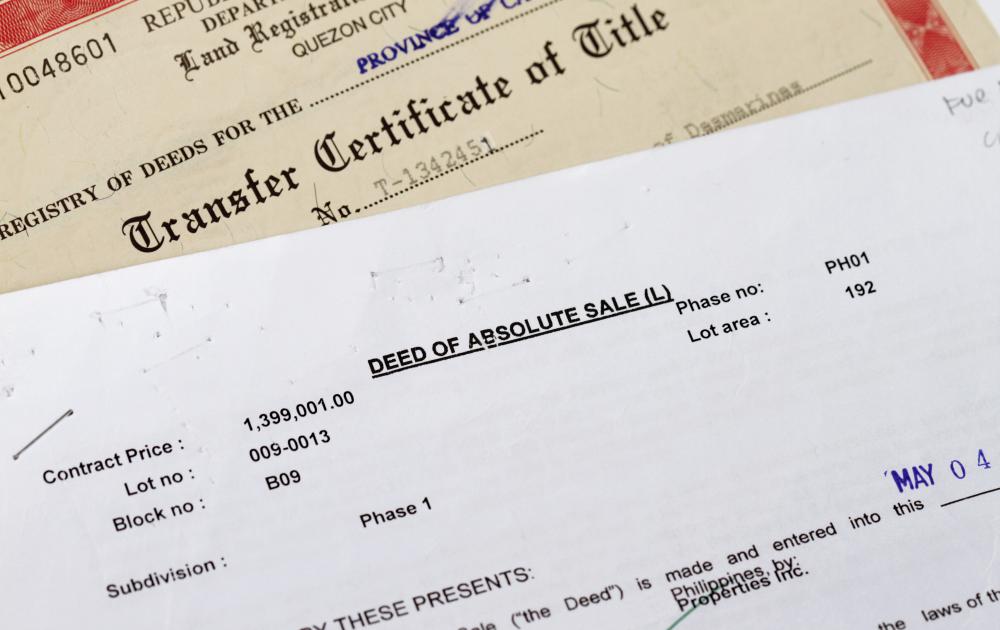

What is a security deed? This legal instrument plays a crucial role in real estate transactions, offering an alternative to traditional mortgages. It essentially acts as a lien on property, securing a loan for the borrower. Unlike a mortgage, where the borrower retains ownership of the property, a security deed transfers title to the lender until the loan is fully repaid.

This arrangement offers unique advantages and disadvantages for both borrowers and lenders, shaping the landscape of real estate financing.

Understanding the nuances of security deeds is vital for anyone involved in real estate, whether as a buyer, seller, or lender. This guide delves into the intricacies of security deeds, exploring their definition, key features, advantages, disadvantages, legal implications, and practical applications. By shedding light on this often overlooked aspect of real estate finance, we aim to empower individuals with the knowledge necessary to make informed decisions in their property transactions.

Key Features of a Security Deed: What Is A Security Deed

A security deed, also known as a deed of trust, is a legal document used to secure a loan. It’s basically a contract between the borrower (the grantor) and the lender (the grantee). The grantor transfers ownership of the property to the grantee as collateral for the loan. This means that if the borrower defaults on the loan, the lender can foreclose on the property and sell it to recover their losses.

Essential Elements of a Security Deed

A valid security deed must contain several essential elements to be legally binding. These elements ensure that the document is clear, unambiguous, and protects the rights of both parties involved.

- Grantor and Grantee Information: This includes the full legal names and addresses of both the borrower (grantor) and the lender (grantee). This ensures that the parties involved are clearly identified and that the deed can be easily traced.

- Legal Description of the Property: The deed must accurately describe the property being used as collateral. This includes the address, lot number, and any other details necessary to uniquely identify the property. This prevents confusion and ensures that the correct property is being used as collateral.

- Loan Amount and Terms: The deed should specify the exact amount of the loan, the interest rate, and the repayment schedule. This ensures transparency and clarity regarding the financial obligations of the borrower.

