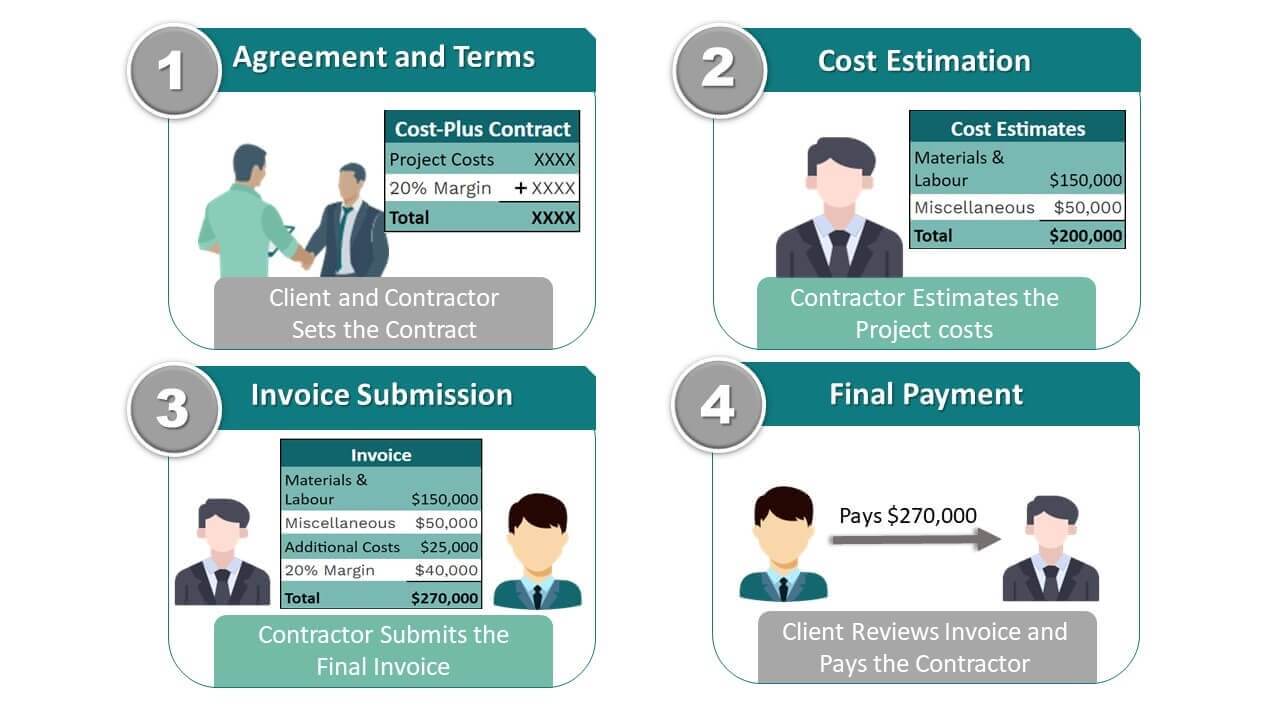

What are cost plus contract – What are cost-plus contracts? Imagine you’re ordering a custom-made outfit, and you’re paying for the fabric, tailoring, and a bit extra for the designer’s expertise. That’s basically what a cost-plus contract is – you pay for the actual costs of the project plus a predetermined fee for the contractor’s work. It’s like getting a bespoke deal, but with more transparency and flexibility.

Cost-plus contracts are commonly used in projects where the scope or complexity is uncertain, like construction projects, research and development, or government procurement. These contracts offer both buyers and sellers unique advantages and disadvantages, depending on the specific project and its goals.

Disadvantages of Cost-Plus Contracts

While cost-plus contracts offer benefits for both buyers and sellers, they also come with several potential drawbacks that should be carefully considered. Understanding these disadvantages can help parties make informed decisions about whether a cost-plus contract is the right choice for their specific project.

Disadvantages for the Buyer

Cost-plus contracts can present significant challenges for buyers, primarily due to the lack of upfront cost certainty and the potential for cost overruns.

