What is service contract fee – What is a service contract fee? This seemingly simple question often leads to confusion and uncertainty for consumers. In essence, a service contract fee is a payment made to a provider for extended coverage and support beyond the standard warranty period of a product or service. This fee grants access to a range of benefits, such as repairs, replacements, or maintenance services, often offering peace of mind for individuals concerned about unexpected expenses.

From electronics to appliances, automobiles to home systems, service contracts are commonly offered for a wide array of products and services, with varying terms and conditions depending on the specific provider and the scope of coverage.

Understanding the components and implications of a service contract fee is crucial for making informed decisions. This article delves into the intricacies of service contract fees, exploring their benefits, drawbacks, and alternative solutions. It provides valuable insights to help consumers navigate the complexities of these agreements and make informed choices about whether or not to purchase a service contract.

What is a Service Contract Fee?: What Is Service Contract Fee

Ever wondered why you sometimes have to pay extra for a product to get a warranty or some extra protection? That’s where the service contract fee comes in. It’s basically a payment you make to ensure your product is covered in case something goes wrong.

Real-world Examples of Service Contract Fees, What is service contract fee

Think of it like this: you buy a brand new washing machine, and you want to make sure you’re covered if the motor goes kaput or the spin cycle starts acting up. You might be offered a service contract that covers repairs or replacements for a specific period. This extra fee you pay is the service contract fee. Here are some common examples:

- Electronics: TVs, laptops, smartphones, and other gadgets often come with service contract options.

- Appliances: Washing machines, dryers, refrigerators, and ovens are prime candidates for service contracts.

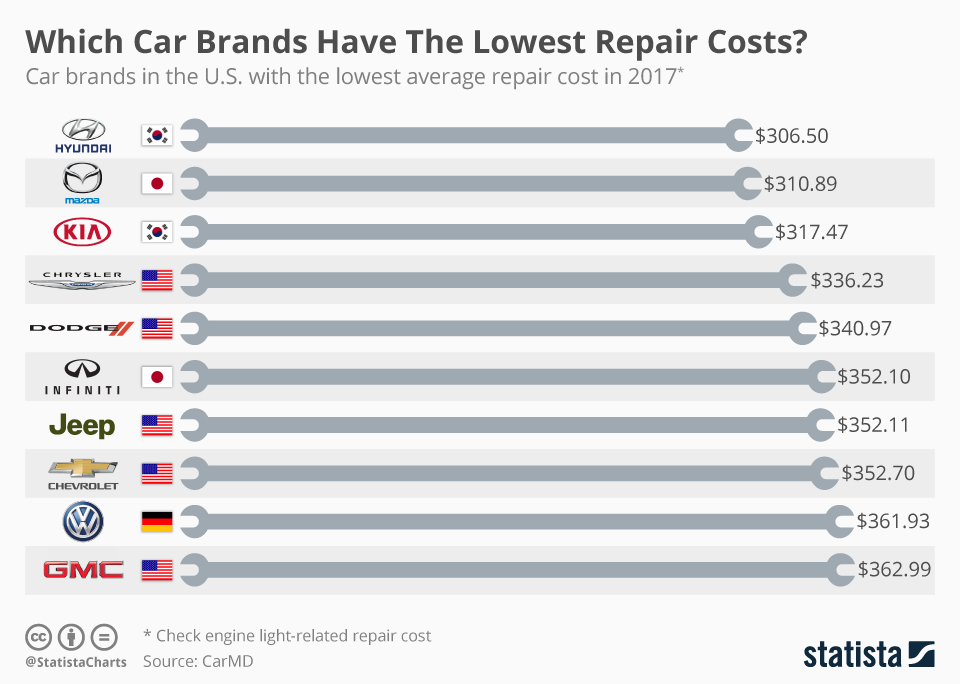

- Vehicles: Extended warranties for cars, trucks, and motorcycles are service contracts that offer protection beyond the manufacturer’s warranty.

- Home Appliances: Service contracts for home appliances, like water heaters, furnaces, and air conditioners, can provide peace of mind.

Purpose of Service Contract Fees

So, what’s in it for you and the provider?

- For the consumer: Service contracts offer a sense of security and peace of mind. You’re covered in case of unexpected repairs or breakdowns. Think of it as a safety net, especially for expensive items. It can save you from a hefty repair bill or the cost of replacing the product entirely.

- For the provider: Service contracts are a source of revenue for companies. They generate income from the fees, and they also can help them predict repair costs and manage their inventory of spare parts.

Components of a Service Contract Fee

So, you’ve got a shiny new gadget, and you’re thinking about buying a service contract. But before you dive into the “Yes!” button, let’s break down what makes up that little fee. It’s like dissecting a frog in biology class, but way less messy (and hopefully more fun).Think of a service contract fee as a multi-faceted gem, with different parts contributing to its overall value.

These components are usually calculated based on a few key factors, like the type of service, the duration of the contract, and the level of coverage. Let’s delve into each aspect.

