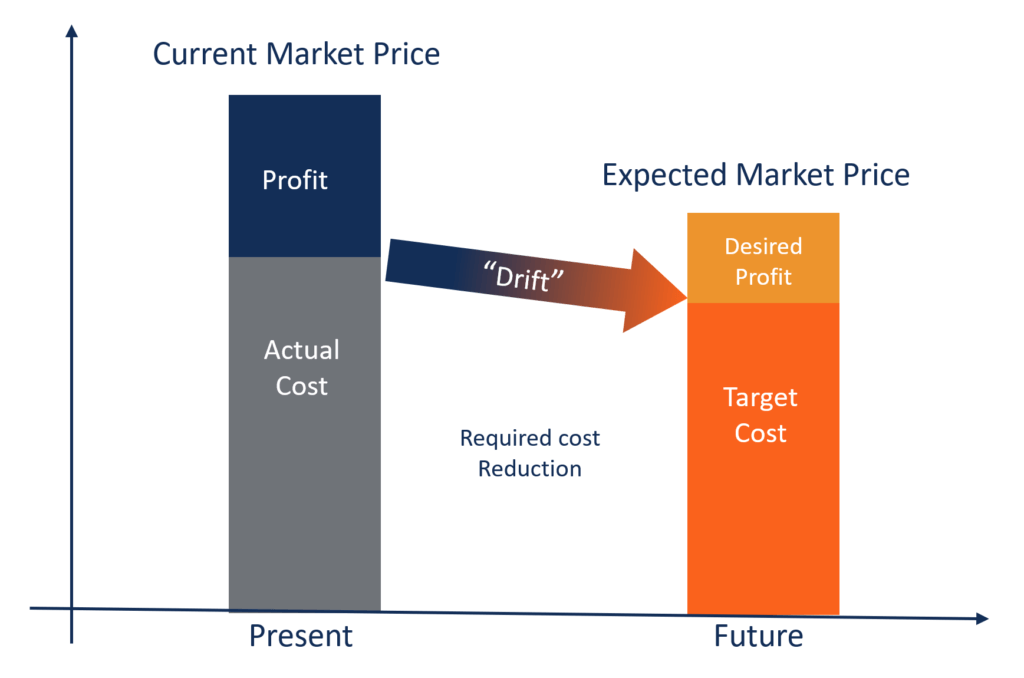

What is target cost contract – What is a target cost contract? It’s a unique type of agreement that sets a target for the total cost of a project, offering both the buyer and seller a chance to share in the benefits of cost savings or bear the burden of cost overruns. Unlike fixed-price contracts, which lock in a set price regardless of actual costs, target cost contracts provide a framework for collaboration and incentivize both parties to work together to achieve cost efficiency.

This approach can lead to greater innovation and a shared sense of ownership in the project’s success.

Imagine a scenario where a construction company is building a new office complex. Instead of simply agreeing on a fixed price, the company and the client might agree on a target cost for the project. If the construction company manages to complete the project under budget, both parties share in the savings. Conversely, if costs exceed the target, both parties share in the overruns.

This shared risk and reward system encourages the construction company to find ways to optimize costs and the client to be more involved in the decision-making process.

Definition of Target Cost Contract

A target cost contract is a type of agreement where the buyer and seller agree on a target cost for a project or product. The seller is then reimbursed for the actual costs incurred, up to the target cost, plus a predetermined profit margin. This type of contract aims to incentivize the seller to control costs and achieve efficiency while ensuring a fair return on investment for the buyer.

Key Elements of a Target Cost Contract

The key elements of a target cost contract are:

- Target Cost: This is the estimated cost of completing the project or producing the product. It is based on the seller’s best estimate of the resources needed and the prevailing market prices.

- Target Profit: This is the profit margin that the seller is expected to earn on the project. It is typically negotiated upfront and is based on the seller’s expertise, risk involved, and market conditions.

- Price Ceiling: This is the maximum price that the buyer is willing to pay for the project. It acts as a safeguard against cost overruns and provides a clear limit on the seller’s potential profit.

