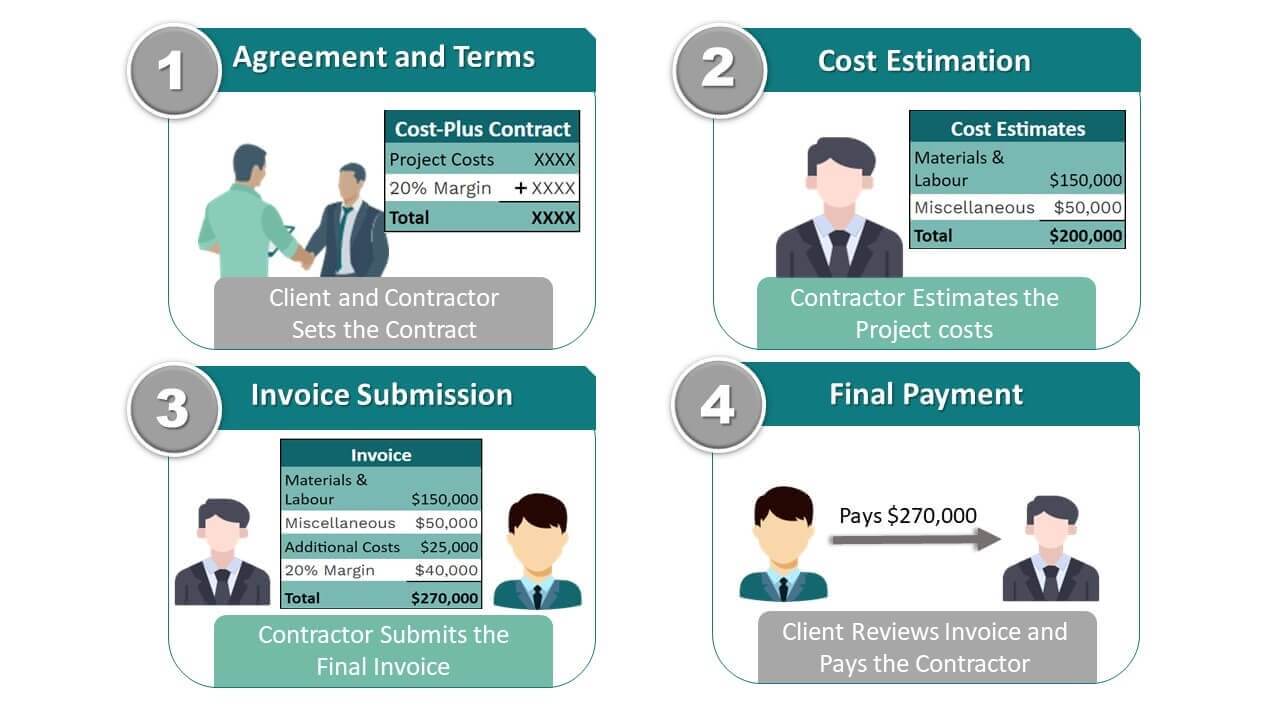

What is cost plus contract in construction – What is a cost plus contract in construction? It’s a type of agreement where the contractor is paid for all their direct costs, plus an agreed-upon markup or fee. This approach differs from fixed-price or lump-sum contracts, where the contractor agrees to a specific price upfront, regardless of the actual costs incurred. Cost plus contracts are often used in complex projects where the scope of work is uncertain or may change significantly during construction.

Imagine building a custom home with unique architectural features. You might choose a cost plus contract because the exact materials and labor needed are difficult to predict upfront. The contractor would track all expenses, from materials to labor, and you would pay for those costs plus their agreed-upon fee. This way, you’re guaranteed to get exactly what you want, even if the project’s scope evolves.

Definition of Cost Plus Contract

A cost-plus contract, also known as a cost-reimbursement contract, is a type of construction contract where the contractor is paid for all the actual costs incurred in completing the project, plus a predetermined fee or percentage for their services. This fee is typically a percentage of the total project cost or a fixed amount. Unlike fixed-price or lump-sum contracts, where the contractor agrees to complete the project for a predetermined price regardless of the actual costs incurred, cost-plus contracts shift the risk of cost overruns from the contractor to the owner.