Factors Affecting Service Contract Fee Calculation

The cost of a service contract isn’t pulled out of thin air. It’s based on several factors that influence the risk and cost involved for the service provider.

- Type of Service: A service contract for a smartphone will be different from one for a refrigerator. Think about it, smartphones have a higher risk of needing repairs due to drops, spills, and the occasional angry fling across the room (we’ve all been there).

- Duration of the Contract: The longer the contract, the higher the fee. This is because the provider is committing to covering repairs for a longer period, increasing their potential liability.

- Level of Coverage: A contract that covers accidental damage will cost more than one that only covers manufacturer defects. This is because the provider is taking on more risk by covering a wider range of potential issues.

Components of a Service Contract Fee

The service contract fee can be broken down into several components:

- Administrative Costs: These include the costs associated with managing the service contract program, such as marketing, customer service, and processing claims.

- Repair Costs: This is the biggest chunk of the fee, representing the estimated cost of repairs for the covered device or service. The provider uses historical data and repair trends to calculate this.

- Profit Margin: Like any business, the service provider needs to make a profit. This margin is factored into the fee to cover their operating expenses and generate revenue.

- Risk Assessment: The provider assesses the risk of having to repair a particular device or service, considering factors like the device’s reliability, its popularity, and the frequency of repairs. This risk assessment is reflected in the fee.

Benefits of a Service Contract

So, you’ve just purchased a shiny new appliance, maybe a fancy washing machine that sings opera while it cleans your clothes (we’re not judging, we’ve all been there). But what happens when that sweet melody turns into a screeching, sputtering nightmare? Enter the service contract, your new best friend in the world of appliance woes.Think of a service contract as an insurance policy for your appliance, offering peace of mind and a safety net for those unexpected repair costs that can leave you feeling like you’ve been hit by a washing machine (metaphorically, of course).

Types of Services and Coverage

A service contract typically covers a range of services and repairs, depending on the specific contract and the appliance in question. Here’s a glimpse into the world of service contract coverage:

- Parts and Labor: Most service contracts cover the cost of parts and labor needed for repairs. This means you won’t have to worry about digging into your savings for that expensive new compressor or a technician’s hourly rate.

- Preventive Maintenance: Some contracts include preventive maintenance services, like regular cleaning or tune-ups. This can help keep your appliance running smoothly and extend its lifespan, saving you money in the long run.

- Accidental Damage: If you’re prone to spills or clumsiness, a service contract might cover accidental damage, such as a broken door or a shattered glass panel. This is especially helpful for appliances with delicate parts.

Protection from Unexpected Repair Costs

Now, let’s talk about how a service contract can save you from those nasty surprise repair bills that can leave you feeling like you’ve just lost a game of financial Jenga.Imagine this: Your dishwasher decides to go on strike, refusing to clean your dishes and leaving you with a mountain of dirty plates. You call a repair person, only to be told that the part you need is as rare as a unicorn with a PhD in astrophysics.

Without a service contract, you’d be looking at a hefty repair bill, enough to make you question your life choices. But with a service contract, you can breathe a sigh of relief, knowing that the repair will be covered, leaving you free to enjoy the peace of clean dishes and a perfectly functioning dishwasher (and maybe even a celebratory dance with your clean plates).

Drawbacks of a Service Contract

Let’s face it, service contracts can sound like a great deal, promising peace of mind and protection against unexpected repair costs. But before you sign on the dotted line, it’s crucial to understand the potential drawbacks. Just like a delicious-looking dessert can be packed with hidden sugar, service contracts can come with their own set of sneaky surprises.While service contracts can offer a sense of security, they’re not always the best value for your money.

There are a few things you should consider before signing up for one.

Hidden Fees and Limitations

The fine print can be a real buzzkill, especially when it comes to service contracts. These agreements often contain hidden fees and limitations that can leave you feeling like you’ve been had. Think of it as a magician’s sleight of hand, where they make the contract look appealing, but then pull out these sneaky fees and limitations.

- Deductibles: You might be surprised to find a hefty deductible attached to your service contract. This means you’ll have to pay a certain amount out of pocket before the contract kicks in, potentially making it less worthwhile. It’s like paying for a fancy coffee, only to find out you have to pay extra for the whipped cream and sprinkles.

- Service Limitations: Service contracts often have limitations on what they cover. For example, they might exclude certain types of repairs or parts, leaving you stuck with the bill. Imagine signing up for a gym membership only to find out you can’t use the weight room or the sauna. That’s the kind of disappointment you could face with a service contract.

- Exclusions: Be on the lookout for exclusions in the fine print. These are situations where the contract won’t cover repairs, even if you paid for it. It’s like having a parachute that doesn’t work when you jump out of a plane. You’ll be left hanging.

