How does cost plus contract work? Unlock the secrets of this powerful contracting method! Understanding cost-plus contracts is crucial for businesses navigating complex projects. Whether you’re a seasoned contractor or a first-time client, this guide demystifies the process, revealing the intricacies of cost allocation, risk management, and fee structures. Prepare to gain a competitive edge in your negotiations and project management.

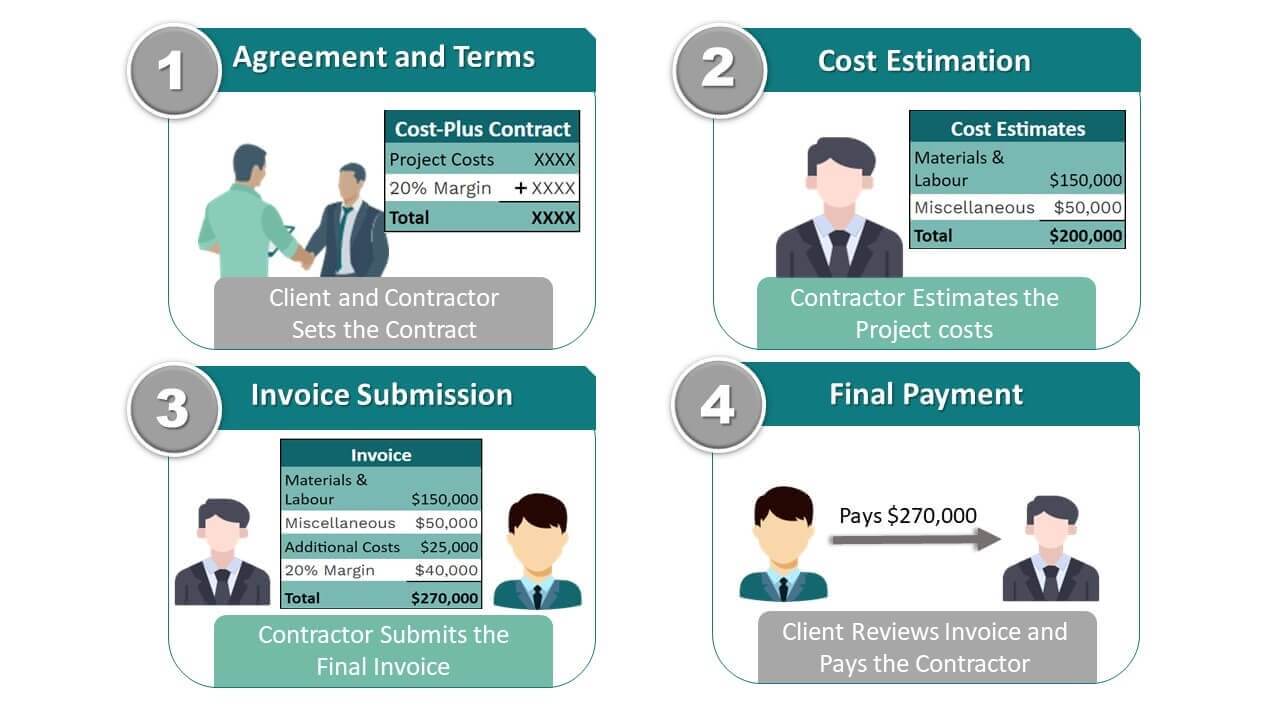

Cost-plus contracts, unlike fixed-price agreements, offer a unique approach to project budgeting. Instead of setting a predetermined price, this method reimburses the contractor for all allowable project costs, adding a predetermined fee or percentage. This flexibility allows for adaptability in complex projects with uncertain scopes, but it also necessitates meticulous cost tracking and transparent communication between the contractor and client.

We’ll explore the different types of cost-plus contracts, delve into risk allocation strategies, and provide real-world examples to illuminate this dynamic contracting model.

Definition of Cost-Plus Contracts

Cost-plus contracts represent a significant category within the realm of contractual agreements, particularly prevalent in projects characterized by uncertainty or complexity. These contracts operate on a fundamental principle of reimbursing the contractor for all allowable costs incurred during the project’s execution, plus an additional fee, structured to incentivize efficient cost management. This contrasts sharply with fixed-price contracts, where the total cost is predetermined.

The choice between these contract types significantly impacts risk allocation and project success.

