What is a secured bond? It’s a type of debt security that offers investors a level of comfort through the inclusion of collateral. Unlike unsecured bonds, which rely solely on the issuer’s creditworthiness, secured bonds provide an additional layer of protection in the form of specific assets pledged as security. These assets, which can range from real estate to equipment, serve as a guarantee for bondholders, ensuring that they have recourse in the event of the issuer’s default.

Throughout history, secured bonds have played a vital role in the financial landscape, evolving to meet the changing needs of investors and borrowers. Their appeal lies in the reduced risk they offer compared to their unsecured counterparts. This, in turn, often translates to lower interest rates, making them attractive to both conservative investors and those seeking a stable income stream.

Introduction to Secured Bonds

Secured bonds are debt securities that are backed by specific assets. This means that if the issuer defaults on the bond, the bondholders have the right to claim those assets to recover their investment. This provides a level of protection for bondholders, as they are more likely to receive their principal and interest payments even if the issuer faces financial difficulties.

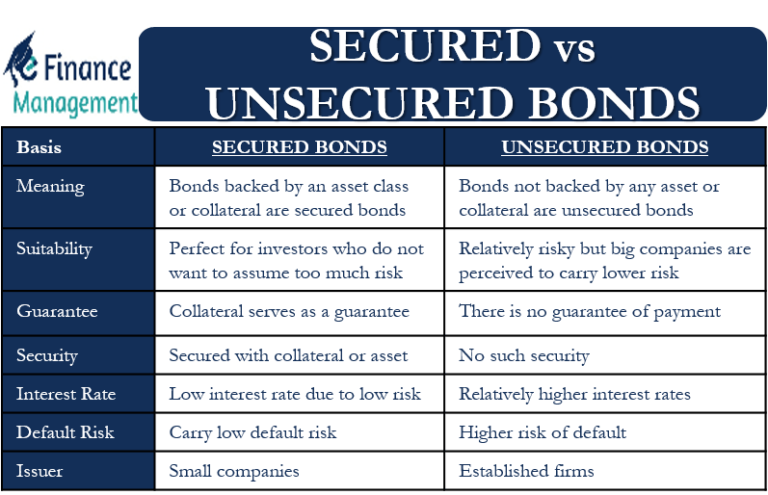

Secured bonds are distinct from unsecured bonds, which are not backed by any specific assets. Unsecured bondholders are considered general creditors and are only entitled to receive their investment after all secured creditors have been paid. As a result, unsecured bonds typically carry a higher interest rate to compensate for the greater risk.

Historical Context and Evolution of Secured Bonds

Secured bonds have been around for centuries, dating back to the early days of commercial lending. In the past, secured bonds were often backed by tangible assets such as land, buildings, or equipment. However, as financial markets have evolved, the types of assets that can be used as collateral for secured bonds have become more diverse. For example, secured bonds can now be backed by intangible assets such as intellectual property or receivables.

This has made it easier for companies to access capital by offering secured bonds, even if they do not have significant tangible assets.The evolution of secured bonds has also been driven by changes in regulatory requirements. In recent years, regulators have placed greater emphasis on the need for transparency and accountability in the bond market. This has led to the development of new types of secured bonds, such as asset-backed securities (ABS), which are backed by a pool of assets such as mortgages or car loans.

Collateral and Security in Secured Bonds

Collateral plays a crucial role in secured bonds, providing an additional layer of protection for bondholders. It serves as a tangible asset that can be claimed by bondholders if the issuer defaults on its debt obligations. This security feature enhances the bond’s creditworthiness and reduces the risk for investors.

Types of Collateral Commonly Used in Secured Bonds

Collateral in secured bonds can take various forms, each offering a specific level of security and risk mitigation. The type of collateral used depends on the nature of the bond and the issuer’s assets.

- Real Estate: This is a common form of collateral, often used for mortgage-backed securities. The underlying real estate property serves as security for the bond, allowing bondholders to claim the property if the issuer defaults.

- Tangible Assets: These can include machinery, equipment, inventory, or other physical assets. For example, a company issuing bonds to finance the purchase of new equipment may pledge that equipment as collateral.

- Financial Assets: Bonds, stocks, or other financial instruments can also serve as collateral. For instance, a company might issue bonds backed by its own stock holdings.

- Cash and Cash Equivalents: In some cases, bonds may be secured by cash or highly liquid assets like Treasury bills. This provides a direct and readily available source of repayment for bondholders.

Role of Collateral in Mitigating Risk for Bondholders

The presence of collateral significantly reduces the risk for bondholders in secured bonds. This is because the collateral provides a tangible asset that can be liquidated to recover the investment in case of default.

- Reduced Default Risk: The existence of collateral incentivizes the issuer to meet its debt obligations, as defaulting would result in the loss of the collateral. This reduces the overall risk of default for bondholders.

- Priority in Repayment: Secured bondholders have a higher priority claim on the issuer’s assets in case of bankruptcy or liquidation. They are typically paid before unsecured bondholders.

