What is a cost reimbursable contract? This type of agreement, often employed in complex projects with uncertain scope or fluctuating costs, involves the buyer reimbursing the seller for incurred expenses, plus a predetermined fee or profit margin. Unlike fixed-price contracts where the seller bears the risk of cost overruns, cost reimbursable contracts shift this risk to the buyer, making them particularly suitable for projects where the exact requirements or specifications are not fully defined upfront.

These contracts are prevalent in industries such as construction, research and development, and government procurement, where projects often involve a high degree of uncertainty and require flexibility in adapting to changing circumstances. The key elements of a cost reimbursable contract include a detailed scope of work, a cost reimbursement mechanism, and a clear definition of the seller’s fee or profit margin.

Different cost reimbursement methods, each with its own advantages and disadvantages, are available, allowing parties to tailor the contract to the specific needs of the project.

Definition of Cost Reimbursable Contract: What Is A Cost Reimbursable Contract

A cost reimbursable contract, also known as a cost-plus contract, is a type of agreement where the buyer (or client) agrees to pay the seller (or contractor) for all the actual costs incurred in performing the work, plus an agreed-upon fee or profit margin. This type of contract is often used in situations where the scope of work is uncertain or complex, and the exact costs are difficult to estimate in advance.The key characteristic that distinguishes cost reimbursable contracts from other contract types is the risk allocation.

In a cost reimbursable contract, the buyer assumes a higher level of risk than in a fixed-price contract, as they are ultimately responsible for the actual costs incurred by the seller. However, they also have greater control over the project and can influence the seller’s decisions.

Industries and Projects Where Cost Reimbursable Contracts are Commonly Used

Cost reimbursable contracts are frequently used in industries where projects are highly complex, require specialized expertise, or involve a significant degree of uncertainty. These contracts are particularly common in the following industries:

- Government Contracting: The government often uses cost reimbursable contracts for large-scale, complex projects such as defense contracts, research and development, and infrastructure projects.

- Construction: Cost reimbursable contracts can be used for large-scale construction projects, especially when the scope of work is uncertain or subject to change.

- Engineering and Design: Engineering and design firms may use cost reimbursable contracts for projects with highly technical requirements or where the scope of work is not fully defined.

- Research and Development: Cost reimbursable contracts are common in research and development projects, as the scope of work and costs are often uncertain.

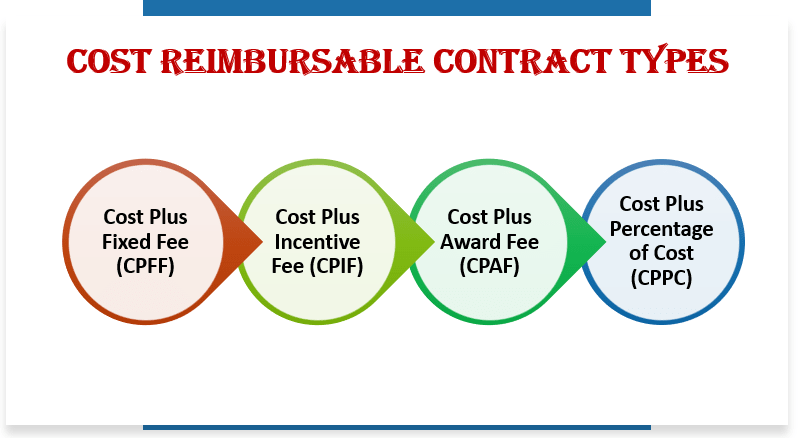

Types of Cost Reimbursable Contracts

There are several types of cost reimbursable contracts, each with its own specific characteristics:

- Cost Plus Fixed Fee (CPFF): In this type of contract, the buyer reimburses the seller for all allowable costs incurred in performing the work, plus a fixed fee that is agreed upon at the outset. The fixed fee is typically a percentage of the estimated costs or a predetermined amount.

- Cost Plus Incentive Fee (CPIF): This type of contract provides an incentive for the seller to control costs and achieve specific performance targets. The buyer reimburses the seller for all allowable costs, and the seller also receives an incentive fee that is based on the achievement of predetermined performance goals.

- Cost Plus Award Fee (CPAF): In this type of contract, the buyer reimburses the seller for all allowable costs and also pays an award fee based on the seller’s performance, which is assessed by the buyer. The award fee is typically a lump sum or a percentage of the estimated costs.

