What does a secured bond mean? It’s a type of investment that’s backed by collateral, which means you’re getting a piece of something tangible in case things go south. Think of it like a loan, but instead of borrowing money, you’re lending it to a company or government, and they’re giving you a piece of their stuff as a promise they’ll pay you back.

This collateral can be anything from real estate to equipment to even a pile of cash! So, if the borrower can’t pay you back, you can take possession of the collateral to recoup your losses. This makes secured bonds a safer bet than unsecured bonds, which are basically just promises to pay without any collateral to back them up.

Secured bonds are often seen as a more conservative investment option, especially for investors who prioritize safety over high returns. They can be a good choice for diversifying your portfolio and mitigating risk. But, like any investment, there are pros and cons to consider. We’ll explore the details of secured bonds, their advantages and disadvantages, and how they work in the real world.

Understanding Secured Bonds

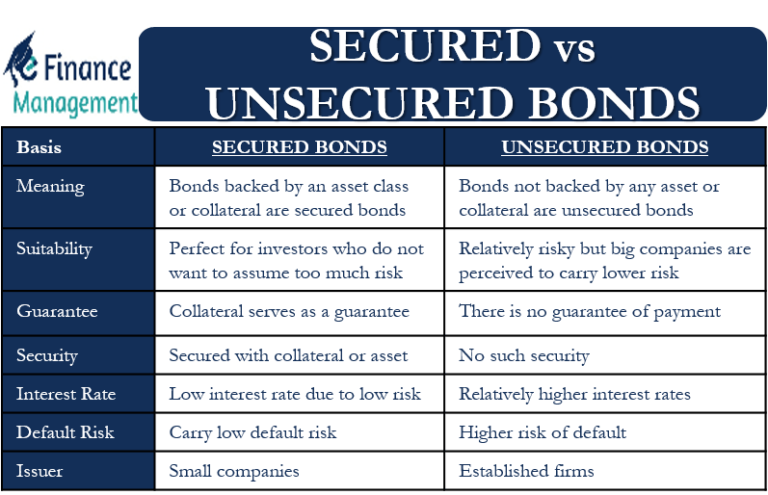

A secured bond is a type of debt security that is backed by specific assets, known as collateral. This means that if the issuer of the bond defaults on their payments, the bondholders have the right to claim the collateral to recover their investment. In contrast, unsecured bonds, also known as debentures, are not backed by any specific assets and rely solely on the issuer’s creditworthiness.

Types of Collateral

The collateral used for secured bonds can vary widely depending on the type of bond and the issuer. Some common types of collateral include:

- Real estate: This is a common type of collateral for mortgage-backed bonds, where the bondholders have a claim on the underlying property.

- Equipment: Bonds secured by equipment, such as aircraft or machinery, are often used by companies in industries like transportation or manufacturing.

- Inventory: Secured bonds backed by inventory can be issued by companies in industries like retail or manufacturing, providing bondholders with a claim on the company’s goods.

- Cash: In some cases, bonds may be secured by cash deposits held in a trust account, providing bondholders with a direct claim on the funds.

Advantages of Secured Bonds

Secured bonds generally offer several advantages over unsecured bonds:

- Lower risk: The presence of collateral provides bondholders with a higher degree of protection against default, as they have a claim on specific assets.

- Lower interest rates: Due to the lower risk associated with secured bonds, they typically carry lower interest rates compared to unsecured bonds.

Disadvantages of Secured Bonds

While secured bonds offer advantages, they also have some potential drawbacks:

- Limited liquidity: Secured bonds may be less liquid than unsecured bonds, as their value is tied to the specific collateral.

- Complexity: The value of the collateral and the legal processes involved in claiming it can add complexity to investing in secured bonds.

Collateral and its Role: What Does A Secured Bond Mean

Collateral acts as a safety net for bondholders, providing a tangible asset that can be claimed in case the issuer defaults on their debt obligations. It serves as a form of insurance, reducing the risk associated with investing in bonds.

Collateral’s Influence on Interest Rates

The value of the collateral directly impacts the interest rate offered on a secured bond. When the collateral is considered highly valuable and easily liquidatable, it reduces the risk for investors. As a result, the interest rate on the bond can be lower, reflecting the lower risk profile. Conversely, if the collateral is deemed less valuable or difficult to liquidate, the risk for investors increases, leading to a higher interest rate to compensate for the potential losses.

