How much does 1 futures contract cost? This seemingly simple question opens a door to the complex and fascinating world of futures trading. Understanding the cost of a single futures contract requires delving into several key factors, including contract size, margin requirements, brokerage fees, and the inherent volatility of the underlying asset. This exploration will unravel the intricacies of these elements, providing a clearer picture of the financial commitment involved in participating in this dynamic market.

The price you pay isn’t simply a fixed amount; it’s a dynamic interplay of these factors. Contract size, essentially the quantity of the underlying asset represented by the contract, significantly influences the total cost. Then there are margin requirements – the initial deposit needed to secure the contract – which act as a form of collateral. Brokerage fees and commissions add further layers to the equation, varying across different brokers and trading platforms.

Finally, market volatility, the degree of price fluctuation, can dramatically impact both the initial cost and the potential profit or loss during the contract’s lifespan.

Understanding Futures Contracts

Futures contracts are agreements to buy or sell an asset at a specific price on a future date. Think of it as a promise to exchange something—be it gold, wheat, or even a stock index—at a predetermined price on a specified day. This allows buyers and sellers to hedge against price fluctuations or speculate on future price movements.

Futures Contract Pricing Factors

Several factors influence the price of a futures contract. The most significant is the price of the underlying asset itself. If the price of gold rises in the spot market, the price of a gold futures contract will generally rise as well. Other factors include interest rates (higher rates can increase the cost of carrying the asset until the future date), storage costs (relevant for physical commodities), and supply and demand dynamics for the contract itself.

Market sentiment and geopolitical events can also play a significant role, leading to price volatility. For example, a sudden geopolitical crisis might drastically impact the price of oil futures.

Types of Futures Contracts

Futures contracts cover a wide range of underlying assets. Index futures, for instance, track the performance of a specific stock market index like the S&P 500. This allows investors to gain exposure to the entire index without buying individual stocks. Commodity futures involve agricultural products (e.g., corn, soybeans), precious metals (e.g., gold, silver), and energy resources (e.g., crude oil, natural gas).

Currency futures allow traders to hedge against exchange rate fluctuations.

Futures Contract Characteristics

| Contract Type | Underlying Asset | Trading Exchange | Typical Contract Size |

|---|---|---|---|

| S&P 500 Index Futures | S&P 500 Index | Chicago Mercantile Exchange (CME) | $500 x Index Value |

| Gold Futures | Gold | COMEX (Division of CME) | 100 troy ounces |

| Crude Oil Futures | West Texas Intermediate (WTI) Crude Oil | NYMEX (Division of CME) | 1,000 barrels |

| Corn Futures | Corn | CBOT (Division of CME) | 5,000 bushels |

Contract Size and Price

Understanding the cost of a futures contract requires a deep dive into the concept of contract size. This seemingly simple element significantly influences the overall price and the financial commitment required from a trader. Let’s explore this crucial aspect of futures trading.Contract size refers to the standardized quantity of the underlying asset represented by one futures contract. This quantity is predetermined by the exchange and remains consistent for all contracts of a particular type.

For example, one contract for gold might represent 100 troy ounces, while one contract for corn might represent 5,000 bushels. This standardized quantity is vital for efficient trading and price discovery. The larger the contract size, the greater the price fluctuation with each point move, and consequently, the higher the overall cost of the contract.

Contract Size and its Impact on Cost

The cost of a single futures contract is directly influenced by the contract size and the current market price of the underlying asset. The total cost is calculated by multiplying the contract size by the current market price per unit of the underlying asset. For example, if the price of gold is $1,800 per troy ounce, and the contract size is 100 troy ounces, the total cost of one contract would be $180,000.

This price, however, is not what a trader pays upfront. Instead, they pay a margin, which is a much smaller amount.

Examples of Contract Sizes

Different commodities and financial instruments have different contract sizes. Understanding these variations is crucial for effective risk management.

- Gold (GC): 100 troy ounces. A small price movement can result in significant profit or loss due to the large contract size.

- Crude Oil (CL): 1,000 barrels. The price volatility of crude oil, coupled with this large contract size, necessitates careful consideration of risk.

- Corn (C): 5,000 bushels. Agricultural futures contracts, like corn, can have large contract sizes influenced by the volume typically traded in these markets.

