ES futures contract cost is a crucial factor for anyone trading these contracts. Understanding the various components that contribute to the overall cost—from brokerage fees and commissions to slippage and data subscriptions—is essential for successful trading. This guide delves into each aspect, providing a clear and comprehensive overview to empower informed decision-making in the dynamic world of ES futures trading.

This exploration will cover the mechanics of ES futures contracts, including contract specifications, margin requirements, and the influence of interest rates and market volatility on pricing. We’ll also analyze brokerage fees from different providers, explore the impact of slippage and order types, and detail the costs associated with accessing real-time market data. Ultimately, the aim is to provide you with a complete picture of the costs involved, enabling you to optimize your trading strategy and maximize profitability.

Understanding ES Futures Contracts: Es Futures Contract Cost

The world of financial derivatives can feel like a labyrinth, a complex web of interconnected risks and rewards. Yet, understanding the mechanics of instruments like ES futures contracts is crucial for navigating this landscape. These contracts, representing the S&P 500 index, offer a powerful tool for both hedging and speculation, but their intricacies demand careful consideration. This section will illuminate the core elements of ES futures contracts, providing a clearer path through the seeming complexity.

ES Futures Contract Mechanics

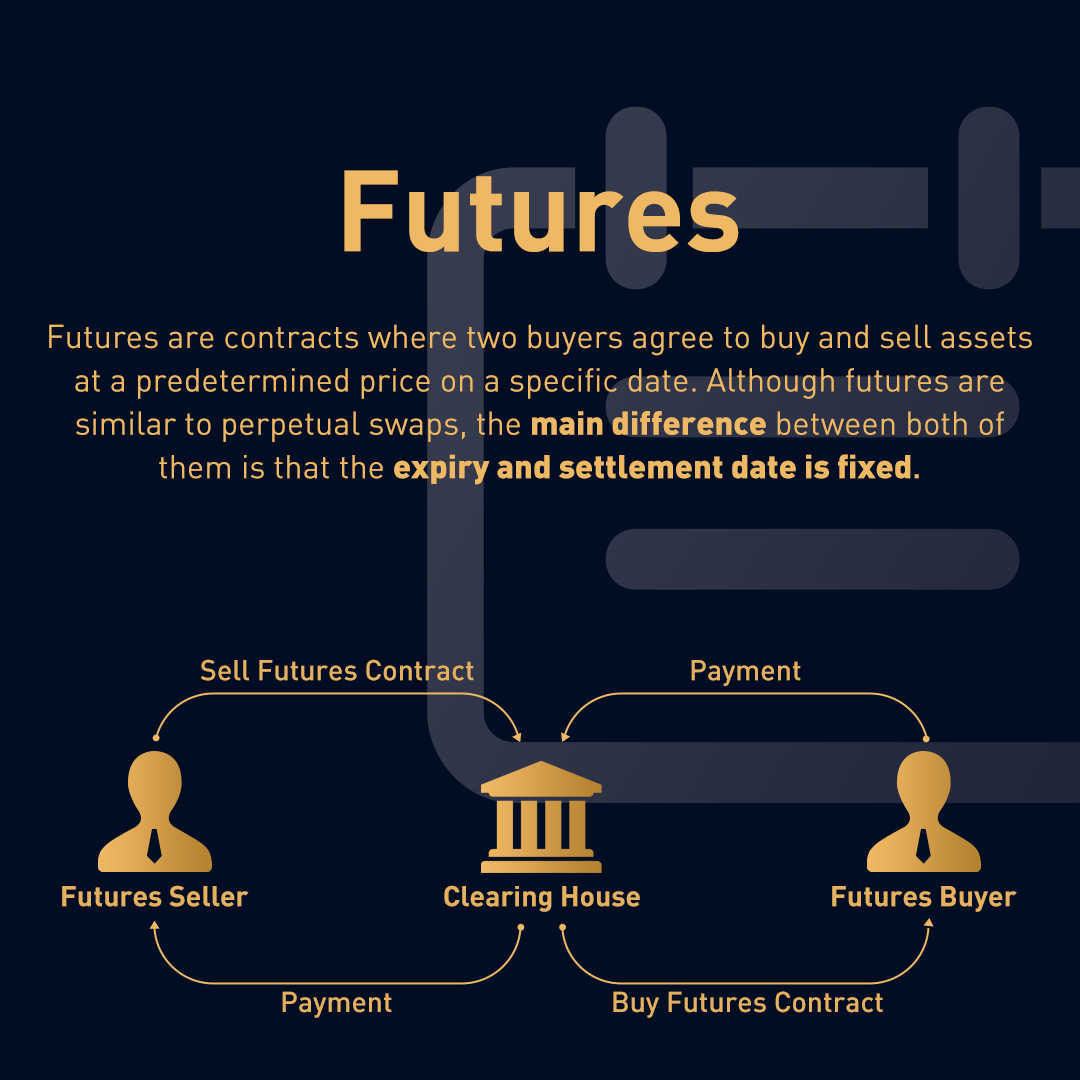

An ES futures contract is an agreement to buy or sell a specified number of S&P 500 index shares at a predetermined price on a future date. Unlike options contracts, which grant the

- right* but not the

- obligation* to buy or sell, futures contracts obligate both parties to fulfill the agreement. This commitment introduces a significant element of risk, but also allows for precise hedging strategies and leveraged trading opportunities. The price is established through open market trading, fluctuating based on supply and demand, mirroring the underlying index’s performance. Settlement typically occurs through cash settlement rather than physical delivery of the index components.

ES Futures Contract Specifications

