What is a cost reimbursable contract? This type of contract, unlike its fixed-price counterpart, involves the buyer reimbursing the seller for actual costs incurred in completing a project. The buyer agrees to pay for all allowable expenses, plus a predetermined fee or incentive. This structure creates a collaborative environment, where both parties share the risks and rewards associated with the project.

Cost reimbursable contracts offer a unique approach to project management, providing flexibility for complex and unpredictable endeavors. They are often favored in situations where the scope of work is unclear, technological advancements are expected, or significant uncertainties exist. However, this flexibility comes with inherent risks, particularly the potential for cost overruns.

What is a Cost Reimbursable Contract?

A cost reimbursable contract, also known as a cost-plus contract, is a type of agreement where the buyer (the client) reimburses the seller (the contractor) for the actual costs incurred in performing the work, plus a predetermined fee or profit margin. This type of contract is typically used for projects with high uncertainty, where the scope of work is not fully defined, or when the risks are significant and cannot be easily quantified.

Key Characteristics of Cost Reimbursable Contracts

Cost reimbursable contracts are distinguished by their flexible nature, allowing for adjustments to the scope of work and budget as the project progresses. This flexibility is particularly advantageous when dealing with projects that involve unpredictable factors, such as technological advancements, changing market conditions, or unforeseen circumstances.

Difference Between Cost Reimbursable and Fixed-Price Contracts

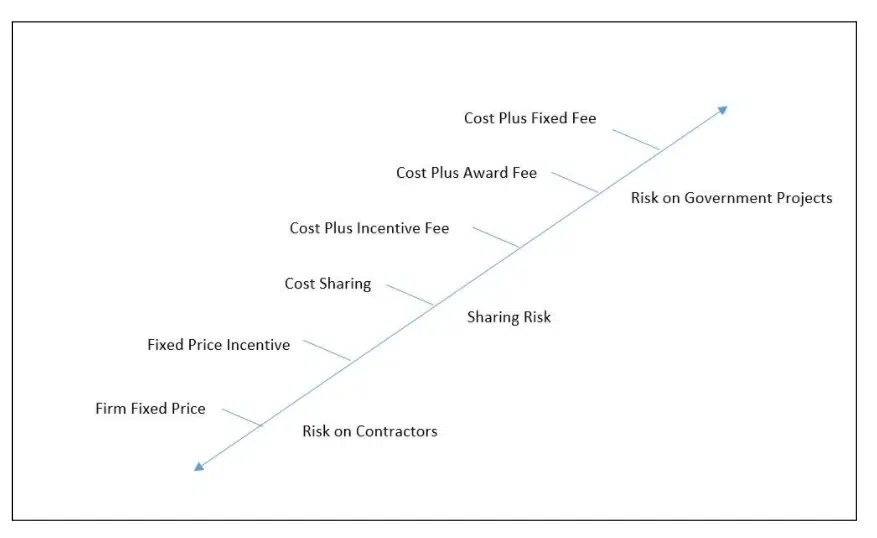

Unlike fixed-price contracts, where the total price is predetermined and the risk of cost overruns is borne by the contractor, cost reimbursable contracts shift the risk of cost overruns to the buyer. In a fixed-price contract, the contractor is responsible for managing costs and delivering the project within the agreed-upon price. However, in a cost reimbursable contract, the buyer assumes the responsibility of managing costs and paying for any unforeseen expenses.

Key Elements of Cost Reimbursable Contracts

Cost Sharing

Cost sharing is a common feature in cost reimbursable contracts, where the buyer and contractor agree to share the costs of the project based on a predetermined ratio. This sharing mechanism helps to align incentives and encourages both parties to manage costs effectively.

Fee Structures

The fee structure in a cost reimbursable contract typically includes a fixed fee, a percentage of the allowable costs, or a combination of both. The fee structure is designed to compensate the contractor for its efforts and expertise in managing the project.

Performance Incentives

Performance incentives are often incorporated into cost reimbursable contracts to motivate the contractor to achieve specific performance goals. These incentives can be based on factors such as project completion time, quality of work, or exceeding performance targets.

