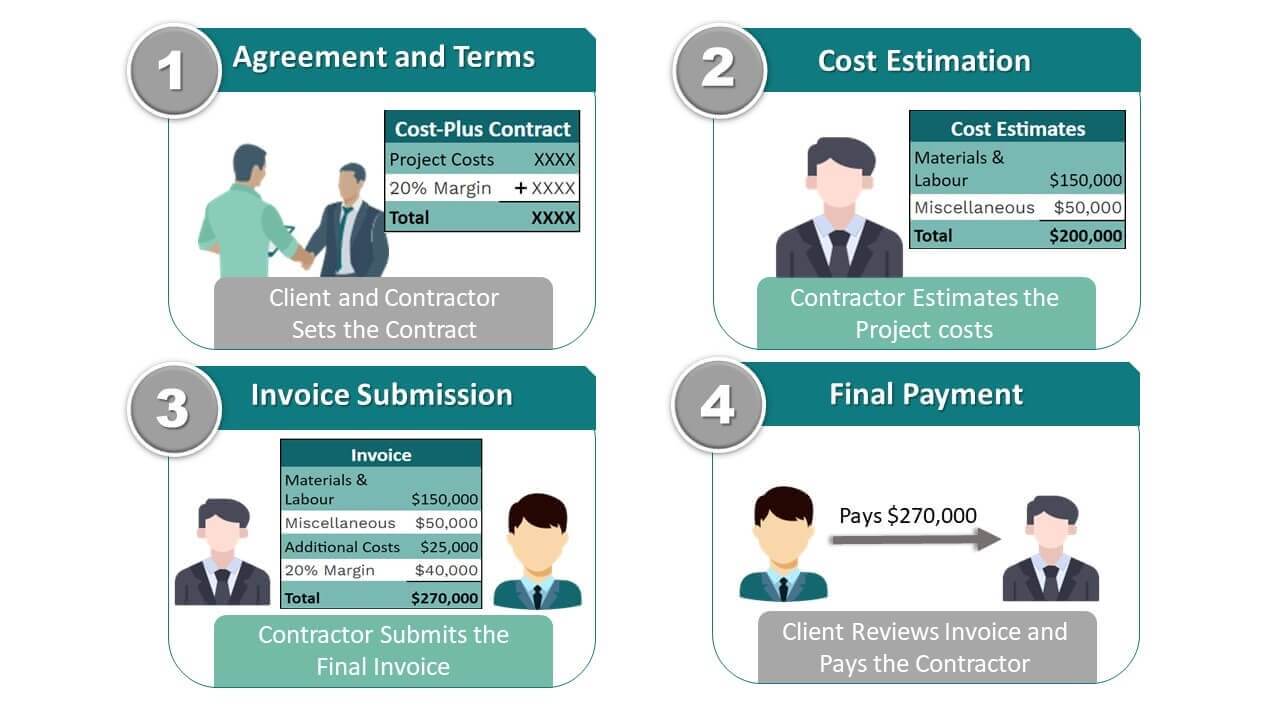

How does cost plus contract work – How does cost-plus contract work? This question delves into a complex yet crucial area of contract law and project management. Cost-plus contracts, unlike fixed-price agreements, reimburse the contractor for all allowable project costs plus a predetermined fee or percentage. This approach offers flexibility and risk-sharing, but necessitates rigorous cost accounting and transparent communication between parties. Understanding the nuances of different cost-plus models, such as cost-plus-fixed-fee and cost-plus-incentive-fee, is paramount to successful project execution and dispute avoidance.

This presentation will explore the intricacies of cost-plus contracts, encompassing their core components, negotiation strategies, risk mitigation techniques, and suitability for various project types. We will analyze the critical role of cost accounting and documentation, examining best practices for maintaining accurate records and ensuring compliance. Furthermore, we will delve into dispute resolution mechanisms and provide practical examples to illustrate the lifecycle of a cost-plus contract, highlighting key financial milestones and potential challenges.