- Enhanced Creditworthiness: The presence of collateral generally improves the creditworthiness of the bond issuer, making the bonds more attractive to investors.

Examples of Specific Assets Serving as Collateral

Several specific assets can be used as collateral for secured bonds, offering different levels of security and risk mitigation.

- Mortgage-Backed Securities (MBS): These bonds are secured by residential or commercial mortgages. In case of default, the bondholders can claim the underlying real estate properties.

- Asset-Backed Securities (ABS): These bonds are backed by a pool of assets, such as auto loans, credit card receivables, or student loans. The underlying assets serve as collateral for the bonds.

- Collateralized Loan Obligations (CLOs): These complex financial instruments are backed by a pool of loans, often including both secured and unsecured loans. The underlying loans serve as collateral for the CLOs.

Advantages and Disadvantages of Secured Bonds: What Is A Secured Bond

Secured bonds offer investors a degree of protection that other types of bonds may not provide. This protection stems from the collateral backing the bond, which acts as a safety net in case the issuer defaults. However, like any investment, secured bonds come with their own set of advantages and disadvantages that investors should carefully consider before making a decision.

Advantages of Secured Bonds

Secured bonds offer a number of advantages that make them an attractive investment option for risk-averse investors. These advantages include:

- Lower Risk of Default: The presence of collateral significantly reduces the risk of default. If the issuer fails to meet its obligations, the bondholders can claim the collateral to recover their investment. This provides a safety net that is not available with unsecured bonds.

- Higher Credit Rating: Secured bonds tend to have higher credit ratings compared to unsecured bonds due to the reduced risk of default. This translates to lower interest rates for investors, as the issuer is considered more creditworthy.

- Greater Stability: The collateral backing secured bonds provides a degree of stability to the investment. In times of market volatility, secured bonds tend to perform better than unsecured bonds, as the collateral provides a buffer against losses.

Disadvantages of Secured Bonds

While secured bonds offer several advantages, they also come with some potential disadvantages that investors should be aware of. These include:

- Lower Interest Rates: Secured bonds typically offer lower interest rates compared to unsecured bonds. This is because the reduced risk of default makes them less attractive to investors seeking higher returns.

- Limited Investment Opportunities: The availability of secured bonds can be limited compared to unsecured bonds. Not all companies or entities issue secured bonds, as it may not be feasible or desirable in their specific circumstances.

- Complexity of Collateral: Understanding the nature and value of the collateral backing a secured bond can be complex. Investors need to carefully assess the collateral to ensure its value is sufficient to cover their investment in case of default.

Comparison with Other Investment Options

Secured bonds can be compared to other investment options, such as:

- Unsecured Bonds: Unsecured bonds, also known as debentures, do not have collateral backing them. They offer higher interest rates but carry a higher risk of default. Investors need to carefully assess the creditworthiness of the issuer before investing in unsecured bonds.

- Stocks: Stocks represent ownership in a company and offer the potential for higher returns than bonds. However, stocks also carry higher risk, as their value can fluctuate significantly based on market conditions and company performance.

- Real Estate: Real estate investments can provide diversification and potential for appreciation. However, real estate investments require significant capital and can be illiquid, making them less suitable for short-term investment goals.

Examples of Secured Bonds

Secured bonds offer investors a degree of protection against default by the issuer because they are backed by specific assets. This collateral serves as a safety net for investors, providing a tangible source of repayment if the issuer fails to meet its obligations.

Types of Secured Bonds

Secured bonds are classified based on the type of collateral backing them. This classification helps investors understand the specific assets securing the bond and the associated risks and potential returns. Here are some common types of secured bonds, along with their features and risk profiles:

| Bond Type | Collateral | Typical Features | Risk Profile |

|---|---|---|---|

| Mortgage-Backed Securities (MBS) | Residential or commercial mortgages |

|

|

| Asset-Backed Securities (ABS) | Various assets, such as auto loans, credit card receivables, or equipment leases |

|

|

| Collateralized Debt Obligations (CDOs) | A pool of debt securities, such as mortgages, corporate bonds, or asset-backed securities |

|

|

Importance of Due Diligence

Due diligence is a crucial step in evaluating secured bonds, ensuring investors make informed decisions and mitigate potential risks. It involves a thorough examination of the bond’s features, the issuer’s financial health, and the collateral backing the bond.

Assessing Collateral Quality

Collateral quality is a key aspect of due diligence for secured bonds. Investors need to understand the nature, value, and liquidity of the collateral.

- Type of Collateral: The type of collateral can range from tangible assets like real estate or equipment to intangible assets like intellectual property or financial instruments. Understanding the specific type of collateral is essential to assess its value and potential for recovery in case of default.

- Valuation: An independent appraisal of the collateral is crucial to determine its fair market value. This helps investors understand the potential recovery value in case of default.

- Liquidity: The ease with which the collateral can be converted into cash is another important factor. Highly liquid collateral, such as cash or marketable securities, provides greater assurance of recovery.