Situations Where a Service Contract Might Not Be Necessary

Sometimes, a service contract is just a waste of money. It’s like buying a lottery ticket when you already won the jackpot. Here are some situations where a service contract might not be worth the investment:

- New Products: If you’re buying a brand-new product, it’s likely covered by a manufacturer’s warranty. The warranty is like a free service contract, so you don’t need to pay extra for it. Think of it as a free trial for your new product.

- Reliable Products: Some products are known for their reliability and rarely need repairs. For these products, a service contract might be a waste of money. It’s like buying insurance for a car that never gets into accidents.

- High-Deductible Contracts: If the deductible on your service contract is high, it might not be worth it. You’ll end up paying a lot out of pocket before the contract covers anything. Think of it as a super expensive insurance policy with a huge co-pay.

Factors to Consider Before Purchasing a Service Contract

So, you’re thinking about buying a service contract. It’s like buying insurance for your stuff, but instead of covering a house fire, it covers your fancy new washing machine going kaput. Before you dive in headfirst, let’s talk about some things you should consider. You wouldn’t buy a car without checking the engine, right?

Understanding the Terms and Conditions

Think of this as the fine print of the contract. It’s important to read it carefully, because it’s like a map to your potential savings or your future headaches. You don’t want to be stuck with a contract that only covers the “dust bunnies” in your refrigerator.

Remember, this isn’t a game of “spot the difference”. You need to understand what’s covered, what’s not, and what you’re actually paying for.

Comparing Service Contract Options

Just like comparing apples and oranges, it’s important to compare service contract options. Don’t just settle for the first one you see, because you might be missing out on a better deal.

Think of it like a buffet: You wouldn’t just grab the first plate of food you see, right? You’d want to check out all the options and see what fits your budget and your taste.

- Coverage: What does the contract cover? Does it include parts and labor? What about accidental damage? Are there any exclusions?

- Duration: How long does the contract last? Does it cover the entire life of the product or just a specific period?

- Cost: How much does the contract cost? Is it worth it compared to the cost of potential repairs?

- Deductible: How much do you have to pay out of pocket for repairs? A higher deductible means you’ll pay less for the contract, but more for repairs.

- Provider Reputation: Research the company offering the contract. Are they reputable and reliable? Are they known for good customer service?

Alternative Solutions to Service Contracts

So you’re thinking about a service contract, but you’re not sure if it’s the right move. You’re not alone! Many people find themselves wondering if there are other ways to protect themselves from unexpected repair costs. Well, buckle up, because we’re about to dive into the exciting world of alternative solutions, where you can save money and still keep your sanity intact.

Let’s face it, service contracts can be a real money pit, especially if you’re a cautious soul who likes to plan for every possible scenario. But fear not! There are other options that can help you avoid the dreaded “surprise repair bill” without breaking the bank.

Savings Accounts

You know what they say, “a penny saved is a penny earned.” And that’s exactly what a savings account is all about. Think of it as your personal repair fund, where you can stash away a little bit of money each month, ready to tackle any unexpected repair expenses.

- Pros: Savings accounts offer flexibility and control. You can deposit and withdraw money as needed, and you’re not tied down to a specific product or service. Plus, you’ll earn interest on your savings, which is always a nice bonus.

- Cons: Savings accounts might not be as glamorous as a fancy service contract, but they can be a bit boring. You’ll need to be disciplined and consistent with your savings to ensure you have enough money when you need it.

Extended Warranties

Extended warranties are like the “insurance” for your appliances, offering extra coverage beyond the manufacturer’s standard warranty. They can be a good option if you’re worried about breakdowns after the initial warranty period.

- Pros: Extended warranties can provide peace of mind, especially if you’re buying a high-priced appliance. They can cover repairs or replacements for a longer period, giving you extra protection against unexpected costs.

- Cons: Extended warranties can be pricey, and they often have limitations. Make sure you read the fine print carefully to understand exactly what’s covered and what’s not. Plus, you might end up paying for coverage you don’t need, especially if your appliance has a good track record of reliability.

Ultimately, the decision to purchase a service contract is a personal one, requiring careful consideration of individual needs and financial circumstances. While service contracts can provide valuable protection against unexpected repair costs, it is essential to weigh the potential benefits against the associated costs and limitations. By understanding the nuances of service contract fees, consumers can make informed choices that align with their specific requirements and ensure they are making the best financial decisions for their circumstances.

Key Questions Answered

What are some common examples of products or services that often include a service contract fee?

Common examples include electronics (laptops, smartphones), appliances (refrigerators, washing machines), automobiles, home warranties, and even extended warranties for certain products.

Are service contracts mandatory?

No, service contracts are typically optional. Consumers are not obligated to purchase them, and they often have the choice to decline them.

How can I compare different service contract options?

When comparing service contract options, consider the level of coverage, the duration of the contract, the cost of the fee, any limitations or exclusions, and the reputation of the provider.

What are some alternatives to purchasing a service contract?

Alternatives include extended warranties, savings accounts specifically for unexpected repairs, or opting for products with longer standard warranties.