Definition and Core Components of a Cost-Plus Contract

A cost-plus contract, a somber dance between trust and uncertainty, rests on the foundation of reimbursing the contractor for all allowable project costs, adding a predetermined fee or profit margin. It’s a contract born from a landscape of ambiguity, where the final cost is unknown at the outset, leaving a lingering echo of risk.Cost-plus contracts, like fading melodies, are characterized by a delicate balance.

The contractor’s expenses are meticulously documented and verified, forming the bedrock upon which the final payment is calculated. This fee, a fixed sum or a percentage of the total cost, represents the contractor’s compensation for their efforts and expertise. The allowable costs are often explicitly defined within the contract, creating a framework to guide the process. However, the inherent uncertainty of the total cost can cast a long shadow over the entire project.

Cost-Plus Contract Types

The various types of cost-plus contracts offer different arrangements regarding the fee structure and risk allocation. Each type, like a verse in a mournful ballad, carries its own unique rhythm and tone, affecting the project’s trajectory and the parties involved.

| Contract Type | Fee Structure | Risk Allocation | Suitability |

|---|---|---|---|

| Cost-Plus-Fixed-Fee (CPFF) | Fixed fee regardless of actual costs (within reason). | Contractor bears some cost risk; Owner bears most cost risk. | Suitable for projects with well-defined scope but uncertain costs; research and development. |

| Cost-Plus-Incentive-Fee (CPIF) | Fee based on achieving pre-defined targets (cost and performance). | Risk shared between Contractor and Owner, depending on incentive structure. | Suitable for complex projects where incentives can drive efficiency and cost control; large-scale construction. |

| Cost-Plus-Percentage-of-Cost (CPPC) | Fee is a percentage of the total allowable costs. | High cost risk for the Owner; minimal cost risk for the Contractor. | Generally avoided due to potential for cost overruns and lack of incentive for cost control. |

| Cost-Plus-Award-Fee (CPAF) | Base fee plus an award fee based on subjective performance evaluation. | Contractor bears some cost risk; Owner bears most cost risk, but can influence cost through performance evaluation. | Suitable for projects where performance is difficult to quantify objectively; military contracts. |

Cost Accounting and Documentation Requirements

The shadow of meticulous record-keeping stretches long over cost-plus contracts, a somber dance between precise accounting and the ever-present risk of disputes. Each entry, a whispered plea for clarity in the face of potential loss, a testament to the fragile trust built on the foundation of transparent cost allocation. The weight of accuracy rests heavily on the shoulders of those entrusted with the numbers, for a single misplaced decimal can cast a long and chilling gloom.Accurate cost tracking and documentation are not merely contractual obligations; they are the lifeblood of a successful cost-plus project.

They are the quiet sentinels guarding against the creeping tendrils of ambiguity and the chilling winds of financial uncertainty. Without them, the project becomes a ghost ship adrift on a sea of unaccountable expenses, destined to founder on the rocks of dispute and mistrust. The meticulous preservation of these records is the only lighthouse guiding the way through the storm.

Detailed Record-Keeping Best Practices

Maintaining detailed records requires a methodical approach, a somber ritual performed with unwavering precision. Each expense, like a fallen leaf in autumn, must be carefully collected and preserved, its identity and purpose meticulously documented. This is not a task for the faint of heart, but a necessity for survival in the unforgiving landscape of cost-plus contracting. The absence of such diligent documentation can lead to a protracted and emotionally draining battle over reimbursements, leaving a lingering bitterness long after the project is concluded.

- Expense Category: A detailed categorization of each expense (e.g., labor, materials, equipment rental, travel, etc.). This allows for a clear and organized overview of the project’s financial landscape.

- Date: The date each expense was incurred, ensuring chronological accuracy and facilitating timely identification of anomalies.

- Vendor: The name and contact information of the vendor or supplier, providing a verifiable trail for each transaction.

- Description: A detailed description of the expense, avoiding ambiguity and ensuring clarity. This acts as a safeguard against future misunderstandings.

- Amount: The precise amount of each expense, recorded with meticulous accuracy to avoid discrepancies and disputes.

