How much does a micro emini contract cost – How much does a micro E-mini contract cost? That’s the million-dollar question, or maybe the thousand-dollar question, depending on your trading strategy! Diving into the world of micro E-mini contracts can feel like surfing a Balinese wave – exhilarating and potentially lucrative, but you need the right knowledge to avoid getting wiped out. We’ll break down the costs, from commissions and margin requirements to those sneaky hidden fees that can catch you off guard.

Get ready to ride the wave responsibly!

Understanding the true cost involves more than just the initial investment. Brokerage fees, margin calls, slippage, and even regulatory charges all play a part. This guide will walk you through each element, providing clear examples and comparisons so you can confidently navigate the exciting – and sometimes unpredictable – world of micro E-mini trading. Think of it as your personal Bali surf guide, but for your finances!

Understanding Micro E-mini Contracts

Micro E-mini contracts are scaled-down versions of their standard counterparts, offering traders access to major market indices with significantly reduced capital requirements. This makes them an attractive entry point for smaller accounts or those seeking to diversify their portfolios with smaller position sizes. The reduced risk inherent in these smaller contracts doesn’t diminish the potential for both profit and loss; the market’s volatility remains a constant, irrespective of contract size.

Differences Between Standard and Micro E-mini Contracts

The primary distinction lies in contract size. Standard E-mini contracts represent a larger number of index shares, demanding a considerably higher margin and initial investment. Micro E-mini contracts, on the other hand, offer a fraction of this size, typically one-tenth. This translates to a significantly lower margin requirement and smaller price fluctuations per point. This smaller size allows for greater flexibility and potentially more trades within a given capital allocation.

The underlying asset, however, remains the same, mirroring the price movements of the full-sized contract.

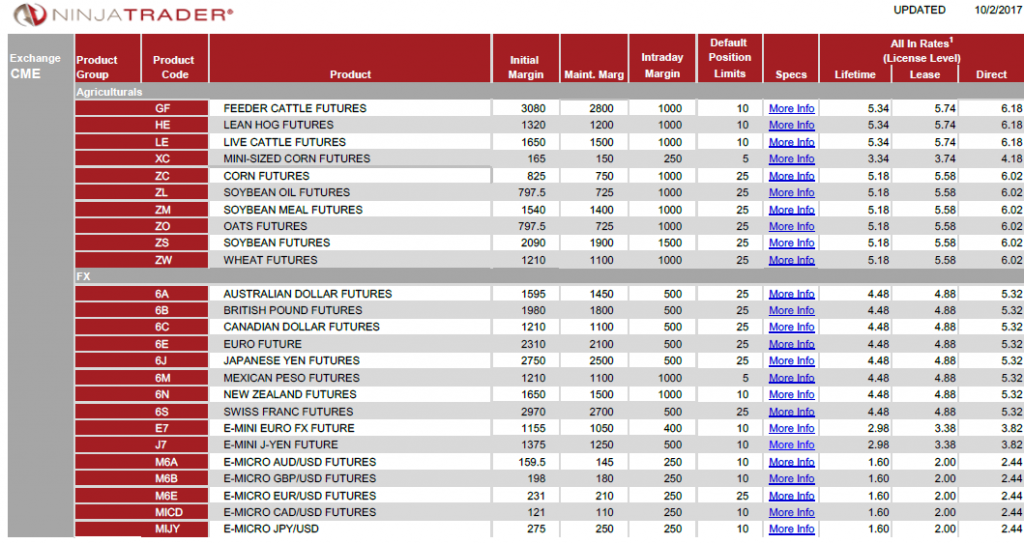

Margin Requirements for Micro E-mini Contracts

Margin requirements for micro E-mini contracts vary depending on the broker and the specific contract. However, they are consistently lower than their standard counterparts. Brokers often specify these requirements on their platforms. It’s crucial to check your broker’s specific margin requirements before initiating any trades, as these can change based on market conditions and broker policies. Factors like account type and overall trading activity can also influence the margin called for.

For example, a more active trader might encounter slightly higher margin requirements compared to someone with a less frequent trading pattern.

Examples of Common Micro E-mini Contracts Traded

Several popular indices are available as micro E-mini contracts, providing exposure to various market sectors. Common examples include the Micro E-mini S&P 500 (MES), Micro E-mini Nasdaq 100 (MNQ), and Micro E-mini Dow Jones Industrial Average (MYM). These contracts allow traders to participate in the movements of these major indices with a significantly reduced financial commitment. The accessibility offered by these micro contracts extends the reach of the market to a broader spectrum of investors.

