How much do options contracts cost sets the stage for this enthralling narrative, offering readers a glimpse into a world of financial instruments that can be both lucrative and risky. Options contracts, a type of derivative, give buyers the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date.

Understanding the cost of these contracts is crucial for making informed investment decisions.

The price of an options contract, known as the premium, is influenced by a multitude of factors. The underlying asset’s price, its volatility, the time until expiration, and prevailing interest rates all play a role in determining the cost. As the price of the underlying asset increases, the value of a call option typically rises, while the value of a put option decreases.

Volatility, a measure of price fluctuations, also affects the premium, with higher volatility generally leading to higher premiums. The time to expiration also influences the cost, with longer-term options typically commanding higher premiums.

Understanding Option Contract Basics: How Much Do Options Contracts Cost

Options contracts are financial instruments that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. They are popular among investors seeking to manage risk, generate income, or speculate on market movements.

Types of Options Contracts

Options contracts can be categorized into two main types: call options and put options.

- Call options give the holder the right to buy the underlying asset at the strike price. Call options are beneficial when the investor believes the price of the underlying asset will increase.

- Put options give the holder the right to sell the underlying asset at the strike price. Put options are beneficial when the investor believes the price of the underlying asset will decrease.

Key Terms Associated with Options Contracts

Understanding the following key terms is crucial for comprehending options contracts:

- Strike price: The predetermined price at which the holder can buy or sell the underlying asset.

- Expiration date: The date on which the option contract expires.

- Premium: The price paid by the buyer to purchase the option contract. The premium represents the cost of the right to buy or sell the underlying asset.

- Underlying asset: The asset that the option contract is based on, such as stocks, commodities, indices, or currencies.

Real-World Examples of Options Contracts

Here are some real-world examples of how options contracts are used:

- Hedging risk: A company that expects the price of its raw materials to increase can buy call options to protect itself from price fluctuations. If the price of the raw materials rises, the company can exercise its call options and buy the materials at the strike price, mitigating the impact of the price increase.

- Speculating on market movements: An investor who believes that a particular stock will increase in value can buy call options on that stock. If the stock price rises, the investor can exercise the call option and buy the stock at the strike price, profiting from the price difference.

- Generating income: An investor can sell call options on a stock they own, generating income from the premium. However, the investor must be prepared to sell the stock at the strike price if the buyer exercises the option.

Factors Influencing Option Contract Cost

The cost of an options contract, known as the premium, is determined by several factors that influence the likelihood of the option being exercised. These factors play a crucial role in determining the price an investor pays for the right, but not the obligation, to buy or sell an underlying asset at a specific price within a specified time frame.

Underlying Asset’s Price

The current price of the underlying asset is a significant factor affecting the cost of an options contract. For a call option, a higher underlying asset price generally leads to a higher premium. Conversely, a lower underlying asset price typically results in a lower premium. This relationship is directly related to the intrinsic value of the option. Intrinsic value represents the immediate profit an option holder would realize if they exercised the option.

Volatility

Volatility, a measure of price fluctuations in the underlying asset, plays a crucial role in determining the cost of an options contract. Higher volatility implies greater uncertainty about the future price movement of the asset, making options more valuable. This is because a higher chance of large price swings increases the likelihood of the option being exercised, resulting in a higher premium.

Conversely, lower volatility, indicating less price fluctuation, leads to a lower premium.

Time to Expiration

The time remaining until the option expires, known as the time value, is a significant factor in the cost of an options contract. The longer the time to expiration, the higher the premium. This is because there is a greater chance for the underlying asset’s price to move favorably for the option holder within a longer timeframe. As the expiration date approaches, the time value decays, and the premium decreases.

Interest Rates

Interest rates can influence the cost of options contracts, although their impact is generally less pronounced than other factors. For call options, higher interest rates tend to increase the premium, as the cost of carrying the underlying asset is higher. Conversely, lower interest rates tend to decrease the premium. For put options, the relationship is reversed, with higher interest rates generally leading to lower premiums.

Table Illustrating Factor Combinations

The following table illustrates how different combinations of the discussed factors can influence the cost of an option:| Factor | Impact on Premium ||————————————-|——————-|| Higher Underlying Asset Price | Higher || Lower Underlying Asset Price | Lower || Higher Volatility | Higher || Lower Volatility | Lower || Longer Time to Expiration | Higher || Shorter Time to Expiration | Lower || Higher Interest Rates (Call Options) | Higher || Lower Interest Rates (Call Options) | Lower || Higher Interest Rates (Put Options) | Lower || Lower Interest Rates (Put Options) | Higher |It is important to note that these factors are interconnected and can interact in complex ways.

Therefore, the premium of an options contract is a dynamic price that reflects the interplay of these factors.

Option Pricing Models

Option pricing models are mathematical tools used to estimate the fair value of an option contract. These models consider various factors, including the underlying asset’s price, time to expiration, volatility, interest rates, and dividends, to determine the theoretical price of an option. The accuracy and reliability of these models play a crucial role in option trading and risk management.

