What is cost of carry in futures contracts? It’s a question that gets traders and investors buzzing, especially when you’re dealing with the world of commodities and financial instruments. Imagine you’re holding onto a stock, but you’re not just holding it, you’re holding onto a futures contract. You’re locked in for the future, and that future has its own price tag.

That price tag is the cost of carry, and it’s a key ingredient in the recipe for futures trading.

Cost of carry represents the expenses associated with holding an asset until its future delivery date. It’s like a hidden fee, a cost of doing business, and it plays a major role in how futures contracts are priced. We’ll break down the components of cost of carry, including storage costs, interest expenses, insurance premiums, and opportunity costs, and show how these costs affect the price of a futures contract.

Introduction to Futures Contracts

Futures contracts are standardized agreements to buy or sell an underlying asset at a predetermined price on a future date. They are traded on organized exchanges, offering a platform for participants to manage price risk and speculate on future price movements. Futures contracts play a crucial role in various industries, including agriculture, energy, and finance. They allow producers, consumers, and investors to hedge against price fluctuations, lock in future prices, and capitalize on market opportunities.

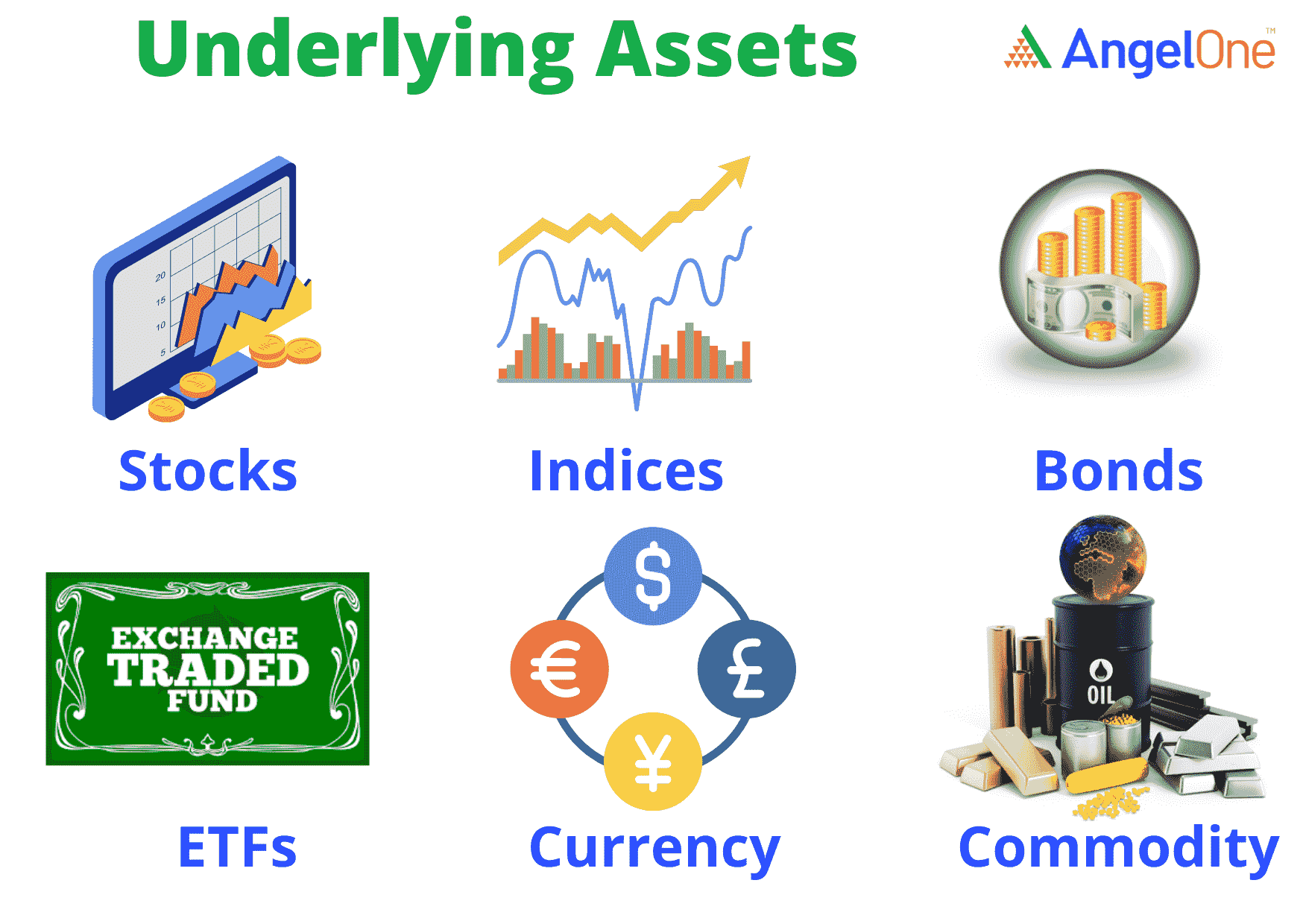

Underlying Assets in Futures Contracts

Underlying assets are the physical commodities, financial instruments, or indices that futures contracts are based on. These assets represent the subject matter of the agreement and determine the value of the contract. Examples of underlying assets include:

- Agricultural commodities: Wheat, corn, soybeans, cotton, etc.

- Energy commodities: Crude oil, natural gas, gasoline, etc.

- Metals: Gold, silver, copper, etc.

- Financial instruments: Stock indices, interest rates, currencies, etc.

The value of a futures contract is directly linked to the price of the underlying asset. As the price of the underlying asset changes, the value of the futures contract also fluctuates accordingly. This relationship makes futures contracts a valuable tool for managing price risk.

Standardized Terms and Conditions

Futures contracts are characterized by standardized terms and conditions, ensuring uniformity and transparency in the market. These standardized terms include:

- Contract size: The amount of the underlying asset that is traded in a single contract. For example, a futures contract for crude oil might represent 1,000 barrels of oil.

- Delivery date: The specific date on which the underlying asset is to be delivered. This date is predetermined and set by the exchange.

- Trading unit: The minimum number of contracts that can be traded. This is typically one contract, but may vary depending on the exchange.