Cost-Plus Contract Fundamentals

Cost-plus contracts, at their core, involve a reimbursement mechanism for the contractor’s documented expenses. This reimbursement is then augmented by a pre-agreed fee, which can take several forms. The contractor meticulously tracks and documents all eligible costs, providing comprehensive records for verification and reimbursement by the client. This transparency is paramount, and rigorous auditing procedures are frequently employed to ensure the accuracy and legitimacy of the claimed expenses.

Effective cost control mechanisms are crucial on both sides of the agreement.

Types of Cost-Plus Contracts

Several variations exist within the framework of cost-plus contracts, each with its unique fee structure and risk-sharing implications. The selection of a particular type depends largely on the nature of the project, the level of risk tolerance, and the relationship between the client and the contractor.

Cost-Plus-Fixed-Fee (CPFF) Contracts

In CPFF contracts, the contractor is reimbursed for all allowable costs, plus a fixed fee that is predetermined at the contract’s inception. This fixed fee remains unchanged regardless of the project’s actual cost, providing the contractor with a predictable profit margin while still incentivizing cost-effective performance. The client’s risk is primarily related to potential cost overruns, while the contractor bears the risk of inefficiencies impacting their profit margin.

For example, a construction project with a clearly defined scope but potentially unpredictable material costs might utilize a CPFF contract.

Cost-Plus-Percentage-of-Costs (CPPC) Contracts

CPPC contracts reimburse the contractor for all allowable costs, plus a percentage of those costs as a fee. This percentage is pre-agreed upon at the outset of the project. While seemingly simple, this structure presents a significant risk for the client. The contractor’s profit is directly tied to the project’s overall cost, potentially creating an incentive to inflate costs.

This type of contract is generally less favored due to its inherent risk of cost escalation. A hypothetical example could involve a renovation project where the contractor’s profit is directly linked to the overall expenditure on materials and labor.

Cost-Plus-Incentive-Fee (CPIF) Contracts

CPIF contracts combine elements of fixed-fee and incentive-based structures. The contractor receives reimbursement for allowable costs plus a base fee. However, an additional incentive fee is earned if the project is completed under budget or ahead of schedule, providing a strong motivation for efficient management. Conversely, penalties might be applied for significant cost overruns or delays. This approach fosters a collaborative environment, aligning the interests of both the client and the contractor.

A large-scale software development project with ambitious deadlines could benefit from a CPIF structure.

Comparative Analysis: Cost-Plus vs. Fixed-Price Contracts

The following table summarizes the key differences between cost-plus and fixed-price contracts:

| Contract Type | Cost Structure | Risk Allocation | Suitability for Projects |

|---|---|---|---|

| Fixed-Price | Predetermined total price | Contractor bears significant cost risk; Client has price certainty | Clearly defined scope, predictable costs, low uncertainty |

| Cost-Plus-Fixed-Fee (CPFF) | All allowable costs + fixed fee | Client bears significant cost risk; Contractor has profit certainty | Uncertain scope, potential for cost fluctuations, high complexity |

| Cost-Plus-Percentage-of-Costs (CPPC) | All allowable costs + percentage of costs | High cost risk for client; Contractor incentivized to increase costs | Generally unsuitable due to high client risk |

| Cost-Plus-Incentive-Fee (CPIF) | All allowable costs + base fee + incentive/penalty | Shared risk; Contractor incentivized for cost efficiency and timely completion | Complex projects with potential for cost or schedule variations |

Cost Elements Included in a Cost-Plus Contract

Cost-plus contracts, while offering flexibility, necessitate a clear understanding of allowable cost elements to prevent disputes and ensure fair pricing. This section delves into the specifics of these cost components, addressing both direct and indirect costs, and the crucial auditing process involved. Think of it as a careful accounting before God, ensuring transparency and fairness in all transactions.

Allowable costs in a cost-plus contract are meticulously defined within the contract itself. However, generally, they fall under two broad categories: direct and indirect costs. Direct costs are easily traceable to a specific project or task, while indirect costs are shared across multiple projects and require allocation.

Direct Costs

Direct costs represent the expenses directly attributable to the specific project. These are typically straightforward to identify and track. Consider them as the building blocks of the project, essential for its completion.

- Materials: The cost of all raw materials, components, and supplies used in the project. This includes the purchase price, transportation, and any applicable taxes.

- Labor: Wages, salaries, benefits, and payroll taxes paid to employees directly involved in the project. This includes overtime pay, if applicable, and any bonuses specifically tied to project performance.

