How to get tax stamp for silencer – How to get a tax stamp for a silencer is a question that requires careful navigation of federal regulations. Securing this crucial document involves understanding the intricacies of ATF Form 4, undergoing thorough background checks, and paying the associated fees. This process, while potentially complex, is manageable with a clear understanding of the requirements and a methodical approach.

This guide provides a comprehensive overview, breaking down each step to ensure a smooth and successful application.

The process begins with the completion of ATF Form 4, a detailed application that requires accurate and complete information. Supporting documentation, including fingerprints and photographs, is also essential. Applicants must meet specific eligibility criteria, and failure to do so can result in application denial. Understanding the background check process and potential disqualifying factors is paramount. Once the application is submitted and the fees are paid, applicants must wait for approval, which can take several months.

Finally, responsible ownership and compliance with all relevant regulations are crucial throughout the process and beyond.

Understanding the ATF Form 4 Process

Navigating the ATF Form 4 process for obtaining a tax stamp for a silencer can seem daunting, but breaking it down into manageable steps makes it significantly less intimidating. This guide provides a clear overview of the procedure, required documentation, and a comparison of individual versus trust applications. Remember, this information is for guidance only and should not be considered legal advice.

Always consult with legal counsel or a knowledgeable firearms expert for personalized advice.

Completing ATF Form 4

The ATF Form 4 is the core document for your application. It requires meticulous completion, as any errors can lead to delays or rejection. The form itself is available for download from the ATF website. You’ll need to provide detailed personal information, including your full name, address, date of birth, and Social Security number. Crucially, you must accurately describe the silencer itself, including its make, model, serial number, and manufacturer.

You’ll also need to specify the location where the silencer will be stored. Incorrect or incomplete information is a common reason for application delays. Take your time, double-check everything, and consider having someone else review it before submitting.

Required Documentation for a Silencer Tax Stamp Application

Beyond the completed Form 4, several supporting documents are required to complete your application. These documents are essential for verifying your identity, background, and the legality of your silencer acquisition. Failing to provide all necessary documentation will result in delays or rejection of your application. These supporting documents generally include a copy of your government-issued photo identification (such as a driver’s license or passport), photographs of the silencer (clear, high-quality images are crucial), and proof of your legal ownership of the silencer (such as a bill of sale or receipt).

Depending on your circumstances, additional documents might be needed. For example, if you’re applying through a trust, you’ll need to provide documentation for the trust itself.

Checklist of Necessary Forms and Supporting Materials

A comprehensive checklist ensures you’ve gathered everything before submitting your application. This reduces the risk of delays. This list isn’t exhaustive, and additional documents may be required based on individual circumstances. Always refer to the ATF website for the most up-to-date requirements.

- Completed ATF Form 4

- Copy of Government-Issued Photo Identification

- Clear Photographs of the Silencer

- Proof of Silencer Ownership

- Fingerprint Cards (from a certified vendor)

- Payment (check or money order)

- (If applicable) Trust Documents and supporting documentation for all trust members

Comparison of Individual vs. Trust Applications

Applying as an individual or through a trust has significant differences in the process. Trusts offer some advantages, particularly regarding inheritance and liability. However, they also involve more complex paperwork and potentially higher initial costs.

