How much does a contract review cost? The answer is not simple, as the price tag can vary significantly based on a number of factors. From the complexity of the contract itself to the expertise of the reviewer, several elements contribute to the final cost. This guide will explore the key factors that influence contract review costs, providing a comprehensive understanding of what to expect when seeking professional legal guidance.

Understanding the factors that determine the cost of a contract review can help you make informed decisions about your legal needs. Whether you’re a small business owner, a large corporation, or an individual, knowing the intricacies of contract review pricing can empower you to choose the right service for your specific situation.

Factors Influencing Contract Review Costs: How Much Does A Contract Review Cost

The cost of a contract review can vary significantly depending on a number of factors. Understanding these factors is crucial for both clients seeking contract review services and legal professionals offering them.

Complexity of the Contract

The complexity of a contract is a primary driver of review costs. Contracts involving intricate legal terms, complex financial arrangements, or multifaceted business structures require more time and expertise to analyze and interpret. For instance, a simple employment contract might involve a fixed hourly rate, while a merger and acquisition agreement could involve extensive due diligence, legal research, and negotiation, resulting in a higher review cost.

Length of the Contract

The length of a contract also influences the review cost. Longer contracts, with numerous clauses and provisions, naturally demand more time and effort to review comprehensively. For example, a standard lease agreement might be reviewed within a few hours, while a multi-page construction contract could require several days of intensive analysis.

Industry Involved

The industry in which the contract operates can impact the review cost. Contracts in specialized industries, such as healthcare, technology, or finance, often involve unique legal and regulatory considerations. Legal professionals with expertise in these industries may charge higher fees due to their specialized knowledge.

Experience of the Reviewer

The experience and expertise of the reviewer significantly influence the review cost. Experienced legal professionals with a proven track record in contract review can command higher fees due to their knowledge, judgment, and ability to identify potential risks and opportunities. Junior lawyers or paralegals may charge lower fees, but their experience and expertise might be limited.

Urgency of the Review

The urgency of the review can also affect the cost. Clients requiring immediate contract review services may need to pay a premium for expedited services. Legal professionals may adjust their fees to reflect the urgency of the request, as it may require them to prioritize the review and potentially work overtime.

Types of Contract Review Services

Contract review services can be categorized into different types, each focusing on a specific aspect of the contract and offering varying levels of depth and analysis. Understanding these types helps you determine the most appropriate service for your needs and budget.

General Contract Review

General contract review provides a comprehensive assessment of the contract’s overall structure, language, and clarity. This service aims to identify potential risks, ambiguities, and inconsistencies that could lead to legal disputes or financial losses. It typically involves a thorough analysis of the contract’s key provisions, including:

- Scope of work: Defines the specific tasks or deliverables expected from each party.

- Payment terms: Artikels the payment schedule, milestones, and methods.

- Termination clauses: Specifies the conditions under which either party can terminate the agreement.

- Liability and indemnification: Allocates responsibility for potential damages or losses.

- Confidentiality and intellectual property: Addresses the protection of sensitive information and ownership rights.

A general contract review is suitable for various contracts, including:

- Sales agreements: Defining the terms of goods or services exchange.

- Service agreements: Outlining the scope of work and payment terms for service providers.

- Employment contracts: Establishing the terms of employment between an employer and employee.

- Leases: Defining the rights and obligations of the landlord and tenant.

The cost of a general contract review varies depending on the complexity of the contract, the experience of the reviewer, and the geographic location. However, it generally falls within a reasonable range, making it an accessible service for businesses of all sizes.

Due Diligence Review

Due diligence reviews are conducted during mergers, acquisitions, or investments to assess the legal and financial risks associated with a target company. This service involves a comprehensive examination of the target’s contracts, including:

- Loan agreements: Analyzing the terms of debt financing and potential risks.

- Leases: Evaluating the terms of property rentals and potential liabilities.

- Supply agreements: Assessing the reliability of suppliers and potential disruptions to operations.

- Employment contracts: Identifying potential liabilities related to employee benefits and termination.