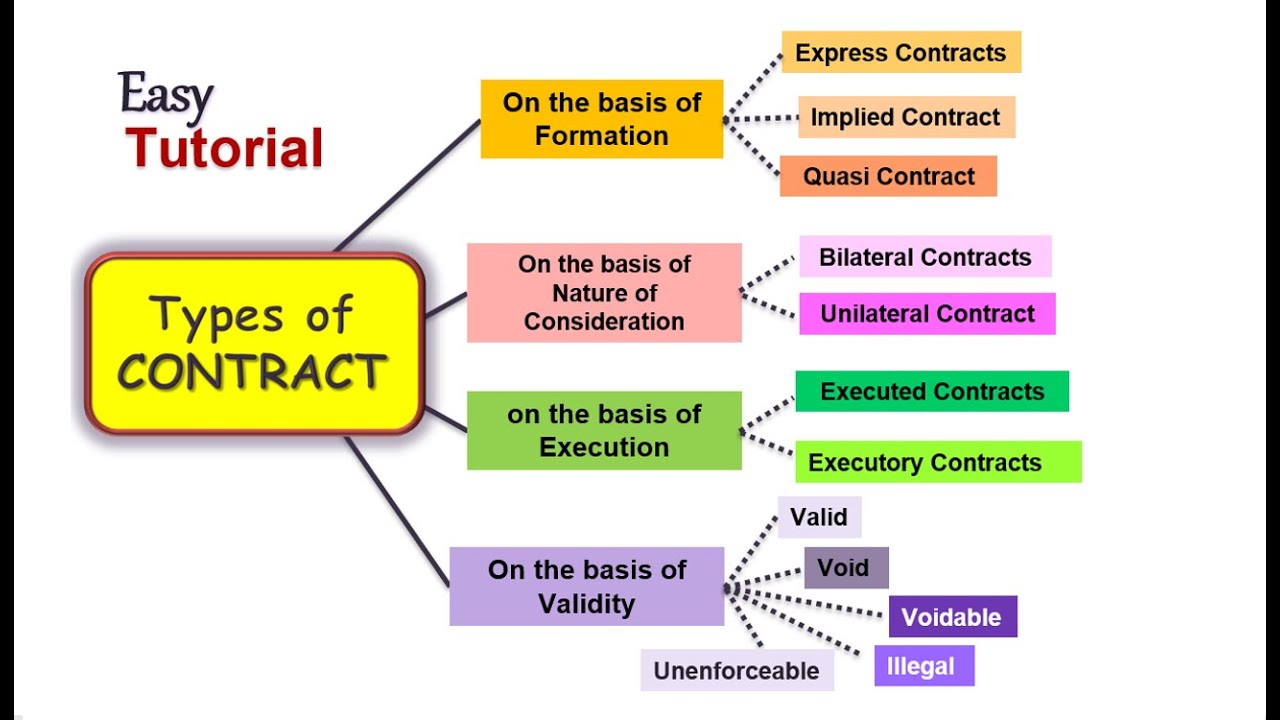

Comparison with Other Contract Types

- Fixed-Price Contract: In a fixed-price contract, the seller agrees to deliver the project or product for a predetermined price, regardless of the actual costs incurred. This type of contract provides certainty for the buyer but can incentivize the seller to cut corners or compromise quality to maximize profit.

- Cost-Plus Contract: In a cost-plus contract, the buyer reimburses the seller for all actual costs incurred, plus a predetermined fee. This type of contract provides flexibility for the seller but can lead to cost overruns and a lack of cost control. The buyer bears the risk of cost increases.

A target cost contract is a hybrid of a fixed-price contract and a cost-plus contract. It offers the buyer a degree of cost certainty while still incentivizing the seller to control costs and achieve efficiency.

How Target Cost Contracts Work

Target cost contracts, also known as “cost-plus incentive fee” contracts, operate on the principle of shared risk and reward between the buyer and the seller. The contract Artikels a target cost for the project, and both parties agree to share any cost overruns or savings generated. This collaborative approach encourages efficient project execution and fosters a strong partnership between the buyer and the seller.

Negotiating a Target Cost Contract

Negotiating a target cost contract requires careful consideration of various factors. Both parties must agree on a target cost that reflects a realistic estimate of the project’s actual cost. This target cost serves as the baseline for calculating any potential cost overruns or savings.

- The negotiation process typically involves a detailed discussion of the project scope, specifications, and potential risks. The buyer and seller must agree on a clear understanding of the project requirements and the responsibilities of each party.

- The parties must also determine the sharing ratio for cost overruns and savings. This ratio reflects the level of risk each party is willing to assume. For example, a 50/50 sharing ratio indicates that both the buyer and seller will share equally in any cost overruns or savings.

- In addition to the sharing ratio, the contract should also define the maximum and minimum fees that the seller can earn. This ensures that the seller is appropriately compensated for their efforts while also limiting their potential profits.

