What is service contract fee – What is a service contract fee? It’s basically that extra bit of cash you cough up for a bit of extra peace of mind, innit. Think of it like insurance for your stuff – if something goes wrong, you’re covered. You’ll often see this fee on things like phones, appliances, or even cars. It’s a bit like a safety net, making sure you’re not left high and dry if something breaks.

But hold your horses, there’s more to it than just a simple fee. It’s a whole package deal, with different bits and bobs that make up the total cost. The price can vary depending on what you’re getting, how long the contract lasts, and who you’re buying it from. So, it’s worth taking a closer look to see if it’s really worth your while.

What is a Service Contract Fee?

A service contract fee is a recurring payment you make to a company for the promise of future services. It’s like an insurance policy for your appliances, electronics, or even your car. You pay a fee upfront, and in return, the company agrees to fix or replace the item if it breaks down within a certain timeframe.

Common Services with Service Contract Fees

Service contract fees are prevalent in various industries, offering protection for a range of services and products.

- Appliances: Refrigerators, washing machines, dryers, ovens, and dishwashers are commonly covered by service contracts. These contracts often include repairs, replacement parts, and even labor costs for fixing breakdowns.

- Electronics: Smartphones, laptops, televisions, and other electronic devices are frequently protected by service contracts. These contracts can cover accidental damage, malfunctions, and even software issues.

- Vehicles: Car warranties often include service contracts that cover repairs beyond the standard manufacturer’s warranty. These contracts can cover engine problems, transmission issues, and other major mechanical breakdowns.

- Home Systems: HVAC systems, plumbing, electrical systems, and even home security systems are sometimes covered by service contracts. These contracts can offer peace of mind knowing that repairs and replacements will be covered.

Purpose of a Service Contract Fee

The primary purpose of a service contract fee is to provide you with financial protection against unexpected repair costs. It acts as a safety net, ensuring that you won’t have to pay a hefty sum out of pocket if your appliance, electronic device, or vehicle breaks down.

Service contracts are designed to offer peace of mind, knowing that you’re covered in the event of a breakdown.

Components of a Service Contract Fee

A service contract fee is a complex cost that encompasses various factors, each contributing to the overall price. Understanding these components is crucial for both providers and consumers to ensure transparency and fairness in the agreement.

Breakdown of a Service Contract Fee

The components of a service contract fee are meticulously calculated to cover the provider’s expenses, ensure profitability, and deliver the promised services. These components include:

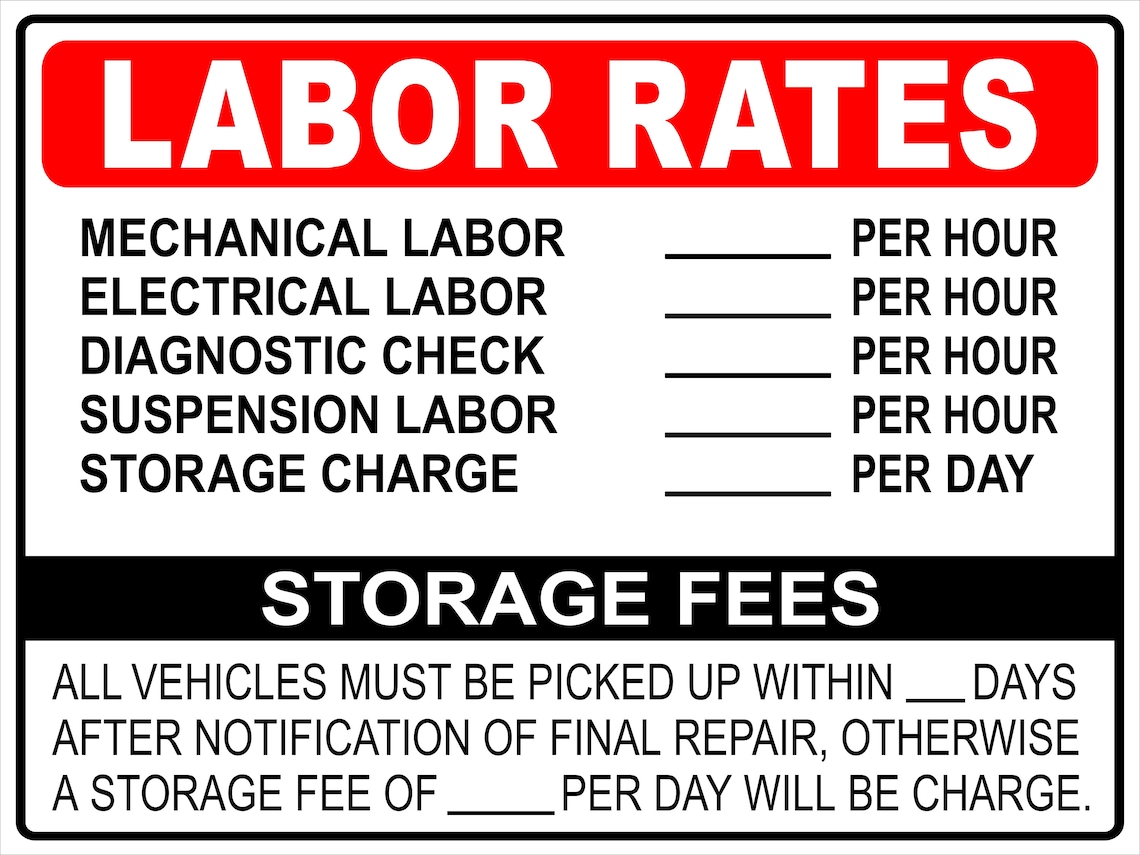

Labor Costs

This component accounts for the wages, benefits, and training of technicians and other personnel involved in providing the services.

Parts and Materials

The cost of replacement parts, consumables, and other materials used during service is factored into the fee.

Overhead Costs

This component encompasses expenses like rent, utilities, insurance, and administrative costs associated with running the business.

Profit Margin

This represents the provider’s desired profit on the service contract, accounting for their investment and risk.

Service Call Charges

These charges cover the cost of dispatching a technician to the customer’s location, including travel time and transportation.

Warranty Costs

Providers may include a cost for potential warranty claims associated with the services provided.

Illustrative Breakdown of a Service Contract Fee

Here’s a table illustrating the breakdown of a typical service contract fee for a home appliance:| Component | Percentage of Fee | Example Cost ||—|—|—|| Labor Costs | 30% | $150 || Parts and Materials | 25% | $125 || Overhead Costs | 20% | $100 || Profit Margin | 15% | $75 || Service Call Charges | 5% | $25 || Warranty Costs | 5% | $25 || Total Fee | 100% | $500 |

Benefits of Service Contracts

Service contracts offer a range of benefits that can provide peace of mind and financial security for consumers. By investing in a service contract, you can safeguard yourself against unexpected repair costs and ensure the longevity of your valuable possessions.

Financial Protection

Service contracts act as a safety net, shielding you from exorbitant repair bills. Imagine your washing machine breaking down just as you’re facing a financial crunch. A service contract can alleviate this stress by covering the cost of repairs or replacements, preventing you from incurring unexpected expenses.

Factors Influencing Service Contract Fees

The cost of a service contract is influenced by various factors that determine the level of coverage, the duration of the contract, and the service provider’s overhead. These factors contribute to the final price you pay for the peace of mind that comes with having a service contract.

Types of Service, What is service contract fee

The type of service covered by the contract significantly affects the fee. A service contract for a complex appliance, such as a refrigerator or a washing machine, will generally be more expensive than a contract for a simpler appliance, like a toaster or a coffee maker. This is because the cost of repairing or replacing complex appliances is typically higher due to their intricate mechanisms and specialized parts.

Duration of Service Contract

The duration of a service contract directly impacts the fee. A longer contract duration will usually result in a higher overall cost, but it also provides extended coverage and peace of mind. Conversely, shorter contracts may be less expensive but offer less protection. Consider your needs and the expected lifespan of the appliance or service when deciding on the contract duration.

Coverage

The level of coverage offered by a service contract is another key factor determining the fee. Contracts with comprehensive coverage, including parts, labor, and other benefits, will generally be more expensive than those with limited coverage. Think about the specific needs and risks associated with the appliance or service and choose a contract that provides adequate protection.

Service Provider

The service provider’s reputation, experience, and pricing structure influence the cost of a service contract. Reputable providers with a strong track record and excellent customer service may charge higher fees, reflecting their expertise and commitment to quality. However, their higher prices can be justified by the value they provide in terms of reliability and responsiveness. Conversely, less established providers may offer lower prices, but their service quality and reliability may be uncertain.