- E-mini S&P 500 (ES): 50 times the S&P 500 index. This contract offers leverage and allows participation in the index with a smaller capital commitment than other index futures.

Contract Size and Margin Requirements

Margin requirements are the amount of money a trader must deposit with their broker to open and maintain a futures position. The margin requirement is a percentage of the total contract value and is set by the exchange and the broker. While the contract size directly impacts the total contract value, it doesn’t directly determine the margin requirement.

However, the larger the contract size and thus the larger the total contract value, the higher the margin requirement in dollar terms. A trader must have sufficient funds to cover potential losses within the margin account. For instance, a larger contract size necessitates a larger margin deposit to protect against adverse price movements. A smaller contract size, in contrast, requires a smaller margin, making it accessible to traders with limited capital.

However, this also limits potential profits.

Margin Requirements and Initial Investment: How Much Does 1 Futures Contract Cost

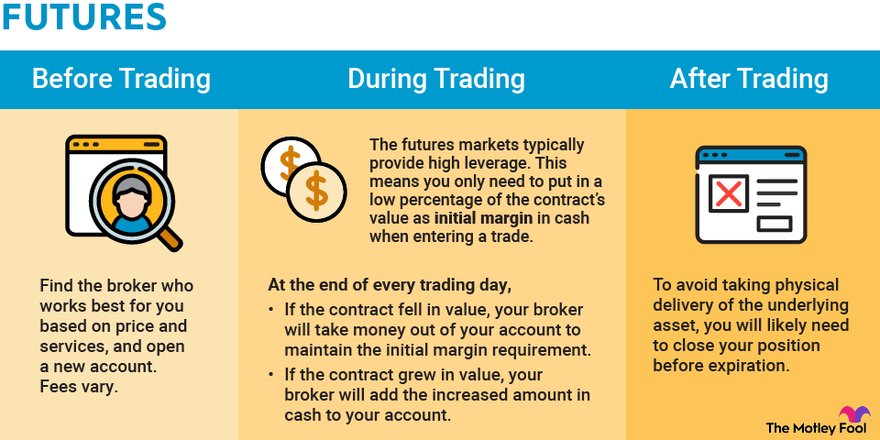

Futures trading, while offering significant profit potential, involves substantial risk. Understanding margin requirements is crucial for managing this risk and ensuring you can participate in the market effectively. This section delves into the mechanics of margin, illustrating its role in futures trading with a practical example.Margin in futures trading is not a down payment; rather, it’s a good-faith deposit that secures your position.

It acts as collateral, guaranteeing your ability to meet your obligations if the market moves against you. The exchange requires this margin to mitigate their risk, ensuring that traders can cover potential losses. Think of it as a security deposit, demonstrating your commitment to the trade.

Initial Margin Requirements, How much does 1 futures contract cost

The initial margin is the amount of money you must deposit into your brokerage account before entering a futures contract. This amount varies depending on several factors, including the specific contract, the underlying asset’s volatility, and the brokerage’s own risk assessment. The exchange sets minimum margin requirements, but brokers often impose higher requirements to further protect themselves. Calculations typically involve a percentage of the contract’s notional value (the total value of the contract at the current market price).

For instance, a contract with a notional value of $100,000 and a 5% initial margin requirement would necessitate a $5,000 deposit.

Maintenance Margin

Maintenance margin represents the minimum amount of equity you must maintain in your account while holding a futures position. It’s typically a lower percentage than the initial margin. If your account equity falls below the maintenance margin level due to adverse price movements, you’ll receive a margin call. This requires you to deposit additional funds to bring your account back up to the initial margin level, thus avoiding a forced liquidation of your position.

Failure to meet a margin call can lead to the broker closing your position to limit potential losses.

Hypothetical Trading Scenario

Let’s imagine trading a corn futures contract. Suppose one contract represents 5,000 bushels of corn, and the current market price is $6 per bushel. The notional value of the contract is therefore $30,000 (5,000 bushels

- $6/bushel). If the initial margin requirement is 5%, you would need to deposit $1,500 ($30,000

- 0.05) to initiate the trade. The maintenance margin might be set at 3%, requiring a minimum equity of $900 ($30,000

- 0.03). If the market price drops, and your account equity falls below $900, you’ll receive a margin call, prompting you to deposit more funds to cover the potential losses. For example, if the price falls to $5.40 per bushel, reducing the notional value to $27,000, your equity might fall below the maintenance margin, triggering a margin call.

