What were cost-plus contracts? They represent a unique and often misunderstood agreement type where the contractor is compensated for their actual expenses plus an agreed-upon markup or fee. Unlike fixed-price contracts, where the total cost is predetermined, cost-plus contracts shift the risk of cost overruns to the client. This approach offers both advantages and disadvantages, making it particularly relevant in scenarios where project scope or cost estimations are highly uncertain.

These contracts are commonly employed in industries like construction, defense, and research, where the complexity of the project necessitates a flexible approach to cost management. Understanding the intricacies of cost-plus contracts is crucial for both contractors and clients to ensure transparency, fair compensation, and successful project completion.

Definition of Cost-Plus Contracts

Cost-plus contracts, also known as cost-reimbursement contracts, are a type of agreement where the buyer reimburses the seller for all allowable costs incurred in the performance of a project or service, plus a predetermined fee or profit margin. This fee is typically calculated as a percentage of the total cost or as a fixed amount.The core principle of cost-plus contracts lies in the shared risk and reward between the buyer and seller.

The buyer assumes the risk of cost overruns, while the seller benefits from the potential for increased profits based on efficient cost management.

Fundamental Differences from Fixed-Price Contracts

Cost-plus contracts differ significantly from fixed-price contracts. In a fixed-price contract, the seller agrees to deliver a specific product or service for a predetermined price, regardless of the actual costs incurred. The seller assumes the risk of cost overruns, while the buyer enjoys price certainty.

Types of Cost-Plus Contracts

Cost-plus contracts come in various forms, each with its own specific fee structure and risk allocation. Some common types include:

- Cost-Plus-Fixed-Fee (CPFF): In this type, the seller is reimbursed for all allowable costs incurred plus a fixed fee, which is predetermined and does not vary with the actual cost of the project. The seller has an incentive to control costs, but the buyer bears the risk of cost overruns.

- Cost-Plus-Incentive-Fee (CPIF): This type involves a fee that is adjusted based on the seller’s performance in relation to pre-established targets. The seller receives a higher fee if they achieve cost savings or meet performance goals, while the buyer benefits from cost reductions and improved performance. The risk and reward are shared between the parties.

- Cost-Plus-Percentage-of-Cost (CPPC): This type involves a fee calculated as a percentage of the total allowable costs incurred. The seller’s profit increases proportionally with the project’s cost, potentially incentivizing them to inflate costs. This type is generally considered less favorable than other cost-plus contract types due to the potential for cost escalation.