| Application Type | Required Forms | Processing Time | Fees |

|---|---|---|---|

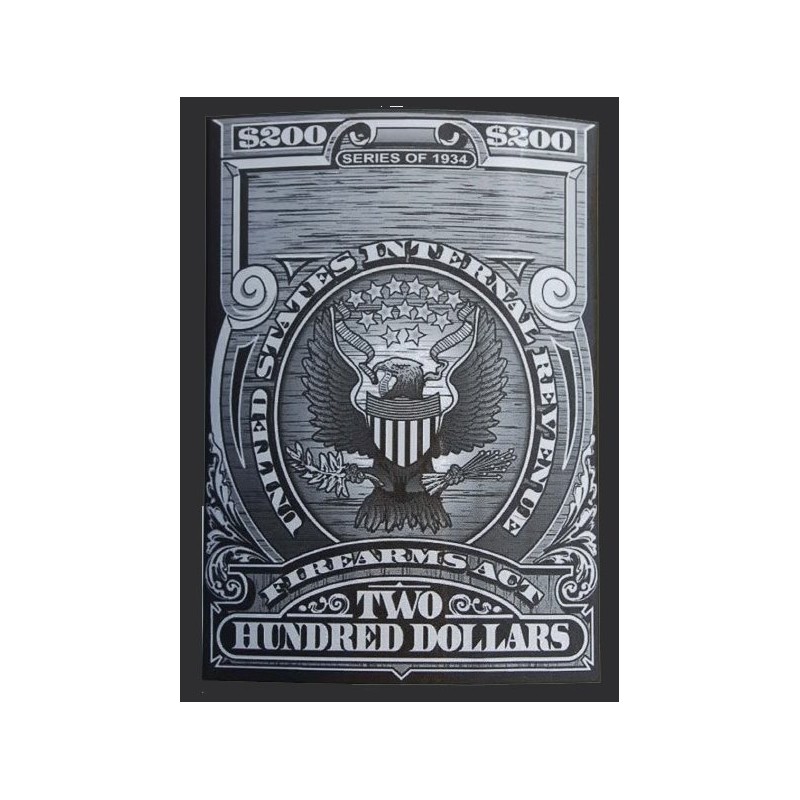

| Individual | ATF Form 4, supporting documentation | Currently, processing times are highly variable, and can range from several months to over a year. | $200 |

| Trust | ATF Form 4, supporting documentation, Trust Documents, supporting documentation for all trust members | Currently, processing times are highly variable, and can range from several months to over a year. | $200 |

Background Checks and Eligibility Requirements

Getting a tax stamp for a silencer involves a thorough background check by the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF). This process is designed to ensure that only eligible individuals, those who pose no significant risk to public safety, can legally own these devices. The ATF meticulously reviews your application to determine your suitability, considering various factors and legal precedents.The ATF’s background check goes far beyond a simple name search.

It involves a comprehensive review of your criminal history, using databases maintained by federal, state, and local law enforcement agencies. They examine records for felony convictions, domestic violence misdemeanors, and any history of drug abuse or mental health issues that could potentially indicate a risk to public safety. The depth and breadth of this investigation ensure a high level of scrutiny for each application.

Disqualifying Factors

Several factors can prevent approval of your Form 4 application. These disqualifying factors are explicitly Artikeld in federal law and are rigorously applied by the ATF. Failure to meet these requirements will result in an immediate denial.

- Felony convictions: A history of felony convictions, regardless of the specifics, typically disqualifies an applicant. The severity and age of the conviction may be considered in some limited cases, but a felony conviction significantly impacts eligibility.

- Domestic violence misdemeanors: A conviction for a domestic violence misdemeanor is another major disqualifying factor. This reflects the seriousness with which the government views domestic violence and its potential link to firearm-related violence.

- Drug abuse and mental health issues: A history of drug abuse or certain mental health conditions, particularly those involving violence or instability, can also lead to denial. The ATF considers the nature and severity of the condition, as well as the applicant’s treatment history and current stability.

- Unlawful use or possession of firearms: Prior convictions or documented instances of unlawful use or possession of firearms will likely result in denial.

- Dishonorable discharge from the military: A dishonorable discharge from the armed forces is another significant factor that can lead to rejection.

Legal Ramifications of Providing False Information

Submitting false information on your ATF Form 4 is a serious federal offense. This can lead to significant penalties, including substantial fines and imprisonment. The consequences extend beyond the immediate denial of your application; it can have long-term implications on your ability to legally own firearms and other regulated items. Such actions also severely damage your credibility and standing within the legal system.

