How much does one es futures contract cost –

How much does one ES futures contract cost? This question is central to understanding the world of futures trading. ES futures contracts, based on the S&P 500 index, are a popular tool for investors and traders looking to gain exposure to the US stock market. The cost of an ES futures contract is influenced by various factors, including the underlying index price, margin requirements, and trading fees.

Let’s delve into the key aspects that determine the cost of an ES futures contract.

ES futures contracts represent a standardized agreement to buy or sell a specific quantity of the underlying asset (the S&P 500 index) at a predetermined price on a future date. The contract size for ES futures is 250 times the S&P 500 index, meaning each contract represents $250,000 worth of the index. This allows traders to gain significant exposure to the stock market with a relatively small investment.

The cost of an ES futures contract is primarily determined by the futures price, which fluctuates based on market conditions. The margin requirement, which is a deposit held by the brokerage firm to ensure the contract’s fulfillment, also plays a crucial role. Furthermore, trading fees, including brokerage commissions and exchange fees, add to the overall cost of trading ES futures contracts.

*

Understanding ES Futures Contracts

ES futures contracts are a popular financial instrument used by traders and investors to speculate on or hedge against price movements in the S&P 500 index. These contracts represent an agreement to buy or sell a specific quantity of the underlying asset at a predetermined price on a future date.

The Underlying Asset

The underlying asset for the ES futures contract is the S&P 500 index. The S&P 500 is a market-capitalization-weighted index that tracks the performance of 500 large-cap U.S. companies listed on the New York Stock Exchange (NYSE) and Nasdaq. The index is widely considered a benchmark for the U.S. stock market and is often used as a proxy for overall market performance.

Contract Specifications, How much does one es futures contract cost

ES futures contracts have specific specifications that determine their trading characteristics. These specifications include:

- Contract Size: Each ES futures contract represents 250 shares of the S&P 500 index. This means that each point move in the ES futures contract represents a $250 change in the value of the underlying index.

- Trading Unit: ES futures contracts are traded in units of one contract. This means that traders can buy or sell one or more contracts, depending on their desired exposure to the market.

- Tick Size: The minimum price fluctuation for ES futures contracts is 0.25 points. This means that the price of an ES futures contract can only move in increments of $62.50 (0.25 points x $250 per point).

Determining the Cost of an ES Futures Contract: How Much Does One Es Futures Contract Cost

The cost of an ES futures contract is influenced by various factors, including the underlying index price, margin requirements, and trading fees. Understanding these components is crucial for effectively managing your trading costs and potential profits.

Futures Price and Contract Cost

The futures price reflects the anticipated price of the underlying asset at the contract’s expiration date. This price is determined by market forces and represents the agreed-upon price for the future delivery of the asset. The contract cost is directly linked to the futures price.

The contract cost is calculated by multiplying the futures price by the contract size.

For example, if the ES futures price is 4,000 points, and the contract size is 50, the contract cost would be $200,000 (4,000 x 50).

Margin Requirements

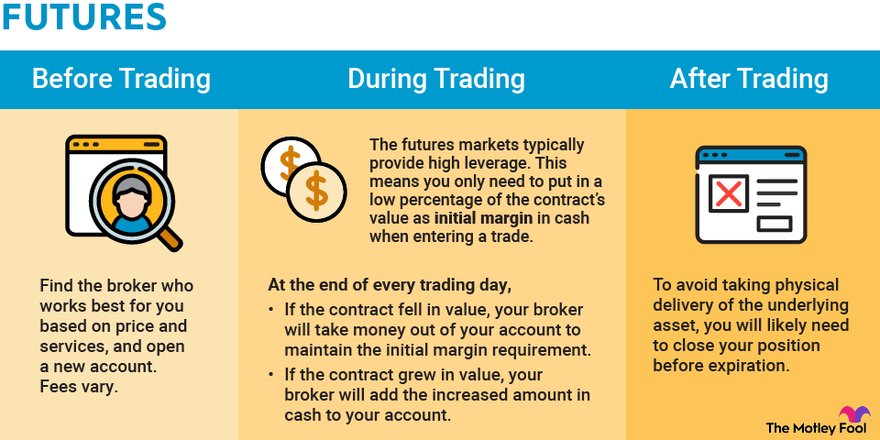

Margin requirements represent the initial capital required to enter into a futures contract. They are a form of collateral that protects the clearinghouse from potential losses arising from price fluctuations.

Margin requirements are typically a percentage of the contract value, and they vary depending on the futures contract and the brokerage firm.

For instance, the initial margin for an ES futures contract might be around 5% of the contract value. This means that for a $200,000 contract, the initial margin would be $10,000.