Claiming Collateral in Case of Default

In the event of a default, bondholders have the right to claim the collateral. The process of claiming collateral typically involves the following steps:

- Notification of Default: The bond issuer formally declares their inability to meet their debt obligations. This triggers the process of claiming collateral.

- Legal Action: Bondholders may initiate legal action to enforce their rights and claim the collateral. This typically involves filing a lawsuit against the issuer.

- Collateral Valuation: The collateral is appraised to determine its current market value. This valuation is crucial for determining the amount that bondholders can claim.

- Collateral Sale: The collateral is typically sold to recover the value owed to bondholders. The proceeds from the sale are distributed among the bondholders according to their claims.

It is important to note that the process of claiming collateral can be complex and time-consuming. The outcome of the process is also dependent on various factors, including the value of the collateral, the legal framework, and the issuer’s financial situation.

Types of Secured Bonds

Secured bonds, as discussed earlier, are backed by specific assets that can be sold to repay investors if the issuer defaults. This collateral provides an extra layer of protection for bondholders, making secured bonds generally considered less risky than unsecured bonds. The type of collateral backing a secured bond directly impacts its characteristics and risk profile.

Types of Secured Bonds Based on Collateral

The most common types of secured bonds are classified based on the type of collateral backing them. Here’s a table outlining the key characteristics of different types of secured bonds:

| Bond Type | Collateral | Key Characteristics |

|---|---|---|

| Mortgage-Backed Securities (MBS) | Residential or commercial mortgages |

|

| Asset-Backed Securities (ABS) | A variety of assets, such as auto loans, credit card receivables, or equipment leases |

|

| Collateralized Debt Obligations (CDOs) | A pool of various types of debt, including mortgages, bonds, and other loans |

|

| Equipment Trust Certificates | Specific pieces of equipment, such as airplanes or railroad cars |

|

| Collateralized Loan Obligations (CLOs) | A pool of corporate loans |

|

Investment Considerations

Investing in secured bonds involves careful consideration of various factors to ensure a sound investment decision. Understanding the nuances of the underlying collateral and the issuer’s financial health is crucial to assess the risk and potential returns.

Assessing Collateral Quality and Value

The value of the underlying collateral is a primary factor in evaluating secured bonds. Assessing its quality and market value is essential to determine the bond’s security and potential recovery in case of default.

- Type of Collateral: The type of collateral can significantly impact its value. Real estate, equipment, and inventory are common types of collateral. Assessing the market demand, condition, and location of the collateral is crucial. For example, a secured bond backed by a prime commercial property in a thriving market is likely to hold more value than one backed by a dilapidated industrial building in a declining area.

- Collateral Value: The market value of the collateral should be assessed by a qualified professional. This involves considering factors such as recent comparable sales, appraisals, and potential depreciation. The collateral’s value should exceed the bond’s principal amount to provide adequate protection against potential losses.

- Liquidity of Collateral: The ease with which the collateral can be sold in the market is another crucial factor. Highly liquid collateral, such as publicly traded stocks or readily marketable real estate, provides greater security as it can be quickly converted into cash to cover bond obligations.

Issuer’s Financial Health

While secured bonds offer some protection against default, it’s essential to assess the issuer’s financial health. A strong issuer with a history of profitability and sound financial management is more likely to meet its obligations.

- Credit Rating: Credit rating agencies like Moody’s and Standard & Poor’s provide independent assessments of the issuer’s creditworthiness. A higher credit rating indicates a lower risk of default. Investors should consider the issuer’s credit rating and its implications for potential returns.

- Financial Statements: Reviewing the issuer’s financial statements, including income statements, balance sheets, and cash flow statements, provides insights into its financial performance, debt levels, and overall financial health. Look for trends in profitability, cash flow generation, and debt management practices.

- Industry Outlook: Understanding the industry in which the issuer operates is crucial. A favorable industry outlook can enhance the issuer’s financial prospects and reduce the risk of default. Consider factors such as industry growth, competition, and regulatory environment.

