What are the four types of cost reimbursable contracts? This question is a common one among those involved in complex projects, where uncertainty reigns supreme. In essence, cost reimbursable contracts represent a unique approach to project management, where the client agrees to reimburse the contractor for all incurred expenses, along with a predetermined fee. These contracts are often favored for projects with high levels of risk and ambiguity, where the exact scope of work or the required resources are not yet fully defined.

The key difference between cost reimbursable contracts and fixed-price contracts lies in the allocation of risk. In fixed-price contracts, the contractor assumes the majority of the risk, while in cost reimbursable contracts, the client bears a larger portion of the risk.

Cost reimbursable contracts come in four primary flavors: Cost Plus Fixed Fee (CPFF), Cost Plus Incentive Fee (CPIF), Cost Plus Percentage of Cost (CPPC), and Cost Plus Award Fee (CPAF). Each of these contract types offers a distinct payment structure and fee calculation method, tailored to the specific needs and risk tolerance of both the contractor and the client.

Cost Reimbursable Contracts: What Are The Four Types Of Cost Reimbursable Contracts

Cost reimbursable contracts are a type of agreement where the buyer (or customer) reimburses the seller (or contractor) for the actual costs incurred in performing the work, plus an agreed-upon fee or profit margin. This means the seller is not taking on the financial risk of the project, but instead is compensated for their expenses and effort.The primary reason for using cost reimbursable contracts is to manage projects with high levels of complexity and uncertainty.

When the scope of work is not fully defined, the technologies required are still evolving, or there is a significant potential for unforeseen challenges, a cost reimbursable contract provides flexibility and allows the seller to adapt to changing circumstances.

Comparison with Fixed-Price Contracts

Cost reimbursable contracts differ significantly from fixed-price contracts in terms of risk allocation and payment structures. In a fixed-price contract, the seller assumes the risk of completing the project within a predetermined budget, regardless of the actual costs incurred. The buyer pays a fixed price for the work, and the seller is responsible for managing costs and delivering the project within the agreed-upon budget.

In contrast, cost reimbursable contracts shift the risk to the buyer. The seller is reimbursed for their actual costs, which can fluctuate depending on the project’s requirements and unforeseen circumstances. This means the buyer has less certainty about the final project cost, but they gain greater flexibility and control over the project’s scope and execution.

Cost reimbursable contracts are typically used for projects where the scope of work is not fully defined, the technologies required are still evolving, or there is a significant potential for unforeseen challenges.

Types of Cost Reimbursable Contracts

Cost reimbursable contracts are a type of contract where the client reimburses the contractor for the actual costs incurred in performing the work, plus an agreed-upon fee. These contracts are typically used for projects with high uncertainty, where the scope of work is not fully defined at the outset. This allows for flexibility in adapting to changing requirements and unforeseen circumstances.

Cost Reimbursable Contract Types

The four main types of cost reimbursable contracts are:

- Cost Plus Fixed Fee (CPFF)

- Cost Plus Incentive Fee (CPIF)

- Cost Plus Percentage of Cost (CPPC)

- Cost Plus Award Fee (CPAF)

Each type of contract has a different payment structure, fee calculation method, and risk allocation between the contractor and the client.

