How much does a futures contract cost sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Futures contracts are agreements to buy or sell an asset at a predetermined price on a future date. They are popular among traders seeking to speculate on price movements or hedge against risk.

Understanding the costs associated with entering a futures contract is crucial for informed decision-making.

The cost of a futures contract is influenced by several factors, including margin requirements, brokerage fees, and the underlying asset’s price volatility. Margin requirements, which are a percentage of the contract value, act as a security deposit to ensure contract fulfillment. Brokerage fees, charged by brokers for facilitating trades, and exchange fees, levied by the exchange where the contract is traded, also contribute to the overall cost.

Understanding Futures Contracts

Futures contracts are agreements to buy or sell an asset at a predetermined price on a future date. They are standardized contracts traded on organized exchanges, allowing investors to speculate on price movements or hedge against price risk.

Key Characteristics of Futures Contracts

Futures contracts have several key characteristics that distinguish them from other financial instruments.

- Standardized Contracts: Futures contracts are standardized, meaning they have predetermined contract sizes, delivery dates, and quality specifications. This standardization facilitates trading and liquidity. For example, a futures contract for gold would specify the weight and purity of the gold to be delivered.

- Exchange Trading: Futures contracts are traded on organized exchanges, which provide a centralized marketplace for buyers and sellers. The exchange ensures fair and transparent trading practices and provides a mechanism for settling trades.

- Margin Requirements: To enter into a futures contract, traders must deposit a certain amount of money with their broker, known as margin. Margin acts as a guarantee against potential losses and ensures that traders have the financial resources to fulfill their obligations. The margin requirement varies depending on the underlying asset and market conditions.

Types of Futures Contracts

Futures contracts are available for a wide range of underlying assets, including:

- Commodity Futures: These contracts are for commodities like gold, oil, and agricultural products. Commodity futures allow investors to speculate on price movements or hedge against price risk in the commodity markets. For example, an oil producer might enter into an oil futures contract to lock in a selling price for their oil production, thereby mitigating the risk of falling oil prices.

- Index Futures: These contracts are for stock market indexes, such as the S&P 500 or the Nasdaq 100. Index futures allow investors to speculate on the direction of the stock market or hedge against market risk. For instance, a portfolio manager might use index futures to hedge against a potential decline in the stock market.

- Currency Futures: These contracts are for currencies, such as the US dollar, euro, or Japanese yen. Currency futures allow investors to speculate on exchange rate movements or hedge against currency risk. For example, an exporter might enter into a currency futures contract to lock in a favorable exchange rate for their export earnings, thereby mitigating the risk of currency depreciation.

Cost Components of a Futures Contract

While futures contracts themselves have no upfront cost, understanding the associated expenses is crucial for informed trading. These costs, which vary depending on the specific contract and trading platform, directly impact profitability.

Margin Requirements

Margin requirements are a crucial aspect of futures trading. They represent the initial capital deposited with the broker to secure the contract and cover potential losses. The margin amount is a percentage of the contract’s value, determined by the exchange and subject to changes based on market volatility.

- Initial Margin: This is the initial deposit required to open a futures position. It acts as a good-faith deposit and safeguards against potential losses.

- Maintenance Margin: This is the minimum amount of margin that must be maintained in the account. If the account balance falls below the maintenance margin, the trader receives a margin call, requiring them to deposit additional funds to bring the account back to the initial margin level.

Margin requirements are not a cost in the traditional sense; they are a deposit held by the broker. However, they represent a significant opportunity cost, as the funds are tied up and cannot be used for other investments.

Other Costs

Beyond margin requirements, other costs associated with futures trading include:

- Brokerage Fees: These fees are charged by brokers for facilitating trades. They can vary based on the broker, trading volume, and the type of account.

- Exchange Fees: These fees are levied by the exchange where the futures contract is traded. They cover the costs of operating the exchange and maintaining market integrity.

- Clearing Fees: These fees are charged by the clearinghouse, which acts as an intermediary between buyers and sellers. They guarantee contract fulfillment and manage risk.

- Data Fees: Some traders may incur costs for accessing real-time market data and analytical tools.

These fees can add up, particularly for high-volume traders. It’s essential to factor in these costs when calculating potential profits and losses.

Factors Influencing Futures Contract Costs

The cost of a futures contract is influenced by a multitude of factors that interact in complex ways. Understanding these factors is crucial for traders to make informed decisions about entering and exiting futures positions.

Underlying Asset Price Volatility

The volatility of the underlying asset’s price plays a significant role in determining the margin requirement, which is a key component of the overall cost of a futures contract.

- Higher Volatility, Higher Margin: When the price of the underlying asset fluctuates widely, the risk of losses for both the trader and the clearinghouse increases. To mitigate this risk, clearinghouses typically set higher margin requirements for contracts on more volatile assets. This means traders need to deposit more capital to cover potential losses, which increases the overall cost of trading futures.

