What is an option fee in a real estate contract? It’s a powerful tool that can be a game-changer in real estate transactions, offering both buyers and sellers a unique opportunity to secure their interests. It’s like a handshake, a commitment, a way to say, “I’m serious about this deal, and I want to make sure it happens.” This fee, essentially a deposit, grants a buyer the exclusive right to purchase a property for a set period, giving them time to conduct due diligence, secure financing, or simply wait for the right moment to make the final move.

But, like any financial maneuver, it comes with its own set of rules, benefits, and potential pitfalls. Let’s delve deeper into the world of option fees and understand how they can work for you.

In essence, an option fee is a sum of money paid by a potential buyer to a seller, giving the buyer the right, but not the obligation, to purchase a property at a predetermined price within a specific timeframe. It’s a strategic move that can be beneficial for both parties involved, but it’s crucial to understand the nuances and potential risks before committing.

What is an Option Fee?

An option fee, also known as an option money or earnest money, is a non-refundable payment made by a potential buyer to a seller in a real estate transaction. It is a fee paid to secure the right to purchase a property within a specified time frame. This right is called an option, and it gives the buyer the exclusive opportunity to buy the property without any obligation.

The option fee is distinct from the earnest money deposit, which is a refundable payment made to show the buyer’s good faith intention to purchase a property.

Purpose of an Option Fee

An option fee serves several purposes in a real estate transaction:

- Securing the Right to Purchase: The option fee grants the buyer the exclusive right to purchase the property within the agreed-upon timeframe, preventing the seller from selling the property to another buyer during that period. This is crucial for buyers who need time to conduct due diligence, obtain financing, or finalize their plans before making a final purchase decision.

- Compensation for the Seller: The option fee compensates the seller for taking the property off the market and for the opportunity cost associated with not selling to another buyer. It also incentivizes the seller to hold the property for the buyer, even if a higher offer is received from another potential buyer.

- Demonstrating Serious Interest: The payment of an option fee demonstrates the buyer’s serious interest in purchasing the property and their commitment to the transaction. It signifies that the buyer is willing to invest a sum of money to secure the right to purchase the property, even if they ultimately decide not to buy.

Scenarios Where an Option Fee is Used

Option fees are commonly used in various real estate scenarios:

- Property Development: Developers may use option fees to secure land for future development projects. This allows them to acquire the property without immediate purchase, providing time to obtain permits, financing, and finalize plans before proceeding with the development.

- Property Flipping: Investors who engage in property flipping often use option fees to secure distressed properties at a lower price. They can then renovate the property and resell it at a profit, utilizing the option period to complete the renovations and secure a buyer.

- Commercial Real Estate: Option fees are common in commercial real estate transactions, particularly when large, complex deals are involved. This allows buyers to conduct thorough due diligence, negotiate leases, and secure financing before committing to the purchase.

How Option Fees Work

An option fee is a payment made by a potential buyer to a seller in exchange for the right to purchase a property within a specific timeframe. This fee is not refundable, and it essentially secures the property for the buyer, giving them time to make a decision without the pressure of a looming deadline.

The Process of Paying an Option Fee

The option fee is typically paid at the time the option agreement is signed. This agreement Artikels the terms of the option, including the purchase price, the duration of the option period, and the amount of the option fee. It’s essential to have a clear understanding of these terms before signing the agreement.

The Structure of an Option Fee

- Amount: The amount of the option fee can vary depending on the value of the property and the length of the option period. It is generally a small percentage of the purchase price, often ranging from 1% to 5%.

- Duration: The option period can range from a few weeks to several months, depending on the buyer’s needs and the seller’s willingness to wait.

Legal Implications of an Option Fee

An option fee creates a legally binding contract between the buyer and seller. This means that the buyer is obligated to purchase the property if they exercise their option, while the seller is obligated to sell the property to the buyer if they exercise their option.

Important Note: If the buyer chooses not to exercise their option, they forfeit the option fee. The seller can then sell the property to another buyer.

Benefits of Using an Option Fee

An option fee in a real estate contract offers distinct advantages for both the buyer and the seller. It provides a period of exclusivity for the buyer while allowing the seller to continue marketing the property to other potential buyers. This structure helps ensure a smoother and more secure transaction for both parties.