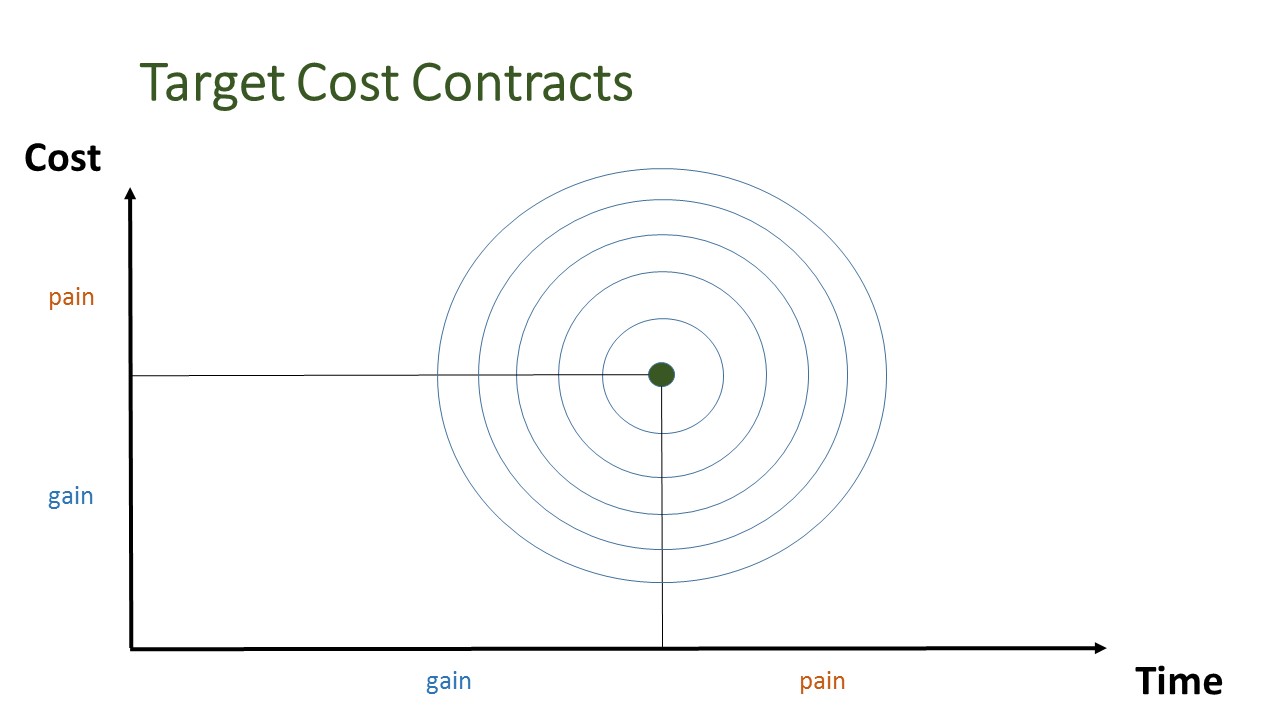

Cost Sharing and Risk Allocation

The foundation of target cost contracts lies in the principle of shared risk and reward. This means that both the buyer and the seller share in the financial consequences of cost overruns or savings.

The cost-sharing arrangement incentivizes the seller to control costs and improve efficiency, as they directly benefit from cost savings.

- Cost overruns are typically shared according to the agreed-upon sharing ratio. For instance, if the sharing ratio is 70/30, the seller would bear 70% of any cost overruns, while the buyer would bear the remaining 30%.

- Similarly, cost savings are also shared based on the agreed-upon ratio. If the project is completed below the target cost, the seller receives a portion of the savings as an incentive. This encourages the seller to identify and implement cost-saving measures.

Incentivizing Cost Control and Efficiency

Target cost contracts inherently motivate the seller to prioritize cost control and efficiency. By sharing in any cost savings, the seller is directly incentivized to minimize project expenses.

- The seller is encouraged to adopt innovative approaches, explore cost-effective solutions, and implement efficient project management practices. This focus on cost control ultimately benefits both the buyer and the seller.

- The shared risk and reward structure fosters a collaborative environment where both parties work together to achieve project success. This collaborative approach can lead to improved communication, increased transparency, and a stronger partnership between the buyer and the seller.

