ES futures contract cost: The phrase itself whispers of risk and reward, a dance on the precipice of financial gain and potential loss. Understanding the intricacies of these contracts is crucial for navigating the volatile world of futures trading. This journey delves into the heart of ES futures, unraveling the complexities of their pricing, the factors influencing their cost, and the strategies for minimizing expenses.

Prepare to uncover the secrets behind these powerful financial instruments, and learn how to effectively manage the financial commitment required for success.

From the mechanics of contract specifications—contract size, tick size, and the various contract types available—to the nuances of calculating total cost, including commissions and margin requirements, this exploration provides a comprehensive understanding. We’ll examine how interest rates, market sentiment, and supply and demand interplay to shape ES futures contract prices, comparing and contrasting them with other investment options like stocks and ETFs.

Finally, we’ll equip you with strategies to optimize your trading costs, from negotiating lower commissions to implementing efficient risk management techniques.

Understanding ES Futures Contracts

ES futures contracts are derivative instruments that track the performance of the S&P 500 index. They allow investors to speculate on the future direction of the market or hedge against potential losses in their stock portfolio. Understanding their mechanics and specifications is crucial for successful trading.

ES Futures Contract Mechanics

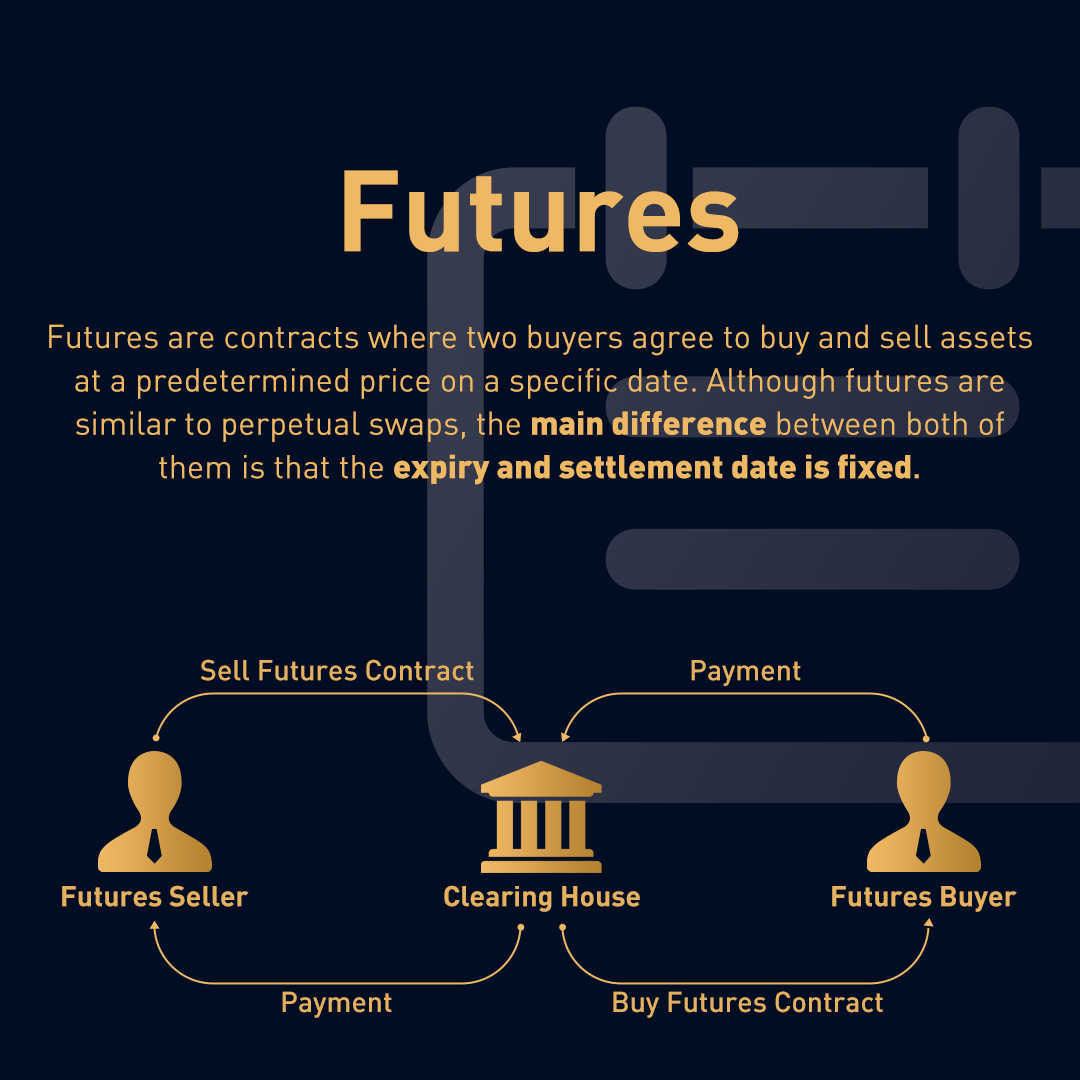

An ES futures contract is an agreement between two parties to buy or sell a specific number of S&P 500 index shares at a predetermined price on a future date. The buyer agrees to purchase the index at the contract’s price, while the seller agrees to deliver the equivalent value of the index. These contracts are standardized, meaning the terms are pre-defined and traded on exchanges, ensuring liquidity and transparency.

The contract’s value fluctuates based on the movement of the underlying S&P 500 index, resulting in profits or losses for the involved parties. Daily settlement of gains and losses is a key feature, mitigating large potential losses.

Types of ES Futures Contracts

While the core function remains consistent, ES futures contracts are categorized primarily by their expiration month. These contracts are available for various months in the future, allowing traders to select a timeframe that aligns with their trading strategy. For example, there are near-month contracts (the closest expiration date), mid-month contracts, and far-month contracts (those expiring several months or even a year in the future).

The choice of contract depends on the investor’s outlook and risk tolerance. The specific contract months offered will vary depending on the exchange.

ES Futures Contract Specifications

ES futures contracts have specific details that define their characteristics.

Contract Size and Tick Size

