Can you get food stamps if your married – Can you get food stamps if you’re married? It’s a question that pops up in many a kitchen conversation, especially when the fridge is lookin’ emptier than a politician’s promises. The good news is, yes, you can! But just like with any good recipe, there’s a whole bunch of ingredients to consider – income, assets, and even how many mouths you gotta feed.

So, grab a seat, pour yourself a cuppa, and let’s break down the nitty-gritty of food stamp eligibility for married folks. We’ll go over the rules, the regulations, and even some sneaky tips to make sure you’re getting what you deserve.

Income and Asset Calculation for Married Couples

The eligibility for food stamps, formally known as the Supplemental Nutrition Assistance Program (SNAP), for married couples depends on their combined income and assets. This means both spouses’ income and assets are considered when determining eligibility.

Income Calculation for Married Couples

The income of both spouses is considered when determining food stamp eligibility. This includes earned income, such as wages and salaries, and unearned income, such as Social Security benefits, unemployment benefits, and child support. The income of both spouses is added together to determine the household’s total income.

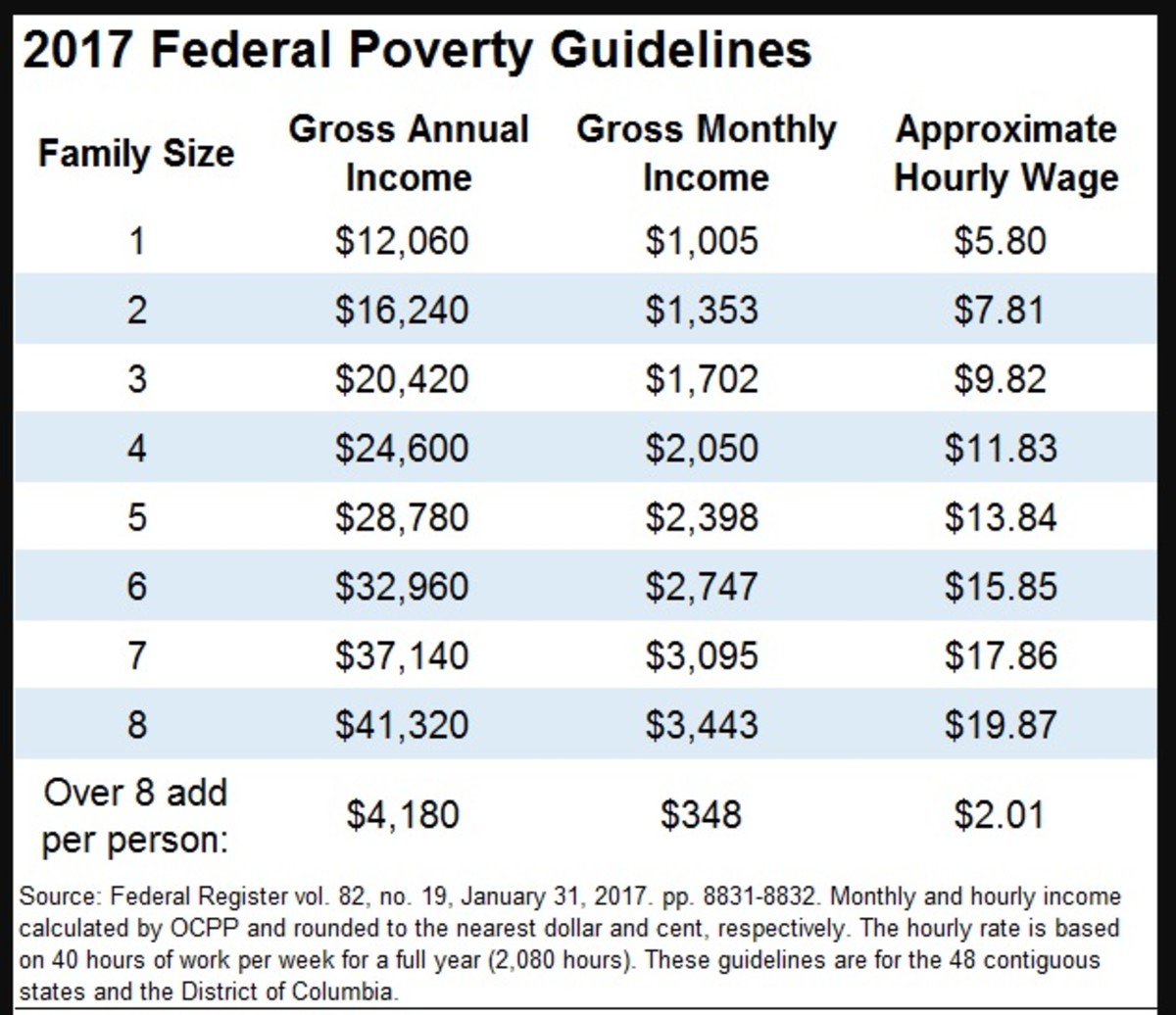

Here is a table illustrating different income scenarios for married couples and their corresponding food stamp eligibility. It is important to note that these are just examples and the actual eligibility criteria may vary depending on the state.

| Scenario | Spouse 1 Income | Spouse 2 Income | Combined Income | Food Stamp Eligibility |

|---|---|---|---|---|

| Scenario 1 | $1,500 | $1,000 | $2,500 | Eligible |

| Scenario 2 | $2,000 | $1,500 | $3,500 | Not eligible |

| Scenario 3 | $1,200 | $800 | $2,000 | Eligible |

For instance, if a married couple has a combined income of $2,500 per month, they might be eligible for food stamps. However, if their combined income is $3,500 per month, they may not be eligible. It’s important to note that these are just examples, and the actual eligibility criteria may vary depending on the state and other factors.

Asset Calculation for Married Couples

Assets, such as savings, property, and vehicles, are also factored into the eligibility calculation for food stamps. However, the asset limits are generally higher than the income limits.

“The asset limits are generally higher than the income limits.”

This means that a couple can have a significant amount of assets and still be eligible for food stamps, as long as their income is below the eligibility threshold. For example, a couple might own a house and a car, but still be eligible for food stamps if their income is low enough.