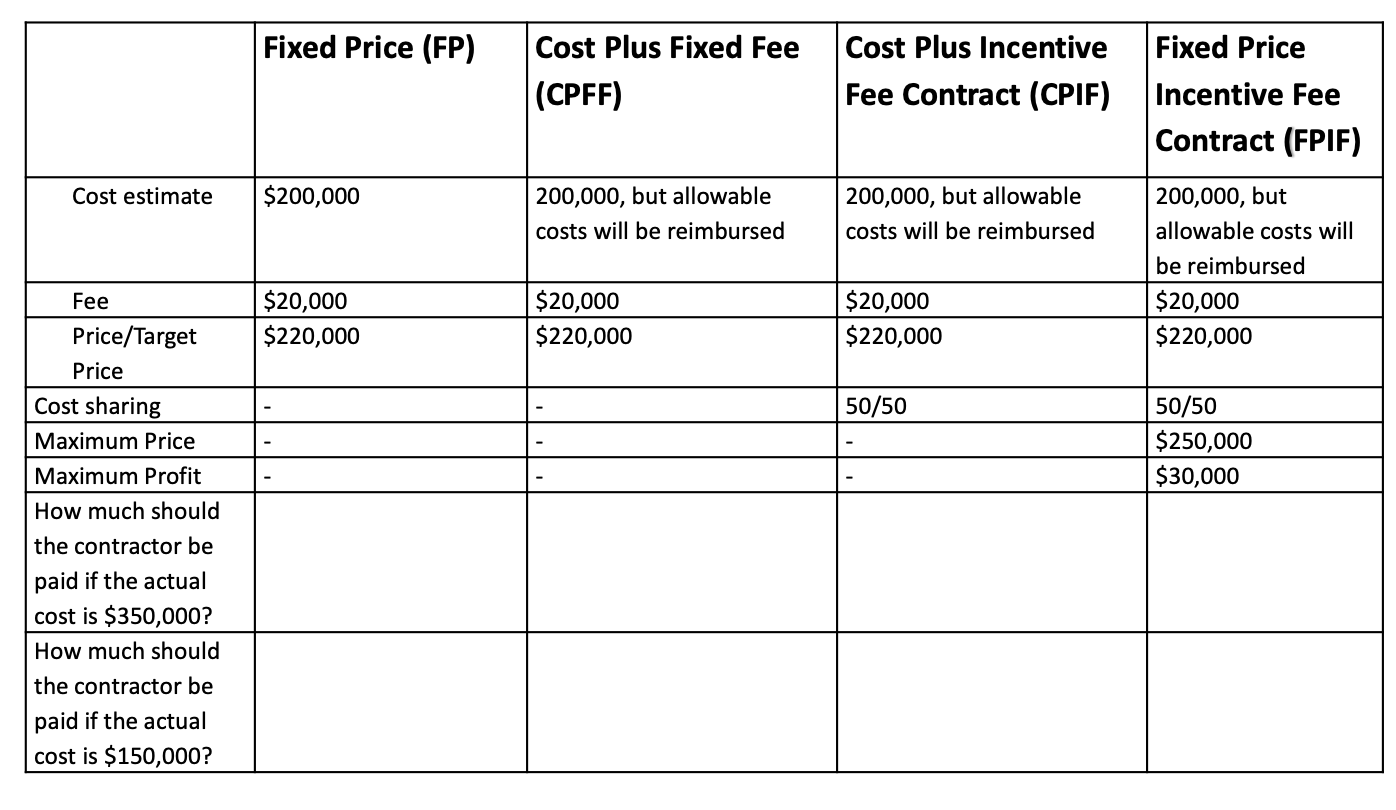

Cost Reimbursable Contract Types: A Comparison, What are the four types of cost reimbursable contracts

The following table summarizes the key features of each type of cost reimbursable contract:

| Contract Type | Payment Structure | Fee Calculation Method | Risk Allocation |

|---|---|---|---|

| Cost Plus Fixed Fee (CPFF) | Reimbursement of actual costs incurred + fixed fee | Fixed fee is negotiated upfront and does not change based on actual costs | Contractor bears most of the cost risk, while the client bears most of the schedule risk. |

| Cost Plus Incentive Fee (CPIF) | Reimbursement of actual costs incurred + incentive fee | Incentive fee is calculated based on the contractor’s performance against agreed-upon targets | Both the contractor and the client share the cost and schedule risk. |

| Cost Plus Percentage of Cost (CPPC) | Reimbursement of actual costs incurred + percentage of costs | Percentage of costs is negotiated upfront and is applied to all actual costs | Contractor has a strong incentive to increase costs, as this directly increases their fee. This type of contract is rarely used in practice. |

| Cost Plus Award Fee (CPAF) | Reimbursement of actual costs incurred + award fee | Award fee is based on the contractor’s performance against subjective criteria, such as quality, schedule, and innovation | Contractor bears most of the cost risk, while the client bears most of the schedule and performance risk. |

Cost Plus Fixed Fee (CPFF)

In a CPFF contract, the contractor is reimbursed for all allowable costs incurred in performing the work, plus a fixed fee that is negotiated upfront. The fixed fee is not affected by the actual costs incurred, and it serves as a profit margin for the contractor.

CPFF contracts are suitable for projects with a high degree of uncertainty, where the scope of work is not fully defined at the outset.

For example, a CPFF contract could be used for a research and development project, where the exact technical challenges and solutions are not known in advance.

Cost Plus Incentive Fee (CPIF)

A CPIF contract is similar to a CPFF contract, but it includes an incentive fee that is calculated based on the contractor’s performance against agreed-upon targets. The incentive fee can be used to motivate the contractor to achieve specific performance goals, such as completing the project on time and within budget.