The contract size for an ES futures contract represents the value of the underlying index represented by one contract. Currently, the contract size is $500 times the index value. For example, if the S&P 500 index is at 4,500, the contract value is $2,250,000. The tick size, which represents the minimum price fluctuation, is 0.25 index points. This translates to a $12.50 price change per contract ($0.25 x $500).

Comparison of ES Futures Contract Characteristics

The following table summarizes key characteristics of different ES futures contracts, keeping in mind that the specific details may vary slightly depending on the exchange and the specific contract month.

| Contract Month | Contract Size | Tick Size (Index Points) | Tick Value ($) |

|---|---|---|---|

| December 2023 | $500 x S&P 500 Index Value | 0.25 | 12.50 |

| March 2024 | $500 x S&P 500 Index Value | 0.25 | 12.50 |

| June 2024 | $500 x S&P 500 Index Value | 0.25 | 12.50 |

| September 2024 | $500 x S&P 500 Index Value | 0.25 | 12.50 |

Factors Influencing ES Futures Contract Cost

The price of an E-mini S&P 500 (ES) futures contract, like any other financial derivative, is influenced by a complex interplay of factors. Understanding these factors is crucial for effective trading and risk management. While seemingly volatile, the price ultimately reflects the market’s collective expectation of the underlying S&P 500 index’s future value.

Interest Rates

Interest rates significantly impact ES futures pricing through a mechanism called the cost of carry. Higher interest rates increase the cost of holding the underlying assets (represented by the index), making futures contracts relatively more attractive. Conversely, lower interest rates reduce the cost of carry, potentially leading to a lower futures price. This is because investors can earn a return on the cash equivalent of holding the underlying index, and the futures price adjusts to reflect this opportunity cost.

For example, a period of rising interest rates might lead to a higher ES futures price, all else being equal, as the opportunity cost of holding the index increases.

Market Sentiment

Market sentiment, encompassing the overall optimism or pessimism among investors, profoundly affects ES futures prices. Positive sentiment, fueled by economic indicators, corporate earnings, or geopolitical events, typically drives prices upward. Conversely, negative sentiment can lead to significant price drops. This sentiment is often reflected in trading volume and volatility. For instance, during periods of high uncertainty, such as during a major geopolitical crisis, market sentiment can become highly volatile, leading to sharp fluctuations in ES futures prices.

Supply and Demand

The fundamental principle of supply and demand governs ES futures prices. High demand, driven by factors like bullish market sentiment or increased hedging activity, pushes prices higher. Conversely, increased supply, perhaps due to profit-taking or bearish sentiment, puts downward pressure on prices. The interplay between buyers and sellers constantly determines the equilibrium price, with significant imbalances causing noticeable price swings.

