ES Futures Contract Cost: Diving headfirst into the world of futures trading can feel like jumping into a shark tank – exciting, potentially lucrative, but definitely risky! Understanding the true cost of an ES futures contract is crucial before you even think about placing a trade. It’s not just about the initial price; we’re talking commissions, fees, margin requirements, and the ever-shifting landscape of market sentiment.

This post breaks down all the hidden (and not-so-hidden) costs, helping you navigate the complexities and make informed decisions.

We’ll explore the mechanics of ES futures contracts, examining contract specifications like size and tick increments, and delve into the various fees involved. Then, we’ll unpack the factors that influence the price, from market sentiment and interest rates to the behavior of the underlying S&P 500 index. Finally, we’ll equip you with the tools to calculate your total cost, understand margin requirements, and compare commission structures from different brokers.

Get ready to demystify the financial intricacies and confidently navigate the world of ES futures trading!

Understanding ES Futures Contracts

ES futures contracts, tracking the S&P 500 index, are a popular instrument for traders seeking leveraged exposure to the US equity market. They offer a way to speculate on the direction of the market or to hedge existing equity positions. Understanding their mechanics is crucial for successful trading.

ES Futures Contract Mechanics

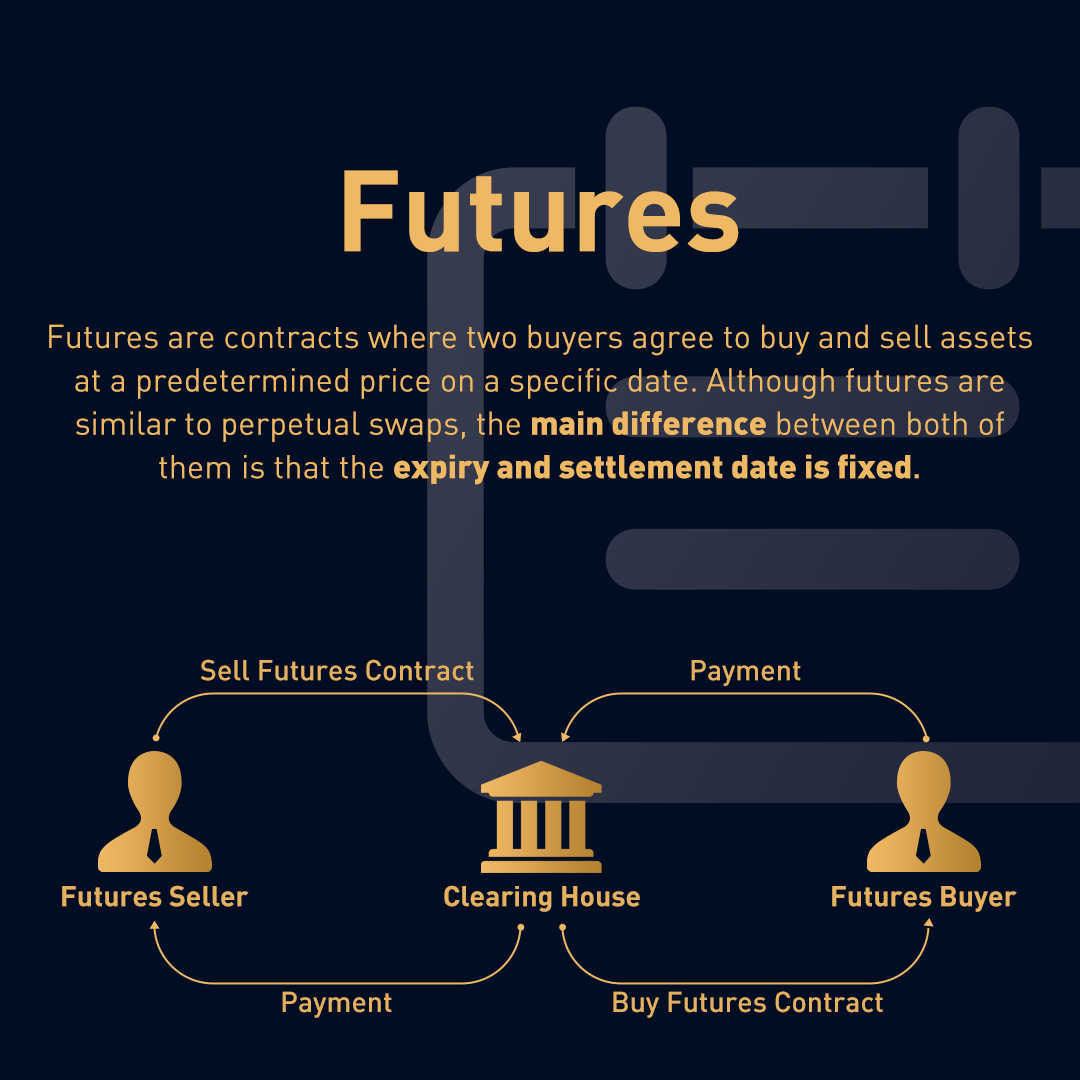

An ES futures contract is an agreement to buy or sell a specified number of S&P 500 index shares at a predetermined price on a future date. The buyer (long position) anticipates the index rising, while the seller (short position) anticipates a decline. The contract’s value fluctuates based on the movements of the underlying S&P 500 index. Profit or loss is realized upon closing the position (selling a long position or buying a short position).

Margin accounts are required, demanding a percentage of the contract’s value as collateral to mitigate risk.

ES Futures Contract Specifications

Several key specifications define an ES futures contract. The contract size is typically 500 times the index value, meaning a one-point move in the index equates to a $500 change in the contract’s value. The tick size, representing the minimum price fluctuation, is 0.25 points, or $12.50 per contract. Trading hours generally align with the regular trading hours of the underlying S&P 500 index, with electronic trading extending beyond these hours.

Each contract has a specific expiration date, after which it settles. Contracts are available for various months, allowing traders to select their desired timeframe.

Fees Associated with ES Futures Trading