Due diligence reviews are more extensive and complex than general contract reviews, requiring specialized expertise in corporate law, finance, and accounting. Consequently, the cost of this service is significantly higher than a general contract review.

Specialized Contract Review

Specialized contract review focuses on specific areas of law or industry, requiring expertise in niche legal fields or specific business practices. This service is often necessary for complex contracts with specialized requirements or those involving high-risk transactions. Examples of specialized contract reviews include:

- Intellectual property agreements: Analyzing the terms of licensing, assignment, and confidentiality agreements.

- Construction contracts: Evaluating the terms of construction projects, including payment schedules, warranties, and dispute resolution mechanisms.

- Healthcare contracts: Reviewing the terms of agreements between healthcare providers, insurance companies, and patients.

- Technology contracts: Analyzing the terms of software licenses, cloud services, and data privacy agreements.

Specialized contract reviews require expertise in specific areas of law or industry, which translates into higher costs compared to general contract reviews. The cost can vary significantly depending on the complexity of the contract, the expertise required, and the geographic location.

Contract Review Fees and Billing Structures

Understanding the different fee structures employed by contract reviewers is crucial for clients seeking to manage their legal expenses effectively. This section delves into common billing methods, outlining their advantages and disadvantages, and provides a table for comparing their suitability across various contract review scenarios.

Hourly Rates

Hourly rates are the most prevalent billing structure in the legal profession. Contract reviewers charge a fixed amount for every hour spent on the review process. This method offers flexibility and transparency as clients are charged only for the time spent on their specific project.

- Advantages: Hourly rates provide a transparent and flexible billing structure, allowing clients to track costs closely and adjust project scope as needed. They are particularly suitable for complex reviews with unpredictable time requirements.

- Disadvantages: Hourly rates can be unpredictable, as the final cost may vary depending on the time required. Clients with tight budgets may find it challenging to estimate their expenses upfront.

Flat Fees

Flat fees involve a fixed price for the entire contract review, regardless of the time spent. This approach provides clients with predictable costs, making it easier to budget for legal expenses.

- Advantages: Flat fees offer predictable costs and eliminate the uncertainty associated with hourly rates. This structure is particularly beneficial for clients with fixed budgets or those seeking a clear understanding of their legal expenses.

- Disadvantages: Flat fees may not be suitable for complex or extensive reviews, as the reviewer may be incentivized to expedite the process to maximize their profits. This can lead to less thorough reviews and potential oversights.

Retainer Agreements

Retainer agreements involve an upfront payment for a specified period of time or number of hours, allowing clients to secure the services of a contract reviewer on an ongoing basis. This structure is particularly useful for businesses with recurring contract review needs.

- Advantages: Retainer agreements offer predictable costs and ensure access to a dedicated reviewer for ongoing contract needs. They can also lead to more efficient and streamlined review processes as the reviewer becomes familiar with the client’s specific requirements.

- Disadvantages: Retainer agreements may not be suitable for clients with infrequent contract review needs. They also require an upfront investment, which may not be feasible for all clients.

Comparison of Fee Structures

| Fee Structure | Advantages | Disadvantages | Suitable for |

|---|---|---|---|

| Hourly Rates | Transparency, Flexibility | Unpredictable Costs | Complex reviews, unpredictable time requirements |

| Flat Fees | Predictable Costs | May incentivize expedited reviews | Simple reviews, fixed budgets |

| Retainer Agreements | Predictable Costs, Dedicated Reviewer | May not be suitable for infrequent needs | Recurring contract review needs |

Finding and Choosing a Contract Reviewer

Finding the right contract reviewer is crucial for ensuring your legal interests are protected and your agreements are watertight. A qualified reviewer will not only identify potential risks and liabilities but also offer practical advice on how to mitigate them.

Online Directories and Professional Associations

Online directories and professional associations provide a starting point for identifying potential contract reviewers. These resources can help you narrow down your search based on specific criteria, such as expertise, location, and experience.