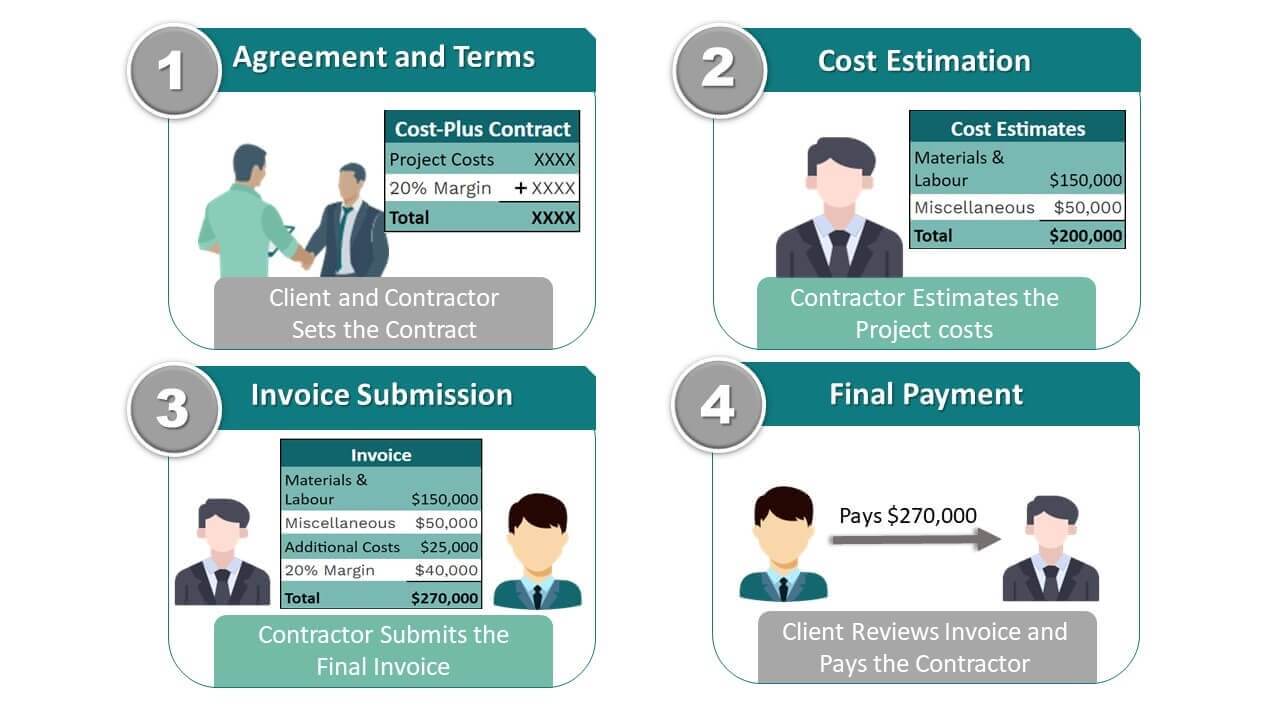

How Cost-Plus Contracts Work

Cost-plus contracts are a type of agreement where the contractor is reimbursed for all their actual costs incurred in completing a project, plus an agreed-upon profit margin. This method is often used when the scope of work is uncertain, or when the project involves complex or unique requirements.Cost-plus contracts are transparent and provide a clear understanding of the costs involved.

However, they can be more complex to manage than fixed-price contracts and may require careful monitoring to prevent cost overruns.

Cost Calculation Process

The cost calculation process in a cost-plus contract involves a detailed accounting of all expenses incurred by the contractor. This includes direct costs, such as materials, labor, and equipment, as well as indirect costs, such as overhead and administrative expenses. The process typically involves the following steps:

- Cost Tracking: The contractor meticulously tracks all costs associated with the project, including direct and indirect expenses.

- Cost Documentation: All cost documentation, such as invoices, receipts, and time sheets, is maintained and organized for verification purposes.

- Cost Reporting: Regular cost reports are submitted to the client, detailing the incurred costs and providing a breakdown of expenses.

- Cost Verification: The client or a designated representative may conduct cost audits to verify the accuracy of the reported costs.

- Cost Adjustment: If any discrepancies or errors are found during the audit, adjustments are made to the final cost calculation.

- Profit Margin Calculation: The agreed-upon profit margin is added to the verified total costs to determine the final contract price.

Cost Audits and Verification

Cost audits and verification are crucial aspects of cost-plus contracts. They ensure that the contractor is only reimbursed for legitimate expenses and that the client is protected from potential cost overruns.

- Independent Auditors: Independent auditors, such as certified public accountants, may be hired to conduct cost audits and verify the accuracy of the reported costs.

- Auditing Scope: The scope of the audit may vary depending on the complexity of the project and the contract terms. It may include a review of cost documentation, cost allocation, and cost control measures.

- Audit Findings: The audit findings are documented and shared with both the contractor and the client. Any discrepancies or errors are addressed and resolved through a collaborative process.

Contract Clauses

Cost-plus contracts typically include various clauses to protect both parties. These clauses may address:

- Cost Control Measures: The contract may specify cost control measures, such as budget limits, cost reporting requirements, and cost-saving initiatives.

- Cost Audit Provisions: The contract may Artikel the procedures for conducting cost audits, the frequency of audits, and the responsibilities of both parties.

- Profit Margin: The contract clearly defines the profit margin that the contractor is entitled to, which may be a fixed percentage or a predetermined formula.

- Change Orders: The contract may Artikel the process for handling change orders, which are modifications to the original scope of work.

- Dispute Resolution: The contract may specify a mechanism for resolving disputes, such as arbitration or mediation.

Advantages of Cost-Plus Contracts

Cost-plus contracts offer distinct advantages for both the contractor and the client, particularly in situations characterized by high uncertainty. These advantages stem from the inherent flexibility and transparency of this contract type, which allows for collaborative problem-solving and the potential for innovation.

Benefits for the Contractor

The cost-plus contract structure provides significant benefits for the contractor, particularly in projects with high uncertainty or complex requirements.

- Guaranteed Profit: Cost-plus contracts ensure a predetermined profit margin for the contractor, regardless of the actual project costs. This eliminates the risk of losing money due to unforeseen expenses or cost overruns, providing financial security for the contractor.

- Flexibility and Adaptability: Cost-plus contracts offer greater flexibility for the contractor to adapt to changing project requirements or unforeseen circumstances. This allows for adjustments in scope, materials, or design without jeopardizing the project’s profitability for the contractor.

- Reduced Risk: Cost-plus contracts shift the risk of cost overruns from the contractor to the client. This reduces the financial burden on the contractor and allows them to focus on delivering high-quality work without being constrained by strict budget limitations.

