What is cost of money in government contracts – What is the cost of money in government contracts? This question is super important, especially for those in the biz. It’s not just about the cash you get, but also how much it actually costs to borrow that cash. Think about interest rates, inflation, and even how long a project takes. All of these factors play a big role in how much money you’ll need to make a profit.

Imagine you’re building a new bridge for the government. You’re going to need a lot of money to buy materials, pay your workers, and cover all the expenses. But you might not have all that cash upfront. So, you’ll need to borrow some money. That’s where the “cost of money” comes in.

The interest rate you pay on that loan will affect how much money you make, and whether the project is even worth it in the end.

Understanding the Cost of Money in Government Contracts

The cost of money, also known as the time value of money, is a crucial factor in government contracts. It represents the cost associated with borrowing funds to finance a project or the opportunity cost of using funds for a project instead of investing them elsewhere. This concept plays a significant role in contract pricing and project feasibility.

The Influence of Economic Factors

The cost of money is influenced by various economic factors, including interest rates, inflation, and risk.

- Interest Rates: Higher interest rates increase the cost of borrowing money, making it more expensive to finance projects. Conversely, lower interest rates reduce borrowing costs.

- Inflation: Inflation erodes the purchasing power of money over time. When inflation is high, contractors need to factor in higher prices for materials and labor, increasing the overall project cost.

- Risk: The perceived risk of a project also affects the cost of money. Projects with higher risks, such as those with complex technical requirements or uncertain timelines, are likely to attract higher interest rates.

Impact on Contract Pricing

The cost of money significantly impacts contract pricing. Contractors need to factor in the cost of financing the project when determining their bid price. This includes the interest expense on any borrowed funds and the opportunity cost of using funds for the project instead of investing them elsewhere.

The cost of money can be a significant component of a project’s total cost, especially for large-scale, long-term projects.

Project Feasibility

The cost of money can also influence the feasibility of a project. If the cost of financing is too high, it may make the project economically unviable.

- Example: Consider a government contract for a new infrastructure project. If interest rates are high, the cost of borrowing funds to finance the project could make it too expensive to undertake. This could lead to the project being canceled or delayed.

Cost of Money in Contract Financing

The cost of money is a crucial factor in government contract financing. It represents the interest rate or the cost of borrowing funds to finance contract performance. Understanding the cost of money is essential for contractors to make informed financial decisions and ensure profitability.

Financing Options for Government Contractors, What is cost of money in government contracts

Contractors have several financing options available to them, each with its own associated cost of money.

- Bank Loans: Commercial banks offer a variety of loan products, including lines of credit, term loans, and revolving credit facilities. These loans typically have interest rates that fluctuate with market conditions and are often tied to the contractor’s creditworthiness.

- Government Loans: The U.S. government offers various loan programs specifically designed to support small businesses and contractors working on government projects. These programs often provide lower interest rates and more flexible repayment terms compared to commercial bank loans.

- Private Equity: Private equity firms invest in companies by purchasing equity stakes or providing debt financing. They can provide significant capital infusions for contractors but often seek higher returns and may have more stringent requirements.

Factoring the Cost of Money into Financing Decisions

The cost of money is a key consideration when choosing a financing option. Contractors must carefully evaluate the following factors:

- Interest Rates: Different financing options will have varying interest rates. Lower interest rates translate into lower borrowing costs, improving profitability.

- Loan Terms: Repayment terms, such as the loan duration and amortization schedule, impact the overall cost of borrowing. Shorter loan terms may result in higher monthly payments but lower overall interest costs.

- Fees and Charges: Loan agreements often include fees and charges, such as origination fees, commitment fees, and late payment penalties. These fees add to the overall cost of borrowing.

- Collateral Requirements: Some financing options require collateral, such as real estate or equipment, to secure the loan. The availability and value of collateral can influence the terms and cost of borrowing.

Impact of Cost of Money on Contract Profitability

The cost of money can significantly impact the profitability of a government contract. For example:

- Higher Interest Rates: If a contractor secures a loan with a high interest rate, a larger portion of the contract revenue will be allocated to debt repayment, reducing profit margins.

- Unfavorable Loan Terms: Long loan terms or balloon payments can create financial strain and increase the risk of default, impacting the contractor’s ability to perform the contract and generate profits.

- Unanticipated Fees: Unexpected fees or charges associated with financing can erode profitability, especially for contracts with tight profit margins.

Cost of Money and Contract Risk

The cost of money in government contracts is not just a matter of calculating interest rates. It’s also about understanding and managing the inherent risks associated with these contracts. Factors like contract duration, project complexity, and payment terms can significantly influence the cost of money, impacting the overall financial viability of a project.

Risk Factors Influencing the Cost of Money

Understanding how risk factors can influence the cost of money is crucial for making informed financial decisions.