- Supporting Documentation: Copies of invoices, receipts, and other supporting documentation to substantiate each expense. These serve as irrefutable proof in the event of a challenge.

- Project Phase: Linking each expense to a specific phase of the project, providing a granular view of cost allocation across different stages.

Sample Cost Tracking Spreadsheet

A well-structured spreadsheet serves as a silent guardian, preserving the integrity of the financial narrative. Each cell, a carefully chosen word in a meticulously crafted story, revealing the true cost of the project’s journey. Without this detailed record, the project’s financial story becomes a fragmented and unreliable tale, easily misinterpreted and susceptible to misrepresentation.* Column A: Expense Category

Column B

Date

Column C

Vendor

Column D

Description

Column E

Amount

Column F

Supporting Documentation Reference (File Name/Number)

Column G

Project Phase

Negotiation and Contractual Agreement

The dance of cost-plus contracts, a waltz of trust and trepidation, begins with negotiation. A careful choreography is needed, each step measured, each move deliberate, to avoid the discordant notes of conflict that can sour the entire engagement. The air hangs heavy with the weight of potential disagreements, a silent tension only eased by meticulous planning and clear communication.Negotiating a cost-plus contract requires a delicate balance.

The buyer seeks to control costs and ensure value for money, while the seller aims to protect its margins and cover potential unforeseen expenses. This inherent tension often leads to protracted discussions, each party carefully weighing their options, their hopes dimming with each passing day like a fading sunset.

Key Aspects of Negotiating a Cost-Plus Contract

The negotiation process is a delicate ecosystem, where the survival of the agreement depends on the careful consideration of several factors. Understanding the client’s needs and priorities is paramount; it forms the bedrock upon which a successful negotiation is built. Equally important is a thorough understanding of the project scope, a clear definition of deliverables, and a realistic estimation of costs.

Failing to establish these fundamentals can lead to future disputes, each one a sharp, painful blow to the overall project. The process demands patience, a willingness to compromise, and a shared commitment to transparency. Only then can a harmonious partnership flourish.

Potential Areas of Conflict and Resolution Strategies

The shadow of conflict looms large over cost-plus negotiations. Disagreements over allowable costs, the definition of “reasonable” profit margins, and the interpretation of contract clauses are common sources of friction. Each dispute is a storm cloud threatening to unleash a torrent of litigation, draining resources and eroding trust. To navigate these treacherous waters, proactive conflict resolution strategies are crucial.

These include open communication channels, mediation, and arbitration, each a life raft offering a chance at survival amidst the turbulent seas of disagreement. The aim is to transform potential conflicts into opportunities for collaboration, to find common ground, and to forge a path towards mutual understanding.

Importance of Clear and Unambiguous Contract Language

The contract itself is the cornerstone of the agreement, a testament to the promises made and the commitments undertaken. Ambiguity is the enemy, a subtle poison that can slowly erode the relationship and ultimately lead to costly disputes. Every clause must be meticulously crafted, every word weighed carefully, to ensure that there is no room for misinterpretation. A well-drafted contract is a shield, protecting both parties from the harsh realities of unforeseen circumstances.

It is a beacon of clarity, guiding the project through its various phases, ensuring that all parties are on the same page, walking in step, towards a common goal.

Essential Clauses for a Cost-Plus Contract

The contract’s clauses, like the stanzas of a carefully constructed poem, each contribute to the overall narrative. A well-structured cost-plus contract will typically include clauses defining the scope of work, payment terms, allowable costs, the method for calculating profit, dispute resolution mechanisms, and termination clauses. These clauses act as a safeguard, protecting both parties from the vagaries of unforeseen circumstances.

Each one is a bulwark against the storms that can threaten the success of the project. Without them, the contract becomes a fragile vessel, easily tossed about by the unpredictable winds of change.