- Granting Clause: This clause states that the grantor is transferring ownership of the property to the grantee as collateral for the loan. This clause is crucial for establishing the legal basis for the security deed.

- Default Clause: This clause Artikels the conditions under which the borrower can be considered in default of the loan. This includes situations like missed payments, failure to maintain the property, or violation of other loan terms. This clause provides the lender with legal grounds to foreclose on the property if the borrower fails to fulfill their obligations.

- Foreclosure Clause: This clause describes the process for the lender to foreclose on the property if the borrower defaults on the loan. It Artikels the steps involved, including the notice period required and the methods for selling the property. This clause ensures that the foreclosure process is conducted fairly and legally.

- Signatures and Witnesses: Both the grantor and grantee must sign the deed, and it may also require witnesses to ensure authenticity and legal validity.

Roles of the Grantor and Grantee

The grantor and grantee have distinct roles in a security deed transaction. Understanding these roles is crucial for both parties to make informed decisions and protect their interests.

- Grantor: The grantor is the borrower who is using the property as collateral for the loan. They retain possession of the property and continue to use it as they see fit. However, they are obligated to make timely payments and adhere to the terms of the loan agreement. Failure to do so could result in foreclosure.

- Grantee: The grantee is the lender who is providing the loan. They have a legal interest in the property, meaning they have the right to foreclose on the property if the borrower defaults. They are responsible for managing the foreclosure process if necessary.

Rights and Obligations of the Parties

Both the grantor and grantee have specific rights and obligations in a security deed transaction. These rights and obligations are Artikeld in the deed and should be carefully reviewed by both parties before signing.

- Grantor’s Rights:

- Right to Possession: The grantor retains possession of the property and can continue to use it as they see fit. However, they must maintain the property in good condition.

- Right to Redemption: In some cases, the grantor may have the right to redeem the property by paying off the loan in full, even after defaulting. This right may be limited by the terms of the deed and state laws.

- Grantor’s Obligations:

- Obligation to Make Payments: The grantor is obligated to make timely payments on the loan according to the terms of the deed.

- Obligation to Maintain the Property: The grantor is obligated to maintain the property in good condition and ensure that it is not damaged or neglected. This helps protect the lender’s investment.

- Obligation to Comply with Loan Terms: The grantor must comply with all other terms of the loan agreement, including any restrictions on the property’s use.

- Grantee’s Rights:

- Right to Foreclose: If the grantor defaults on the loan, the grantee has the right to foreclose on the property and sell it to recover their losses. This right is Artikeld in the deed and is subject to state laws.

- Right to Receive Payments: The grantee has the right to receive timely payments from the grantor according to the terms of the loan agreement.

- Grantee’s Obligations:

- Obligation to Follow Foreclosure Procedures: The grantee must follow the proper legal procedures when foreclosing on the property. This includes providing the grantor with proper notice and following the requirements of state law.

- Obligation to Act in Good Faith: The grantee must act in good faith when dealing with the grantor and must not engage in unfair or deceptive practices.

Advantages and Disadvantages of Using a Security Deed

A security deed, also known as a deed of trust, is a type of real estate financing that can be a viable option for borrowers, especially those who may have less-than-perfect credit or who are looking for a faster closing process. But like any financial tool, it comes with its own set of advantages and disadvantages that you need to consider before making a decision.

Advantages of a Security Deed

Using a security deed can offer several benefits for borrowers, especially those who are looking for a more flexible and potentially faster financing option. Here are some of the key advantages:

- Faster Closing: Security deeds often have a simpler closing process compared to traditional mortgages, which can be a significant advantage for borrowers who need to close quickly.

- Lower Closing Costs: The closing costs associated with a security deed can be lower than those for a mortgage, as there are fewer intermediaries involved in the process.

- More Flexible Terms: Security deeds can offer more flexibility in terms of repayment schedules and interest rates, which can be beneficial for borrowers with unique financial situations.

- Potential for Lower Interest Rates: In some cases, borrowers may be able to secure lower interest rates on a security deed compared to a mortgage, especially if they have a good credit history.