- Contract Duration: Longer contracts introduce more uncertainty, as economic conditions and market fluctuations can significantly impact the project’s profitability over time. This uncertainty translates into a higher cost of money for the contractor.

- Project Complexity: Complex projects involve greater technical challenges and require specialized expertise. The potential for unforeseen delays, cost overruns, and performance issues increases with complexity, leading to a higher cost of money to compensate for these risks.

- Payment Terms: Delayed payments or uncertain payment schedules can strain a contractor’s cash flow, increasing their borrowing needs and, consequently, the cost of money. For example, a contract with a lengthy payment cycle might require the contractor to secure additional financing, raising their overall borrowing costs.

Risk Mitigation Strategies and Cost of Money

Effective risk mitigation strategies can reduce the cost of money by mitigating the uncertainties associated with government contracts.

- Detailed Contractual Provisions: Clearly defined scope of work, performance metrics, and payment terms minimize ambiguity and reduce the risk of disputes. This clarity can lower the cost of money by reducing the likelihood of costly delays and legal challenges.

- Robust Project Management: Implementing rigorous project management practices, such as thorough planning, risk assessments, and proactive communication, can minimize the impact of unforeseen challenges. This can lead to a lower cost of money by reducing the potential for cost overruns and delays.

- Insurance and Bonding: Securing insurance and bonding can protect contractors from financial losses arising from unforeseen events like accidents, natural disasters, or project failures. This can lower the cost of money by transferring some of the risk to insurers and bond providers.

Cost of Money as a Risk Assessment Tool

The cost of money can be a valuable tool for assessing the overall risk associated with a government contract.

- Higher Cost of Money = Higher Risk: A higher cost of money signals a higher perceived risk associated with the project. This could be due to factors like complex project requirements, uncertain payment terms, or a lengthy contract duration. Contractors may demand a higher return to compensate for these risks, leading to a higher cost of money.

- Lower Cost of Money = Lower Risk: A lower cost of money indicates a lower perceived risk. This could be due to factors like a well-defined scope of work, predictable payment schedules, or a shorter contract duration. Contractors may be willing to accept a lower return due to the reduced risk, leading to a lower cost of money.

Cost of Money and Contract Negotiation

Understanding the cost of money is crucial during contract negotiations. It can be leveraged to secure favorable terms and minimize financial risks. This section delves into various negotiation tactics and provides a hypothetical scenario to illustrate how contractors can effectively negotiate the cost of money.

Negotiation Tactics for Addressing the Cost of Money

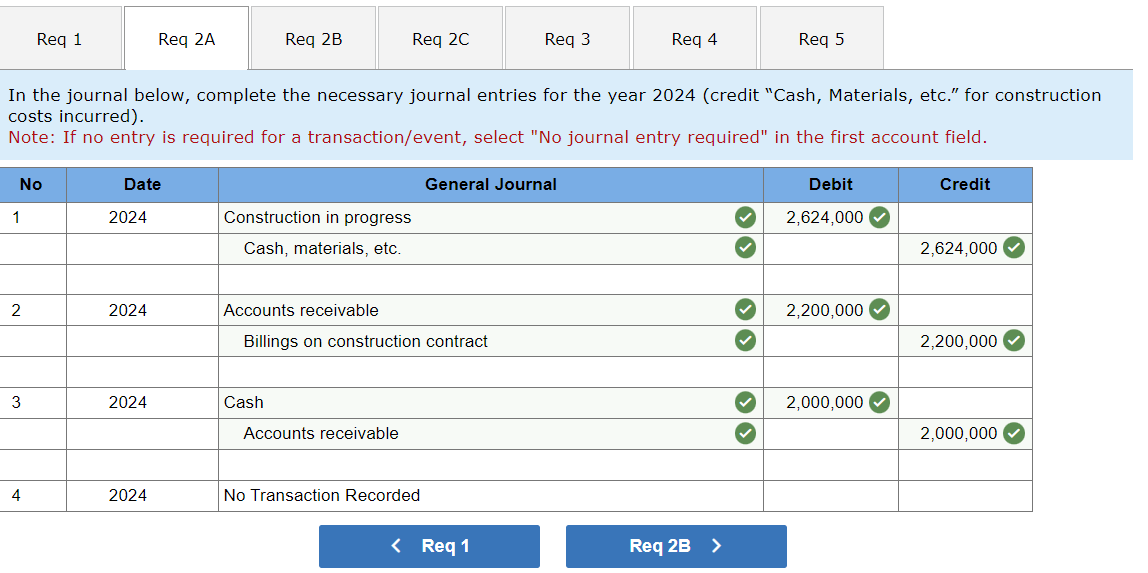

The cost of money can be addressed during negotiations through various tactics. Each approach has its own strengths and weaknesses, and the best strategy depends on the specific circumstances of the contract.Here’s a table comparing different negotiation tactics for addressing the cost of money:

| Negotiation Tactic | Description | Strengths | Weaknesses |

|---|---|---|---|

| Cost-Plus Pricing | The contractor is reimbursed for all actual costs incurred, plus a predetermined profit margin. | Provides cost certainty for the contractor. | Can lead to cost overruns if not properly managed. |

| Fixed-Price Contracts | The contractor agrees to a fixed price for the work, regardless of actual costs. | Provides cost certainty for the government. | Can be risky for the contractor if costs exceed the fixed price. |

| Incentive Contracts | The contractor is rewarded for exceeding performance targets or achieving cost savings. | Motivates the contractor to improve efficiency and reduce costs. | Can be complex to design and administer. |

| Negotiated Cost of Money | The contractor and government negotiate a specific rate for the cost of money. | Allows for flexibility and transparency. | Requires careful analysis and negotiation. |

Hypothetical Scenario

Imagine a contractor bidding on a construction project for a new government building. The project is expected to take two years to complete. The contractor estimates the cost of money at 6% per year. During negotiations, the contractor proposes a fixed-price contract with a cost of money clause that reflects their estimated rate. The government, concerned about potential cost overruns, proposes a cost-plus contract with a lower cost of money rate.The contractor, understanding the government’s concerns, suggests a hybrid approach.

They propose a fixed-price contract with an incentive clause for cost savings. If the contractor can complete the project within budget, they will receive a bonus. However, if costs exceed the agreed-upon price, the contractor will absorb the difference. This approach allows the government to maintain cost certainty while incentivizing the contractor to manage costs effectively.In this scenario, the contractor successfully negotiated a favorable cost of money by understanding the government’s priorities and proposing a creative solution that addressed both parties’ concerns.

Impact of Cost of Money on Government Spending

The cost of money, often referred to as the interest rate, plays a significant role in shaping the overall cost of government contracts. It directly impacts the amount of money the government spends on various projects and programs. Understanding this relationship is crucial for policymakers and stakeholders to effectively manage government finances.

Impact of Cost of Money on Government Spending

The cost of money influences government spending in several ways:

- Increased Contract Costs: When interest rates rise, the cost of borrowing money increases. This translates into higher interest payments for government contracts, leading to a higher overall cost for the project. For example, if the government borrows money to finance a large infrastructure project, a higher interest rate will result in greater interest payments over the life of the loan, increasing the total cost of the project.

- Reduced Investment: Higher interest rates can discourage government investment in projects with long-term payoffs. This is because the higher cost of borrowing makes such projects less financially attractive. For instance, if the government is considering investing in a research and development project with a long-term return on investment, a high interest rate might make the project less appealing due to the increased cost of financing.

- Impact on Government Debt: As interest rates rise, the interest payments on government debt also increase. This can lead to a larger budget deficit and put pressure on government finances. For example, if the government has a significant amount of outstanding debt, a rise in interest rates can significantly increase the annual interest payments, requiring the government to allocate more funds to debt servicing and potentially reducing funds available for other programs.

Comparison of Cost of Money Scenarios

Different cost of money scenarios have distinct impacts on government spending:

- Low Interest Rates: In a low-interest rate environment, government borrowing is relatively inexpensive. This can encourage increased government spending on infrastructure projects, research and development, and other programs. The lower cost of borrowing allows the government to allocate more funds to these projects while keeping overall spending manageable.

- High Interest Rates: Conversely, high interest rates make government borrowing more expensive. This can lead to a reduction in government spending, as the increased cost of borrowing makes projects less financially viable. The government might prioritize essential services and reduce spending on discretionary programs to manage the higher debt burden.

Visual Representation of the Relationship

A simple graph can illustrate the relationship between the cost of money and government spending.[ Visual Representation: A graph with “Interest Rate” on the X-axis and “Government Spending” on the Y-axis. The graph should show a general trend of increased government spending as interest rates decrease and decreased government spending as interest rates increase. The graph should be labeled and have a clear title.]

In a nutshell, the cost of money is a big deal in government contracts. It can make or break your project. So, you gotta be smart about how you manage your finances, understand the risks, and negotiate a good deal. Don’t forget to factor in the cost of money when you’re bidding on a contract. It’s not just about the price tag, but also about the real cost of getting that money.

General Inquiries: What Is Cost Of Money In Government Contracts

What are some common risk factors that affect the cost of money in government contracts?

Some common risk factors include the length of the project, how complex the project is, and how the government will pay you. The longer the project takes, the more likely it is that interest rates will change or inflation will go up, which can affect the cost of money.

How can I negotiate a favorable cost of money in a government contract?

You can negotiate a favorable cost of money by doing your research, understanding the market, and being willing to walk away if the deal isn’t good enough. You can also try to get the government to pay you sooner rather than later, which can help you avoid paying a lot of interest.