Analyzing Issuer’s Financial Health

Evaluating the issuer’s financial health is equally important. This involves examining key financial ratios and indicators to assess the issuer’s ability to meet its financial obligations, including interest payments and principal repayment.

- Debt-to-Equity Ratio: A high debt-to-equity ratio indicates that the issuer relies heavily on debt financing, which can increase the risk of default.

- Profitability Ratios: Profitability ratios, such as return on equity (ROE) and return on assets (ROA), provide insights into the issuer’s ability to generate profits and cover its expenses.

- Cash Flow Analysis: Analyzing the issuer’s cash flow statement helps determine its ability to generate enough cash to meet its debt obligations.

Examining Bond Agreement Terms

The terms of the bond agreement Artikel the rights and obligations of both the issuer and the bondholders. A thorough review of the agreement is crucial to understand the following aspects:

- Interest Rate and Payment Schedule: The agreement specifies the interest rate and payment schedule, which impact the bond’s overall return.

- Maturity Date: The maturity date indicates when the principal amount of the bond is due to be repaid.

- Default Provisions: The agreement should Artikel the procedures for handling default, including the process for seizing and selling the collateral.

Due Diligence: A Multifaceted Process

Due diligence is a comprehensive process that requires a combination of financial analysis, legal review, and market research. It helps investors identify potential risks and make informed investment decisions.

Role of Secured Bonds in Investment Portfolios

Secured bonds can play a significant role in a diversified investment portfolio, offering a balance between potential returns and risk mitigation. By understanding how secured bonds contribute to risk management and portfolio diversification, investors can make informed decisions about incorporating them into their investment strategies.

Benefits of Secured Bonds in a Diversified Portfolio

Secured bonds can contribute to a well-rounded investment portfolio by providing potential benefits such as:

- Lower Risk: Secured bonds typically carry a lower risk profile compared to unsecured bonds or equities. This is because the bondholder has a claim on specific assets in case of default, providing a safety net.

- Stable Income: Secured bonds offer a predictable stream of income through regular interest payments. This can be particularly beneficial for investors seeking steady cash flow, especially during periods of market volatility.

- Portfolio Diversification: Including secured bonds in a portfolio can help diversify investments across different asset classes. This can reduce overall portfolio risk by spreading investments across various sectors and industries.

- Inflation Hedge: Some secured bonds, like those linked to inflation-adjusted assets, can provide a hedge against inflation. This can help protect investors from the eroding effects of rising prices.

Risk Management and Portfolio Diversification

Secured bonds contribute to risk management and portfolio diversification in several ways:

- Reduced Default Risk: The presence of collateral reduces the risk of default for investors. In the event of a company’s bankruptcy, secured bondholders have priority access to the collateral, increasing their chances of recovering their investment.

- Correlation with Other Assets: Secured bonds often have lower correlations with other asset classes like stocks. This means their price movements are less likely to be influenced by the same factors, leading to a more balanced portfolio.

- Portfolio Stability: The stable income stream and lower risk profile of secured bonds can help stabilize a portfolio during market downturns. This can be particularly valuable for investors seeking to preserve capital.

Investment Strategies Utilizing Secured Bonds, What is a secured bond

Secured bonds can be integrated into various investment strategies, depending on individual investor goals and risk tolerance. Examples include:

- Conservative Income Strategy: Investors seeking a steady stream of income with lower risk can allocate a significant portion of their portfolio to high-quality secured bonds. This strategy focuses on generating consistent returns while minimizing potential losses.

- Balanced Portfolio: Investors aiming for a balanced approach can incorporate a mix of secured bonds, equities, and other asset classes. This strategy aims to strike a balance between potential returns and risk mitigation.

- Strategic Allocation: Investors with a longer-term investment horizon can utilize secured bonds as a strategic allocation within their portfolio. This approach involves adjusting the allocation to secured bonds based on market conditions and investment goals.

Secured bonds offer a compelling blend of security and potential returns, making them a valuable tool for investors seeking to manage risk and diversify their portfolios. By understanding the intricacies of collateral, the advantages and disadvantages, and the importance of due diligence, investors can make informed decisions and potentially unlock the benefits of this unique asset class. As you navigate the world of investments, remember that a secured bond, with its underlying collateral, can serve as a foundation for a well-structured and potentially rewarding financial strategy.

Question & Answer Hub

What are some examples of collateral used in secured bonds?

Common collateral types include real estate (mortgages), equipment (asset-backed securities), and financial assets (collateralized debt obligations).

How do secured bonds impact my overall investment portfolio?

Secured bonds can contribute to a balanced portfolio by providing a measure of stability and mitigating risk. They can help diversify your holdings and reduce the overall volatility of your investments.

Are secured bonds always risk-free?

While secured bonds offer a higher level of security than unsecured bonds, they still carry some level of risk. The value of the collateral can fluctuate, and there’s always a chance that the issuer may default.