For example, a sudden influx of sell orders could overwhelm buy orders, resulting in a rapid decline in the ES futures price. Conversely, a surge in buying pressure might quickly push the price upward.

Calculating the Cost of an ES Futures Contract

Determining the total cost of an ES futures contract involves more than just the contract price. Several factors contribute to the overall expense, including commissions, fees, and margin requirements. Understanding these components is crucial for effective risk management and profitability.

The price you see quoted for an ES futures contract represents the price per contract. However, this is only one element of the total cost. Brokers charge commissions for executing trades, and exchanges levy fees. Additionally, traders need to maintain a margin account to cover potential losses, which ties up capital. Let’s break down each of these cost components.

Commission Structures

Brokerage firms offer various commission structures for ES futures contracts. These can range from fixed fees per contract to tiered pricing based on trading volume. Some brokers may also charge additional fees for things like data subscriptions or account maintenance. Understanding your broker’s fee schedule is essential for accurate cost calculations.

For example, one broker might charge a flat fee of $5 per contract, regardless of the contract value or trading volume. Another broker might offer a tiered system, charging $7 per contract for trades under 10 contracts per month, and $5 per contract for trades exceeding 10 contracts. A third might offer a per-share commission structure, charging a small percentage of the contract value.

It’s crucial to compare different brokers and their fee schedules to find the most cost-effective option for your trading style and volume.

Exchange Fees

In addition to brokerage commissions, exchanges also charge fees for executing trades. These fees are typically small per contract but can accumulate, especially with high-volume trading. These fees are often included in the overall commission charged by your broker, so it’s important to clarify this with your broker to ensure transparency.

Margin Requirements

The margin requirement is the amount of money a trader must deposit with their broker to open and maintain a futures position. This amount acts as collateral to cover potential losses. The margin requirement is usually a percentage of the contract’s value and is set by the exchange. It’s important to note that margin requirements can fluctuate based on market volatility.

Calculating the margin requirement is a straightforward process. It involves multiplying the contract’s value by the margin percentage set by the exchange. For instance, if the margin requirement for an ES contract is 5% and the contract value is $50,000, the margin requirement would be $2,500 (5% of $50,000). However, this is just the initial margin; maintenance margin requirements may be lower.

It’s crucial to understand your broker’s margin policy and requirements.

Step-by-Step Calculation of Margin Requirement

- Determine the current contract value. This is readily available from your brokerage platform or financial news sources.

- Find the margin requirement percentage. This is usually specified by the exchange and can vary based on the contract and market conditions. Check your broker’s documentation or contact them for the most up-to-date information.

- Calculate the initial margin: Multiply the contract value by the margin percentage. For example: Contract Value x Margin Percentage = Initial Margin Requirement

- Consider maintenance margin. Your broker will have a lower maintenance margin level. If your account equity falls below this level, you’ll receive a margin call requiring you to deposit more funds to bring your account back above the maintenance margin.

Hypothetical Trading Scenario

Let’s imagine a trader buys one ES futures contract at a price of $4,000 per contract. Their broker charges a commission of $5 per contract, and the exchange fee is $1 per contract. The initial margin requirement is 5% of the contract value.

Here’s the cost breakdown:

- Contract Price: $4,000

- Brokerage Commission: $5

- Exchange Fee: $1

- Initial Margin Requirement: $4,000 x 0.05 = $200

- Total Immediate Cost: $4,000 + $5 + $1 = $4,006

- Total Capital Tied Up: $4,006 + $200 = $4,206

This illustrates that the total cost extends beyond the contract price itself. The trader needs to consider commissions, fees, and the capital tied up in the margin requirement to accurately assess the overall cost of their trade.

ES Futures Contract Costs vs. Other Investment Options

Understanding the cost structure of ES futures contracts requires comparing them to other common investment vehicles. This comparison helps investors determine if futures contracts align with their risk tolerance and financial goals. Factors such as commissions, margin requirements, and potential for leverage significantly impact the overall cost.

The cost of investing in ES futures contracts differs significantly from investing in stocks or ETFs. While stocks and ETFs involve straightforward brokerage commissions and potentially management fees, ES futures contracts present a more complex cost structure involving margin requirements, commissions, and the potential for significant losses if the market moves against your position. This comparison highlights the key differences and associated advantages and disadvantages.

Cost Comparison: ES Futures, Stocks, and ETFs

The following points Artikel the key cost differences between investing in ES futures contracts, stocks, and exchange-traded funds (ETFs).

