What is an options contract fee? It’s a crucial element of trading options that often goes unnoticed. This fee, which is a charge levied on each options contract you buy or sell, can significantly impact your overall trading costs. It’s essential to understand the various components of this fee, such as brokerage fees, exchange fees, and regulatory fees, as they can vary depending on the type of option, the underlying asset, and the contract’s expiration date.

Understanding the intricacies of options contract fees is crucial for making informed trading decisions. It allows you to minimize costs, optimize your profits, and navigate the complex world of options trading with greater confidence. Let’s delve into the specifics of these fees and explore how they can influence your trading strategies.

Understanding Options Contracts

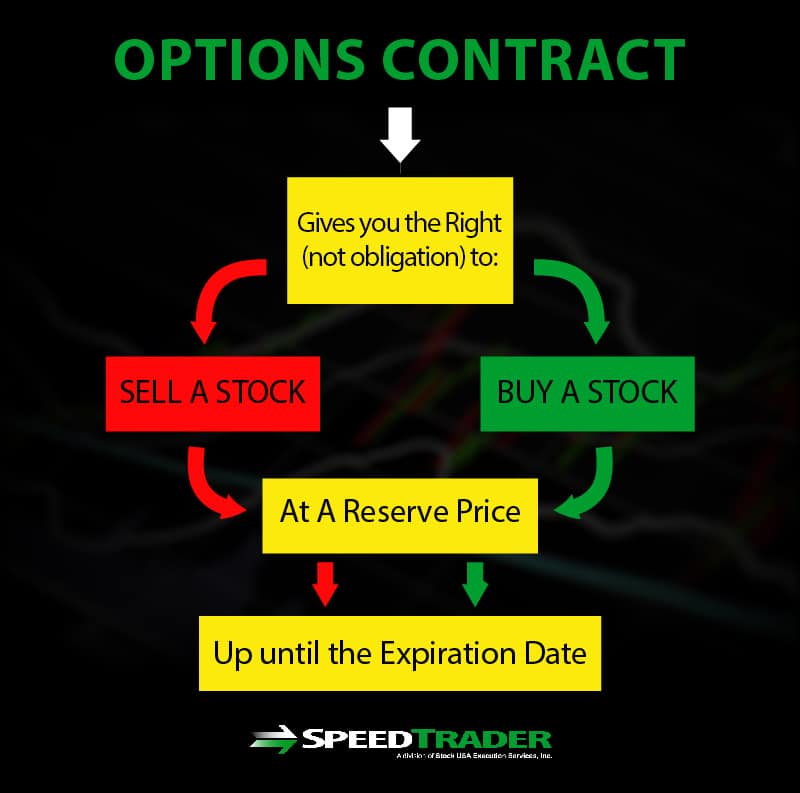

An options contract is a financial instrument that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). These contracts are traded on exchanges and can be used for various purposes, including hedging, speculation, and income generation.

Types of Options Contracts

Options contracts are categorized into two main types: call options and put options.

- Call options give the buyer the right to buy the underlying asset at the strike price. Call options are typically purchased by investors who believe the price of the underlying asset will increase. If the price of the asset rises above the strike price, the call option holder can exercise their right to buy the asset at the lower strike price and sell it in the market for a profit.

Conversely, if the price of the asset falls below the strike price, the call option holder would not exercise their right and would lose the premium paid for the option.

- Put options give the buyer the right to sell the underlying asset at the strike price. Put options are typically purchased by investors who believe the price of the underlying asset will decrease. If the price of the asset falls below the strike price, the put option holder can exercise their right to sell the asset at the higher strike price and make a profit.

Conversely, if the price of the asset rises above the strike price, the put option holder would not exercise their right and would lose the premium paid for the option.

Key Elements of an Options Contract

An options contract is defined by several key elements:

- Strike price: The predetermined price at which the underlying asset can be bought or sold.

- Expiration date: The date on which the option contract expires. After this date, the option can no longer be exercised.

- Premium: The price paid by the buyer to acquire the option contract. The premium represents the cost of the right to buy or sell the underlying asset.

- Underlying asset: The asset that the option contract is based on. This can be a stock, index, commodity, currency, or other financial instrument.

Options Contract Fees: What Is An Options Contract Fee

When you buy or sell an options contract, you’ll encounter various fees that contribute to the overall cost of the transaction. These fees are charged by different entities involved in the options market, including brokers, exchanges, and regulatory bodies. Understanding these fees is crucial for making informed trading decisions.

Types of Options Contract Fees

Options contract fees are typically categorized into three main types: brokerage fees, exchange fees, and regulatory fees.

- Brokerage Fees: This is the most common fee you’ll encounter. Your broker charges a commission for executing your options trade. Brokerage fees can vary widely depending on the broker, the type of account you have, and the volume of your trades. Some brokers offer commission-free trading, while others charge a flat fee per contract or a percentage of the transaction value.

- Exchange Fees: These fees are charged by the options exchange where the contract is traded. Exchange fees cover the costs of operating the exchange, including clearing and settlement services. These fees are usually a small amount per contract and vary depending on the exchange and the underlying asset.

