Can long-term disability garnish social security – The intricate dance between long-term disability benefits and Social Security garnishment often leaves individuals navigating a complex web of legal and financial considerations. This journey, fraught with uncertainty, demands a clear understanding of the rules governing these benefits and the potential consequences of their intersection.

Understanding the nuances of long-term disability and Social Security benefits is paramount for anyone facing a disability. These benefits are often a lifeline for individuals struggling to make ends meet, but the possibility of garnishment casts a long shadow. This article delves into the intricacies of this situation, exploring the circumstances under which Social Security benefits can be garnished, the potential impact on individuals, and the legal protections available to safeguard these crucial financial resources.

Understanding Long-Term Disability and Social Security

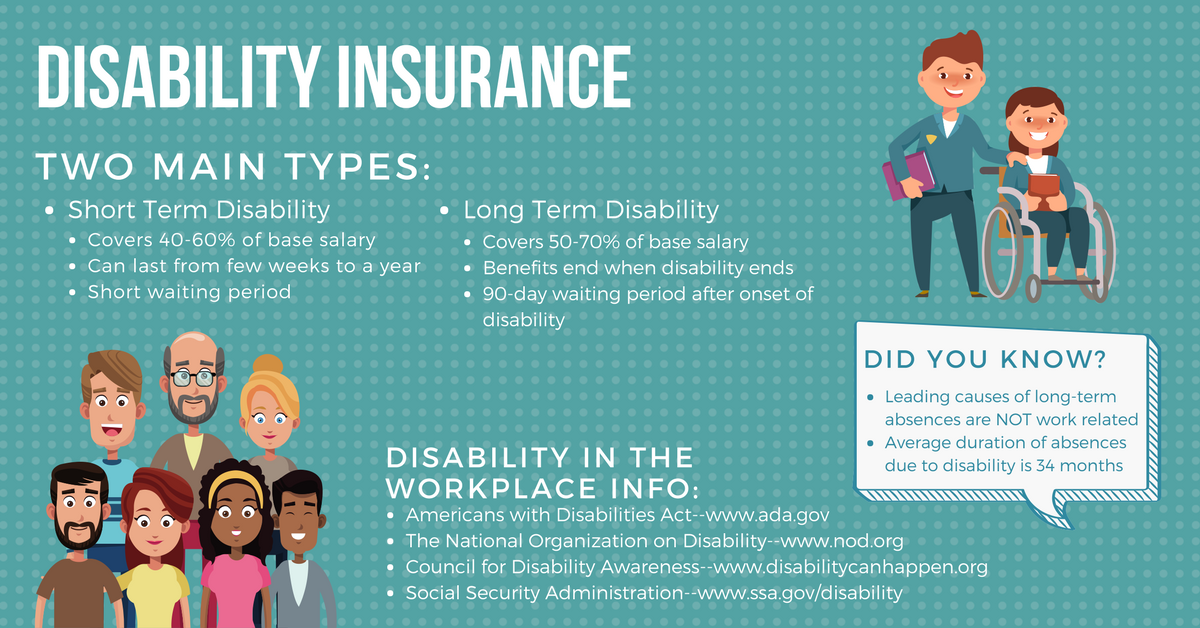

Long-term disability (LTD) and Social Security are two separate programs that provide financial assistance to individuals who are unable to work due to a disability. While both programs aim to help individuals during difficult times, they differ in their eligibility criteria, benefits, and administration.

Difference between Long-Term Disability and Social Security Benefits

Long-term disability benefits are typically provided by private insurance companies, either through an employer-sponsored plan or an individual policy. Social Security benefits, on the other hand, are a federal program funded through payroll taxes.

- Long-Term Disability Benefits: These benefits are designed to replace a portion of your lost income if you are unable to work due to a disability. The amount of benefits you receive will depend on your policy and the severity of your disability.

- Social Security Disability Benefits: These benefits are intended to provide financial support to individuals who are unable to work due to a severe, long-term disability. The amount of benefits you receive is based on your earnings history.

Eligibility Criteria for Long-Term Disability Benefits

To be eligible for long-term disability benefits, you must meet the following criteria:

- Be covered by a long-term disability insurance policy: You must have an active policy with a private insurance company, either through your employer or an individual policy.

- Be unable to perform your own occupation: Your disability must prevent you from performing the essential duties of your job.

- Meet the policy’s definition of disability: Each policy has its own definition of disability, which may vary depending on the insurer.

- Satisfy the waiting period: There is usually a waiting period before you can receive benefits, typically 30 to 90 days.

