How much does it cost to buy a futures contract? This question often arises for investors seeking to delve into the world of derivatives, a complex financial instrument that offers both potential rewards and significant risks. Futures contracts are agreements to buy or sell an asset at a predetermined price on a specific date in the future. They’re used by traders to speculate on price movements and by businesses to hedge against price fluctuations.

Understanding the cost of buying a futures contract requires exploring several factors, including initial and maintenance margin requirements, brokerage fees, exchange fees, and clearing fees. These costs can vary depending on the specific futures contract, the underlying asset, and the trading platform used.

Understanding Futures Contracts: How Much Does It Cost To Buy A Futures Contract

Futures contracts are agreements to buy or sell an asset at a predetermined price on a specific future date. They are standardized contracts traded on exchanges, offering investors a way to manage price risk or speculate on the future price of an asset.

Types of Futures Contracts

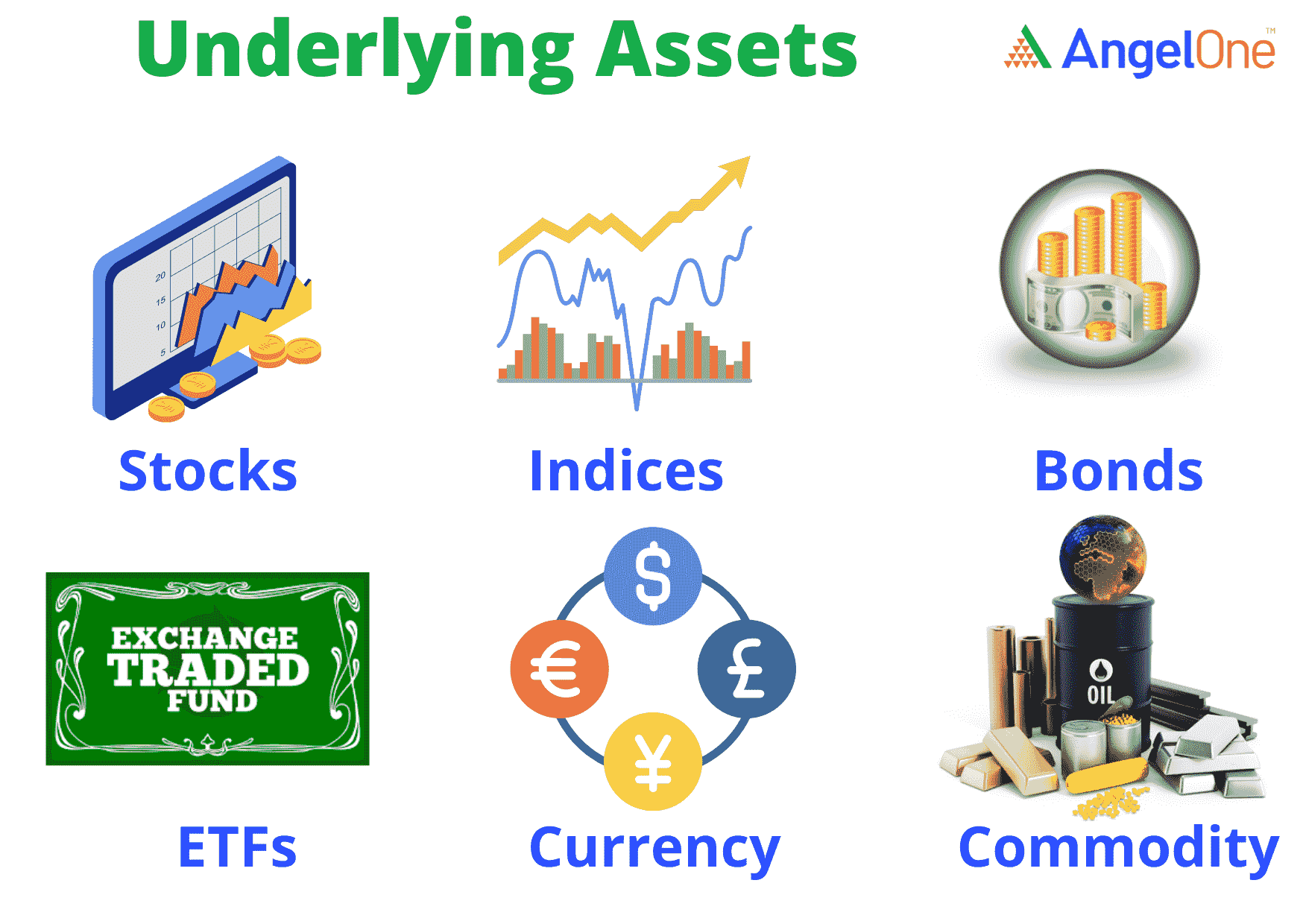

Futures contracts cover a wide range of assets, each with its own specific characteristics and applications. Here are some common types of futures contracts:

- Commodity Futures: These contracts involve the trading of physical commodities, such as oil, gold, coffee, and wheat. They are used by producers, consumers, and speculators to manage price risk and profit from price fluctuations.

- Index Futures: These contracts track the performance of a specific stock market index, such as the S&P 500 or the Nasdaq 100. They allow investors to gain exposure to a broad basket of stocks without buying individual shares.

- Currency Futures: These contracts involve the trading of foreign currencies, such as the US dollar, euro, and Japanese yen. They are used by businesses, investors, and speculators to hedge against currency risk or profit from currency fluctuations.

Key Features of Futures Contracts, How much does it cost to buy a futures contract

Futures contracts have several key features that distinguish them from other financial instruments:

- Standardized Contracts: Futures contracts are standardized, meaning they have predetermined contract sizes, delivery dates, and quality specifications. This standardization facilitates trading and reduces counterparty risk.

- Trading on Exchanges: Futures contracts are traded on organized exchanges, such as the Chicago Mercantile Exchange (CME) and the Intercontinental Exchange (ICE). This provides a transparent and regulated marketplace for buyers and sellers.

- Margin Requirements: To trade futures contracts, investors need to deposit a margin, which is a percentage of the contract value. This margin serves as a guarantee against potential losses and ensures the contract’s performance.

