What is secured bond – What is a secured bond? In the complex world of finance, understanding the intricacies of debt instruments is crucial. Secured bonds, also known as collateralized bonds, offer a unique approach to debt financing, where the issuer pledges specific assets as collateral to back the bond. This collateral acts as a safety net for investors, mitigating risk and enhancing the bond’s security.

The concept of secured bonds is a cornerstone of debt markets, playing a significant role in various sectors, from real estate to infrastructure.

Imagine investing in a bond backed by a tangible asset, like a piece of property or equipment. This tangible asset serves as collateral, providing an extra layer of protection for investors in case the issuer defaults on their debt obligations. Secured bonds, therefore, offer a potentially lower-risk investment compared to unsecured bonds, which rely solely on the issuer’s creditworthiness.

Definition of a Secured Bond

Imagine lending money to someone, but you want to make sure you get your money back. That’s where secured bonds come in. They’re like a loan where the lender gets a guarantee – a specific asset – to cover their investment if the borrower defaults. A secured bond is a type of debt security that gives the bondholder a claim on specific assets of the issuer in case of default.

Think of it as a safety net for your investment.

Examples of Collateral, What is secured bond

Collateral for secured bonds can be a variety of assets, including:

- Real Estate: This is one of the most common forms of collateral. The bondholder can claim ownership of the property if the issuer fails to repay the bond. Think of it as a mortgage on a building.

- Equipment: Companies can issue bonds backed by specific equipment, such as airplanes or manufacturing machinery. If the company can’t repay the debt, the bondholder can claim ownership of the equipment.

- Inventory: A company might issue bonds backed by its inventory, like raw materials or finished goods. If the company defaults, the bondholder can sell the inventory to recover their investment.

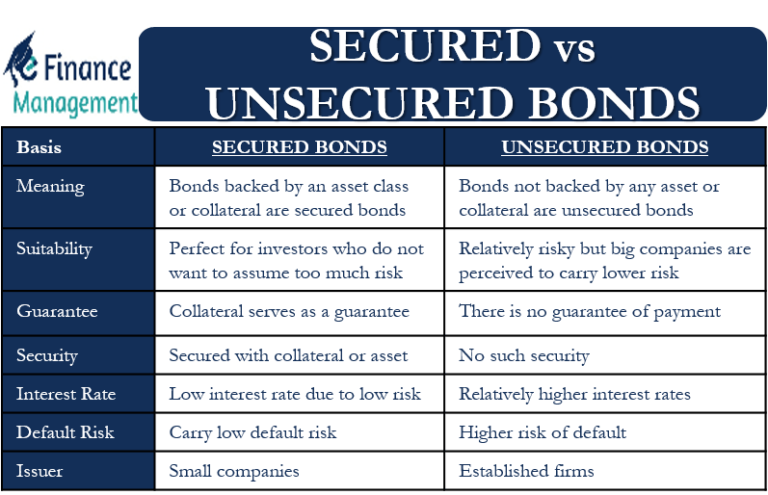

Secured Bonds vs. Unsecured Bonds

The key difference between secured bonds and unsecured bonds (also known as debentures) lies in the collateral.

- Secured Bonds: Offer a higher level of security for the bondholder as they have a claim on specific assets. This makes them generally considered less risky than unsecured bonds.

- Unsecured Bonds: Don’t have specific collateral backing them. In case of default, the bondholder is considered a general creditor and has to compete with other creditors for any remaining assets of the issuer. This makes them riskier than secured bonds.

Secured bonds offer a higher level of safety, but they often come with lower interest rates compared to unsecured bonds, reflecting the lower risk.

Features of Secured Bonds

Secured bonds, as the name suggests, are debt securities backed by specific assets that serve as collateral. This feature distinguishes them from unsecured bonds, which rely solely on the issuer’s creditworthiness. The presence of collateral provides bondholders with an additional layer of protection, mitigating the risk of default and enhancing the overall attractiveness of these bonds.

Collateral and Risk Mitigation

Collateral plays a crucial role in mitigating risk for bondholders. In the event of the issuer’s default, bondholders have the legal right to seize and sell the collateral to recover their investment. This right to claim the collateral serves as a safety net for bondholders, reducing their exposure to potential losses.

- Reduced Default Risk: The existence of collateral significantly lowers the risk of default for bondholders. If the issuer fails to meet its obligations, bondholders can claim the collateral and recover their investment, minimizing their potential losses.

- Enhanced Creditworthiness: The presence of collateral enhances the issuer’s creditworthiness, making it easier for them to secure financing at lower interest rates. This benefit translates into lower borrowing costs for the issuer, potentially leading to a more favorable investment opportunity for bondholders.

