How much does a gold futures contract cost? This question is at the heart of understanding the world of gold futures trading, a market where investors and traders speculate on the price of gold, aiming to capitalize on price fluctuations. Gold futures contracts are agreements to buy or sell a specific amount of gold at a predetermined price on a future date.

Unlike spot gold purchases, where you take immediate possession of the metal, futures contracts allow you to lock in a price for future delivery, providing potential advantages for hedging, speculation, or arbitrage.

Understanding the cost of a gold futures contract involves exploring various factors, including initial margin requirements, maintenance margins, brokerage fees, and commissions. The initial margin, a percentage of the contract value, acts as a security deposit to ensure your ability to fulfill the contract obligations. The maintenance margin, a lower percentage than the initial margin, ensures that the contract remains financially viable throughout its life.

These costs, along with other trading expenses, contribute to the overall cost of participating in the gold futures market.

Understanding Gold Futures Contracts

A gold futures contract is a standardized agreement to buy or sell a specific amount of gold at a predetermined price on a future date. This differs from spot gold purchases, where you buy the physical metal immediately at the prevailing market price. Futures contracts are traded on exchanges, allowing investors to speculate on the price of gold or hedge against price fluctuations.

Key Features of Gold Futures Contracts

Futures contracts have several key features that define their terms and conditions:

- Contract Size: The amount of gold specified in the contract. For example, a gold futures contract on the COMEX exchange is for 100 troy ounces of gold.

- Trading Unit: The minimum number of contracts that can be traded. Most gold futures contracts are traded in units of 100 ounces, although some exchanges may offer smaller units.

- Delivery Date: The date on which the buyer is obligated to take delivery of the gold, and the seller is obligated to deliver it. Gold futures contracts typically have delivery dates ranging from a few months to several years into the future.

Types of Gold Futures Contracts

Different exchanges offer various types of gold futures contracts, each with its own specifications. Some common types include:

- COMEX Gold Futures: These are the most widely traded gold futures contracts in the world. They are traded on the COMEX division of the New York Mercantile Exchange (NYMEX). COMEX gold futures contracts have a contract size of 100 troy ounces and are available for delivery dates ranging from a few months to several years into the future.

- London Bullion Market Association (LBMA) Gold Futures: These contracts are traded on the London Metal Exchange (LME). LBMA gold futures contracts have a contract size of 100 kilograms and are available for delivery dates ranging from a few months to several years into the future.

- Shanghai Gold Exchange (SGE) Gold Futures: These contracts are traded on the SGE. SGE gold futures contracts have a contract size of 1 kilogram and are available for delivery dates ranging from a few months to several years into the future.

Factors Influencing Gold Futures Contract Prices

The price of gold futures contracts is determined by a complex interplay of various factors, reflecting the inherent value of gold as a safe-haven asset and its role in the global financial system. These factors can be categorized into economic, market, and geopolitical influences.

Global Economic Conditions

Global economic conditions play a significant role in shaping gold futures prices. Gold is often seen as a safe-haven asset during times of economic uncertainty. When economic indicators suggest a weakening economy, investors may flock to gold as a hedge against inflation, currency devaluation, and market volatility. Conversely, a robust global economy with low inflation and stable growth can dampen demand for gold, leading to lower prices.

- Interest Rates: Rising interest rates typically exert downward pressure on gold prices. This is because higher interest rates increase the opportunity cost of holding non-interest-bearing assets like gold. Investors may prefer to invest in bonds or other assets that offer higher returns.

- Inflation: Inflation can have a mixed impact on gold prices. While gold is often seen as a hedge against inflation, high inflation can also lead to increased interest rates, which can negatively impact gold demand. Gold’s historical performance as an inflation hedge depends on the specific inflationary environment and the expectations of investors.

- Currency Fluctuations: Gold is priced in US dollars. A weakening US dollar can make gold more attractive to international investors, driving up demand and prices. Conversely, a strengthening US dollar can make gold less attractive, leading to lower prices.

Supply and Demand Dynamics

The supply and demand dynamics of the gold market are crucial determinants of gold futures prices. Gold is a finite resource, and its supply is influenced by factors such as mining output, recycling, and central bank holdings. Demand for gold comes from various sources, including jewelry, industrial applications, and investment.

- Mining Production: Gold mining production plays a significant role in shaping the supply of gold. Increased mining output can lead to lower prices, while reduced output can push prices higher. Mining costs, technological advancements, and geopolitical factors can influence mining production levels.

- Investment Demand: Investment demand for gold can significantly impact prices. Investors often turn to gold during periods of economic uncertainty, geopolitical instability, or market volatility. Central banks also play a role in gold demand, as they can buy or sell gold to influence market prices or manage their reserves.