- Equipment Rental: Costs associated with renting equipment specifically used for the project. This includes rental fees, maintenance, and transportation costs.

Indirect Costs

Indirect costs are shared across multiple projects and require careful allocation. Think of these as the infrastructure supporting the project’s construction. Fair and equitable allocation is crucial for accurate cost accounting.

The allocation of indirect costs often involves a cost allocation base, such as labor hours, machine hours, or square footage. This ensures a fair distribution among different projects. Common indirect costs include:

- Overhead: Costs associated with general business operations, such as rent, utilities, administrative salaries, and insurance. These costs are usually allocated based on a predetermined percentage or a more complex formula.

- General and Administrative Expenses (G&A): Expenses related to the overall management and administration of the company. These costs are often allocated using a similar method to overhead costs.

Auditing and Verifying Claimed Costs

The process of auditing and verifying claimed costs is vital to ensure the integrity of the cost-plus contract. This acts as a safeguard, much like a shepherd protects his flock, ensuring that all costs are legitimate and properly documented. A thorough audit involves reviewing supporting documentation for all claimed costs. This may include invoices, receipts, timesheets, and other relevant financial records.

Discrepancies or irregularities are investigated to ensure compliance with the contract terms.

Example of a Cost Breakdown

Imagine a construction project where a cost-plus contract is used. A simplified cost breakdown might look like this:

- Direct Costs:

- Materials: $50,000

- Labor: $75,000

- Equipment Rental: $10,000

- Indirect Costs:

- Overhead (20% of Direct Labor): $15,000

- G&A (10% of Direct Costs): $13,500

- Total Costs: $163,500

Fee Structure in Cost-Plus Contracts

Cost-plus contracts, while offering flexibility, require careful consideration of the fee structure to ensure fairness and prevent cost overruns. The fee, representing the contractor’s profit and overhead, is a crucial component influencing project economics and incentivizing efficient performance. Different fee structures exist, each with its own implications for both the client and the contractor.The determination of the fee in a cost-plus contract hinges on several factors, including the complexity of the project, the contractor’s experience and reputation, the level of risk involved, and the prevailing market conditions.

The fee can be a fixed amount, a percentage of the allowable costs, or a combination of both. This choice significantly impacts the contractor’s motivation and the overall project cost.

Fixed Fee in Cost-Plus Contracts

A fixed fee is a predetermined amount added to the allowable costs. This structure provides the contractor with a clear profit margin regardless of the actual costs incurred. The contractor is incentivized to control costs efficiently to maximize their profit, as any cost savings remain theirs. However, if unforeseen circumstances drastically increase costs, the contractor may absorb losses.

For example, a construction project might have a fixed fee of $1 million added to the total allowable costs. This provides the contractor with a predictable profit, encouraging efficient cost management.

Percentage-Based Fee in Cost-Plus Contracts

In a percentage-based fee structure, the contractor receives a percentage of the allowable costs as their fee. This percentage is typically negotiated upfront and can vary depending on the project’s complexity and risk. While this offers a potentially higher profit for the contractor if costs escalate, it can also incentivize cost overruns, as the contractor’s profit directly correlates with the project’s total cost.

For instance, a 10% fee on a $10 million project would yield a $1 million fee for the contractor. This structure can lead to a moral hazard if not carefully managed.

Incentive Fees in Cost-Plus Contracts

To mitigate the potential for cost overruns associated with percentage-based fees, incentive fees can be incorporated. These fees reward the contractor for achieving specific performance targets, such as completing the project ahead of schedule or under budget. This structure aligns the contractor’s interests with those of the client, encouraging efficiency and cost control. For example, a bonus might be awarded if the project is completed within a specified timeframe and under a predetermined cost ceiling.

This approach can foster a collaborative relationship and lead to better project outcomes.

Comparison of Fixed and Percentage-Based Fees

A comparison of fixed versus percentage-based fees reveals a fundamental trade-off. A fixed fee provides cost certainty for the client but may limit the contractor’s motivation to control costs beyond a certain point. Conversely, a percentage-based fee offers the contractor a potentially higher profit but introduces the risk of cost overruns for the client. The optimal choice depends on the specific circumstances of the project and the risk tolerance of both parties.

Careful negotiation and clearly defined parameters are crucial in either case. A well-defined scope of work and rigorous cost tracking are essential to minimize risks under both models.