Legal Framework and Bondholder Rights

The legal framework surrounding secured bonds Artikels the rights and obligations of both the issuer and the bondholders. This framework ensures the protection of bondholders’ interests and provides a clear path for the recovery of their investment in case of default.

- Security Agreement: A security agreement is a legal document that Artikels the terms of the collateral arrangement. This agreement specifies the type of collateral, the rights of the bondholders, and the procedures for seizing and selling the collateral in case of default.

- Lien: A lien is a legal claim on the collateral, giving bondholders the right to seize and sell the assets if the issuer defaults. This legal protection ensures that bondholders have a priority claim on the collateral over other creditors.

- Foreclosure: In case of default, bondholders can initiate foreclosure proceedings to seize and sell the collateral. This process allows bondholders to recover their investment by realizing the value of the collateral.

“Secured bonds provide bondholders with a higher level of protection compared to unsecured bonds, due to the presence of collateral. This feature makes them particularly attractive to investors seeking a lower-risk investment option.”

Types of Secured Bonds

Secured bonds are a type of debt security that is backed by specific assets, known as collateral. This means that if the issuer defaults on the bond, the bondholders have the right to claim the collateral to recover their investment. Secured bonds generally offer lower interest rates than unsecured bonds because they are considered less risky.

There are several types of secured bonds, each with its own unique characteristics and risk-return profile.

Types of Secured Bonds

Secured bonds are categorized based on the specific assets used as collateral. Here’s a breakdown of common types:

| Type of Secured Bond | Description | Collateral | Risk | Return |

|---|---|---|---|---|

| Mortgage Bonds | Bonds backed by real estate, such as commercial or residential properties. | Real estate properties | Lower risk than unsecured bonds, but higher than other secured bonds. | Lower return than unsecured bonds, but higher than other secured bonds. |

| Equipment Trust Certificates | Bonds secured by specific pieces of equipment, such as airplanes or trains. | Equipment such as airplanes or trains | Lower risk than unsecured bonds, but higher than mortgage bonds. | Lower return than unsecured bonds, but higher than mortgage bonds. |

| Collateralized Bonds | Bonds backed by a pool of assets, such as loans or mortgages. | Pool of assets such as loans or mortgages | Risk depends on the quality of the underlying assets. | Return depends on the quality of the underlying assets. |

Advantages and Disadvantages of Secured Bonds

Secured bonds offer a higher level of security for investors compared to unsecured bonds. This is because they are backed by specific assets, which can be liquidated to repay bondholders in case of default. This security comes with its own set of advantages and disadvantages, which we will explore in this section.

Advantages of Secured Bonds

Investors and issuers both benefit from the added security that secured bonds provide.

For Investors

- Lower Risk: Secured bonds offer a lower risk of default compared to unsecured bonds. This is because investors have a claim on specific assets that can be used to repay them if the issuer defaults.

- Higher Credit Rating: Secured bonds typically have a higher credit rating than unsecured bonds, which reflects their lower risk. This can result in lower interest rates for investors.

- Greater Peace of Mind: Knowing that their investment is backed by specific assets can provide investors with greater peace of mind, especially during times of economic uncertainty.

For Issuers

- Lower Interest Rates: Because secured bonds are seen as less risky, issuers can often obtain financing at lower interest rates than they would for unsecured bonds. This can save them money on interest payments over the life of the bond.

- Greater Access to Capital: Secured bonds can be more attractive to investors, which can make it easier for issuers to raise capital. This is especially important for companies with a lower credit rating or a history of financial instability.

- Enhanced Reputation: Issuing secured bonds can demonstrate a company’s commitment to financial stability and transparency, which can enhance its reputation among investors.

Disadvantages of Secured Bonds

While secured bonds offer several advantages, they also come with some potential drawbacks.

For Investors

- Limited Returns: Secured bonds typically offer lower returns than unsecured bonds because they are considered less risky. This is because investors are willing to accept lower returns for the added security.

- Collateral Value Fluctuations: The value of the collateral backing a secured bond can fluctuate over time. If the value of the collateral decreases, it could affect the bond’s value and the amount that investors receive in the event of default.

For Issuers

- Limited Flexibility: Issuing secured bonds can limit a company’s flexibility in managing its assets. For example, a company may be restricted from selling or using the collateral that backs its secured bonds without obtaining permission from the bondholders.

- Potential for Liquidation: If a company defaults on its secured bonds, the collateral backing the bonds can be liquidated to repay bondholders. This can result in the loss of valuable assets for the company, which can have a negative impact on its operations.