Advantages for the Buyer, What is an option fee in a real estate contract

The option fee provides the buyer with a valuable window of opportunity to secure the property while completing due diligence, obtaining financing, or making other necessary preparations. Here are some key benefits:

- Time to Secure Financing: The option period allows the buyer to secure financing without the pressure of a rapidly approaching closing date. This is especially crucial in situations where the buyer requires a mortgage or other forms of financing.

- Due Diligence: The option period provides time for the buyer to conduct thorough due diligence on the property. This includes inspections, appraisals, and title searches, ensuring they have a complete understanding of the property’s condition and legal status.

- Negotiation Flexibility: The option fee provides the buyer with leverage in negotiations. They can secure the property while continuing to refine the terms of the purchase agreement, including price, closing date, and other contingencies.

- Market Uncertainty: In a volatile real estate market, an option fee can help the buyer secure a property while waiting for market conditions to stabilize. This can be particularly beneficial if the buyer anticipates a potential price increase or desires to avoid the risk of losing the property to another buyer.

Advantages for the Seller

Accepting an option fee provides the seller with a guaranteed income stream and the potential for a higher sale price. It also helps them avoid the uncertainty of waiting for a buyer who may not be able to close on time.

- Guaranteed Income: The option fee provides the seller with a guaranteed income stream during the option period. This can be a significant advantage, especially if the seller needs immediate funds or is facing financial constraints.

- Market Exposure: The seller can continue to market the property to other potential buyers during the option period. This increases the likelihood of receiving a higher offer, potentially leading to a more favorable sale price.

- Reduced Risk: The option fee reduces the seller’s risk of losing the sale due to the buyer’s inability to close on time. The buyer is financially incentivized to complete the transaction, as they risk losing their option fee if they fail to do so.

- Control Over Timing: The seller retains control over the timing of the closing. They can choose to extend the option period or terminate it if the buyer fails to meet the terms of the agreement. This gives them flexibility in managing the sale process.

Risks and Considerations

While option fees offer potential benefits, it’s crucial to understand the associated risks for both buyers and sellers. Carefully considering these risks can help you make informed decisions about whether an option fee is suitable for your real estate transaction.

Risks for Buyers

Option fees can be a valuable tool for buyers, but they also carry certain risks. It’s essential to understand these potential downsides before committing to an option fee agreement.

- Loss of Option Fee: If you decide not to proceed with the purchase after securing the option, you will lose the option fee. This fee is non-refundable, regardless of the reason for your decision.

- Unforeseen Circumstances: Even if you initially feel confident about purchasing the property, unforeseen circumstances could arise that make the purchase undesirable. For example, changes in your financial situation, job loss, or unexpected repairs could influence your decision.

- Market Fluctuations: The market value of the property could decline during the option period. If the property’s value drops significantly, you may be stuck with a purchase agreement that is no longer financially advantageous.

- Seller’s Default: There is a risk that the seller might default on the agreement, making it impossible to complete the purchase. In such cases, you may lose your option fee and the potential to acquire the property.

Risks for Sellers

While option fees can help sellers secure a potential buyer and generate income, they also come with potential risks.

- Loss of Potential Buyers: By granting an option, you may be excluding other potential buyers from making offers during the option period. If the option holder decides not to purchase, you may need to start the marketing process again, potentially delaying the sale.

- Binding Agreement: The option agreement creates a binding obligation for you to sell the property to the option holder if they exercise their option. This can limit your flexibility if you receive a better offer during the option period.

- Low Option Fee: A low option fee may not be sufficient to compensate you for the opportunity cost of tying up your property for the option period.

- Buyer’s Default: The buyer may default on the agreement, leaving you with a property that is difficult to sell.

Situations Where Option Fees May Not Be Beneficial

- Uncertain Market Conditions: If the real estate market is volatile or uncertain, it may be unwise to tie up your property with an option agreement. Market fluctuations could make the property less attractive to the option holder, or you might miss out on potential buyers during the option period.

- High Demand: If your property is in high demand and you receive multiple offers, an option fee might not be necessary. You can likely secure a buyer without granting an option.