Eligibility Criteria for Social Security Disability Benefits

To be eligible for Social Security disability benefits, you must meet the following criteria:

- Have a severe, long-term disability: Your disability must be expected to last at least 12 months or result in death.

- Be unable to perform any substantial gainful activity: This means you cannot perform work that is considered “substantial” or “gainful,” even if you can perform some other type of work.

- Meet the Social Security Administration’s definition of disability: The Social Security Administration (SSA) has a specific definition of disability that includes medical and vocational factors.

- Have sufficient work credits: You must have worked long enough and paid Social Security taxes to be eligible for benefits.

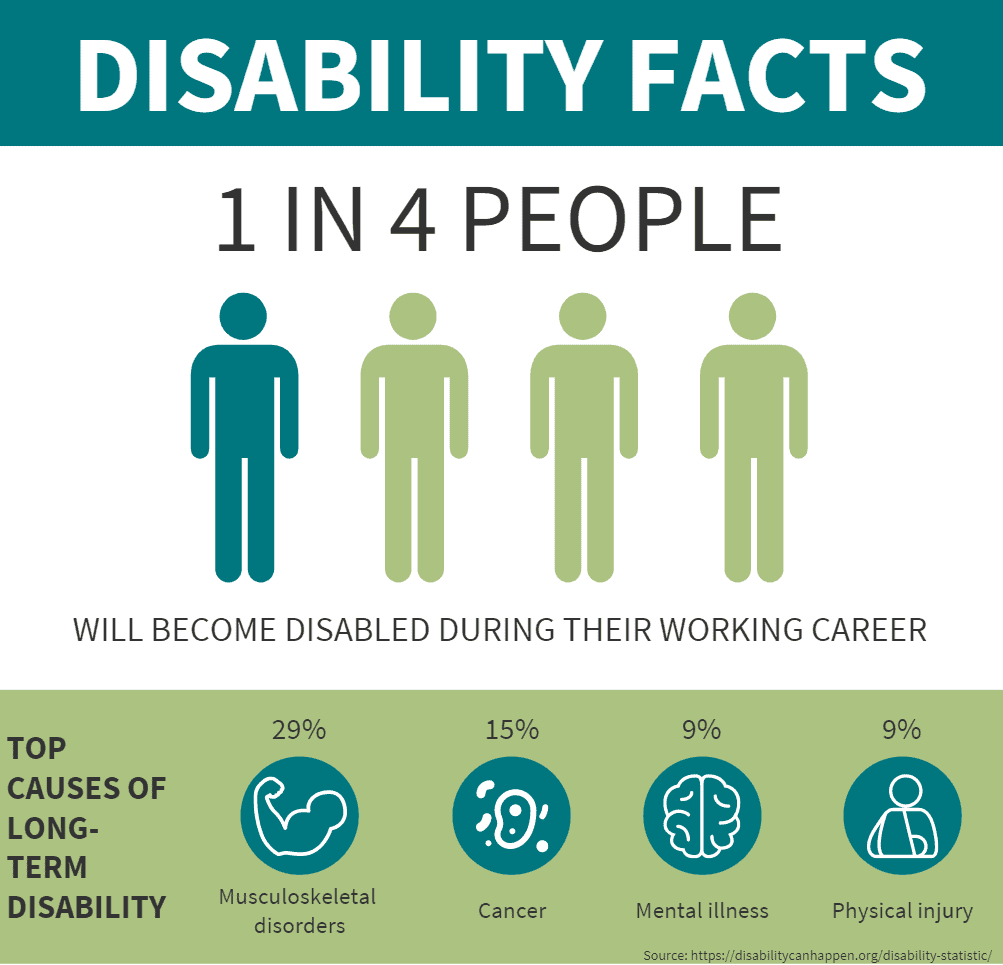

Examples of Common Reasons for Receiving Long-Term Disability Benefits

Here are some common reasons why someone might receive long-term disability benefits:

- Serious illness: Conditions such as cancer, heart disease, stroke, and multiple sclerosis can make it impossible to work.

- Severe injury: Injuries from accidents, falls, or sports can cause permanent disability.

- Mental health conditions: Conditions such as depression, anxiety, and bipolar disorder can significantly impair an individual’s ability to work.

- Chronic pain: Chronic pain conditions such as arthritis, back pain, and fibromyalgia can make it difficult to perform work duties.