Risk Allocation in Cost-Plus Contracts

Cost-plus contracts, while offering flexibility, present a unique landscape of risk distribution between the client and the contractor. Understanding this allocation is crucial for successful project completion and avoiding potential disputes. The inherent nature of these contracts, where the contractor’s costs are reimbursed, necessitates a careful consideration of who bears the brunt of unforeseen circumstances.The allocation of risk in a cost-plus contract is a complex dance, a delicate balance between trust and accountability.

The client, while bearing the ultimate financial responsibility for the project’s costs, retains control over the scope and specifications. Conversely, the contractor assumes the risk associated with efficient cost management and timely project delivery within the defined scope. However, the contractor’s risk is mitigated by the guaranteed reimbursement of allowable costs. This shared responsibility creates a collaborative environment, yet also presents potential pitfalls if not clearly defined and managed.

Contractor’s Risks in Cost-Plus Contracts

Several risks are inherent for the contractor in a cost-plus arrangement. These include the potential for cost overruns due to unforeseen circumstances, delays impacting profitability, and the possibility of disputes regarding allowable costs. Efficient project management and meticulous cost tracking are essential for the contractor to mitigate these risks. A lack of clear communication and detailed scope definition can also lead to disagreements and financial losses.

For instance, a contractor might encounter unexpected soil conditions during a construction project, leading to increased excavation costs not initially accounted for. This highlights the importance of comprehensive risk assessment and contingency planning.

Client’s Risks in Cost-Plus Contracts

While the client’s financial exposure is potentially higher in a cost-plus contract, their risks are different in nature. These include the risk of cost overruns due to poor contractor management, potential for scope creep (uncontrolled expansion of project requirements), and the possibility of encountering a less-than-competent contractor. Effective oversight, clear contract terms, and robust monitoring mechanisms are crucial for the client to minimize these risks.

For example, a lack of detailed specifications could lead to a contractor interpreting the scope broadly, resulting in significantly higher costs than initially anticipated. This underscores the importance of precise project definition and ongoing client involvement.

Risk Mitigation Strategies

Effective risk mitigation requires proactive measures from both the client and the contractor. A well-defined contract with clearly stated responsibilities, robust cost control mechanisms, and a transparent communication channel are fundamental.

For the Client:

- Implement rigorous project monitoring and reporting systems to track progress and costs closely.

- Employ independent cost estimators to verify contractor’s cost claims.

- Clearly define the project scope, specifications, and deliverables to minimize scope creep.

- Establish a strong communication channel with the contractor to address issues promptly.

- Thoroughly vet and select a reputable contractor with a proven track record.

For the Contractor:

- Develop a detailed project plan with realistic timelines and budgets.

- Implement robust cost control measures to track expenses diligently.

- Maintain accurate and transparent accounting records.

- Establish open communication with the client to address potential issues proactively.

- Engage in thorough risk assessment and develop contingency plans for unforeseen events.

Contract Administration and Management: How Does Cost Plus Contract Work

Effective administration is the cornerstone of a successful cost-plus contract, ensuring both parties understand their obligations and the project progresses smoothly. Without diligent oversight, ambiguities can arise, leading to disputes and potentially jeopardizing the entire undertaking. This section will illuminate the crucial aspects of managing these contracts, highlighting the importance of clear communication and proactive problem-solving.

Administering a cost-plus contract demands a multifaceted approach, encompassing regular monitoring of costs, meticulous tracking of progress, and the establishment of robust dispute resolution mechanisms. This collaborative effort between the contractor and the client necessitates open communication channels and a shared commitment to transparency and fairness. The success of the contract hinges on the effectiveness of this ongoing management process.

Regular Cost Reporting and Progress Updates

Regular cost reporting and progress updates are vital for maintaining transparency and controlling expenses within a cost-plus contract. These reports provide a clear picture of the project’s financial health and allow for timely intervention should any discrepancies arise. They also serve as a crucial mechanism for identifying potential cost overruns and implementing corrective measures.

Consider a scenario involving the construction of a large-scale hospital. Monthly reports detailing labor costs, material expenses, and subcontractor payments would be essential. These reports should be compared against the initial budget and any variances should be thoroughly investigated and explained. Similarly, regular progress updates, perhaps weekly, charting the completion of milestones such as foundation laying, structural framing, and interior finishing, are equally crucial for ensuring the project stays on schedule.