This means that the owner bears the responsibility for any unexpected cost increases, while the contractor is incentivized to keep costs as low as possible.

Types of Cost Plus Contracts

There are several types of cost-plus contracts, each with its own specific variations and risk allocation. Some common types include:

- Cost Plus Fixed Fee (CPFF): In this type, the contractor is reimbursed for all actual costs incurred, plus a fixed fee that is determined at the beginning of the project. This fee is not affected by the actual cost of the project.

- Cost Plus Percentage of Cost (CPPC): This type involves the contractor being reimbursed for all actual costs, plus a percentage of those costs as their fee. This percentage is typically negotiated upfront and can vary depending on the complexity and risk of the project.

- Cost Plus Incentive Fee (CPIF): This type incentivizes the contractor to control costs by offering a bonus or incentive fee if the project is completed within a certain budget or timeframe. The incentive fee is typically calculated based on the project’s cost savings compared to the target cost.

Real-World Scenarios

Cost-plus contracts are often used in construction projects where:

- The scope of work is uncertain or complex: When the exact nature of the project is unclear, it can be difficult to estimate the costs accurately. Cost-plus contracts allow for flexibility and adjustments as the project progresses.

- There is a high risk of unforeseen costs: In projects with complex geological conditions, potential environmental issues, or other unpredictable factors, cost-plus contracts provide protection for the owner against unexpected cost overruns.

- Time is critical: When a project has a tight deadline, cost-plus contracts can incentivize the contractor to expedite the work without worrying about exceeding a fixed budget.

- The owner wants to control the quality of materials and workmanship: Cost-plus contracts allow the owner to specify the materials and workmanship standards, ensuring that the project meets their specific requirements.

Advantages of Cost Plus Contracts

Cost-plus contracts offer several advantages, including:

- Flexibility: Cost-plus contracts allow for changes to the project scope and design as needed, without the need for renegotiation of the contract price.

- Transparency: The owner has access to detailed cost information and can track the project’s expenses closely.

- Risk Sharing: The owner and contractor share the risk of cost overruns, reducing the potential for disputes.

Disadvantages of Cost Plus Contracts

However, cost-plus contracts also have some disadvantages:

- Potential for Cost Overruns: Without a fixed price, there is a greater risk of cost overruns, as the owner is ultimately responsible for all expenses.

- Lack of Incentive for Cost Control: Some contractors may not be as motivated to control costs as they would be under a fixed-price contract.

- Complexity: Cost-plus contracts can be more complex to administer than fixed-price contracts, requiring careful monitoring and tracking of expenses.

Examples of Cost Plus Contracts, What is cost plus contract in construction

Cost-plus contracts are commonly used in various construction projects, including:

- Government contracts: Many government projects, particularly those involving complex infrastructure or research and development, are awarded using cost-plus contracts.

- Large-scale infrastructure projects: Cost-plus contracts are often used for projects like bridges, tunnels, and airports, where the scope of work is uncertain and the risk of unforeseen costs is high.

- Renovations and repairs: When the extent of damage or the required repairs is unknown, cost-plus contracts can provide flexibility for the owner and contractor.

Advantages and Disadvantages of Cost Plus Contracts

Cost-plus contracts are often used in construction projects where the exact scope of work or the cost of materials and labor is uncertain. These contracts offer a unique balance between risk and reward for both the owner and the contractor. Understanding the advantages and disadvantages of cost-plus contracts is crucial for making informed decisions about their use in construction projects.

Advantages of Cost Plus Contracts

Cost-plus contracts offer several advantages, particularly in situations where project scope or cost uncertainties are significant. These advantages make them a viable option for projects requiring flexibility and collaboration.

