What does 00 secured bond mean – What does a $5000 secured bond mean? In the intricate world of legal proceedings, financial security plays a crucial role. Secured bonds, like the $5000 example, serve as a financial guarantee, ensuring that certain obligations are met. This article delves into the meaning and significance of secured bonds, exploring their purpose, implications, and the factors that determine their value.

Secured bonds, often required in legal cases, act as a safety net for the court or the party seeking the bond. They provide assurance that financial obligations, such as court costs, damages, or bail, will be met. The amount of the bond, such as the $5000 figure, is determined by various factors, including the severity of the case, the potential risks involved, and the financial standing of the individual or entity posting the bond.

What is a Bond?

A bond, in the context of finance and legal systems, is a financial instrument representing a debt that a borrower owes to a lender. This debt is typically repaid with interest over a specified period. Bonds are commonly used in legal proceedings as a form of security or guarantee.

Purpose of Bonds in Legal Proceedings

Bonds play a crucial role in legal proceedings, serving as a financial guarantee that ensures the fulfillment of specific obligations. These obligations can include:

- Appearance in Court: A bond can be required to ensure a defendant’s appearance at court hearings. If the defendant fails to appear, the bond amount is forfeited.

- Payment of Fines or Restitution: Bonds can be used to guarantee the payment of fines or restitution owed to the victim in a criminal case.

- Compliance with Court Orders: Bonds can be issued to ensure compliance with court orders, such as restraining orders or child custody arrangements.

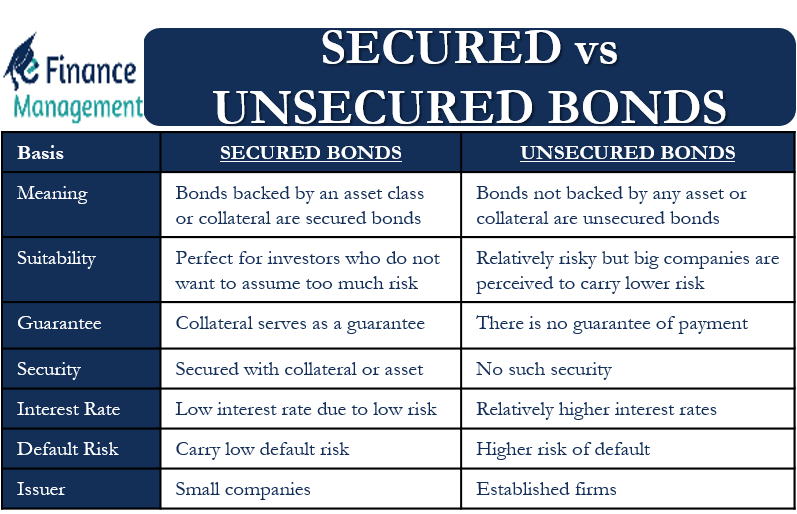

Secured vs. Unsecured Bonds

The distinction between a secured and an unsecured bond lies in the presence of collateral.

Secured bonds are backed by specific assets, such as real estate or investments, that can be seized by the lender if the borrower defaults on the bond.

Unsecured bonds, on the other hand, are not backed by any specific assets. These bonds rely on the borrower’s creditworthiness and ability to repay the debt.

In the context of legal proceedings, a secured bond offers a greater level of protection for the lender, as they have a tangible asset to claim in case of default. An unsecured bond, however, carries a higher risk for the lender as they have no specific asset to recover if the borrower fails to fulfill their obligations.

Secured Bonds in Legal Contexts: What Does 00 Secured Bond Mean

A secured bond in a legal context refers to a financial guarantee that is backed by specific assets or property. This means that if the individual or entity who posted the bond fails to fulfill their legal obligations, the court can seize and sell the designated assets to cover the financial losses.

Purpose and Implications of Secured Bonds in Legal Proceedings

Secured bonds serve a crucial purpose in legal proceedings, acting as a safeguard for various parties involved. These bonds are commonly required in situations where there is a risk of financial loss or harm due to non-compliance with legal orders or judgments. The implications of a secured bond can vary depending on the specific legal scenario.

Types of Secured Bonds and Their Applications

Secured bonds can be categorized into different types, each serving a specific purpose in legal proceedings. These bonds provide financial security for various parties involved in legal matters, ensuring compliance with court orders and mitigating potential risks.