Several key specifications define each ES futures contract. The contract size, for instance, dictates the number of shares represented. A single ES contract typically represents 500 times the S&P 500 index. The tick size, the minimum price fluctuation, is typically 0.25 points, representing a $12.50 price movement per contract. Trading hours mirror the core trading hours of the underlying S&P 500 index, generally from 9:30 AM to 4:00 PM ET.

These specifics are vital for calculating potential profits and losses, and understanding the granularity of price movements.

ES Futures Margin Requirements

Margin requirements represent the amount of capital a trader must deposit with their broker to secure the contract. This acts as collateral against potential losses. Margin requirements are subject to change based on market volatility and broker policies, but they typically represent a percentage of the contract’s notional value. A higher margin requirement reflects a higher risk associated with the contract.

Failing to maintain the required margin level can lead to a margin call, demanding additional funds to cover potential losses or contract liquidation.

Comparison of ES Futures with Other Equity Index Futures

Understanding the relative characteristics of ES futures requires comparing them to similar instruments. The following table provides a comparative overview, illustrating differences in contract specifications, margin requirements, and trading costs. Note that these values are illustrative and subject to change.

| Contract | Contract Size | Tick Size | Margin Requirements (Approximate) |

|---|---|---|---|

| ES (S&P 500) | 500 x Index | 0.25 points ($12.50) | Varies by broker and volatility |

| NQ (Nasdaq 100) | 20 x Index | 0.25 points ($5.00) | Varies by broker and volatility |

| YM (Dow Jones) | 5 x Index | 1 point ($5.00) | Varies by broker and volatility |

Factors Influencing ES Futures Contract Cost

The price of an E-mini S&P 500 futures contract, like any derivative, isn’t arbitrary. It’s a complex dance of interconnected market forces, reflecting the collective wisdom—or perhaps, folly—of countless traders and investors. Understanding these forces is crucial for navigating the often-turbulent waters of futures trading. Ignoring them is akin to sailing without a compass.The cost of an ES futures contract is primarily determined by the underlying S&P 500 index.

Its price fluctuations directly translate into changes in the futures contract’s value. However, several other factors subtly, and sometimes dramatically, influence this cost. These factors act as unseen currents, shifting the price even when the index itself remains relatively stable.

