meet targets.

- Risk Allocation: In a CPIF contract, the contractor still bears a significant portion of the cost risk, but the incentive fee mechanism provides some motivation to control costs. The risk allocation is shared between the contractor and the client, with the contractor having more control over the project’s cost and performance.

- Fee Structure: The fee structure in a CPIF contract includes a fixed fee and an incentive fee. The fixed fee is paid regardless of project performance, while the incentive fee is earned based on achieving specific performance targets. The incentive fee is typically a percentage of the total project cost or a lump sum.

- Incentive Mechanisms: CPIF contracts provide a strong incentive for the contractor to control costs, improve performance, and complete the project on time. The incentive fee mechanism aligns the interests of the contractor with those of the client, encouraging collaboration and efficiency.

- Example: A CPIF contract might be used for a complex construction project where the client wants to incentivize the contractor to complete the project ahead of schedule and within budget. The incentive fee would be based on factors such as project completion time, cost savings, and quality of work.

Cost-Plus-Percentage-of-Cost (CPPC)

In a CPPC contract, the contractor is reimbursed for all allowable costs incurred during the project, plus a percentage of the total cost. The percentage is typically agreed upon upfront and remains constant throughout the project. This type of contract provides the contractor with a profit margin that is directly proportional to the project’s cost.

- Risk Allocation: The contractor bears little to no cost risk in a CPPC contract, as their profit is directly tied to the project’s cost. However, this can lead to a lack of motivation to control costs.

- Fee Structure: The fee structure in a CPPC contract is simple, with the contractor receiving a percentage of the total project cost as their profit. This can lead to high profit margins for the contractor, especially if the project cost is high.

- Incentive Mechanisms: CPPC contracts offer little incentive for the contractor to control costs or improve performance, as their profit is directly tied to the project’s cost. This can lead to cost overruns and a lack of efficiency.

- Example: CPPC contracts are rarely used today due to their potential for cost overruns and lack of incentive for cost control. However, they may be used in situations where the project scope is highly uncertain and the client is willing to bear the risk of high costs.

Cost-Plus-Award-Fee (CPAF)

In a CPAF contract, the contractor is reimbursed for all allowable costs incurred during the project, plus an award fee that is based on the contractor’s performance. The award fee is typically determined by a panel of independent experts who assess the contractor’s performance against a set of predetermined criteria.

- Risk Allocation: The contractor bears a significant portion of the cost risk in a CPAF contract, as they are responsible for any cost overruns. However, the award fee mechanism provides some motivation to control costs and improve performance.

- Fee Structure: The fee structure in a CPAF contract includes a fixed fee and an award fee. The fixed fee is paid regardless of project performance, while the award fee is earned based on achieving specific performance targets. The award fee is typically a lump sum or a percentage of the total project cost.

- Incentive Mechanisms: CPAF contracts provide a strong incentive for the contractor to control costs, improve performance, and meet the client’s expectations. The award fee mechanism encourages the contractor to focus on delivering value and exceeding expectations.

- Example: A CPAF contract might be used for a complex software development project where the client wants to incentivize the contractor to deliver a high-quality product that meets specific performance requirements. The award fee would be based on factors such as functionality, usability, and security.

Cost-Plus Contract Negotiation

Negotiating a cost-plus contract requires careful consideration of various factors to ensure both parties are protected and the project is successful. The negotiation process should be transparent, collaborative, and focused on establishing a clear understanding of the project scope, cost control mechanisms, and performance metrics.

Defining the Scope of Work

The scope of work should be meticulously defined to avoid ambiguity and potential disputes. A clear and comprehensive scope of work helps establish a framework for cost estimation and performance evaluation.

- Detailed Description: The scope of work should include a detailed description of all tasks, deliverables, and milestones. This helps to ensure that both parties are on the same page regarding the project’s objectives and expectations.

- Specific Deliverables: Define specific deliverables with clear acceptance criteria. This helps to ensure that the project meets the agreed-upon standards and requirements.

- Timeline and Milestones: Establish a clear timeline and define specific milestones to track progress and ensure timely completion.

- Change Management Process: Establish a formal change management process to handle any changes in the scope of work. This helps to prevent cost overruns and delays caused by unforeseen modifications.

Cost Control Mechanisms

Effective cost control mechanisms are crucial for managing project expenses and preventing cost overruns.

- Budgeted Costs: Establish a detailed budget that Artikels all anticipated costs, including labor, materials, equipment, and overhead. This serves as a baseline for tracking actual expenses.

- Cost Tracking and Reporting: Implement a system for tracking and reporting actual costs against the budget. This allows for early identification of potential cost overruns and corrective action.

- Cost Variance Analysis: Regularly analyze cost variances to identify the root causes of deviations from the budget. This helps to improve cost control and prevent future overruns.