- Easier Qualification: Borrowers with less-than-perfect credit may find it easier to qualify for a security deed than a traditional mortgage.

Disadvantages of a Security Deed, What is a security deed

While security deeds offer some advantages, they also come with potential drawbacks that borrowers need to be aware of. Here are some of the disadvantages:

- Risk of Foreclosure: If you default on your payments, the lender can foreclose on your property much faster than with a traditional mortgage. The process can be much quicker, and you may have fewer legal options to challenge the foreclosure.

- Limited Legal Protections: Borrowers may have fewer legal protections under a security deed compared to a mortgage. For example, you may have less recourse if the lender violates the terms of the agreement.

- Potential for Higher Interest Rates: While security deeds can sometimes offer lower interest rates, they can also be higher than mortgages, especially for borrowers with poor credit history.

- Less Transparency: The terms of a security deed may not be as transparent as those of a mortgage, which can make it more difficult to understand your obligations and rights.

- Potential for Hidden Fees: Security deeds may include hidden fees or charges that are not disclosed upfront, which can increase the overall cost of financing.

Comparing Security Deeds and Mortgages

Understanding the key differences between a security deed and a mortgage can help you determine which financing option is right for your situation.

- Ownership: With a mortgage, you retain legal ownership of the property throughout the loan term. With a security deed, the lender holds legal title to the property until the loan is fully repaid. You essentially have equitable title, which means you have the right to possess and use the property, but the lender technically owns it.

- Foreclosure Process: Foreclosure with a mortgage typically involves a lengthy legal process that provides more opportunities for borrowers to catch up on payments or challenge the foreclosure. With a security deed, foreclosure can be much faster and less transparent, potentially leaving you with fewer options.

- Legal Protections: Borrowers under a mortgage have more legal protections and recourse in case of lender violations or unfair practices. Security deeds may offer fewer protections, potentially leaving borrowers with less recourse.

Legal Implications of a Security Deed

A security deed is a legally binding agreement, and understanding its legal implications is crucial. It Artikels the rights and responsibilities of both the borrower and the lender, ensuring fairness and transparency in the transaction. Let’s explore the legal aspects of creating, enforcing, and defaulting on a security deed.

Creating and Enforcing a Security Deed

The creation and enforcement of a security deed involve a series of legal steps. These steps are designed to ensure that the agreement is valid, binding, and legally enforceable.

- Proper Execution and Recording: The security deed must be properly executed by both the borrower and the lender. This involves signing the document in the presence of a notary public. The deed must also be recorded with the appropriate county or state office to provide public notice of the lien. This recording ensures that the deed is legally valid and that third parties are aware of the lender’s interest in the property.

- Legal Counsel: It is highly recommended that both parties seek legal counsel from a qualified attorney before signing a security deed. This ensures that the terms of the agreement are clear, fair, and legally sound. An attorney can also advise on any potential legal risks and ensure that the document complies with all applicable laws.

- Enforcement of the Deed: If the borrower defaults on the terms of the security deed, the lender has the legal right to enforce the deed. This typically involves a foreclosure process, which allows the lender to sell the property to recover the outstanding debt.

Legal Ramifications of Defaulting on a Security Deed Agreement

Defaulting on a security deed agreement can have serious legal consequences. It is important to understand these consequences to make informed decisions and avoid potential legal issues.

- Foreclosure: The most common consequence of defaulting on a security deed is foreclosure. This is a legal process that allows the lender to take possession of the property and sell it to recover the outstanding debt. The borrower may lose their property and any equity they have built up in it.

- Legal Action: The lender may also take legal action against the borrower, such as filing a lawsuit to recover the debt. This can result in additional costs, including court fees, legal fees, and potential judgments against the borrower.

- Damage to Credit Score: Defaulting on a security deed can significantly damage the borrower’s credit score. This can make it difficult to obtain loans or credit in the future.

Potential Consequences of a Foreclosure Process

The foreclosure process can result in several consequences for the borrower, both legal and financial. It is crucial to understand these consequences to make informed decisions about their financial situation.

