How much does a micro emini contract cost – How much does a micro E-mini contract cost? That’s the burning question for anyone dipping their toes into the exciting world of futures trading. Micro E-minis offer a more accessible entry point to the market compared to their standard counterparts, but understanding the associated costs is crucial before you start trading. This involves more than just the initial price; factors like margin requirements, commissions, and fees all play a significant role in determining your overall expenses.

Let’s break down the cost components to give you a clearer picture.

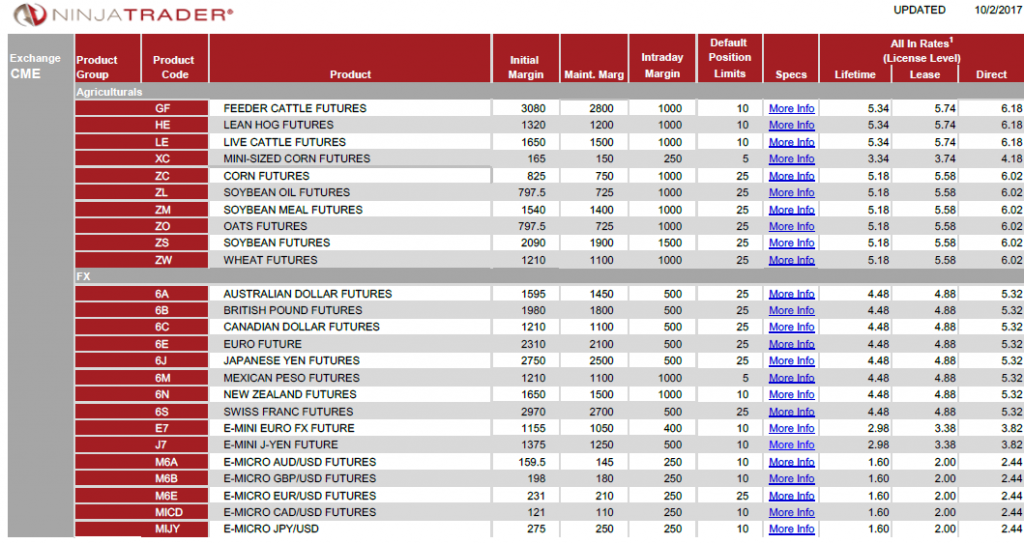

We’ll explore the various asset classes available for micro E-mini trading, from indices to currencies, and delve into the specifics of contract specifications. We’ll compare margin requirements and commission structures across different brokerages, helping you make informed decisions about where to trade. Understanding leverage and its impact on potential profits and losses is also key, along with strategies for managing risk and minimizing costs, especially during periods of high market volatility.

Finally, we’ll look at real-world examples to illustrate how all these factors combine to determine the actual cost of a trade.

Understanding Micro E-mini Contracts

Micro E-mini contracts are smaller, more accessible versions of standard E-mini contracts, designed to lower the barrier to entry for retail traders. They offer the same market exposure but with significantly reduced financial risk. This makes them a popular choice for those new to futures trading or those with limited capital.Micro E-mini contracts share the same underlying assets and price movements as their standard counterparts, but differ significantly in contract size.

This difference impacts the capital required to trade and the potential profit or loss per trade. The reduced contract size makes them ideal for diversification and position sizing strategies.

Comparison of Standard and Micro E-mini Contracts

Standard E-mini contracts require a substantially larger capital commitment compared to their micro counterparts. This higher capital requirement can be prohibitive for many traders. Micro E-mini contracts, however, allow participation with a smaller initial investment, thereby increasing accessibility. The price fluctuations are identical for both contract types, reflecting the same underlying asset movements, but the overall monetary impact of those fluctuations is scaled down proportionally in micro contracts.

This reduced impact mitigates the risk associated with larger positions.

Available Asset Classes for Micro E-mini Trading

Micro E-mini contracts are available across several asset classes, providing traders with diverse options to match their investment strategies. Currently, indices and currencies are predominantly offered as micro E-mini contracts. The expansion into other asset classes is possible depending on market demand and regulatory considerations. These contracts allow for sophisticated hedging strategies and diversified portfolio construction.