The Black-Scholes Model

The Black-Scholes model is a foundational option pricing model developed by Fischer Black and Myron Scholes in 1973. It is a cornerstone in financial mathematics and is widely used by traders and investors to price European options. This model assumes that the underlying asset price follows a geometric Brownian motion, meaning that price changes are random and normally distributed.The Black-Scholes model calculates the theoretical value of an option based on the following key inputs:* Underlying asset price (S): The current market price of the underlying asset.

Strike price (K)

The price at which the option can be exercised.

Time to expiration (T)

The remaining time until the option expires.

Risk-free interest rate (r)

The rate of return on a risk-free investment, such as a government bond.

Volatility (σ)

The standard deviation of the underlying asset’s price movements.The model’s formula is complex and involves several mathematical concepts, but it essentially calculates the present value of the expected payoff from the option.

The Black-Scholes formula for a European call option is:C = S

- N(d1)

- K

- e^(-rT)

- N(d2)

where:

- C is the call option price.

- N(d1) and N(d2) are cumulative distribution functions of the standard normal distribution.

- e is the exponential function.

- d1 and d2 are calculated based on the inputs mentioned above.

The Black-Scholes model has had a significant impact on the financial industry, earning its creators a Nobel Prize in Economics. Its contribution to option pricing is immense, as it provides a standardized framework for valuing options and managing risk. However, it is essential to acknowledge that the model has limitations, including:* Assumptions: The model relies on certain assumptions, such as the underlying asset’s price following a geometric Brownian motion, which may not always hold true in reality.

Volatility

Estimating volatility accurately is crucial for the model’s accuracy, but volatility can be difficult to predict.

Real-world complexities

The model does not account for factors such as transaction costs, dividends, and other real-world complexities.

Other Option Pricing Models

Besides the Black-Scholes model, several other models are used for option pricing. Some of the commonly used models include:* Binomial Model: This model simplifies the underlying asset price movement into discrete steps, representing an up or down movement. It uses a tree-like structure to calculate the option price by working backward from the expiration date. The binomial model is relatively straightforward to understand and implement, making it a valuable tool for educational purposes and for pricing options with limited time to expiration.

Monte Carlo Simulations

This model involves generating a large number of random paths for the underlying asset price. By simulating these paths, the model estimates the option price based on the average payoff across all simulations. Monte Carlo simulations are particularly useful for pricing options with complex features or underlying assets that exhibit non-standard price movements.

Finite Difference Methods

This model uses numerical methods to solve the partial differential equation that governs option pricing. It involves discretizing the time and price space and then iteratively calculating the option price at each point in the grid. Finite difference methods are generally more computationally intensive than other models but can handle more complex option structures and underlying asset models.

Comparison of Option Pricing Models

| Model | Strengths | Weaknesses ||—|—|—|| Black-Scholes | Widely accepted and used; provides a standardized framework for option pricing; relatively simple to implement. | Assumes a constant volatility; does not account for dividends or transaction costs; may not be accurate for options with complex features. || Binomial Model | Easy to understand and implement; can handle options with discrete dividends; useful for educational purposes.

| May not be accurate for options with long time to expiration; can be computationally intensive for options with many steps. || Monte Carlo Simulations | Can handle complex options and underlying assets; more realistic than other models in some cases. | Can be computationally intensive; may not be accurate for options with short time to expiration; relies on assumptions about the underlying asset’s price distribution.

|| Finite Difference Methods | Can handle complex options and underlying assets; more accurate than other models in some cases. | Can be computationally intensive; requires specialized knowledge and software. |Each option pricing model has its strengths and weaknesses. The choice of model depends on the specific option being priced, the underlying asset’s characteristics, and the desired level of accuracy.

Option Contract Costs in Practice

The cost of an options contract is determined by various factors, including the underlying asset’s price, time to expiration, volatility, and interest rates. These factors influence the premium, which is the price paid for the option contract. Understanding how these factors affect the cost of an options contract is crucial for investors to make informed decisions about buying or selling options.

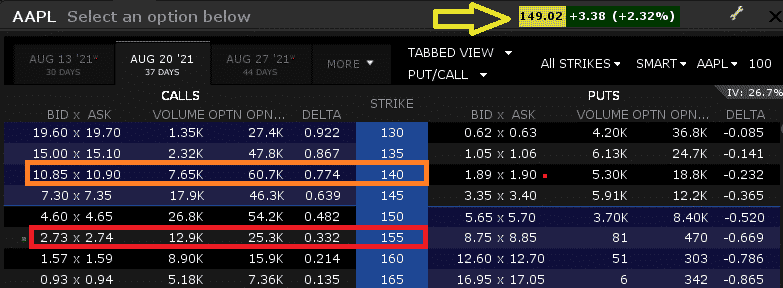

Real-World Option Contract Prices

Option contract prices vary widely depending on the underlying asset, the strike price, the expiration date, and other factors. Here are some examples of real-world option contract prices for various underlying assets:

- Apple (AAPL) Stock Options: A call option on AAPL with a strike price of $170 and an expiration date of January 2024 might cost around $10. This means that the buyer of the option contract would pay $1,000 (10 x 100) for the right to purchase 100 shares of AAPL at $170 per share before January

2024. - Tesla (TSLA) Stock Options: A put option on TSLA with a strike price of $250 and an expiration date of June 2024 might cost around $15. This means that the buyer of the option contract would pay $1,500 (15 x 100) for the right to sell 100 shares of TSLA at $250 per share before June

2024. - Gold (GC) Futures Options: A call option on GC with a strike price of $1,800 and an expiration date of December 2024 might cost around $20. This means that the buyer of the option contract would pay $2,000 (20 x 100) for the right to purchase 100 ounces of gold at $1,800 per ounce before December 2024.

Calculating the Cost of an Options Contract

The cost of an options contract can be calculated by multiplying the premium by the number of contracts purchased. For example, if the premium for an AAPL call option is $10 and the investor purchases 5 contracts, the total cost of the options contract would be $500 (10 x 5 x 100).

Relationship Between Option Contract Cost and Potential Profit or Loss

The cost of an options contract is directly related to the potential profit or loss for the buyer or seller.

- For the buyer: The potential profit is unlimited, while the maximum loss is limited to the premium paid.

- For the seller: The potential profit is limited to the premium received, while the maximum loss is unlimited.

For example, if an investor buys an AAPL call option for $10 and the price of AAPL rises to $200, the investor can exercise the option to purchase 100 shares of AAPL at $170 and immediately sell them in the market for $200, making a profit of $30 per share or $3,000 in total. However, if the price of AAPL falls below $170, the investor will not exercise the option and will only lose the premium paid ($1,000).

Trading Options Contracts

Options contracts are traded on specialized exchanges and through brokers, allowing investors to participate in the market. This section will explore the different ways to trade options contracts, associated costs and fees, and the process of buying and selling options contracts.

Trading Options Contracts Through Exchanges

Options contracts are traded on organized exchanges like the Chicago Board Options Exchange (CBOE) and the American Stock Exchange (AMEX). These exchanges provide a centralized platform for buying and selling options contracts, ensuring transparency and fairness in pricing.

Trading Options Contracts Through Brokers

Investors can also trade options contracts through brokers. Brokers act as intermediaries between investors and exchanges, facilitating the execution of trades. They offer platforms for placing orders, managing accounts, and accessing market data.

Costs and Fees Associated with Trading Options Contracts

Trading options contracts involves various costs and fees. These include:

- Brokerage Fees: Brokers charge commissions for executing trades. These fees vary depending on the broker and the type of account.

- Exchange Fees: Exchanges also charge fees for trading options contracts. These fees are typically a small percentage of the contract’s value.

- Regulatory Fees: Regulatory fees are levied by the Securities and Exchange Commission (SEC) and other regulatory bodies.

- Clearing Fees: Clearing firms handle the settlement of trades and charge fees for their services.

- Margin Requirements: Some brokers require margin deposits to cover potential losses on options trades.

Buying and Selling Options Contracts, How much do options contracts cost

The process of buying and selling options contracts involves placing orders through a broker. There are various order types available, each with its own characteristics.

- Market Orders: Market orders are executed at the best available price in the market. They offer speed but may not guarantee the desired price.

- Limit Orders: Limit orders specify a maximum price for buying or a minimum price for selling. They provide price control but may not be executed if the desired price is not reached.

- Stop Orders: Stop orders are triggered when the underlying asset reaches a specified price. They are used to limit losses or to enter a trade when a certain price level is reached.

Options contracts can be complex financial instruments, but understanding their costs is essential for navigating the world of derivatives. By analyzing the various factors that influence the premium, investors can make informed decisions about buying or selling options contracts. Remember, the cost of an option contract is just one piece of the puzzle; careful consideration of potential risks and rewards is paramount.

FAQ Section

What is the difference between a call option and a put option?

A call option gives the buyer the right to purchase the underlying asset at the strike price, while a put option gives the buyer the right to sell the underlying asset at the strike price.

How is the premium of an options contract calculated?

The premium is determined by a complex interplay of factors, including the underlying asset’s price, volatility, time to expiration, and interest rates. Various pricing models, such as the Black-Scholes model, are used to estimate the premium.

Are there any fees associated with trading options contracts?

Yes, there are typically brokerage fees, exchange fees, and potentially other charges associated with trading options contracts. These fees can vary depending on the broker and the specific contract.

What are some examples of real-world options contract prices?

The price of an options contract can vary significantly depending on the underlying asset, the strike price, the expiration date, and other factors. For example, an option contract on a stock like Apple might cost a few dollars, while an option contract on a commodity like oil might cost hundreds of dollars.

Can I trade options contracts on my own?

While you can trade options contracts on your own, it’s important to have a thorough understanding of the risks involved. It’s recommended to seek professional advice from a qualified financial advisor before trading options contracts.