Factors Influencing Futures Contract Prices

Futures contract prices are influenced by a complex interplay of factors that reflect the underlying asset’s value, market sentiment, and economic conditions. Understanding these factors is crucial for investors seeking to profit from futures trading.

Supply and Demand Dynamics

Supply and demand dynamics play a significant role in determining futures prices. When demand for a particular commodity or asset is high, prices tend to rise as buyers compete for limited supply. Conversely, when supply exceeds demand, prices tend to fall as sellers compete for buyers.

- For example, if a severe drought reduces the harvest of a specific agricultural commodity, the supply of that commodity will decrease, leading to higher futures prices.

- Conversely, if a new technology increases the production of a particular metal, the supply will increase, potentially driving down futures prices.

Interest Rates

Interest rates play a crucial role in futures pricing, particularly for contracts with longer maturities. When interest rates rise, the cost of holding an asset for a longer period increases, making futures contracts less attractive to investors. This can lead to a decrease in futures prices. Conversely, when interest rates fall, the cost of holding an asset decreases, making futures contracts more attractive, potentially leading to an increase in prices.

Inflation

Inflation, a general increase in prices for goods and services, can also impact futures prices. In an inflationary environment, the purchasing power of money decreases over time. This can lead to higher futures prices as investors anticipate the need to pay more for the underlying asset in the future.

Economic Indicators

Various economic indicators can influence futures prices, reflecting the overall health of the economy and its potential impact on the underlying asset. These indicators can include:

- Gross Domestic Product (GDP): A measure of a country’s total economic output, a strong GDP growth rate can indicate increased demand for commodities and assets, potentially leading to higher futures prices.

- Consumer Price Index (CPI): A measure of inflation, a high CPI can signal increased demand for commodities and assets, potentially leading to higher futures prices.

- Unemployment Rate: A measure of the percentage of the labor force that is unemployed, a low unemployment rate can indicate a strong economy, potentially leading to higher futures prices.

Initial Margin and Maintenance Margin

Futures trading involves using leverage, which allows traders to control a large amount of underlying asset with a relatively small initial investment. However, this leverage comes with risks, and to mitigate those risks, exchanges require traders to deposit a certain amount of money in a margin account. This margin requirement is designed to ensure that traders can cover potential losses on their futures positions.