Several fees are associated with trading ES futures contracts. These include brokerage commissions, which vary depending on the brokerage firm and trading volume. Exchange fees are also levied by the Chicago Mercantile Exchange (CME), the primary exchange for ES futures. Data fees may apply for real-time market data subscriptions. Finally, potential financing costs, such as interest charges on margin accounts, need to be considered.

These costs can accumulate, so it’s crucial to factor them into trading strategies.

Comparison of ES Futures with Other Instruments

The following table compares ES futures contracts with other similar financial instruments:

| Feature | ES Futures | S&P 500 ETFs (e.g., SPY) | S&P 500 Index Options |

|---|---|---|---|

| Leverage | High | Moderate | High (depending on strike price and premium) |

| Liquidity | Very High | Very High | High |

| Cost | Commissions, exchange fees | Commissions | Commissions, premium |

| Risk | High (potential for unlimited losses) | Moderate | Moderate to High (depending on strategy) |

Factors Influencing ES Futures Contract Cost

The price of an E-mini S&P 500 (ES) futures contract, like any other derivative, is intricately linked to the dynamics of its underlying asset – the S&P 500 index. Several key factors interplay to determine its cost, creating a complex but predictable system for seasoned traders. Understanding these influences is crucial for effective trading strategies.

Underlying S&P 500 Index Performance

The most significant factor driving ES futures prices is the performance of the S&P 500 index itself. As the index rises, so too does the price of the ES contract, and vice-versa. This direct correlation is fundamental to understanding ES futures trading. For instance, a strong positive economic report leading to increased investor confidence will likely push the S&P 500 higher, consequently increasing the price of the ES contract.

Conversely, negative news about corporate earnings or geopolitical instability might cause the index and the futures contract to fall. This relationship isn’t always a perfect 1:1 mirroring, due to other market forces, but it forms the bedrock of price determination.

Market Sentiment and Speculation

Market sentiment plays a crucial role in influencing ES futures prices, often exceeding the direct impact of the underlying index’s movement. Optimistic sentiment, fueled by factors like positive economic forecasts or technological breakthroughs, can lead to higher prices even if the S&P 500 shows only moderate growth. Conversely, fear and uncertainty, perhaps stemming from inflation concerns or political turmoil, can drive prices down regardless of the index’s underlying performance.

This speculative element introduces volatility and can lead to significant price discrepancies between the index and the futures contract in the short term.