Brokerage Fees and Commissions

Trading futures contracts involves more than just the price of the contract itself. Understanding the associated brokerage fees and commissions is crucial for accurate cost calculation and effective risk management. These fees can significantly impact profitability, especially for frequent traders or those dealing with a large number of contracts. Ignoring these costs can lead to inaccurate budget projections and potentially disappointing returns.Brokerage fees and commissions vary considerably across different brokerage firms.

These variations stem from differences in pricing models, service offerings, and the technology used. Some brokers may charge a flat fee per contract, while others employ a tiered system based on trading volume or account size. Additionally, certain brokers might offer discounted rates for high-frequency traders or those managing substantial portfolios. This competitive landscape necessitates careful comparison before selecting a broker.

Brokerage Fee Structures

Different brokers utilize various fee structures. Some common models include per-contract fees, tiered pricing based on trading volume, and commission-based structures. Understanding these structures is essential for choosing a broker that aligns with your trading style and volume.

Comparison of Brokerage Firms

Let’s consider three hypothetical brokerage firms, Broker A, Broker B, and Broker C, to illustrate the differences in their fee structures. Broker A charges a flat fee of $5 per contract, regardless of the contract value or trading frequency. Broker B implements a tiered system. For example, trading up to 100 contracts per month might cost $7 per contract, while exceeding that volume could reduce the cost to $4 per contract.

Broker C, on the other hand, operates on a commission-based model, charging a percentage of the contract value (e.g., 0.1%) with a minimum fee of $10 per trade. These examples highlight the potential differences in cost depending on your trading activity.

Transaction Cost Breakdown

Consider a scenario where you buy and then sell a single futures contract. With Broker A’s flat fee structure, the total brokerage cost would be $10 ($5 for buying and $5 for selling). Using Broker B’s tiered system, assuming you are within the higher volume tier, the cost would be $8. Broker C’s commission-based structure, assuming a contract value of $10,000, would result in a cost of $20 (0.1% of $10,000 for both buying and selling, exceeding the minimum fee).

This example demonstrates how the total transaction cost can vary substantially depending on the chosen broker and the specific fee structure. It’s crucial to factor these costs into your trading strategy.

It’s essential to obtain the most up-to-date fee schedule directly from the brokerage firm before making any trading decisions. Fee structures are subject to change.

Impact of Market Volatility

Market volatility, the degree to which prices fluctuate, significantly influences the cost and risk associated with futures contracts. Understanding this impact is crucial for anyone considering trading in this market. The inherent leverage of futures contracts amplifies both potential profits and losses, making volatility a double-edged sword.Market volatility directly affects the price of a futures contract through supply and demand dynamics.

During periods of high volatility, uncertainty increases, leading to more dramatic price swings. Fear and uncertainty can cause a rush to sell, driving prices down, while periods of optimism can lead to rapid price increases. This fluctuation is amplified by the leveraged nature of futures trading, meaning even small price movements can result in substantial gains or losses for traders.

Volatility’s Influence on Futures Prices

Increased volatility leads to wider price swings in futures contracts. For example, during times of geopolitical instability or unexpected economic news, investors may react swiftly, leading to sharp price increases or decreases. Conversely, periods of low volatility often result in more stable and predictable price movements, offering potentially less risk but also lower potential returns. The magnitude of these price changes is dependent on the underlying asset’s inherent volatility and the market’s overall sentiment.

Historical Examples of Volatility’s Impact

The 1987 Black Monday stock market crash serves as a prime example. The significant drop in stock prices caused a corresponding crash in various stock index futures contracts. Prices plummeted dramatically in a single day, resulting in substantial losses for many traders. Similarly, the events surrounding the COVID-19 pandemic in early 2020 triggered extreme volatility in numerous markets, including oil futures.

The unprecedented demand shock and supply chain disruptions led to wild price swings, with oil futures prices briefly turning negative. These events highlight the potential for extreme price fluctuations during periods of market turmoil.

Volatility and Margin Requirements

The relationship between volatility and margin requirements is directly proportional. As market volatility increases, exchanges typically raise margin requirements to mitigate the risk of substantial losses for both traders and the clearinghouse. Higher margin requirements mean traders need to deposit more funds to maintain their positions, limiting their potential losses but also reducing their leverage. This protective measure helps to ensure market stability and reduce the risk of defaults.