However, there are some exceptions to this rule. For example, if a couple has a large amount of money in a savings account, they may not be eligible for food stamps, even if their income is low.

Step-by-Step Guide to Calculate Income and Assets for Married Couples Applying for Food Stamps

Here is a step-by-step guide on how to calculate income and assets for married couples applying for food stamps:

- Gather income information for both spouses.This includes earned income, such as wages and salaries, and unearned income, such as Social Security benefits, unemployment benefits, and child support.

- Add together the income of both spouses to determine the household’s total income.

- Gather asset information for both spouses.This includes savings accounts, checking accounts, stocks, bonds, real estate, vehicles, and other valuable possessions.

- Subtract any debts from the total value of assets.

- Compare the household’s total income and assets to the eligibility criteria for your state.

Impact of Marriage on Food Stamp Eligibility

The decision to get married can have significant implications for your eligibility for food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP). While marriage itself doesn’t automatically disqualify you, it changes how your eligibility is determined. Understanding the impact of marriage on food stamp eligibility is crucial for couples who are considering getting married or who are already married and seeking benefits.

Eligibility Requirements for Single Individuals and Married Couples

The eligibility requirements for food stamps differ between single individuals and married couples. Here’s a breakdown of the key differences:

- Income:For single individuals, income is assessed based on their own earnings and other sources of income. For married couples, the combined income of both spouses is considered. This means that even if one spouse has a low income, the other spouse’s income could affect their eligibility.

- Assets:Similar to income, asset limits are also stricter for married couples. The total value of assets owned by both spouses is taken into account, including bank accounts, vehicles, and real estate. Single individuals have a higher asset limit.

- Household Size:The number of people in a household is a crucial factor in determining food stamp eligibility. Married couples are considered a single household, even if they have no children living with them. This means they may have a lower benefit amount compared to single individuals with the same income, as the benefit amount is calculated based on household size.