Dispute Resolution in Cost-Plus Contracts

Disputes are an inherent risk in any contractual agreement, and cost-plus contracts are no exception. However, a well-defined dispute resolution process can minimize conflict and ensure a fair and efficient resolution. This process typically involves a series of steps, from informal negotiation to formal arbitration or litigation, depending on the complexity and severity of the disagreement.

A structured approach to dispute resolution is paramount. This approach reduces the likelihood of escalation and protects the overall relationship between the contracting parties. The following step-by-step procedure Artikels a typical approach:

- Informal Negotiation: The first step involves direct communication between the contractor and the client to identify the points of contention and attempt to reach a mutually agreeable solution. This often involves a review of the contract terms and relevant documentation.

- Mediation: If informal negotiation fails, mediation by a neutral third party can be employed. The mediator facilitates communication and helps the parties find common ground. This step promotes a collaborative solution while maintaining a respectful dialogue.

- Arbitration: If mediation is unsuccessful, arbitration by a neutral expert can be pursued. The arbitrator hears evidence from both parties and renders a binding decision. This process is more formal than mediation but still avoids the expense and time of litigation.

- Litigation: As a last resort, litigation may be necessary. This involves bringing the dispute before a court of law for a final resolution. This option is generally the most time-consuming and costly.

Examples of Cost-Plus Contracts in Different Industries

Cost-plus contracts, while carrying inherent risks, are often favored in situations where the scope of a project is uncertain or subject to significant change. This approach allows for flexibility and adaptability, crucial in environments with evolving requirements or technological advancements. Let us examine several real-world examples to illustrate the diverse applications of this contract type.

The following examples demonstrate how cost-plus contracts are used in various industries, highlighting the reasons behind their selection in specific project contexts. The choice often hinges on the need for flexibility, the complexity of the project, and the difficulty in accurately estimating costs upfront.

Cost-Plus Contracts in Construction

Cost-plus contracts are frequently used in large-scale construction projects, particularly those involving complex designs or unforeseen site conditions. For example, the construction of a large-scale hospital or a complex infrastructure project like a bridge often employs this model. The contractor’s costs are reimbursed, plus a predetermined fee or percentage markup. This approach allows for adjustments to the project scope as needed, accommodating unexpected challenges like changes in material costs or unforeseen geological issues.

The rationale is that precise cost estimation before commencing such large-scale and complex projects is often practically impossible.

Cost-Plus Contracts in Software Development, How does cost plus contract work

In the software development industry, cost-plus contracts are employed when the project requirements are not fully defined at the outset or are likely to evolve during development. A classic example would be the development of a custom enterprise resource planning (ERP) system. The initial specifications might be high-level, with detailed requirements emerging during the iterative development process. The client reimburses the developer for all allowable costs, plus a fee, allowing for adaptation to changing business needs and technological advancements.

This mitigates the risk for the developer, who can focus on delivering a high-quality product without being constrained by a fixed budget that might not accurately reflect the final scope.

Cost-Plus Contracts in Research and Development

Cost-plus contracts are common in research and development (R&D) projects, especially in areas involving scientific breakthroughs or uncertain outcomes. Consider a pharmaceutical company commissioning research into a new drug. The unpredictable nature of scientific research makes accurate cost estimation extremely difficult. A cost-plus contract allows the research institution to be reimbursed for all eligible expenses, including personnel costs, materials, and equipment, plus a predetermined fee.

This incentivizes the researchers to focus on achieving the scientific goals without the pressure of a fixed budget potentially limiting the scope of their investigation.

Examples of Cost-Plus Contracts Across Industries

| Industry | Project Type | Contract Type | Rationale for Selection |

|---|---|---|---|

| Construction | Hospital Construction | Cost-Plus-Fixed-Fee | Uncertain site conditions, complex design requiring flexibility. |

| Software Development | Custom ERP System Development | Cost-Plus-Percentage-of-Costs | Evolving requirements, iterative development process. |

| Research & Development | New Drug Research | Cost-Plus-Incentive-Fee | Uncertain research outcomes, need for flexibility in resource allocation. |

| Aerospace | Development of a new satellite | Cost-Plus-Award-Fee | High technological complexity, long development cycle, and potential for significant changes during the project. |

Advantages and Disadvantages of Cost-Plus Contracts

Cost-plus contracts, while offering flexibility, present a complex tapestry of benefits and drawbacks. Understanding these aspects is crucial for both contractors and clients seeking to navigate the intricacies of this contractual arrangement. A careful consideration of these factors can significantly impact the success and profitability of a project.