- Short Option Period: A short option period may not provide enough time for the buyer to secure financing, conduct inspections, or make a fully informed decision. This can lead to uncertainty and potential complications.

Option Fees in Different Real Estate Transactions: What Is An Option Fee In A Real Estate Contract

Option fees are commonly used in various real estate transactions, each with its own nuances and considerations. Understanding how option fees function in different contexts is crucial for making informed decisions.

Residential Real Estate

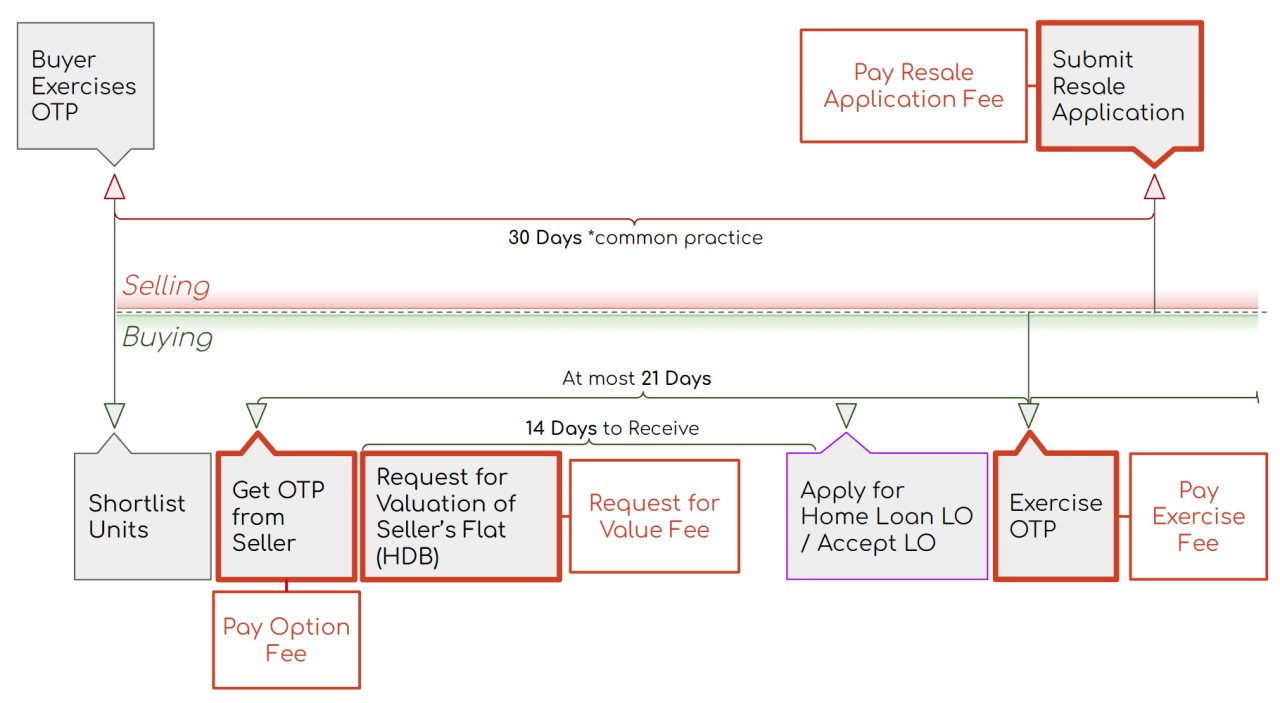

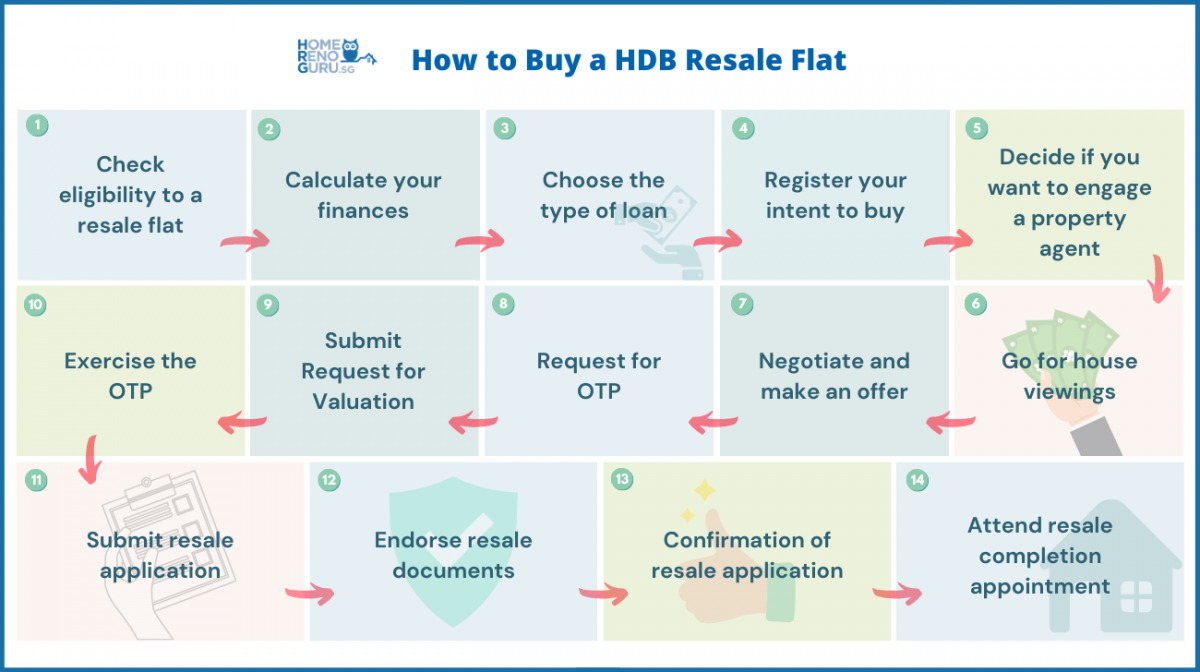

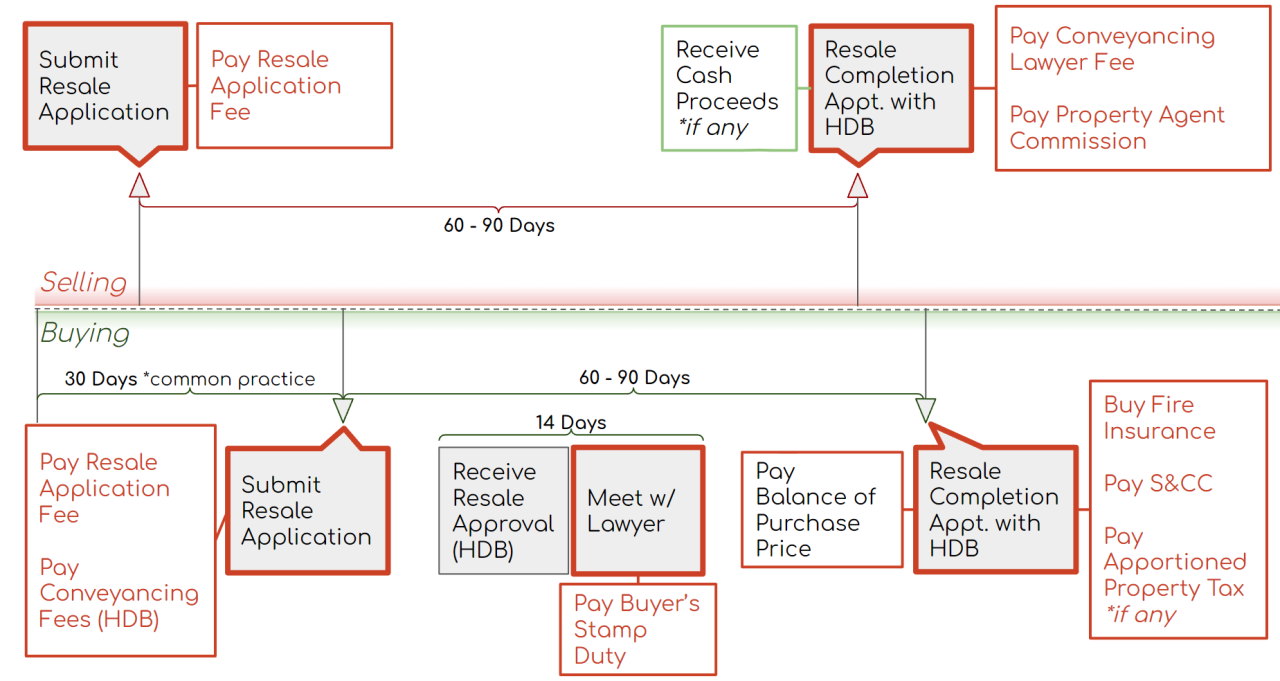

Option fees are frequently used in residential real estate, particularly when a buyer needs more time to secure financing, sell their existing property, or conduct due diligence. In these situations, the buyer pays an option fee to the seller to secure the right to purchase the property within a specific timeframe.

- Option Period: The option period allows the buyer to explore financing options, conduct inspections, and finalize their decision without the pressure of a strict closing deadline. This can be particularly helpful in a competitive market or when dealing with complex financing arrangements.

- Option Fee Amount: The option fee amount in residential real estate is usually a percentage of the purchase price, typically ranging from 1% to 3%. It is non-refundable if the buyer decides not to proceed with the purchase.

- Example: A buyer wants to purchase a $500,000 home but needs time to sell their current property. They negotiate an option period of 60 days with a 2% option fee. This means the buyer pays $10,000 to the seller to secure the right to purchase the property within the next 60 days. If the buyer decides not to purchase, the $10,000 is forfeited.

Commercial Real Estate