Interest Rates

Interest rates exert a significant, albeit often indirect, influence on ES futures contract costs. Higher interest rates generally increase the cost of carrying a long position in futures contracts. This is because the opportunity cost of tying up capital in a futures contract increases as interest rates rise. Conversely, lower interest rates reduce this cost, making long positions more attractive.

The relationship isn’t always linear; complex models and arbitrage opportunities often complicate the direct correlation. For instance, during periods of significant economic uncertainty, the relationship between interest rates and futures prices can become inverted, as investors seek safe havens.

Market Volatility, Es futures contract cost

Market volatility plays a pivotal role in determining the cost of trading ES futures. High volatility translates to wider bid-ask spreads and increased transaction costs. Traders demand a larger premium for bearing the increased risk associated with volatile markets. This premium is reflected in the price of the contract, making it more expensive to enter and exit positions.

Conversely, during periods of low volatility, trading costs are generally lower, as risk is perceived to be less significant.

High Volatility vs. Low Volatility Trading Costs

Consider two scenarios: one where the VIX (Volatility Index) is hovering around 15, indicating relatively calm markets, and another where the VIX is soaring above 30, reflecting significant market uncertainty. In the low-volatility scenario (VIX around 15), the cost of trading ES futures would be relatively low, with narrow bid-ask spreads and lower commission fees. Traders feel comfortable taking positions with a smaller margin of safety.

However, during periods of high volatility (VIX above 30), the cost increases significantly. Bid-ask spreads widen, commissions might remain the same, but the risk of large, rapid price swings necessitates a more cautious approach, impacting the overall cost-benefit analysis of any trading strategy. The potential for substantial losses necessitates a larger margin, effectively increasing the cost of entry and the potential for larger losses.

The increased uncertainty means traders will demand a higher premium for accepting the increased risk.

Brokerage Fees and Commissions

The cost of trading ES futures contracts extends beyond the price of the contract itself. A significant, and often overlooked, component is the fee structure imposed by brokerage firms. Understanding these fees is crucial for effective risk management and maximizing potential profits. These fees can vary considerably depending on the broker, the volume of trades, and the specific services utilized.

Brokerage fees for ES futures contracts typically encompass commissions, exchange fees, and potentially other regulatory charges. Commissions are the fees brokers charge for executing trades, while exchange fees are levied by the exchange (in this case, the CME Group) for facilitating the trade. Regulatory charges cover compliance costs and oversight. The complexity of these fees often leads to confusion, but a clear understanding is vital for informed decision-making.

Typical Brokerage Fee Components

Brokerage fees are rarely simple, fixed amounts. They often involve a combination of per-contract fees, tiered pricing based on trading volume, and potentially other charges for specific services. For example, some brokers may offer a reduced commission per contract for high-volume traders, while others may charge a flat fee regardless of volume. Understanding the specifics of each broker’s fee structure is essential for cost comparison.

Comparative Brokerage Fee Table

The following table illustrates a simplified comparison of fees from three hypothetical brokers. Note that these are illustrative examples and actual fees may vary significantly. It is crucial to check the most up-to-date fee schedules directly with each broker before making a trading decision.

| Broker | Commission per Contract | Exchange Fees per Contract | Other Fees |

|---|---|---|---|

| Broker A | $2.50 | $1.50 | Regulatory fees (variable, approximately $0.50 per contract) |

| Broker B | $3.00 (Tiered: discounts for >100 contracts/month) | $1.50 | None |

| Broker C | $2.00 + $0.10 per contract (minimum $5.00 per trade) | Included in commission | Technology fee ($10/month) |

Additional Costs

Beyond commissions, exchange fees, and potential regulatory charges, other costs may arise. These can include data fees for real-time market data, software subscription fees, and potentially inactivity fees if the account remains dormant for extended periods. Some brokers might also charge for specific services like margin interest if a trader holds a leveraged position overnight. These additional charges, though often small individually, can accumulate and significantly impact the overall trading costs.

It’s imperative to obtain a complete fee schedule from your chosen broker to avoid any surprises.

