How much does it cost to cancel a timeshare contract? This question is a common one, and the answer isn’t always straightforward. Timeshare contracts can be complex, with various clauses and fees that can make it difficult to break free. But don’t worry, we’re here to help you navigate the maze of timeshare cancellation costs and explore your options.

From understanding the typical structure of a timeshare contract to exploring legal avenues for cancellation, this guide will equip you with the knowledge you need to make informed decisions. We’ll delve into the common cancellation fees and penalties, discuss the potential costs of resale or transfer, and shed light on the risks and benefits of using timeshare exit companies. By the end of this journey, you’ll be better equipped to determine the best course of action for your situation.

Understanding Timeshare Contracts

Timeshare contracts are legally binding agreements that Artikel the terms of your ownership or use of a vacation property. Understanding the details of your contract is crucial, as it can significantly impact your rights and obligations.

Ownership Rights and Responsibilities

Timeshare contracts define the nature and extent of your ownership rights. You might own a specific unit for a particular period each year (fixed-week ownership), or you might have access to a pool of units within a resort (floating ownership). The contract will specify your ownership period, the size of your unit, and any associated amenities.

- Fixed-week ownership grants you the right to use a specific unit for a predetermined week or weeks each year.

- Floating ownership allows you flexibility in choosing your vacation dates within a specific timeframe, but you don’t own a specific unit.

- Points-based systems offer flexibility and allow you to accumulate points that can be redeemed for various vacation options.

It’s important to note that even though you might own a timeshare, you don’t own the entire property. You’re sharing ownership with other timeshare owners, and you’ll be subject to the rules and regulations of the resort.

Maintenance Fees

Timeshare contracts often require owners to pay annual maintenance fees, which cover expenses like upkeep, repairs, utilities, and resort management. These fees can vary depending on the size of the unit, the amenities offered, and the location of the resort.

- Maintenance fees can increase over time, and it’s important to factor this into your financial planning.

- Some timeshare contracts allow for a separate account to be established for maintenance fees, ensuring that the funds are specifically allocated to the upkeep of the property.

Cancellation Clauses

Timeshare contracts often contain cancellation clauses that Artikel the conditions under which you can terminate your ownership. These clauses can be complex and vary significantly from one contract to another.

- Right of Rescission: This allows you to cancel your contract within a specific period, typically 14 days, after signing it. This right is often granted by state law and protects consumers from impulsive purchases.

- Cooling-off period: This period allows you to cancel your contract within a specific timeframe, typically 14 days, after signing it. This right is often granted by state law and protects consumers from impulsive purchases.

- Contractual Cancellation Clauses: Some contracts might offer cancellation options based on specific events, such as death, disability, or financial hardship. However, these clauses are often restrictive and may require documentation and proof.

Legal Terms and Phrases

Timeshare contracts often use legal terms and phrases that can be confusing. Understanding these terms is essential for making informed decisions about your ownership.

Rescission: The act of revoking or canceling a contract.

Deed of Trust: A legal document that transfers ownership of a property to a trustee, who holds it for the benefit of the lender (usually a bank or financial institution).

Lien: A legal claim against a property that can be used to secure payment of a debt.

Default: Failure to fulfill the terms of a contract, such as missing payments or failing to comply with the rules of the resort.

Foreclosure: The process of seizing a property to recover unpaid debts.

Types of Timeshare Contracts

Timeshare contracts can vary in structure and cancellation policies depending on the type of ownership.

- Fixed-week ownership contracts typically offer limited cancellation options, as the ownership is tied to a specific week or weeks each year.

- Floating ownership contracts might offer more flexibility in terms of cancellation, as you’re not bound to a specific week or unit.

- Points-based systems often have more flexible cancellation policies, as you can accumulate points that can be redeemed for various vacation options.

It’s important to carefully review your timeshare contract and understand the cancellation policies before making a purchase.