Cost Reimbursement Methods

Cost reimbursement contracts offer flexibility in managing complex projects with uncertain scopes. These contracts allow the contractor to be reimbursed for all allowable costs incurred during the project. However, the method of cost reimbursement can vary, each with its own advantages and disadvantages.

Cost Plus Fixed Fee (CPFF)

The CPFF method is a common cost reimbursement approach. In this method, the contractor is reimbursed for all allowable costs incurred during the project, plus a fixed fee that is agreed upon at the beginning of the project. The fixed fee is typically a percentage of the estimated cost of the project. The CPFF method provides the contractor with a predictable profit margin, regardless of the actual cost of the project.

This can incentivize the contractor to control costs and complete the project efficiently.

The fixed fee is a pre-determined amount, independent of the actual project cost.

However, the CPFF method can also lead to a lack of cost control, as the contractor is not directly penalized for exceeding the estimated cost of the project. This can be a concern for projects with a high degree of uncertainty or where cost control is a critical factor. Advantages:

- Predictable profit margin for the contractor.

- Incentivizes cost control and efficient project completion.

- Suitable for projects with a high degree of uncertainty or complex requirements.

Disadvantages:

- Potential for cost overruns if cost control is not effective.

- Limited incentive for the contractor to minimize costs.

- May not be suitable for projects with a clear scope and predictable costs.

Example:A research and development project with an uncertain scope and potential for significant cost fluctuations.

Cost Plus Incentive Fee (CPIF)

The CPIF method is a variation of the CPFF method that introduces an incentive for the contractor to control costs. In this method, the contractor is reimbursed for all allowable costs incurred during the project, plus a fee that is based on the actual cost of the project. The incentive fee is typically a percentage of the difference between the estimated cost of the project and the actual cost of the project.

The higher the cost savings achieved by the contractor, the higher the incentive fee.

The incentive fee is calculated as a percentage of the difference between the target cost and the actual cost of the project.

The CPIF method provides the contractor with a strong incentive to control costs and complete the project efficiently. This can lead to significant cost savings for the project owner. Advantages:

- Strong incentive for the contractor to control costs.

- Potential for significant cost savings for the project owner.

- Suitable for projects where cost control is a critical factor.

Disadvantages:

- Potential for complex calculations and disputes regarding the incentive fee.

- May not be suitable for projects with a high degree of uncertainty or where cost control is not a primary concern.

Example:A construction project with a defined scope but potential for cost fluctuations due to unforeseen circumstances.

Cost Plus Percentage of Cost (CPPC)

The CPPC method is a less common cost reimbursement approach. In this method, the contractor is reimbursed for all allowable costs incurred during the project, plus a percentage of the total cost of the project. The percentage of cost is typically agreed upon at the beginning of the project and is a fixed amount.

The percentage of cost is a fixed amount, regardless of the actual cost of the project.

The CPPC method can provide the contractor with a predictable profit margin, but it can also lead to a lack of cost control, as the contractor’s profit is directly tied to the total cost of the project. Advantages:

- Predictable profit margin for the contractor.

- Suitable for projects with a high degree of uncertainty or where cost control is not a primary concern.

Disadvantages:

- Potential for cost overruns if cost control is not effective.

- Limited incentive for the contractor to minimize costs.

- May not be suitable for projects with a clear scope and predictable costs.

Example:A project with a high degree of uncertainty and a limited budget, where cost control is not a critical factor.

Cost Control and Management

Cost control and management are crucial in cost-reimbursable contracts. Because the contractor is reimbursed for their actual costs, there is a greater incentive to keep costs low. This is especially important in projects where the scope of work is not fully defined or where there is a high risk of unforeseen costs.

Challenges and Risks of Cost Control

Cost control in cost-reimbursable contracts can be challenging due to inherent complexities. The lack of a fixed price can lead to uncontrolled expenses, potentially exceeding budget. Moreover, the risk of cost overruns is high, especially when dealing with complex or lengthy projects. Here are some of the key challenges and risks associated with cost control in cost-reimbursable contracts:

- Lack of Incentive for Cost Efficiency: The contractor may have less incentive to control costs as they are reimbursed for incurred expenses. This can lead to inflated costs and reduced profitability for the client.

- Scope Creep: As the project progresses, there may be a tendency for the scope of work to expand, leading to unforeseen costs. This can be exacerbated by unclear project requirements or changes in the client’s needs.