- Trading hours: The specific time period during which futures contracts can be traded on the exchange.

- Settlement procedure: The method used to settle the contract at the end of the trading day. This can be through cash settlement or physical delivery.

These standardized terms and conditions ensure that all participants in the futures market have a clear understanding of the contract’s obligations and risks. They facilitate fair and efficient trading by providing a common framework for all market participants.

Cost of Carry

The cost of carry is a significant factor in determining the price of futures contracts. It represents the expenses associated with holding an underlying asset until the futures contract’s maturity date. Understanding cost of carry is crucial for traders and investors to make informed decisions regarding futures trading.

Components of Cost of Carry

The cost of carry comprises various expenses incurred during the holding period of the underlying asset. These expenses can be categorized into the following components:

- Storage Costs: These costs are associated with storing the underlying asset, such as warehousing, handling, and maintenance. For commodities like grains, oil, and metals, storage costs can be a significant component of the cost of carry.

- Interest Expenses: Holding the underlying asset requires financing, which incurs interest expenses. The cost of borrowing funds to finance the purchase of the asset is included in the cost of carry.

- Insurance Premiums: Protecting the underlying asset against damage or loss necessitates insurance coverage. Insurance premiums are included in the cost of carry, particularly for assets susceptible to risks like natural disasters or theft.

- Opportunity Costs: Opportunity cost represents the potential return lost by investing in the underlying asset instead of other investment options. It considers the alternative returns that could have been earned if the funds were invested elsewhere.

Relationship between Cost of Carry and Futures Price

The cost of carry directly influences the futures price. The futures price is typically determined by the spot price of the underlying asset plus the cost of carry. The relationship can be expressed as follows:

Futures Price = Spot Price + Cost of Carry

In a normal market, the futures price is expected to be higher than the spot price, reflecting the cost of holding the asset until the futures contract’s maturity date. This difference between the futures price and the spot price is known as the “carry premium.”For instance, consider a futures contract on wheat with a maturity date of six months. The current spot price of wheat is $5 per bushel, and the estimated cost of carry for six months is $0.50 per bushel.

The futures price would be calculated as follows:

Futures Price = $5 + $0.50 = $5.50 per bushel

The futures price of $5.50 reflects the cost of carry, which includes expenses such as storage, interest, insurance, and opportunity costs.