Advantages of Target Cost Contracts

Target cost contracts offer several advantages for both the buyer and the seller, fostering a collaborative environment that encourages innovation and cost optimization. This type of contract promotes transparency and mutual understanding, leading to a win-win situation for all parties involved.

Benefits for the Buyer

Target cost contracts provide a clear framework for the buyer to control costs and ensure that the project is completed within a reasonable budget. They offer several benefits for the buyer:

- Cost Certainty: Target cost contracts provide the buyer with a clear understanding of the expected project cost, reducing the risk of unexpected cost overruns. The buyer knows the maximum price they will pay, offering greater financial predictability and stability.

- Incentive for Cost Reduction: The target cost contract motivates the seller to find cost-effective solutions and innovative ways to complete the project. The seller is rewarded for identifying and implementing cost-saving measures, resulting in potential cost savings for the buyer.

- Increased Collaboration: The shared risk and reward structure of target cost contracts encourages collaboration and open communication between the buyer and seller. Both parties are incentivized to work together to achieve the project goals efficiently and cost-effectively. This fosters a more cooperative and trusting relationship, leading to improved project outcomes.

Benefits for the Seller

Target cost contracts provide the seller with a fair opportunity to earn a profit while also incentivizing them to optimize costs and deliver high-quality work. They offer several benefits for the seller:

- Potential for Increased Profitability: By exceeding expectations and delivering cost savings, the seller can earn a higher profit than they would with a fixed-price contract. This motivates the seller to actively seek cost-effective solutions and innovative approaches.

- Reduced Risk: The shared risk structure of target cost contracts reduces the financial risk for the seller, as they are not solely responsible for any cost overruns. This allows the seller to focus on delivering quality work without the pressure of managing potential financial losses.

- Improved Project Management: The collaborative nature of target cost contracts encourages the seller to be more involved in the project planning and execution. This allows for better communication and coordination, leading to improved project management and overall efficiency.

Impact on Innovation and Cost Reduction

Target cost contracts create an environment that encourages innovation and cost reduction by aligning the interests of both the buyer and the seller. This collaborative approach fosters creativity and efficiency, leading to innovative solutions and cost-effective practices:

“Target cost contracts incentivize sellers to propose innovative solutions and cost-saving measures, resulting in potential cost reductions for the buyer. The shared risk and reward structure encourages both parties to work together to achieve the project goals efficiently and cost-effectively.”

The shared risk and reward structure motivates both parties to explore innovative solutions and implement cost-saving measures, resulting in a more efficient and cost-effective project outcome. This approach encourages a proactive and collaborative mindset, leading to better project management, increased efficiency, and ultimately, a more successful project.

Disadvantages of Target Cost Contracts: What Is Target Cost Contract

Target cost contracts, while offering potential benefits, also present certain drawbacks that require careful consideration. These disadvantages primarily stem from the complexities involved in accurately estimating target costs, managing cost performance, and the potential for disputes arising from cost overruns.

Challenges in Estimating Target Costs

Accurately estimating the target cost is crucial for the success of a target cost contract. However, achieving this accuracy can be challenging due to the inherent uncertainties associated with project scope, technological advancements, and market fluctuations.

- Unforeseen Circumstances: Projects often encounter unforeseen circumstances, such as changes in regulatory requirements, material shortages, or unexpected site conditions. These factors can significantly impact the estimated target cost, leading to potential cost overruns.

- Technological Advancements: Rapid technological advancements can make it difficult to accurately predict the cost of new technologies or materials. For example, the cost of solar panels has significantly decreased over the past decade, making it difficult to estimate the target cost of a solar energy project with accuracy.

- Market Fluctuations: Fluctuations in market prices for labor, materials, and other resources can affect the target cost. For instance, a sudden increase in the price of steel could significantly impact the estimated target cost of a construction project.

Managing and Monitoring Cost Performance, What is target cost contract

Managing and monitoring cost performance under a target cost contract requires rigorous processes and effective communication between the parties involved.

- Complex Cost Tracking: Tracking and analyzing costs under a target cost contract can be complex, requiring detailed records and frequent reviews. This process can be time-consuming and resource-intensive, especially for large-scale projects.

- Potential for Disputes: Disputes can arise if there is a disagreement between the parties regarding the interpretation of cost elements or the allocation of costs. This can lead to delays and increased costs, undermining the benefits of the target cost contract.

- Incentive Alignment: While the target cost contract aims to align incentives between the parties, there can be a risk of misalignment if the contractor is overly focused on maximizing profits or minimizing costs without considering the overall project objectives.