Transaction Costs and Slippage

The dance of futures trading, especially in the frenetic world of E-mini S&P 500 contracts, isn’t solely about predicting market movements. A significant, often overlooked, element is the friction inherent in the transaction itself – the costs beyond the contract price. Slippage, a particularly insidious cost, can silently erode profits, transforming a potentially lucrative trade into a frustrating loss.

Understanding its mechanics is crucial for navigating the complexities of the market.Slippage in ES futures trading refers to the difference between the expected price of a trade and the actual execution price. It’s the unexpected price movement that occurs between the time you place your order and the time it’s filled. This discrepancy isn’t always a result of market manipulation; rather, it’s a consequence of market dynamics and order type.

Think of it as the price you pay for immediacy – the speed at which you want your trade executed.

Slippage Occurrence and Impact

Slippage can arise in various scenarios. High volatility periods, characterized by rapid and significant price fluctuations, are prime breeding grounds for slippage. Imagine a scenario where you place a market order to buy at the current price of 4000, but before the order is filled, the price jumps to 4005 due to a sudden news event. That 5-point difference is slippage, directly impacting your profit margin.

Similarly, low liquidity situations, where there aren’t enough buyers or sellers at the desired price, can lead to slippage. A large order in a thinly traded market might execute at a less favorable price than anticipated, as it takes time to find enough counterparties to fill the order completely. The impact can range from minor adjustments to significant losses, depending on the size of the trade and the extent of the slippage.

Order Type and Slippage Minimization

The type of order you use significantly influences your vulnerability to slippage. Market orders, designed for immediate execution at the best available price, are inherently more susceptible to slippage, particularly during volatile periods. Limit orders, which specify a maximum price (for buys) or a minimum price (for sells), offer more control. While they don’t guarantee execution, they provide a safety net by preventing trades from being filled at significantly unfavorable prices.

A limit order placed at 4000 will only be executed if the market price reaches that level or better; if the price jumps past it, your order remains unfilled, preventing potentially costly slippage.

Order Size and Transaction Costs

Order size interacts intricately with both transaction costs and slippage. Larger orders often face greater slippage, especially in less liquid markets, as finding enough counterparties to fill the order quickly becomes more challenging. This necessitates a price concession, increasing the slippage. Furthermore, larger orders generally incur higher brokerage fees and commissions, although this is typically a more predictable component of the overall cost.

Conversely, smaller orders may have less slippage but might not be as efficient in terms of cost per contract if the brokerage fees are fixed or have a significant fixed component. The optimal order size involves balancing the potential for slippage against the fixed costs associated with each transaction.

Data and Information Costs

The seemingly invisible hand of data costs can significantly impact the profitability of ES futures trading. While the contract price itself is a major factor, the cost of accessing the necessary real-time information to make informed trading decisions is equally crucial, often overlooked until it significantly impacts the bottom line. Ignoring these costs can lead to a distorted view of actual trading performance.The price of real-time market data for ES futures varies greatly depending on the provider, the level of detail offered, and the features included.

Understanding these variations is key to optimizing your trading strategy and maximizing your returns. These costs aren’t simply a line item; they’re a direct investment in your ability to compete effectively in the market.

Real-Time Market Data Provider Comparison

Choosing the right data provider is a strategic decision. The features and pricing structures can dramatically influence your trading effectiveness. The following table compares three prominent providers, highlighting key differences in pricing and the services offered:

| Data Provider | Pricing (Monthly, approximate) | Key Features | ES Futures Data Coverage |

|---|---|---|---|

| Provider A (e.g., Bloomberg Terminal) | $2000 – $5000+ | Comprehensive market data, advanced analytics, news feeds, charting tools, order routing | Full depth of market, historical data, real-time quotes |

| Provider B (e.g., Refinitiv Eikon) | $1000 – $3000+ | Real-time market data, charting, news, analytical tools, less comprehensive than Provider A | Real-time quotes, level II market depth, historical data |

| Provider C (e.g., A smaller, specialized provider) | $200 – $1000 | Real-time quotes, basic charting, limited analytical tools | Real-time quotes, limited historical data |