- Incentive for Innovation: Cost-plus contracts can encourage innovation and creativity by allowing the contractor to propose and implement new solutions without fearing financial repercussions for cost increases. This fosters a collaborative environment where both parties can explore innovative approaches to meet the project goals.

Benefits for the Client

While cost-plus contracts might seem less appealing to clients due to the potential for higher costs, they offer significant advantages, particularly in situations of high uncertainty.

- Transparency and Accountability: Cost-plus contracts provide transparency and accountability for the client by requiring the contractor to meticulously track and document all project expenses. This allows the client to closely monitor the project’s financial performance and ensure that costs are justified.

- Flexibility and Adaptability: Similar to the contractor, the client also benefits from the flexibility and adaptability of cost-plus contracts. Changes in project scope or requirements can be readily accommodated without the need for renegotiation or additional contracts. This is particularly beneficial in projects with evolving needs or unforeseen challenges.

- Risk Sharing: Cost-plus contracts allow for risk sharing between the client and the contractor. The client assumes the risk of cost overruns, while the contractor assumes the risk of project delays or unforeseen challenges. This shared risk approach can foster a collaborative and mutually beneficial relationship.

- Access to Expertise: Cost-plus contracts can provide clients with access to specialized expertise and resources that might not be readily available through fixed-price contracts. The contractor’s incentive to provide high-quality work, coupled with the transparency of the contract, encourages the utilization of specialized knowledge and resources to achieve the project goals.

Potential for Innovation and Flexibility

Cost-plus contracts offer a unique environment for innovation and flexibility, as they encourage collaboration and problem-solving between the contractor and the client.

- Collaborative Problem-Solving: Cost-plus contracts promote a collaborative approach to problem-solving. The contractor is not bound by strict budget constraints, allowing them to explore innovative solutions and implement changes without fear of financial repercussions. This encourages open communication and joint decision-making, leading to more effective and efficient solutions.

- Adaptability to Changing Requirements: Cost-plus contracts provide a flexible framework for adapting to changing project requirements or unforeseen circumstances. The client can modify the project scope or specifications without requiring extensive contract renegotiations or additional agreements. This adaptability is crucial in projects with dynamic needs or unpredictable environments.

- Incentive for Continuous Improvement: Cost-plus contracts can incentivize continuous improvement by rewarding the contractor for finding cost-effective solutions and implementing innovative approaches. This encourages the contractor to seek ways to optimize project processes and reduce overall costs, ultimately benefiting both parties.

Disadvantages of Cost-Plus Contracts

Cost-plus contracts, despite their benefits, come with inherent disadvantages that can significantly impact project outcomes. Understanding these drawbacks is crucial for making informed decisions about contract types.

Potential for Cost Overruns

Cost overruns are a significant risk associated with cost-plus contracts. This risk stems from the lack of a fixed price ceiling, which can incentivize contractors to inflate costs, leading to higher project expenses than anticipated.

- Lack of Incentive to Control Costs: Without a fixed price, contractors may not be as motivated to find cost-effective solutions or manage expenses efficiently. They might prioritize project scope and quality over cost optimization, potentially leading to cost overruns.

- Unforeseen Contingencies: Cost-plus contracts often include clauses for reimbursing unforeseen contingencies. However, the definition of “unforeseen” can be subjective, potentially leading to disputes over whether certain costs are reimbursable.

- Poor Cost Estimation: Accurate cost estimation is crucial for project success, but in cost-plus contracts, initial estimates may not be as precise due to the absence of a fixed price target. This can lead to significant cost discrepancies during project execution.

Challenges of Monitoring and Controlling Costs

Monitoring and controlling costs effectively under a cost-plus contract can be challenging due to the open-ended nature of the agreement.

- Limited Contractual Oversight: Cost-plus contracts typically lack detailed specifications for cost components, making it difficult to track and verify expenses. This can create opportunities for cost inflation or misuse of funds.

- Complex Cost Reporting: Contractors may present complex cost reports that are difficult to understand and analyze, hindering effective cost monitoring and control.

- Lack of Cost-Consciousness: The absence of a fixed price can lead to a lack of cost-consciousness among both the contractor and the client. This can result in a relaxed approach to expense management, potentially leading to cost overruns.

Potential for Moral Hazard

Cost-plus contracts can create a moral hazard situation where contractors may be tempted to inflate costs or overcharge for services.

- Incentive for Cost Padding: The absence of a fixed price can create an incentive for contractors to inflate costs, as they are reimbursed for all reasonable expenses. This can lead to excessive billing and ultimately higher project costs.

