Delving into the world of futures contracts, a captivating realm where investors navigate the intricate dance of price fluctuations, we often find ourselves pondering a crucial question: How much do futures contracts cost? These contracts, standardized agreements to buy or sell an asset at a predetermined price and date, hold the potential for both substantial gains and significant losses.

Understanding the costs associated with futures contracts is paramount for making informed trading decisions and managing risk effectively.

Futures contracts involve a complex interplay of factors, including margin requirements, trading fees, and rollover costs, each playing a vital role in determining the overall cost of participation. While the initial allure of futures contracts lies in their potential for high returns, it is essential to grasp the intricacies of these costs to ensure that your trading ventures are both profitable and sustainable.

Let’s embark on a journey to unravel the complexities of futures contract costs, illuminating the path to informed trading decisions.

Understanding Futures Contracts

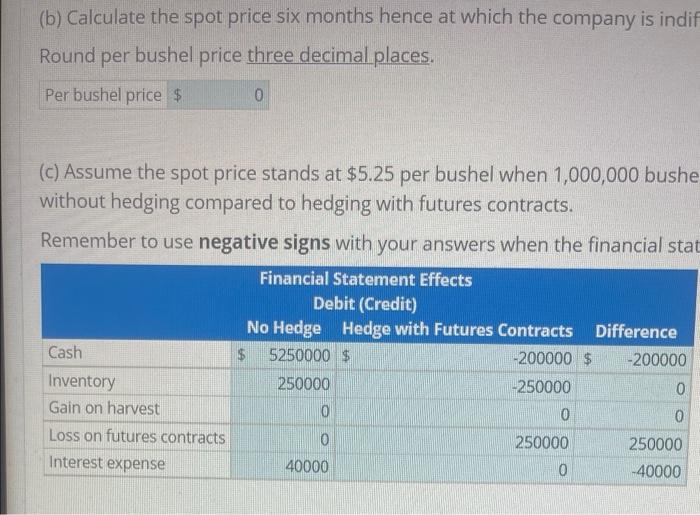

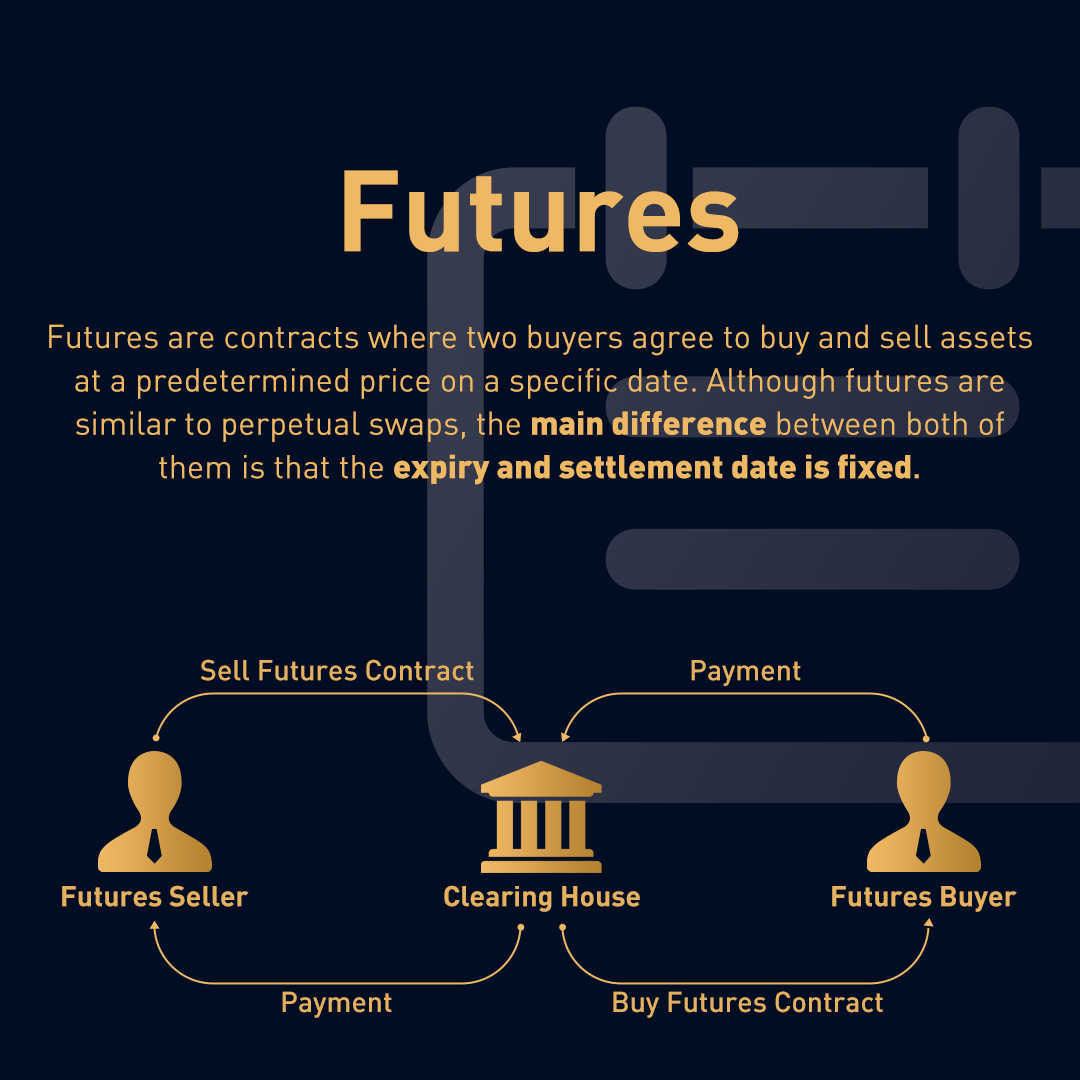

Futures contracts are legally binding agreements to buy or sell an underlying asset at a predetermined price and future date. These contracts are standardized, traded on exchanges, and settled through a clearinghouse, making them a unique and widely used financial instrument.

Key Characteristics of Futures Contracts

Futures contracts possess distinct features that differentiate them from other financial instruments. These characteristics are essential for understanding the functioning and applications of futures contracts.

- Standardized Contracts: Futures contracts are standardized, meaning they have predetermined specifications regarding the underlying asset, quantity, quality, delivery date, and settlement procedures. This standardization facilitates trading and ensures transparency among market participants.

- Exchange-Traded: Futures contracts are traded on organized exchanges, which provide a centralized platform for buyers and sellers to interact. This exchange-traded nature ensures liquidity and price discovery, making futures contracts a highly efficient instrument for risk management and speculation.

- Settlement Procedures: Futures contracts typically settle through a clearinghouse, a financial institution that acts as an intermediary between buyers and sellers. The clearinghouse guarantees the performance of both parties and reduces counterparty risk, ensuring the timely settlement of contracts.

Purpose and Uses of Futures Contracts

Futures contracts serve a variety of purposes in various markets, catering to the needs of different market participants, including producers, consumers, investors, and speculators.

- Price Risk Management: Futures contracts allow market participants to hedge against price fluctuations in the underlying asset. For example, a farmer can use futures contracts to lock in a price for their wheat crop, mitigating the risk of price declines.