Cancellation Fees and Penalties

Timeshare contracts often include cancellation fees and penalties designed to discourage owners from terminating their ownership. These fees can be substantial and vary significantly depending on several factors.

Cancellation Fees

Cancellation fees are typically charged when an owner decides to terminate their timeshare contract before the end of the agreed-upon ownership period. The calculation of cancellation fees is often based on a percentage of the remaining purchase price or a fixed amount. These fees can be influenced by various factors, including:

- The age of the contract: Older contracts often have higher cancellation fees as the developer has already recouped a significant portion of their investment.

- The resort’s location and popularity: Highly sought-after resorts with high occupancy rates may have steeper cancellation fees to reflect the potential loss of revenue.

- The terms of the original contract: Specific clauses in the contract may dictate the cancellation fee structure.

Examples of Cancellation Fee Scenarios

- Scenario 1: A timeshare owner purchased a contract for $20,000 with a 20-year term. After 5 years, they decide to cancel. The contract states that the cancellation fee is 50% of the remaining purchase price. In this case, the cancellation fee would be $9,000 (50% of $18,000, which is the remaining purchase price after 5 years).

- Scenario 2: A timeshare owner purchased a contract for $15,000 with a 10-year term. The contract includes a fixed cancellation fee of $5,000, regardless of the remaining ownership period. If the owner cancels after 3 years, they would still be required to pay the full $5,000 cancellation fee.

Legal Options for Cancellation

While timeshare contracts are legally binding, there are instances where you might have legal grounds to cancel your contract. It is important to consult with a legal professional to explore your specific options and understand the applicable laws in your jurisdiction.

Rescission Rights

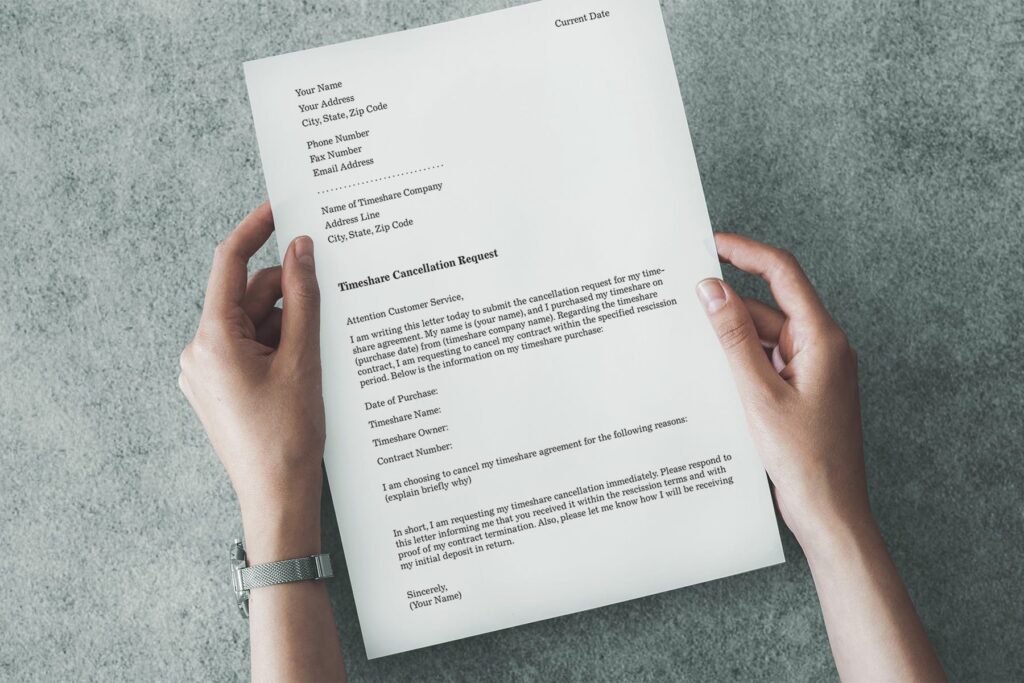

In some cases, you might have a right to rescind your timeshare contract within a specific timeframe. This right is often granted by state laws, particularly for contracts signed outside of your home state or at a timeshare presentation. Rescission allows you to cancel the contract without penalty and receive a full refund.To exercise your rescission rights, you typically need to send a written notice of cancellation within a specific period, often within 14 days of signing the contract.

