What are the four types of cost reimbursable contracts? In the world of business, where every project demands a careful balance of cost, risk, and reward, cost reimbursable contracts stand out as a unique and often complex approach. Unlike fixed-price contracts, where the total cost is predetermined, cost reimbursable contracts allow for greater flexibility and collaboration, particularly when the project’s scope is uncertain or the work involves innovative technologies.

These contracts, often favored in industries like aerospace, defense, and research and development, provide a framework for shared responsibility and risk, offering a compelling alternative to traditional fixed-price agreements.

The core principle of cost reimbursable contracts lies in the reimbursement of actual costs incurred by the contractor, along with a predetermined fee. This fee structure can take various forms, including a fixed fee, an incentive fee, a percentage of cost, or an award fee. Each type of cost reimbursable contract carries its own set of advantages and disadvantages, requiring careful consideration of the project’s specific needs and the risk appetite of both parties involved.

Introduction to Cost Reimbursable Contracts

Cost reimbursable contracts, also known as cost-plus contracts, are a type of agreement where the buyer (or customer) agrees to pay the seller (or contractor) for all allowable costs incurred in performing the work, plus an agreed-upon fee or profit. This fee can be a fixed amount, a percentage of the total cost, or a combination of both. The core principle of cost reimbursable contracts is that the buyer assumes a significant portion of the financial risk associated with the project.

The seller is compensated for their actual costs, regardless of whether they exceed the initial estimate. This type of contract is typically used when the scope of work is uncertain, the risks are high, or the buyer wants to have a close relationship with the seller.

Key Difference from Fixed-Price Contracts

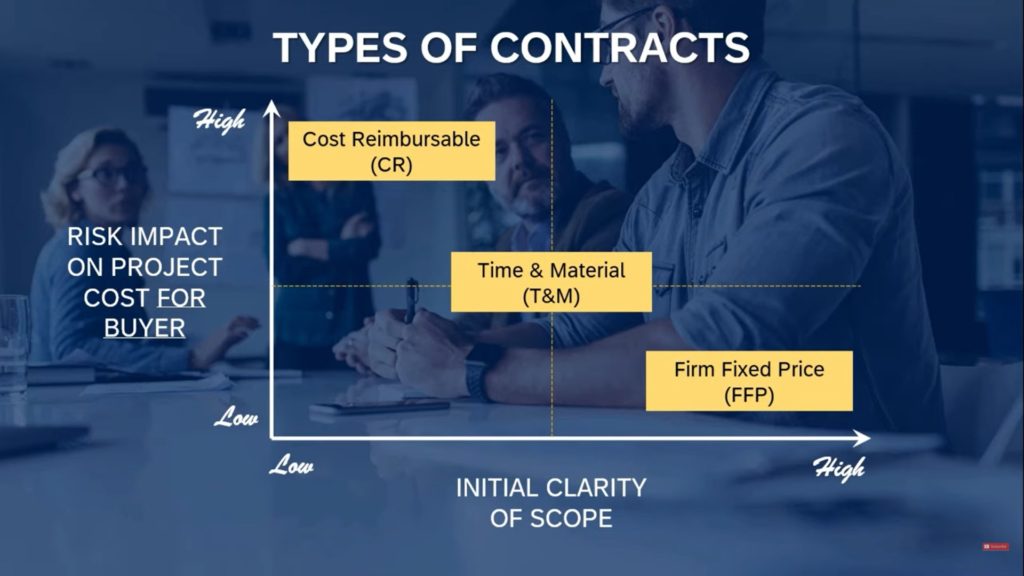

Unlike fixed-price contracts, where the buyer agrees to pay a predetermined price for the work, regardless of the actual costs incurred, cost reimbursable contracts involve a higher level of uncertainty for the buyer. The final price is not known until the project is completed, and the buyer is exposed to the risk of cost overruns. However, this type of contract offers greater flexibility for the seller, allowing them to adjust the scope of work as needed and to incorporate changes without significant financial repercussions.