Potential Changes in Eligibility Due to Marriage

Marriage can lead to changes in food stamp eligibility in several ways:

- Loss of Eligibility:If a single individual is receiving food stamps and marries someone with a higher income or significant assets, they may lose their eligibility. This is because the combined income and assets of the couple may exceed the eligibility limits.

- Reduced Benefits:Even if a couple remains eligible for food stamps after marriage, their benefit amount may be reduced. This is because the benefit amount is calculated based on household size, and married couples are considered a single household. As a result, they may receive a lower benefit amount than they did as single individuals.

- Change in Reporting Requirements:Married couples are required to report their income and assets jointly. This means both spouses must provide information about their earnings, savings, and other assets. This can be a more complex process than reporting as a single individual.

Impact of Spouse’s Income and Assets

The income and assets of one spouse can significantly affect the other spouse’s eligibility for food stamps. Here’s how:

- Combined Income:As mentioned earlier, the combined income of both spouses is considered for food stamp eligibility. This means that even if one spouse has a low income, the other spouse’s income could make them ineligible for benefits.

- Joint Assets:The total value of assets owned by both spouses is also considered. This includes bank accounts, vehicles, real estate, and other assets. If one spouse has significant assets, it could affect the other spouse’s eligibility, even if their own income is low.

Specific Rules and Regulations Related to Marriage and Food Stamp Eligibility

There are specific rules and regulations related to marriage and food stamp eligibility that you should be aware of:

- Common-Law Marriage:Some states recognize common-law marriage, which means that couples who live together and present themselves as married can be considered married for food stamp purposes, even if they haven’t obtained a marriage license.

- Spousal Support:If one spouse receives spousal support from their former spouse, this income is considered for food stamp eligibility. This means that even if one spouse is not working, their spouse’s income could affect their eligibility.

- De Facto Marriage:Even if a couple is not legally married, they may be considered a married couple for food stamp purposes if they live together, present themselves as married, and share finances. This is known as a “de facto” marriage.

State-Specific Food Stamp Programs: Can You Get Food Stamps If Your Married

The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, is a federal program, but states have the authority to implement their own policies and programs that can impact eligibility and benefits for married couples. These state-specific variations can significantly affect how married couples access food assistance.

State-Specific Eligibility Criteria

Some states have established unique eligibility criteria that can impact married couples’ access to SNAP benefits. For instance, certain states may have stricter asset limits for married couples, while others might have different income thresholds for eligibility. It is crucial to check with your state’s SNAP office for specific eligibility requirements.

State-Level Programs Supporting Married Couples

Several states have implemented programs or initiatives aimed at supporting married couples experiencing food insecurity. These programs often provide additional assistance, such as:

- Expanded eligibility criteria:Some states have broadened their SNAP eligibility criteria to include more married couples. This might involve adjusting income thresholds or asset limits to accommodate the needs of families.

- Increased benefit amounts:Certain states have increased the SNAP benefit amounts for married couples, ensuring they receive more financial assistance to meet their food needs.

- Targeted outreach programs:Several states have launched outreach programs to raise awareness about SNAP benefits and encourage married couples to apply. These programs often provide information and support to help couples navigate the application process.

- Partnerships with community organizations:Some states collaborate with local food banks and community organizations to provide additional food assistance and support services to married couples experiencing food insecurity.

State-Specific Food Stamp Programs: Examples

- California:California has a program called CalFresh, which provides food assistance to low-income individuals and families. The state has implemented policies that make it easier for married couples to access CalFresh benefits, including expanded eligibility criteria and increased benefit amounts.

- New York:New York’s SNAP program offers additional benefits to married couples with children, including a higher income threshold and more generous benefit amounts.

- Texas:Texas has a program called SNAP-ED (Supplemental Nutrition Assistance Program – Education) that provides nutrition education and counseling to SNAP recipients, including married couples. This program aims to improve food choices and promote healthy eating habits.