This notice should be sent to the timeshare company by certified mail with return receipt requested.

Breach of Contract, How much does it cost to cancel a timeshare contract

If the timeshare company fails to uphold its obligations as Artikeld in the contract, you may have grounds to cancel the agreement. This could include situations like:

- Failure to provide the promised accommodations or services

- Misrepresentation of the timeshare property or its amenities

- Failure to disclose material information about the timeshare

To pursue a breach of contract claim, you need to gather evidence of the company’s violation. This could include written correspondence, photographs, or witness testimonies. You may also need to provide a formal notice of breach to the timeshare company, outlining the specific violations and requesting a remedy.

Fraud

If you can prove that the timeshare company engaged in fraudulent activities to induce you into signing the contract, you might be able to have it declared void. This could include situations like:

- Misleading representations about the timeshare property or its value

- Concealing important information about the contract terms or fees

- Using high-pressure sales tactics to coerce you into signing

To establish fraud, you need to demonstrate that the timeshare company intentionally misled you and that you relied on their misrepresentations when making your decision. This can be a complex legal process that requires substantial evidence.

Successful Cancellation Cases

Several individuals have successfully cancelled their timeshare contracts through legal means. One example is a case where a couple successfully sued a timeshare company for misrepresenting the property’s amenities and services. They were able to prove that the company had failed to disclose important information about the property’s condition and maintenance, leading to a successful cancellation of their contract.

Timeshare Resale and Transfer: How Much Does It Cost To Cancel A Timeshare Contract

Selling or transferring your timeshare contract to another individual can be a way to exit your ownership. However, it is essential to understand the process and potential challenges involved.

Resale Process

Timeshare resale involves selling your ownership rights to another individual, typically through a resale market or marketplace. This process usually involves the following steps:

- Listing your timeshare: You will need to find a reputable timeshare resale company or marketplace to list your timeshare for sale. This usually involves providing details about your timeshare, including the resort, unit size, and maintenance fees.

- Marketing your timeshare: Resale companies may assist with marketing your timeshare to potential buyers, using various methods such as online listings, print publications, and networking.

- Negotiating a sale: Once a potential buyer is interested, you will need to negotiate a sale price and agree on the terms of the transfer. This may involve a closing attorney or escrow company to handle the legal aspects of the transaction.

- Completing the transfer: After the sale is finalized, the ownership of the timeshare will be transferred to the new buyer. This usually involves paperwork filed with the resort management company and the relevant state authorities.

Costs and Challenges

Reselling a timeshare can be challenging, and it may not be as straightforward as selling a traditional property. Here are some potential costs and challenges to consider:

- Marketing and advertising costs: Resale companies typically charge fees for listing and marketing your timeshare, which can vary depending on the company and the services offered.

- Legal fees: You may need to hire an attorney to review the transfer documents and ensure the transaction is legally binding. Legal fees can range from a few hundred dollars to several thousand dollars, depending on the complexity of the transaction.

- Closing costs: Similar to traditional real estate transactions, you may incur closing costs, which can include escrow fees, recording fees, and transfer taxes.

- Maintenance fees: You will be responsible for paying maintenance fees until the sale is completed. If the sale takes time, this can accumulate and become a significant expense.

- Limited demand: Timeshare resale can be challenging due to limited demand. Many potential buyers are hesitant to purchase a timeshare, especially due to the high upfront costs and ongoing maintenance fees.

- Potential for scams: There are many scams associated with timeshare resale, so it is essential to research and choose a reputable resale company. Be wary of companies that promise quick and easy sales or offer unrealistic prices.