For example, during periods of extreme market stress, margin calls may become more frequent and substantial, potentially forcing traders to liquidate their positions prematurely.

Case Study: Crude Oil Futures (CL) During the COVID-19 Pandemic

Analyzing the price fluctuations of Crude Oil futures (CL) during the initial stages of the COVID-19 pandemic provides a clear illustration of volatility’s impact. In early 2020, as lockdowns were implemented globally and demand for oil plummeted, CL futures prices experienced a dramatic decline. The price of the contract fell significantly, reaching negative territory for a brief period – an unprecedented event.

This volatility led to margin calls for many traders, forcing some to liquidate their positions at substantial losses. The sharp price swings highlighted the risks associated with trading futures contracts during periods of high volatility, emphasizing the importance of risk management strategies.

Illustrative Example

Let us delve into a practical example to illuminate the costs involved in trading futures contracts. We will examine a hypothetical scenario involving a single contract of corn futures traded on the Chicago Mercantile Exchange (CME). This example will illustrate both profitable and unprofitable outcomes, highlighting the various cost components.

Our example will focus on a single contract of corn futures, with a contract size of 5,000 bushels. We will assume a starting price of $6.00 per bushel, a monthly holding period, and a brokerage commission structure commonly found in the industry.

Scenario Setup

We will consider the following parameters for our illustrative example:

- Contract: Corn Futures (CBT)

- Contract Size: 5,000 bushels

- Initial Price: $6.00 per bushel

- Initial Margin Requirement: 5% of contract value (This is a simplified example; actual requirements vary by broker and contract.)

- Maintenance Margin: 75% of the initial margin requirement.

- Brokerage Commission (round trip): $50 (This is a simplified example; actual commissions vary by broker and trade volume.)

- Holding Period: 1 month

Cost Calculation

The total cost of acquiring and maintaining the position for one month includes several components:

- Initial Margin: 5% of (5,000 bushels

– $6.00/bushel) = $1,500 - Brokerage Commission (Buying): $25

- Brokerage Commission (Selling): $25

- Interest on Margin (if applicable): Assume 2% annual interest, resulting in approximately $2.50 interest for one month. This is a simplified calculation and actual interest will vary by broker and prevailing interest rates.

Therefore, the total cost of establishing and maintaining the position (excluding potential losses) is $1,552.50 ($1,500 + $25 + $25 + $2.50).

Profitable Scenario

Let’s imagine the price of corn increases to $6.50 per bushel by the end of the month.

- Profit per bushel: $6.50 – $6.00 = $0.50

- Total Profit from price movement: $0.50/bushel

– 5,000 bushels = $2,500 - Net Profit: $2,500 (profit)

-$1,552.50 (costs) = $947.50

Unprofitable Scenario

Now, let’s consider a scenario where the price of corn decreases to $5.50 per bushel by the end of the month.

- Loss per bushel: $6.00 – $5.50 = -$0.50

- Total Loss from price movement: -$0.50/bushel

– 5,000 bushels = -$2,500 - Net Loss: -$2,500 (loss) + $1,552.50 (costs) = -$3,052.50

Ultimately, determining the cost of a single futures contract is not a straightforward calculation. It’s a multifaceted process involving understanding contract specifications, navigating brokerage fees, and anticipating market fluctuations. While the initial investment may seem manageable, the potential for both significant gains and losses highlights the importance of thorough research, risk management, and a clear understanding of the underlying asset before entering into a futures contract.

Careful consideration of all these factors is crucial for informed decision-making and successful futures trading.

FAQ Guide

What is the minimum amount of money I need to trade futures?

The minimum amount depends on the contract’s margin requirements and your broker’s policies. It can vary significantly across different contracts and brokers.

Can I lose more than my initial investment in futures trading?

Yes, futures trading involves leverage, meaning you can control a larger position than your initial investment. This amplifies both potential profits and losses; you can lose more than your initial margin.

Are there any tax implications for futures trading?

Yes, profits and losses from futures trading are generally considered capital gains or losses and are subject to applicable tax laws in your jurisdiction. Consult a tax professional for specific guidance.

How often are futures contracts settled?

Most futures contracts have a specific expiration date, at which point they are settled either by delivery of the underlying asset or cash settlement, depending on the contract terms.