- Lack of Cost Certainty and Potential for Cost Overruns: Cost-plus contracts lack a fixed price, making it difficult for buyers to accurately budget for the project. This uncertainty can lead to significant cost overruns, especially if the project scope changes or unforeseen circumstances arise. For example, if a construction project encounters unexpected geological conditions, the costs could escalate significantly, and the buyer would be responsible for covering those additional expenses.

- Increased Complexity in Contract Administration and Cost Tracking: Cost-plus contracts require meticulous contract administration and cost tracking. The buyer must carefully monitor the seller’s expenses to ensure they are reasonable and accurate. This process can be time-consuming and complex, requiring dedicated resources and expertise.

- Potential for Seller to Inflate Costs: Without a fixed price, there is a risk that the seller might inflate costs to maximize their profit. This is especially true if the buyer lacks the expertise to adequately monitor the seller’s expenses.

Disadvantages for the Seller

Cost-plus contracts can also present challenges for sellers, particularly in terms of limited profit potential and increased administrative burden.

- Limited Profit Potential if Costs are Higher Than Anticipated: While sellers are compensated for their actual costs, their profit margin is typically fixed as a percentage of those costs. If project costs exceed expectations, the seller’s profit may be significantly reduced or even eliminated. For instance, if a software development project encounters unforeseen technical challenges, the seller’s profit margin could be significantly impacted.

- Increased Administrative Burden for Cost Reporting and Documentation: Sellers must meticulously document and report all project costs to the buyer. This process can be time-consuming and resource-intensive, requiring dedicated staff and systems for cost tracking and reporting.

Factors to Consider When Choosing a Cost-Plus Contract

Cost-plus contracts offer a unique approach to project management, but they come with their own set of considerations. Deciding whether a cost-plus contract is the right choice for a specific project requires careful evaluation of various factors. Understanding these factors can help you make an informed decision and navigate the potential benefits and drawbacks of this contract type.

Project Complexity and Uncertainty, What are cost plus contract

The complexity and uncertainty of a project are crucial factors influencing the suitability of a cost-plus contract. When dealing with projects involving high levels of complexity, unpredictable factors, or rapidly changing requirements, a cost-plus contract can provide flexibility and mitigate the risks associated with fixed-price contracts. This is because it allows for adjustments to the project scope and budget as the project progresses, accommodating unforeseen circumstances.

Buyer’s Risk Tolerance and Budget Constraints

A buyer’s risk tolerance and budget constraints are equally important factors to consider. Cost-plus contracts place a higher level of financial risk on the buyer, as the final cost is not fixed. Buyers with a higher risk tolerance and a flexible budget may be more comfortable with the potential for cost overruns associated with this contract type. However, buyers with tight budgets and a lower risk tolerance may find fixed-price contracts more appealing.

Seller’s Experience and Track Record

The seller’s experience and track record play a significant role in determining the success of a cost-plus contract. Working with a seller with a proven track record of delivering projects on time and within budget is crucial. This ensures that the seller has the expertise and resources to manage the project effectively and minimize the potential for cost overruns.

Availability of Reliable Cost Tracking and Reporting Mechanisms

Transparent and reliable cost tracking and reporting mechanisms are essential for cost-plus contracts. Both the buyer and the seller need to have access to real-time cost data to monitor project progress and identify potential issues early on. This helps to ensure that the project stays within budget and avoids surprises at the end.

Comparison of Cost-Plus and Fixed-Price Contracts

| Feature | Cost-Plus Contract | Fixed-Price Contract |

|---|---|---|

| Price | Reimbursable costs plus a fixed fee or percentage | Fixed price agreed upon before project start |

| Risk | Higher risk for buyer, lower risk for seller | Lower risk for buyer, higher risk for seller |

| Flexibility | High flexibility to adjust scope and budget | Limited flexibility, changes require renegotiation |

| Incentive for Efficiency | Lower incentive for seller to minimize costs | Strong incentive for seller to minimize costs |

| Transparency | Requires detailed cost tracking and reporting | Less emphasis on cost tracking, but buyer must monitor performance |

| Suitable for | Complex projects, uncertain scope, high risk tolerance | Well-defined projects, predictable scope, lower risk tolerance |

Cost-Plus Contracts in Practice: What Are Cost Plus Contract

Cost-plus contracts are widely used across various industries, particularly when project scope, complexity, or uncertainty is high. These contracts are valuable for projects where the exact costs are difficult to predict upfront, and flexibility is crucial. Let’s delve into how these contracts are employed in different sectors and explore real-world examples of their implementation.