Interest Rates and Their Influence

Interest rates exert a less direct but still significant influence on ES futures prices. Higher interest rates generally increase the cost of borrowing, making it less attractive for investors to hold long positions in futures contracts. This is because the opportunity cost of tying up capital in a futures contract increases. Conversely, lower interest rates can stimulate demand for ES futures, pushing prices higher.

The impact of interest rate changes is often less immediate than the impact of index performance or market sentiment, but it’s a factor that should be considered in long-term price forecasting. The Federal Reserve’s monetary policy decisions, therefore, indirectly impact ES futures prices.

Comparison of ES Futures and S&P 500 Index Price Movements

While ES futures prices generally track the S&P 500 index closely, discrepancies can and do occur. These discrepancies are usually short-lived, and the longer the timeframe considered, the closer the correlation becomes. However, during periods of high volatility or significant market events, short-term deviations can be substantial. Factors like market sentiment, speculation, and interest rates contribute to these temporary divergences.

Understanding these factors is crucial for discerning whether a price movement in the ES contract is simply mirroring the S&P 500 or is influenced by other market forces. For example, a sudden surge in market volatility might cause a larger price swing in the ES contract compared to the underlying index’s movement due to increased hedging activity and speculative trading.

Calculating the Total Cost of an ES Futures Contract: Es Futures Contract Cost

Trading ES futures contracts involves more than just the price of the contract itself. Several other costs contribute to the overall expense, and understanding these is crucial for effective risk management and profitability. This section details the calculation of the total cost, providing examples to illustrate the process.

Components of the Total Cost

The total cost of an ES futures contract comprises several key elements. A thorough understanding of each component is vital for accurate cost estimation and effective trading strategy development. Ignoring even minor costs can lead to inaccurate financial planning and potentially impact trading performance.

- Initial Margin: This is the amount of money required to open a position. It acts as collateral, protecting the broker against potential losses. Margin requirements vary depending on the broker and market conditions, typically expressed as a percentage of the contract’s value. For example, a 5% margin requirement on a contract valued at $50,000 would necessitate an initial margin of $2,500.

- Commissions: Brokers charge commissions for executing trades. These fees vary depending on the broker, trading volume, and contract size. Some brokers offer tiered commission structures, providing discounts for higher trading volumes.

- Fees: Beyond commissions, other fees may apply, such as regulatory fees or exchange fees. These are typically smaller than commissions but contribute to the overall cost.

- Interest (on Margin): If the margin balance is negative (a loss), interest might accrue on the borrowed amount. This interest is charged by the broker and adds to the total cost of the trade.

- Rollover Fees (if applicable): When holding a futures contract beyond its expiration date, a rollover to a subsequent contract is necessary. This often involves a small fee, depending on the broker and market conditions.

Calculating Total Cost: A Step-by-Step Guide

Estimating the total cost before entering a trade is a prudent practice. This process involves a systematic approach, considering all relevant cost components.

- Determine Contract Value: Identify the current market price of the ES futures contract. This is usually quoted in points, with each point representing a certain dollar value (typically $12.50 for E-mini S&P 500 futures).

- Calculate Initial Margin: Multiply the contract value by the broker’s margin requirement (expressed as a percentage). This will provide the amount of money needed to open the position.

- Estimate Commissions: Check the broker’s commission schedule to determine the cost per contract. Multiply this by the number of contracts traded.

- Estimate Fees: Inquire with your broker about any additional fees that may apply, such as regulatory or exchange fees.

- Calculate Total Cost: Sum the initial margin, commissions, and fees to arrive at the total estimated cost of the trade. Note that potential interest charges and rollover fees are not included in this initial calculation as they are dependent on the holding period and trade outcome.

Example Calculation

Let’s consider an example. Suppose an investor wants to buy one E-mini S&P 500 futures contract (ES) at a price of 4,000 points. The broker’s margin requirement is 5%, and the commission per contract is $5.00. The contract value is 4000 points – $12.50/point = $50,000.* Initial Margin: $50,0000.05 = $2,500

Commission

$5.00

Total Estimated Cost (excluding potential interest and rollover)

$2,505.00

Now, let’s consider a scenario with two contracts at the same price and conditions.* Initial Margin: ($50,000

- 2)

- 0.05 = $5,000

- 2 contracts = $10.00

Commission

$5.00/contract

Total Estimated Cost (excluding potential interest and rollover)

$5,010.00

This demonstrates how the total cost increases proportionally with the number of contracts traded. Remember that this is an estimate; the actual cost might vary slightly depending on the specific circumstances.