- Cost Audits: Conduct periodic cost audits to ensure that expenses are aligned with the project scope and budget. This helps to maintain transparency and accountability.

Performance Metrics

Performance metrics are essential for evaluating project success and ensuring that the project meets the agreed-upon standards.

- Key Performance Indicators (KPIs): Identify key performance indicators (KPIs) that align with the project objectives. These metrics should be measurable, relevant, and achievable.

- Performance Reporting: Regularly report on performance against the established KPIs. This helps to track progress and identify areas for improvement.

- Performance Reviews: Conduct periodic performance reviews to assess project progress and identify any areas that require adjustments.

- Incentive Structures: Consider incorporating incentive structures that reward performance exceeding the agreed-upon metrics. This can motivate the contractor to deliver high-quality results.

Ensuring Transparency and Accountability

Transparency and accountability are crucial for building trust and fostering a successful project partnership.

- Open Communication: Maintain open and transparent communication throughout the project lifecycle. This includes regular meetings, progress reports, and prompt responses to inquiries.

- Documentation: Maintain detailed documentation of all project activities, including costs, decisions, and changes. This ensures a clear audit trail and facilitates accountability.

- Independent Audits: Consider incorporating independent audits to ensure that costs are reasonable and expenses are properly documented.

- Dispute Resolution Mechanisms: Establish a clear and fair dispute resolution mechanism to address any disagreements that may arise during the project.

Cost-Plus Contract Management

Cost-plus contracts, while offering flexibility and risk sharing, require meticulous management to ensure successful project completion and prevent cost overruns. Effective management involves a structured approach to cost tracking, progress monitoring, and risk mitigation.

Cost Tracking

Tracking costs is crucial for maintaining transparency and controlling expenses in a cost-plus contract. This involves accurately recording all project expenditures, categorizing them, and comparing them against the initial budget.

- Detailed Cost Records: Maintain comprehensive records of all project expenses, including labor, materials, equipment, and other relevant costs. This documentation should be detailed and organized for easy analysis.

- Cost Breakdown Structure (CBS): Establish a cost breakdown structure (CBS) to categorize project costs systematically. This allows for better understanding of where funds are being allocated and facilitates cost control.

- Regular Cost Reports: Generate regular cost reports to monitor actual expenses against the estimated budget. These reports should highlight any significant variances and potential cost overruns.

Progress Monitoring

Monitoring project progress is essential to ensure the project stays on schedule and within budget. This involves tracking key milestones, evaluating performance against deadlines, and identifying potential delays or issues.

- Milestone Tracking: Establish clear project milestones and track their completion dates. This provides a visual representation of project progress and allows for timely adjustments.

- Performance Measurement: Develop key performance indicators (KPIs) to measure project performance against pre-defined standards. These metrics can include productivity, efficiency, and quality.

- Progress Reports: Generate regular progress reports to communicate project status, highlight achievements, and identify any challenges or delays. These reports should be shared with both the buyer and the seller.

Risk Management

Identifying and mitigating risks is critical in cost-plus contracts, as both parties share the financial responsibility for potential issues. This involves proactive risk assessment, developing contingency plans, and implementing risk mitigation strategies.

- Risk Identification: Conduct a comprehensive risk assessment to identify potential risks throughout the project lifecycle. This may include technical, financial, regulatory, or environmental risks.

- Contingency Planning: Develop contingency plans for identified risks to minimize their impact on the project. These plans should Artikel alternative strategies and resources in case of unforeseen events.

- Risk Mitigation: Implement risk mitigation strategies to reduce the likelihood and impact of identified risks. This may involve using specialized equipment, adopting best practices, or securing insurance.

Communication and Collaboration

Open and frequent communication between the buyer and the seller is crucial for effective cost-plus contract management. This ensures both parties are informed about project progress, potential issues, and any necessary adjustments.

- Regular Meetings: Schedule regular meetings to discuss project updates, review progress, and address any concerns. These meetings should involve key stakeholders from both parties.

- Transparent Reporting: Provide regular and transparent reports to keep both parties informed about project status, costs, and potential risks. These reports should be clear, concise, and accurate.

- Open Dialogue: Foster an open dialogue between the buyer and the seller to encourage feedback, address issues promptly, and ensure mutual understanding.

Cost-Plus Contract Examples

Cost-plus contracts are commonly employed in projects where uncertainty is high, and precise cost estimation is difficult. These contracts offer flexibility, allowing for adjustments based on changing circumstances. However, it’s crucial to carefully consider the potential drawbacks before opting for this type of contract.