Types of Cost Reimbursable Contracts

Cost-reimbursable contracts are flexible and can be tailored to the specific needs of a project. However, the different types of cost-reimbursable contracts have varying fee structures and risk allocation mechanisms. Understanding these differences is crucial for choosing the right type of contract for a particular project.

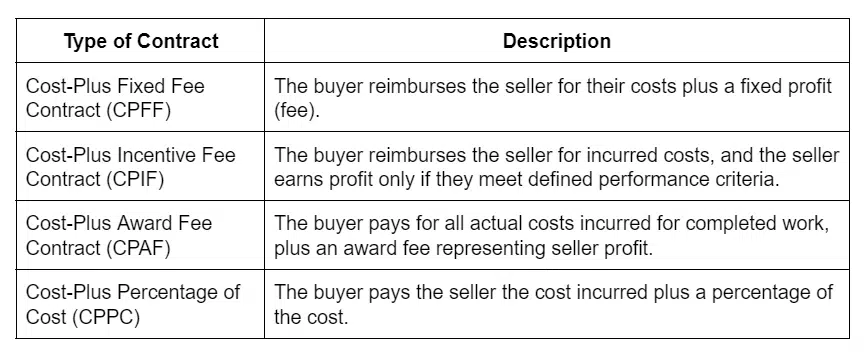

Cost-Plus-Fixed-Fee (CPFF), What is a cost reimbursable contract

The CPFF contract is the most common type of cost-reimbursable contract. In this type of contract, the contractor is reimbursed for all allowable costs incurred in performing the work, plus a fixed fee that is negotiated at the outset. The fixed fee is typically a percentage of the estimated cost of the project and is intended to compensate the contractor for its overhead and profit.

- Fee Structure: The contractor receives a fixed fee, regardless of the actual cost of the project. The fixed fee is typically a percentage of the estimated cost of the project, ranging from 5% to 15% depending on the complexity and risk of the project.

- Risk Allocation: The contractor bears the risk of cost overruns, while the client bears the risk of the contractor’s performance not meeting the requirements of the contract.

Example: A government agency might use a CPFF contract to hire a contractor to develop a new weapons system. The agency would reimburse the contractor for all allowable costs, plus a fixed fee. The fixed fee would compensate the contractor for its overhead and profit, regardless of the actual cost of the project.

Cost-Plus-Incentive-Fee (CPIF)

The CPIF contract is similar to the CPFF contract, but it includes an incentive fee that is paid to the contractor if it meets or exceeds certain performance goals. The incentive fee is typically a percentage of the estimated cost of the project and is intended to motivate the contractor to achieve the desired performance levels.

- Fee Structure: The contractor receives a fixed fee, plus an incentive fee that is based on the contractor’s performance. The incentive fee is typically a percentage of the estimated cost of the project, and it can be structured in a variety of ways to incentivize different performance goals.

- Risk Allocation: The contractor bears the risk of cost overruns, while the client bears the risk of the contractor’s performance not meeting the requirements of the contract. The contractor also shares some of the risk of cost overruns if the incentive fee is structured in a way that penalizes the contractor for exceeding the estimated cost of the project.

Example: A private company might use a CPIF contract to hire a contractor to build a new manufacturing facility. The company would reimburse the contractor for all allowable costs, plus a fixed fee. The company would also pay an incentive fee to the contractor if it meets or exceeds certain performance goals, such as completing the project on time and within budget.

Cost-Plus-Award-Fee (CPAF)

The CPAF contract is a type of cost-reimbursable contract where the contractor is paid a fee based on the client’s subjective evaluation of the contractor’s performance. The award fee is typically a lump sum payment, and it is awarded at the end of the project.

- Fee Structure: The contractor receives a fixed fee, plus an award fee that is based on the client’s subjective evaluation of the contractor’s performance. The award fee is typically a lump sum payment, and it can be structured in a variety of ways to incentivize different performance goals.