- Unforeseen Circumstances: Unexpected events like natural disasters, supply chain disruptions, or labor shortages can significantly impact project costs. The contractor may not be able to anticipate these events and mitigate their impact.

- Difficulty in Monitoring Costs: The contractor’s cost accounting system may not be transparent or accurate, making it difficult for the client to track and monitor costs effectively. This can lead to discrepancies and disputes.

- Lack of Cost Control Measures: Without proper cost control measures, there is a higher risk of overspending and exceeding the budget. This can negatively impact the project’s profitability and lead to financial strain.

Best Practices for Effective Cost Control

Effective cost control is essential to mitigate risks and ensure project success. It involves a combination of strategies and practices that focus on identifying, monitoring, and controlling costs throughout the project lifecycle. Here are some best practices for effective cost control in cost-reimbursable contracts:

- Clear and Detailed Scope Definition: A well-defined scope of work is crucial to prevent scope creep and ensure that all project deliverables are clearly Artikeld. This helps in accurately estimating costs and avoiding unexpected expenses.

- Cost Control Measures: Implementing cost control measures like budgets, cost tracking systems, and cost variance analysis is essential to monitor and manage expenses effectively. These measures help identify cost overruns early on and take corrective actions.

- Regular Cost Reviews: Conducting periodic cost reviews and audits ensures that costs are aligned with the project budget and scope. This helps in identifying potential cost overruns and taking corrective actions before they become significant.

- Incentivize Cost Efficiency: Implementing incentives for the contractor to control costs can be beneficial. This can include performance-based bonuses or penalties for exceeding budget targets. Such measures can motivate the contractor to prioritize cost efficiency.

- Strong Contract Management: A well-defined and enforceable contract is crucial to establish clear responsibilities, cost reimbursement mechanisms, and dispute resolution processes. This helps in managing expectations and minimizing the risk of cost-related disputes.

Risk Allocation and Management

Cost reimbursable contracts inherently involve a higher level of risk compared to fixed-price contracts. This is due to the open-ended nature of the contract, where the final cost is not determined until the project is completed. Therefore, effective risk allocation and management are crucial to ensure a successful and mutually beneficial outcome for both the buyer and the seller.

Risk Allocation

Risk allocation in cost reimbursable contracts primarily focuses on identifying and assigning responsibility for potential risks to the party best equipped to manage them. This involves a thorough analysis of the project scope, potential risks, and the capabilities of both the buyer and the seller.

- Buyer’s Risks: The buyer typically assumes responsibility for risks related to project scope changes, delays caused by external factors, and overall project success. This is because the buyer has the ultimate control over the project’s objectives and requirements.

- Seller’s Risks: The seller, on the other hand, assumes responsibility for risks related to cost overruns due to inefficient management, technical difficulties, or unforeseen circumstances. The seller is directly accountable for managing their resources and executing the project efficiently.

Risk Management Strategies

Effective risk management in cost reimbursable contracts involves proactive measures to mitigate potential risks and minimize their impact on the project. Common strategies include:

- Detailed Project Scope Definition: A well-defined project scope helps minimize the risk of scope creep and cost overruns by clearly outlining the deliverables and expectations. This reduces ambiguity and potential disputes.

- Cost Control Mechanisms: Implementing robust cost control mechanisms, such as regular cost reporting, budget reviews, and variance analysis, allows for early identification and management of cost overruns. This ensures that costs remain within acceptable limits.

- Risk Sharing Provisions: Cost reimbursable contracts often include risk-sharing provisions, such as cost-sharing clauses or incentive mechanisms, to encourage both parties to actively manage risks and share the burden of potential losses.

- Insurance: Utilizing insurance policies can help mitigate financial losses arising from unforeseen events, such as natural disasters or accidents, that could impact the project’s progress and cost.

Potential Risks and Responsibilities

Both the buyer and the seller face specific risks and responsibilities in cost reimbursable contracts.

Buyer’s Risks and Responsibilities

- Cost Overruns: The buyer faces the risk of significant cost overruns due to the open-ended nature of the contract. It’s crucial for the buyer to establish clear budget parameters and monitor costs diligently.

- Project Delays: Delays caused by the seller’s performance, technical difficulties, or unforeseen circumstances can impact the buyer’s project schedule and timelines. Effective project management and communication are essential to minimize delays.

- Quality Control: The buyer is responsible for ensuring that the seller delivers work meeting the specified quality standards. This requires rigorous quality control measures and regular inspections throughout the project.