Common Reasons for Application Denials

Denials are often attributed to applicants failing to fully and accurately disclose information on their application. Omitting details about past convictions, mental health issues, or drug use is a common reason for rejection. Inaccurate information, even if unintentional, can lead to denial. Another common cause is failure to meet the specific requirements for the type of silencer being applied for, or a lack of proper documentation.

For instance, an incomplete or improperly filled-out application can also cause delays or denial.

Paying the Tax and Filing Fees

So, you’ve filled out your Form 4 and passed your background check. The final hurdle before your suppressor arrives? Paying the tax and filing fees. This might seem like a small step, but getting this part right is crucial to avoid delays. Let’s break down the costs and payment process.The current tax stamp fee for a silencer is $200.

This is a federal tax mandated by the National Firearms Act (NFA). However, this isn’t the only cost you’ll encounter. You’ll also likely incur fees from your dealer for their services in handling the paperwork and transferring the suppressor to you. These fees can vary widely depending on the dealer, ranging from $20 to $100 or more.

It’s always best to confirm these additional costs upfront to avoid any surprises.

Payment Methods

The ATF accepts several payment methods for the $200 tax stamp. These include personal checks, cashier’s checks, and money orders. Credit cards arenot* accepted directly by the ATF. Remember to make your check or money order payable to the “U.S. Department of the Treasury.” Incorrectly addressed payments can cause significant delays.

Tracking Payment Status

Once you’ve submitted your Form 4 and payment, you’ll receive a confirmation number. This number is crucial for tracking your payment’s status. While the ATF doesn’t offer online real-time tracking of payments in the same way some other government agencies do, you can indirectly track the progress of your application by checking the status of your Form 4 through the ATF’s eForm system.

This system will show you the current stage of your application processing, which will indirectly reflect the acceptance of your payment. If your application shows significant delays, contacting the ATF directly to inquire about your payment is a good idea.

Payment Process Flowchart

Imagine a flowchart with these steps:

1. Start

You submit your completed Form 4 and payment (check, money order, or cashier’s check) to your licensed dealer.

2. Dealer Receives Form 4 and Payment

Your dealer reviews the paperwork for completeness and accuracy.

3. Dealer Submits to ATF

Your dealer submits the Form 4 and payment to the ATF.

4. ATF Receives and Processes

The ATF receives the Form 4 and payment. The payment is processed and verified.

5. Payment Confirmation (Indirect)

The ATF processes the Form 4, and its status updates in the eForm system, indirectly confirming payment receipt. This usually takes several weeks to months.

6. End

Your application is either approved or denied. If approved, you can take possession of your suppressor.

Waiting for Approval and Receiving Your Tax Stamp

So, you’ve filled out the Form 4, paid your fees, and sent it off to the ATF. Now comes the hardest part: the wait. Getting your tax stamp can feel like waiting for a package from Amazon on Christmas Eve – except the stakes are a little higher. This section will break down what you can expect during this period and how to handle the final steps.The typical processing time for a silencer tax stamp application varies significantly, unfortunately.

While the ATF aims for a certain timeframe, it’s not uncommon to see processing times stretching from several months to over a year, or even longer in some cases. Factors like current ATF workload, background check complexities, and even the sheer volume of applications all play a role. Think of it like the DMV, but with firearms.

Processing Timeframes and What to Expect

The ATF doesn’t provide a guaranteed timeframe, and any estimations you find online should be taken with a grain of salt. Anecdotal evidence suggests processing times can fluctuate wildly depending on various factors. For example, a simple application with a clean background check might be processed relatively quickly, while one involving additional scrutiny or complex circumstances could take significantly longer.

The best advice is to be patient and prepared for a lengthy wait. During this time, keep your copy of the application and supporting documentation in a safe place. You’ll need it for reference if you have questions or need to contact the ATF. Don’t contact them repeatedly, however, as this can actually slow things down.

Notification of Approval or Denial, How to get tax stamp for silencer

You’ll receive notification of your application’s status via mail. This is typically a letter from the ATF, either approving your application and providing your tax stamp (which is essentially a numbered approval document), or denying it and explaining the reasons for the denial. Make sure your address on file with the ATF is correct and up-to-date to avoid any delays or miscommunications.