Garnishment of Social Security Benefits

Garnishment is a legal process where a portion of your earnings, including Social Security benefits, can be withheld to pay off a debt. While Social Security benefits are generally protected from creditors, there are specific circumstances under which they can be garnished.

Circumstances for Garnishment

The Social Security Administration (SSA) can garnish Social Security benefits in specific circumstances, typically involving unpaid debts to the government or court-ordered payments. The SSA follows strict guidelines for garnishment and ensures that the process is fair and transparent.

- Child Support: The most common reason for garnishing Social Security benefits is to collect unpaid child support. States have the authority to collect child support payments, and this can include garnishing Social Security benefits. The SSA will deduct a portion of your benefits and send it to the state child support enforcement agency.

- Overpayments: If the SSA has overpaid you Social Security benefits, they can recover the overpayment by garnishing your benefits. This could happen if you received benefits you were not eligible for or if there was an error in calculating your benefits.

- Federal Tax Liens: The Internal Revenue Service (IRS) can file a tax lien against you if you owe federal taxes. If you have a tax lien, the IRS can garnish your Social Security benefits to recover the unpaid taxes.

- State and Local Taxes: Some states and localities can garnish Social Security benefits to collect unpaid state and local taxes. However, this is less common than federal tax liens.

- Student Loans: The Department of Education can garnish Social Security benefits to collect unpaid student loans. However, this is usually a last resort, and the Department of Education will typically attempt to collect the debt through other means first.

- Court-Ordered Payments: In some cases, a court may order the garnishment of Social Security benefits to pay for other debts, such as unpaid medical bills or judgments from lawsuits.

Process for Garnishment

The SSA will notify you in writing if your benefits are going to be garnished. This notice will explain the reason for the garnishment and how much of your benefits will be withheld. You have the right to challenge the garnishment, and the SSA will provide you with information on how to do so.

The SSA generally will not garnish more than 15% of your Social Security benefits, but the specific amount withheld will depend on the circumstances.

Long-Term Disability and Social Security Garnishment: Can Long-term Disability Garnish Social Security

In the realm of long-term disability insurance, the possibility of garnishment of Social Security benefits arises when an insurer seeks to recoup payments made to a policyholder who is also receiving Social Security benefits. This complex interplay between disability insurance and Social Security benefits raises questions about the legal basis for garnishment and the specific scenarios under which it might be permitted.

Garnishment of Social Security Benefits

The legal basis for garnishment of Social Security benefits stems from the Social Security Act, which permits certain types of deductions from benefits. This act grants the right to a long-term disability insurer to offset its payments with Social Security benefits received by the policyholder in specific situations.The legal basis for garnishment is rooted in the principle of “subrogation,” where an insurer, having paid benefits to a policyholder, steps into the shoes of the insured and assumes their right to recover from a third party.

In this case, the insurer seeks to recover from Social Security, which is considered a third party in the context of disability benefits.

Scenarios for Garnishment

The potential for a long-term disability insurer to garnish Social Security benefits is dependent on specific circumstances and legal interpretations. The following table Artikels the key scenarios where garnishment might be permissible:

| Scenario | Explanation | Legal Basis |

|---|---|---|

| Overpayment of Benefits | When an insurer has overpaid benefits to a policyholder due to errors or miscalculations, it may be able to recover the overpayment from Social Security benefits. | The insurer’s right to recover overpayments is typically Artikeld in the policy contract. |

| Offset for Benefits Received | In cases where the policyholder is receiving both Social Security benefits and long-term disability benefits, the insurer may seek to offset its payments with the Social Security benefits, particularly if the policy contract explicitly permits such an offset. | The policy contract’s provisions regarding offsets are crucial in determining the insurer’s right to garnish Social Security benefits. |

| Fraudulent Claims | If a policyholder has fraudulently obtained long-term disability benefits, the insurer may have grounds to pursue garnishment of Social Security benefits to recover its losses. | The insurer’s right to recover benefits obtained through fraud is supported by both contract law and legal principles of unjust enrichment. |

Impact of Garnishment on Individuals

Garnishment of Social Security benefits can have a significant impact on individuals, both financially and emotionally. It can create a challenging situation, forcing individuals to adjust their spending habits and cope with the stress of reduced income.

Financial Consequences

Garnishment can significantly impact an individual’s financial stability, potentially leading to difficulties in meeting basic needs such as housing, food, and healthcare.

- Reduced Income: The most immediate consequence of garnishment is a reduction in monthly Social Security benefits. This reduction can significantly impact an individual’s ability to pay bills and cover essential expenses.