Investment Considerations Checklist

Before investing in secured bonds, consider the following:

- Investment Objectives: Determine your investment goals, risk tolerance, and time horizon. Secured bonds are typically considered lower-risk investments than unsecured bonds, but they still carry some level of risk.

- Interest Rates: Compare the interest rates offered by secured bonds with other investment options. Consider the current interest rate environment and potential for rate changes.

- Maturity Date: The maturity date determines when you will receive your principal back. Consider your investment horizon and choose bonds with maturity dates that align with your needs.

- Call Provisions: Some bonds may have call provisions that allow the issuer to redeem them before maturity. This can impact your investment returns if the bond is called at a lower price than expected.

- Tax Implications: Understand the tax implications of investing in secured bonds. Interest income from bonds is typically taxable.

Secured Bonds in the Market

Secured bonds represent a significant portion of the fixed-income market, offering investors a balance between potential returns and relative safety. Understanding the current market trends and the factors influencing their performance is crucial for informed investment decisions.

Prominent Issuers of Secured Bonds, What does a secured bond mean

Prominent issuers of secured bonds span various sectors, each with its own set of collateral backing the debt.

- Real Estate Investment Trusts (REITs): REITs often issue mortgage-backed bonds secured by commercial or residential properties. These bonds offer investors exposure to the real estate market with the security of underlying assets. For instance, a REIT might issue bonds secured by a portfolio of office buildings or apartment complexes, providing investors with a claim on those assets in case of default.

- Corporations: Corporations may issue secured bonds backed by specific assets, such as equipment, inventory, or receivables. For example, a manufacturing company might issue bonds secured by its production machinery, offering investors a claim on those assets in case of default.

- Government Entities: Government entities, including municipalities and state agencies, often issue bonds secured by specific projects or infrastructure. These bonds may be backed by revenue generated from the project, such as toll roads or airports. For example, a city might issue bonds secured by the revenue generated from a new sports stadium, providing investors with a claim on those revenues in case of default.

Economic Factors Influencing Secured Bond Performance

The performance of secured bonds is influenced by various economic factors that impact both the issuer’s ability to repay and the value of the underlying collateral.

- Interest Rates: When interest rates rise, the value of existing bonds, including secured bonds, tends to decline. This is because investors can earn higher returns on newly issued bonds, making existing bonds less attractive. However, the impact of interest rate changes on secured bonds can be mitigated by the presence of collateral.

- Inflation: Inflation erodes the purchasing power of bond payments. However, secured bonds may offer some protection against inflation if the value of the underlying collateral appreciates at a rate that outpaces inflation. For example, if a bond is secured by real estate, and the value of the property rises faster than inflation, the bondholder may be able to recover their investment in real terms.

- Economic Growth: Strong economic growth typically supports the performance of secured bonds, as it strengthens the issuer’s ability to repay and may increase the value of the underlying collateral. Conversely, economic downturns can increase the risk of default, impacting the value of secured bonds.

- Industry Specific Factors: The performance of secured bonds can also be influenced by factors specific to the industry in which the issuer operates. For example, a bond secured by oil and gas assets might be affected by fluctuations in energy prices, while a bond secured by a manufacturing facility might be influenced by changes in consumer demand.

Secured bonds offer a potentially safer investment than unsecured bonds, but they’re not without their risks. By understanding the collateral backing these bonds, you can make informed decisions about whether they fit your investment goals. Remember, the value of collateral can fluctuate, and even if you can claim it, you might not get back your full investment. As with any investment, do your research, weigh the pros and cons, and invest wisely!

FAQ

What is the main advantage of investing in a secured bond?

The main advantage is the extra layer of protection you get from the collateral. If the issuer defaults, you can claim the collateral to recoup some or all of your investment.

Are secured bonds always risk-free?

No, even secured bonds carry some risk. The value of the collateral can fluctuate, and you might not be able to sell it quickly or easily. Additionally, the process of claiming collateral can be complex and time-consuming.

How do I know if a secured bond is a good investment?

Consider factors like the quality of the collateral, the issuer’s creditworthiness, and the interest rate offered. It’s always best to do your research and consult with a financial advisor.

What are some examples of secured bonds?

Mortgage-backed securities, asset-backed securities, and bonds backed by tangible assets like gold or oil are common examples.