Option fees are also common in commercial real estate transactions, but the dynamics can differ significantly from residential deals. The option fee amount, period, and terms are typically negotiated based on the specific circumstances of the transaction.

- Higher Option Fees: In commercial real estate, option fees tend to be higher than in residential transactions, often ranging from 3% to 5% or more of the purchase price. This reflects the greater complexity and larger sums involved in commercial deals.

- Negotiated Terms: The option period and other terms are often subject to extensive negotiation, reflecting the specific needs and objectives of both the buyer and seller.

- Example: A developer wants to purchase a commercial property for $10 million but needs time to secure financing and obtain necessary permits. They negotiate an option period of 12 months with a 5% option fee, totaling $500,000. This allows the developer to pursue their plans without losing the opportunity to acquire the property.

Land Acquisition

Option fees are particularly prevalent in land acquisition transactions. Landowners may use option agreements to secure a future sale of their property, while buyers can use them to lock in the purchase price and secure the land for future development.

- Long-Term Options: Land acquisition options often have longer periods than those used in residential or commercial transactions, sometimes lasting several years. This allows buyers to plan for future development and secure the land at a predetermined price.

- Potential for Development: Option fees in land acquisition are often contingent on the buyer obtaining necessary permits, zoning approvals, or financing for the proposed development. This protects the landowner from holding the property for an extended period without a guaranteed sale.