There are two types of margin requirements: initial margin and maintenance margin.

Initial Margin

The initial margin is the amount of money that traders must deposit into their margin account before they can open a futures position. It is a percentage of the contract’s total value and acts as a good faith deposit, demonstrating the trader’s commitment to the trade. This initial margin requirement varies depending on the specific futures contract, the volatility of the underlying asset, and the overall market conditions.

Maintenance Margin

The maintenance margin is the minimum amount of money that must be maintained in the margin account at all times. It is typically a lower percentage of the contract’s value than the initial margin. The maintenance margin acts as a buffer against losses. If the market moves against the trader’s position, the value of the margin account may decline. If the account balance falls below the maintenance margin level, the trader will receive a margin call.

Margin Calculation

Margin requirements are calculated based on the volatility of the underlying asset and the potential for price fluctuations. Exchanges use sophisticated algorithms to determine the appropriate margin levels for each futures contract. These algorithms consider historical price data, market trends, and other factors to assess the risk associated with the contract.

Margin Call

A margin call occurs when the account balance falls below the maintenance margin level. This indicates that the trader’s position is losing money and that they need to deposit more funds to cover potential losses. If the trader fails to meet the margin call, the brokerage firm may liquidate their position to recover the losses.

Implications of Margin Requirements

Margin requirements can have a significant impact on the overall cost of trading futures. The initial margin acts as a down payment, and traders need to have access to this capital to enter the market. Additionally, margin calls can create liquidity issues if traders are unable to meet the required deposit. However, margin requirements also serve as a risk management tool, helping to protect both traders and exchanges from significant losses.

The higher the volatility of the underlying asset, the higher the margin requirement.

Trading Costs Associated with Futures Contracts

Futures contracts involve various costs beyond the initial margin. These costs are incurred when buying or selling futures contracts and can vary depending on factors such as the underlying asset, the exchange, and the broker. Understanding these costs is crucial for investors to accurately assess the profitability of their futures trading strategies.

Brokerage Fees

Brokerage fees are charged by brokers for facilitating futures trades. These fees are typically calculated as a percentage of the contract value or as a fixed fee per contract. The amount of brokerage fees can vary significantly depending on the broker, the trading platform used, and the volume of trades. Some brokers offer discounted rates for high-volume traders or those who trade specific futures contracts.

Brokerage fees can be a significant expense for futures traders, especially those who trade frequently or with large contract sizes.

Exchange Fees

Exchange fees are charged by the futures exchange for providing the trading platform and clearing services. These fees are typically levied on each contract traded and can vary depending on the exchange and the specific contract.

Exchange fees are typically charged on a per-contract basis and are a standard cost for all futures traders.

Clearing Fees

Clearing fees are charged by the clearinghouse for guaranteeing the performance of futures contracts. These fees are typically calculated as a percentage of the contract value and are paid by both buyers and sellers.

Clearing fees help ensure the financial stability of the futures market by mitigating counterparty risk.

Transaction Costs Fluctuation

Transaction costs can fluctuate based on market conditions and trading volume. For instance, during periods of high market volatility or increased trading activity, brokerage fees, exchange fees, and clearing fees may increase.

It is important to note that transaction costs can vary significantly, and traders should factor these costs into their trading decisions.

Profit and Loss Calculation in Futures Trading

:max_bytes(150000):strip_icc()/futures-contract-4195880_blue-bde91eaa2f2a40e5914f1091adb37089.jpg)

Futures trading involves speculating on the future price movements of an underlying asset. Profit or loss in futures trading is determined by the difference between the price at which the contract was bought or sold and the price at which it is closed out.Futures contracts are bought and sold at a specific price known as the opening price. The price of a futures contract fluctuates constantly, influenced by various market factors.

When a trader decides to close out a futures contract, they do so at the prevailing market price. The difference between the opening price and the closing price determines the profit or loss.

Profit Calculation in Futures Trading

Profit is realized when the closing price of a futures contract is higher than the opening price. For example, suppose a trader buys a futures contract for crude oil at $80 per barrel and closes out the position at $85 per barrel. In this scenario, the trader would make a profit of $5 per barrel, or $5 multiplied by the contract size.