- Jewelry and Industrial Demand: Gold is used in jewelry, electronics, and other industries. Changes in consumer demand for gold jewelry or industrial applications can impact gold prices. Economic growth, fashion trends, and technological advancements can influence demand in these sectors.

Geopolitical Events

Geopolitical events can significantly impact gold futures prices. Gold is often perceived as a safe-haven asset during times of geopolitical uncertainty or conflict. Events such as wars, political instability, or trade tensions can lead to increased demand for gold, driving up prices. For example, the 2008 financial crisis and the 2014 annexation of Crimea by Russia led to significant increases in gold prices.

- Political Instability: Political instability in major gold-producing countries or regions can disrupt supply chains and lead to price volatility. For example, political unrest in South Africa, a major gold producer, can impact gold production and prices.

- Trade Wars: Trade wars and protectionist policies can create uncertainty and volatility in the global economy, driving investors toward safe-haven assets like gold. The US-China trade war, for example, has led to increased gold demand and prices.

Cost Components of a Gold Futures Contract

The cost of trading gold futures contracts involves various components, each contributing to the overall financial commitment associated with this market. Understanding these costs is crucial for traders to effectively manage their risk and optimize their trading strategies.

Initial Margin Requirement

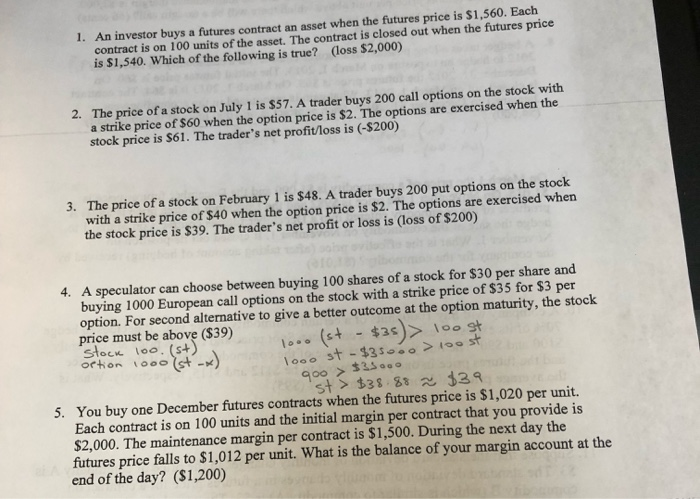

The initial margin requirement is the amount of money that traders must deposit with their brokerage firm to open a gold futures position. This margin serves as a guarantee against potential losses and ensures that traders can fulfill their contractual obligations. The initial margin requirement is a percentage of the contract’s total value, typically ranging from 5% to 10%.

The initial margin requirement for a gold futures contract is a percentage of the contract’s total value, typically ranging from 5% to 10%.

For instance, if a gold futures contract is worth $100,000, and the initial margin requirement is 5%, the trader must deposit $5,000. The initial margin requirement is subject to change based on market volatility and the broker’s policies.

Maintenance Margin Requirement

The maintenance margin requirement is the minimum amount of money that must be maintained in the trader’s margin account to keep the position open. If the account balance falls below the maintenance margin, the trader receives a margin call, requiring them to deposit additional funds to bring the account back to the initial margin level. This ensures that traders have sufficient funds to cover potential losses and prevent defaulting on their contracts.

The maintenance margin requirement is typically lower than the initial margin requirement, and it is also subject to change based on market conditions.

Other Costs Associated with Gold Futures Trading

In addition to margin requirements, traders incur other costs when trading gold futures contracts. These include:

- Brokerage Fees and Commissions: Brokerage firms charge fees and commissions for facilitating trades. These fees can vary depending on the brokerage firm, the trading platform used, and the volume of trades executed.

- Exchange Fees: Exchanges where gold futures contracts are traded charge fees for clearing and settling transactions.

- Interest Charges: If the trader’s margin account balance falls below the initial margin requirement, the broker may charge interest on the borrowed funds.

Trading Gold Futures Contracts

Trading gold futures contracts involves buying or selling contracts that represent the right to buy or sell a specific amount of gold at a predetermined price on a future date. These contracts are traded on regulated exchanges, providing a standardized and transparent marketplace for participants.

Trading Methods

Trading gold futures contracts is typically conducted through reputable brokerage firms that offer access to futures exchanges. These brokers act as intermediaries, facilitating the execution of trades on behalf of their clients.

- Exchange-Traded Trading: The most common method involves trading gold futures contracts directly on exchanges like the COMEX (Commodity Exchange) division of the New York Mercantile Exchange (NYMEX) or the CME Group. These exchanges provide a regulated and transparent platform for trading futures contracts.

