What is a cost reimbursement contract sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Imagine a scenario where the exact scope of a project is uncertain, and the costs involved are difficult to predict upfront. This is where cost reimbursement contracts come into play, offering a flexible framework for managing complex projects.

Cost reimbursement contracts are agreements where one party, typically the buyer, agrees to reimburse the other party, the contractor, for the actual costs incurred in completing a project. This type of contract is often used in situations where the project is highly complex, innovative, or involves a high degree of uncertainty. They allow for greater flexibility and adaptability, as the contractor can adjust their approach and resources as the project progresses.

Definition of a Cost Reimbursement Contract

A cost reimbursement contract, or a cost-plus contract, is a type of agreement where the buyer pays the seller for all the actual costs incurred in performing the work, plus a predetermined fee or profit margin. It’s basically like saying, “I’ll pay you for all the stuff you need to do this job, plus a bit extra for your effort.”

Core Principles of Cost Reimbursement Contracts

Cost reimbursement contracts are built on a few key principles:

- Cost Sharing: The buyer and seller share the financial risk of the project. The buyer covers all the costs, but the seller’s profit is tied to the project’s actual costs.

- Transparency: The seller is obligated to keep detailed records of all costs incurred and provide them to the buyer for review and approval. It’s like keeping an open book so the buyer can see where their money is going.

- Fee Structure: The seller’s profit is typically calculated as a percentage of the actual costs, a fixed fee, or a combination of both. This means the seller’s profit can fluctuate depending on the project’s costs.

Examples of Industries and Scenarios

Cost reimbursement contracts are often used in situations where:

- The scope of work is uncertain or complex: This is because it’s difficult to estimate costs accurately upfront. Imagine building a spaceship – you don’t know exactly what you’ll need until you start building it!

- The project involves a high level of risk: If there’s a chance the project could go over budget, a cost reimbursement contract allows the seller to be compensated for the extra costs. Imagine you’re building a bridge in a remote location – there’s a chance you might encounter unexpected geological challenges, and a cost reimbursement contract covers you for those unexpected costs.

- The buyer needs a high level of control: Cost reimbursement contracts give the buyer a lot of control over the project’s costs and how the work is performed. This is especially important for projects with a high budget or where the buyer wants to ensure the work is done to their specific standards.

Key Features of Cost Reimbursement Contracts

Cost reimbursement contracts, often referred to as “cost-plus” contracts, are a type of agreement where the buyer pays the seller for all allowable costs incurred in performing the work, plus an agreed-upon fee. These contracts are commonly used in situations where the scope of work is uncertain, or where the risks associated with the project are high.

Types of Cost Reimbursement Contracts, What is a cost reimbursement contract

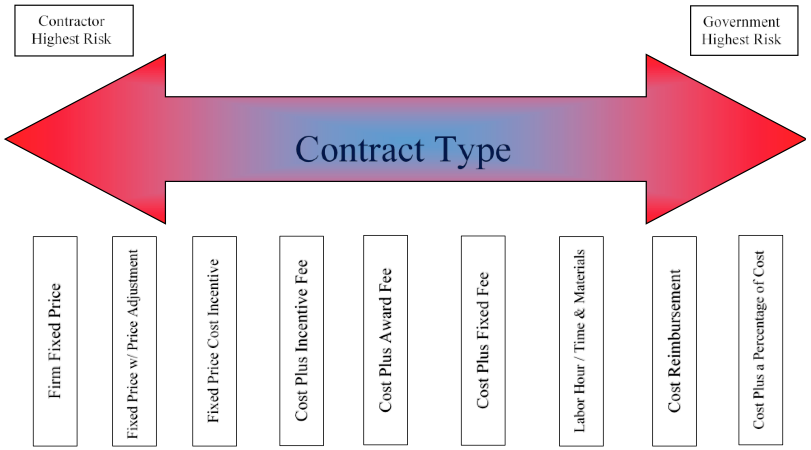

Cost reimbursement contracts come in different forms, each with its own unique characteristics and implications. These variations are designed to address different levels of risk and provide flexibility in how costs are shared between the buyer and seller.