The decision to utilize a cost-plus contract should be made after a thorough evaluation of the project’s unique characteristics, the level of risk involved, and the capabilities of both parties involved. Weighing the potential advantages against the inherent disadvantages is paramount to making an informed choice.

Advantages of Cost-Plus Contracts

Cost-plus contracts offer several compelling advantages, particularly in situations where project scope is uncertain or subject to significant change. These advantages can provide crucial benefits for both the contractor and the client, fostering a collaborative environment and mitigating some of the inherent risks associated with complex projects.

- Reduced Contractor Risk: The contractor is reimbursed for all allowable costs, eliminating the risk of unforeseen expenses leading to financial losses. This fosters a collaborative atmosphere, encouraging the contractor to focus on efficient execution rather than cost minimization at the expense of quality or performance.

- Flexibility and Adaptability: Changes in project scope or requirements are easily accommodated, as the contract allows for adjustments to costs based on the revised scope. This is particularly beneficial for projects with evolving needs or those facing unforeseen challenges.

- Incentive for Quality: While the contractor’s profit is fixed as a percentage of costs, they are still incentivized to manage costs effectively, as this directly impacts their overall profit margin. Furthermore, the absence of strict cost constraints encourages a focus on quality and performance.

- Enhanced Collaboration: The shared risk approach fosters a collaborative relationship between the client and contractor, promoting open communication and a joint commitment to project success. This shared understanding can lead to more effective problem-solving and better overall outcomes.

Disadvantages of Cost-Plus Contracts

Despite their advantages, cost-plus contracts also present significant disadvantages that must be carefully considered. These drawbacks can lead to increased costs, reduced accountability, and potential conflicts if not properly managed.

- Potential for Cost Overruns: Without a fixed price, there’s a higher risk of cost overruns if costs are not carefully monitored and controlled. This lack of a predefined budget can lead to significant financial implications for the client.

- Reduced Cost Control: The client has less control over the project’s final cost, relying heavily on the contractor’s cost management practices and transparency. This can lead to a lack of transparency and potential for cost inflation.

- Lack of Incentive for Cost Efficiency: While there’s an incentive to manage costs, the absence of a fixed price can potentially reduce the contractor’s motivation to find the most cost-effective solutions. This can lead to higher overall project costs.

- Complexity in Contract Administration: Cost-plus contracts require more extensive administration and monitoring to ensure accurate cost tracking and proper reimbursement. This adds to the administrative burden for both parties.

Comparison of Advantages and Disadvantages

The following table summarizes the key advantages and disadvantages of cost-plus contracts to facilitate a clear comparison and aid in decision-making.

| Feature | Advantage | Disadvantage |

|---|---|---|

| Risk Allocation | Reduced contractor risk, shared risk approach | Increased client risk, potential for cost overruns |

| Flexibility | High adaptability to changes in scope | Less predictable final cost |

| Cost Control | Incentive for quality, focus on performance | Reduced client control, potential for cost inflation |

| Collaboration | Enhanced communication and teamwork | Increased complexity in contract administration |

Mastering cost-plus contracts empowers you to navigate complex projects with confidence. By understanding the intricacies of cost allocation, risk management, and fee structures, you can confidently negotiate favorable terms and ensure project success. Remember, clear communication, thorough cost tracking, and a well-defined contract are key to maximizing the benefits of this flexible contracting method. Are you ready to leverage the power of cost-plus contracts in your next venture?

Essential Questionnaire

What are the common pitfalls of cost-plus contracts?

Cost overruns due to poor cost control and a lack of transparency are common. Unclear contract terms can also lead to disputes. Careful planning and diligent monitoring are essential.

How is the fee structure determined in a cost-plus contract?

The fee structure varies depending on the contract type. It can be a fixed fee, a percentage of costs, or a combination of both. The specifics are negotiated between the client and contractor.

Can a cost-plus contract be used for small projects?

While suitable for large, complex projects, cost-plus contracts can be used for smaller projects if the scope is uncertain or likely to change significantly. However, the administrative overhead might outweigh the benefits for very small projects.

What is the role of auditing in a cost-plus contract?

Auditing ensures that all claimed costs are legitimate and reasonable. Independent audits can provide an extra layer of protection for both the client and the contractor.