- Risk Allocation: The contractor bears the risk of cost overruns, while the client bears the risk of the contractor’s performance not meeting the requirements of the contract. The contractor also shares some of the risk of cost overruns if the award fee is structured in a way that penalizes the contractor for exceeding the estimated cost of the project.

Example: A government agency might use a CPAF contract to hire a contractor to provide training services to military personnel. The agency would reimburse the contractor for all allowable costs, plus a fixed fee. The agency would also award a lump sum payment to the contractor if it meets or exceeds certain performance goals, such as providing high-quality training and achieving desired learning outcomes.

Advantages and Disadvantages of Cost Reimbursable Contracts

Cost reimbursable contracts are a type of contract where the buyer reimburses the seller for the actual costs incurred in performing the work, plus a predetermined fee. These contracts can be advantageous in situations where the scope of work is uncertain, or where the buyer desires a high level of flexibility and control. However, they also come with certain disadvantages, such as the potential for cost overruns and reduced cost control.

Advantages of Cost Reimbursable Contracts

The primary advantages of using cost reimbursable contracts are their flexibility, shared risk, and potential for innovation.

- Flexibility: Cost reimbursable contracts allow for greater flexibility in the scope of work, as the buyer and seller can adjust the project requirements as needed. This can be particularly beneficial for projects with uncertain or changing requirements, where a fixed-price contract may be too restrictive. For example, if a construction project encounters unforeseen geological conditions, a cost reimbursable contract allows for adjustments to the scope of work and costs without the need for renegotiation.

- Shared Risk: Cost reimbursable contracts can help to share risk between the buyer and seller. This can be beneficial for projects with high levels of uncertainty, as both parties are incentivized to manage costs and minimize risks. For instance, in a research and development project, both the buyer and seller share the risk of the project not being successful, as the seller is compensated for their actual costs and the buyer is not obligated to pay for any unrealistic cost estimates.

- Potential for Innovation: Cost reimbursable contracts can encourage innovation, as the seller is not limited by a fixed price and can focus on finding the best solutions, even if they are more expensive. This can be particularly valuable for projects that require cutting-edge technology or complex engineering solutions. For example, in a project to develop a new type of aircraft engine, a cost reimbursable contract would allow the seller to explore different design options and materials without being constrained by a fixed budget.

Disadvantages of Cost Reimbursable Contracts

The primary disadvantages of using cost reimbursable contracts are the potential for cost overruns, reduced cost control, and increased complexity.

- Potential for Cost Overruns: Cost reimbursable contracts can lead to cost overruns if the seller is not careful in managing their costs. This is because the seller is reimbursed for their actual costs, regardless of whether they are efficient or not. For instance, a poorly managed project with excessive labor costs could lead to significant cost overruns for the buyer.

- Reduced Cost Control: Cost reimbursable contracts can reduce the buyer’s control over costs, as the seller is responsible for managing their own expenses. This can make it difficult for the buyer to track and monitor costs, and to ensure that they are getting value for their money. For example, if a seller does not adequately track their labor hours or material costs, the buyer may end up paying more than they anticipated for the project.

- Increased Complexity: Cost reimbursable contracts can be more complex than fixed-price contracts, as they require more detailed accounting and reporting. This can add to the administrative burden for both the buyer and seller, and can make it more difficult to manage the project. For example, cost reimbursable contracts often require detailed cost breakdowns, progress reports, and audits, which can increase the administrative workload for both parties.

Cost Reimbursable Contracts in Practice

Cost reimbursable contracts are widely used across various industries, each presenting unique challenges and opportunities. These contracts offer flexibility and risk sharing, but careful planning and monitoring are essential for successful implementation.

Examples of Cost Reimbursable Contracts in Different Industries

The use of cost reimbursable contracts is prevalent in industries where projects are complex, uncertain, or require significant innovation. Here are some examples:

- Construction: Large-scale infrastructure projects, such as bridges, tunnels, and airports, often utilize cost reimbursable contracts due to the inherent complexity and uncertainties involved. For instance, the construction of the Channel Tunnel, a 31-mile undersea tunnel connecting England and France, was undertaken using a cost-plus contract, allowing for unforeseen challenges and adjustments. This approach provided flexibility for the contractors to adapt to the complex geological conditions and engineering requirements.