The incentive fee is typically calculated as a percentage of the target cost, with the percentage varying based on the contractor’s performance.

For example, a CPIF contract could be used for a construction project, where the incentive fee could be based on the project’s completion date and the number of defects identified.

Cost Plus Percentage of Cost (CPPC)

In a CPPC contract, the contractor is reimbursed for all allowable costs incurred, plus a percentage of those costs. The percentage is negotiated upfront and is applied to all actual costs.

CPPC contracts are rarely used in practice, as they create a strong incentive for the contractor to increase costs.

This is because the contractor’s fee is directly proportional to the costs incurred.

Cost Plus Award Fee (CPAF)

A CPAF contract is similar to a CPFF contract, but it includes an award fee that is based on the contractor’s performance against subjective criteria, such as quality, schedule, and innovation. The award fee is not directly related to the actual costs incurred, and it is typically paid out at the end of the project.

CPAF contracts are suitable for projects where performance is more important than cost, such as research and development projects or complex engineering projects.

For example, a CPAF contract could be used for a software development project, where the award fee could be based on the software’s functionality, usability, and security.

Cost Plus Fixed Fee (CPFF)

The Cost Plus Fixed Fee (CPFF) contract is a type of cost-reimbursable contract where the contractor is reimbursed for all allowable costs incurred during the project, plus a fixed fee that is negotiated upfront. This fixed fee is independent of the project’s actual costs and remains constant regardless of cost fluctuations. The fixed fee in a CPFF contract serves as a profit incentive for the contractor, encouraging them to efficiently manage project costs while ensuring quality work.

This structure balances the contractor’s financial risk with the client’s need for cost control.

The Fixed Fee’s Role in Cost Control

The fixed fee is a predetermined amount that the contractor receives in addition to the actual costs incurred during the project. This fee is typically a percentage of the estimated project costs, and it remains constant regardless of the actual costs incurred. The purpose of the fixed fee is to provide the contractor with a profit incentive while also motivating them to control costs within reasonable limits.The fixed fee is independent of the project’s actual costs, meaning the contractor’s profit is not directly tied to cost overruns.

This structure encourages the contractor to focus on delivering quality work and managing costs efficiently, as excessive cost overruns would not directly impact their profitability.

Examples of CPFF Contract Use

CPFF contracts are typically employed in scenarios where:

- The project scope is uncertain or subject to change.

- The client values quality and performance over strict cost control.

- The project involves complex technical requirements or high risk.

- The client desires a strong partnership with the contractor.

For example, CPFF contracts are often used in research and development projects, where the scope of work may evolve as new discoveries are made. They are also commonly used in government contracts for defense projects, where performance and quality are paramount.

Cost Plus Incentive Fee (CPIF)

The Cost Plus Incentive Fee (CPIF) contract is a cost-reimbursable contract type that provides an incentive for the contractor to achieve specific project milestones or performance targets. This incentive is in the form of an incentive fee, which is paid to the contractor in addition to the reimbursable costs. The CPIF contract encourages the contractor to control costs and enhance performance, leading to a more efficient and successful project.

Incentive Fee Structure

The incentive fee is calculated based on the contractor’s performance against predetermined goals and targets. The incentive fee structure is defined in the contract and typically includes a target cost, a target fee, and a shared savings or loss arrangement. The target cost is an estimate of the total cost of the project, and the target fee is the maximum incentive fee the contractor can earn.

The shared savings or loss arrangement determines how the incentive fee is adjusted based on the actual project costs. If the actual costs are lower than the target cost, the contractor and the government share the savings. Conversely, if the actual costs exceed the target cost, the contractor and the government share the loss.

The incentive fee is a powerful motivator for the contractor to achieve or exceed performance expectations.

Incentive Fee Calculation and Adjustment

The incentive fee is typically calculated using a formula that takes into account the actual cost of the project and the performance against predetermined targets. The formula for calculating the incentive fee can be complex and varies depending on the specific project and contract terms. The incentive fee can be adjusted based on performance. For example, if the contractor exceeds the performance targets, the incentive fee may be increased.

Conversely, if the contractor fails to meet the performance targets, the incentive fee may be reduced or even eliminated.

For instance, a CPIF contract for a software development project may set a target cost of $1 million and a target fee of $100,000. The contract may also include a shared savings or loss arrangement, where the contractor and the government share any savings or losses equally. If the actual cost of the project is $900,000, the contractor would receive an incentive fee of $150,000, representing a 50% share of the $200,000 savings. Conversely, if the actual cost of the project is $1.2 million, the contractor would receive no incentive fee and would share the $200,000 loss with the government.