Cost of Carry in Relation to Futures Pricing

:max_bytes(150000):strip_icc()/DDM_INV_cost-of-carry_df-3x2-0e9e3a1232b147019147b85b68e4cdb4.jpg)

The cost of carry is a crucial factor in determining the futures price. It represents the expenses associated with holding an asset until its futures contract maturity. These expenses can include storage costs, interest, insurance, and any other costs associated with holding the asset. The cost of carry directly influences the relationship between the spot price and the futures price.

Relationship Between Cost of Carry and Futures Price

The cost of carry plays a vital role in determining the futures price. In a normal market, the futures price reflects the expected spot price at maturity, adjusted for the cost of carry. The futures price is expected to be higher than the spot price if the cost of carry is positive, and lower than the spot price if the cost of carry is negative.

This relationship can be represented by the following formula:

Futures Price = Spot Price + Cost of Carry

For example, if the cost of carry for a commodity is positive, the futures price will be higher than the spot price. This is because investors holding the commodity until maturity need to be compensated for the storage costs, interest, and other expenses. Conversely, if the cost of carry is negative, the futures price will be lower than the spot price.

This might occur when the cost of holding the asset is offset by benefits like dividends or interest earned on the asset.

Contango and Backwardation in Futures Markets

Contango and backwardation are two common market conditions in futures markets, directly influenced by the cost of carry.

Contango

Contango occurs when the futures price is higher than the spot price. This usually happens when the cost of carry is positive, meaning the cost of holding the asset until maturity is higher than the benefits. Investors need to be compensated for these costs, leading to a higher futures price.

Backwardation

Backwardation occurs when the futures price is lower than the spot price. This happens when the cost of carry is negative, meaning the benefits of holding the asset outweigh the costs. This can be driven by factors like convenience yield or strong demand for the underlying asset.

Examples of Cost of Carry Impact

The cost of carry impacts various futures contracts, including commodities and financial instruments.

Commodities

Commodities like oil, gold, and agricultural products are subject to cost of carry. For instance, the cost of carry for oil includes storage costs, insurance, and transportation. If the cost of carry is high, the futures price for oil will be higher than the spot price.

Financial Instruments

Financial instruments, like interest rate futures and stock index futures, also have a cost of carry. For interest rate futures, the cost of carry includes the interest rate differential between the spot rate and the futures rate. For stock index futures, the cost of carry includes dividends paid by the underlying stocks.

Factors Affecting Cost of Carry

The cost of carry is influenced by several factors that affect the price of a futures contract relative to the underlying asset. These factors determine the cost of holding the underlying asset until the futures contract expires, and they play a crucial role in the pricing of futures contracts.

Interest Rates

Interest rates are a significant factor influencing the cost of carry. When interest rates are high, the opportunity cost of holding the underlying asset increases. This is because the investor could earn a higher return by investing the funds in a risk-free asset, such as a government bond. As a result, the cost of carry for the futures contract rises, and the futures price tends to be higher than the spot price.

The cost of carry is directly proportional to interest rates.

Conversely, when interest rates are low, the opportunity cost of holding the underlying asset decreases. This makes the cost of carry lower, and the futures price tends to be closer to the spot price.

Storage Costs

Storage costs are the expenses incurred in storing the underlying asset until the futures contract expires. These costs can include warehousing fees, insurance premiums, and spoilage or deterioration of the asset. The higher the storage costs, the higher the cost of carry for the futures contract.

The cost of carry is directly proportional to storage costs.

For example, consider the case of agricultural commodities like wheat or corn. Storing these commodities requires specialized facilities and incurs significant costs for maintaining quality and preventing spoilage. These costs directly contribute to the cost of carry for futures contracts on these commodities.

Market Volatility and Demand/Supply Dynamics

Market volatility and demand/supply dynamics can also impact the cost of carry. When market volatility is high, the uncertainty surrounding future prices increases. This uncertainty can lead to higher risk premiums being incorporated into the cost of carry, resulting in a higher futures price.

The cost of carry is positively correlated with market volatility.

Similarly, if demand for the underlying asset is expected to increase, the cost of carry may rise. This is because investors are willing to pay a premium for the right to acquire the asset at a future date when demand is expected to be higher. Conversely, if supply is expected to increase, the cost of carry may decline as the price of the asset is likely to fall in the future.