Loss Calculation in Futures Trading

A loss occurs when the closing price of a futures contract is lower than the opening price. For example, if a trader sells a futures contract for wheat at $6 per bushel and closes out the position at $5.50 per bushel, they would incur a loss of $0.50 per bushel.

Impact of Price Fluctuations on Profit and Loss

Price fluctuations play a crucial role in determining profit or loss in futures trading.

The greater the price difference between the opening and closing price, the larger the profit or loss.

For example, if the price of a futures contract for gold rises by $100 per ounce, a trader who bought the contract at the opening price would make a significant profit. Conversely, if the price drops by $100 per ounce, the trader would incur a substantial loss.Futures trading involves inherent risk, and traders should be aware of the potential for both profit and loss.

It is essential to have a well-defined trading plan and risk management strategy to mitigate losses and maximize potential profits.

Risks Associated with Futures Trading

Futures trading, while offering potential for significant profits, also carries inherent risks. Understanding these risks is crucial for making informed trading decisions and implementing effective risk management strategies.

Potential for Significant Losses

Futures contracts are leveraged instruments, meaning that a small initial investment can control a large amount of underlying asset. This leverage magnifies both potential profits and losses. Market volatility can lead to rapid price fluctuations, resulting in substantial losses if positions are not managed carefully.

For example, a trader might need to put up only a small initial margin to control a large futures contract. If the market moves against the trader’s position, the loss could be significantly larger than the initial margin.

Key Risks Associated with Futures Trading

Several factors contribute to the inherent risks associated with futures trading:

- Market Volatility: Futures markets are known for their high volatility, making it difficult to predict price movements accurately. Unexpected events or news can cause sharp price swings, leading to significant losses.

- Leverage: As mentioned earlier, leverage amplifies both profits and losses. While it can enhance returns, it also increases the risk of losing more than the initial investment.

- Liquidity Risk: In some cases, it may be difficult to exit a futures position quickly due to limited liquidity in the market. This can lead to larger losses if the market moves against the trader’s position.

- Counterparty Risk: Futures contracts involve an agreement between two parties. If the counterparty defaults on their obligations, the trader may face significant losses.

- Margin Calls: Futures traders are required to maintain a certain margin in their account to cover potential losses. If the market moves against the trader’s position, they may receive a margin call, requiring them to deposit additional funds. Failure to meet a margin call can lead to the liquidation of the trader’s position.

Importance of Risk Management Strategies

Effective risk management is essential for mitigating the risks associated with futures trading. This involves:

- Setting Stop-Loss Orders: Stop-loss orders are used to automatically exit a position when the price reaches a predetermined level, limiting potential losses.

- Diversification: Spreading investments across different futures contracts or asset classes can help reduce overall risk.

- Position Sizing: Carefully determining the size of a trade based on risk tolerance and account size is crucial for managing potential losses.

- Monitoring Market Conditions: Staying informed about market trends, economic indicators, and news events is essential for making informed trading decisions.

Navigating the world of futures contracts requires a deep understanding of the costs involved. From initial margin and maintenance margin to brokerage and exchange fees, these expenses can significantly impact your trading strategy and profitability. By carefully analyzing these costs and managing your risk, you can make informed decisions and potentially benefit from the unique opportunities offered by futures trading.

FAQ Resource

What is the minimum amount I need to buy a futures contract?

The minimum amount required to buy a futures contract is determined by the initial margin, which is a percentage of the contract’s value that you need to deposit as collateral. The initial margin varies depending on the specific contract and the exchange.

How do I calculate the profit or loss on a futures contract?

Profit or loss on a futures contract is calculated based on the difference between the entry price and the exit price. If the price of the underlying asset increases, you make a profit, and if it decreases, you incur a loss. The profit or loss is also affected by the contract size and the margin used.

Are futures contracts suitable for all investors?

Futures contracts are not suitable for all investors. They are highly leveraged instruments that carry significant risk. You should have a good understanding of futures trading and risk management before trading them.

What are the risks associated with futures trading?

Futures trading involves significant risk, including the potential for significant losses due to market volatility. Other risks include margin calls, counterparty risk, and liquidity risk.