Trading Costs

Trading futures contracts involves additional costs beyond the initial margin. These costs can include:

- Brokerage fees: These are commissions charged by brokerage firms for executing trades.

- Exchange fees: These are fees levied by the exchange for facilitating trading activities.

- Clearing fees: These are fees charged by the clearinghouse for guaranteeing the performance of both sides of the transaction.

- Interest costs: If you hold a futures contract overnight, you may incur interest charges on the margin account.

These costs can vary depending on the brokerage firm, the exchange, and the trading volume. It’s important to factor in these costs when calculating the overall cost of trading futures contracts.

Factors Influencing ES Futures Contract Costs

The price of an ES futures contract, like any financial instrument, is determined by a confluence of factors that reflect the underlying market conditions and economic environment. Understanding these factors is crucial for investors and traders to make informed decisions and manage risk effectively.

Market Volatility

Market volatility plays a significant role in influencing the cost of ES futures contracts. When the market is volatile, meaning prices are fluctuating rapidly, the risk associated with trading increases. This increased risk is reflected in higher contract prices. Conversely, in periods of low volatility, contract costs tend to be lower.

High volatility leads to higher contract prices, while low volatility results in lower prices.

For instance, during periods of economic uncertainty, geopolitical tensions, or major market events, volatility tends to spike, driving up the cost of ES futures contracts. Conversely, during periods of economic stability and low market uncertainty, volatility tends to decrease, leading to lower contract prices.

Trading ES Futures Contracts

Trading ES futures contracts involves buying or selling contracts based on the expected future price of the S&P 500 index. This can be done through a brokerage account, with the process involving several steps, including opening an account, funding it, and placing orders.

Entering and Exiting ES Futures Contracts

To enter an ES futures contract, traders place an order to buy or sell a specific number of contracts at a certain price. This is typically done through a trading platform provided by a brokerage firm. The order is then executed if a matching order is found in the market. Exiting a contract involves placing a closing order, which is essentially the opposite of the entry order.

If a trader bought a contract, they would place a sell order to close it, and vice versa.

Trading Strategies for ES Futures Contracts

Traders utilize various strategies to profit from ES futures contracts, with some of the most common ones including:

- Scalping: This strategy involves taking advantage of small price fluctuations in the market. Scalpers typically hold positions for a short period, often just seconds or minutes.

- Day Trading: This strategy involves opening and closing positions within the same trading day. Day traders aim to profit from intraday price movements and typically close out their positions before the market closes.

- Swing Trading: This strategy involves holding positions for a longer period, typically several days or weeks. Swing traders look for price trends and try to capitalize on them.

- Trend Following: This strategy involves identifying and trading in the direction of a long-term price trend. Trend followers typically hold positions for a longer period, even months or years.

Risks and Rewards Associated with ES Futures Contracts

Trading ES futures contracts can be highly profitable but also involves significant risks. Some of the key risks include:

- Market Volatility: The S&P 500 index can be highly volatile, leading to substantial price fluctuations that can result in significant losses.

- Leverage: ES futures contracts offer leverage, which allows traders to control a large amount of underlying assets with a smaller amount of capital. While leverage can amplify profits, it can also amplify losses.

- Margin Requirements: Traders must deposit a certain amount of margin to open and maintain a position. If the market moves against the trader, they may be required to deposit additional margin, known as a margin call.

- Liquidity Risk: In volatile market conditions, liquidity can dry up, making it difficult to enter or exit a position.

Understanding the cost of an ES futures contract is essential for informed trading decisions. While the initial cost may seem daunting, the leverage offered by futures contracts allows for significant gains. However, it’s crucial to be aware of the risks associated with futures trading, including potential losses exceeding the initial margin deposit. By carefully analyzing market conditions, managing risk effectively, and employing appropriate trading strategies, traders can leverage ES futures contracts to potentially enhance their portfolio returns.

Top FAQs

What is the minimum margin requirement for an ES futures contract?

The minimum margin requirement for an ES futures contract can vary depending on the brokerage firm and the specific account type. However, it typically ranges from $5,000 to $10,000.

What are the typical trading fees associated with ES futures contracts?

Trading fees for ES futures contracts include brokerage commissions and exchange fees. Brokerage commissions can range from a few dollars per contract to a percentage of the contract value. Exchange fees are typically a fixed amount per contract.

How can I minimize the costs associated with trading ES futures contracts?

To minimize costs, choose a brokerage firm with competitive commission rates and consider using a futures trading platform with low exchange fees. Additionally, employing strategies that minimize the number of trades can help reduce overall costs.

-*