- Cost-Plus-Fixed-Fee (CPFF): In this type of contract, the buyer reimburses the seller for all allowable costs incurred in performing the work, plus a fixed fee that is predetermined at the start of the project. The fixed fee is typically a percentage of the estimated total cost and serves as compensation for the seller’s overhead and profit. This type of contract places the most risk on the buyer, as they are responsible for all incurred costs.

However, it also provides the seller with a predictable income stream.

- Cost-Plus-Incentive-Fee (CPIF): This type of contract is similar to CPFF, but it includes an incentive fee that is based on the seller’s performance. The incentive fee is calculated based on a predetermined formula that considers factors such as cost, schedule, and quality. This type of contract encourages the seller to achieve the best possible results, as their fee is directly tied to their performance.

However, it also introduces complexity into the contract and requires careful planning and monitoring.

- Cost-Plus-Award-Fee (CPAF): In this type of contract, the buyer reimburses the seller for all allowable costs, and the seller receives a fee that is based on their overall performance. The award fee is typically a lump sum payment that is determined subjectively by the buyer, based on criteria such as schedule, quality, and overall project success. This type of contract provides the buyer with greater flexibility in rewarding the seller for their performance, but it also introduces subjectivity and potential for disputes.

Cost Reimbursement Contract Structure

A cost reimbursement contract structure is designed to be flexible and adaptable, reflecting the inherent uncertainty in projects where the scope or final costs are difficult to determine upfront. This structure ensures that the contractor is compensated for all legitimate expenses incurred while working on the project, while also providing the client with a degree of control over the project’s costs.

Key Provisions and Clauses

Cost reimbursement contracts typically include a set of key provisions and clauses to define the scope of the agreement and manage the financial aspects of the project. These clauses ensure clarity and transparency throughout the project lifecycle.

- Cost Allowability: This provision Artikels the types of costs that are eligible for reimbursement. It defines which expenses are considered reasonable and directly related to the project, ensuring that the contractor is only compensated for legitimate costs.

- Cost Accounting Standards: The contract will often specify the cost accounting standards that the contractor must adhere to. This ensures that the costs are tracked and reported in a consistent and transparent manner.

- Cost Control Mechanisms: To prevent cost overruns, cost reimbursement contracts often incorporate mechanisms for controlling costs. These mechanisms can include budget limits, cost-sharing arrangements, or regular cost reporting requirements.

- Audits: The client typically has the right to audit the contractor’s cost records to ensure accuracy and compliance with the contract.

- Fee Structure: While the primary focus is on reimbursing costs, cost reimbursement contracts often include a fee structure to compensate the contractor for their time, expertise, and management of the project.

- Termination Provisions: Cost reimbursement contracts typically include provisions for termination of the contract under certain circumstances. These provisions may include termination for convenience, termination for default, or termination for cause.

Examples of Provision Applications

- Cost Allowability: Imagine a construction project where the contractor incurs costs for unexpected site remediation. The cost allowability clause would determine if these costs are eligible for reimbursement. If the remediation was necessary to complete the project, the costs would likely be considered allowable.

- Cost Control Mechanisms: A software development project might have a budget limit set for each phase. The cost control mechanisms would ensure that the contractor stays within the allocated budget for each phase, preventing cost overruns.

- Audits: A research project funded by a government agency might require the contractor to undergo regular audits to verify the accuracy of their cost records.

Cost Reimbursement Contract Management: What Is A Cost Reimbursement Contract

Managing cost reimbursement contracts can be a bit of a rollercoaster ride, especially if you’re not clued up on the ins and outs. You’re basically trusting the other side to be on the level, and it’s your job to make sure they’re not pulling a fast one.

Challenges of Managing Cost Reimbursement Contracts

It’s not all sunshine and rainbows when you’re dealing with these contracts. Here’s the lowdown on the main challenges:

- Keeping a close eye on costs: You need to be super vigilant with cost tracking, as the contract is based on actual expenses. It’s easy for costs to spiral out of control, so you need to be on top of it.

- Preventing cost overruns: It’s a constant battle to keep costs under control. You need to be proactive in spotting potential overruns and putting measures in place to avoid them.