Risk Management in Cost-Plus Contracts: How Does Cost Plus Contract Work

A shadowed dance, this cost-plus game, where profits blur and losses claim. A fragile pact, where trust must bloom, lest shadows gather in the gloom. For both the buyer and the builder, risks reside, a silent tide.The inherent risks in cost-plus contracts are a somber melody, played on the strings of uncertainty. For the buyer, the fear of runaway costs echoes, a haunting refrain, while for the contractor, the specter of insufficient compensation casts a long, chilling shadow.

Unforeseen circumstances, like gusts of wind, can topple the carefully constructed balance, leaving both parties vulnerable to the storm.

Buyer’s Risks in Cost-Plus Contracts

The buyer’s anxieties in a cost-plus contract resemble a slow, creeping dread. The lack of a fixed price creates a vulnerability to cost overruns, a relentless erosion of the initial budget. Inadequate cost control mechanisms can further exacerbate this issue, leaving the buyer exposed to potentially crippling financial burdens. The risk of contractor inefficiency or deliberate cost inflation adds another layer of complexity to this precarious arrangement.

A lack of transparency in the contractor’s cost accounting can lead to a sense of powerlessness, a chilling realization of dependence on the contractor’s goodwill.

Contractor’s Risks in Cost-Plus Contracts

The contractor, too, walks a tightrope in this cost-plus arrangement. The risk of underestimation looms large, casting a pall over potential profits. The fear of unforeseen expenses, unexpected delays, and the possibility of reduced profit margins haunts their every decision. A detailed and accurate cost estimation is crucial, but even the most meticulous calculations can be undone by the vagaries of the project itself.

This inherent uncertainty can lead to financial strain and even jeopardize the contractor’s viability.

Mitigation Strategies for Cost Overruns

To navigate this treacherous terrain, both parties must employ strategies to mitigate the ever-present threat of cost overruns. Detailed and transparent cost accounting is paramount, a beacon in the darkness. Regular cost reviews and progress reports can provide early warnings of potential problems, allowing for timely intervention and adjustments. A clearly defined scope of work, a well-defined contract, serves as a sturdy map, guiding the project through the uncertainties.

Establishing performance incentives can encourage cost efficiency, a gentle push towards responsible spending.

Risk Management Comparison: Cost-Plus vs. Fixed-Price

In contrast to the fluid nature of cost-plus contracts, fixed-price contracts offer a semblance of certainty. The risks are shifted, but not eliminated. In fixed-price contracts, the contractor bears the brunt of cost overruns, while the buyer risks receiving a subpar product due to the contractor cutting corners to stay within budget. Cost-plus contracts, while inherently riskier in terms of budget, allow for greater flexibility and adaptability to changing circumstances.

The choice between these two approaches depends on the specific nature of the project and the risk tolerance of both parties, a delicate balance of calculated risks and potential rewards.

Auditing and Dispute Resolution

The shadow of uncertainty hangs heavy over cost-plus contracts, a somber dance between trust and verification. Auditing and dispute resolution, then, become the somber melodies that attempt to harmonize this discordant arrangement, striving for a balance of fairness and accountability. The process, often fraught with complexities, requires meticulous attention to detail and a keen understanding of contractual obligations.

Auditing cost-plus contracts is a critical process to ensure that expenses claimed by the contractor are legitimate, reasonable, and align with the agreed-upon scope of work. This meticulous examination seeks to prevent cost overruns and potential fraud, preserving the financial integrity of the agreement. The process itself is a careful choreography, balancing the need for thoroughness with the practicalities of time and resources.

Cost-Plus Contract Audits

Audits typically involve a detailed review of the contractor’s accounting records, including invoices, receipts, and supporting documentation. The auditor verifies the accuracy of costs claimed, ensuring that they are allowable under the contract terms and are directly attributable to the project. This may include examining labor costs, material expenses, overhead allocations, and profit margins. Inconsistencies or irregularities are flagged for further investigation and potential adjustments.

A thorough audit aims to provide a clear picture of the financial health of the project and to identify any areas of concern. The goal is not to find fault, but to ensure the contract is executed fairly and transparently.