Comparison of Micro E-mini Contracts

The following table illustrates the differences in contract size, margin requirements, and typical price movements for three common micro E-mini contracts. Remember that these values are approximate and can fluctuate based on market conditions and broker policies. Always consult your broker for the most up-to-date information.

| Contract | Contract Size | Typical Margin (Approximate) | Typical Price Movement per Point |

|---|---|---|---|

| Micro E-mini S&P 500 (MES) | 1/10 of a standard S&P 500 E-mini contract | $50 – $100 | $12.50 |

| Micro E-mini Nasdaq 100 (MNQ) | 1/10 of a standard Nasdaq 100 E-mini contract | $40 – $80 | $5.00 |

| Micro E-mini Dow Jones Industrial Average (MYM) | 1/10 of a standard Dow Jones E-mini contract | $60 – $120 | $5.00 |

Brokerage Fees and Commissions: How Much Does A Micro Emini Contract Cost

Navigating the world of micro E-mini contracts involves more than just understanding the market; it demands a keen awareness of the often-overlooked costs associated with each trade. These fees, seemingly minor individually, can cumulatively impact profitability, transforming a potentially lucrative strategy into a draining exercise. Understanding the intricacies of brokerage fees is crucial for successful micro E-mini trading.

Brokerage fees for micro E-mini contracts are a multifaceted landscape, varying wildly depending on the broker, the account type, and even the volume of trades executed. A transparent understanding of these costs is essential to making informed trading decisions and maximizing returns. The fees aren’t simply a flat rate; they’re a complex equation involving commissions, regulatory fees, and potential hidden charges that can significantly impact your bottom line.

Commission Structures Across Different Brokers

Commission structures vary significantly among brokers. Some utilize a per-contract model, charging a fixed fee for each micro E-mini contract traded. Others may employ a tiered system, offering lower rates for higher trading volumes. Some brokers might even incorporate a combination of both, adjusting their fees based on factors like contract size and account balance. This complexity underscores the need for meticulous research before selecting a broker.

A seemingly small difference in commission rates can dramatically alter your profitability over a series of trades.

Potential Hidden Fees and Charges

Beyond the explicitly stated commissions, various hidden fees can unexpectedly chip away at your profits. These often include inactivity fees, data fees for market information, and potentially even fees associated with account maintenance or specific software usage. Certain brokers may also charge fees for wire transfers or other payment processing methods. A thorough review of the broker’s fee schedule is crucial to uncover these potential hidden costs.

Failing to do so can lead to unpleasant surprises and a diminished trading experience.

Comparison of Brokerage Commission Rates

The following table compares commission rates for three hypothetical brokers, illustrating the variability across different account types. Remember that these are examples and actual rates should be verified directly with the broker.

| Broker | Standard Account (per contract) | Active Trader Account (per contract) | VIP Account (per contract) |

|---|---|---|---|

| Broker A | $0.50 | $0.35 | $0.25 |

| Broker B | $0.75 | $0.60 | $0.40 |

| Broker C | $0.60 | $0.45 + $0.01/share | $0.30 + $0.005/share |

Impact of Leverage and Margin Calls

Leverage, a double-edged sword in the world of futures trading, magnifies both profits and losses. In the context of micro E-mini contracts, understanding its impact is crucial for navigating the market effectively and mitigating potential risks. This section delves into the mechanics of leverage and margin calls, providing practical examples and a step-by-step guide to calculating margin requirements.Leverage significantly reduces the initial capital needed to control a larger position in the market.

With micro E-mini contracts, this amplified effect can lead to substantial gains with relatively small investments. However, the same magnification applies to losses, potentially resulting in rapid depletion of trading capital if the market moves against your position.

Leverage’s Influence on Micro E-mini Trading Costs

The cost of trading micro E-mini contracts isn’t directly determined by leverage itself, but leverage drastically alters the potential cost of a losing trade. While the commission per trade remains constant, a leveraged position means that a small adverse price movement can result in a significant loss exceeding your initial investment. Conversely, a small favorable price movement can generate a substantial profit.

The true cost, therefore, becomes intertwined with the degree of leverage employed and the market’s volatility. For example, a 10:1 leverage ratio means a 1% adverse movement wipes out 10% of your capital. A lower leverage ratio, say 2:1, would reduce this loss to 2%.