- Loss of Property: The most immediate consequence of foreclosure is the loss of the property. The borrower will be evicted from the property, and the lender will take possession of it. This can be a significant financial and emotional hardship for the borrower.

- Deficiency Judgment: In some cases, the sale of the property may not cover the full amount of the debt owed. If this happens, the lender may obtain a deficiency judgment against the borrower. This means that the borrower will still be liable for the remaining debt, even after the property has been sold.

- Negative Impact on Credit Score: A foreclosure will have a severe negative impact on the borrower’s credit score. This can make it difficult to obtain loans or credit in the future, and it can also affect the borrower’s ability to rent an apartment or obtain employment.

Practical Applications of Security Deeds

Security deeds are a unique financing tool that offers a flexible approach to real estate transactions. They’re particularly valuable in situations where traditional lending options might not be readily available or where borrowers seek greater control over their financial arrangements.

Scenarios Where Security Deeds are Used

Security deeds are commonly used in several real estate scenarios, offering advantages that cater to specific needs. Here’s a breakdown of how they are applied:

Land Acquisition and Development

- In land acquisition, security deeds allow developers to secure property rights while deferring full payment, providing flexibility during the development process.

- Security deeds are especially useful for acquiring raw land that requires significant preparation and infrastructure development, allowing developers to manage cash flow effectively.

Owner Financing

- Security deeds are often used in owner financing arrangements, where the seller provides the financing for the property instead of relying on traditional lenders.

- This can be advantageous for sellers who wish to control the terms of the loan and avoid the complexities of traditional mortgages.

Private Lending

- Security deeds are commonly employed in private lending transactions, where individuals or entities lend money to borrowers outside the traditional banking system.

- Private lenders often favor security deeds due to their flexibility in structuring loan terms and managing risk.

Real Estate Investments

- Security deeds can be beneficial for investors seeking to acquire properties with limited cash reserves or who prefer to structure their investments with greater control.

- They can also be used in joint venture agreements, allowing partners to secure their respective interests in the property.

Advantages of Using Security Deeds

Security deeds offer several advantages in real estate transactions, making them an attractive alternative to traditional mortgages in specific situations:

Flexibility in Loan Terms

- Security deeds allow for more flexible loan terms, such as variable interest rates, shorter loan periods, and customized repayment schedules.

- This flexibility can be particularly advantageous for borrowers with unique financial situations or who need tailored financing arrangements.

Reduced Closing Costs

- Security deeds often involve lower closing costs compared to traditional mortgages, as they typically avoid the involvement of third-party lenders and associated fees.

- This cost savings can be significant, particularly for smaller transactions or borrowers with limited financial resources.

Simplified Documentation

- Security deeds generally involve simpler documentation and fewer legal complexities compared to traditional mortgages.

- This can streamline the transaction process and reduce the time and effort required to finalize the deal.

Greater Control for Borrowers

- Security deeds allow borrowers greater control over their financing arrangements, as they are not subject to the strict regulations and requirements of traditional lenders.

- This can be beneficial for borrowers who prefer to manage their finances independently and maintain greater flexibility.

Comparison of Security Deeds in Different Real Estate Transactions

| Transaction Type | Advantages of Using Security Deeds | Disadvantages of Using Security Deeds |

|---|---|---|

| Land Acquisition and Development | Flexibility in payment terms, allows developers to manage cash flow effectively | Limited access to traditional financing options, potential legal complexities |

| Owner Financing | Sellers have greater control over loan terms, avoids traditional mortgage complexities | Limited access to traditional financing options, potential legal complexities |

| Private Lending | Flexibility in loan terms, customized financing arrangements | Higher risk for lenders, potential legal complexities |

| Real Estate Investments | Flexibility in structuring investments, greater control over financing | Limited access to traditional financing options, potential legal complexities |

Security Deeds and State Laws

Security deeds, like any legal document, are subject to the laws of the state where they are used. This means that the rules and regulations governing security deeds can vary significantly from one state to another. Understanding these variations is crucial for ensuring the validity and enforceability of security deeds in different jurisdictions.