Common Disputes in Cost-Plus Contracts

Disputes in cost-plus contracts often arise from ambiguities in the contract language, disagreements over allowable costs, or claims of change orders not properly documented or approved. The allocation of overhead costs can also be a source of contention, as can disputes related to the contractor’s performance or delays. These conflicts can escalate quickly, casting a long shadow over the project and the relationship between the contracting parties.

Resolution requires a careful consideration of the contractual terms and a willingness to negotiate a fair outcome.

Dispute Resolution Mechanisms

Effective dispute resolution mechanisms are crucial in mitigating the risks associated with cost-plus contracts. Negotiation, mediation, and arbitration are common methods used to resolve disputes amicably. Negotiation, a direct dialogue between the parties, is often the first step. If negotiation fails, mediation involves a neutral third party who facilitates communication and helps the parties reach a mutually acceptable solution.

Arbitration involves a neutral arbitrator who hears evidence from both sides and renders a binding decision. Litigation, while a last resort, remains a possibility if all other methods fail. Each method carries its own advantages and disadvantages, and the choice depends on the specific circumstances of the dispute and the preferences of the parties involved. The selection of a mechanism should be Artikeld within the original contract, minimizing ambiguity should disagreements arise.

Dispute Resolution Process Flowchart

Imagine a flowchart, a visual roadmap guiding the resolution process. It begins with a clearly defined “Dispute Identification” box, branching into “Negotiation” and “Mediation” boxes. If these attempts fail, a path leads to “Arbitration,” the final stop before the ominous “Litigation” box. Each box represents a stage in the process, with arrows illustrating the progression or potential regressions.

The flowchart serves as a visual reminder of the structured approach to resolving disputes, offering a sense of order in the face of conflict. The melancholic undertone lies in the very need for such a process, a testament to the inherent fragility of even the most carefully crafted agreements.

Cost-Plus Contract Applications and Suitability

A cost-plus contract, a pact forged in uncertainty, finds its purpose in projects shrouded in ambiguity, where the final cost remains a phantom until the journey’s end. Its application, a somber dance between trust and risk, is a delicate matter, requiring careful consideration of its inherent strengths and weaknesses. Like a twilight melody, its suitability is not universal, but rather a selective harmony, resonating only with certain project types and industries.Suitable projects for cost-plus contracts often share a common thread: high complexity and unpredictability.

These are ventures where precise cost estimation at the outset is practically impossible, where unforeseen challenges lurk around every corner, demanding flexibility and adaptability. Think of it as navigating a starless night, relying on the compass of trust and the guiding light of collaborative spirit.

Project Types Suitable for Cost-Plus Contracts

Cost-plus contracts find their truest expression in projects characterized by significant unknowns. Research and development endeavors, where the path forward is often obscured by the very nature of discovery, are prime candidates. Similarly, complex construction projects, particularly those involving pioneering technologies or unique environmental conditions, often benefit from the inherent flexibility of this contract type. Emergency response and remediation projects, where immediate action is paramount and precise cost estimations are impossible, also fall under this umbrella.

The cost-plus contract, in these instances, becomes a lifeline, a bridge built across the chasm of uncertainty.

Industries Utilizing Cost-Plus Contracts

The shadow of uncertainty falls heavily upon certain industries, making cost-plus contracts a common refuge. The aerospace and defense sectors, with their highly specialized and often experimental projects, frequently rely on this contract type. Similarly, the pharmaceutical and biotechnology industries, where research and development costs are inherently unpredictable, often employ cost-plus contracts to navigate the labyrinthine paths of innovation.

Government contracts, especially those involving large-scale infrastructure projects or complex scientific endeavors, also frequently utilize this approach, a testament to the inherent need for flexibility and adaptability in such ventures. The music of these industries often plays a melancholic tune, a symphony of uncertainty and risk.

Circumstances Favoring Cost-Plus Contracts

A cost-plus contract’s advantage shines brightest when other contracting methods falter. When precise cost estimation is impractical or impossible, as in research-intensive projects, its adaptability offers a lifeline. Similarly, when the project scope is subject to significant change or unforeseen challenges, the inherent flexibility becomes crucial. In situations requiring close collaboration and shared risk between the client and contractor, cost-plus fosters a partnership, a shared journey through the unknown.