Margin Call Procedures in Micro E-mini Trading

A margin call occurs when the equity in your trading account falls below the maintenance margin requirement set by your broker. This essentially means your losses have eaten into your available funds to the point where your broker deems your position too risky. The broker will then demand additional funds to cover potential further losses. Failure to meet a margin call results in the broker forcibly liquidating (selling) a portion or all of your positions to restore the account’s equity to the acceptable level.

The process typically involves a notification from your broker, outlining the shortfall and the required deposit to avoid liquidation. The timeframe given to meet the margin call varies by broker, but it’s usually quite short, requiring immediate action.

Examples of Leverage’s Impact on Profit and Loss

Consider two scenarios involving a micro E-mini S&P 500 contract (MES) with a contract size of $5. Assume the initial margin requirement is $50.Scenario 1: A trader uses 10:1 leverage, investing $50 to control a position equivalent to $500. If the MES price increases by 1 point, the trader gains $5 (1 point x $5 contract size).

This represents a 10% return on the initial investment ($5/$50). Conversely, a 1-point decrease results in a 10% loss.Scenario 2: The same trader uses 2:1 leverage, investing $250 to control the same $500 position. A 1-point price increase still yields a $5 profit, but this represents only a 2% return on the initial investment ($5/$250). Similarly, a 1-point price decrease results in a 2% loss.These examples highlight the amplified effect of leverage on both profits and losses.

Higher leverage magnifies returns but also increases the risk of significant losses.

Calculating Margin Requirements

Calculating margin requirements is essential for managing risk and avoiding margin calls. Here’s a step-by-step procedure:

Before starting, you need to know:

- The contract size of the micro E-mini contract.

- The initial margin requirement set by your broker (often expressed as a percentage of the contract value).

- The number of contracts you intend to trade.

The calculation proceeds as follows:

- Determine the total value of your position: Contract size x Number of contracts x Current market price.

- Calculate the required margin: Total position value x Initial margin requirement (expressed as a decimal).

For example, if the contract size is $5, the initial margin requirement is 10%, and you’re trading 10 contracts at a price of $2000, your required margin would be: ($5 x 10 x $2000) x 0.10 = $1000.

Transaction Costs Beyond Commissions

The seemingly straightforward cost of micro E-mini contracts, often reduced to brokerage commissions, belies a more intricate reality. A trader’s total expense extends far beyond the explicit fees charged by their broker, encompassing a shadowy realm of implicit costs that can significantly erode profits, even rendering initially promising trades unprofitable. These hidden expenses, often overlooked by novice traders, represent the true cost of market participation.

Understanding these subtleties is crucial for navigating the treacherous currents of high-frequency trading.Slippage and spreads represent the silent assassins of trading profits. Slippage, the difference between the expected price and the actual execution price, can arise from market volatility, particularly during periods of rapid price movement. Imagine a scenario where a trader places an order to buy at a specific price, only to find the price has jumped significantly by the time the order is filled.

This seemingly insignificant discrepancy, multiplied across numerous trades, can accumulate into a substantial loss. Similarly, spreads, the difference between the bid and ask price, directly impact the cost of entry and exit. Wider spreads, common during periods of low liquidity or heightened market uncertainty, increase the cost of each trade, effectively reducing the potential profit margin.

Slippage and Spreads

Slippage and spreads are intertwined and directly impact the final cost of a trade. Slippage is the difference between the price a trader expects to get and the price they actually get. This can happen due to a lack of liquidity, rapid price changes, or large order sizes. For example, a trader might place an order to buy at $100, but due to slippage, they end up paying $100.05.

Spreads, the difference between the bid and ask price, are another major factor. A wider spread means a higher cost of trading. Imagine a spread of $0.02; this means the trader will pay $0.01 more than the quoted price. These seemingly small amounts can add up significantly over many trades. The impact is particularly severe during volatile market conditions or when trading less liquid instruments.

The cumulative effect of these two factors can dramatically reduce profitability, especially in high-frequency trading strategies where numerous trades are executed.

Regulatory Fees and Other Charges, How much does a micro emini contract cost

Beyond brokerage commissions, regulatory fees and other charges contribute to the overall cost of micro E-mini trading. These fees, imposed by regulatory bodies like the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC), are often levied on a per-contract basis or as a percentage of the trade value. Furthermore, data fees, charged by market data providers, are a necessary expense for real-time market information.

