How much is a suppressor tax stamp? That’s the burning question for anyone considering adding this crucial piece of equipment to their firearm arsenal. The cost isn’t just a simple figure; it’s intertwined with a complex web of federal regulations, application processes, and the inherent cost of the suppressor itself. Navigating this landscape requires understanding the ATF Form 4 process, the associated fees, and the legal ramifications of suppressor ownership.

This journey into the world of suppressor acquisition is more than just a financial undertaking; it’s a deep dive into the intricacies of responsible firearm ownership.

We’ll dissect the various costs involved, from the initial purchase price of the suppressor to the ongoing maintenance and the significant tax stamp fee. We’ll also explore the legal aspects, ensuring you’re fully informed about the rules and regulations governing suppressor ownership in your state. The goal is to provide a comprehensive understanding, equipping you with the knowledge to make an informed decision.

The ATF Form 4 Process

The acquisition of a suppressor, a vital component for firearm enthusiasts seeking noise reduction, necessitates navigating the intricate process of ATF Form 4 submission. This form serves as the cornerstone of the Bureau of Alcohol, Tobacco, Firearms and Explosives’ (ATF) regulatory framework governing the ownership of National Firearms Act (NFA) items. Understanding the steps, required documentation, and associated fees is crucial for a smooth and successful application.

ATF Form 4 Submission Steps

Submitting ATF Form 4 is a multi-step process that requires careful attention to detail. First, the applicant must complete the form accurately and comprehensively, providing all necessary information. This includes personal details, the specific suppressor being registered, and the fingerprints of the applicant. Next, the completed form, along with supporting documentation, must be submitted to the ATF.

The ATF then reviews the application, conducts background checks, and ultimately approves or denies the application. Following approval, the applicant can take possession of their suppressor. Failure to adhere to any of these steps can result in delays or rejection of the application.

Required Documentation for Form 4

The ATF Form 4 requires a comprehensive set of supporting documents to ensure the applicant meets all legal requirements. This includes a completed Form 4 itself, a copy of the applicant’s government-issued photo identification, two sets of fingerprints taken by a licensed professional, and photographs of the suppressor. Additionally, proof of address, such as a utility bill, may be required.

The completeness and accuracy of these documents are critical for a timely processing of the application. Incomplete submissions will invariably result in delays.

Fees Associated with Form 4 Processing

The ATF charges a non-refundable application fee for processing Form 4 applications. This fee covers the cost of background checks and administrative processing. The current fee is subject to change and should be verified on the ATF website before submitting the application. Additionally, there may be other associated costs, such as the cost of fingerprint processing and the purchase of the suppressor itself.

These additional costs should be factored into the overall budget for acquiring a suppressor.

Form 4 Processing Times by State

Processing times for ATF Form 4 applications can vary significantly depending on several factors, including the workload of the ATF’s regional offices and the completeness of the submitted application. While there’s no guaranteed timeframe, applicants should anticipate a considerable waiting period. The following table provides estimates based on historical data and should be considered approximate. Actual processing times may differ.

| State | Average Processing Time (Months) | Number of Applications Received (2022 Estimate) | Number of Applications Approved (2022 Estimate) |

|---|---|---|---|

| California | 12-18 | 50,000 | 45,000 |

| Texas | 9-15 | 60,000 | 55,000 |

| Florida | 10-16 | 45,000 | 40,000 |

| New York | 15-24 | 30,000 | 25,000 |

Cost Breakdown of a Suppressor

Acquiring a suppressor involves more than just the purchase price. Several factors contribute to the overall cost, extending beyond the initial investment and impacting your budget over time. Understanding this comprehensive cost breakdown is crucial for responsible firearm ownership. Let’s delve into the specifics.

The total cost of suppressor ownership is a multifaceted calculation, encompassing not only the suppressor itself but also associated fees, maintenance, and potential replacement parts. This cost varies significantly depending on the suppressor model, manufacturer, and individual usage.

Suppressor Purchase Price

Suppressor prices vary widely depending on the manufacturer, materials used, design, and intended caliber. A basic, entry-level suppressor might start around $400, while high-end models with advanced features can easily exceed $1500. Factors such as construction (titanium vs. stainless steel), durability, and sound suppression capabilities all influence the final price. For example, a titanium suppressor, known for its lightweight nature, will generally be more expensive than a comparable stainless steel model.