Examples of Industries and Projects

Cost reimbursable contracts are commonly used in industries where the scope of work is complex, the risks are high, or the buyer requires a high level of control over the project. Some examples include:* Research and Development (R&D): In R&D projects, the outcomes are often uncertain, and the scope of work can change frequently. Cost reimbursable contracts allow for flexibility and adaptability, ensuring that the seller can adjust to new discoveries and challenges.

Government Contracts

Government contracts, particularly those involving defense, aerospace, and space exploration, often use cost reimbursable contracts due to the high complexity and risk associated with these projects. The government wants to ensure that the best possible technology is developed, even if it comes at a higher cost.

Construction Projects

Large-scale construction projects, such as bridges, tunnels, or skyscrapers, can be complex and unpredictable. Cost reimbursable contracts can help to mitigate the risk of unforeseen challenges and ensure that the project is completed to the highest standards.

Engineering and Consulting Services

Engineering and consulting projects often involve complex technical solutions and require a high level of expertise. Cost reimbursable contracts provide the flexibility for the seller to bring in the necessary resources and expertise to meet the project’s specific needs.

Types of Cost Reimbursable Contracts

Cost-reimbursable contracts offer flexibility and are suitable for projects with uncertain scope or complex requirements. However, they also present a higher level of risk for the buyer, as the final cost is not fixed upfront. Understanding the different types of cost-reimbursable contracts is crucial for choosing the most appropriate one for your project.

Types of Cost Reimbursable Contracts

The four primary types of cost-reimbursable contracts are:

- Cost Plus Fixed Fee (CPFF)

- Cost Plus Incentive Fee (CPIF)

- Cost Plus Percentage of Cost (CPPC)

- Cost Plus Award Fee (CPAF)

Each type has a distinct fee structure, risk allocation, and suitability for different scenarios.

Advantages and Disadvantages of Cost Reimbursable Contracts

Cost reimbursable contracts, often favored in situations where the scope of work is uncertain or highly complex, offer a unique balance between risk and reward for both the contractor and the client. Understanding the advantages and disadvantages of these contracts is crucial for making informed decisions about project management.

Advantages of Cost Reimbursable Contracts

Cost reimbursable contracts present several advantages that can be beneficial for both parties involved.

- Reduced Risk for the Contractor: One of the primary advantages for the contractor is the reduced risk associated with cost overruns. In a cost reimbursable contract, the client assumes a significant portion of the financial burden for unexpected costs. This can be particularly appealing for projects with a high degree of uncertainty or complexity, where unforeseen circumstances are more likely to arise.

- Flexibility and Adaptability: The inherent flexibility of cost reimbursable contracts allows for changes to the scope of work during the project lifecycle. This adaptability is especially valuable in projects where requirements may evolve or new challenges emerge. For example, in research and development projects, the discovery of new information or the emergence of unforeseen technical difficulties can necessitate changes to the project scope.

Cost reimbursable contracts provide the framework for accommodating these changes, ensuring the project remains aligned with the evolving goals.

- Access to Specialized Expertise: Cost reimbursable contracts can be particularly advantageous for projects requiring specialized skills or expertise that may not be readily available within the client’s organization. The contractor, often a specialist in the field, can leverage their expertise to provide solutions tailored to the specific needs of the project. This access to specialized knowledge can lead to innovative solutions and better project outcomes.

- Stronger Collaboration and Communication: Cost reimbursable contracts foster a collaborative environment between the contractor and the client. With both parties sharing in the financial responsibility for the project, there is a greater incentive for open communication and a shared commitment to success. This collaborative approach can lead to better problem-solving, more effective decision-making, and ultimately, a more successful project outcome.

- Incentivizes Innovation: Cost reimbursable contracts can encourage innovation and creativity by allowing the contractor to explore new solutions without the constraints of a fixed price. This can be particularly beneficial in projects with a high degree of uncertainty or where the desired outcome is not fully defined. The contractor, not being limited by a fixed budget, can pursue novel approaches and experiment with innovative solutions, potentially leading to breakthroughs and significant improvements.

Disadvantages of Cost Reimbursable Contracts

While cost reimbursable contracts offer several advantages, they also come with inherent drawbacks that require careful consideration.