- Reduced Risk for the Owner: One of the primary advantages of cost-plus contracts is that they shift the risk of cost overruns to the contractor. The owner pays for the actual costs incurred, plus a predetermined fee, making them less vulnerable to unexpected expenses. This is particularly beneficial for projects with complex designs, unpredictable site conditions, or evolving requirements.

- Flexibility and Adaptability: Cost-plus contracts provide significant flexibility for changes and modifications during the project. This allows for adjustments to the scope of work based on changing needs, discoveries during construction, or new opportunities. This adaptability can be crucial for projects with evolving requirements or where unforeseen circumstances arise.

- Increased Collaboration and Transparency: Cost-plus contracts promote a collaborative environment between the owner and the contractor. With a shared interest in controlling costs, both parties are motivated to work together efficiently and effectively. This transparency fosters trust and open communication, leading to better decision-making and potentially better project outcomes.

- Access to Specialized Expertise: For projects requiring specialized skills or knowledge, cost-plus contracts can be advantageous. They allow the owner to engage experienced contractors who can provide valuable expertise and guidance throughout the project. This can be particularly beneficial for complex projects with unique technical challenges.

Disadvantages of Cost Plus Contracts

While cost-plus contracts offer certain advantages, they also come with potential disadvantages that must be carefully considered. These disadvantages can impact project costs and create challenges for both the owner and the contractor.

- Potential for Cost Overruns: The lack of a fixed price in cost-plus contracts can lead to cost overruns if proper controls and monitoring are not in place. Without a clear budget, there is a higher risk of expenses exceeding initial estimates, particularly if the project scope changes or unforeseen challenges arise.

- Limited Incentive for Cost Control: Since the contractor is reimbursed for actual costs, there may be a reduced incentive to minimize expenses. This can lead to a lack of cost consciousness and potentially higher project costs. It is crucial to have robust cost-control measures and clear performance incentives to mitigate this risk.

- Complexity and Administrative Overhead: Cost-plus contracts require more detailed record-keeping and administrative oversight than fixed-price contracts. This can increase the administrative burden for both the owner and the contractor, potentially leading to higher overhead costs.

- Potential for Disputes: The lack of a fixed price in cost-plus contracts can create opportunities for disputes regarding costs and project scope. Clear contract language, detailed documentation, and regular communication are essential to minimize the risk of disagreements.

Comparison with Other Contract Types

Cost-plus contracts are just one of many types of contracts used in construction. Comparing them to other contract types can provide valuable insights into their strengths and weaknesses.

- Fixed-Price Contracts: Fixed-price contracts offer a fixed price for the project, providing greater certainty for the owner regarding the total cost. However, they offer less flexibility for changes and can shift the risk of cost overruns to the contractor.

- Lump-Sum Contracts: Lump-sum contracts are similar to fixed-price contracts, with a fixed price for the entire project. However, they are typically used for smaller, more defined projects with less uncertainty.

- Unit-Price Contracts: Unit-price contracts define a price per unit of work, such as per square foot of construction. This provides more flexibility than fixed-price contracts but still offers some cost certainty.

Types of Cost Plus Contracts: What Is Cost Plus Contract In Construction

Cost-plus contracts offer flexibility and transparency in construction projects, but their variations differ in how the contractor’s profit is determined. This section explores the common types of cost-plus contracts, outlining their key characteristics and practical applications.

Cost-Plus Percentage of Cost

This type of contract compensates the contractor for the actual project costs plus a predetermined percentage of those costs as profit.

The formula for calculating the total contract price is: Total Contract Price = Project Costs + (Percentage of Cost x Project Costs)

The percentage of cost serves as the contractor’s profit margin. It’s typically negotiated upfront and can range from 5% to 15%, depending on factors like project complexity, risk, and market conditions.

Example:

A construction project has actual costs of $1,000,

000. The contract stipulates a 10% percentage of cost for the contractor’s profit. The total contract price would be calculated as follows

$1,000,000 + (10% x $1,000,000) = $1,100,000

Advantages:

- Transparency: The owner has clear visibility into all project costs.