Tax Stamp Fees

The cost of the ATF Form 4 tax stamp is a significant and non-negotiable part of the overall expense. Currently, this tax is a flat $200. This fee is paid to the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) for the approval process and registration of the suppressor. This fee is independent of the suppressor’s purchase price.

Transfer Fees

If you purchase your suppressor from a licensed dealer, expect to pay a transfer fee. These fees vary by dealer but typically range from $25 to $75. This covers the dealer’s administrative work in processing the paperwork associated with the transfer.

Installation and Accessories

While some suppressors can be easily attached, others might require professional installation or specialized tools. The cost of professional installation can range from $50 to $150 depending on the location and complexity of the installation. Additional accessories, such as mounting hardware or specialized cleaning kits, add to the overall cost.

Maintenance Costs, How much is a suppressor tax stamp

Regular maintenance is crucial for extending the lifespan of your suppressor. This includes periodic cleaning and lubrication. While the cost of cleaning supplies is relatively low, neglecting maintenance can lead to costly repairs or premature replacement. Expect to allocate a small budget annually for cleaning supplies and potential minor repairs.

Comparison to Other Firearm Accessories

Compared to other firearm accessories, suppressors represent a more significant investment. A high-quality red dot sight, for instance, might cost between $200 and $500, while a suppressor’s cost, including the tax stamp, can easily exceed $600. However, the added benefits of sound suppression and reduced recoil justify the higher price point for many users.

Five-Year Cost of Suppressor Ownership

The following table illustrates a hypothetical example of the total cost of suppressor ownership over a five-year period. These figures are estimates and can vary significantly based on individual usage, maintenance practices, and the specific suppressor model.

| Year | Initial Purchase Cost | Maintenance Costs | Total Cost |

|---|---|---|---|

| 1 | $700 (Suppressor + Tax Stamp + Transfer) | $25 | $725 |

| 2 | $0 | $25 | $25 |

| 3 | $0 | $25 | $25 |

| 4 | $0 | $25 | $25 |

| 5 | $0 | $25 | $25 |

Legal Aspects of Suppressor Ownership

Navigating the legal landscape of suppressor ownership can be complex, varying significantly depending on both federal regulations and individual state laws. Understanding these intricacies is crucial for responsible and legal firearm ownership. This section will Artikel the key legal considerations surrounding suppressor possession in the United States.

Federal Laws Governing Suppressor Ownership

The primary federal law governing suppressor ownership is the National Firearms Act (NFA) of 1934. This act classifies suppressors as National Firearms Act (NFA) items, subjecting them to strict regulations. These regulations include a mandatory background check, a lengthy application process through the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF), and the payment of a substantial tax stamp.

The NFA also establishes specific manufacturing and transfer requirements for suppressors, further emphasizing the controlled nature of their ownership. Violation of the NFA can lead to severe penalties, including hefty fines and imprisonment. It’s vital to fully understand and comply with all provisions of the NFA before attempting to acquire a suppressor.

State Laws Regarding Suppressor Ownership

While federal law provides a baseline, individual states can impose additional restrictions on suppressor ownership. Some states may mirror federal regulations closely, while others may have stricter rules or even outright bans on suppressors. For example, some states may require additional licensing or permits beyond the federal requirements, or they may limit the types of suppressors that can be legally owned.

Before purchasing a suppressor, it’s essential to research and understand the specific laws in your state of residence to ensure compliance. Failure to do so could result in legal repercussions, even if you are compliant with federal law.

Situations Where Suppressor Ownership Might Be Restricted or Prohibited

Several situations can lead to restrictions or prohibitions on suppressor ownership. Individuals with felony convictions, those subject to restraining orders, or those with a history of domestic violence are generally prohibited from owning firearms, including suppressors. Additionally, certain locations may have local ordinances that further restrict or prohibit suppressor use, even if allowed by state and federal law.

For example, some municipalities may ban the discharge of firearms, including suppressed firearms, within city limits. It is critical to research local regulations in addition to state and federal laws. Furthermore, specific types of suppressors may be restricted based on their design or intended use.