- Technology: Research and development projects in the technology sector often employ cost reimbursable contracts to support innovation and exploration. For example, the development of the first commercially successful personal computer, the IBM PC, involved a cost-plus contract between IBM and its suppliers, enabling the rapid prototyping and iterative development of new technologies.

- Government Procurement: Government agencies frequently use cost reimbursable contracts for projects that involve national security, public safety, or critical infrastructure. For example, the development of advanced military systems, such as fighter jets and missile defense systems, often relies on cost-plus contracts, allowing for the integration of complex technologies and the management of high-risk development phases.

Challenges and Opportunities in Different Industries

The application of cost reimbursable contracts in different industries presents both challenges and opportunities. Here are some examples:

- Construction: The inherent uncertainty in construction projects can lead to cost overruns and delays. However, cost reimbursable contracts provide flexibility to address unforeseen circumstances and adapt to changing project requirements. The challenge lies in establishing clear cost control mechanisms and monitoring the project closely to prevent excessive cost growth.

- Technology: The rapid pace of technological advancements can make it difficult to define project scope and budget upfront. Cost reimbursable contracts provide the flexibility to adapt to evolving technologies and market demands. The challenge lies in managing the potential for scope creep and ensuring that the project remains aligned with the initial objectives.

- Government Procurement: Government projects often involve complex regulatory requirements and stringent oversight. Cost reimbursable contracts can facilitate the development of innovative solutions and meet the specific needs of government agencies. The challenge lies in ensuring transparency, accountability, and value for money, while adhering to the legal and ethical standards of public procurement.

Combining Cost Reimbursable Contracts with Other Contract Types

Cost reimbursable contracts can be effectively combined with other contract types to achieve specific project objectives. Here are some examples:

- Fixed-Price Contracts: In some cases, a project may involve a combination of well-defined tasks and uncertain elements. A fixed-price contract can be used for the well-defined tasks, while a cost reimbursable contract can be employed for the uncertain elements. For example, a construction project may involve a fixed-price contract for the foundation work, while a cost reimbursable contract is used for the complex superstructure design and construction.

- Time and Materials Contracts: Time and materials contracts can be used for tasks where the scope is uncertain or subject to change. Cost reimbursable contracts can be used to manage the overall project, while time and materials contracts can be used for specific tasks within the project. For example, a technology project may involve a cost reimbursable contract for the overall project management, while time and materials contracts are used for individual development tasks.

Managing Cost Reimbursable Contracts: What Is A Cost Reimbursable Contract

Managing cost reimbursable contracts effectively is crucial to ensuring project success and minimizing financial risks. This requires a structured approach, strong communication, and robust monitoring mechanisms.

Key Steps in Managing Cost Reimbursable Contracts

Managing cost reimbursable contracts involves a series of key steps to ensure effective control and mitigate potential risks.

- Define Clear Scope and Objectives: A well-defined scope of work and clear project objectives are essential. This includes outlining deliverables, milestones, and performance criteria to ensure both parties are aligned on expectations.

- Establish a Robust Cost Tracking System: Implementing a comprehensive cost tracking system is critical for monitoring expenses and identifying potential cost overruns. This system should include detailed records of all project costs, including labor, materials, and overhead.

- Implement Regular Performance Monitoring: Regular performance reviews are essential to track progress against project milestones and identify any potential issues or delays. This may involve regular meetings, status reports, and performance evaluations.

- Maintain Open Communication: Effective communication is paramount for successful contract management. This involves regular updates, transparent reporting, and prompt resolution of any disputes or concerns.

- Establish a Strong Change Management Process: Changes to the scope of work or project requirements are common in cost reimbursable contracts. A well-defined change management process is essential for managing these changes effectively and ensuring that they are properly documented and approved.

Importance of Clear Communication

Clear and open communication is the cornerstone of effective cost reimbursable contract management. It fosters trust, transparency, and mutual understanding between the parties involved.