- Regulatory Fees: These fees are charged by regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, to oversee the options market and ensure its fairness and integrity. Regulatory fees are typically a small percentage of the contract value and are charged on a per-contract basis.

Factors Influencing Options Contract Fees

Several factors influence the cost of options contract fees, including:

- Type of Option: Different types of options, such as calls and puts, may have different fees. For example, some exchanges may charge higher fees for complex options strategies like spreads or straddles.

- Underlying Asset: The underlying asset of the option can also affect the fees. Options on highly volatile assets, such as stocks with high trading volume, may have higher exchange fees.

- Contract’s Expiration Date: Options contracts with longer expiration dates generally have higher fees than contracts with shorter expiration dates. This is because longer-term contracts involve greater risk and require more resources to manage.

Brokerage Fees

Brokerage fees are an important factor to consider when trading options. These fees can vary depending on the broker you choose, the type of options contract you trade, and the volume of your trades. Understanding how brokerage fees are calculated and how to minimize them can help you maximize your profits.

How Brokerage Fees are Calculated for Options Contracts

Brokerage fees for options contracts are typically calculated based on a per-contract fee, a percentage of the contract price, or a combination of both.

A per-contract fee is a fixed amount charged for each options contract you buy or sell.

A percentage-based fee is a percentage of the contract price, which can vary depending on the broker and the type of contract.

Some brokers also charge a minimum fee per trade, regardless of the number of contracts traded. Additionally, certain brokers may charge inactivity fees if you don’t trade frequently.

Comparison of Brokerage Fees Charged by Different Brokers

Brokerage fees can vary significantly between different brokers. Here’s a comparison of the fees charged by some popular online brokers:| Broker | Per-Contract Fee | Percentage Fee | Minimum Fee ||—|—|—|—|| Broker A | $0.65 | 0.15% | $1.00 || Broker B | $0.50 | 0.10% | $0.50 || Broker C | $0.75 | 0.20% | $1.50 |It’s important to note that these fees are just examples and can change over time.

You should always check the current fee schedule of your chosen broker before trading.

Minimizing Brokerage Fees When Trading Options

There are several strategies you can use to minimize brokerage fees when trading options:

Choose a broker with low fees

Comparing fees across different brokers can save you money in the long run.

Trade in higher-priced contracts

If you’re trading options contracts with a higher price, the percentage-based fees will be higher. Consider trading contracts with lower prices to reduce your fees.

Trade a large volume

Some brokers offer discounts for high-volume traders.

Utilize discount programs

Many brokers offer discount programs for specific types of trades, such as options trading.

Avoid inactivity fees

If you don’t trade frequently, choose a broker that doesn’t charge inactivity fees.

Exchange Fees

Options contracts are traded on various exchanges worldwide. Each exchange levies fees for options transactions, impacting the overall cost of trading.

Exchange fees are a significant factor in determining the overall cost of trading options. These fees vary depending on the exchange, the type of option, and the contract size. Understanding these fees is crucial for traders to optimize their trading strategies and minimize their costs.

Exchange Fees Charged, What is an options contract fee

Exchange fees are typically charged on a per-contract basis. The specific fees charged can vary depending on the exchange and the type of option being traded. These fees cover the exchange’s operating costs and help ensure the smooth functioning of the market.

- Transaction Fees: These fees are charged for each executed order and typically vary based on the type of option traded (e.g., call or put) and the contract size. These fees are often referred to as “exchange fees” or “clearing fees.”

- Regulatory Fees: These fees are levied by regulatory bodies like the Securities and Exchange Commission (SEC) in the United States. They are designed to cover the costs of overseeing the options market and protecting investors.

- Data Fees: Exchanges often charge fees for accessing real-time market data, such as quotes, trades, and order book information. These fees can be charged on a subscription basis or per-request.

Exchange Fee Comparison

Here’s a comparison of exchange fees charged by some of the major options exchanges:

| Exchange | Transaction Fee (per contract) | Regulatory Fee (per contract) | Data Fee (per month) |

|---|---|---|---|

| Chicago Board Options Exchange (CBOE) | $0.75 – $1.50 | $0.01 | $100 – $500 |

| Nasdaq Options Market (NOM) | $0.50 – $1.00 | $0.01 | $75 – $400 |

| New York Stock Exchange (NYSE) | $0.60 – $1.20 | $0.01 | $90 – $450 |

Note: These fees are subject to change and may vary depending on the specific option being traded. It’s essential to consult the exchange’s website for the most up-to-date information.

Regulatory Fees

Regulatory fees are a component of the total cost of trading options. These fees are levied by government agencies to oversee and regulate the options market, ensuring fairness and transparency. They are collected by exchanges and clearinghouses and ultimately passed on to investors.

Regulatory Fees Collection and Usage

Regulatory fees are typically collected by exchanges and clearinghouses as a percentage of the contract value or as a fixed fee per contract. The collected funds are then used by the regulatory bodies to cover the costs of market oversight, including:

- Monitoring market activity to detect and prevent fraud and manipulation.

- Developing and enforcing rules and regulations to ensure fair and orderly markets.