- Financial Strain: Garnishment can lead to financial strain, forcing individuals to make difficult choices about how to allocate their limited resources. This may involve cutting back on essential expenses, delaying medical treatments, or taking on additional debt.

- Difficulty in Budgeting: Garnishment can make it challenging to budget effectively. Individuals need to factor in the reduced benefit amount, making it difficult to plan for future expenses or unexpected events.

- Impact on Credit Score: If garnishment leads to missed payments on loans or other debts, it can negatively impact an individual’s credit score, making it harder to obtain future loans or credit cards.

Emotional and Psychological Effects

Garnishment can also have significant emotional and psychological effects on individuals, leading to feelings of stress, anxiety, and depression.

- Stress and Anxiety: Garnishment can create significant stress and anxiety, as individuals worry about meeting their financial obligations and maintaining their standard of living.

- Loss of Independence: Having Social Security benefits garnished can lead to feelings of loss of independence and control over one’s finances.

- Shame and Embarrassment: Some individuals may feel shame or embarrassment about having their benefits garnished, leading to social isolation and reluctance to seek help.

- Depression: The financial and emotional stress associated with garnishment can contribute to depression, affecting an individual’s overall well-being.

Resources and Strategies

Individuals facing Social Security benefit garnishment have options to address the situation and seek support.

- Contact the Social Security Administration (SSA): Individuals should contact the SSA to understand the reason for garnishment and explore potential options for reducing or eliminating the garnishment.

- Negotiate with Creditors: Individuals can attempt to negotiate with creditors to reduce the amount owed or establish a payment plan that fits their budget.

- Seek Legal Assistance: Individuals facing garnishment should consider seeking legal assistance from a qualified attorney to explore their rights and options. An attorney can help navigate the legal process and advocate on their behalf.

- Explore Financial Counseling: Individuals can benefit from seeking financial counseling from a reputable organization. A financial counselor can help develop a budget, explore debt management strategies, and connect individuals with resources to address their financial situation.

Legal Considerations and Protections

While the possibility of Social Security benefit garnishment due to long-term disability payments can be unsettling, individuals facing this situation are not without legal protections. The law recognizes the importance of safeguarding Social Security benefits, which are meant to provide essential financial support.

Protections Against Garnishment, Can long-term disability garnish social security

The Social Security Act includes provisions that protect Social Security benefits from garnishment. These protections are designed to ensure that individuals receive the financial assistance they need, even when they are facing other financial obligations.

- Limited Garnishment: The Social Security Act restricts the amount of Social Security benefits that can be garnished. Typically, only a specific percentage of your benefits can be garnished, and this percentage is determined by law.

- Exemptions: Certain types of debts are not subject to garnishment of Social Security benefits. For example, child support and alimony payments are generally exempt from garnishment.

- “Essential Needs” Protection: The law recognizes that Social Security benefits are intended to cover essential needs like food, housing, and medical care. Garnishment orders are generally limited to prevent the complete depletion of Social Security benefits, ensuring that individuals can meet their basic needs.

Challenging a Garnishment Order

If you believe that a garnishment order is incorrect or violates your legal protections, you have the right to challenge it. This process typically involves filing a legal action to dispute the garnishment.

- Legal Grounds: You can challenge a garnishment order on various grounds, such as improper notice, lack of jurisdiction, or violation of your legal rights.

- Procedures: The specific procedures for challenging a garnishment order vary depending on the jurisdiction. You may need to file a formal objection or motion with the court.

- Evidence: To support your challenge, you may need to provide evidence to demonstrate that the garnishment order is incorrect or violates your rights.

Role of an Attorney

Navigating the legal process involved in challenging a garnishment order can be complex. Consulting with an attorney who specializes in Social Security law can be crucial in protecting your rights and maximizing your chances of success.

- Expert Guidance: An attorney can provide expert legal advice on the specific circumstances of your case, explaining your rights and options.

- Negotiation and Litigation: An attorney can negotiate with creditors on your behalf and represent you in court if necessary.

- Protecting Your Rights: An attorney can ensure that your rights are protected throughout the legal process and that any garnishment order complies with applicable laws.

Preventing Garnishment

Protecting your Social Security benefits from garnishment is crucial when you’re receiving long-term disability payments. While it’s not always possible to prevent garnishment entirely, taking proactive steps can significantly minimize the risk. This section explores practical strategies and essential steps to safeguard your benefits.

Communication with Insurer and SSA

Open and consistent communication with both your disability insurer and the Social Security Administration (SSA) is essential. Clear communication helps you understand your rights and obligations, as well as the potential impact of any decisions you make.