- Minimizing Misunderstandings: Clear communication helps prevent misunderstandings about project requirements, deliverables, and cost expectations, reducing the risk of disputes or delays.

- Facilitating Collaboration: Open communication encourages collaboration and facilitates the timely resolution of issues. This is especially important in cost reimbursable contracts, where both parties need to work together to manage costs and ensure project success.

- Promoting Transparency: Regular communication fosters transparency and accountability, allowing both parties to track progress, identify potential risks, and address concerns proactively.

Importance of Robust Cost Tracking Mechanisms

Cost tracking mechanisms are vital for monitoring expenses, identifying potential overruns, and ensuring that project costs are managed effectively.

- Early Detection of Overruns: Robust cost tracking allows for the early detection of potential cost overruns, providing an opportunity to implement corrective measures and prevent further escalation.

- Data-Driven Decision-Making: Detailed cost data provides a basis for informed decision-making. It allows for the identification of cost-saving opportunities, the optimization of resource allocation, and the adjustment of project plans as needed.

- Improved Cost Control: Accurate cost tracking enables effective cost control, ensuring that expenses are aligned with project budgets and minimizing the risk of financial losses.

Importance of Strong Performance Monitoring

Performance monitoring is crucial for ensuring that project goals are met and deliverables are delivered on time and within budget.

- Identifying Potential Issues: Regular performance monitoring allows for the early identification of potential issues, such as delays, performance shortfalls, or quality concerns. This enables proactive intervention and mitigation strategies.

- Measuring Progress: Performance monitoring provides a framework for measuring project progress against established milestones and objectives. This data is essential for assessing project performance and identifying areas for improvement.

- Ensuring Accountability: Strong performance monitoring promotes accountability among all stakeholders, ensuring that everyone is working towards common goals and contributing to project success.

Checklist of Essential Considerations

When entering into a cost reimbursable contract, it is essential to consider the following factors:

- Clearly Defined Scope of Work: A detailed scope of work that Artikels deliverables, milestones, and performance criteria is crucial for ensuring that both parties are aligned on project expectations.

- Robust Cost Tracking System: Establishing a comprehensive cost tracking system is vital for monitoring expenses, identifying potential overruns, and ensuring that project costs are managed effectively.

- Regular Performance Monitoring: Implementing a regular performance monitoring process is essential for tracking progress against project milestones, identifying potential issues, and ensuring that project goals are met.

- Effective Communication: Maintaining open and transparent communication is paramount for fostering trust, resolving disputes, and ensuring that both parties are informed about project progress and any potential challenges.

- Change Management Process: Establishing a well-defined change management process is crucial for managing changes to the scope of work or project requirements effectively and ensuring that they are properly documented and approved.

- Risk Assessment and Mitigation: Conducting a thorough risk assessment and developing a comprehensive risk mitigation plan is essential for identifying potential risks and implementing strategies to minimize their impact.

- Contractual Terms and Conditions: Carefully reviewing and understanding the contractual terms and conditions, including payment terms, dispute resolution mechanisms, and termination clauses, is crucial for protecting both parties’ interests.

Understanding the intricacies of cost reimbursable contracts is crucial for both buyers and sellers. While these contracts offer flexibility and shared risk, they require meticulous planning, transparent communication, and robust cost control mechanisms to ensure successful project execution. By carefully considering the advantages and disadvantages, and implementing appropriate management strategies, stakeholders can leverage the benefits of cost reimbursable contracts while mitigating potential risks.

FAQ Compilation

How do cost reimbursable contracts differ from fixed-price contracts?

In a fixed-price contract, the buyer agrees to pay a predetermined price for the completed project, regardless of the actual costs incurred. In a cost reimbursable contract, the buyer reimburses the seller for actual costs plus a fee.

What are some common examples of cost reimbursable contracts?

Cost-plus-fixed-fee (CPFF), cost-plus-incentive-fee (CPIF), and cost-plus-award-fee (CPAF) are common types of cost reimbursable contracts.

What are the potential risks associated with cost reimbursable contracts?

Cost overruns, reduced cost control, and increased complexity are potential risks associated with cost reimbursable contracts.