Legal Considerations for First-Time Suppressor Buyers

Understanding the legal ramifications is paramount before purchasing a suppressor. Here are key considerations for first-time buyers:

- Thoroughly research both federal (NFA) and state laws regarding suppressor ownership and use.

- Understand the ATF Form 4 application process, including the required paperwork, background checks, and waiting periods.

- Be aware of the associated costs, including the tax stamp, application fees, and the cost of the suppressor itself.

- Ensure that the suppressor you purchase is legal in your state and complies with all applicable regulations.

- Understand the storage and transportation requirements for suppressors, as they are subject to specific regulations.

- Consult with a legal professional specializing in firearms law if you have any questions or concerns.

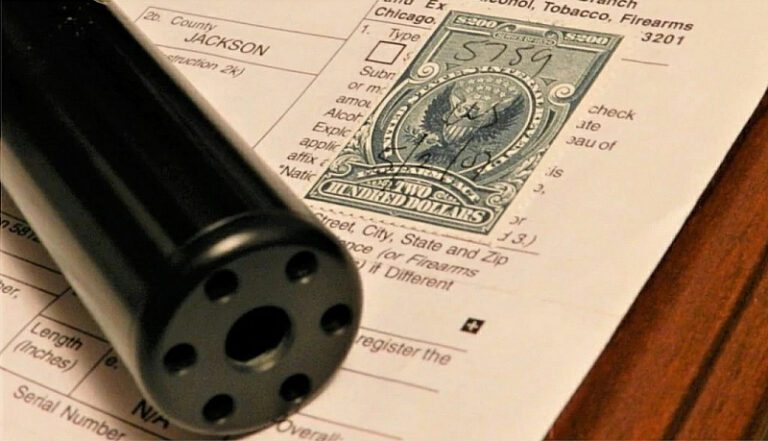

The Suppressor Tax Stamp Itself

The suppressor tax stamp isn’t a physical stamp in the traditional sense; rather, it’s a crucial legal document representing your authorization to own a suppressor. It’s the culmination of the ATF Form 4 process and signifies that the government has reviewed your application and deemed you eligible to possess the regulated item. Think of it as your official permission slip from the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF).The tax stamp itself serves as irrefutable proof of your legal ownership and is essential for demonstrating compliance with federal regulations.

Without it, possessing a suppressor is a serious offense.

Information Contained on the Tax Stamp

The tax stamp contains vital identifying information linking the suppressor to its legal owner. This information is crucial for tracking the suppressor throughout its lifespan and ensuring responsible ownership. Precise details vary slightly, but generally include the owner’s name and address, the suppressor’s serial number, the date of approval, and the unique tax stamp number itself. This number acts as a permanent identifier, linking the owner to the specific suppressor.

It’s akin to a driver’s license for your suppressor, proving legal possession. This information allows law enforcement to verify legal ownership should the need arise.

Penalties for Failing to Obtain a Tax Stamp

Failing to obtain the necessary tax stamp before taking possession of a suppressor carries severe consequences. The penalties are substantial and can include significant fines, imprisonment, and the forfeiture of the suppressor itself. The severity of the punishment depends on various factors, including the individual’s prior criminal record and the specific circumstances surrounding the violation. It’s not a minor infraction; it’s a federal felony with serious legal ramifications.

For instance, a first-time offender might face thousands of dollars in fines and several years of imprisonment, while repeat offenders or those with aggravated circumstances could face significantly harsher penalties. The potential legal and financial consequences emphasize the absolute necessity of obtaining the tax stamp before possessing a suppressor.

Visual Representation of a Sample Tax Stamp

Imagine a small, official-looking document, roughly the size of a business card. At the top, the ATF seal would be prominently displayed. Below the seal, the document would clearly state “FIREARMS TAX STAMP” in bold lettering. The document would then list the owner’s full legal name and address, followed by the suppressor’s serial number and a unique, alphanumeric tax stamp number.

A date of approval would be clearly indicated, and perhaps a small, official signature or authentication mark. The overall impression would be one of formality and official government documentation, designed to prevent counterfeiting and ensure authenticity. The document would be printed on high-quality paper, possibly with security features to prevent tampering or duplication.