- Making sure everything is legit: You need to be extra careful about the legitimacy of all the costs being claimed. There’s always a risk of fraud or inflated costs, so you need to be on the ball.

- Keeping everyone in the loop: Communication is key in these contracts. You need to keep everyone informed about the progress of the project and any potential cost issues.

- Managing disputes: Disputes can crop up from time to time, so you need to have a clear process in place for resolving them.

Importance of Robust Cost Tracking and Reporting Mechanisms

Cost tracking and reporting are your best mates when it comes to managing these contracts. They’re like your eyes and ears, giving you the inside scoop on how things are going.

- Keeping tabs on the budget: Cost tracking lets you see exactly how much you’re spending and whether you’re on track to meet the budget.

- Spotting potential problems early: Regular reporting helps you identify any potential cost overruns or other issues before they become major headaches.

- Making informed decisions: Having accurate cost data allows you to make informed decisions about the project, such as whether to make changes to the scope or budget.

- Supporting your case: In case of any disputes, having detailed cost records can help you back up your position.

Effective Communication and Collaboration

Communication is the key to a smooth and successful cost reimbursement contract. It’s all about keeping everyone on the same page and working together to achieve the project goals.

- Regular meetings: Schedule regular meetings with the other party to discuss progress, costs, and any potential issues.

- Open and honest communication: Be open and honest about any concerns you have, and encourage the other party to do the same.

- Clear and concise reporting: Provide clear and concise cost reports to the other party, and make sure they understand the information presented.

- Building trust: Building trust with the other party is essential for a successful contract. This means being transparent and reliable in your dealings.

Risk and Cost Considerations

![]()

Cost reimbursement contracts can be a bit of a gamble, mate. They can be really beneficial for complex projects where the scope isn’t fully clear, but they also come with some risks that you need to be aware of. You need to be on top of your game to make sure you’re not getting ripped off, and you need to have a good plan in place to manage the risks.

Risk Mitigation Strategies

To make sure you’re not getting stung, you need to be savvy about managing the risks associated with cost reimbursement contracts. Here are some things you can do to keep things on track:

- Clear and detailed scope of work: Make sure you’ve got a solid understanding of what’s involved in the project. The more detailed the scope of work, the less likely you are to get hit with unexpected costs.

- Detailed cost breakdowns: Get the contractor to break down their costs in detail so you can see exactly where your money is going. This will help you spot any potential red flags.

- Regular progress reports: Stay in the loop with regular progress reports. This will help you keep track of how the project is going and make sure it’s on budget.

- Cost control measures: Put in place some strict cost control measures. This could include things like setting budget limits, approving invoices, and requiring the contractor to get your approval before making any significant changes.

- Negotiate a fair fee: Don’t just take the contractor’s word for it. Negotiate a fair fee for their services. This could be a fixed fee, a percentage of the project cost, or a combination of both.

- Performance incentives: Consider offering performance incentives to motivate the contractor to complete the project on time and within budget. This could be a bonus for meeting certain milestones or completing the project early.

Cost Control Measures

Cost control is crucial for any project, but it’s especially important with cost reimbursement contracts.

- Establish clear cost control procedures: You need to have a system in place for tracking costs and ensuring they’re within budget. This could involve using a budgeting software, creating a cost control spreadsheet, or setting up a cost control committee.

- Monitor costs regularly: Don’t just wait until the end of the project to see how much you’ve spent. Keep a close eye on costs throughout the project and make sure you’re on track.

- Identify and address cost overruns: If you spot a cost overrun, act quickly to investigate the cause and find a solution. Don’t let it snowball and become a major problem.

- Negotiate with the contractor: If you’re facing a potential cost overrun, try to negotiate with the contractor to find a way to reduce costs. You might be able to agree on a revised scope of work, a change in materials, or a lower fee.