Other Factors

Several other factors can influence service contract fees, including:

- Age and condition of the appliance or service

- Location of the service provider

- Market demand for the service

- Special promotions or discounts

Negotiating Service Contract Fees: What Is Service Contract Fee

The art of negotiating service contract fees is a delicate dance, requiring a blend of assertiveness, knowledge, and diplomacy. By understanding the components of the fee, identifying cost-saving opportunities, and communicating effectively with service providers, you can secure a contract that aligns with your budget and needs.

Identifying Opportunities for Cost Savings

Identifying opportunities for cost savings requires a thorough analysis of the service contract and a keen eye for potential reductions.

- Review the scope of services: Carefully examine the services included in the contract and identify any unnecessary or redundant elements. For example, if your needs are basic, you may not require the comprehensive package offered.

- Compare service providers: Seek quotes from multiple providers and compare their offerings and pricing. This competitive analysis can reveal significant differences in fees and highlight potential cost savings.

- Explore alternative service options: Consider alternative service options, such as using in-house resources or partnering with smaller, local businesses. These alternatives can offer more competitive pricing.

- Negotiate payment terms: Explore options for staggered payments, upfront discounts, or payment plans. These adjustments can significantly impact your overall costs.

Strategies for Effective Communication

Effective communication is essential for successful negotiation. This involves a clear understanding of your needs and expectations, as well as a respectful and assertive approach to communicating with service providers.

- Clearly articulate your requirements: Communicate your specific needs and expectations in a clear and concise manner. This ensures the service provider understands your requirements and can tailor their services accordingly.

- Demonstrate your research: Showcase your knowledge of the market and your understanding of the service contract’s components. This establishes your credibility and strengthens your negotiating position.

- Be prepared to walk away: Maintain a firm stance and be prepared to walk away from the negotiation if the service provider is unwilling to meet your needs. This demonstrates your commitment to finding a fair and mutually beneficial agreement.

- Maintain a professional demeanor: Approach the negotiation with respect and professionalism. This fosters a positive relationship with the service provider and increases the likelihood of a successful outcome.

Common Service Contract Fee Misconceptions

Service contract fees are often shrouded in misconceptions, leading to confusion and potentially detrimental financial decisions. It’s crucial to understand the realities of these fees to make informed choices about protecting your valuable assets.

Service Contracts Are Always a Waste of Money

This misconception stems from the perception that service contracts are merely a way for companies to extract more money from customers. However, this is not always the case. While it’s true that some service contracts might be overpriced or offer minimal value, others can provide significant financial protection against unexpected repair costs.

A service contract can be a worthwhile investment if it covers major repairs or replacements that would otherwise cost a substantial amount.

Consider the following:

- Cost of Repairs: The cost of repairing or replacing a major appliance or vehicle can be astronomical, especially if it breaks down outside of the warranty period. A service contract can help mitigate these costs by covering a significant portion of the repair expenses.

- Peace of Mind: A service contract can provide peace of mind knowing that you have financial protection in case of unexpected breakdowns. This can be particularly valuable for individuals with limited financial resources or those who rely heavily on a particular appliance or vehicle.

Service Contracts Cover Everything

Another common misconception is that service contracts cover all possible repairs and replacements. This is rarely the case. Service contracts typically have limitations and exclusions, such as:

- Wear and Tear: Service contracts generally don’t cover normal wear and tear, which can include issues like faded paint, worn-out tires, or minor cosmetic defects.

- Pre-existing Conditions: If a problem existed before the service contract was purchased, it might not be covered. It’s essential to review the contract’s terms and conditions carefully to understand what is and isn’t covered.

- Specific Parts or Components: Some service contracts might exclude specific parts or components from coverage, such as those that are considered consumable or prone to wear and tear.

Service Contracts Are Only for Older Products

Many people believe that service contracts are only necessary for older products that are nearing the end of their life expectancy. However, this is not always the case. Even newer products can benefit from service contract protection.

New products are not immune to manufacturing defects or unforeseen breakdowns. A service contract can help mitigate these risks and protect your investment.

For example, a new car might have a factory warranty that covers certain repairs for a limited period. However, after the warranty expires, you could be left responsible for expensive repairs if something goes wrong. A service contract can extend your coverage and provide financial protection beyond the initial warranty period.

Service Contracts Are Always Worth the Cost

While service contracts can offer valuable protection, they are not always worth the cost. The decision to purchase a service contract should be based on a careful assessment of your individual needs and circumstances.

Consider factors such as the cost of the service contract, the likelihood of needing repairs, and the potential cost of those repairs.