Alternatives to Suppressors and Their Costs

While suppressors offer the most effective noise reduction for firearms, they come with significant cost and regulatory hurdles. Let’s explore some alternatives, examining their effectiveness and cost-benefit ratios. It’s important to remember that these alternatives are generally less effective than suppressors, and their suitability depends heavily on the specific shooting environment and the shooter’s needs.

The primary alternative methods focus on managing the sound at its source or protecting the shooter’s hearing. These methods, while less effective than suppressors, are often more readily accessible and significantly cheaper. Understanding their limitations is crucial for making an informed decision.

Ear Protection

Effective ear protection is a fundamental aspect of safe shooting practice, regardless of whether a suppressor is used. High-quality electronic hearing protection, for example, allows the shooter to hear ambient sounds while significantly attenuating the sharp crack of gunfire. This technology allows for communication and situational awareness, which are often compromised by traditional passive hearing protection. The cost varies widely depending on the brand and features, ranging from a few tens of dollars for basic earplugs to several hundred dollars for advanced electronic muffs.

Passive hearing protection, such as foam earplugs or simple muffs, provides a lower level of protection at a lower cost, typically ranging from a few dollars to a few tens of dollars.

Distance and Shooting Location

The distance between the shooter and the target, as well as the environment itself, plays a crucial role in perceived noise levels. Shooting outdoors in open spaces, away from reflective surfaces, significantly reduces noise compared to shooting indoors at a range or in enclosed areas. This method is essentially free, barring the cost of travel to a suitable location, and offers a degree of noise reduction simply through environmental factors.

However, this approach offers only limited control over noise levels and is heavily dependent on external circumstances.

Shooting Positions and Techniques

Certain shooting positions and techniques can indirectly reduce noise levels by influencing muzzle blast direction. For instance, shooting from a prone position with the muzzle pointed away from hard surfaces can minimize sound reflection and increase sound dissipation. This is a cost-effective method that relies on shooter skill and awareness of the environment. However, it does not significantly reduce the overall noise level and its effectiveness is limited.

Comparison of Noise Reduction Effectiveness

The following list compares the effectiveness of suppressors against the alternatives discussed. It’s important to note that decibel reduction is highly dependent on many factors, including the firearm, ammunition, and suppressor design. These figures represent approximate ranges and should not be considered precise measurements.

- Suppressors: Can reduce noise by 30-40 dB or more, significantly reducing the perceived loudness of the gunshot.

- Electronic Hearing Protection: Reduces noise by 20-30 dB, depending on the quality and settings. Provides additional benefits of hearing ambient sounds.

- Passive Hearing Protection: Reduces noise by 15-25 dB, offering basic protection but limiting hearing clarity.

- Distance and Location: Offers variable noise reduction depending on environmental factors. Can reduce perceived noise but does not reduce the actual sound level significantly.

- Shooting Positions and Techniques: Minimal impact on actual noise level, primarily affecting sound reflection and direction.

Ultimately, the cost of a suppressor tax stamp is just one piece of a larger puzzle. Understanding the entire process – from the initial application to navigating the legal landscape – is crucial for responsible ownership. While the financial burden might seem significant upfront, the long-term implications of responsible firearm ownership and the benefits of sound suppression must be carefully weighed.

This detailed exploration of costs, legalities, and the overall process should empower you to make a well-informed decision about adding a suppressor to your collection.

User Queries: How Much Is A Suppressor Tax Stamp

What happens if my Form 4 is denied?

A denial typically comes with a detailed explanation of the reasons. You can appeal the decision, but the process is complex and often requires legal assistance.

Can I transfer a suppressor to someone else?

Yes, but it requires filing another ATF Form 4, essentially repeating the entire process with the new owner.

Are there any state-specific regulations beyond the federal requirements?

Absolutely. Several states have additional restrictions or waiting periods beyond the federal regulations. It’s crucial to check your state’s specific laws.

What is the average wait time for approval?

Processing times vary significantly depending on the ATF’s workload and the specific state. Expect significant delays, potentially exceeding a year.