- Commissions: ES futures contracts typically incur lower commissions per contract compared to the commission per share for stocks or ETFs, especially for larger trades. However, the overall cost can be higher depending on the number of contracts traded and the frequency of trading.

- Margin Requirements: Unlike stocks and ETFs, which require the full purchase price upfront, ES futures contracts utilize margin. This means you only need to deposit a percentage of the contract’s value as collateral. While this allows for leverage and potentially higher returns, it also amplifies potential losses. Margin requirements are dynamic and vary depending on market volatility and the broker’s requirements.

A stock or ETF purchase requires the full amount to be paid upfront, while margin accounts for stocks allow borrowing but usually at a higher interest rate than futures margin.

- Financing Costs: Holding a long position in an ES futures contract overnight incurs financing costs (interest), which is calculated daily based on the prevailing interest rates. Stocks and ETFs do not have such daily financing costs unless you are using margin.

- Potential for Leverage: ES futures contracts offer significant leverage, allowing investors to control a larger position with a smaller initial investment. This magnifies both profits and losses. Stocks and ETFs do not inherently offer leverage unless margin accounts are used, which comes with its own associated costs and risks.

- Management Fees: Stocks and ETFs may have annual management fees (expense ratios), especially for actively managed funds. ES futures contracts do not have such ongoing management fees.

Advantages and Disadvantages of Each Investment Option

Each investment option presents a unique set of advantages and disadvantages concerning cost and risk.

- ES Futures Contracts: Advantages include lower commissions per contract (for larger trades) and the potential for high leverage. Disadvantages include margin requirements, daily financing costs, and amplified risk due to leverage. A small market movement can lead to significant losses.

- Stocks: Advantages include straightforward cost structure (brokerage commission) and ownership of the underlying asset. Disadvantages include higher commission per share (especially for smaller trades) and the inability to leverage without margin accounts, which add interest costs.

- ETFs: Advantages include diversification, relatively low expense ratios, and ease of trading. Disadvantages include ongoing management fees (expense ratios) and a lack of leverage unless margin accounts are used.

Managing and Reducing ES Futures Contract Costs

Minimizing the cost of trading ES futures contracts is crucial for maximizing profitability. Several strategies can significantly reduce expenses, from negotiating favorable commission rates to implementing effective risk management techniques. By understanding and applying these methods, traders can optimize their trading strategies and improve their overall return on investment.

Commission Negotiation, Es futures contract cost

Negotiating lower commissions with brokers is a straightforward way to reduce trading costs. The leverage of trading volume is a key factor. Brokers are often more willing to offer discounted rates to high-volume traders. Actively comparing commission structures across different brokerage firms is also beneficial. Consider the total cost, including fees, and not just the commission per contract.

For instance, a broker with a slightly higher commission but fewer additional fees might be more cost-effective in the long run. Building a strong relationship with a broker can also lead to better negotiation opportunities. This might involve consistently using their platform and demonstrating a commitment to long-term trading.

Efficient Risk Management

Efficient risk management plays a vital role in controlling trading costs. Losses incurred due to poor risk management are a significant cost factor. Employing strategies like setting stop-loss orders can limit potential losses and prevent significant financial setbacks. This ensures that losses are contained within a predetermined range, preventing the accumulation of large, potentially devastating, losses. Furthermore, diversifying your portfolio across multiple contracts can help mitigate risk.

This diversification reduces the impact of a single contract performing poorly. Proper position sizing, which is adjusting the number of contracts traded based on risk tolerance and market volatility, is another crucial component. For example, trading smaller positions during periods of high volatility can prevent substantial losses.

Optimizing Trading Costs: A Strategic Plan

Optimizing trading costs requires a structured approach. First, thoroughly analyze your current trading strategy and identify areas where costs can be reduced. This might involve reviewing your commission structure, analyzing your win-loss ratio, and evaluating your risk management practices. Second, negotiate lower commissions with your broker, leveraging your trading volume and history. Third, implement robust risk management techniques such as stop-loss orders and position sizing to minimize potential losses.

Fourth, continuously monitor your trading costs and adjust your strategy as needed. Regularly reviewing performance data helps identify inefficiencies and allows for timely adjustments. For instance, if you find that a particular strategy consistently results in high losses, you can modify it or discontinue it altogether. Fifth, explore alternative trading platforms and brokers to ensure you are getting the best rates and services available.

Comparing different platforms can reveal cost-saving opportunities that might be overlooked otherwise.