- Keep your disability insurer informed of any changes in your financial situation, such as debt collection efforts, legal proceedings, or other circumstances that could affect your benefits.

- Maintain regular contact with the SSA to ensure your records are up-to-date and to clarify any questions you may have about your benefits.

- Understand your policy’s terms and conditions, particularly regarding garnishment and how your benefits might be affected.

Steps to Protect Social Security Benefits

- Review your budget and identify areas where you can cut expenses. This may involve reducing discretionary spending or exploring alternative solutions for debt management.

- Consider exploring options for debt consolidation or settlement, which can reduce the overall amount you owe and potentially decrease the likelihood of garnishment.

- Seek legal advice from a qualified attorney who specializes in Social Security benefits and debt collection. They can provide personalized guidance and help you navigate complex legal issues.

- Consider negotiating a payment plan with creditors. This may involve agreeing to make smaller, more manageable payments over a longer period, potentially reducing the risk of garnishment.

- File for bankruptcy if necessary. Bankruptcy can discharge certain debts, potentially protecting your Social Security benefits from garnishment. However, this should be considered as a last resort, as it can have significant financial and legal implications.

Case Studies and Examples

Understanding the potential for long-term disability garnishment of Social Security benefits is crucial for individuals navigating this complex legal landscape. Real-world examples offer valuable insights into the challenges faced by individuals whose Social Security benefits are subject to garnishment due to long-term disability claims.

Fictional Case Study

Consider the case of Sarah, a 45-year-old single mother who has been receiving Social Security disability benefits for five years following a debilitating back injury. She has been unable to return to her previous job as a nurse and relies on her Social Security benefits to support herself and her two children. Sarah recently filed a long-term disability claim with her private insurer, hoping to supplement her income.

Unfortunately, Sarah’s claim was denied. In an attempt to recover her financial losses, Sarah’s insurer filed a lawsuit against her, seeking to garnish her Social Security benefits to cover the unpaid disability premiums. This situation highlights the potential for long-term disability insurers to target Social Security benefits when claims are denied.

Real-World Examples

- In a landmark case, a federal court ruled that a long-term disability insurer could garnish Social Security benefits to recover unpaid premiums. The court reasoned that Social Security benefits are not exempt from garnishment under federal law. This case established a precedent that has been cited in numerous subsequent cases, making it more likely for insurers to pursue garnishment of Social Security benefits.

- In another instance, a disabled individual was forced to give up a significant portion of their Social Security benefits to satisfy a debt owed to their long-term disability insurer. The individual had been receiving benefits for over a decade and had relied on them to cover basic living expenses. After their claim was denied, the insurer sought to recover the unpaid premiums, leaving the individual with a drastically reduced income and struggling to make ends meet.

Potential Outcomes and Challenges

The garnishment of Social Security benefits can have severe consequences for individuals.

- Reduced Income: Individuals may experience a significant reduction in their monthly income, making it difficult to cover basic necessities such as housing, food, and medical expenses.

- Financial Strain: Garnishment can lead to financial strain, forcing individuals to make difficult choices and potentially putting them at risk of eviction, foreclosure, or bankruptcy.

- Emotional Distress: The loss of a vital income source can cause significant emotional distress and anxiety, impacting overall well-being.

Navigating the intersection of long-term disability and Social Security garnishment requires a delicate balance of knowledge and foresight. Understanding the legal framework, potential consequences, and available protections is crucial for individuals seeking to safeguard their financial security. By navigating this complex terrain with awareness and informed decision-making, individuals can mitigate risks and strive for a secure future.

Top FAQs

What is the difference between long-term disability benefits and Social Security benefits?

Long-term disability benefits are typically provided by an employer or private insurance company, and they are designed to replace a portion of your lost income due to a disability. Social Security benefits, on the other hand, are a federal program that provides income to individuals who are disabled and meet certain eligibility criteria.

Can my Social Security benefits be garnished for other debts, such as credit card debt or medical bills?

Yes, Social Security benefits can be garnished for certain debts, such as unpaid child support or alimony, federal taxes, and student loans. However, there are limitations on how much of your benefits can be garnished, and certain benefits, such as survivor benefits, are generally protected from garnishment.

What are some strategies for preventing Social Security benefit garnishment?

Some strategies include:

- Keeping your contact information updated with the Social Security Administration.

- Negotiating with creditors to avoid defaulting on loans or debts.

- Seeking legal advice to understand your rights and options.