- Example: Consider two futures contracts: one on gold and another on soybeans. Gold is generally considered a more volatile asset than soybeans. As a result, the margin requirement for a gold futures contract would likely be higher than for a soybean futures contract, making it more expensive to trade gold futures.

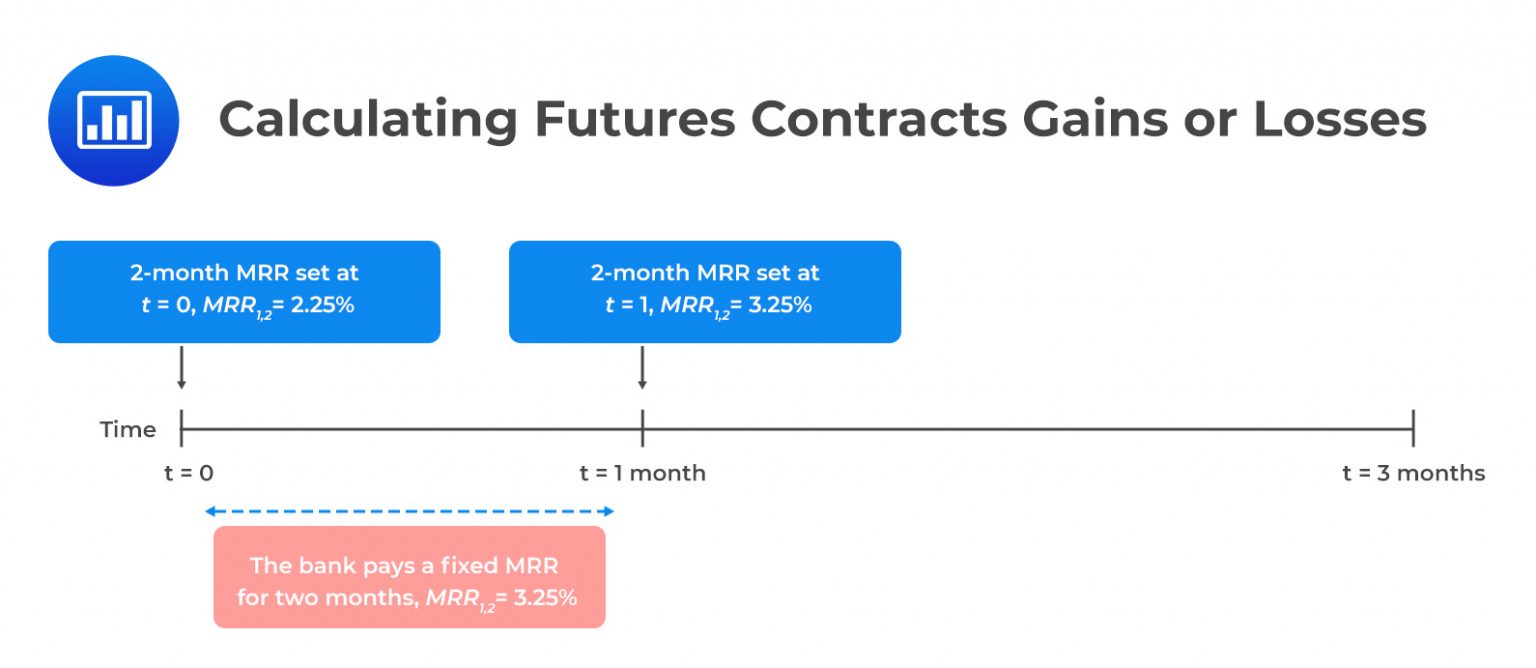

Contract Maturity and Trading Volume

The maturity of a futures contract and the trading volume of the underlying asset also influence the cost of the contract.

- Maturity: Futures contracts expire on specific dates. As a contract approaches its maturity date, its price converges with the spot price of the underlying asset. This convergence can lead to increased volatility and higher margin requirements, particularly in the final days before expiration.

- Trading Volume: Higher trading volume in a futures contract generally indicates greater liquidity and lower transaction costs. This is because a large number of buyers and sellers makes it easier to find a counterparty and execute trades quickly and efficiently. Conversely, low trading volume can result in wider bid-ask spreads and higher transaction costs.

Interest Rates and Market Sentiment

Interest rates and market sentiment can also impact the cost of futures contracts.

- Interest Rates: Interest rates play a role in the cost of carrying a futures contract. When interest rates rise, the cost of borrowing money to finance a futures position increases, making it more expensive to hold the contract. Conversely, falling interest rates can make it cheaper to hold a futures contract.

- Market Sentiment: Market sentiment can influence the price of futures contracts, and consequently, their cost. When market sentiment is bullish, traders tend to be optimistic about the future price of the underlying asset, driving up the price of futures contracts. Conversely, bearish sentiment can lead to lower prices and lower costs.

Cost Example and Calculation

To understand the costs associated with futures contracts, let’s consider a hypothetical scenario. Imagine you want to trade a futures contract on wheat, with a contract size of 5,000 bushels.