- Bail Bonds: These bonds are used to secure the release of an individual from custody pending trial. The bond is posted by a bail bondsman, who guarantees the defendant’s appearance in court. If the defendant fails to appear, the bondsman is responsible for covering the bail amount.

- Appeal Bonds: When a party appeals a court decision, they may be required to post an appeal bond. This bond ensures that the appealing party will pay any court costs or damages if the appeal is unsuccessful.

- Injunction Bonds: Injunctions are court orders that prohibit certain actions. An injunction bond is posted to protect the party who is being restrained from potential financial losses if the injunction is later found to be unjustified.

- Performance Bonds: These bonds guarantee that a contractor will complete a project according to the agreed-upon terms and specifications. If the contractor fails to perform, the bond issuer will cover the costs of completing the project.

- Fidelity Bonds: Fidelity bonds protect businesses from financial losses caused by employee dishonesty, such as embezzlement or fraud. They provide financial compensation if an employee commits a crime that results in financial loss to the company.

Examples of Secured Bonds in Legal Scenarios

Here are some examples of how secured bonds are used in legal proceedings:

- Criminal Proceedings: In criminal cases, a defendant may be required to post a secured bond to ensure their appearance at trial. If the defendant fails to appear, the bond amount will be forfeited.

- Civil Litigation: Secured bonds can be used in civil lawsuits to ensure the payment of judgments or court costs. For instance, a plaintiff might require the defendant to post a bond to guarantee the payment of damages if they are found liable.

- Contract Disputes: Secured bonds are often used in contracts to guarantee the performance of obligations. For example, a contractor might be required to post a performance bond to ensure that they will complete the project as agreed.

- Environmental Protection: Secured bonds can be used to ensure the financial responsibility of companies involved in environmentally sensitive activities. For example, a mining company might be required to post a bond to cover the costs of environmental cleanup if their operations result in pollution.

The Significance of $5000

A $5000 secured bond represents a significant financial commitment, impacting both the individual or entity posting the bond and the recipient of the bond. This amount can influence the course of legal proceedings, affect the financial stability of the involved parties, and potentially determine the outcome of the situation.

Factors Determining the Amount of a Secured Bond

The amount of a secured bond is determined by several factors, ensuring a fair and proportionate balance between the potential risks and the financial resources available. These factors include:

- Nature of the legal proceedings: The severity of the potential risks involved in the legal proceedings significantly impacts the bond amount. More serious offenses or cases with higher potential financial liabilities often necessitate a larger secured bond.

- Defendant’s financial history: The defendant’s financial stability plays a crucial role in determining the bond amount. A history of financial instability or a high risk of absconding may result in a higher secured bond requirement.

- Jurisdiction and court practices: Different jurisdictions and courts may have varying standards for setting secured bond amounts. These standards are influenced by local laws, judicial precedents, and the specific circumstances of the case.

- Risk assessment: A thorough risk assessment is conducted to evaluate the likelihood of the defendant failing to appear in court or fulfilling their legal obligations. This assessment considers factors such as the defendant’s criminal history, the strength of the evidence against them, and their potential flight risk.

Consequences of Failing to Post a Secured Bond

Failing to post a secured bond can have serious consequences, potentially jeopardizing the defendant’s freedom and financial stability. These consequences include:

- Detention: If the defendant fails to post the required secured bond, they may be detained in custody until the legal proceedings are concluded. This detention can significantly disrupt the defendant’s life and work, potentially leading to financial hardship and loss of income.

- Financial penalties: Failing to post a secured bond can result in financial penalties, such as forfeiture of the bond amount or additional fines. These penalties can further strain the defendant’s financial resources, potentially leading to debt and financial instability.

- Negative impact on legal proceedings: Failing to post a secured bond can negatively impact the defendant’s legal proceedings. It may be perceived as a sign of disregard for the legal process and potentially weaken their defense.

- Damage to reputation: Failing to post a secured bond can damage the defendant’s reputation, potentially affecting their future business dealings and social standing. This damage can be difficult to repair and may have long-lasting consequences.

Who Requires a Secured Bond?