- Speculation: Futures contracts provide an opportunity for investors to speculate on the future price movements of an asset. Speculators aim to profit from price changes, either by buying or selling futures contracts based on their market outlook.

- Arbitrage: Futures contracts can be used to exploit price discrepancies between the spot market and the futures market. Arbitrageurs profit by simultaneously buying and selling the underlying asset in different markets, taking advantage of price differences.

Costs Associated with Futures Contracts

Futures contracts, while offering potential for profit, come with various costs that traders need to consider. These costs can significantly impact the overall profitability of a futures trading strategy.

Initial Margin Requirements

Initial margin is the amount of money a trader needs to deposit with their broker to open a futures position. It acts as a security deposit, ensuring the trader can cover potential losses. The initial margin requirement is typically a percentage of the contract’s value, and it varies depending on factors such as:

- Underlying asset: The volatility of the underlying asset influences the margin requirement. More volatile assets generally require higher margins.

- Contract size: Larger contract sizes necessitate higher margin requirements due to the potential for greater losses.

- Market volatility: During periods of high market volatility, margin requirements tend to increase.

Maintenance Margin Requirements

Maintenance margin is the minimum amount of money that must be maintained in the margin account to keep the position open. If the account balance falls below the maintenance margin, the trader receives a margin call, requiring them to deposit additional funds to bring the account back to the initial margin level.

Trading Fees

Trading futures contracts involves various fees, including:

- Brokerage fees: Brokers charge commissions for executing trades.

- Exchange fees: Futures exchanges charge fees for clearing and settling trades.

Rollover Costs

Futures contracts have a specific expiration date. To maintain a position beyond the expiration date, traders need to roll over the contract to a later expiration date. This process involves selling the expiring contract and buying a new contract with a later expiration date. The difference in price between the two contracts is the rollover cost.

Interest Charges

Margin accounts often accrue interest charges, especially if the account balance is negative. The interest rate charged can vary depending on the broker and the account type.

Impact of Margin Requirements on Profits and Losses

Margin requirements play a crucial role in determining the potential profits and losses from futures trading. The margin acts as a leverage mechanism, magnifying both gains and losses. For example, a 10% margin requirement allows a trader to control a position worth 10 times their initial margin investment. This leverage can lead to significant profits if the market moves in the trader’s favor.