Applications of Target Cost Contracts

Target cost contracts find their niche in projects where a strong emphasis is placed on cost control and collaboration between the buyer and the contractor. This type of contract encourages innovation and efficiency, leading to mutually beneficial outcomes.

Industries and Projects Where Target Cost Contracts Are Commonly Used

Target cost contracts are frequently employed in various industries and project types where cost control and collaboration are paramount.

- Construction: Large-scale construction projects, such as infrastructure development, commercial buildings, and industrial facilities, often utilize target cost contracts. This is because these projects typically involve complex designs, fluctuating material costs, and tight deadlines. The collaborative nature of target cost contracts allows for adjustments based on changing circumstances and fosters open communication between the contractor and the owner.

- Aerospace and Defense: The aerospace and defense industries rely heavily on target cost contracts for the development and production of complex aircraft, missiles, and other military equipment. The high-value nature of these projects, combined with the need for stringent quality standards and performance requirements, makes target cost contracts a suitable choice. These contracts allow for flexibility in design and manufacturing processes while maintaining a focus on cost-effectiveness.

- Technology and Research & Development: Target cost contracts are commonly used in technology and research & development projects where the final product or outcome is uncertain. This is because these projects often involve a high degree of innovation and require a close partnership between the buyer and the contractor. Target cost contracts enable both parties to share the risks and rewards associated with the project, fostering a collaborative environment for innovation and cost optimization.

- Information Technology: In the IT sector, target cost contracts are frequently employed for software development, system integration, and large-scale IT infrastructure projects. The complexity and evolving nature of these projects make target cost contracts a viable option. The contract structure allows for adjustments to scope and requirements based on changing technology and market dynamics, while maintaining a focus on delivering value within a predetermined cost framework.

Scenarios Where Target Cost Contracts Are Particularly Beneficial

Target cost contracts are particularly beneficial in specific scenarios where traditional fixed-price or cost-plus contracts may not be suitable.

- Projects with Uncertain Scope or Requirements: When the project scope or requirements are not fully defined at the outset, target cost contracts offer flexibility and allow for adjustments based on changing needs. This is crucial for projects involving research and development, where the final outcome may be uncertain.

- Projects with a High Degree of Innovation: Target cost contracts are well-suited for projects involving significant innovation or technological advancements. The contract structure allows for both parties to share the risks and rewards associated with the project, encouraging creativity and innovation. This is particularly relevant in industries like aerospace, technology, and pharmaceuticals, where innovation is paramount.

- Projects with a Strong Emphasis on Collaboration: Target cost contracts foster a collaborative environment between the buyer and the contractor. This is essential for projects where open communication, shared risk, and mutual trust are crucial for success. The collaborative nature of target cost contracts allows for better communication, faster decision-making, and a shared focus on achieving project goals.

- Projects with a Long Duration: Target cost contracts are well-suited for projects with a long duration, such as infrastructure development or large-scale construction projects. These contracts provide flexibility in responding to changing market conditions and material costs, while maintaining a focus on cost control and project completion within a reasonable timeframe.

Suitability of Target Cost Contracts for Different Types of Projects

| Project Type | Suitability for Target Cost Contract | Reasoning |

|---|---|---|

| Large-scale construction projects (e.g., bridges, airports, skyscrapers) | High | Complex designs, fluctuating material costs, and long durations make target cost contracts suitable for managing risks and fostering collaboration. |

| Research and development projects (e.g., new drug development, software innovation) | High | Uncertain scope, high innovation, and shared risk-reward dynamics make target cost contracts beneficial for fostering collaboration and managing uncertainties. |

| Aerospace and defense projects (e.g., aircraft development, missile systems) | High | Complex designs, stringent quality standards, and high-value projects necessitate a collaborative approach and cost control, making target cost contracts an ideal choice. |

| Information technology projects (e.g., software development, system integration) | Moderate | Evolving technology and changing requirements can be accommodated by target cost contracts, but clear scope definition and risk management are crucial. |

| Small-scale construction projects (e.g., residential homes, small commercial buildings) | Low | The relatively simple scope and lower risk associated with small-scale projects may make fixed-price contracts a more suitable option. |

Key Considerations for Target Cost Contracts

Target cost contracts, while offering potential benefits for both parties, require careful consideration before implementation. Understanding the nuances and potential challenges associated with this contract type is crucial for successful project execution.