These fees, while seemingly minor individually, accumulate and must be factored into the overall cost analysis. For example, SEC fees, though small per transaction, can become substantial when considering high-volume trading strategies. Similarly, data subscriptions can be a significant annual expense.

Potential Transaction Costs

It is crucial to consider all potential transaction costs to accurately assess profitability. Failing to account for these hidden expenses can lead to inaccurate projections and ultimately, financial losses.

- Brokerage Commissions: The explicit fees charged by the brokerage firm for executing trades.

- Slippage: The difference between the expected execution price and the actual execution price.

- Spreads: The difference between the bid and ask price of a contract.

- Regulatory Fees: Fees imposed by regulatory bodies like the SEC or CFTC.

- Data Fees: Costs associated with accessing real-time market data.

- Financing Charges (if applicable): Interest charged on margin accounts for overnight positions.

- Platform Fees (if applicable): Fees charged by trading platforms for software access or advanced features.

Illustrative Scenarios

The murky depths of micro E-mini trading, like a forgotten river delta, are riddled with unseen currents of cost. Understanding these currents is crucial, lest your carefully constructed trading vessel be swept away by unexpected expenses. The following scenarios, stark and unforgiving, illuminate the financial realities of this often-overlooked aspect of market participation.

The total cost of a micro E-mini trade isn’t simply the price of the contract itself; it’s a complex tapestry woven from commissions, fees, and the ever-present shadow of leverage. Let’s unravel this complexity with concrete examples.

Micro E-mini Trade Example One

Let’s imagine a trader, let’s call him Mr. X, buys one micro E-mini S&P 500 contract (MES) at 3950 and sells it at 3955. His broker charges a commission of $1.00 per contract, round trip. The contract value is $12.50 per point. Therefore, his profit is 5 points

- $12.50/point = $62.50. However, his total cost is $62.50 (profit)

- $2.00 (commissions) = $60.50. This seemingly small commission can significantly impact profitability, especially on smaller trades.

Micro E-mini Trade Example Two

Now, let’s consider Ms. Y, trading the same micro E-mini S&P 500 contract, but using a different broker. Ms. Y’s broker charges a commission structure based on a tiered system: $1.50 per contract for trades under 10 contracts, and $1.00 per contract for trades of 10 or more contracts. Assuming she also executes a trade resulting in a 5-point profit, her profit remains $62.50.

But her commission is $3.00, resulting in a net profit of $59.50. This highlights how broker choice directly influences the final cost, underscoring the importance of comparing commission structures.

Impact of Trading Strategies on Cost

Different trading strategies inherently lead to varying transaction costs. A scalper, executing numerous trades throughout the day, will face substantially higher commission costs compared to a swing trader holding positions for several days or weeks. For instance, a scalper making 10 trades per day with a $1 commission per trade will pay $20 in commissions daily, whereas a swing trader might only incur commission costs once or twice a week.

The frequency of trades directly impacts the overall cost per trade.

Cost Breakdown for a Sample Trade

This visual representation demonstrates the cost breakdown for a single micro E-mini contract trade. Imagine a bar graph. The longest bar represents the profit from the trade (e.g., $62.50). A shorter bar, significantly smaller, represents the broker’s commission ($2.00). A tiny bar represents any regulatory fees or other minor charges (e.g., $0.50). The difference between the profit bar and the sum of the other bars represents the net profit.

So, how much

-does* a micro E-mini contract cost? The answer, my friend, isn’t a simple number. It’s a dynamic equation influenced by your broker, your contract choice, your trading style, and a dash of market volatility. By understanding the various components – commissions, margin, slippage, and hidden fees – you can gain a clearer picture and make informed decisions.

Remember, responsible trading is key to enjoying the ride, so do your homework and choose your waves wisely!

Question Bank

What’s the difference between a standard and micro E-mini contract?

Micro E-minis are smaller versions of standard E-mini contracts, requiring less capital to trade. This makes them more accessible to smaller accounts.

Can I lose more than my initial investment?

Yes, leverage magnifies both profits and losses. Margin calls can occur if your account balance falls below the required margin level.

What are slippage and spreads?

Slippage is the difference between the expected price and the actual execution price. Spreads are the difference between the bid and ask price.

How often do margin calls happen?

The frequency depends on market volatility and your leverage. In volatile markets, margin calls can be more common.