Contract Specifications for Selected Micro E-mini Contracts

The following table details the contract specifications for three example micro E-mini contracts. Note that these specifications are subject to change and traders should always refer to the most up-to-date information from their brokerage.

| Asset Class | Contract Size | Tick Size | Minimum Price Fluctuation |

|---|---|---|---|

| E-mini S&P 500 (MES) | $12.50 per index point | 0.25 index points | $3.125 |

| E-mini Nasdaq 100 (MNQ) | $5.00 per index point | 0.25 index points | $1.25 |

| Micro E-mini EUR/USD (M6E) | 1 EUR per point | 0.0001 | $0.0001 (per contract) |

Calculating the Cost of a Micro E-mini Contract

The total cost of trading a micro E-mini contract encompasses several key components. Understanding these components is crucial for effective risk management and profitability. Ignoring any of these factors can lead to inaccurate cost estimations and potentially impact trading outcomes.The primary components influencing the cost are margin requirements, commissions, and regulatory fees. Margin requirements represent the amount of capital a trader must maintain in their brokerage account to secure a position.

Commissions are fees charged by the brokerage for executing trades, while regulatory fees are levied by exchanges and regulatory bodies. These costs, while seemingly small individually, can accumulate significantly over multiple trades.

Margin Requirements

Margin requirements are determined by the brokerage firm and are subject to change based on market volatility and the specific contract being traded. They function as a form of collateral, protecting the broker against potential losses if the trade moves against the trader. Generally, margin requirements for micro E-mini contracts are significantly lower than those for standard E-mini contracts, making them more accessible to retail traders with smaller capital bases.

The calculation often involves a percentage of the contract’s notional value. For example, a broker might require a 1% margin on a $50 notional value micro E-mini contract, resulting in a $0.50 margin requirement per contract. However, this percentage can fluctuate based on market conditions and broker policies. Some brokers may offer tiered margin requirements, where the percentage decreases with larger account balances.

Commission Structures

Brokerage firms offer various commission structures, significantly influencing the overall trading cost. A comparison of two prominent brokerage firms illustrates this diversity.

- Broker A: This firm might charge a fixed commission per contract, regardless of the trade size or frequency. For example, they might charge $1.00 per contract traded. This structure provides predictability in trading costs, making it easier to budget for expenses.

- Broker B: This firm might adopt a tiered commission structure, where the commission per contract decreases as the trading volume increases. For instance, they might charge $1.50 per contract for fewer than 100 trades per month and $1.00 per contract for more than 100 trades. This incentivizes higher trading frequency but introduces complexity in cost estimation.

It’s crucial to note that these are simplified examples, and actual commission structures can be considerably more intricate, often incorporating additional fees for specific services or account types. Thorough research and comparison of brokerage offerings are essential before selecting a broker for micro E-mini trading.

Regulatory Fees

Regulatory fees, often relatively small per trade, are levied by exchanges and regulatory bodies to cover operational and regulatory costs. These fees are typically included in the overall brokerage commission and are not always explicitly itemized. The specific amounts vary depending on the exchange and the contract traded. While seemingly insignificant per trade, they contribute to the overall cost of trading over time.

Margin Requirements and Leverage

Micro E-mini contracts, due to their smaller size, require lower margin compared to their standard E-mini counterparts. Margin is the amount of money a trader must deposit with their broker to open and maintain a position. This deposit acts as collateral, securing the trade against potential losses. The specific margin requirement varies depending on the broker, the specific contract, and prevailing market conditions.

Understanding margin requirements and the associated leverage is crucial for effective risk management in micro E-mini trading.Margin requirements and leverage are intrinsically linked. Leverage magnifies both profits and losses. A higher leverage ratio, achieved with a lower margin requirement, means a smaller initial investment controls a larger position value. Conversely, a lower leverage ratio (higher margin requirement) reduces the potential for both significant gains and substantial losses.