Factors to Consider When Using a Target Cost Contract

Choosing a target cost contract involves evaluating various factors to determine if it aligns with the project’s objectives and the parties’ risk tolerance.

- Project Complexity: Target cost contracts are best suited for projects with well-defined specifications and a clear understanding of the scope of work. Complex projects with uncertain requirements or potential for significant changes might be better handled with other contract types.

- Risk Tolerance: Both the buyer and the seller need to assess their risk tolerance. Target cost contracts place a higher degree of risk on the seller, as they are responsible for managing costs within the target range. Buyers must be comfortable with the potential for cost overruns if the project experiences unforeseen challenges.

- Relationship and Trust: Establishing a strong relationship of trust and open communication between the buyer and seller is essential. This fosters a collaborative environment where both parties are committed to achieving the project’s goals efficiently and within budget.

- Project Management Capabilities: The seller must possess robust project management capabilities to effectively manage costs and deliver the project within the target range. This includes efficient planning, resource allocation, and risk mitigation strategies.

- Cost Estimation Accuracy: Accurate cost estimation is critical for target cost contracts. Both parties need to collaborate closely to develop a realistic target cost based on thorough analysis and historical data.

- Incentive Alignment: The contract should clearly define the incentives for both parties. The seller should be motivated to control costs and deliver high-quality work, while the buyer should be incentivized to provide support and collaboration.

- Dispute Resolution Mechanisms: Establishing clear and efficient dispute resolution mechanisms is crucial. This helps address any disagreements regarding costs, performance, or contract interpretation.

Best Practices for Developing and Managing Target Cost Contracts

Effective development and management of target cost contracts involve implementing best practices to ensure project success and mutual satisfaction.

- Clearly Define the Scope of Work: A comprehensive and unambiguous scope of work document is crucial. It should Artikel the project deliverables, milestones, and performance criteria.

- Establish a Target Cost and Fee Structure: Develop a realistic target cost based on detailed cost estimations and historical data. Define a fair and transparent fee structure that incentivizes cost control and efficiency.

- Implement Cost Control Mechanisms: Establish robust cost control mechanisms, such as regular cost reviews, variance analysis, and change management processes. This ensures that costs remain within the target range.

- Foster Open Communication and Collaboration: Encourage open communication and collaboration between the buyer and seller. Regular meetings, progress reports, and shared decision-making foster transparency and mutual understanding.

- Implement a Performance Measurement System: Develop a comprehensive performance measurement system to track progress, identify potential issues, and evaluate the effectiveness of cost control measures.

- Ensure Contract Compliance: Regularly review the contract to ensure compliance with all terms and conditions. This includes monitoring cost variances, reviewing change requests, and addressing any disputes promptly.

Importance of Clear Communication, Transparency, and Trust

Effective communication, transparency, and trust are essential for successful target cost contracts. These elements contribute to a collaborative environment that fosters mutual understanding, efficient problem-solving, and project success.

- Clear Communication: Regular and open communication between the buyer and seller is crucial. This ensures that both parties are aware of project progress, potential issues, and any changes in scope or requirements.

- Transparency: Both parties must be transparent in their actions and decision-making. This includes sharing cost information, project updates, and any potential risks or challenges.

- Trust: Building a strong foundation of trust is essential for a successful target cost contract. This involves demonstrating integrity, respecting commitments, and being responsive to each other’s concerns.

In essence, target cost contracts represent a shift from a purely transactional approach to a collaborative partnership. They foster transparency, communication, and a shared commitment to achieving project goals. While there are potential challenges, such as accurately estimating costs and managing potential overruns, the benefits of increased efficiency, innovation, and shared success can outweigh the risks for both parties. As we delve deeper into the intricacies of target cost contracts, we’ll explore the specific applications, advantages, and considerations that make this type of agreement a valuable tool for various projects and industries.

FAQ Explained

How are target cost contracts different from cost-plus contracts?

While both involve sharing costs, target cost contracts have a defined target cost and profit, while cost-plus contracts reimburse actual costs plus a fixed percentage for profit. This difference creates a stronger incentive for cost control in target cost contracts.

What are some common industries that use target cost contracts?

Target cost contracts are prevalent in industries like construction, aerospace, defense, and research and development, where complex projects require significant collaboration and cost optimization.

How can I ensure a successful target cost contract?

Clear communication, transparent cost tracking, and regular performance reviews are essential for success. It’s also crucial to establish a strong working relationship based on trust and collaboration.