- Lack of Accountability: The open-ended nature of cost-plus contracts can make it difficult to hold contractors accountable for their expenses. This lack of accountability can contribute to cost overruns and project delays.

Applications of Cost-Plus Contracts

Cost-plus contracts are prevalent in various industries where uncertainty and complexity are inherent, making it challenging to accurately estimate project costs beforehand. This contract type offers flexibility and risk sharing, making it suitable for projects with evolving requirements or unpredictable circumstances.

Industries Where Cost-Plus Contracts Are Commonly Used

Cost-plus contracts are commonly used in industries where projects involve high levels of complexity, uncertainty, or require ongoing collaboration and adaptation. These industries include:

- Construction: Cost-plus contracts are often used in large-scale construction projects, such as infrastructure projects, hospitals, and skyscrapers, where the scope of work may be subject to change or unforeseen challenges arise. The contractor is reimbursed for actual costs incurred, plus a predetermined fee or percentage for their services.

- Defense: The defense industry relies heavily on cost-plus contracts for the development and procurement of sophisticated weapons systems, military equipment, and research projects. The government often uses this type of contract to ensure that the contractor is fully compensated for their efforts and that the project is completed to the required specifications.

- Research and Development: Cost-plus contracts are common in research and development projects, particularly for innovative technologies and scientific breakthroughs. These projects often involve significant uncertainties and evolving requirements, making it difficult to estimate costs accurately. The contract allows for flexibility and risk sharing, enabling researchers to pursue new avenues without being constrained by fixed budgets.

- Engineering: Cost-plus contracts are used in complex engineering projects, such as bridge construction, power plants, and oil and gas pipelines. These projects often involve specialized skills and materials, making it challenging to estimate costs accurately upfront. The contract provides flexibility to adjust the scope of work as needed and ensures that the contractor is compensated for actual costs incurred.

Specific Scenarios Where Cost-Plus Contracts Are Particularly Suitable, What were cost-plus contracts

Cost-plus contracts are particularly suitable for projects that exhibit certain characteristics, including:

- Uncertain Scope of Work: When the scope of work is not fully defined or is subject to change, cost-plus contracts provide flexibility to adjust the project requirements as needed. This is particularly beneficial for projects where new information or unforeseen challenges emerge during the project lifecycle.

- High Risk and Complexity: Cost-plus contracts are advantageous for projects with a high degree of risk and complexity, where traditional fixed-price contracts may not be feasible. The contract allows for sharing the financial burden of unexpected challenges or cost overruns, mitigating the risk for both the contractor and the client.

- Innovative or Experimental Projects: Cost-plus contracts are well-suited for innovative or experimental projects where the outcome is uncertain. The contract allows for flexibility to explore new approaches and adjust the project scope as needed, without the financial constraints of a fixed-price contract.

- Long-Term Projects: Cost-plus contracts are suitable for long-term projects, such as infrastructure development or research programs, where the project duration is extended and the scope of work may evolve over time. The contract allows for ongoing adjustments to the project requirements and ensures that the contractor is compensated for actual costs incurred.

Factors Influencing the Decision to Use a Cost-Plus Contract

Several factors influence the decision to use a cost-plus contract over other contract types, including:

- Project Complexity and Uncertainty: The level of complexity and uncertainty associated with a project is a key factor. When the project scope is poorly defined, the risks are high, or the project involves innovative technologies, cost-plus contracts offer flexibility and risk sharing.

- Client-Contractor Relationship: A strong and collaborative relationship between the client and contractor is essential for successful cost-plus contracts. Open communication, trust, and shared understanding are crucial for managing the project effectively and ensuring transparency in cost reporting.

- Cost Control Mechanisms: Cost-plus contracts require robust cost control mechanisms to ensure that the contractor is not inflating costs or taking advantage of the arrangement. This typically involves regular cost reporting, audits, and agreed-upon cost control measures.

- Project Budget and Timeline: Cost-plus contracts may not be suitable for projects with tight budget constraints or strict deadlines. The flexibility of the contract can lead to cost overruns if not managed effectively, and the lack of a fixed price can make it difficult to predict the project’s final cost and timeline.

Cost-Plus Contract Variations

Cost-plus contracts, while offering flexibility and risk transfer to the buyer, come in various forms, each with its own structure and implications for cost control and risk allocation. Understanding these variations is crucial for selecting the most suitable contract type for a particular project.

Cost-Plus-Percentage-of-Cost

This type of contract is straightforward, with the buyer paying the contractor’s actual costs plus a predetermined percentage of those costs as profit. The percentage acts as the contractor’s fee and is typically negotiated upfront. This approach simplifies cost calculation, making it easier for the buyer to understand the final price.