Reputable Timeshare Resale Companies

Here are a few examples of reputable timeshare resale companies:

- RedWeek: A popular online marketplace that allows timeshare owners to list their units for sale. They offer a range of services, including listing, marketing, and buyer assistance.

- Timeshare Users Group (TUG): A non-profit organization that provides resources and information to timeshare owners, including a resale marketplace. TUG offers a range of services, including legal advice and consumer protection resources.

- SellMyTimeshareNow: A company that specializes in helping timeshare owners sell their units. They offer a variety of services, including listing, marketing, and closing assistance.

Transferring a Timeshare

Timeshare transfer involves transferring ownership of your timeshare to another individual, typically a family member or friend. The process is similar to resale, but it may be less complex and involve fewer fees.

- Resort approval: You will need to contact your resort management company to initiate the transfer process. The resort may have specific requirements for transferring ownership, such as a transfer fee or a background check on the new owner.

- Legal documents: You will need to prepare and sign legal documents, such as a deed of transfer or a timeshare agreement. It is advisable to consult with an attorney to ensure the transfer is legally binding.

- Maintenance fees: The new owner will be responsible for paying maintenance fees from the date of transfer. You may need to agree on a method for transferring any outstanding maintenance fees.

Timeshare Exit Companies and Services

Timeshare exit companies offer services aimed at helping owners get out of their timeshare contracts. They typically employ various strategies, such as negotiating with the resort, finding buyers, or even pursuing legal action. While these companies promise a solution, understanding their methods and potential risks is crucial.

Types of Timeshare Exit Companies and Their Services

Timeshare exit companies can be categorized based on their primary methods:

- Negotiation Companies: These companies focus on negotiating with the timeshare resort to buy back the contract or modify its terms. They often use persuasive tactics and leverage their knowledge of the industry to secure favorable outcomes.

- Resale Companies: These companies act as intermediaries, connecting timeshare owners with potential buyers. They often advertise their services as a “quick and easy” way to sell your timeshare.

- Legal Companies: These companies use legal strategies to challenge the validity of timeshare contracts. They might argue for contract breach, fraud, or deceptive practices.

- Cancellation Companies: These companies offer to cancel your timeshare contract, often claiming to have secret methods or insider connections. They may promise to “get you out of your timeshare” without any upfront fees.

Potential Risks and Benefits of Using Timeshare Exit Companies

While some companies genuinely strive to help owners, others may engage in unethical practices. Here are some potential risks and benefits to consider:

- Potential Risks:

- High Fees: Timeshare exit companies often charge substantial fees upfront, with no guarantee of success.

- False Promises: Some companies make unrealistic claims about their ability to cancel contracts or find buyers quickly.

- Scams: Unfortunately, some companies operate as scams, taking money without providing any real service.

- Legal Complications: Legal action against timeshare companies can be complex and expensive, and there is no guarantee of a favorable outcome.

- Potential Benefits:

- Expert Negotiation: Some companies have experienced negotiators who can effectively communicate with resorts and potentially secure favorable terms.

- Access to Resources: Reputable companies may have access to resources, such as legal expertise or a network of potential buyers, that individual owners may not have.

- Stress Reduction: Using a timeshare exit company can relieve the burden of dealing with the timeshare company directly.

Examples of Successful and Unsuccessful Experiences with Timeshare Exit Companies

- Successful Experience: In 2019, a couple in Florida hired a reputable timeshare exit company to help them get out of their contract. The company negotiated with the resort, and after several months, the couple successfully relinquished their ownership for a significantly reduced price.

- Unsuccessful Experience: A family in California paid a large upfront fee to a timeshare exit company that promised to cancel their contract. However, the company failed to deliver on its promises, and the family was left with their timeshare and a substantial financial loss.

Consumer Protection and Legal Resources

Understanding your rights and the legal options available to you is crucial when dealing with timeshare contracts. This section Artikels consumer protection laws, the role of government agencies, and resources for legal advice and support.