If you don’t receive a response within a reasonable timeframe (which, again, is subjective and depends on current processing times), it’s acceptable to inquire about the status of your application, but do so politely and professionally.

Storing and Handling Your Tax Stamp

Once you receive your approved tax stamp, treat it like gold. This document legally authorizes you to possess your silencer. Store it in a safe and secure location, separate from your silencer. A fireproof safe or a dedicated lockbox are excellent choices. Consider making a photocopy and keeping it separate from the original for added security.

Never leave it unattended or in an easily accessible location. The tax stamp is crucial proof of your legal ownership, so safeguarding it is paramount. Keep in mind, losing it means you’ll likely have to go through the entire process again.

Choosing a Silencer and Transferring Ownership: How To Get Tax Stamp For Silencer

Selecting the right suppressor and understanding the transfer process are crucial steps in responsible firearm ownership. This section will guide you through the considerations involved in choosing a silencer and the legal requirements for transferring ownership.Choosing a suppressor involves several key factors beyond just price. The caliber of your firearm is the most important consideration; you’ll need a suppressor rated for that specific caliber.

Beyond that, factors like size and weight, materials, and sound suppression capabilities will influence your choice. Remember, a larger, heavier suppressor will generally offer better sound reduction but may be less practical for concealed carry.

Silencer Types and Applications

Different suppressors are designed for different applications. For instance, a pistol suppressor is typically shorter and lighter than a rifle suppressor, prioritizing maneuverability over maximum sound reduction. Rifle suppressors, on the other hand, are often longer and heavier, designed to handle the higher pressures and larger calibers of rifles. Subsonic ammunition used with a suppressor will further enhance sound reduction.

Some suppressors are even designed for use with multiple calibers, offering versatility. Consider the specific needs of your firearm and intended use when making your selection.

Transferring Ownership of a Silencer

Transferring a silencer requires adherence to strict ATF regulations. This is not a simple process like selling a firearm and involves several steps to ensure compliance with the law. Failure to follow these steps can lead to significant legal repercussions.

Steps Involved in a Legal Silencer Transfer

The process of legally transferring ownership of a silencer involves careful documentation and adherence to ATF guidelines. Here’s a breakdown of the steps:

- Seller completes ATF Form 4: The seller must complete an ATF Form 4, providing accurate information about both the seller and the buyer.

- Buyer completes ATF Form 4: The buyer also completes their portion of the ATF Form 4, providing their personal information and agreeing to all regulations.

- Payment of Transfer Fee: A transfer tax is required and must be paid to the ATF.

- Submission of Form 4 to ATF: Both the seller and buyer must sign the form, and it is then submitted to the ATF along with the necessary fees and supporting documentation.

- Background Checks for Both Parties: Both the seller and the buyer will undergo background checks.

- ATF Approval: Once the ATF approves the transfer, the silencer can legally change ownership. This process can take several months.

- Documentation of Transfer: Retain all documentation related to the transfer, including the approved ATF Form 4, as proof of legal ownership.

Understanding Legal Implications and Compliance

Owning a silencer, while legal with the proper paperwork, comes with significant legal responsibilities. Understanding these responsibilities and adhering to all applicable regulations is crucial to avoid serious legal consequences. Failure to comply can result in hefty fines, imprisonment, and the permanent loss of your right to own firearms.Silencer ownership is governed by both federal and state laws.

Federal regulations are primarily enforced by the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF), while state laws vary widely. It’s vital to understand both sets of regulations to ensure complete compliance. This section will Artikel the key legal aspects of silencer ownership and provide guidance on maintaining compliance.

Legal Responsibilities of Silencer Owners

Silencer owners are responsible for ensuring their possession and use of the silencer remain within the bounds of the law at all times. This includes understanding and adhering to all relevant federal and state laws and regulations, including those concerning the transportation, storage, and use of the silencer. Improper storage, for instance, could lead to legal repercussions if the silencer is misused by another person.