- Providing investor education and protection.

- Funding research and development to improve market efficiency and stability.

Examples of Regulatory Fees

Here are some examples of regulatory fees charged by different regulatory bodies:

- Securities and Exchange Commission (SEC): The SEC charges a transaction fee on options trades, which is currently set at 0.0022% of the contract value. These fees are used to fund the SEC’s regulatory activities, including market surveillance, investor protection, and enforcement.

- Financial Industry Regulatory Authority (FINRA): FINRA charges a regulatory fee on options trades, which is currently set at 0.001% of the contract value. These fees are used to fund FINRA’s regulatory activities, including market surveillance, enforcement, and investor education.

- Options Clearing Corporation (OCC): The OCC charges a regulatory fee on options trades, which is currently set at 0.001% of the contract value. These fees are used to fund the OCC’s clearing and settlement activities, including risk management, financial stability, and investor protection.

Total Options Contract Cost

The total cost of an options contract is the sum of the premium paid, the brokerage fees, the exchange fees, and the regulatory fees. Understanding these costs is crucial for evaluating the potential profitability of an options trading strategy.

Impact of Fees on Profitability

Fees can significantly impact the profitability of options trading, especially for smaller trades. High fees can erode potential profits, making it challenging to achieve a positive return. For instance, if an investor buys an option contract for $100 and incurs $10 in fees, the net cost of the contract becomes $110. This means that the investor needs the underlying asset to move favorably by at least $110 to break even.

Examples of How Fees Can Affect Trading Decisions

- Choosing a Brokerage Account: Different brokerage accounts charge varying fees for options trading. An investor may choose a brokerage with lower fees for high-frequency trading or a brokerage with a flat fee structure for long-term investments.

- Selecting an Options Strategy: The cost of fees can influence the selection of an options strategy. For example, an investor may choose a less expensive strategy, like buying a covered call, instead of a more expensive strategy, like selling a naked put, to minimize the impact of fees.

- Determining Trade Size: The impact of fees on profitability is more significant for smaller trades. An investor may choose to trade a larger contract size to offset the impact of fees, or they may choose to avoid trading smaller contracts altogether.

Minimizing Options Contract Fees

Minimizing options contract fees is crucial for maximizing your potential profits. While some fees are unavoidable, there are strategies you can employ to reduce their impact on your overall trading costs. By understanding the different types of fees, their impact, and the options available to you, you can make informed decisions and save money on your options trading.

Choosing the Right Broker and Exchange

The broker and exchange you choose play a significant role in determining your overall options contract fees. Different brokers and exchanges have varying fee structures, and selecting the right one can lead to substantial savings.

- Compare Brokerage Fees: Before settling on a broker, thoroughly compare their fee structures. Look for brokers offering lower commission rates, tiered pricing, or flat-fee options for options trading. Some brokers may offer discounts for high-volume traders or those who maintain a specific account balance.

- Consider Exchange Fees: While exchange fees are generally standardized, some brokers may offer discounts or rebates on exchange fees, particularly for high-volume traders. Investigate whether your chosen broker offers such benefits.

- Explore Alternative Exchanges: If you are a high-volume trader, consider exploring alternative exchanges that may offer lower fees compared to traditional exchanges. These exchanges often cater to professional traders and may have different fee structures.

Negotiating Lower Fees with Brokers

Many brokers are open to negotiating fees, especially for high-volume traders or those who maintain a substantial account balance.

- Highlight Your Trading Volume: Emphasize your trading volume and the potential revenue you generate for the broker. This demonstrates your value as a client and increases your leverage in negotiations.

- Explore Bundled Services: Inquire about bundled services that include discounted fees for options trading. Some brokers may offer bundled packages that include research tools, educational resources, or other value-added services in exchange for reduced fees.

- Consider Alternative Fee Structures: If your broker is not willing to negotiate a lower commission rate, explore alternative fee structures such as tiered pricing or flat-fee options. These structures can be beneficial for high-volume traders or those who prefer predictable fees.

Navigating the world of options trading requires a comprehensive understanding of options contract fees. By understanding the different types of fees, how they are calculated, and strategies for minimizing their impact, you can make more informed trading decisions and potentially enhance your overall profitability. Remember, the cost of trading options is not solely determined by the price of the underlying asset but also includes these essential fees.

By incorporating this knowledge into your trading strategies, you can gain a competitive edge in the market.

FAQ Overview

How often are options contract fees charged?

Options contract fees are typically charged each time you buy or sell an options contract.

Are options contract fees the same for all brokers?

No, brokerage fees can vary significantly depending on the broker you choose. Some brokers offer lower fees for active traders, while others may have higher fees for specific types of options contracts.

Are there any ways to avoid paying options contract fees?

While it’s impossible to completely avoid options contract fees, you can minimize them by choosing a broker with lower fees, trading on exchanges with lower fees, and negotiating with your broker for lower rates.

What are some examples of regulatory fees associated with options trading?

Examples of regulatory fees include Securities and Exchange Commission (SEC) fees, Financial Industry Regulatory Authority (FINRA) fees, and fees charged by other regulatory bodies.