- Flexibility: The contract allows for changes and adjustments to the project scope without significantly impacting the contractor’s profit.

- Risk Sharing: The owner shares the risk of cost overruns with the contractor.

Disadvantages:

- Potential for Cost Overruns: The contractor may have less incentive to control costs, potentially leading to higher expenses.

- Lack of Cost Control: The owner may lack the expertise to effectively monitor and manage project costs.

- Potential for Disputes: Disagreements can arise regarding the accuracy of reported costs.

Cost-Plus Fixed Fee

This contract type compensates the contractor for the actual project costs plus a fixed fee, which represents the contractor’s profit. The fixed fee is determined upfront and remains constant regardless of the project’s actual costs.

The formula for calculating the total contract price is: Total Contract Price = Project Costs + Fixed Fee

Example:

A construction project has actual costs of $1,200,The contract includes a fixed fee of $200,000 for the contractor’s profit. The total contract price would be:$1,200,000 + $200,000 = $1,400,000

Advantages:

- Cost Certainty: The owner has a predictable total project cost, as the fixed fee remains constant.

- Incentive for Cost Control: The contractor is motivated to minimize project costs to maximize their profit margin.

- Reduced Risk for the Owner: The owner’s risk of cost overruns is mitigated by the fixed fee.

Disadvantages:

- Limited Flexibility: The fixed fee limits the contractor’s ability to adjust to unforeseen project changes.

- Potential for Disputes: Disagreements can arise over the scope of work covered by the fixed fee.

- Lack of Incentive for Efficiency: The contractor may have less motivation to improve project efficiency beyond the fixed fee.

Cost-Plus Incentive Fee

This contract type incentivizes the contractor to achieve specific project goals, such as completing the project on time or within budget. The contractor receives a base fee for project costs, plus an additional incentive fee if certain performance targets are met.

The formula for calculating the total contract price is: Total Contract Price = Project Costs + Base Fee + (Incentive Fee x Performance Achieved)

The incentive fee is typically tied to predetermined performance metrics, such as project completion within a specific timeframe, cost savings, or quality standards. The contract Artikels the performance targets and the corresponding incentive fee structure.

Example:

A construction project has actual costs of $1,500,000. The contract includes a base fee of $150,000 for the contractor. The contract also includes an incentive fee structure where the contractor receives an additional $50,000 if the project is completed within 10% of the original budget. If the project is completed within 5% of the original budget, the contractor receives an additional $100,000.

If the project is completed within the original budget, the contractor receives the full incentive fee of $150,000.

Advantages:

- Strong Incentive for Performance: The contractor is motivated to exceed expectations to maximize their profit.

- Alignment of Interests: The owner and contractor share a common goal of achieving project success.

- Flexibility: The contract allows for adjustments to the incentive structure based on project needs.

Disadvantages:

- Complexity: Developing a fair and transparent incentive structure can be complex.

- Potential for Disputes: Disagreements can arise over the interpretation of performance metrics.

- Limited Cost Certainty: The total contract price can vary depending on the contractor’s performance.

Understanding cost plus contracts is crucial for anyone involved in construction, whether you’re a homeowner, developer, or contractor. While these contracts offer flexibility and transparency, they require careful planning and robust cost control mechanisms to ensure both parties are protected. By understanding the advantages, disadvantages, and legal considerations of cost plus contracts, you can make informed decisions about the best approach for your construction project.

Answers to Common Questions

What are some common examples of cost plus contracts in construction?

Cost plus contracts are frequently used in projects with complex or uncertain scopes, such as renovations, government infrastructure projects, and large-scale commercial developments.

How is the cost baseline established in a cost plus contract?

The cost baseline is usually determined through a detailed cost estimate, which may involve breaking down the project into specific tasks and estimating the cost of materials, labor, and equipment. This baseline serves as a starting point for tracking actual costs.

What are the key risks associated with cost plus contracts?

Key risks include potential cost overruns, lack of clear cost control mechanisms, and the possibility of disputes over the contractor’s markup or fee.