Effective risk management necessitates a careful consideration of the trade-off between leverage and risk tolerance.

Margin Requirements in Micro E-mini Trading

Micro E-mini contracts typically have significantly lower margin requirements than their standard counterparts. For instance, while the margin for a standard E-mini S&P 500 contract might be several thousand dollars, the margin for the corresponding micro E-mini contract could be a few hundred. This lower barrier to entry makes micro E-mini contracts accessible to a wider range of traders, particularly those with smaller trading accounts.

However, it’s essential to remember that even with lower margin, losses can still exceed the initial margin deposit, potentially leading to margin calls. Margin calls require the trader to deposit additional funds to maintain their position, or face liquidation.

Leverage and its Impact on Profit and Loss

Leverage amplifies the potential return on investment (ROI) but also magnifies potential losses. In micro E-mini trading, a small price movement can result in a proportionally larger profit or loss due to the leverage inherent in using margin. The leverage ratio is calculated as the value of the position divided by the margin requirement. For example, if a trader controls a $10,000 position with a $500 margin requirement, the leverage ratio is 20:1.

A 1% price increase would result in a 20% return on the margin, while a 1% decrease would result in a 20% loss. This illustrates the double-edged sword of leverage; while it enhances potential profits, it simultaneously increases the risk of significant losses.

Hypothetical Trading Scenario: Impact of Margin Levels

The following scenario demonstrates the impact of different margin levels on potential gains and losses in micro E-mini trading, assuming a $10,000 contract value.

- Scenario 1: High Leverage (Low Margin): Margin requirement: $

500. Leverage: 20:1. A 2% price increase results in a $200 profit (40% return on margin). A 2% price decrease results in a $200 loss (40% loss on margin). - Scenario 2: Moderate Leverage (Medium Margin): Margin requirement: $

1000. Leverage: 10:1. A 2% price increase results in a $200 profit (20% return on margin). A 2% price decrease results in a $200 loss (20% loss on margin). - Scenario 3: Low Leverage (High Margin): Margin requirement: $

2000. Leverage: 5:1. A 2% price increase results in a $200 profit (10% return on margin). A 2% price decrease results in a $200 loss (10% loss on margin).

This demonstrates that while the profit and loss in dollar terms remain the same, the percentage return on margin varies significantly depending on the leverage employed. Higher leverage amplifies both gains and losses, requiring a higher risk tolerance.

Brokerage Fees and Commissions

Brokerage fees and commissions represent a significant cost component in micro E-mini futures trading. Understanding these fees is crucial for accurate cost calculation and effective risk management. These fees vary across brokers and depend on several factors, including trading volume and the specific services utilized.

Types of Brokerage Fees

Several fee types are commonly associated with micro E-mini trading accounts. Inactivity fees are charged to accounts that remain dormant for a specified period, usually a month or quarter, without sufficient trading activity. Data fees cover the cost of real-time market data feeds necessary for executing trades. Regulatory fees, often levied by exchanges, contribute to the overall cost.

Platform fees may apply depending on the brokerage’s software or trading platform used. Withdrawal fees are charged for transferring funds out of the brokerage account.

Commission Structures

Brokerages employ various commission structures. Per-contract pricing involves a fixed fee for each contract traded, regardless of the contract’s value. Tiered pricing offers discounted rates based on trading volume, with higher volumes attracting lower per-contract fees. A minimum commission may apply, guaranteeing a certain minimum fee even for small trades. Some brokers offer bundled packages that include data fees and commissions for a single monthly charge.