However, it can also amplify losses if the market moves against the trader’s position.

Factors Influencing Futures Contract Costs

The cost of a futures contract is influenced by several factors, including the underlying asset price, time to expiration, interest rates, and market volatility. These factors interact in complex ways to determine the final cost of trading futures contracts.

Underlying Asset Price

The price of the underlying asset is the most significant factor influencing the cost of a futures contract. As the price of the underlying asset rises, the cost of the futures contract also increases. This is because the futures contract represents a promise to buy or sell the underlying asset at a predetermined price in the future. For example, if the price of gold rises, the cost of a gold futures contract will also rise.

Time to Expiration

The time to expiration of a futures contract also affects its cost. As the expiration date approaches, the cost of the futures contract typically converges with the spot price of the underlying asset. This is because the futures contract becomes more likely to be settled by delivery of the underlying asset, and the cost of the futures contract reflects the current market value of the asset.

For example, a futures contract with a longer expiration date will generally be more expensive than a contract with a shorter expiration date.

Interest Rates

Interest rates can also affect the cost of futures contracts. Higher interest rates generally lead to higher futures prices, as investors demand a higher return for holding a futures contract. This is because holding a futures contract involves a certain level of risk, and investors require compensation for that risk. For example, if interest rates rise, the cost of a futures contract on a stock index might increase.

Market Volatility

Market volatility also influences the cost of futures contracts. When the market is volatile, the price of the underlying asset can fluctuate significantly, making it more difficult to predict the future price. This uncertainty makes futures contracts more expensive, as investors demand a higher premium for the risk they are taking. For example, during periods of high market volatility, the cost of a futures contract on crude oil might increase.

The relationship between the cost of futures contracts and the spot price of the underlying asset is complex and dynamic. The cost of a futures contract can deviate from the spot price due to factors such as interest rates, market volatility, and the time to expiration.

Cost Comparisons with Other Instruments: How Much Do Futures Contracts Cost

Futures contracts are just one type of financial instrument used for hedging and speculation. Understanding how their costs compare to other instruments is crucial for making informed decisions. This section will compare the costs of futures contracts with options contracts, forward contracts, and spot contracts, highlighting their advantages and disadvantages.

Comparison with Options Contracts

Options contracts provide the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a specific date. Unlike futures contracts, options have a premium, which is the price paid for the right to exercise the option. The cost of an options contract depends on various factors, including:

- The price of the underlying asset

- The strike price (the price at which the option can be exercised)

- The time to expiration

- The volatility of the underlying asset

Futures contracts, on the other hand, do not have a premium. Instead, the cost is determined by the initial margin requirement, which is a percentage of the contract value that must be deposited with the clearinghouse. Here’s a table summarizing the cost comparisons:

| Feature | Futures Contracts | Options Contracts |

|---|---|---|

| Cost | Initial margin requirement | Premium |

| Obligation | Obligation to buy or sell the underlying asset | Right, but not obligation, to buy or sell the underlying asset |

| Risk | Higher risk due to unlimited potential losses | Lower risk due to limited potential losses (premium paid) |

| Flexibility | Less flexible, as the contract must be fulfilled | More flexible, as the option can be exercised or allowed to expire |

Comparison with Forward Contracts

Forward contracts are similar to futures contracts in that they obligate the parties to buy or sell an underlying asset at a specific price on a specific date. However, forward contracts are traded over-the-counter (OTC), meaning they are not standardized and are not exchange-traded.The cost of a forward contract is typically determined by the parties involved and is not subject to margin requirements.

This lack of standardization and lack of margin requirements can make forward contracts more risky than futures contracts.Here’s a table summarizing the cost comparisons:

| Feature | Futures Contracts | Forward Contracts |

|---|---|---|

| Trading | Exchange-traded | Over-the-counter (OTC) |

| Standardization | Standardized contracts | Non-standardized contracts |

| Cost | Margin requirements | Negotiated between parties |

| Risk | Lower risk due to margin requirements and exchange oversight | Higher risk due to lack of standardization and margin requirements |

Comparison with Spot Contracts

Spot contracts are agreements to buy or sell an underlying asset immediately at the current market price. Spot contracts have no future obligations or price commitments.The cost of a spot contract is simply the current market price of the underlying asset.Here’s a table summarizing the cost comparisons:

| Feature | Futures Contracts | Spot Contracts |

|---|---|---|

| Time of Delivery | Future delivery | Immediate delivery |

| Price | Agreed upon price at the time of contract | Current market price |

| Risk | Price fluctuations between the time of contract and delivery | No price risk, as delivery is immediate |

| Flexibility | Less flexible, as the contract must be fulfilled | More flexible, as the transaction is immediate |

Real-World Examples and Case Studies

Futures contracts are widely used across various industries to manage risk and speculate on future price movements. These contracts allow participants to lock in prices for commodities, financial instruments, and other assets, providing a degree of certainty in an uncertain market.