Additionally, owners must understand the limitations on where they can use their suppressors, as some states or localities may have further restrictions beyond federal regulations. For example, some jurisdictions might prohibit the use of suppressors while hunting, even if it’s legally permissible at the federal level.

Consequences of Non-Compliance with ATF Regulations

Non-compliance with ATF regulations concerning silencers can lead to a range of serious consequences. These can include substantial fines, potentially reaching tens of thousands of dollars depending on the severity of the violation. More severe violations, such as unregistered possession or the use of a silencer in the commission of a crime, could result in felony charges and significant prison time.

Furthermore, non-compliance can lead to the permanent revocation of your right to own firearms. The ATF takes violations seriously, and the penalties reflect this. For example, a case of failing to register a silencer could result in a fine of $10,000 or more, plus potential imprisonment.

Maintaining Accurate Silencer Ownership Records

Maintaining accurate and complete records related to your silencer ownership is paramount. This includes retaining copies of your ATF Form 4, proof of purchase, and any other relevant documentation. These records should be stored securely and kept up-to-date. Accurate record-keeping can be crucial in demonstrating compliance with ATF regulations and can help protect you in the event of an audit or investigation.

For instance, having readily available documentation showing the date of purchase, the serial number, and the ATF approval can significantly expedite any potential inquiries from authorities. Consider a dedicated, secure filing system for these documents.

Registering a Silencer with State and Local Authorities

While federal registration with the ATF is mandatory, some states and localities may have additional registration requirements for silencers. It’s essential to research and comply with any state or local regulations in your area. These requirements can vary significantly, and failure to comply can result in penalties at the state or local level. For example, some states might require additional paperwork or background checks beyond the federal requirements.

Always check with your state and local law enforcement agencies to determine whether additional registration is necessary. Failure to do so could lead to separate fines or legal issues, even if you are in compliance with federal law.

Common Mistakes to Avoid

Navigating the ATF Form 4 process can be tricky, and even minor errors can lead to significant delays or even application denial. Understanding common pitfalls and implementing preventative measures is crucial for a smooth and timely approval. This section highlights frequent mistakes applicants make and offers strategies for avoiding them, ultimately increasing your chances of a successful application.The most common reason for delays or denials stems from incomplete or inaccurate information provided on the Form 4 itself.

Successful applications are characterized by meticulous attention to detail, thoroughness in completing all sections, and accurate reporting of personal information and firearm specifications. Unsuccessful applications, conversely, often reveal inconsistencies, omissions, or errors in these critical areas. This can range from typos in your address to inaccurate descriptions of the silencer itself.

Incomplete or Inaccurate Form 4 Information

Providing incomplete or inaccurate information on your Form 4 is a major source of delays and denials. This includes errors in personal information (name, address, date of birth), incorrect descriptions of the silencer (make, model, serial number), and failing to properly complete all sections of the form. Double- and triple-checking every entry before submission is essential. Imagine an application where the applicant mistakenly listed their address from five years ago.

This simple oversight could delay the process considerably, as the ATF would need to verify the current address. Similarly, a minor typo in the serial number of the silencer could cause a significant delay as the ATF tries to match the information to their records. Careful review and verification are key.

Failure to Properly Complete the Photographs and Fingerprinting

The ATF requires clear, high-quality photographs and properly completed fingerprints as part of the application process. Poor quality photos or improperly taken fingerprints can lead to rejection. Ensure you use a professional service or follow ATF guidelines meticulously. For example, if the photos are too blurry or the fingerprints are smudged, the ATF may request resubmission, adding significant time to the process.

Conversely, a successful application will showcase crisp, clear photos and perfectly legible fingerprints.

Issues with the Chief Law Enforcement Officer (CLEO) Notification

The CLEO notification process, though often overlooked, is critical. Failure to properly notify your CLEO or receiving a negative response can significantly impact your application. Ensure you understand your local laws and procedures regarding CLEO notification. A successful application will demonstrate clear and timely communication with the CLEO, resulting in a positive response. An unsuccessful application may show a lack of communication, resulting in a delayed or denied application.