Seller’s Risks and Responsibilities

- Cost Control: The seller is responsible for managing costs effectively and ensuring that the project remains within budget. This requires efficient resource allocation, careful planning, and effective cost monitoring.

- Technical Risks: The seller assumes responsibility for technical risks associated with the project, such as design flaws, material defects, or unforeseen technical challenges. They need to have the necessary expertise and resources to address these risks effectively.

- Performance Risks: The seller’s performance is crucial to the project’s success. Meeting deadlines, adhering to quality standards, and effectively communicating with the buyer are essential for maintaining a positive project outcome.

Contract Administration and Monitoring

Cost reimbursable contracts require meticulous administration and monitoring to ensure effective cost control, project completion within budget, and adherence to contract terms. This involves a comprehensive approach that encompasses regular tracking, reporting, and communication between the contracting parties.

Importance of Contract Administration and Monitoring

Effective contract administration and monitoring are crucial for successful cost reimbursable projects. They provide a framework for:

- Cost Control and Management: Regular monitoring helps identify potential cost overruns and allows for timely corrective actions to keep the project within budget.

- Project Completion on Time: By tracking progress and identifying potential delays, contract administration ensures the project stays on schedule.

- Contract Compliance: Regular monitoring ensures adherence to the contract terms and conditions, minimizing disputes and misunderstandings.

- Risk Management: Monitoring helps identify and assess potential risks, enabling timely mitigation strategies to prevent project derailment.

- Improved Communication: Regular communication between the contracting parties fosters transparency, builds trust, and facilitates prompt resolution of issues.

Key Steps in Contract Administration and Monitoring

Contract administration and monitoring involve a series of essential steps:

- Establishing Clear Contract Terms: The contract should clearly define the scope of work, payment terms, cost reporting requirements, and dispute resolution mechanisms.

- Developing a Monitoring Plan: A detailed monitoring plan should Artikel the frequency, methods, and key performance indicators (KPIs) for tracking project progress and costs.

- Regular Cost Reporting and Analysis: The contractor should submit regular cost reports detailing actual expenses incurred, comparing them to the budget and identifying any variances.

- Performance Reviews: Periodic performance reviews assess project progress, identify any deviations from the plan, and discuss corrective actions.

- Audits and Inspections: Independent audits and inspections can be conducted to verify cost reports and ensure adherence to contract terms.

- Communication and Collaboration: Open and transparent communication between the contracting parties is essential for effective contract administration and monitoring. This includes regular meetings, discussions, and documentation of all key decisions and actions.

- Dispute Resolution: The contract should specify a clear process for resolving any disputes that may arise during the project lifecycle.

Legal Considerations

Cost reimbursable contracts present unique legal considerations that must be carefully addressed to ensure both parties’ rights and obligations are clearly defined and enforced. The complexity of these contracts arises from their open-ended nature, where the final cost is unknown until the project is completed.

Contract Language and Documentation

Clear and unambiguous contract language is paramount in cost reimbursable contracts. This is crucial to prevent disputes and ensure a transparent and fair allocation of risks and responsibilities.

- The contract should explicitly define the scope of work, including deliverables, milestones, and performance standards. This ensures a clear understanding of what is expected from both parties.

- The contract should specify the cost reimbursement method, including allowable costs, cost reporting procedures, and audit rights. This ensures transparency and prevents disputes regarding the cost of the project.

- The contract should Artikel the process for change orders, including the procedures for approval, cost adjustments, and schedule impacts. This helps manage project scope changes and prevents cost overruns.

- The contract should clearly define the termination clauses, including the grounds for termination, procedures for termination, and the consequences of termination. This ensures a fair and orderly process for ending the contract if necessary.

Legal Issues in Cost Reimbursable Contracts

Several legal issues can arise in cost reimbursable contracts.

- Cost overruns: The lack of a fixed price makes cost overruns a significant risk in cost reimbursable contracts. Disputes can arise over the reasonableness of costs, particularly if the contractor seeks reimbursement for costs that are not directly related to the project or are deemed excessive.

- Changes in scope: Changes in scope are common in cost reimbursable contracts, as the project’s requirements may evolve during its execution. These changes can lead to disputes over the cost of the changes, the impact on the project schedule, and the responsibility for the changes.