*Note: Pricing is approximate and subject to change. Features and pricing vary based on specific subscription levels.*

Data Subscription Levels and Value Proposition

Different data providers offer tiered subscription levels, each with a corresponding price and feature set. A basic subscription might provide only real-time quotes, while higher-tier subscriptions include advanced analytics, historical data, and news feeds. The value proposition of each level depends on the trader’s needs and sophistication. For example, a high-frequency trader might require the most comprehensive data package, while a less active trader may find a basic subscription sufficient.

The key is to carefully assess your needs and avoid paying for features you won’t utilize. Overspending on data can quickly erode profits.

Cost Savings Strategies for Market Data

Several strategies can help mitigate the costs associated with market data. Negotiating with providers, especially for higher-volume subscriptions, can yield significant discounts. Exploring alternative data sources, such as free or low-cost charting tools with limited real-time data, might be appropriate for less demanding trading styles. Consolidating data needs with other trading-related services could lead to bundled discounts.

Furthermore, carefully considering your data usage patterns and adjusting your subscription accordingly, perhaps opting for a lower tier during periods of reduced trading activity, can also yield substantial savings. The goal is to find the optimal balance between data access and cost-effectiveness.

Visual Representation of Cost Components

Understanding the financial landscape of ES futures trading requires a clear grasp of its constituent costs. While the individual components – brokerage fees, slippage, data expenses, and others – have been explored, visualizing their interplay provides a crucial perspective on the overall expense. This allows for a more informed assessment of profitability and the strategic implications of various trading approaches.A pie chart effectively illustrates the relative proportions of these cost components.

Imagine a circle representing the total cost of a single ES futures contract trade. Each slice of the pie represents a different cost category, its size directly proportional to its contribution to the total.

Cost Component Breakdown in ES Futures Trading

The largest slice might represent brokerage commissions and fees, typically a significant expense, especially for high-frequency traders executing numerous trades. This slice’s size would vary depending on the broker and the trading volume. A moderately sized slice would represent slippage, the difference between the expected price and the actual execution price. Slippage is often influenced by market volatility and order size.

Smaller slices would represent data subscription fees, exchange fees, and other miscellaneous costs. The exact proportions would depend on the specific trading strategy employed, the frequency of trades, and the broker chosen. For instance, a scalping strategy might see a larger proportion allocated to brokerage fees and slippage due to the high volume of trades, whereas a swing trading strategy might show a relatively larger proportion allocated to data costs due to the need for in-depth market analysis.

A hypothetical example could show brokerage fees accounting for 40%, slippage for 30%, data costs for 20%, and other miscellaneous fees for 10%. These percentages are illustrative and will vary greatly in practice.

Successfully navigating the world of ES futures trading requires a keen understanding of all associated costs. From the initial margin requirements and brokerage fees to the often-overlooked expenses like slippage and data subscriptions, every element contributes to your overall profitability. By carefully considering each cost component and employing strategies to minimize expenses, traders can enhance their trading performance and increase their chances of success in this dynamic market.

This guide has provided a framework for understanding these costs; now, armed with this knowledge, you can confidently approach the complexities of ES futures trading.

User Queries

What is slippage in ES futures trading?

Slippage refers to the difference between the expected price of a trade and the actual execution price. It often occurs due to market volatility or a lack of liquidity.

How do different order types affect slippage?

Limit orders generally reduce slippage compared to market orders because they only execute at a specified price or better. Market orders execute immediately at the best available price, potentially leading to larger slippage during volatile periods.

Are there any tax implications for ES futures trading?

Yes, profits and losses from ES futures trading are generally considered capital gains or losses and are subject to applicable tax laws. Consult a tax professional for specific guidance.

What are some strategies for minimizing data costs?

Consider less expensive data providers, explore free or lower-tier data options for less critical information, and potentially share data subscriptions within a trading group.