- Increased Risk for the Client: One of the primary disadvantages of cost reimbursable contracts is the increased financial risk for the client. The client assumes the responsibility for all costs incurred by the contractor, including potential cost overruns. This can lead to significant financial exposure if the project encounters unforeseen challenges or the contractor fails to manage costs effectively.

- Potential for Cost Overruns: Without the incentive of a fixed price, there is a greater potential for cost overruns in cost reimbursable contracts. The contractor may be less motivated to control costs, leading to higher expenses for the client. It is crucial for the client to establish clear cost control mechanisms and monitor the project closely to mitigate this risk.

- Less Incentive for Efficiency: Cost reimbursable contracts can create a situation where the contractor may be less incentivized to complete the project efficiently. With the client assuming the financial burden, the contractor may be less motivated to minimize costs and maximize productivity. This can lead to delays and increased project costs.

- Complexity and Administration: Cost reimbursable contracts often involve complex administrative processes and require careful monitoring and oversight. The client must track and verify all costs incurred by the contractor, which can be time-consuming and resource-intensive. This added complexity can increase the administrative burden for both parties involved.

- Potential for Disputes: The potential for disputes over costs and performance is higher in cost reimbursable contracts. The client may question the contractor’s expenses, while the contractor may seek reimbursement for costs that the client deems unreasonable. This can lead to delays and increased legal costs.

Comparison with Fixed-Price Contracts

Cost reimbursable contracts differ significantly from fixed-price contracts in terms of risk allocation and project management.

- Risk Allocation: In a fixed-price contract, the contractor assumes the primary risk for cost overruns. The client pays a predetermined price for the project, regardless of the actual costs incurred by the contractor. In contrast, in a cost reimbursable contract, the client assumes the primary risk for cost overruns, paying for the contractor’s actual costs plus a fee.

- Project Management: Fixed-price contracts typically involve a more defined scope of work and a greater emphasis on project planning and cost control. The contractor is responsible for delivering the project within the agreed-upon budget and timeframe. In cost reimbursable contracts, the scope of work may be less defined, and the emphasis is on collaboration and adaptability.

- Incentives: Fixed-price contracts incentivize the contractor to complete the project efficiently and within budget. The contractor is rewarded for delivering the project on time and under budget. In contrast, cost reimbursable contracts incentivize the contractor to provide high-quality work and meet the client’s evolving needs.

- Suitability: Fixed-price contracts are generally suitable for projects with well-defined scopes of work and low levels of uncertainty. Cost reimbursable contracts are more suitable for projects with uncertain scopes of work, high levels of complexity, or a need for ongoing collaboration and adaptability.

Best Practices for Using Cost Reimbursable Contracts

Cost-reimbursable contracts can be a valuable tool for complex projects where the scope of work is uncertain or subject to change. However, they also present unique challenges in terms of risk management and cost control. To maximize the benefits of cost-reimbursable contracts while mitigating potential drawbacks, it is essential to follow best practices for negotiation, management, and risk mitigation.

Negotiating Cost Reimbursable Contracts

Effective negotiation is crucial for establishing a clear understanding of the project scope, cost parameters, and risk allocation. This involves careful consideration of the following aspects:

- Define the Scope of Work: Clearly define the project deliverables, milestones, and acceptance criteria. This ensures both parties have a shared understanding of the project’s boundaries.

- Establish Cost Control Mechanisms: Implement mechanisms like budget ceilings, cost reporting requirements, and independent cost audits to monitor and control costs. This helps prevent runaway expenses.

- Allocate Risk: Clearly define the responsibilities for managing various risks, including cost overruns, delays, and changes in scope. This helps ensure that each party is aware of their obligations and potential liabilities.

- Establish Payment Terms: Define payment milestones, reimbursement rates, and dispute resolution procedures. This provides a clear framework for financial transactions and conflict resolution.

Managing Cost Reimbursable Contracts, What are the four types of cost reimbursable contracts

Once the contract is in place, effective management is critical for successful project execution and cost control. This involves:

- Regular Cost Monitoring: Track actual costs against the budget, identifying potential cost overruns early on. This allows for proactive adjustments and mitigation strategies.