Margin Requirements and Their Impact on Cost

Trading ES futures contracts involves leveraging, meaning you don’t need to put up the full contract value to participate. Instead, you deposit a smaller amount called margin, which acts as collateral to secure your position. Understanding margin requirements is crucial because they directly affect the cost of trading and your potential profit or loss.Margin requirements influence the overall cost of trading ES futures primarily through the impact on capital utilization and potential losses.

While margin itself isn’t a direct cost like commissions, it represents a significant capital commitment. The higher the margin requirement, the more capital a trader needs to tie up, reducing their ability to invest in other opportunities. Furthermore, substantial price movements against a trader’s position can lead to margin calls, requiring additional funds to be deposited quickly to maintain the position.

Failure to meet a margin call results in the liquidation of the position, potentially leading to significant losses exceeding the initial margin.

Initial Margin and Maintenance Margin

Initial margin is the amount required to open a new position. Maintenance margin is the minimum amount required to keep a position open. If the account equity falls below the maintenance margin level due to adverse price movements, a margin call is issued. For example, let’s say the initial margin for one ES contract is $5,000, and the maintenance margin is $4,000.

A trader opening one contract must deposit $5,000. If the market moves against their position, and their equity drops to $4,000, they will receive a margin call, requiring them to deposit additional funds to bring their equity back above the maintenance margin level. Failure to meet this call will lead to liquidation of the position.

Margin Scenarios and Corresponding Costs, Es futures contract cost

Consider two scenarios: Trader A opens one ES contract with an initial margin of $5,000. Trader B opens two contracts, requiring $10,000 initial margin. Both experience a 1% adverse price movement. Trader A’s loss might be $500, while Trader B’s loss is $1,000. However, therelative* cost of the loss is the same (1% of their capital tied up).

The difference lies in the absolute dollar amount and the potential for margin calls. Trader B is more exposed and faces a higher risk of a margin call.

Impact of Margin Changes on Profitability

Changes in margin requirements, often implemented by exchanges due to market volatility, can significantly affect profitability. An increase in margin requirements forces traders to commit more capital, reducing their leverage and potentially limiting their position sizes. This directly reduces potential profits, even if the market moves favorably. Conversely, a decrease in margin requirements can increase leverage and potential profits, but also increases the risk of larger losses if the market moves against the trader’s position.

For instance, if margin requirements double from $5,000 to $10,000, a trader can only hold half as many contracts with the same capital, thereby halving their potential profit for the same price movement.

Commission Structures and Their Influence

Understanding commission structures is crucial for effectively managing the overall cost of trading ES futures contracts. Different brokers offer various fee models, each impacting profitability differently depending on trading frequency and volume. Careful consideration of these structures is essential for optimizing trading expenses.Commission structures significantly affect the final cost of an ES futures contract. While the contract price itself is a major factor, commissions represent an additional, often overlooked, expense that can accumulate substantially over time.

This section details common commission structures and their impact on trading costs.

Types of Commission Structures

Brokers typically offer several commission structures for ES futures trading. These include fixed-rate commissions, tiered commissions, and commissions based on a percentage of the trade value. The choice of structure depends on individual trading styles and volume. A high-frequency trader, for example, might benefit from a tiered structure offering reduced rates for larger volumes, while a less frequent trader might find a fixed-rate structure simpler to manage.

Comparison of Commission Costs

Fixed-rate commissions charge a flat fee per contract traded, regardless of the contract’s value. This offers predictability but can be less cost-effective for high-volume traders. Tiered commissions offer decreasing rates per contract as trading volume increases. This incentivizes higher trading activity and can be more beneficial for active traders. Percentage-based commissions charge a percentage of the contract’s value, meaning costs increase proportionally with the contract price.

This structure is less common for ES futures due to the relatively high value of each contract.