A secured bond is typically required by a party or entity seeking to mitigate the risk of financial loss due to the potential non-performance of an obligation by another party. This bond serves as a guarantee, ensuring that the obligee (the party receiving the guarantee) will be compensated in the event of a breach of contract or failure to meet a specific requirement.The requirement for a secured bond often arises in situations involving financial transactions, legal proceedings, or contractual agreements where the potential financial risk is substantial.

Government Agencies

Government agencies frequently require secured bonds as a condition for granting licenses, permits, or contracts. This is because government agencies are responsible for public funds and need to ensure that contractors and licensees fulfill their obligations. For example, a construction company bidding on a public project might be required to provide a performance bond guaranteeing the completion of the project on time and within budget.

Financial Institutions

Financial institutions, such as banks and insurance companies, may require secured bonds as collateral for loans or other financial products. This ensures that the lender will be compensated in the event of a default by the borrower. For instance, a bank might require a secured bond from a borrower seeking a large loan to guarantee repayment.

Legal Proceedings

In legal proceedings, secured bonds may be required to cover potential financial liabilities arising from lawsuits or court orders. For example, a defendant in a civil case might be required to post a bond to secure payment of any damages awarded to the plaintiff.

Contractual Agreements

Secured bonds can also be included in contractual agreements to guarantee performance or financial obligations. For instance, a supplier providing goods or services to a company might be required to provide a performance bond guaranteeing the timely delivery of the goods or services.

Specific Circumstances

The specific circumstances under which a secured bond is necessary can vary widely depending on the nature of the transaction, the parties involved, and the potential risks. However, some common circumstances include:

- High-value transactions involving significant financial risk.

- Situations where the obligor has a history of non-performance or financial instability.

- Contracts involving complex or specialized services or products.

- Legal proceedings where there is a significant risk of financial liability.

Legal Implications of a Secured Bond

A secured bond, while often used as a financial instrument, carries significant legal implications. It’s crucial to understand the legal ramifications, rights, and obligations associated with posting a secured bond, as well as the legal processes involved in securing and releasing it.

Rights and Obligations of a Secured Bond

Understanding the rights and obligations associated with a secured bond is essential for both the bond provider and the beneficiary.

- The bond provider, the individual or entity posting the bond, is legally obligated to fulfill the terms of the bond agreement. This typically involves ensuring the performance of a specific action or the fulfillment of a particular obligation.

- The beneficiary, the party who benefits from the bond, has the right to claim the bond’s full value if the bond provider fails to meet their obligations. This right is exercised through legal processes.

- The bond provider has the right to receive the bond back, along with any accrued interest, if the bond conditions are met and the obligation is fulfilled.

Legal Processes for Securing and Releasing a Bond, What does 00 secured bond mean

The legal processes involved in securing and releasing a bond are Artikeld below.

- Securing a bond typically involves a formal application process with a surety company or financial institution. This process requires providing detailed information about the bond purpose, the parties involved, and the associated risks. The bond provider may need to provide collateral or proof of financial stability to secure the bond.

- Releasing a bond involves fulfilling the terms of the bond agreement and providing evidence of successful completion. This may include providing proof of performance, completion of a project, or payment of a debt. Once the surety company verifies the fulfillment of the bond conditions, they release the bond, and the bond provider regains control of their collateral, if any.

Understanding the concept of a secured bond is essential for anyone involved in legal proceedings. It provides a clear picture of the financial responsibilities and guarantees involved. Whether you are a defendant, a plaintiff, or a party seeking to ensure compliance, grasping the meaning of a secured bond empowers you to navigate legal processes with confidence. By understanding the purpose, implications, and potential consequences associated with secured bonds, you can make informed decisions and protect your interests throughout the legal journey.

Frequently Asked Questions

What happens if I fail to post a secured bond?

Failing to post a secured bond can have serious consequences, potentially leading to fines, imprisonment, or the forfeiture of the amount of the bond. It’s crucial to consult with a legal professional to understand your obligations and options.

Who decides the amount of the secured bond?

The amount of a secured bond is typically determined by a judge or court official based on the specific circumstances of the case. Factors like the severity of the offense, the potential risk of flight, and the defendant’s financial situation all contribute to the bond amount.

Can I get my secured bond money back?

Yes, under most circumstances, you can get your secured bond money back once the legal proceedings are completed and all obligations are met. However, if you fail to fulfill your obligations, the bond money may be forfeited.