Consumer Protection Laws and Regulations

Several federal and state laws protect consumers from unfair and deceptive business practices, including those related to timeshares.

- The Timeshare Resale and Rental Act (TSRRA) is a federal law that regulates the resale and rental of timeshares. It requires timeshare developers to disclose certain information to potential buyers, including the developer’s financial condition and the timeshare’s operating history. The TSRRA also prohibits certain deceptive practices, such as misrepresenting the value of a timeshare or failing to disclose the existence of liens on the property.

- The Federal Trade Commission (FTC) has authority to enforce the TSRRA and other consumer protection laws. The FTC has issued numerous guidance documents and enforcement actions against timeshare companies that engage in deceptive or unfair practices.

- The Real Estate Settlement Procedures Act (RESPA) requires lenders to provide borrowers with certain disclosures about the costs of closing a loan, including the fees charged by timeshare developers.

- The Truth in Lending Act (TILA) requires lenders to disclose the terms of a loan, including the interest rate, the amount of the loan, and the total amount of interest that will be paid. This helps consumers compare loan offers and avoid high-interest rates.

- Many states have their own laws that regulate timeshares. These state laws may provide additional consumer protections, such as a right to cancel a contract within a certain period of time.

Role of Government Agencies and Consumer Protection Organizations

Government agencies and consumer protection organizations play a crucial role in protecting consumers from unfair and deceptive timeshare practices.

- The FTC investigates and prosecutes companies that violate consumer protection laws, including those related to timeshares. Consumers can file complaints with the FTC if they believe they have been the victim of a timeshare scam.

- The Consumer Financial Protection Bureau (CFPB) enforces federal consumer financial laws, including the Truth in Lending Act and the Real Estate Settlement Procedures Act. The CFPB also provides consumers with information and resources about timeshares.

- The Department of Justice (DOJ) enforces federal criminal laws, including those related to fraud. The DOJ may investigate and prosecute timeshare developers that engage in criminal activities, such as racketeering or wire fraud.

- State attorneys general also have authority to enforce consumer protection laws and investigate complaints against timeshare companies.

- Consumer protection organizations, such as the American Resort Development Association (ARDA), provide consumers with information and resources about timeshares. They may also offer mediation or arbitration services to help resolve disputes between consumers and timeshare developers.

Legal Resources for Timeshare Cancellation Issues

If you are having trouble canceling your timeshare contract, there are several legal resources available to you.

- Consult with an attorney specializing in timeshare law. An attorney can help you understand your rights and options, and they can represent you in negotiations with the timeshare developer.

- Consider filing a lawsuit. If you believe that the timeshare developer has violated your rights, you may be able to file a lawsuit to seek damages or to rescind the contract.

- File a complaint with the FTC or your state attorney general’s office. These agencies may be able to investigate your complaint and take action against the timeshare developer.

- Seek mediation or arbitration. If you and the timeshare developer are willing, you may be able to resolve your dispute through mediation or arbitration.

So, how much does it cost to cancel a timeshare contract? The answer depends on a variety of factors, including the specific terms of your contract, the cancellation method you choose, and the legal jurisdiction in which your timeshare is located. While there are costs associated with canceling a timeshare, it’s important to remember that you have options. By understanding your rights and exploring all possible avenues, you can increase your chances of successfully breaking free from your timeshare obligations and reclaiming your financial freedom.

Commonly Asked Questions

What is a timeshare?

A timeshare is a type of ownership or right to use a vacation property for a specific period each year.

Can I cancel my timeshare contract without paying any fees?

It’s rare to cancel a timeshare contract without incurring any fees. Most contracts have cancellation clauses that specify fees or penalties.

Are timeshare exit companies legitimate?

Some timeshare exit companies are legitimate, but others are scams. It’s essential to research any company thoroughly before engaging their services.

What are my legal rights regarding timeshare cancellation?

You may have legal rights to cancel your timeshare contract under certain circumstances, such as fraud or breach of contract. Consult with an attorney to determine your options.