- Example: A developer wants to acquire a 100-acre parcel of land for a future residential development. They negotiate an option period of five years with a 2% option fee, totaling $200,000. This gives the developer time to secure financing, obtain necessary permits, and finalize their plans for the development. If the developer fails to obtain the necessary approvals or financing within the five-year period, the option fee is forfeited, and the landowner can sell the property to another buyer.

Navigating the world of real estate transactions can be complex, and option fees are no exception. They offer a unique blend of opportunity and risk, requiring careful consideration and a thorough understanding of the legal implications. Whether you’re a buyer looking to secure a promising property or a seller aiming to attract serious offers, consulting with legal counsel is always recommended.

With careful planning and expert guidance, option fees can be a valuable tool in achieving your real estate goals.

Clarifying Questions

What happens to the option fee if the buyer decides not to purchase the property?

In most cases, the option fee is non-refundable. This means the buyer loses the fee if they choose not to proceed with the purchase. However, specific circumstances might allow for a partial refund, so it’s essential to review the contract terms carefully.

Can an option fee be used for both residential and commercial properties?

Yes, option fees can be utilized for both residential and commercial real estate transactions. However, the specific terms and conditions might vary depending on the type of property and the local market.

What are the tax implications of an option fee?

The tax implications of an option fee can vary depending on the specific circumstances and jurisdiction. It’s advisable to consult with a tax professional to understand the tax treatment of option fees in your situation.