Comparative Table of Brokerage Commissions

The following table compares commission rates from three hypothetical brokers. Note that these are illustrative examples and actual rates may vary depending on the specific account type, trading volume, and other factors. It’s essential to consult each broker directly for the most up-to-date pricing information.

| Broker Name | Commission per Contract | Minimum Commission | Other Relevant Fees |

|---|---|---|---|

| Broker A | $0.50 | $5.00 | $5.00 monthly inactivity fee; $10.00 monthly data fee |

| Broker B | $0.75 (first 10 contracts), $0.50 (11-50 contracts), $0.25 (51+ contracts) | $7.50 | $2.00 per withdrawal; no inactivity fee; data included |

| Broker C | $1.00 | $10.00 | No inactivity fee; $15.00 monthly data fee; $1.00 per withdrawal |

Impact of Market Volatility on Cost: How Much Does A Micro Emini Contract Cost

Market volatility significantly impacts the cost of trading micro E-mini contracts, primarily through its influence on margin requirements and the potential for increased losses. Higher volatility leads to wider price swings, increasing the risk of margin calls and potentially substantial losses if positions are not managed effectively. Understanding this relationship is crucial for successful micro E-mini trading.Market volatility affects the cost of trading micro E-mini contracts through its impact on margin requirements and the potential for larger price fluctuations.

During periods of high volatility, brokers may increase margin requirements to mitigate their risk exposure. This means traders need to deposit more funds to maintain their positions, increasing the overall cost of trading. Simultaneously, larger price swings can lead to greater potential losses if the market moves against the trader’s position. This can result in margin calls, where the broker demands additional funds to cover potential losses, or even forced liquidation of positions if the trader fails to meet the margin call.

Margin Call Implications During High Volatility

Increased volatility necessitates a deeper understanding of margin calls. A margin call occurs when the equity in a trader’s account falls below the maintenance margin level set by their broker. This typically happens when the market moves against the trader’s position, resulting in unrealized losses. During periods of high volatility, these losses can accumulate rapidly, leading to more frequent and larger margin calls.

Meeting these calls requires additional capital, which directly increases the trading cost. Failure to meet a margin call can lead to the forced liquidation of the trader’s positions at potentially unfavorable prices, further amplifying losses.

Hypothetical Example of Volatility’s Impact

Consider a trader who buys one micro E-mini S&P 500 contract (MES) at $ The initial margin requirement is $

50. Let’s examine two scenarios

- Scenario 1: Low Volatility: The price of the MES contract fluctuates within a narrow range of ±$5. The trader’s maximum potential loss is limited to $5

– 5 (contract multiplier) = $25. The cost, excluding commissions, remains relatively low. - Scenario 2: High Volatility: The price of the MES contract experiences significant swings, dropping by $50. The trader’s loss is now $50

– 5 = $250. This loss might trigger a margin call, requiring the trader to deposit additional funds to maintain their position. The total cost now includes not only the initial margin but also the additional funds deposited to meet the margin call, significantly increasing the overall trading cost.

This example highlights how even a small number of contracts can incur substantial losses and increased costs during periods of heightened market volatility.

Risk Management Strategies to Mitigate Volatility’s Impact

Effective risk management is crucial for mitigating the impact of market volatility on trading costs. Several strategies can be employed:

- Position Sizing: Carefully determining the number of contracts to trade based on the trader’s risk tolerance and account size helps to limit potential losses during volatile periods. Smaller positions reduce the impact of price swings on the overall account balance.

- Stop-Loss Orders: Setting stop-loss orders automatically exits a position when the price reaches a predetermined level, limiting potential losses. This strategy prevents significant losses during sudden market drops.

- Diversification: Diversifying across multiple assets reduces the overall risk exposure to any single market. If one market experiences high volatility, the impact on the overall portfolio is lessened.

- Hedging Strategies: Using hedging techniques, such as employing options or inverse ETFs, can help to mitigate losses during periods of market volatility. This requires a sophisticated understanding of financial instruments and risk management principles.

Illustrative Examples of Trading Costs

Understanding the true cost of micro E-mini trading requires considering various factors beyond the initial contract price. This section presents concrete examples to illustrate the total cost involved in different trading scenarios. These examples assume a specific brokerage with particular commission structures; actual costs may vary depending on your chosen broker and account type.

The following examples demonstrate the calculation of total trading costs, incorporating margin requirements, commissions, and potential profits or losses. Note that these are simplified examples and do not include potential regulatory fees or other less common charges. Always consult your brokerage for their specific fee schedule.