Comparison of State Food Stamp Programs

| State | Eligibility Requirements | Benefit Amounts ||—|—|—|| California | Higher income thresholds, expanded asset limits | Increased benefit amounts for married couples with children || New York | More generous benefit amounts for married couples with children | Higher income thresholds || Texas | Standard SNAP eligibility criteria | Standard SNAP benefit amounts |

Resources and Support for Married Couples

Navigating the food stamp application process can be challenging, especially for married couples. This section provides a comprehensive overview of resources and support available to assist couples in accessing this vital benefit.

Organizations Offering Assistance

Various organizations offer support and guidance to married couples seeking food stamps. These organizations provide valuable information, resources, and assistance throughout the application process.

- The United States Department of Agriculture (USDA):The USDA is the primary agency responsible for administering the SNAP program. Their website provides comprehensive information about eligibility criteria, application procedures, and state-specific program details.

- Local Food Banks:Many food banks operate in communities across the country. They provide food assistance to low-income families, including married couples facing food insecurity.

- Community Action Agencies:These agencies are dedicated to addressing poverty and promoting self-sufficiency in local communities. They often offer food assistance programs, case management services, and referrals to other resources.

- Legal Aid Organizations:Legal aid organizations provide free or low-cost legal assistance to individuals and families with limited income. They can help couples navigate complex legal issues related to food stamps and other benefits.

Applying for Food Stamps

The application process for food stamps involves several steps. Married couples should gather the necessary documentation and follow the prescribed procedures to ensure a smooth application process.

- Gather Required Documentation:Couples must provide proof of identity, residency, income, and household size.

- Complete the Application:The application form can be obtained online or from local SNAP offices.

- Submit the Application:The completed application, along with supporting documentation, should be submitted to the designated SNAP office.

- Interview and Verification:The SNAP office may schedule an interview to verify the information provided in the application.

- Decision and Benefit Issuance:Once the application is processed, the SNAP office will notify the couple of their eligibility status. If approved, benefits will be issued through an electronic benefit transfer (EBT) card.

Support Programs for Married Couples

Several support programs are designed specifically for married couples facing food insecurity. These programs provide financial assistance, food resources, and other support services.

- Temporary Assistance for Needy Families (TANF):This program provides financial assistance to low-income families, including married couples.

- WIC (Women, Infants, and Children):This program provides food assistance and nutrition education to low-income pregnant women, breastfeeding women, and children under the age of five.

- Child Care Assistance Programs:These programs provide financial assistance to low-income families for child care expenses, allowing parents to work or attend school.

- Housing Assistance Programs:Housing assistance programs provide rental subsidies or help with mortgage payments to low-income families.

Tips for Married Couples Applying for Food Stamps, Can you get food stamps if your married

- Gather all required documentation before submitting the application.This will help ensure a smooth and timely application process.

- Be truthful and accurate in your application.Providing false information can lead to disqualification from the program.

- Keep track of all income and expenses.This will help you accurately report your financial situation on the application.

- Contact your local SNAP office if you have any questions.They can provide guidance and support throughout the application process.

Final Thoughts

Navigating the world of food stamps can feel like trying to find a parking spot in Jakarta – a whole lot of “almost” but not quite there yet. But don’t despair! By understanding the rules, knowing your rights, and using the resources available, you can get the help you need.

Remember, everyone deserves a decent meal, even if you’re married and your bank account is feeling a bit thin. So, chin up, and keep on cookin’ those delicious meals!

Questions and Answers

What if my spouse works but I don’t?

Even if one spouse works, the income of both spouses is considered when determining food stamp eligibility.

Can I get food stamps if I own a car?

Yes, you can! But the value of your vehicle is factored into the asset limit calculation, so it’s important to keep that in mind.

Are there any state-specific rules I should be aware of?

Absolutely! Each state has its own regulations and programs that may impact your eligibility. Make sure to check with your local SNAP office for specific guidelines.

:max_bytes(150000):strip_icc()/Proper-way-to-address-an-envelope-1216777_01_color-de1a67af181b4065b5698aa19f5ecf16.jpg?w=150&resize=150,150&ssl=1)