Cost-Plus Contracts in Construction

Cost-plus contracts are frequently used in large-scale construction projects, especially those involving complex engineering or design challenges. These contracts allow for greater flexibility in adapting to unforeseen circumstances, such as changes in site conditions, regulatory requirements, or material availability.

- Example: The construction of the Burj Khalifa in Dubai utilized a cost-plus contract, which allowed the developers to manage the intricate design and engineering challenges while mitigating risks associated with the project’s unprecedented height and complexity.

Cost-Plus Contracts in Research and Development

Research and development projects often involve significant uncertainty and require a high degree of collaboration between the contractor and the client. Cost-plus contracts are well-suited for these projects, allowing for continuous adjustments as the project progresses and new discoveries are made.

- Example: The development of new pharmaceuticals often involves a cost-plus contract structure, as the research process can be unpredictable and require extensive testing and modifications. This contract type allows for flexibility in adjusting the scope and budget based on research findings.

Cost-Plus Contracts in Government Procurement

Government agencies frequently use cost-plus contracts for projects that involve national security, public safety, or complex technical requirements. These contracts provide the government with greater control over project specifications and allow for adjustments based on evolving needs.

- Example: The development of advanced military aircraft often involves cost-plus contracts, allowing the government to closely monitor the project’s progress and ensure the final product meets stringent performance standards.

Case Studies of Cost-Plus Contract Implementation

- Successful Implementation: The construction of the International Space Station (ISS) involved a complex network of cost-plus contracts between NASA and various international partners. This approach facilitated collaboration, allowed for adjustments based on unforeseen challenges, and ultimately resulted in the successful completion of this ambitious project.

- Unsuccessful Implementation: The development of the F-35 fighter jet, managed under a cost-plus contract, faced significant cost overruns and delays. This case highlights the importance of robust cost controls and careful project management to mitigate risks associated with cost-plus contracts.

Challenges and Best Practices in Managing Cost-Plus Contracts

Managing cost-plus contracts effectively requires careful planning, strong communication, and robust cost control mechanisms.

- Challenges:

- Potential for cost overruns due to lack of clear cost control mechanisms.

- Difficulty in accurately forecasting final project costs.

- Increased risk of disputes and conflicts between the contractor and the client.

- Best Practices:

- Establish clear and detailed project scope and specifications.

- Implement robust cost control mechanisms and regular cost reporting.

- Maintain open communication and collaboration between the contractor and the client.

- Utilize independent cost estimators to verify contractor costs.

Cost-plus contracts are a powerful tool for managing complex projects where uncertainty is high. They offer a balance of risk and reward for both parties, but careful planning and communication are essential to ensure a successful outcome. If you’re considering a cost-plus contract, it’s crucial to understand its nuances, weigh the pros and cons, and ensure you have the right framework in place for a smooth and successful collaboration.

Frequently Asked Questions

What are the main types of cost-plus contracts?

There are three main types: Cost-plus-fixed-fee (CPFF), Cost-plus-incentive-fee (CPIF), and Cost-plus-percentage-of-cost (CPPC). Each type has a different fee structure and risk allocation, so choosing the right one depends on the specific project needs.

Are cost-plus contracts always the best option?

Not necessarily. While they offer flexibility and risk sharing, they also lack cost certainty and require careful administration. Fixed-price contracts might be a better fit for projects with clear scope and predictable costs.

How can I ensure cost control with a cost-plus contract?

It’s important to have clear and detailed cost reporting mechanisms in place, regular communication with the contractor, and strong contract management practices to prevent cost overruns.