Ineffective Communication with the ATF

If issues arise during the process, proactive and respectful communication with the ATF is crucial. Clearly and concisely explain the situation, provide any requested documentation promptly, and maintain a professional tone in all correspondence. Avoid aggressive or confrontational language. For instance, if you receive a request for additional information, respond promptly and completely, attaching all necessary documents.

Conversely, a lack of response or an aggressive response to ATF inquiries will likely result in further delays.

Resources and Further Information

Navigating the world of silencer regulations can be tricky, but thankfully, there are numerous resources available to help you understand the process and ensure compliance. This section provides a compilation of reliable websites, contact information for relevant agencies, and a helpful resource guide to streamline your research. Remember, staying informed is key to a smooth and legal experience.

Understanding the specific regulations and requirements for your state is crucial, as federal laws are supplemented by state and local ordinances. Always double-check your local laws before proceeding with any silencer purchase or transfer.

Reliable Websites and Organizations

Several websites and organizations offer comprehensive information on firearm regulations, including those pertaining to silencers. These resources provide valuable insights into the legal framework, application procedures, and other relevant details. Consulting multiple sources is recommended to ensure a thorough understanding.

- The Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) website: This is the primary source for federal regulations on firearms, including silencers. Their website provides access to forms, guidelines, and other crucial information.

- The National Shooting Sports Foundation (NSSF): The NSSF is a trade association for the firearms industry. They offer educational resources and advocate for responsible gun ownership.

- State-specific firearm licensing agencies: Each state has its own licensing agency that handles firearm-related matters, including potential state-level restrictions on silencers. Check your state’s website for relevant information.

Government Agency Contact Information

Direct contact with relevant government agencies can be helpful for clarifying specific questions or addressing concerns during the application process. It’s always advisable to keep records of all communication.

- Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF): You can find their contact information, including regional offices, on their official website.

Resource Guide

This table provides links to helpful forms and publications that can assist you throughout the silencer acquisition process. Always ensure you are using the most up-to-date versions available on the official websites.

| Resource Name | URL | Description | Relevance |

|---|---|---|---|

| ATF Form 4 | [Insert ATF Form 4 URL Here – this should link to the official ATF website] | Application for a Tax Stamp for a Silencer | Essential for obtaining a silencer |

| ATF Publication 5300.7 | [Insert ATF Publication 5300.7 URL Here – this should link to the official ATF website] | Guide to the National Firearms Act | Provides comprehensive information on NFA regulations |

| [State-Specific Licensing Agency Website] | [Insert State-Specific URL Here – replace with the relevant state’s website] | State-specific firearm regulations | Crucial for understanding state-level requirements |

| NSSF Website | [Insert NSSF Website URL Here] | Information on responsible gun ownership and industry news | Provides general information and resources |

Obtaining a tax stamp for a silencer demands meticulous attention to detail and adherence to all applicable laws and regulations. While the process may seem daunting, a systematic approach, coupled with a thorough understanding of the requirements, significantly increases the likelihood of a successful outcome. This guide has provided a roadmap to navigate the complexities, empowering individuals to confidently pursue their application.

Remember, responsible firearm ownership includes understanding and complying with all legal obligations. Always consult official ATF resources for the most up-to-date information and guidance.

FAQs

What happens if my application is denied?

The ATF will typically provide a reason for denial. You may be able to reapply after addressing the issues raised, but it is advisable to seek legal counsel.

Can I use a silencer before receiving my tax stamp?

No. Possession of a silencer without the appropriate tax stamp is illegal and carries significant penalties.

How long does the background check take?

The background check time varies but can take several months. The overall processing time for the entire application can be significantly longer.

What if I lose my tax stamp?

You should contact the ATF immediately to report the loss. They may have procedures for obtaining a replacement.