Visual Representation of ES Futures Contract Costs

Understanding the cost structure of an ES futures contract is crucial for effective trading. A visual representation can significantly aid in this comprehension, clarifying the various components and their relative impact on the overall cost. This section will explore different ways to visualize these costs, highlighting key factors and their influence.

A pie chart provides an excellent way to illustrate the proportion of different cost components within the total cost of an ES futures contract. Imagine a pie chart divided into segments representing initial margin, maintenance margin, commissions, and potential financing costs (if the contract is held overnight). The size of each segment would directly correspond to its relative contribution to the total cost.

For instance, commissions might constitute a smaller segment compared to the initial margin requirement, especially for larger contracts. The financing costs segment would be highly variable, depending on the interest rate environment and the duration of the position.

ES Futures Contract Cost Components

The pie chart would visually depict the following cost components:

- Initial Margin: This represents the upfront capital required to open a position. This segment would typically be the largest in the pie chart, reflecting its significant contribution to the overall cost.

- Maintenance Margin: This is the minimum amount of equity required to maintain the open position. While less substantial than the initial margin, it still represents a considerable cost, especially for leveraged positions. This segment would be smaller than the initial margin segment.

- Commissions: Brokerage fees charged for executing trades. This segment is usually smaller than the margin segments, though its relative size depends on the brokerage’s fee structure and trading volume.

- Financing Costs: Interest charges incurred when holding a long position overnight. This segment’s size fluctuates greatly based on prevailing interest rates and the holding period. It might be negligible for short-term trades but could become significant for longer-term positions.

Historical Cost of ES Futures Contracts

A line graph charting the historical cost of an ES futures contract over a defined period (e.g., the past year) would offer a dynamic view of cost fluctuations. The y-axis would represent the total cost, and the x-axis would represent time. This graph would show the impact of various market factors on the contract’s cost.

For example, the graph might show periods of relatively low cost coinciding with times of low market volatility and low interest rates. Conversely, periods of high volatility and higher interest rates would likely be reflected in a rise in the total cost. The graph could also display distinct peaks and troughs, reflecting specific market events or economic announcements that impacted the cost of the contract.

Such a visualization would provide valuable insights into the relationship between market conditions and the cost of ES futures contracts.

Factors Influencing ES Futures Contract Cost Fluctuations

Several factors contribute to the variability seen in the historical cost graph. These factors interact in complex ways, making accurate prediction challenging but highlighting the need for careful monitoring.

- Market Volatility: Higher volatility generally leads to increased margin requirements, thus increasing the overall cost. This is because larger price swings necessitate greater capital to mitigate potential losses.

- Interest Rates: Changes in interest rates directly affect financing costs, particularly for longer-term positions. Rising interest rates increase the cost of holding a long position, while falling rates decrease it.

- Supply and Demand: The interplay of supply and demand for the contract itself impacts its price, which in turn affects margin requirements and the overall cost. High demand can drive up prices, potentially increasing margin needs.

- Brokerage Fees: While often a relatively smaller component, changes in brokerage commissions can impact the total cost, especially for frequent traders.

Mastering the art of ES futures trading requires a deep understanding of the cost landscape. This exploration has illuminated the multifaceted nature of ES futures contract costs, revealing the interplay of various factors influencing their price. By grasping the mechanics of contract specifications, the impact of market forces, and the strategies for cost minimization, you’re empowered to make informed decisions, navigate the complexities of the market, and ultimately, enhance your trading success.

Remember, diligent planning and a proactive approach to cost management are key to thriving in this dynamic environment. The path to profitable futures trading begins with a thorough understanding of its inherent costs.

General Inquiries

What is the minimum account size needed to trade ES futures?

Minimum account sizes vary significantly depending on your broker and your risk tolerance. Some brokers may allow trading with smaller accounts, but it’s crucial to have sufficient funds to meet margin requirements and withstand potential losses.

How often are ES futures contract prices updated?

ES futures prices are updated continuously throughout the trading day, reflecting the constant ebb and flow of market activity and information.

Are there tax implications for profits and losses from ES futures trading?

Yes, profits from ES futures trading are considered short-term capital gains or long-term capital gains depending on how long you held the position. Losses can be used to offset capital gains, but consult a tax professional for personalized advice.

What are the risks associated with ES futures trading?

ES futures trading involves substantial risk, including the potential for significant losses exceeding your initial investment due to leverage. It’s crucial to understand these risks before engaging in futures trading.