If the cost of the service contract is significantly higher than the potential cost of repairs, it might not be a worthwhile investment. However, if the potential repair costs are substantial and the service contract offers significant coverage, it could be a wise financial decision.

Alternatives to Service Contracts

Service contracts provide peace of mind and financial protection against unexpected repair costs. However, they often come with a hefty price tag. Thankfully, there are alternative options to consider, each with its own set of benefits and drawbacks.These alternatives can help you save money, but they also require careful consideration of your needs and risk tolerance.

Self-Insurance

Self-insurance, as the name suggests, involves taking responsibility for covering repair costs yourself. This approach can be appealing for those who are comfortable with risk and have a strong financial buffer.

Benefits of Self-Insurance

- Cost Savings: Self-insurance eliminates the monthly premiums associated with service contracts, allowing you to potentially save a significant amount of money over time.

- Flexibility: You have complete control over how you manage your repair funds. You can choose to set aside a specific amount each month or save for repairs as needed.

Drawbacks of Self-Insurance

- Financial Risk: The primary drawback of self-insurance is the risk of incurring substantial repair costs. If a major breakdown occurs, you will be responsible for covering the entire expense.

- Unforeseen Expenses: Repair costs can be unpredictable and vary greatly depending on the age, condition, and complexity of the equipment. This can lead to unexpected financial burdens.

Emergency Funds

Maintaining an emergency fund dedicated to covering unexpected expenses, including repairs, can provide a safety net.

Benefits of Emergency Funds

- Financial Security: Having an emergency fund provides peace of mind knowing that you have a financial cushion to cover unexpected repairs.

- Flexibility: You can use your emergency fund for any unexpected expenses, not just repairs.

Drawbacks of Emergency Funds

- Limited Coverage: Emergency funds may not be sufficient to cover major repairs, especially if you have multiple appliances or systems.

- Potential for Depletion: If you frequently use your emergency fund for repairs, it may become depleted, leaving you vulnerable to future unexpected expenses.

Extended Warranties

Extended warranties are offered by manufacturers or retailers and provide coverage beyond the standard manufacturer’s warranty.

Benefits of Extended Warranties

- Coverage for Defects: Extended warranties often cover defects in materials and workmanship that may arise after the standard warranty period expires.

- Peace of Mind: They provide peace of mind knowing that you have coverage for potential repair costs.

Drawbacks of Extended Warranties

- Limited Coverage: Extended warranties typically cover specific components or systems and may exclude certain types of repairs.

- Cost: Extended warranties can be expensive, especially for high-value appliances or systems.

Homeowner’s Insurance

Homeowner’s insurance policies may include coverage for certain types of repairs, such as damage caused by natural disasters or theft.

Benefits of Homeowner’s Insurance

- Comprehensive Coverage: Homeowner’s insurance policies provide coverage for a wide range of risks, including damage to your home and its contents.

- Financial Protection: They can help you recover from significant losses due to covered events.

Drawbacks of Homeowner’s Insurance

- Limited Coverage: Homeowner’s insurance policies typically do not cover routine maintenance or wear and tear.

- Deductibles: You will have to pay a deductible before your insurance coverage kicks in.

So, there you have it – the lowdown on service contract fees. It’s a bit of a complex beast, but understanding the ins and outs can help you make a more informed decision. Remember, it’s not always about the cheapest option, but about finding the best value for your money. Don’t be afraid to shop around and compare prices, and don’t be shy about asking questions – after all, you’re the one who’s shelling out the cash!

FAQs

Do I really need a service contract?

That depends, mate. If you’re the kind of person who’s always breaking things, then a service contract could be a good idea. But if you’re pretty good at looking after your stuff, you might be able to save some cash by skipping it. It’s all about weighing up the risks and deciding what’s best for you.

Can I negotiate the price of a service contract?

You can always try! Be polite, but firm. Explain your situation and see if you can get a better deal. If you’re buying a big-ticket item, it’s worth asking for a discount or a free upgrade.

What happens if I cancel my service contract?

It depends on the terms of the contract. Some contracts allow you to cancel for a full refund, while others might charge a fee. Make sure you read the fine print before signing anything.

What are the benefits of a service contract?

It’s like having a safety net, innit. If something goes wrong, you’re covered. You don’t have to worry about shelling out a ton of cash for repairs. Plus, it can give you peace of mind, knowing that you’re protected.