- Contract termination: Termination of a cost reimbursable contract can be complex, especially if it occurs before the project’s completion. Disputes may arise over the termination process, the payment of outstanding costs, and the allocation of responsibility for the project’s termination.

- Intellectual property rights: The ownership of intellectual property developed under a cost reimbursable contract can be a source of dispute. The contract should clearly define the ownership of intellectual property rights and the rights of each party to use, exploit, and commercialize the intellectual property.

Comparison with Other Contract Types

Cost reimbursable contracts, while offering flexibility and shared risk, are not the optimal choice for every project. Understanding their strengths and weaknesses requires comparing them to other common contract types, highlighting key differences in risk allocation, payment mechanisms, and control.

Comparison with Fixed-Price Contracts

Fixed-price contracts, also known as lump-sum contracts, represent the most common contract type. They involve a fixed price agreed upon upfront for the complete scope of work, regardless of actual costs incurred.

- Risk Allocation: In fixed-price contracts, the contractor assumes most of the risk, responsible for managing costs and delivering the project within the agreed budget. The buyer enjoys price certainty and predictable costs. In contrast, cost reimbursable contracts shift a greater portion of risk to the buyer, who bears the responsibility for cost overruns.

- Payment Mechanisms: Fixed-price contracts involve a single payment upon project completion or in predefined milestones. Cost reimbursable contracts, on the other hand, involve periodic payments based on actual costs incurred, with potential incentives or penalties based on performance.

- Control: Fixed-price contracts offer the buyer greater control over the project scope and budget, as the contractor is obligated to deliver the agreed-upon deliverables within the fixed price. Cost reimbursable contracts provide less control over costs, requiring the buyer to closely monitor and manage the contractor’s expenses.

Comparison with Time and Materials Contracts

Time and materials contracts, similar to cost reimbursable contracts, involve payment based on actual costs incurred. However, they differ in their scope and risk allocation.

- Risk Allocation: In time and materials contracts, the contractor assumes less risk compared to cost reimbursable contracts, as they are compensated for their time and materials used, regardless of project outcomes. The buyer retains more control over costs but still faces potential risks due to variations in labor hours and material costs.

- Payment Mechanisms: Time and materials contracts typically involve periodic payments based on time spent and materials used, often with a fixed hourly rate or markup on materials. This approach can lead to more predictable costs than cost reimbursable contracts, where costs can fluctuate significantly.

- Control: The buyer has greater control over costs in time and materials contracts, as they can monitor and approve time sheets and material invoices. However, the buyer has less control over the project scope, as the contractor is compensated based on the time and materials used, not the specific deliverables.

Scenarios for Contract Type Selection, What is a cost reimbursable contract

- Fixed-price contracts are best suited for projects with well-defined scope, predictable costs, and low risk. Examples include construction projects with detailed specifications, software development projects with clear requirements, and routine maintenance tasks.

- Cost reimbursable contracts are more appropriate for projects with uncertain scope, high risk, and the need for flexibility. Examples include research and development projects, complex engineering projects with unforeseen challenges, and projects with rapidly evolving requirements.

- Time and materials contracts are often used for projects with less defined scope, but where the buyer wants more control over costs than a cost reimbursable contract allows. Examples include repair and maintenance work, small-scale construction projects, and consulting services.

Cost reimbursable contracts present a unique approach to project management, offering flexibility and risk allocation tailored to complex endeavors. Understanding the intricacies of cost reimbursement methods, risk management strategies, and legal considerations is crucial for both buyers and sellers to ensure a successful and mutually beneficial outcome. By carefully crafting the contract terms, establishing robust cost control mechanisms, and fostering open communication, parties can navigate the complexities of this contract type and achieve their project objectives.

FAQ Compilation

What are the main advantages of using a cost reimbursable contract?

Cost reimbursable contracts offer flexibility in project scope, encourage innovation, and incentivize the seller to prioritize quality over cost.

What are the main disadvantages of using a cost reimbursable contract?

Cost reimbursable contracts can lead to higher overall costs due to potential cost overruns and lack of clear cost control. They also require close monitoring and strong communication between the buyer and seller.

What are some common risk mitigation strategies used in cost reimbursable contracts?

Common risk mitigation strategies include detailed cost reporting, independent cost audits, performance incentives, and clear termination clauses.

What are some legal considerations for cost reimbursable contracts?

Legal considerations include defining the scope of work, establishing clear cost reimbursement mechanisms, addressing potential disputes, and ensuring compliance with relevant regulations.