- Broker-Assisted Trading: Investors can also trade gold futures contracts through brokers who offer access to the exchanges. Brokers provide trading platforms, market analysis, and other support services to their clients.

Opening and Closing Gold Futures Contracts, How much does a gold futures contract cost

The process of opening and closing a gold futures contract involves placing orders with a broker, specifying the desired contract size, price, and expiration date.

Opening a Contract

- Order Types: Investors can place various order types, such as market orders (executed at the best available price), limit orders (executed at a specified price or better), and stop orders (triggered when the market reaches a predetermined price).

- Execution Methods: Orders can be executed through phone calls, online trading platforms, or through a broker’s trading desk.

Closing a Contract

- Offsetting the Position: Closing a futures contract involves placing an order to offset the original position. For example, if an investor bought a gold futures contract, they would close it by selling an equivalent contract.

- Delivery: Alternatively, investors can choose to take physical delivery of the gold at the contract’s expiration date. However, this option is less common, as most investors prefer to offset their positions before expiration.

Risks and Rewards of Trading Gold Futures

Trading gold futures contracts carries inherent risks and potential rewards that investors should carefully consider.

Risks

- Market Volatility: Gold prices can fluctuate significantly, leading to substantial losses if the market moves against an investor’s position.

- Leverage: Futures contracts allow investors to control a large amount of gold with a relatively small investment. While leverage can amplify profits, it can also magnify losses.

- Margin Requirements: To open and maintain a futures position, investors need to deposit a certain amount of money, known as margin, as collateral. If the market moves against the investor’s position, they may face margin calls, requiring them to deposit additional funds to cover potential losses.

- Counterparty Risk: Trading futures contracts involves counterparty risk, meaning the possibility that the other party to the contract may default on their obligations.

Rewards

- Potential for High Returns: Gold futures contracts offer the potential for significant returns if the market moves in the investor’s favor.

- Hedge Against Inflation: Gold is often considered a hedge against inflation, as its price tends to rise during periods of economic uncertainty.

- Diversification: Gold futures contracts can provide diversification benefits to a portfolio by adding a non-correlated asset class.

Strategies for Using Gold Futures Contracts

Gold futures contracts offer a versatile tool for investors seeking to manage risk, capitalize on price fluctuations, or implement specific investment strategies. Understanding the different strategies employed by investors in the gold futures market can provide valuable insights into the potential opportunities and challenges associated with these contracts.

Hedging

Hedging involves using gold futures contracts to mitigate potential losses from adverse price movements in the underlying asset. By taking a position opposite to the one held in the spot market, investors can offset potential losses.

- Example: A gold miner may hedge against a decline in gold prices by selling gold futures contracts. If the price of gold falls, the loss on the futures contract would offset the loss on the gold inventory.

Speculation

Speculation involves taking a position in gold futures contracts with the aim of profiting from anticipated price movements. Speculators may go long (buy contracts) if they expect the price of gold to rise or go short (sell contracts) if they anticipate a decline in price.

- Example: An investor may buy gold futures contracts if they believe that geopolitical tensions will lead to an increase in demand for gold as a safe-haven asset.

Arbitrage

Arbitrage involves exploiting price discrepancies between different markets. This strategy involves buying gold futures contracts in one market and simultaneously selling them in another market where the price is higher.

- Example: If the price of gold futures contracts is higher on the COMEX exchange than on the Shanghai Gold Exchange, an arbitrageur could buy contracts on the Shanghai Gold Exchange and simultaneously sell them on the COMEX exchange, profiting from the price difference.

The cost of a gold futures contract is influenced by a combination of factors, including margin requirements, trading fees, and the inherent volatility of the gold market. While futures contracts offer a unique opportunity to participate in the gold market, it’s crucial to understand the potential risks and rewards associated with this type of trading. By carefully considering your investment objectives, risk tolerance, and the cost components of gold futures contracts, you can make informed decisions that align with your financial goals.

FAQ Resource: How Much Does A Gold Futures Contract Cost

What are the main advantages of trading gold futures contracts?

Gold futures contracts offer several advantages, including the ability to leverage your investment, hedge against inflation, and speculate on price movements. They also provide greater liquidity compared to physical gold, allowing for easier entry and exit from positions.

What are the risks associated with gold futures trading?

Gold futures trading involves significant risks, including the potential for substantial losses due to price fluctuations. Market volatility, leverage, and margin calls can all contribute to potential financial losses. It’s essential to carefully manage your risk and understand the intricacies of futures trading before engaging in this market.

How can I learn more about gold futures trading?

There are various resources available to help you learn more about gold futures trading. You can consult with a financial advisor, research reputable online resources, or take educational courses offered by financial institutions. Understanding the fundamentals of futures trading, risk management strategies, and the specific characteristics of the gold market is crucial for success.