Cost Calculation

Here’s a step-by-step calculation of the total cost involved:

Initial Margin Requirement

The initial margin is the amount of money you need to deposit with your broker to open a futures position. It serves as collateral to cover potential losses. Let’s assume the initial margin requirement for this wheat futures contract is $2,000.

Brokerage Fees

Brokers charge commissions for executing trades. The brokerage fee can vary depending on the broker and the volume of trades. For this example, let’s assume a brokerage fee of $50 per contract.

Potential Losses

Futures contracts are leveraged instruments, meaning you can potentially lose more than your initial margin. The maximum potential loss is the difference between the entry price and the stop-loss order, multiplied by the contract size.

Total Cost

The total cost of entering the futures contract would be:

Initial Margin + Brokerage Fee + Potential Losses = Total Cost

$2,000 + $50 + (Potential Losses) = Total Cost

Comparison with Other Investment Options

The cost of entering a futures contract can be compared with other investment options, such as buying the underlying asset directly.

Direct Purchase

If you were to buy 5,000 bushels of wheat directly, you would need to pay the spot price of wheat, which is the current market price. The cost would be the spot price multiplied by the contract size.

Futures Contract

The cost of entering a futures contract is typically lower than the cost of buying the underlying asset directly. This is because you only need to deposit the initial margin, which is a fraction of the total value of the contract.

Cost Comparison

The following table summarizes the cost comparison between buying the underlying asset directly and entering a futures contract:

| Investment Option | Cost |

|---|---|

| Direct Purchase | Spot Price x Contract Size |

| Futures Contract | Initial Margin + Brokerage Fee + Potential Losses |

The cost of entering a futures contract can be significantly lower than the cost of buying the underlying asset directly. However, it’s important to note that futures contracts are leveraged instruments, and you can potentially lose more than your initial margin.

Futures Trading Risks and Considerations

Futures trading, while offering potential for substantial profits, also carries inherent risks. Understanding these risks and implementing effective risk management strategies is crucial for success in this market.

Margin Calls

Margin calls are a critical aspect of futures trading that can significantly impact your trading experience. Margin requirements represent the initial capital you need to secure a futures contract. Margin calls occur when the market moves against your position, and the value of your account falls below the required margin level.

A margin call requires you to deposit additional funds into your account to cover potential losses. Failure to meet a margin call can result in the liquidation of your position, leading to substantial financial losses.

Price Fluctuations

Futures contracts are highly sensitive to price fluctuations, making them inherently volatile. Market conditions can change rapidly, leading to substantial price swings.

The potential for significant losses due to price fluctuations is a primary risk factor in futures trading. Even a small movement in the underlying asset’s price can translate into significant losses in a futures contract due to leverage.

Counterparty Risk

Counterparty risk arises from the possibility that the other party in a futures contract may not be able to fulfill their obligations.

This risk is particularly relevant when trading with less-established brokers or in volatile markets. Counterparty risk can lead to losses if the other party defaults on their contract, leaving you with an unfulfilled position.

Managing Futures Trading Risks, How much does a futures contract cost

Effectively managing risks is essential for successful futures trading.

By implementing appropriate risk management strategies, you can minimize the potential for losses and maximize your chances of success.

- Stop-Loss Orders: Stop-loss orders are crucial tools for limiting potential losses. They automatically close your position when the market price reaches a predetermined level, preventing further losses.

- Position Limits: Position limits restrict the maximum number of contracts you can hold, limiting your overall exposure to market risk.

- Diversification: Diversifying your trading portfolio across different asset classes and markets can help reduce overall risk.

- Proper Risk Assessment: Before entering any futures trade, carefully assess the potential risks and rewards, considering your risk tolerance and trading strategy.

In conclusion, the cost of a futures contract is a complex interplay of various factors, including margin requirements, brokerage fees, and the underlying asset’s price volatility. Understanding these components and their impact on the overall cost is essential for investors seeking to utilize futures contracts effectively. By carefully considering the potential risks and rewards, traders can make informed decisions and potentially profit from the dynamic world of futures trading.

Questions and Answers: How Much Does A Futures Contract Cost

What is the minimum amount I need to invest in a futures contract?

The minimum investment amount for a futures contract depends on the specific contract and the margin requirements set by the exchange. It’s important to note that margin requirements can fluctuate based on factors like the underlying asset’s price volatility.

Are there any hidden fees associated with futures contracts?

While the initial margin requirement is the most significant cost, there might be additional fees like clearing fees, which are charged by clearinghouses for ensuring contract settlement. It’s advisable to consult your broker for a complete breakdown of all applicable fees.

How do I determine the best time to enter a futures contract?

The optimal time to enter a futures contract depends on your trading strategy and market conditions. Some traders prefer to enter contracts when prices are trending, while others might wait for pullbacks or consolidation periods. Analyzing market data, technical indicators, and fundamental factors can help you make informed decisions.