Secured Bonds vs. Unsecured Bonds

- Risk: Secured bonds are generally considered less risky than unsecured bonds because they are backed by specific assets. Unsecured bonds, on the other hand, are backed only by the issuer’s promise to repay. This means that investors in unsecured bonds have a greater risk of losing their investment in the event of default.

- Returns: Secured bonds typically offer lower returns than unsecured bonds because they are considered less risky. Investors are willing to accept lower returns for the added security of knowing that their investment is backed by specific assets.

- Flexibility: Issuing secured bonds can limit a company’s flexibility in managing its assets. Unsecured bonds, on the other hand, do not have the same limitations. This can be an advantage for companies that need to be able to quickly adjust their asset allocation.

Examples of Secured Bonds in the Real World

Secured bonds are a popular investment option for investors seeking a balance between risk and reward. These bonds are backed by specific assets, providing an extra layer of security compared to unsecured bonds. Understanding how these bonds function in real-world scenarios can provide valuable insights for investors.

Real-World Examples of Secured Bonds

Let’s explore some real-world examples of secured bonds, examining the issuer, the type of bond, the collateral used, and its performance in the market.

| Issuer | Type of Bond | Collateral | Description | Market Performance |

|---|---|---|---|---|

| General Motors (GM) | Asset-Backed Security (ABS) | Automobiles | GM issues ABS backed by a pool of car loans. Investors receive interest payments based on the performance of the loans. | Generally performed well, but faced challenges during the 2008 financial crisis due to the decline in auto sales. |

| Citigroup | Mortgage-Backed Security (MBS) | Residential Mortgages | Citigroup issues MBS backed by a pool of residential mortgages. Investors receive interest payments based on the performance of the mortgages. | Experienced significant losses during the 2008 financial crisis due to the rise in mortgage defaults. |

| ExxonMobil | Corporate Bond | Oil and Gas Reserves | ExxonMobil issues corporate bonds backed by its vast oil and gas reserves. These bonds are considered relatively safe due to the stability of the energy sector. | Generally performed well, but experienced some volatility during periods of oil price fluctuations. |

Factors Contributing to Success or Failure of Secured Bonds

The success or failure of secured bonds depends on various factors, including the following:

- Quality of Collateral: The value and liquidity of the collateral are crucial. A strong collateral base provides greater security for investors. For example, bonds backed by real estate are generally considered safer than bonds backed by inventory, which is subject to rapid depreciation.

- Creditworthiness of the Issuer: Even with strong collateral, the issuer’s creditworthiness plays a significant role. A financially sound issuer is more likely to repay its debts, even if the collateral value declines.

- Market Conditions: Economic conditions can impact the performance of secured bonds. During periods of economic downturn, the value of collateral may decline, increasing the risk for investors. For instance, during the 2008 financial crisis, the value of real estate plummeted, impacting the performance of mortgage-backed securities.

Secured bonds, with their inherent collateralization, offer a valuable tool for both investors seeking lower risk and issuers seeking attractive financing options. Understanding the nuances of secured bonds, including their types, features, and advantages, empowers investors to make informed decisions in the complex world of fixed-income investments. The presence of collateral provides a tangible safety net, mitigating risk and fostering confidence in the debt market.

As investors navigate the diverse landscape of debt instruments, secured bonds stand out as a reliable and often sought-after option, offering a balance of security and potential returns.

Answers to Common Questions: What Is Secured Bond

What are the main types of secured bonds?

There are various types of secured bonds, including mortgage bonds (backed by real estate), equipment trust certificates (backed by equipment), and collateralized bonds (backed by a variety of assets). Each type carries its own risk and return profile, influenced by the specific collateral backing the bond.

How do secured bonds differ from unsecured bonds?

Secured bonds are backed by specific assets, offering investors collateral in case of default. Unsecured bonds, also known as debentures, rely solely on the issuer’s creditworthiness and do not offer collateral.

What are the advantages of investing in secured bonds?

Secured bonds offer investors a lower risk profile compared to unsecured bonds due to the presence of collateral. This provides an additional layer of protection in case of default, enhancing the bond’s security.

Are secured bonds always a safe investment?

While secured bonds offer a lower risk profile, they are not risk-free. The value of the collateral can fluctuate, potentially impacting the bond’s value. It’s crucial to carefully evaluate the quality of the collateral and the issuer’s financial health.

How can I find information about secured bonds?

Information about secured bonds can be found through financial news websites, investment research platforms, and bond rating agencies. It’s essential to thoroughly research the bond’s characteristics, including the collateral backing it, before making an investment decision.