Impact of Commission Fees on Overall Trading Costs

Commission fees directly impact the profitability of each trade. A seemingly small commission per contract can accumulate significantly over numerous trades, especially for active traders. Therefore, understanding and comparing commission structures is vital for maximizing returns. Failing to account for commission fees in trading calculations can lead to inaccurate profit/loss assessments and potentially poor trading decisions. The impact of commission fees is particularly pronounced in sideways or slightly losing markets, where the accumulated commission fees can quickly erode profits.

Commission Costs Across Different Brokers

The following table illustrates the potential commission costs for various trade sizes across three hypothetical brokers, each offering a different commission structure. Note that these are examples and actual commissions vary widely among brokers and may change over time. It’s crucial to check with individual brokers for their current fee schedules.

| Trade Size (Contracts) | Broker A (Fixed Rate: $5/contract) | Broker B (Tiered Rate: $7/$5/$3) | Broker C (Percentage: 0.01%) |

|---|---|---|---|

| 1 | $5 | $7 | $0.5 (assuming $50,000 contract value) |

| 5 | $25 | $25 | $2.5 (assuming $50,000 contract value) |

| 10 | $50 | $20 | $5 (assuming $50,000 contract value) |

| 20 | $100 | $20 | $10 (assuming $50,000 contract value) |

Visualizing ES Futures Contract Cost

Understanding the cost dynamics of an ES futures contract requires visualizing its price movements and how various factors influence the overall expense. This involves examining price charts, understanding margin requirements, and appreciating the impact of commissions.ES futures contract prices are typically displayed on charts showing price against time, often using candlestick or line graphs. Key cost-related features include the contract’s price itself (the cost of acquiring the contract), the daily price fluctuations (indicating potential gains or losses), and the margin requirements which are displayed as a separate line or value.

These charts visually represent the volatility of the contract and the potential for both profit and loss. The price axis displays the contract’s price in dollars, while the horizontal axis represents time, typically in days or weeks.

ES Futures Contract Price Fluctuations: A Hypothetical Scenario

Let’s consider a hypothetical scenario involving an ES futures contract with a starting price of $4000 on January 1st. Over the next month, the price fluctuates. On January 5th, positive news pushes the price up to $4100. However, by January 12th, negative economic data causes a drop to $3950. The price then recovers somewhat, reaching $4050 by January 20th, before settling at $4080 by the end of the month.

This scenario illustrates the typical price volatility inherent in futures contracts, showcasing how the cost – the price of the contract – can change significantly in a relatively short period. This volatility directly impacts the potential profit or loss for the trader. The initial cost of $4000 is not static; it is subject to daily market movements.

Relationship Between Contract Price and Margin Requirements

Margin requirements represent the amount of money a trader must deposit with their broker to secure the contract. This is not part of the contract price itself, but a crucial cost factor. Imagine our hypothetical scenario again. Let’s assume a margin requirement of $5000 per contract. Even if the contract price fluctuates, the margin remains relatively stable, although the broker may adjust it based on market volatility.

If the contract price drops significantly, the trader might receive a margin call, requiring them to deposit additional funds to maintain their position and avoid liquidation. The margin is a critical cost element because, although not directly part of the contract’s purchase price, it represents a significant capital commitment. A larger price fluctuation necessitates a larger margin requirement, increasing the potential cost of holding the position.

Therefore, while the contract price is the initial cost, the margin requirement is a crucial element influencing the overall cost of trading ES futures.

So, there you have it – a clearer picture of the often-overlooked costs associated with ES futures contracts. Remember, understanding these costs isn’t just about minimizing expenses; it’s about making smarter, more informed trading decisions. By carefully considering all the factors we’ve discussed – from commissions and margin requirements to the influence of market sentiment – you can significantly improve your chances of success in this dynamic market.

Happy trading!

Quick FAQs

What is the minimum account balance needed to trade ES futures?

Minimum account balances vary significantly depending on your broker and their margin requirements. It’s best to check directly with your chosen broker.

How often are ES futures contracts settled?

ES futures contracts are typically settled daily through a process called marking to market. This means daily gains or losses are reflected in your account balance.

Are there any tax implications for trading ES futures?

Yes, profits from ES futures trading are considered capital gains and are taxable. Consult a tax professional for specific advice regarding your situation.

Can I use leverage when trading ES futures?

Yes, leverage is a common feature of futures trading. However, leverage magnifies both profits and losses, so it’s crucial to understand the risks involved.