- Effective Communication: Maintain open and frequent communication between the contractor and the client. This facilitates timely problem-solving and prevents misunderstandings.

- Change Management: Establish a clear process for managing changes in scope, budget, or schedule. This ensures that any changes are properly documented, approved, and reflected in the project plan.

- Performance Monitoring: Regularly assess the contractor’s performance against the agreed-upon milestones and deliverables. This helps identify any areas where improvement is needed.

Mitigating Risk in Cost Reimbursable Contracts

Cost-reimbursable contracts inherently involve higher risk compared to fixed-price contracts. To mitigate this risk, consider the following strategies:

- Use Incentives: Incorporate incentives into the contract to encourage the contractor to achieve project goals within budget and on time. This aligns the contractor’s interests with the client’s objectives.

- Establish a Performance-Based Fee: Link a portion of the contractor’s fee to project performance metrics, such as cost savings, schedule adherence, or quality standards. This incentivizes the contractor to prioritize efficient and effective project execution.

- Utilize Independent Audits: Engage an independent third party to conduct periodic audits of the contractor’s costs and expenses. This provides an objective assessment of cost control measures and helps prevent fraud or overbilling.

- Consider a Fixed-Price Element: For certain project components with well-defined scope and predictable costs, consider incorporating a fixed-price element into the contract. This helps reduce risk and provides more predictable cost estimates for those specific aspects of the project.

Examples of Successful Cost Reimbursable Contract Implementations

Numerous examples demonstrate the successful implementation of cost-reimbursable contracts, particularly in projects with high complexity, uncertainty, or evolving requirements.

- NASA’s Space Exploration Programs: NASA frequently uses cost-reimbursable contracts for its ambitious space exploration missions, where the scope of work is highly complex and subject to change. These contracts allow for flexibility in adapting to unforeseen challenges and achieving groundbreaking scientific advancements.

- Research and Development Projects: Cost-reimbursable contracts are often used for research and development projects, where the outcomes are uncertain and the scope of work may evolve as new discoveries are made. This flexibility allows for innovation and exploration without rigid cost constraints.

- Large-Scale Infrastructure Projects: Cost-reimbursable contracts can be advantageous for large-scale infrastructure projects, where the scope of work is extensive and subject to changes due to unforeseen site conditions or regulatory requirements. The flexibility of these contracts allows for adjustments and adaptations as the project progresses.

Navigating the world of cost reimbursable contracts requires a deep understanding of their various types, the intricacies of cost reimbursement, and the delicate balance of risk allocation. Choosing the right type of cost reimbursable contract, carefully defining the cost reimbursement basis, and establishing clear performance incentives are crucial for successful project execution. By embracing transparency, effective communication, and robust contract management practices, both buyers and contractors can harness the benefits of cost reimbursable contracts, fostering a collaborative environment that promotes innovation, efficiency, and shared success.

FAQ Section: What Are The Four Types Of Cost Reimbursable Contracts

What are the key differences between CPFF and CPIF contracts?

CPFF (Cost Plus Fixed Fee) contracts offer a fixed fee regardless of the project’s final cost, while CPIF (Cost Plus Incentive Fee) contracts provide an incentive fee based on the contractor’s performance against pre-defined targets. CPIF contracts encourage better cost control and performance optimization, while CPFF contracts offer more predictable cost estimates.

What are the typical situations where a CPAF contract might be most suitable?

CPAF (Cost Plus Award Fee) contracts are well-suited for projects where the desired outcomes are difficult to quantify or measure precisely. They allow for greater flexibility in evaluating the contractor’s performance based on subjective criteria, making them ideal for research and development projects, or those with complex objectives.

How do cost reimbursable contracts differ from fixed-price contracts?

In fixed-price contracts, the contractor assumes the risk of cost overruns, while in cost reimbursable contracts, the buyer bears a greater portion of the risk. Fixed-price contracts offer more predictable cost estimates, while cost reimbursable contracts allow for greater flexibility and collaboration, particularly in projects with uncertain scope or complex requirements.