The formula for calculating the total contract price is:Total Contract Price = Actual Costs + (Percentage of Cost

Actual Costs)

For example, if the actual costs are $1 million and the agreed-upon percentage is 10%, the total contract price would be $1.1 million ($1 million + (10% – $1 million)).

Cost-Plus-Fixed-Fee

This variation offers a fixed fee to the contractor, independent of the actual project costs. The buyer reimburses the contractor for all incurred costs, and the contractor receives a predetermined, fixed fee for their services. This approach provides a more predictable cost structure for the buyer, as the fee is fixed regardless of project cost fluctuations.

The formula for calculating the total contract price is:Total Contract Price = Actual Costs + Fixed Fee

For example, if the actual costs are $1 million and the fixed fee is $200,000, the total contract price would be $1.2 million ($1 million + $200,000).

Cost-Plus-Incentive-Fee

This variation introduces an incentive fee for the contractor, based on achieving specific project milestones or exceeding performance targets. The incentive fee aims to motivate the contractor to minimize costs and enhance project performance. The fee structure is typically negotiated upfront, with clear performance criteria and corresponding incentive levels.

The formula for calculating the total contract price is:Total Contract Price = Actual Costs + (Base Fee + Incentive Fee)

For example, if the actual costs are $1 million, the base fee is $100,000, and the contractor achieves a 10% cost reduction target, resulting in a $100,000 incentive fee, the total contract price would be $1.2 million ($1 million + ($100,000 + $100,000)).

Cost-Plus-Award-Fee

This variation involves a fixed fee and an additional award fee based on the contractor’s performance against predefined criteria. The award fee is not directly linked to cost savings but focuses on broader performance objectives, such as quality, schedule adherence, and client satisfaction. The award fee structure is typically negotiated upfront, with clear performance criteria and corresponding award levels.

The formula for calculating the total contract price is:Total Contract Price = Actual Costs + (Fixed Fee + Award Fee)

For example, if the actual costs are $1 million, the fixed fee is $100,000, and the contractor receives a $50,000 award fee for exceeding quality targets, the total contract price would be $1.15 million ($1 million + ($100,000 + $50,000)).

Cost-Plus-Time-and-Materials

This variation is often used for projects with uncertain scope or duration. The buyer pays for the actual labor hours and materials used, along with a markup for the contractor’s overhead and profit. This approach provides flexibility for adapting to changing project requirements but can lead to less predictable costs.

The formula for calculating the total contract price is:Total Contract Price = (Labor Hours

- Hourly Rate) + (Material Costs

- Markup) + Overhead

For example, if the labor hours are 1,000 hours at an hourly rate of $50, material costs are $50,000 with a 20% markup, and overhead is $20,000, the total contract price would be $120,000 (($1,000

- $50) + ($50,000

- 1.2) + $20,000).

Cost-Plus-Reimbursable

This variation is similar to cost-plus-fixed-fee but with a more detailed and comprehensive reimbursement structure. The buyer reimburses the contractor for all eligible costs, including direct costs, indirect costs, and overhead, subject to specific guidelines and documentation requirements. This approach provides a high level of transparency and accountability for both parties.

The formula for calculating the total contract price is:Total Contract Price = Reimbursable Costs + Fixed Fee

For example, if the reimbursable costs are $1 million and the fixed fee is $100,000, the total contract price would be $1.1 million ($1 million + $100,000).

In conclusion, cost-plus contracts offer a valuable alternative to fixed-price agreements, particularly when project scope or cost estimations are uncertain. By providing a framework for shared risk and flexibility, these contracts can foster innovation and facilitate complex projects. However, careful consideration of the potential risks associated with cost overruns and the need for robust cost monitoring mechanisms is essential for both parties.

FAQ Insights: What Were Cost-plus Contracts

What are the main types of cost-plus contracts?

Common types include cost-plus-fixed-fee, cost-plus-incentive-fee, and cost-plus-percentage-of-cost. Each variation differs in how the contractor’s fee is calculated and the level of risk shared between parties.

How are cost-plus contracts used in the defense industry?

Cost-plus contracts are prevalent in defense due to the high complexity and uncertain nature of military projects. They allow for flexibility in design and development while ensuring the contractor is adequately compensated for their efforts.

What are the key considerations when negotiating a cost-plus contract?

Key considerations include defining clear cost accounting procedures, establishing a robust cost audit process, and negotiating appropriate fee structures to ensure fairness and transparency.

What are the potential drawbacks of using a cost-plus contract?

Potential drawbacks include the risk of cost overruns, the need for extensive cost monitoring, and the potential for moral hazard if the contractor is not incentivized to control costs effectively.