Cost Plus Percentage of Cost (CPPC)

The Cost Plus Percentage of Cost (CPPC) contract is a type of cost-reimbursable contract where the contractor is reimbursed for all allowable costs incurred during the project, plus a percentage of those costs as a fee. This fee structure directly ties the contractor’s profit to the project’s total costs, creating a strong incentive to minimize expenses.

Potential Drawbacks of CPPC Contracts

CPPC contracts are often considered less desirable than other cost-reimbursable contract types due to their inherent risk of cost overruns. This risk arises from the direct correlation between the contractor’s fee and the project’s total costs. The contractor may have less incentive to control costs effectively, as higher costs translate to a larger fee. This can lead to situations where the contractor prioritizes completing the project, even if it means exceeding the initial budget.

Why CPPC Contracts Are Less Common

The lack of strong incentives for cost control and the inherent risk of cost overruns have contributed to the declining popularity of CPPC contracts. Government agencies and private organizations are increasingly opting for other cost-reimbursable contract types, such as Cost Plus Fixed Fee (CPFF) and Cost Plus Incentive Fee (CPIF), which provide greater control over project costs and offer stronger incentives for cost efficiency.

Cost Plus Award Fee (CPAF)

The Cost Plus Award Fee (CPAF) contract is a cost-reimbursable contract where the contractor is reimbursed for all allowable costs incurred in performing the work, plus an award fee that is based on the contractor’s performance. This type of contract is often used for projects where the scope of work is uncertain or subject to change, and where performance is difficult to quantify objectively.CPAF contracts differ from other cost-reimbursable contracts in that the award fee is not predetermined but is instead based on a subjective evaluation of the contractor’s performance against a set of predetermined criteria.

These criteria are typically defined in the contract and may include factors such as schedule adherence, cost control, quality of work, technical innovation, and overall project success.

Determining the Award Fee

The award fee is determined by the client through a structured evaluation process. The client will assess the contractor’s performance against the predetermined criteria and assign a score. The score is then used to determine the amount of the award fee, which is typically paid as a percentage of the total contract value.The evaluation process for CPAF contracts can be complex and subjective.

It involves a team of evaluators, who may include representatives from the client, the contractor, and independent experts. The evaluators will review the contractor’s performance data, conduct interviews with key personnel, and consider other relevant factors.The evaluation process should be transparent and objective, and the client should provide the contractor with feedback on their performance. This feedback can help the contractor improve their performance on future projects.

Examples of CPAF Contracts

CPAF contracts are often used for projects where performance is difficult to quantify objectively, such as:* Research and development projects: The success of R&D projects is often difficult to measure in advance, and the results may not be known until after the project is completed.

Complex systems engineering projects

These projects often involve a high degree of technical complexity and uncertainty, making it difficult to define clear performance metrics.

Management consulting projects

The success of management consulting projects is often based on subjective factors, such as the client’s satisfaction with the results.In these types of projects, CPAF contracts can be a good way to incentivize the contractor to achieve the desired results, while also providing flexibility for changes in scope or requirements.

Understanding the nuances of each cost reimbursable contract type is crucial for ensuring a successful project. By carefully considering the project’s complexity, the level of uncertainty, and the desired risk allocation, both the contractor and the client can select the most appropriate contract type to maximize their chances of achieving project goals and objectives.

FAQ Explained

What are the benefits of using a cost reimbursable contract?

Cost reimbursable contracts offer several benefits, including the ability to manage complex projects with a high degree of uncertainty, encourage innovation and flexibility, and provide the client with greater control over the project’s scope and progress.

What are the drawbacks of using a cost reimbursable contract?

Cost reimbursable contracts can also present challenges, such as the potential for cost overruns, the need for careful monitoring and oversight, and the possibility of disputes over the contractor’s expenses.

When is it appropriate to use a cost reimbursable contract?

Cost reimbursable contracts are best suited for projects with a high degree of uncertainty, where the scope of work is not fully defined, or where innovation and flexibility are paramount. They are often used in research and development projects, government contracts, and projects with complex technical requirements.

How do I choose the right type of cost reimbursable contract?

The choice of cost reimbursable contract type depends on the specific needs and risk tolerance of both the contractor and the client. It’s essential to carefully consider the project’s complexity, the level of uncertainty, and the desired risk allocation.