- Online Directories: Websites like Avvo, FindLaw, and Martindale-Hubbell offer searchable databases of lawyers and legal professionals, allowing you to filter by specialization, location, and client ratings. These directories often provide information about each reviewer’s experience, credentials, and areas of practice.

- Professional Associations: Joining or accessing the websites of professional associations like the American Bar Association (ABA), the National Association of Legal Professionals (NALP), or the American Health Lawyers Association (AHLA) can provide access to a directory of members who specialize in contract review. These associations often offer online forums and networking opportunities where you can connect with potential reviewers.

Referrals and Networking

Personal referrals from trusted colleagues, business contacts, or legal professionals can be invaluable in finding a qualified contract reviewer. These recommendations provide valuable insights into the reviewer’s expertise, reliability, and communication style.

- Networking: Attending industry events, conferences, or workshops related to your business can provide opportunities to connect with potential reviewers and learn about their expertise.

- Professional Associations: Membership in relevant professional associations can open doors to networking opportunities with lawyers and legal professionals specializing in contract review. These associations often organize events, webinars, and online forums that facilitate connections with potential reviewers.

Evaluating Expertise and Experience

Once you have a list of potential reviewers, it’s essential to evaluate their expertise and experience in contract review. Consider their:

- Legal Specialization: Look for reviewers who specialize in the relevant legal areas of your contracts, such as commercial law, intellectual property, or employment law.

- Industry Experience: Experience in your specific industry or with similar types of contracts can be highly valuable. A reviewer with experience in your industry will have a better understanding of the nuances and common issues related to your business.

- Track Record: Inquire about the reviewer’s track record of success in contract review, including their experience in negotiating favorable terms and identifying potential risks. Look for reviews or testimonials from past clients to gain further insights into their performance.

Questions to Ask Prospective Reviewers, How much does a contract review cost

To determine if a reviewer is a good fit for your project, it’s important to ask specific questions about their experience, approach, and fees.

- What is your experience in reviewing contracts similar to mine? This question helps assess the reviewer’s expertise in your specific industry and with the types of contracts you need reviewed.

- What is your approach to contract review? Understanding the reviewer’s process and methodology can help ensure their approach aligns with your needs and expectations.

- How do you communicate your findings and recommendations? Clear and concise communication is crucial for understanding the reviewer’s insights and making informed decisions.

- What are your fees and billing structures? It’s essential to discuss fees upfront to ensure they align with your budget and project scope.

Cost-Effective Contract Review Strategies

Minimizing contract review costs is crucial for businesses of all sizes, especially when considering the complexities and potential legal ramifications of agreements. By implementing strategic approaches, you can effectively manage expenses without compromising the quality of your contract reviews.

Negotiating Flat Fees

Flat fees offer a predictable cost structure, making it easier to budget for contract review services. This approach can be particularly beneficial for recurring reviews or projects with a defined scope. When negotiating a flat fee, it’s important to clearly define the scope of work, including the number of pages, complexity of the contracts, and any specific deliverables.

- Clearly define the scope of work: Artikel the specific contracts to be reviewed, the number of pages, the level of complexity, and any specific deliverables required.

- Request a detailed breakdown: Understand how the flat fee is calculated, ensuring it aligns with the scope of work and the reviewer’s expertise.

- Negotiate payment terms: Discuss payment schedules and deadlines that suit your financial planning.