Examples of Futures Contracts in Different Industries

Futures contracts find application in diverse industries, enabling businesses and individuals to manage price fluctuations and capitalize on market opportunities. Here are some notable examples:

- Agriculture: Farmers use futures contracts to hedge against price declines in their crops. For instance, a wheat farmer might sell a futures contract for wheat at a predetermined price, guaranteeing a minimum income even if market prices drop. This helps them plan their production and finances more effectively.

- Energy: Energy companies use futures contracts to hedge against price volatility in oil, natural gas, and other energy commodities. For example, an airline might purchase futures contracts for jet fuel to lock in a price for their fuel needs, mitigating the risk of rising fuel costs.

- Finance: Financial institutions use futures contracts to manage interest rate risk and speculate on currency movements. For instance, a bank might sell futures contracts on interest rate futures to hedge against rising interest rates, ensuring their profitability even if interest rates increase.

- Commodities: Futures contracts are essential for trading various commodities, including precious metals, agricultural products, and industrial materials. For example, a jewelry manufacturer might purchase futures contracts for gold to secure a supply of gold at a fixed price, ensuring consistent production costs.

Costs of Futures Contracts for Different Commodities

The cost of a futures contract varies depending on the underlying commodity, the contract’s expiration date, and market conditions. The following table provides an estimated cost for different commodities:

| Commodity | Estimated Cost (USD) |

|---|---|

| Oil (WTI Crude) | $1,000 per contract (1,000 barrels) |

| Gold | $100,000 per contract (100 ounces) |

| Wheat | $5,000 per contract (5,000 bushels) |

| Natural Gas | $10,000 per contract (10,000 MMBtu) |

Note: These costs are approximate and can fluctuate significantly based on market conditions.

Risks and Rewards of Trading Futures Contracts, How much do futures contracts cost

Trading futures contracts involves both potential rewards and risks. Understanding these factors is crucial for informed decision-making:

- Potential Rewards:

- Leverage: Futures contracts allow traders to control a large amount of underlying asset with a relatively small investment, potentially amplifying gains.

- Price Speculation: Futures contracts offer the opportunity to profit from price fluctuations, potentially generating significant returns.

- Hedging: Futures contracts can be used to mitigate price risk by locking in a price for future purchases or sales.

- Potential Risks:

- Market Volatility: Futures contracts are highly sensitive to market fluctuations, potentially leading to significant losses.

- Margin Requirements: Futures contracts require traders to deposit a margin, which can be lost if the market moves against them.

- Counterparty Risk: There is a risk that the counterparty to a futures contract may default on their obligations, resulting in financial losses.

It is crucial to remember that futures contracts are complex financial instruments and should be traded with caution. Thorough research, risk management strategies, and a comprehensive understanding of the market are essential for successful trading.

In the dynamic world of futures contracts, where opportunity and risk intertwine, understanding the associated costs is paramount. From initial margin requirements to trading fees and rollover expenses, each cost element contributes to the overall financial landscape of futures trading. By carefully considering these factors, investors can navigate the intricacies of futures contracts with greater clarity, optimizing their trading strategies and managing risk effectively.

As we delve deeper into the nuances of futures contract costs, we unlock the potential for informed decision-making and ultimately, enhanced trading outcomes.

FAQs

What are margin requirements and how do they work?

Margin requirements are a form of collateral that futures traders must deposit with their brokers to secure their positions. These requirements act as a buffer against potential losses and ensure that traders can fulfill their obligations. Margin requirements are typically a percentage of the contract value and can fluctuate based on market volatility and other factors.

What are the different types of trading fees associated with futures contracts?

Trading fees for futures contracts can include brokerage fees, exchange fees, and clearing fees. Brokerage fees are charged by your brokerage firm for executing trades, while exchange fees are levied by the exchange where the contract is traded. Clearing fees are charged by the clearinghouse, which acts as a central counterparty to guarantee contract performance.

How do rollover costs affect the overall cost of futures contracts?

Rollover costs arise when you choose to extend the maturity date of a futures contract. This process involves closing out the expiring contract and opening a new contract with a later expiry date. Rollover costs can vary depending on the underlying asset, market conditions, and the specific exchange.

What are the risks and rewards associated with trading futures contracts?

Futures contracts offer the potential for high returns but also carry significant risks. The leverage inherent in futures trading can amplify both profits and losses. Factors like market volatility, margin calls, and contract expiry dates can all contribute to potential risks. It is crucial to carefully consider your risk tolerance and trading objectives before engaging in futures trading.