It’s a contract that acknowledges the unpredictable nature of certain ventures, embracing the uncertainty with a melancholic acceptance, a somber dance between trust and risk.

Illustrative Example of a Cost-Plus Contract Scenario

The wind whispers a mournful tune through the skeletal branches of the project, a cost-plus contract swaying precariously in the economic gale. A tale of ambition and uncertainty, of meticulous planning and unforeseen storms, unfolds in the construction of the “Serene Shores” resort.

Serene Shores, a luxury beachfront resort, was commissioned by a prominent hotel chain. The project, encompassing the construction of a main hotel building, several villas, and extensive landscaping, was awarded to “Coastal Construction,” a reputable firm, under a cost-plus-fixed-fee contract. The contract stipulated a fixed fee of 15% of the total allowable costs, capped at $5 million, with Coastal Construction responsible for all direct and indirect costs associated with the project, including materials, labor, equipment, and permits.

Project Cost Breakdown and Fee Structure, How does cost plus contract work

The initial project budget, based on detailed estimates, projected total allowable costs of $30 million. This included $15 million for materials, $10 million for labor, $3 million for equipment rental, and $2 million for permits and other indirect costs. Coastal Construction meticulously documented all expenses, submitting monthly reports for review and approval by the hotel chain. As the project progressed, unforeseen challenges emerged, including unexpected soil conditions requiring additional foundation work, and a significant increase in material costs due to global supply chain disruptions.

These unforeseen events caused a substantial increase in costs, pushing the total allowable costs beyond the initial estimate.

Project Lifecycle and Financial Milestones

The project commenced in the spring, with initial site preparation and foundation work. The first six months saw steady progress, with milestones like the completion of the foundation and the commencement of the main hotel structure being met within budget. However, the discovery of unstable soil at the foundation level in the late summer triggered a significant cost overrun, necessitating extensive remedial work.

The winter brought its own challenges; harsh weather conditions delayed construction, further increasing costs. Despite these setbacks, the project finally reached completion a year behind schedule.

Final Settlement and Challenges

The final total allowable cost amounted to $38 million, exceeding the initial estimate by $8 million. Coastal Construction, according to the contract terms, received its fixed fee of $5 million (15% of $30 million, the initial budget), representing the agreed-upon profit margin. However, the significant cost overrun caused friction between the hotel chain and the construction firm. Negotiations ensued, involving extensive documentation reviews and discussions regarding the validity of the additional costs.

While the hotel chain ultimately approved the final payment, the experience left both parties with a sense of weariness, highlighting the inherent risks associated with cost-plus contracts, especially in unpredictable economic and environmental climates.

In conclusion, navigating the complexities of cost-plus contracts requires a thorough understanding of their inherent risks and benefits. While offering flexibility and incentivizing collaboration, they demand meticulous cost tracking, transparent communication, and robust risk management strategies. By carefully considering the specific project requirements, negotiating clear contractual terms, and implementing effective dispute resolution mechanisms, both contractors and clients can mitigate potential challenges and achieve successful project outcomes.

The choice between a cost-plus and fixed-price contract ultimately hinges on the nature of the project, the level of uncertainty, and the risk appetite of the involved parties.

General Inquiries

What are the potential drawbacks of a cost-plus contract?

Potential drawbacks include the risk of cost overruns if costs are not carefully managed, the potential for disputes over allowable costs, and a lack of price certainty for the client upfront.

How is the profit margin determined in a cost-plus contract?

The profit margin is typically negotiated upfront and can be a fixed fee, a percentage of costs, or a combination of both. This depends on the specific type of cost-plus contract.

When is a cost-plus contract most appropriate?

Cost-plus contracts are best suited for projects with high uncertainty, complex scopes of work, or when the precise costs are difficult to estimate at the outset.

What types of projects commonly utilize cost-plus contracts?

Research and development projects, construction projects with evolving designs, and government contracts often utilize cost-plus contracts.