Leveraging Technology

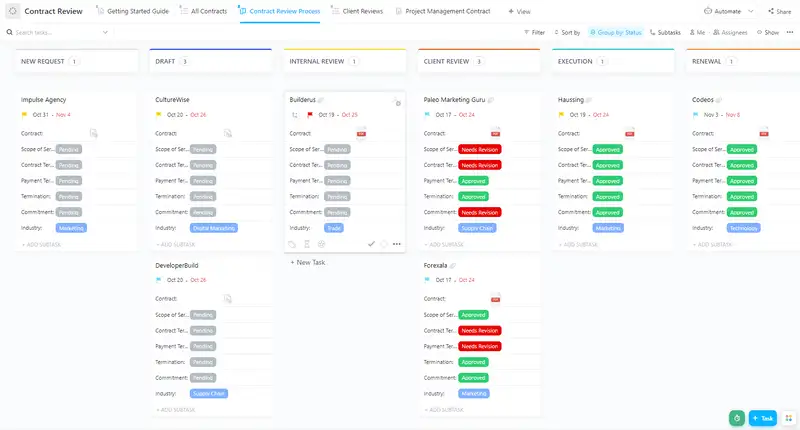

Technology can significantly streamline contract review processes, reducing manual effort and associated costs. Tools like contract lifecycle management (CLM) platforms and artificial intelligence (AI)-powered contract analysis tools can automate tasks such as redlining, clause identification, and risk assessment.

- Utilize contract lifecycle management (CLM) platforms: CLM platforms offer automated workflows, templates, and analytics, streamlining the review process and reducing manual effort.

- Employ AI-powered contract analysis tools: AI tools can analyze contracts for potential risks, inconsistencies, and compliance issues, identifying areas requiring further review.

- Leverage online collaboration tools: Platforms like Google Docs and Microsoft Word allow for real-time collaboration and feedback, reducing the need for multiple drafts and physical meetings.

Utilizing Internal Resources

Internal resources can often provide cost-effective solutions for basic contract reviews. Training legal staff or designated personnel to handle routine reviews can free up external resources for more complex agreements.

- Train legal staff or designated personnel: Provide internal resources with basic contract review training, equipping them to handle routine agreements and standard clauses.

- Develop internal review checklists: Create standardized checklists for common contract types, ensuring consistent review practices and minimizing potential oversights.

- Implement internal review protocols: Establish clear procedures for internal contract review, including escalation processes for complex or high-risk agreements.

Cost-Saving Measures

Several practical measures can help reduce contract review costs without compromising quality. These include:

- Prioritize contracts: Focus on reviewing high-risk or high-value agreements first, allocating resources strategically.

- Negotiate payment terms: Explore options like staggered payments or partial payments based on milestones to manage cash flow.

- Request multiple quotes: Compare rates from different contract reviewers to ensure competitive pricing.

- Seek discounts for bulk reviews: Inquire about volume discounts for multiple contracts or recurring reviews.

Negotiating with Contract Reviewers

Negotiating with contract reviewers is essential for securing the best possible rates. When negotiating, consider the following tips:

- Be clear about your needs: Clearly articulate the scope of work, the specific contracts to be reviewed, and any specific requirements or deliverables.

- Research industry rates: Understand the typical pricing structure for contract review services in your industry or region.

- Be prepared to walk away: If the rates are not competitive or the reviewer is not responsive to your needs, be prepared to seek alternatives.

- Negotiate payment terms: Explore options like staggered payments or partial payments based on milestones to manage cash flow.

Navigating the complexities of contract review costs can feel daunting, but with a clear understanding of the factors involved, you can confidently make informed choices. By considering the complexity of your contract, the type of review required, and the fee structures offered by reviewers, you can find the best value for your legal needs. Remember, investing in a thorough contract review can save you significant time, money, and headaches in the long run.

FAQ Explained

What is the average cost of a contract review?

The average cost of a contract review can vary widely, ranging from a few hundred dollars to thousands of dollars. The specific price will depend on the factors discussed earlier, such as the complexity of the contract and the reviewer’s experience.

Can I negotiate the price of a contract review?

Yes, it is possible to negotiate the price of a contract review. Be prepared to discuss your budget and the specific needs of your project. You may also be able to negotiate a flat fee or a retainer agreement, depending on the reviewer’s willingness.

Is it worth hiring a lawyer to review a contract?

In many cases, it is highly advisable to hire a lawyer to review a contract. A lawyer can identify potential legal risks and ensure that your interests are protected. They can also help you understand the terms of the contract and negotiate favorable changes.

What should I look for in a contract reviewer?

When choosing a contract reviewer, look for someone with experience in your industry and a strong track record of success. You should also consider their communication style and their ability to explain complex legal concepts in a clear and concise manner.