Micro E-mini Trade Examples

Three hypothetical micro E-mini trades are presented below, illustrating the interplay of profit/loss, margin, and brokerage fees. Each example details the contract traded, the trade size (number of contracts), the resulting profit or loss, and the total cost incurred. These examples use simplified commission structures for illustrative purposes.

- Example 1: Successful E-mini S&P 500 Trade

- Contract: Micro E-mini S&P 500 (MES)

- Trade Size: 5 contracts

- Entry Price: 3950

- Exit Price: 3960

- Profit per contract: ($3960 – $3950)

– 5 = $50 - Total Profit: $50

– 5 contracts = $250 - Margin Requirement (assuming 5%): ($3950

– 5 contracts)

– 0.05 = $987.50 - Commission (assuming $1 per contract round trip): $10

- Total Cost: $10 (Commission)

- Net Profit: $250 (Profit)

-$10 (Commission) = $240

- Example 2: Unsuccessful E-mini Nasdaq 100 Trade

- Contract: Micro E-mini Nasdaq 100 (MNQ)

- Trade Size: 2 contracts

- Entry Price: 15000

- Exit Price: 14950

- Loss per contract: ($14950 – $15000)

– 2 = -$100 - Total Loss: -$100

- Margin Requirement (assuming 5%): ($15000

– 2 contracts)

– 0.05 = $1500 - Commission (assuming $1 per contract round trip): $4

- Total Cost: $4 (Commission) + $100 (Loss) = $104

- Net Loss: $104

- Example 3: Break-Even E-mini Russell 2000 Trade

- Contract: Micro E-mini Russell 2000 (M2K)

- Trade Size: 10 contracts

- Entry Price: 1800

- Exit Price: 1800

- Profit/Loss per contract: $0

- Total Profit/Loss: $0

- Margin Requirement (assuming 5%): ($1800

– 10 contracts)

– 0.05 = $900 - Commission (assuming $1 per contract round trip): $20

- Total Cost: $20 (Commission)

- Net Profit/Loss: -$20

Profit/Loss and Cost Breakdown: Example 1

This visual representation describes the profit/loss and cost breakdown for Example 1 (Successful E-mini S&P 500 Trade). Imagine a bar chart. The first bar represents the total profit of $250. A smaller, adjacent bar to the left represents the commission cost of $10. The difference between the two bars visually represents the net profit of $240.

Summary Table of Trading Costs, How much does a micro emini contract cost

The following table summarizes the total costs and profit/loss for each of the three examples.

| Example | Contract | Total Cost | Profit/Loss |

|---|---|---|---|

| Example 1 | Micro E-mini S&P 500 (MES) | $10 | $240 |

| Example 2 | Micro E-mini Nasdaq 100 (MNQ) | $104 | -$104 |

| Example 3 | Micro E-mini Russell 2000 (M2K) | $20 | -$20 |

So, how much

-does* a micro E-mini contract cost? The answer, as we’ve seen, isn’t a simple number. It’s a dynamic calculation influenced by various factors, including the specific contract, your broker, and current market conditions. By understanding margin requirements, commissions, and the impact of volatility, you can better anticipate and manage your trading costs. Remember to carefully compare brokers, consider your risk tolerance, and develop a robust trading strategy to maximize your chances of success in this exciting yet complex market.

Detailed FAQs

What’s the minimum account balance needed to trade micro E-minis?

Minimum account balances vary greatly depending on your broker and the specific contract. Some brokers may allow you to trade with smaller accounts, while others may have higher minimums.

Are there any hidden fees I should be aware of?

Yes, be aware of potential inactivity fees, data fees, and regulatory fees. Always review your brokerage’s fee schedule thoroughly.

Can I trade micro E-minis on a mobile app?

Most major brokerage firms offer mobile trading apps compatible with iOS and Android devices, allowing you to trade micro E-minis on the go.

How often are micro E-mini contracts settled?

Settlement frequency depends on the specific contract. Some are daily, while others might have weekly or monthly settlement periods.