Real-World Examples of Cost-Plus Contracts

Cost-plus contracts are prevalent in various industries, particularly those dealing with complex and unpredictable projects. Here are some notable examples:

- Construction of Large-Scale Infrastructure Projects: The construction of bridges, tunnels, and highways often involves significant uncertainty regarding soil conditions, weather, and unforeseen challenges. Cost-plus contracts provide flexibility for contractors to adapt to these unexpected situations. For instance, the construction of the Channel Tunnel, a 31-mile underwater rail link between England and France, utilized a cost-plus contract to manage the complex engineering challenges and potential risks.

- Research and Development Projects: Innovative research and development projects often require extensive experimentation and iterative development cycles, making it challenging to estimate costs accurately upfront. Cost-plus contracts are frequently used in these situations, allowing for flexibility in adapting to changing research needs and unforeseen discoveries. For example, the development of the COVID-19 vaccines involved extensive research and testing, and cost-plus contracts facilitated the rapid development and production of these life-saving vaccines.

- Military Contracts: The development and procurement of advanced military equipment, such as fighter jets, submarines, and satellites, involve high levels of complexity and uncertainty. Cost-plus contracts are widely used in this sector, allowing for the flexibility to adapt to changing technological requirements and unforeseen challenges. For example, the development of the F-35 Joint Strike Fighter, a fifth-generation multirole combat aircraft, utilized a cost-plus contract to manage the complex technological challenges and evolving requirements.

Factors Influencing the Selection of Cost-Plus Contracts

The decision to use a cost-plus contract is often driven by specific project characteristics and the need for flexibility. Here are some key factors that influence this decision:

- High Uncertainty and Risk: When projects involve significant uncertainty regarding costs, timelines, and technical specifications, cost-plus contracts can provide a more suitable framework. This flexibility allows contractors to adjust to unforeseen challenges and changing circumstances, minimizing potential financial losses.

- Complex and Innovative Projects: Projects involving cutting-edge technologies or complex engineering designs often benefit from cost-plus contracts. The flexibility to adapt to evolving requirements and unforeseen challenges is essential for successful completion.

- Lack of Precise Cost Estimates: In cases where it’s difficult to obtain accurate cost estimates upfront, cost-plus contracts can mitigate risks. This approach allows for the accumulation of actual costs and adjustments based on real-world data.

- Strong Trust and Collaboration: Cost-plus contracts require a high level of trust and collaboration between the parties involved. This is essential for effective cost monitoring, transparency, and mutual understanding of project objectives.

Outcomes of Cost-Plus Contracts

Cost-plus contracts can lead to both positive and negative outcomes, depending on the specific project context and the effectiveness of contract management.

- Successes:

- Flexibility and Adaptability: Cost-plus contracts provide the flexibility to adjust to changing circumstances, allowing for successful completion of projects with high uncertainty.

- Innovation and Creativity: The flexibility offered by cost-plus contracts can encourage innovation and creativity, leading to improved solutions and advancements.

- Strong Collaboration: The shared risk and reward structure of cost-plus contracts fosters strong collaboration between the parties involved, leading to better communication and problem-solving.

- Challenges:

- Cost Overruns: Without proper cost control and monitoring, cost-plus contracts can lead to significant cost overruns, particularly if there is a lack of transparency or accountability.

- Lack of Incentive for Efficiency: Some argue that cost-plus contracts can create a lack of incentive for contractors to maximize efficiency, as they are reimbursed for all incurred costs.

- Complexity and Administrative Burden: Managing cost-plus contracts can be complex and time-consuming, requiring meticulous cost tracking and reporting.

Cost-plus contracts can be a powerful tool for navigating complex projects, but they require careful planning and robust management to ensure transparency and cost control. Understanding the advantages and disadvantages of this contract type is crucial for making informed decisions about your project’s structure. By clearly defining the scope of work, establishing cost control mechanisms, and fostering open communication, both parties can maximize the benefits of a cost-plus arrangement.

User Queries

How are cost-plus contracts different from fixed-price contracts?

In a fixed-price contract, the buyer agrees to pay a predetermined price for the project, regardless of the actual costs incurred. With a cost-plus contract, the buyer pays for all the actual costs plus a fee or percentage for profit. This shifts the risk of cost overruns from the seller to the buyer.

What are some common types of cost-plus contracts?

Some common types include:

- Cost-plus-fixed-fee (CPFF): The seller receives a fixed fee on top of the actual costs.

- Cost-plus-incentive-fee (CPIF): The seller’s fee is adjusted based on the project’s performance.

- Cost-plus-percentage-of-cost (CPPC): The seller’s fee is a percentage of the actual costs.

What are some potential risks associated with cost-plus contracts?

While cost-plus contracts can offer flexibility, they also present risks. The most significant risk is the potential for cost overruns. The buyer may end up paying more than expected if costs are not carefully managed. There’s also the potential for reduced accountability, as the seller may have less incentive to control costs if they are fully reimbursed.