State Law Variations

State laws regarding security deeds can differ in several key areas, including:

- Form and Content: Some states have specific requirements for the form and content of security deeds, such as the need for specific language or clauses. Others may have more general requirements, leaving more room for flexibility.

- Recording Requirements: States may have different rules about how security deeds are recorded, such as where they must be filed and what information must be included in the recording.

- Foreclosure Procedures: The process for foreclosing on a property secured by a security deed can vary significantly from state to state. Some states have more streamlined foreclosure processes, while others have more complex procedures.

- Redemption Rights: Some states allow borrowers to redeem their property after default, even after foreclosure proceedings have begun. These redemption rights can vary in duration and scope.

- Tax Implications: The tax treatment of security deeds can also differ from state to state. Some states may consider security deeds as loans, while others may treat them as outright sales.

Impact of State Law Differences

These variations in state law can have a significant impact on the use of security deeds in different jurisdictions. For example, a security deed that is valid and enforceable in one state may not be valid or enforceable in another state. This can create legal complications and uncertainties for both borrowers and lenders.

Legal Requirements for Security Deeds

The following table provides a summary of the legal requirements for security deeds in selected states:| State | Form and Content Requirements | Recording Requirements | Foreclosure Procedures | Redemption Rights | Tax Implications ||—|—|—|—|—|—|| Alabama | Must be in writing and signed by the borrower. | Must be recorded in the county where the property is located. | Judicial foreclosure is required.

| Borrower has a right of redemption for one year after foreclosure sale. | Treated as a loan for tax purposes. || Arkansas | Must be in writing and signed by the borrower. | Must be recorded in the county where the property is located. | Judicial foreclosure is required.

| Borrower has a right of redemption for one year after foreclosure sale. | Treated as a loan for tax purposes. || Georgia | Must be in writing and signed by the borrower. | Must be recorded in the county where the property is located. | Power of sale foreclosure is allowed.

| Borrower has a right of redemption for one year after foreclosure sale. | Treated as a loan for tax purposes. || Mississippi | Must be in writing and signed by the borrower. | Must be recorded in the county where the property is located. | Judicial foreclosure is required.

| Borrower has a right of redemption for one year after foreclosure sale. | Treated as a loan for tax purposes. || South Carolina | Must be in writing and signed by the borrower. | Must be recorded in the county where the property is located. | Power of sale foreclosure is allowed.

| Borrower has a right of redemption for one year after foreclosure sale. | Treated as a loan for tax purposes. || Texas | Must be in writing and signed by the borrower. | Must be recorded in the county where the property is located. | Non-judicial foreclosure is allowed.

| Borrower has a right of redemption for two years after foreclosure sale. | Treated as a loan for tax purposes. |

Security deeds present a distinct approach to real estate financing, offering unique advantages and disadvantages compared to traditional mortgages. Understanding the legal implications, potential risks, and specific applications of security deeds is crucial for both borrowers and lenders. While they can offer benefits like streamlined transactions and potential cost savings, it’s essential to carefully consider the potential drawbacks and legal ramifications before entering into such an agreement.

Ultimately, choosing the right financing option depends on individual circumstances and specific needs, making it essential to consult with legal and financial professionals for personalized advice.

FAQ Section

Can I use a security deed for any type of property?

Security deeds can be used for various types of real estate, including residential, commercial, and agricultural properties. However, the specific requirements and legal implications may vary depending on the type of property and the state laws governing the transaction.

What happens if I default on a security deed?

Defaulting on a security deed can lead to foreclosure, where the lender can take possession of the property. The legal process for foreclosure under a security deed may differ from that of a mortgage, so it’s crucial to understand the specific terms and conditions of the agreement.

Are security deeds more common in certain areas?

The use of security deeds can vary by region. Some states, particularly in the Southern and Midwestern US, have a stronger tradition of using security deeds in real estate transactions. However, their popularity is increasing nationwide as borrowers seek alternative financing options.