The cost of carry is influenced by demand and supply dynamics.

For example, if a new technology is expected to increase demand for a particular metal, the cost of carry for futures contracts on that metal may increase due to the anticipation of higher prices in the future.

Practical Applications of Cost of Carry: What Is Cost Of Carry In Futures Contract

The concept of cost of carry, as previously explained, plays a pivotal role in understanding futures pricing and identifying potential opportunities in the derivatives market. This section delves into various practical applications of cost of carry, showcasing its significance for traders and investors.

Identifying Arbitrage Opportunities

Arbitrage opportunities arise when price discrepancies exist across different markets. Traders can exploit these discrepancies for profit by simultaneously buying and selling the same asset in different markets. Cost of carry is a key factor in identifying these arbitrage opportunities.The concept of “cost of carry arbitrage” involves comparing the futures price with the spot price of an asset, considering the cost of carrying the asset until the futures contract expires.

If the futures price is significantly higher than the spot price plus the cost of carry, a trader can buy the asset in the spot market, hold it until the futures contract expires, and then sell it at the higher futures price. This strategy profits from the difference between the futures price and the spot price plus the cost of carry.For instance, consider a trader who observes that the futures price of gold is significantly higher than the spot price plus the cost of storage and financing.

This trader can buy gold in the spot market, store it in a secure location, and sell it at the higher futures price when the contract expires, pocketing the difference.

Assessing the Relative Value of Different Futures Contracts, What is cost of carry in futures contract

Cost of carry can be used to compare the relative value of different futures contracts for the same underlying asset but with different maturities. By considering the cost of carry for each contract, traders can determine which contract offers the most favorable pricing.For example, consider two futures contracts on the same commodity, one with a maturity of six months and the other with a maturity of one year.

By comparing the cost of carry for both contracts, a trader can identify the contract with the most attractive pricing. This information can be crucial in making informed decisions about which contract to trade.

Incorporating Cost of Carry into Investment Strategies

Investors can use cost of carry to enhance their investment strategies. Here are a few examples:

- Rollover Strategies: Investors can use cost of carry to determine the optimal timing for rolling over futures contracts. By comparing the cost of carry for different contracts, they can decide when to exit a maturing contract and enter a new contract with a later expiration date. This strategy helps manage the risk of holding futures contracts over extended periods.

- Carry Trade: Investors can use cost of carry to identify opportunities for the carry trade. This strategy involves borrowing money at a lower interest rate and investing it in an asset that offers a higher return. By comparing the cost of carry for different assets, investors can identify those that offer the most attractive carry trade opportunities. For example, an investor might borrow money at a low interest rate and invest in a futures contract with a high cost of carry, hoping to profit from the difference.

- Market Timing: Investors can use cost of carry to help them time the market. By analyzing the relationship between futures prices and the cost of carry, investors can identify potential trends in the market. For instance, if the futures price is significantly higher than the spot price plus the cost of carry, it might suggest that the market is expecting higher prices in the future.

This information can be used to guide investment decisions.

Understanding cost of carry is like having a secret weapon in the world of futures trading. It allows you to predict price movements, spot arbitrage opportunities, and make informed decisions about your investments. By mastering the concept of cost of carry, you can navigate the complex world of futures contracts with confidence and potentially reap the rewards of smart trading strategies.

FAQ Compilation

How does cost of carry impact the price of a futures contract?

If the cost of carry is high, the futures price will typically be higher than the spot price. This is because the seller needs to be compensated for the additional costs associated with holding the asset until delivery. Conversely, if the cost of carry is low, the futures price may be lower than the spot price.

What are some real-world examples of how cost of carry affects futures prices?

Think about crude oil. The cost of storing oil can fluctuate based on factors like storage capacity and transportation costs. These costs get factored into the price of oil futures contracts. Similarly, interest rates can affect the cost of carry for financial instruments like bonds, influencing their futures prices.

How can I use cost of carry to my advantage in futures trading?

You can use cost of carry to identify arbitrage opportunities, where you can buy a futures contract at a lower price and sell it at a higher price, profiting from the difference. You can also use cost of carry to assess the relative value of different futures contracts and make informed investment decisions.