Examples of Cost Reimbursement Contracts

Cost reimbursement contracts are widely used in various industries, particularly when the scope of work is complex, uncertain, or requires a high level of expertise. These contracts offer flexibility and allow for adjustments as the project progresses. Here are some examples of real-world applications of cost reimbursement contracts:

Government Contracts

Government contracts often employ cost reimbursement contracts, especially for large-scale projects like infrastructure development, research and development, and military procurement. This type of contract is preferred because it allows the government to share the risk associated with unforeseen circumstances or changes in project requirements. For example, the US Department of Defense (DoD) frequently utilizes cost reimbursement contracts for developing advanced weapons systems or conducting research on cutting-edge technologies.

These projects often involve significant uncertainties and require constant innovation, making cost reimbursement contracts suitable for managing the inherent risks.

Construction Projects

Cost reimbursement contracts can be beneficial for complex construction projects, especially those involving unique designs, challenging terrain, or unpredictable site conditions. They provide a framework for managing the unexpected challenges that can arise during construction. For instance, a large-scale infrastructure project like a new airport terminal or a high-speed railway might utilize a cost reimbursement contract to handle the complexity and potential for changes in design or construction methods.

The contract allows for adjustments to the project scope and budget as unforeseen issues are encountered, ensuring the project remains on track.

Research and Development (R&D)

Cost reimbursement contracts are common in R&D projects where the scope of work is inherently uncertain and the outcomes are difficult to predict. This type of contract provides flexibility for researchers to adapt their approach as they gather data and gain a deeper understanding of the project’s challenges.For example, a pharmaceutical company developing a new drug might use a cost reimbursement contract to fund the research and development process.

The contract allows for adjustments to the research plan as the company gains insights from clinical trials and adapts its approach based on the results.

Hypothetical Cost Reimbursement Contract Scenario

Imagine a technology company developing a new software platform for a large financial institution. The platform requires a high level of customization and integration with existing systems, making the project scope complex and uncertain. The company proposes a cost reimbursement contract with the financial institution, outlining the following key features:* Fixed Fee: The technology company receives a fixed fee for managing the project and providing technical expertise.

Reimbursable Costs

The financial institution reimburses the technology company for all documented and approved costs incurred during the project, including labor, materials, and other expenses.

Cost Control Measures

The contract includes cost control measures to ensure transparency and accountability, such as regular cost reporting, audits, and budget reviews.

Performance Incentives

The contract may include performance incentives to motivate the technology company to achieve project milestones and deliver a high-quality product.

Risk Sharing

The contract Artikels a clear risk-sharing mechanism, with both parties sharing the potential for cost overruns or delays.This hypothetical scenario demonstrates how cost reimbursement contracts can be tailored to meet the specific needs of a project, providing flexibility, transparency, and risk management mechanisms for both parties involved.

Cost reimbursement contracts, while offering flexibility, require careful planning, communication, and risk management. By understanding the key features, structure, and potential challenges, you can navigate the complexities of this contract type effectively. From defining clear cost control measures to establishing robust reporting mechanisms, managing cost reimbursement contracts demands a proactive and collaborative approach. Ultimately, these contracts offer a unique solution for tackling complex projects, but they require a commitment to transparency, accountability, and effective risk mitigation.

User Queries

What are some real-world examples of cost reimbursement contracts?

Cost reimbursement contracts are commonly used in government procurement, research and development projects, and large-scale construction projects. For instance, NASA uses cost reimbursement contracts for its space exploration programs, allowing contractors to adapt to unforeseen challenges and technological advancements.

What are the main advantages of using a cost reimbursement contract?

The primary advantage is flexibility. Since the contractor is reimbursed for actual costs, they have more freedom to adapt to changing project requirements and unforeseen circumstances. Additionally, it can be beneficial for projects where the scope is uncertain or involves a high degree of innovation.

What are the main disadvantages of using a cost reimbursement contract?

The main drawback is the potential for cost overruns. Without strict cost control measures, the contractor may have an incentive to inflate costs. Additionally, these contracts can be complex to manage, requiring robust reporting and communication mechanisms.

How can I mitigate the risks associated with cost reimbursement contracts?

Careful contract negotiation is crucial. Establish clear cost control measures, define acceptable cost ranges, and implement robust cost tracking and reporting systems. Regular communication and collaboration between the parties involved are essential to ensure transparency and prevent misunderstandings.